Bitcoin Fundamentals Report #148

A relatively slow week for bitcoin compared to recent weeks. We summarize all the relevant sectors of bitcoin and CBDCs this week.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

This week's Bitcoin & Markets content

- (podcast) Reverse Repo, Fed, and Bitcoin - FED 54

- (member) Evening drop Wednesday Was that the bottom? - Bitcoin Pulse #113

Get the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $33,055 (-$1628, -4.7%) |

| Market cap | $618.6 billion |

| Satoshis/$1 USD | 3,025 |

| 1 finney (1/10,000 btc) | $3.30 |

| Median fee confirmed (finneys) | $4.89 (1.48) |

| Market cycle timing | Beginning second half of bull market |

| Weekly trend | Likely bottomed |

| Media sentiment | Negative |

| Network traffic | Low |

| Mining | Dramatic shift |

Market Commentary

After the last few weeks of excitement, the Bitcoin space was relatively quiet at the moment. The quiet before the storm if you will. The main news centered around mining once again, which we cover in depth below in the Mining section. There were also several minor regulatory developments, like a new German law allowing "special funds" to invest up to 20% of their portfolios in bitcoin, the giant exchange Binance is being attacked in the UK and Thailand by regulators, and South Africa to tighten regulations after the recent $4 billion exit scam there. Lastly, Victoria Nuland, U.S. undersecretary for political affairs, US deep state lackey of Ukraine fame, visited El Salvador. What was said is unknown, but it was surely done to apply pressure over their bitcoin as legal tender law.

Overall, the two main factors in sentiment right now are the general uneasiness around the mining situation and the industry collectively holding its breathe for the expected government push back after recent week's hugely bullish news.

We don't expect the major economies to do much of anything against bitcoin other than try to influence or strongarm the situation. They will not come out with dramatic regulations against it. They are stuck in a Catch 22. If they come down hard on bitcoin, they admit it is working and a significant threat. They also know they will be exposed when their rules slide right off bitcoin's back and it continues moving forward.

Fundamentals are soft but not weak, price is soft but not weak, bitcoin is adapting. Many things are aligning for the bears right now, yet price is hanging in there. When everything is looking grim, the slightest improvement is a trend change, and bitcoin can move quickly to the upside.

SHARE our content with friends and family!

Quick Price Analysis

Weekly BMI | 2 : Bullish

Become a paid member to access our much more in depth technical analysis and member newsletter.

