Fundamentals Report #146

This week we deep dive into the El Salvador drama with the World Bank and IMF, give a price analysis update, mining, defi rug pull of Mark Cuban, an more!

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

This week's Bitcoin & Markets content

Get the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $36,447 (-$280, -0.76%) |

| Market cap | $683 billion |

| Satoshis/$1 USD | 2,743 |

| 1 finney (1/10,000 btc) | $3.64 |

| Median fee confirmed (finneys) | $1.80 (0.49) |

| Market cycle timing | Beginning second half of bull market |

| Weekly trend | Strong consolidation |

| Media sentiment | Neutral |

| Network traffic | Low |

| Mining | Steady decline |

Market Commentary

World Bank vs El Salvador

What do you get when a poor country reaches out to the World Bank for help implementing a technical solution to better its people's circumstances? It gets shot down by the archaic organization of the previous era.

The World Bank's work is "to end poverty and boost prosperity for the poorest people", guided by three priorities, "helping create sustainable economic growth, investing in people and building resilience to shocks and threats that can roll back decades of progress." It is a fading organization who has so obviously failed in its goal, and is facing the end of its life due to the slow rise of populism and the end of the expansion of globalization.

Bitcoin is the best performing asset on the planet for 12 years. It is the anti-World Bank. Multiple internal economic crises in Bitcoin have made it stronger, not weaker like the legacy fiat regime, which weakens and slows with each crisis. Bitcoin is in the process of erupting with technical capability and economic green shoots as the old system is caught in stagnation, supply chain collapse, and increasing military threats.

Bitcoin is about it hit its stride, and El Salvador is blazing the trail that many more will follow this year. This new currency is not as risky as holding 99% of debt securities and government bonds. It is an uncorrelated asset, meaning a crash in the stock market or a steep global economic downturn has little affect on it. And very importantly, it cannot be debased or weaponized by a central power to achieve political ends.

El Salvador is a sovereign country which has approved the use of Bitcoin as legal tender as a sensible way to improve the lives of the "the poorest people" in its borders. They face the steep logistical challenge of implementing the infrastructure, since every business and legal contract will be required to settle in bitcoin if at all possible alongside the US dollar. El Salvador reached out to the World Bank, and what is the response they got? No.

The World Bank is beholden to the monetary powers that be. Their real mission seems to be not about ending poverty, but playing a part in a monetary competition to maintain the status quo.

IMF

The IMF is also thinking about denying a $1bn 3 year loan to El Salvador to help meet budget shortfalls, due to this move with Bitcoin. "Adoption of bitcoin as legal tender raises a number of macroeconomic, financial and legal issues that require very careful analysis," said Gerry Rice, an IMF spokesman, during a scheduled press briefing.

The legal issues are very interesting, but first, El Salvador fired back that bitcoin was not the sole legal tender. That they would not stop having the US dollar as legal tender, with bitcoin being a new technology they are trying alongside the USD.

No news has been released about the outcome of the El Salvador-IMF negotiations. It does not matter for bitcoin either way, it is the IMF that has something to lose from this. If they deny the economic loan at this point, it will be interpreted as a highly monetary competition-based, incumbent decision, without the regard for the people of El Salvador. All appearances of the IMF being well-intentioned and unbiased will be lost.

Others will follow

One of our main pillars in our geopolitical view of the future is the decline of globalization. Supply chains will shrink, the world will become broken up in regions of influence. In this process, many nations that benefited from globalization and imposed free trade by the Americans post-WWII become known as "emerging market". They face the very real threat of becoming "third-world countries" again, in a globalization breakdown.

It is no wonder that emerging markets are the first to see bitcoin adoption as "not getting left behind", where major economies, at the top of the status quo, view it as a threat. El Salvador was the first, but since politicians from Panama, Paraguay, Brazil, and Argentina have jumped in the ring, promising to raise the issue and get bitcoin adopted in their countries as legal tender as well.

More Developments

In a weird twist of fate, it turns out the World Bank is required now to accept bitcoin, too, by their Charter. Section 12 of Article V defines acceptable “forms of holdings of currency” as follows, via Forbes:

The Bank shall accept from any member, in place of any part of the member's currency, paid in to the Bank under Article II, Section 7 (i), or to meet amortization payments on loans made with such currency, and not needed by the Bank in its operations, notes or similar obligations issued by the Government of the member or the depository designated by such member, which shall be non-negotiable, non-interest-bearing and payable at their par value on demand by credit to the account of the Bank in the designated depository.

