Fundamentals Report #142

This week: Elon, China, and the IRS try to destroy bitcoin. We cover Taproot signaling, mining, price analysis, why no euro stablecoins?, and google trends.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

This week's Bitcoin & Markets content

- (podcast) The Current Macro Landscape w/ Jeff Snider - FED52

- (member) The Crash in Context - Bitcoin Pulse #110

Get the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $37,721 (-$13,481 -26.3%) |

| Market cap | $695 billion |

| Satoshis/$1 USD | 2,651 |

| 1 finney (1/10,000 btc) | $3.77 |

| Median fee confirmed (finneys) | $10.08 (2.67) |

| Market cycle timing | Halfway through bull market |

| Weekly trend | Crash and bounce |

| Media sentiment | Very negative |

| Network traffic | Moderate |

| Mining | Low hash rate |

Market Commentary

What a crazy week! The bitcoin news cycle is definitely feast or famine. Just a couple weeks ago we were talking about a slow news cycle during the consolidation period. This week? We have the price crash, Elon Musk, China bans, IRS news, and more.

Before we get into some of that, be aware that none of this is unexpected or changes the underlying arguments for bitcoin in any way. Whenever the price of bitcoin experiences massive swings the frantic financial press jumps on any headline to explain it and get clicks.

Musk

We wrote about Elon last week. There was so much back and forth on this one, honestly, it is hard to keep track of, even for a veteran bitcoiner. It doesn't matter if Elon is on board or not, and we can't really draw conclusions about his true feelings and actions from his public trolling tweets anyway.

Elon got mad with the bitcoin cyber-hornets on twitter, eluded to Tesla dumping all their bitcoin, then comes back with "diamond hands", a term for "strong hands" popularized by Wall Street Bets earlier this year.

Tesla has 💎 🙌

— Elon Musk (@elonmusk) May 19, 2021

So what are we to make of this? Not much. Price will fluctuate around a fair market value. In bitcoin that fluctuation is just bigger than normal goods. Without great volatility, abnormally great gains are not possible.

China

Chinese authorities have reiterated their cryptocurrency regulations from 2013 and 2017. Initially, the breaking news here reported new regulation, but that does not seem to be the case. They've simply reiterated warnings and existing bans.

In 2013, China’s central bank barred financial institutions from handling bitcoin (BTC, -2.29%) transactions, according to a notice from China Securities Regulatory Commission.

And then again in 2017, the central bank in China declared initial coin offerings as illegal, which caused bitcoin’s price to fall.

Some analysts are claiming recent comments aren't technically new but could be seen as a tightening of regulation. Banks and payment processors in China might institute more rigorous compliance efforts.

We don't see it as an important issue. Even if they were to do so, China is quickly evaporating as an important bitcoin hub. They have a bunch of mining and trading there, but have lost a massive amount of both in the last 3 years. China isn't really that important to bitcoin anymore. A single whale, buying up $1 billion in bitcoin, outweighs this Chinese announcement several times over.

IRS

Recent reports about the IRS and US agencies like the Treasury Department have been flying a little bit under the radar. Over the last couple of weeks some interesting stories have popped up, but, once again, they aren't earth shattering. Depending on how you look at it, all this could be viewed in a very bullish light.

Binance

A couple weeks ago, it was reported that Binance, the largest bitcoin exchange by volume, is under investigation by the IRS and Department of Justice for possible money-laundering.

Far from being a mainly bitcoin problem, one of the primary use cases of altcoins, and specifically the insane NFT (non-fungible token) market, is exactly money-laundering. Binance is famous for being, what we in the industry call, an "altcoin casino". So, not surprising they are under investigation. Whether anything will come of it? Probably not, at most a fine.

Reporting Bitcoin Transfers to the IRS

The Treasury Department is proposing businesses report "crypto" transactions of $10,000 in value or more to the IRS, because people may attempt to hide income with these.

What jumped out at us in this Agenda doc is how bullish the Treasury is on bitcoin (first quote) and how unenforceable they realize their efforts are (second quote).