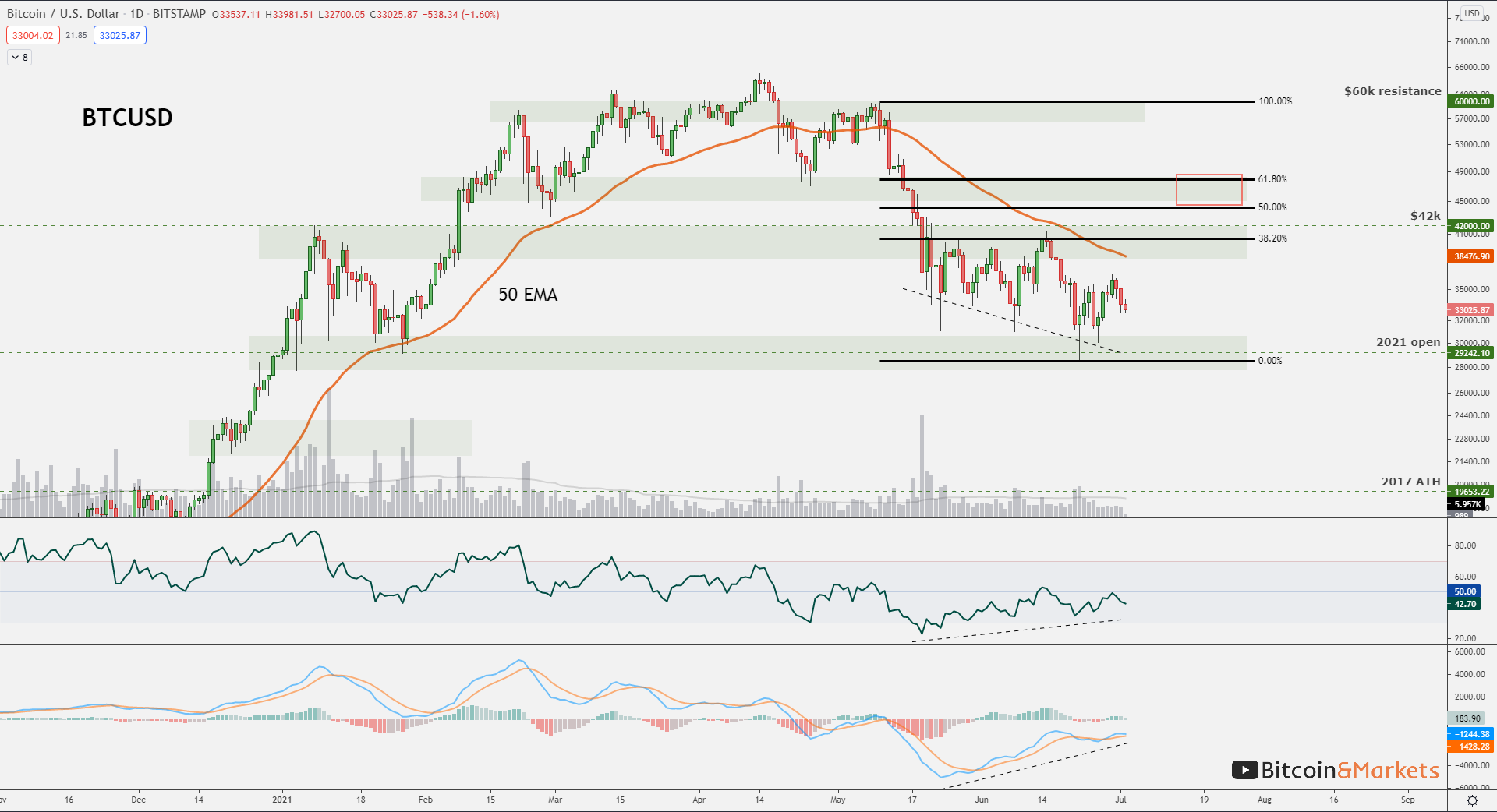

There are several signs of bitcoin bottoming here. In the past, bitcoin typically bottomed in a massive capitulation wick, meaning a strong bounce, not giving people more than one chance to buy the lowest part of the dips. This time, we had a massive capitulation candle, larger than any in the 2017 bull market, but we haven't bounced back as vigorously.

There could be several reasons for that: 1) increase in perceived regulatory threat, 2) market disruption from China, 3) different demand profile (less dominated by retail YOLO), 4) (related to #3) professional traders are changing top and bottom behavior. Of course, all of these things are influencing price, but we tend to lean more toward the latter two. A bigger market, less retail influence, more cautious professional traders.

The price levels to watch for are $31.6k on downside. Below that, we could be looking at new lows pretty quickly. To the upside, $38k will have some resistance. Above that level, we could begin the breakout to our near-term target area of around $48k.

Much more available on Wednesday's Bitcoin Pulse. Become a paid member to get full access to all posts.