And the biggest fallout could be that bitcoin is now backdoored into the US law definition as "money" like the Euro or Yen instead of treated as a capital asset for tax purposes).

2/ In US law “Money means a medium of exchange currently authorized or adopted by a domestic or foreign govt." Historically money has always been tangible tho (or convertible into tangible, ie paper). But you guys--look at p. 34--the new proposal is to recognize INTANGIBLE MONEY!

— Caitlin Long 🔑 (@CaitlinLong_) June 16, 2021

SHARE our content with friends and family!

Quick Price Analysis

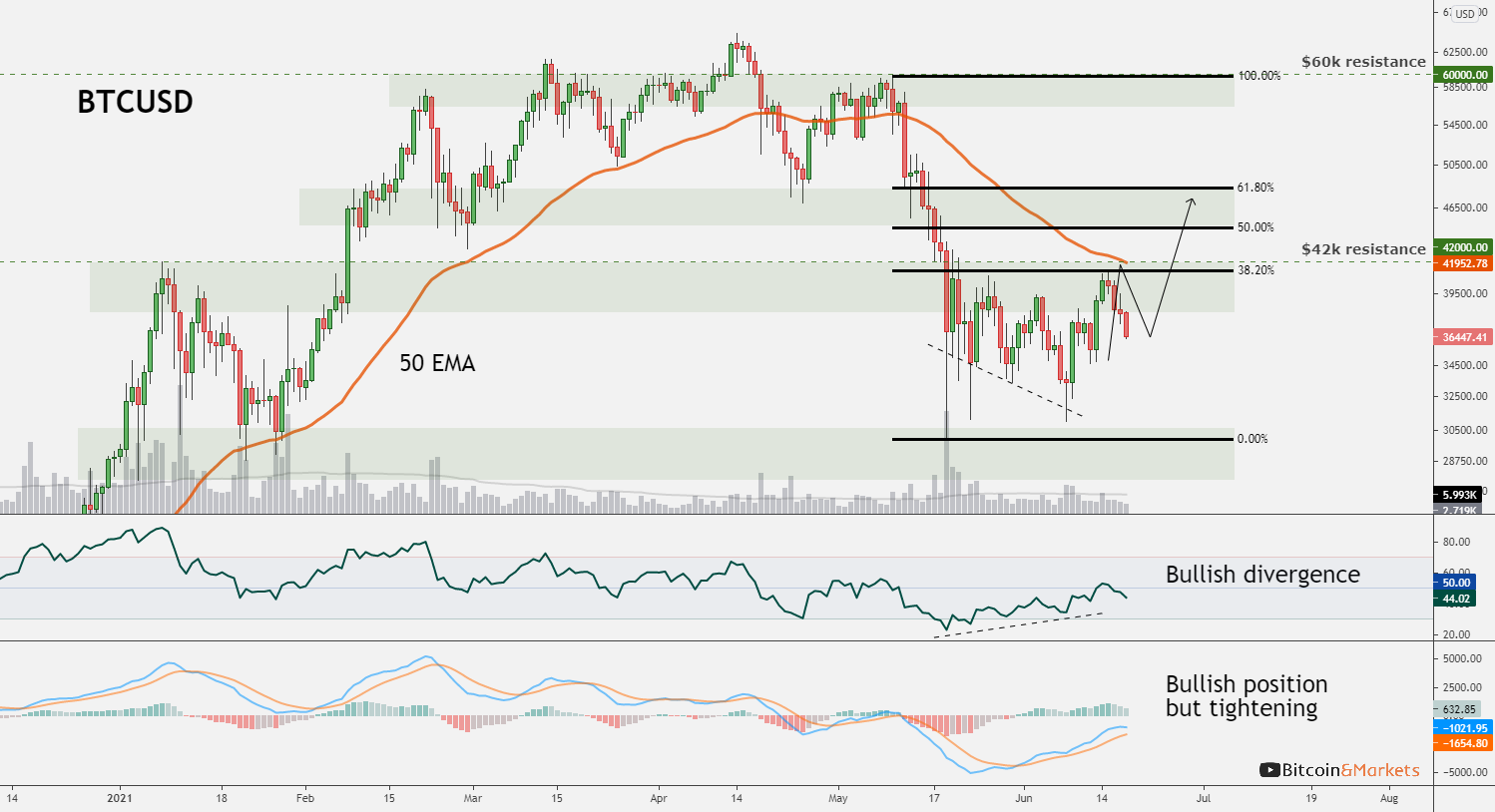

Weekly BMI | 1 : Slightly bullish

Become a paid member to access our much more in depth technical analysis and member newsletter.