Despite constituting a relatively small portion of business income today, cryptocurrency transactions are likely to rise in importance in the next decade, especially in the presence of a broad-based financial account reporting regime.

At the crux of these proposals is a commitment to revitalizing tax enforcement, decreasing noncompliance by about 10% over the course of a decade. (emphasis added)

SHARE our content with friends and family!

Quick Price Analysis

Weekly BMI | 2 : Bullish

Become a paid member to access our much more in depth technical analysis and member newsletter.

Bitcoin crashed in dramatic fashion this week. For those new to bitcoin, welcome to a legit bitcoin dip. Congrats on living through it. Hopefully you were able to buy the dip.

Most signs are point to that being the bottom which Ansel detailed in the Bitcoin Pulse yesterday. Today, we will look at a simple price chart and the SOPR.

As you can see, the drop from $40,000 to $30,000 happened very quickly. The most violent move happened in only 30 mins, dropping from $38k to $30k, there was a strong bounce back up to almost $40k and it was over.

There is a possibility that price retests the mid-30's but it is highly likely that the bottom is in for multiple reasons. On the above chart, we added a red arrow to show a typical recovery path. When price crosses back above $48,000 we can be very certain that new highs are imminent. Until then the recovery isn't complete.

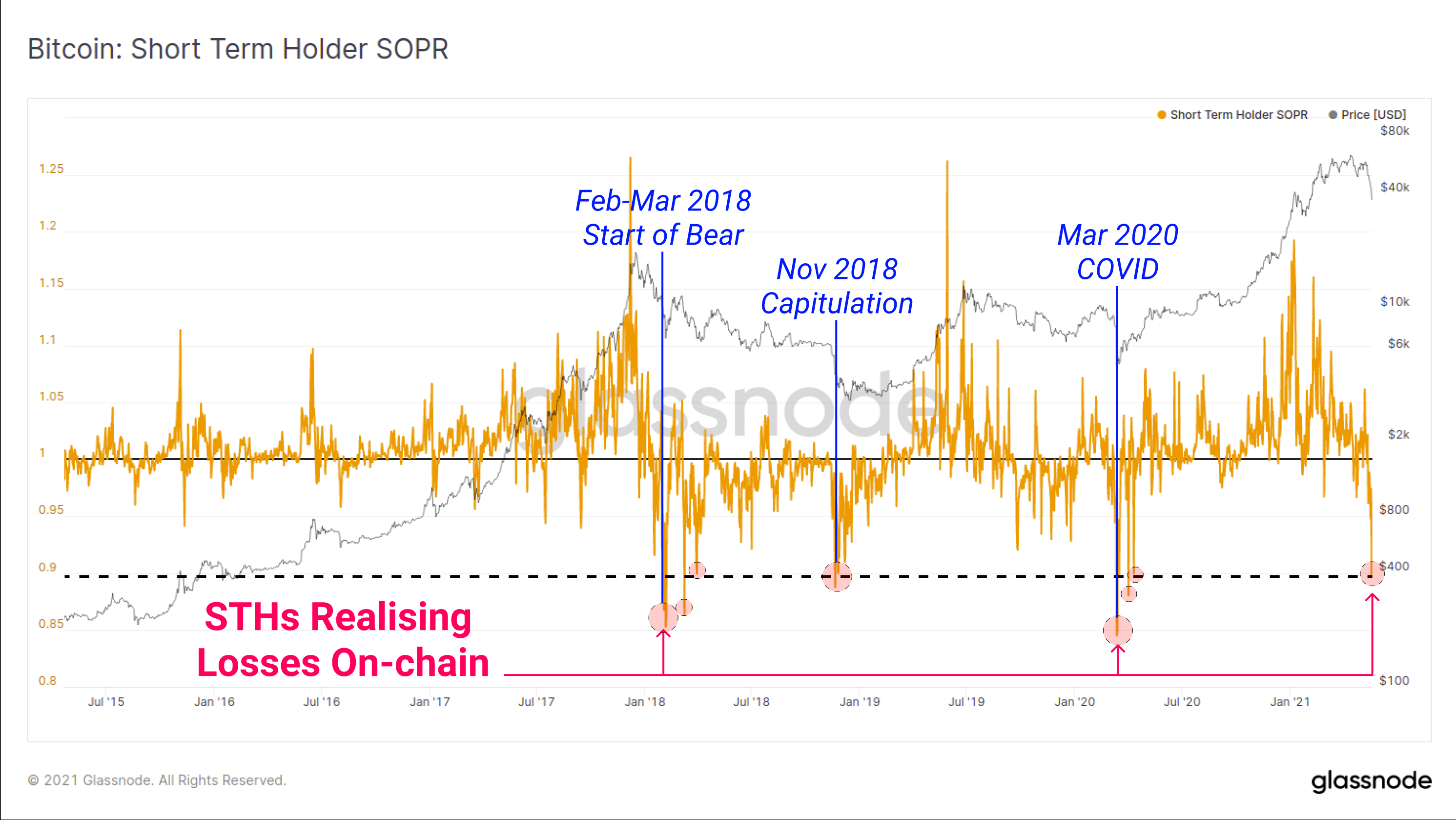

SOPR

SOPR = price sold / price paid. Learn more here

When SOPR > 1, it means that the owners of the spent outputs are in profit at the time of the transaction; otherwise, they are at a loss

What we are seeing on SOPR currently is a capitulation low. When this measure dips below 1, it corresponds to unusual sell-off events. Literally it means people are panic selling at a loss, a very strong sign that downward pressure is exhausted.

No indicator is perfect, but this a uniquely bitcoin indicator that mixes technical price analysis with the unique transparency offered by the Bitcoin network.