Mining

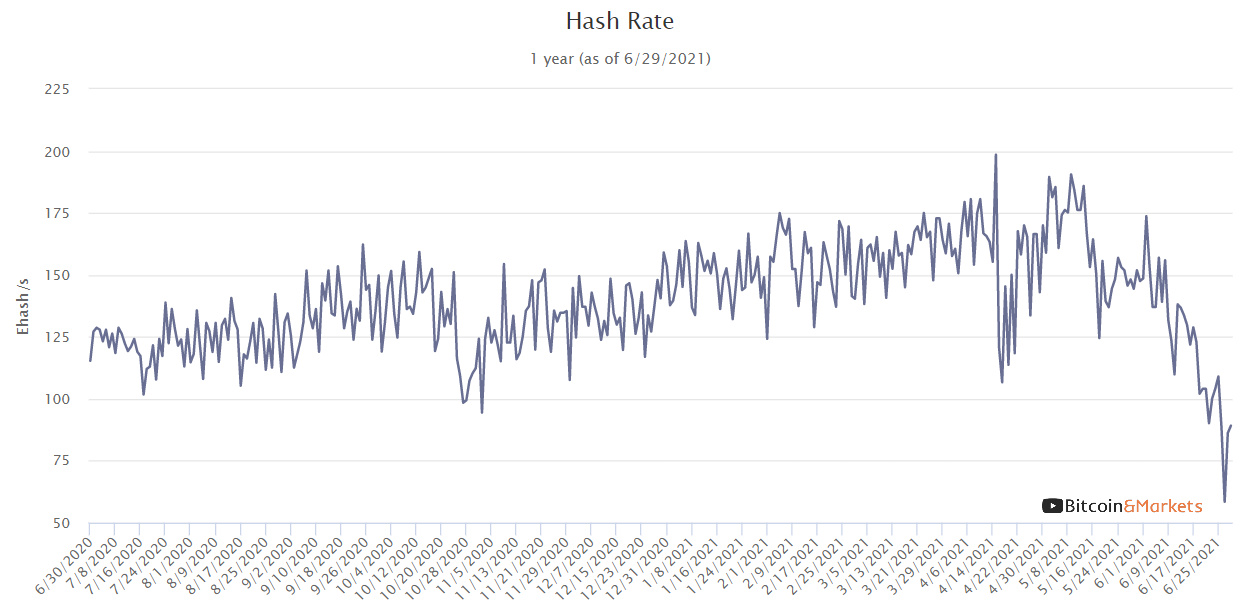

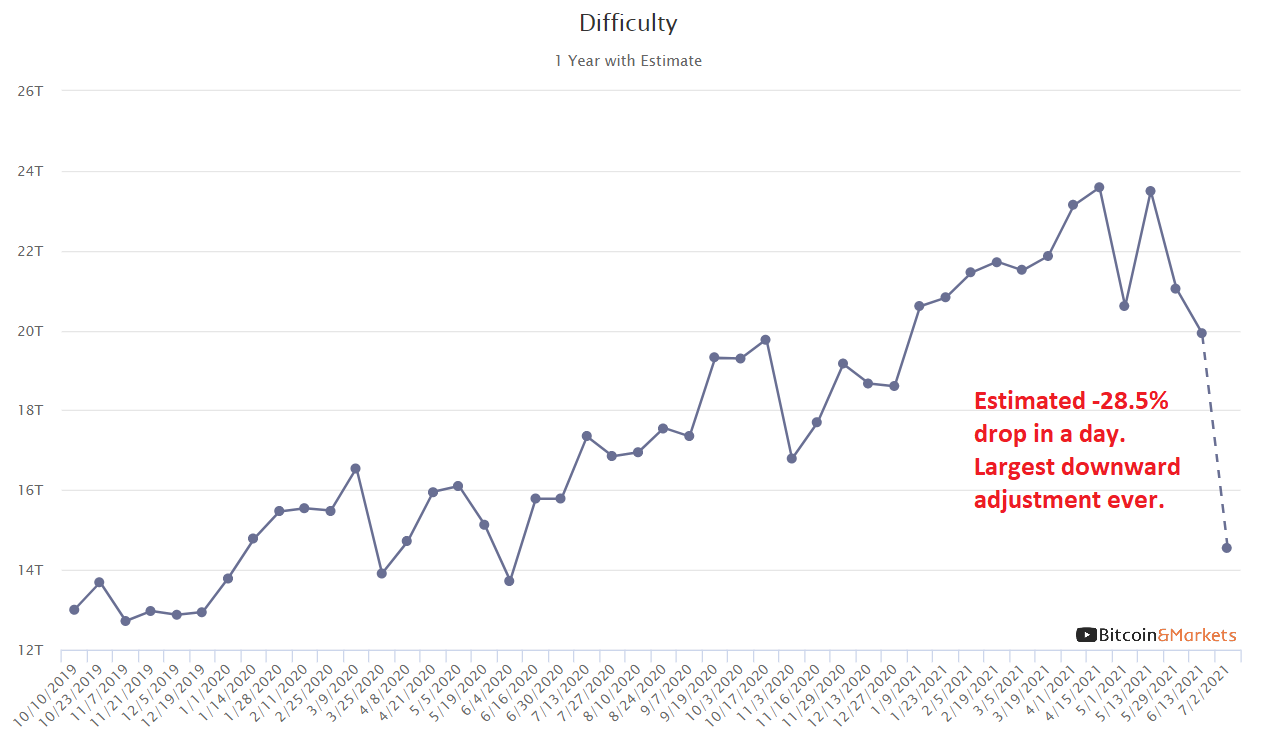

WOW! This is something new even for the OG's in the space. Hash rate has completely fallen off a cliff. We have been writing about this every week for months now, the chip shortage that is affecting the entire world has hit bitcoin quite hard, and then we have this Chinese ban on mining.

Again, we must reiterate that the Chinese ban on mining is a huge positive for bitcoin. Even this temporary crash in hash rate, as mining machines leave China, has had minimal effect on the network. Fees are manageable and the mempool is relatively low on a historical basis. However, these are personal concerns, there is no actual damage done to the network by this move from the CCP. Bitcoin is designed to flex and adjust to changing circumstances, whether it be natural market distortions or a malicious attack.

It is a huge positive for several reasons: 1) it proves the elegant design works as intended, 2) mining is geographically and jurisdictionally diversified, 3) future attacks from the CCP are mitigated in one fell swoop.

The hash rate is going somewhere; so far, the US and Kazakhstan appear to be the big beneficiaries. When hash rate comes back online in a big way in the next few months, it will be a huge boost to confidence.