First off, you might have read the contrary, but the Fed's FOMC meeting did not have a notable affect on bitcoin. As explained above, bitcoin is an uncorrelated asset. The legacy system is in stagnation and decline, is extremely fragile, and out of ammo, while bitcoin is dominated by its own cycles. The Fed moving a few dots on a report and increasing the very niche reverse repo rates from zero to 5 bps (0.05%) has caused all this alarm? That is not the reaction of an economy in a strong inflationary expansion, it is a sign of doubt and depression in the monetary system.

As for bitcoin itself, we remain quite bullish. The momentum to the downside was broken and we are awaiting significant confirmation. However, the technicals are not wildly bullish. Shorts are at a 12-month high, price could not break the 50 EMA, volume never confirmed a reversal, MACD is tightening, etc.

There are bullish technicals, as well as almost all fundamentals are bullish, which is why we think the next major resistance area is $45k to $48k. It is highly likely that we have a decent move in the next week. Become a member for more detail on exactly the indicators we are watching.

Development

Taproot Has Locked-in!!

Read more in the Bitcoin Magazine write up. It's short and sweet. Bottom line, this is a big upgrade for bitcoin and a relatively low drama upgrade process. Congrats bitcoiners! We get a new class of capability in November when it activates.

Taproot will make Bitcoin’s smart contract features more compact, potentially more private, and in some cases a bit more flexible. As a soft fork, the upgrade is backwards compatible as long as a majority of miners enforce the new rules.

Taproot really consists of two big upgrades rolled into one. The first is the introduction of Schnorr signatures. Many cryptographers consider the Schnorr signature scheme to be the best in the field, as its mathematical properties offer a strong level of correctness, it doesn’t suffer from malleability and it is relatively fast to verify. The most notable benefit in the context of Bitcoin, however, is that Schnorr’s “linear math” enables a new class of smart contracts, where tweaks to a signature can be used to embed various spending conditions.