Development

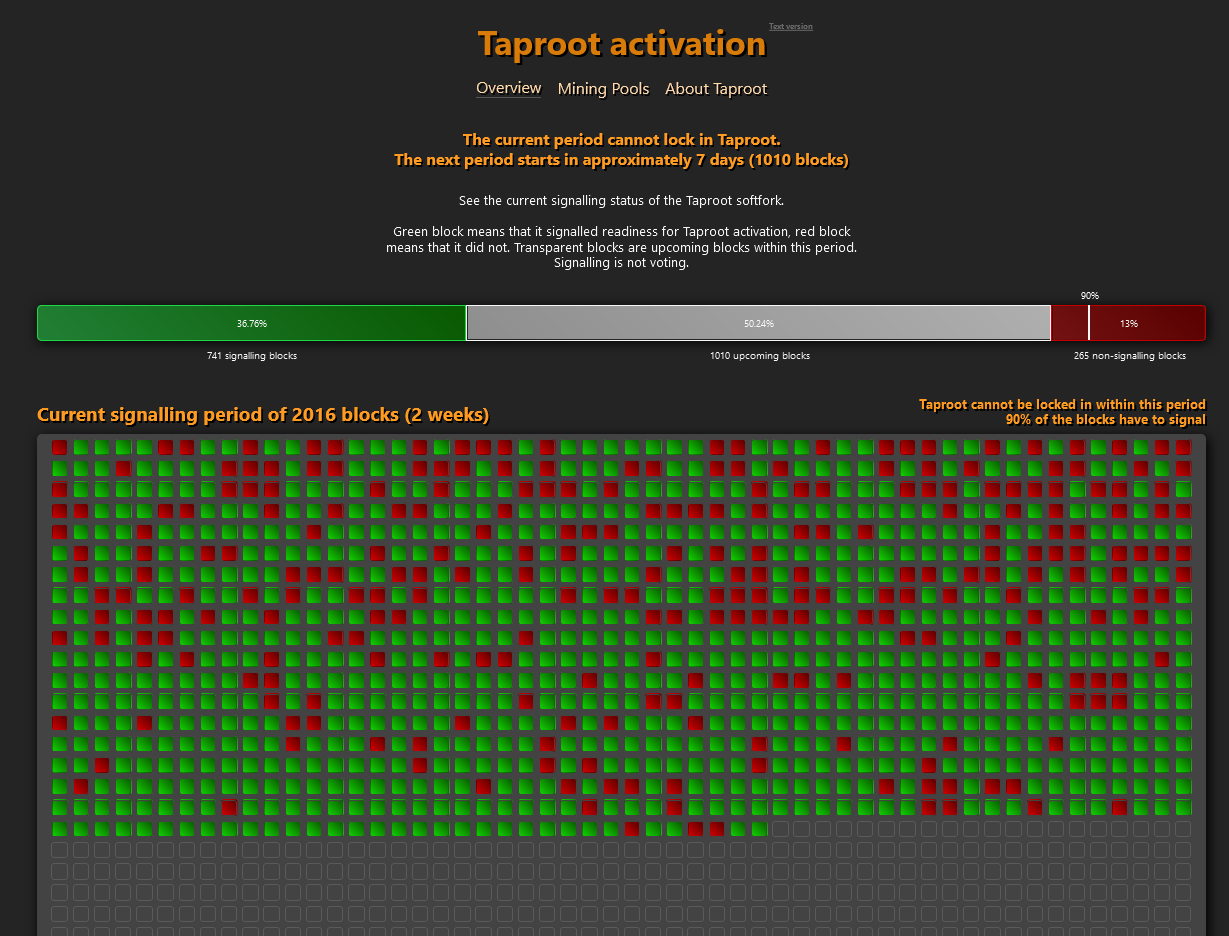

Taproot Signaling

Taproot is now on pace to activate in the next difficulty period which starts in 7 days. As you can see, over 90% of the squares on green on the bottom half of the colored field, meaning enough miners are signaling for Taproot in the last several hundred blocks. We can now expect Taproot to get locked in by end of June, and officially activated in November of this year (according the programmed grace period).

Mining

Hashrate

The price drop has significantly impacted the hashrate of miners as a percentage of mining because unprofitable at current levels. Miners will turn off some of their machines to save money. Blocks are being confirmed on average just under 12 minutes instead of the target of 10 minutes. The difficulty is estimated to adjust down ~13% in one week.

Fees

Fees tend to rise during periods of price volatility as people rush to send their coins into and out of exchanges. This time is no different with fees increasing to 100 sats/byte ($10).

Stablecoins/ Altcoins / CBDC

We wanted to take a minute and update you on the current state of the stablecoin market, specifically comparing different USD stablecoins, as well as comparing between USD and EUR stablecoins.

Currently, total USD stablecoins equal $96 billion in circulating supply. The largest USD stablecoins are:

- Tether (USDT): $58 billion

- USDC: $14 billion

- Binance coin: $7 billion

We've written extensively on Tether, but not much at all about USDC. USDC is a stablecoin provided by the company Circle, and (in our opinion) fulfills the role of most regulatory compliant digital dollar. Tether is still king here, but USDC is growing dramatically.

Circle CEO, Jeremy Allaire (someone with a long history of dissing bitcoin), recently tweeted that USDC added $1 billion in circulating supply in a single day. That is hugely bullish as a gauge of investment interest in bitcoin from the US, because the primary uses of USD stablecoins are getting dollars into the bitcoin ecosystem and moving dollars around for arbitrage. In other words, it is an implicit measure of liquidity in bitcoin.

We had been seeing $1B in net new USDC in circulation every week, but we just did $1B new issuance in a day! USDC now @ 18 billion in circulation.

— Jeremy Allaire (@jerallaire) May 20, 2021

Comparing USD and EUR Stablecoins

It is extremely interesting that the private sector seems absolutely uninterested in a digital euro! The largest digital euro is currently EURS, a token on ethereum, with a total supply of €67 million (not billion, million). Tether's digital euro is smaller than that, at only €40 million. As a comparison, Tether's digital gold token (XAUT) has a supply of 85,417 ounces, or $160 million.