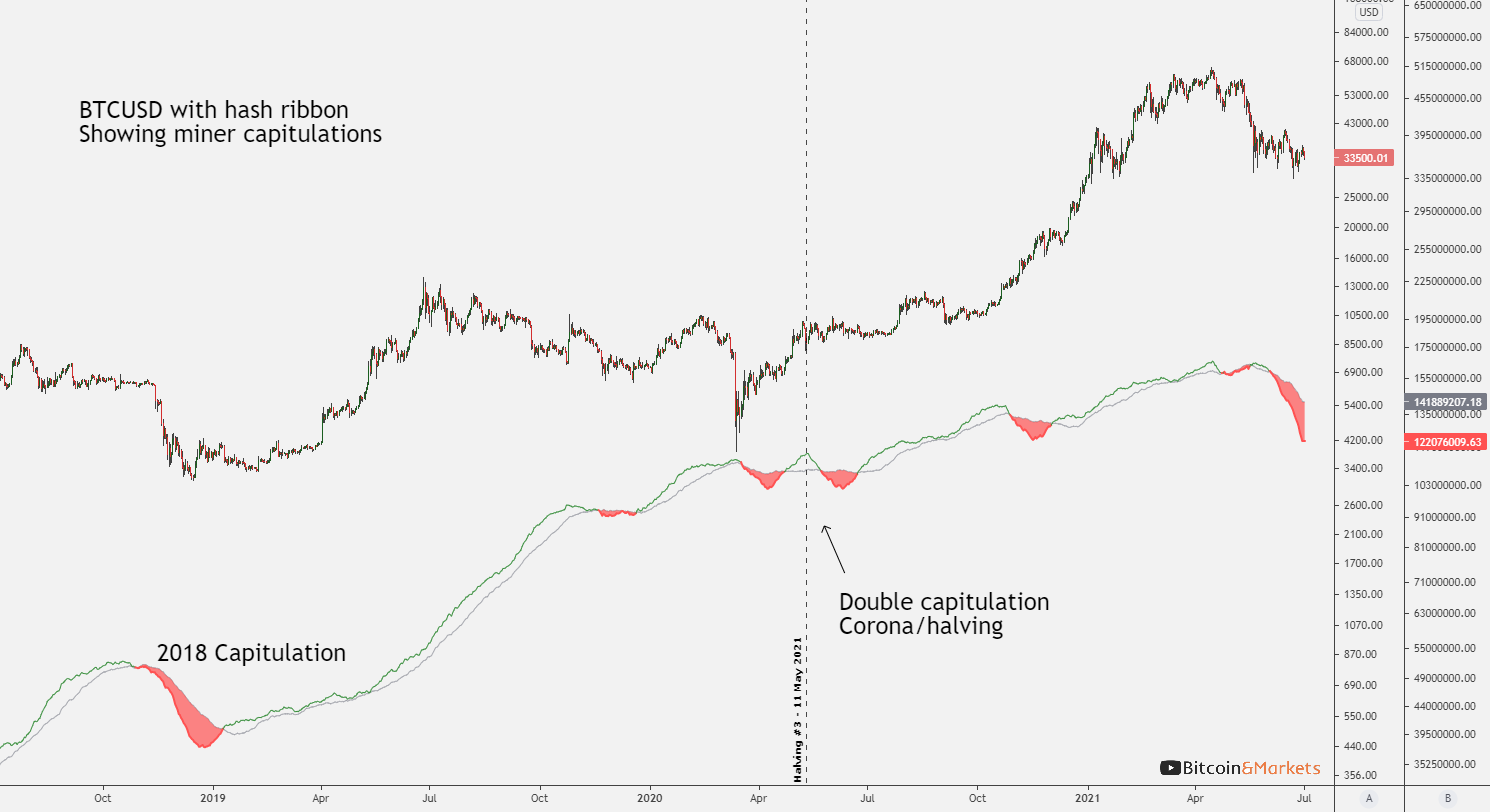

Hash Ribbon

This chart could be included in the Mining or the Price section. This is the Hash Ribbon, and indicator on tradingview, consisting of moving averages of the hash rate and difficulty. The red areas show times which miners are capitulating due to high cost or other circumstances.

Interestingly, these capitulation episodes tend to coincide with market bottoms.

CBDC / Stablecoins / Altcoins

Randal K. Quarles, Vice Chair for Supervision at the Fed and Chair of the Financial Stability Board (FSB) gave a speech this week on CBDCs. We were impressed by the common sense showed in the speech to stablecoins and CBDCs. The Fed is by far the most far along in understanding stablecoins and CBDCs out of all the central banks, but they still leave some to be desired in their understanding of bitcoin.

Below are some excepts, but it would be a good one to read the full transcript.

A wide range of experts and commenters have suggested that the Federal Reserve should issue—and in fact may need to issue—a CBDC. But before we get carried away with the novelty, I think we need to subject the promises of a CBDC to a careful critical analysis.

My first observation is that the general public already transacts mostly in digital dollars—by sending and receiving electronic balances in our commercial bank accounts. These digital dollars are not a CBDC, because they are liabilities of commercial banks rather than the Federal Reserve.

I am skeptical that the Federal Reserve has legal authority to pursue either of these CBDC models without legislation.