Mining

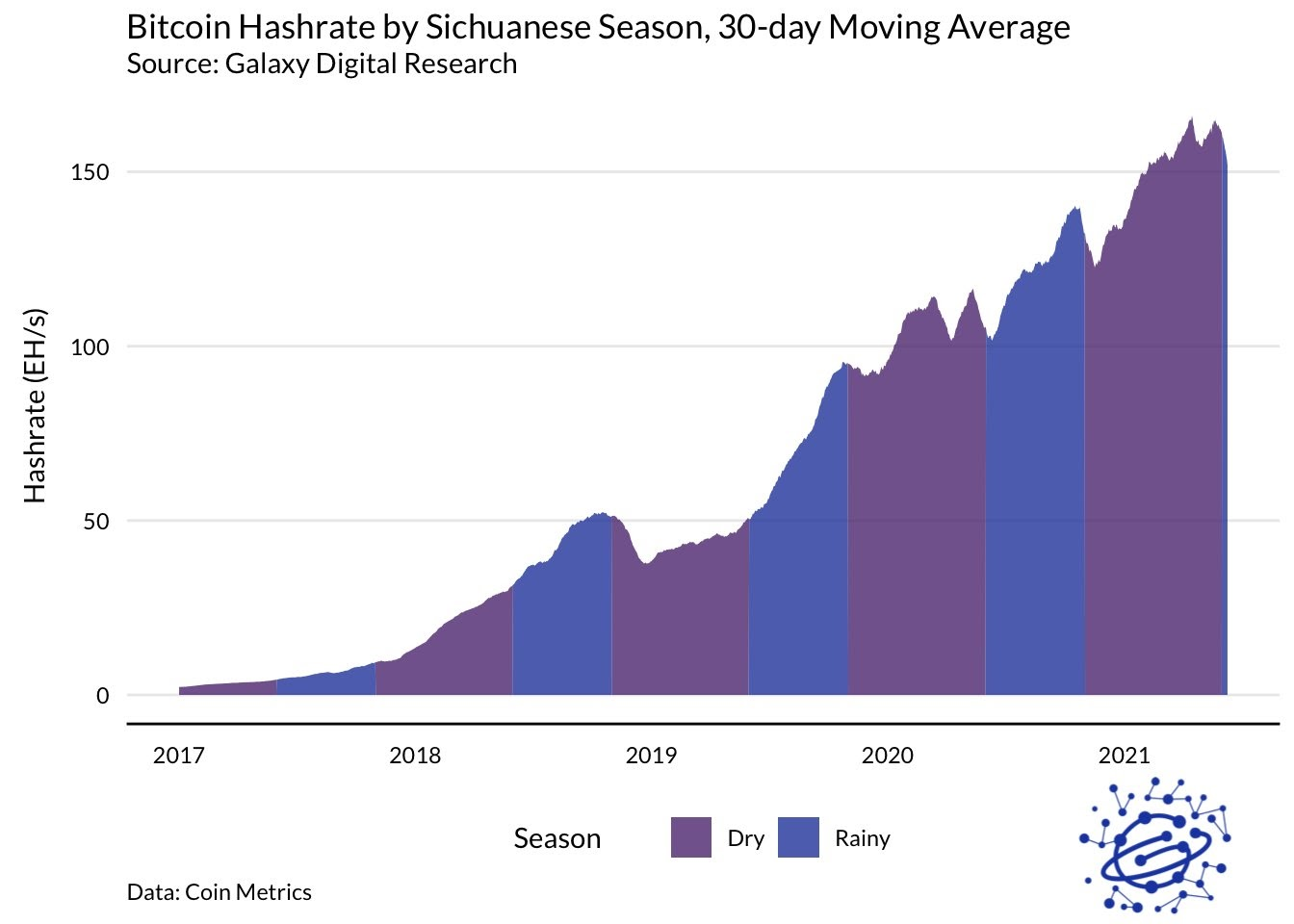

Miners were mining half-full blocks this week as the mempool remained clear for several extended periods of time. The difficulty adjusted down last Sunday by 5.3% and is currently trending down another 5-10%, estimated to adjust in approximately 10 days. One explanation for the drop in hashrate is miners relocating their hardware in the Sichuan region in China to take advantage of cheap energy from their rainy season.

Galaxy Digital Research created the chart below showing the rainy season overlaid with the hashrate. There is also still a microchip processor shortage plaguing all industries, which is expected to continue through the end of the year.

CBDC / Stablecoins / Altcoins

Billionaire Mark Cuban was rug-pulled, losing 100% of his investment in the defi project Iron Finance. I wonder who could have seen that coming.

For beginners, defi is not decentralized or secure. Millions of dollars a week are lost in these projects as they've become a playground for hackers (even inside jobs). Each time this happens the central planners in control of the project step in and freeze the smart contract or even change balances. Even this however, cannot save them, because they usually deal with multiple tokens that are hacked and moved. Iron Finance has central control over their project, but those other coins which many balances within their system depended are controlled by another.

If these projects have a very high bar, they must be bug free, work 100% of the time, no exceptions. If not, one exploit could cause a catastrophic collapse as with Iron Finance. The higher the value contained in their system, the more of a honeypot it becomes. Even Ethereum succumbed to the temptation of centralize control. During the DAO drama in 2016, the central powers of the ethereum network did what they called a "surgical irregular state change", in other words, they stole coins from a specific targeted political enemy with their central power.

The reason there is so much interest in defi, despite their obvious flaws, is because bitcoin is so rock solid and revolutionary. These scams sell their tokens to beginners and laymen, while bitcoin space veterans scream to stay away. Mark Cuban in this case, thought he was smarter than the Bitcoiners warning him it was all a big scam. Now he is calling for regulation of defi.

It is possible this happens, because like we said, defi is centralized. It cannot happen to bitcoin, but bitcoin is true "decentralized finance."