Why is their no demand for a digital euro in the private sector, yet the European Central Bank (ECB) seems desperate to come out with their own CBDC? We'll let you connect those dots, but it isn't because the euro is competitor to the dollar.

Miscellaneous

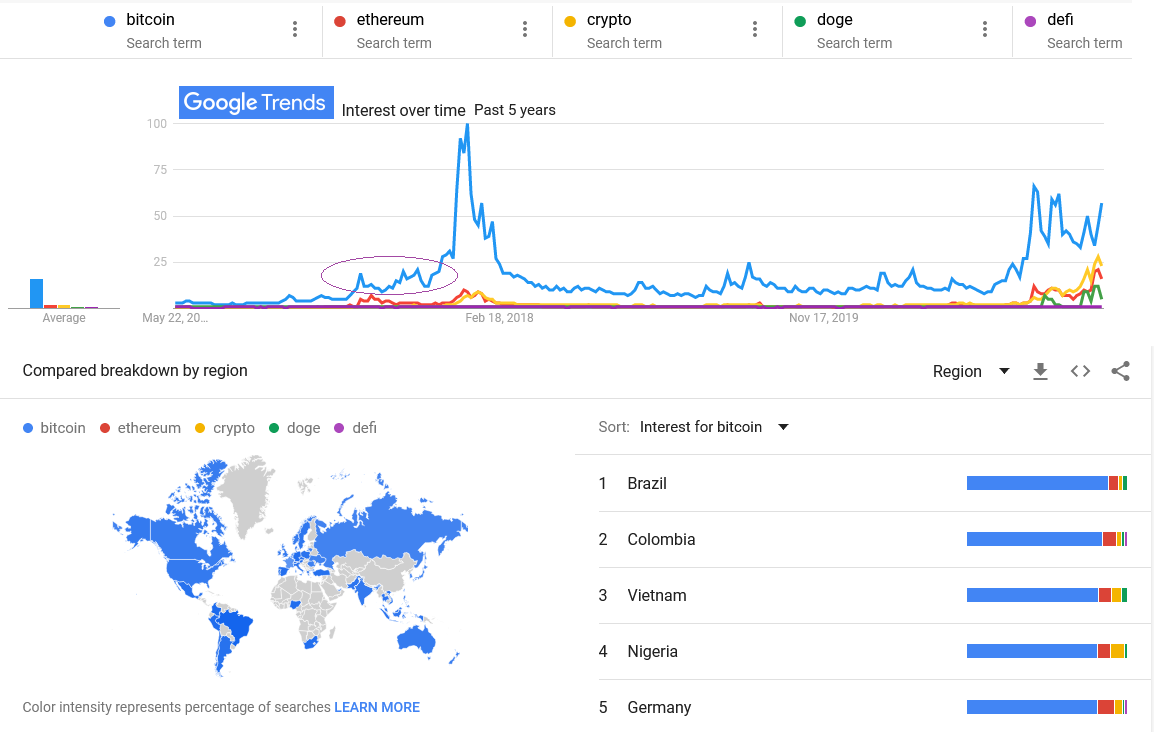

Google search interest involving bitcoin has been rivaling the interest from the 2017 blow off top. The big difference between now and back then however, is that these elevated levels have persisted for nearly six months, compared to two months in 2017.

It appears we could be experiencing an elevated interest level prior to the blow-off top, similar to the circled area in 2017. Once the bitcoin price breaks the ATH again in a few months, expect search interest to go parabolic.

What is even more surprising is "ethereum" and "crypto" have already broke their ATHs with "doge" outpacing ethereum for a short period of time. And, you can't see it on the chart, but we included "defi" (decentralized finance), currently the flavor of the month as THE killer app for ethereum, yet it doesn't even register!

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

May 21, 2021 | Issue #142 | Block 684,439 | Disclaimer

Meme by @RD_btc