Miscellaneous

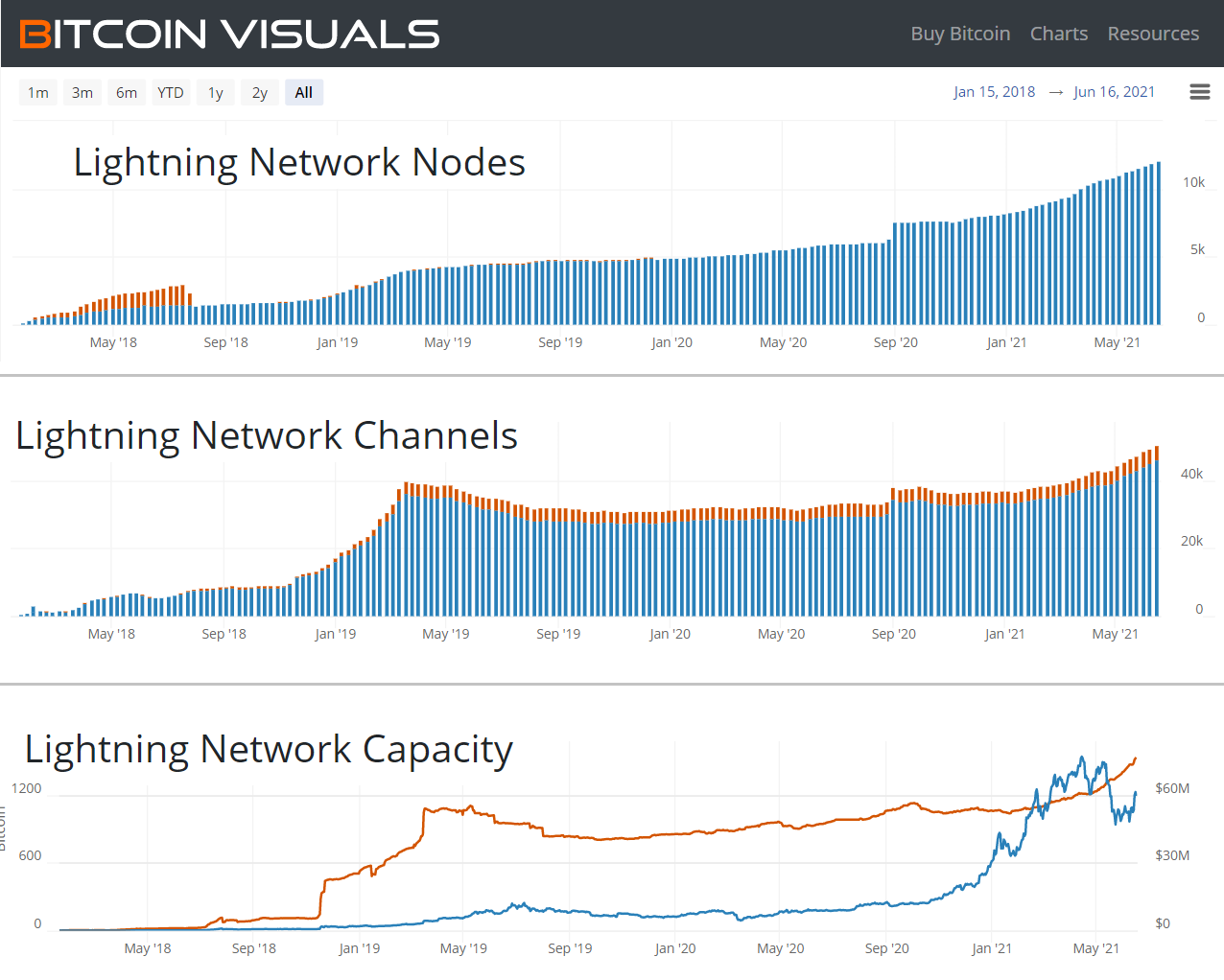

Here is a snapshot of the public Nodes, Channels, and Capacity on the lightning network. We stopped tracking this data a couple years ago because a lot of the network is private and does not show up, so we didn't think it was a useful metric. However, with El Salvadorians starting to not only use bitcoin, but use bitcoin on the Lightning network, we thought it'd be useful to see how the public stats look at the beginning of their venture.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

June 18, 2021 | Issue #146 | Block 688,094 | Disclaimer

Meme by @BTCshopMiami