I think it's inevitable that, as the global economy and financial system continue to evolve, some foreign currencies (including some foreign CBDCs) will be used more in international transactions than they currently are. It seems unlikely, however, that the dollar's status as a global reserve currency, or the dollar's role as the dominant currency in international financial transactions, will be threatened by a foreign CBDC. The dollar's role in the global economy rests on a number of foundations, including the strength and size of the U.S. economy; extensive trade linkages between the United States and the rest of the world; deep financial markets, including for U.S. Treasury securities; the stable value of the dollar over time; the ease of converting U.S. dollars into foreign currencies; the rule of law and strong property rights in the United States; and last but not least, credible U.S. monetary policy. None of these are likely to be threatened by a foreign currency, and certainly not because that foreign currency is a CBDC.

In my judgment, we do not need to fear stablecoins. The Federal Reserve has traditionally supported responsible private-sector innovation. Consistent with this tradition, I believe that we must take strong account of the potential benefits of stablecoins, including the possibility that a U.S. dollar stablecoin might support the role of the dollar in the global economy. For example, a global U.S. dollar stablecoin network could encourage use of the dollar by making cross-border payments faster and cheaper, and it potentially could be deployed much faster and with fewer downsides than a CBDC. And the concern that stablecoins represent the unprecedented creation of private money and thus challenge our monetary sovereignty is puzzling, given that our existing system involves—indeed depends on—private firms creating money every day.

He goes on to bash bitcoin, but we'll leave you to read that on your own.

Miscellaneous

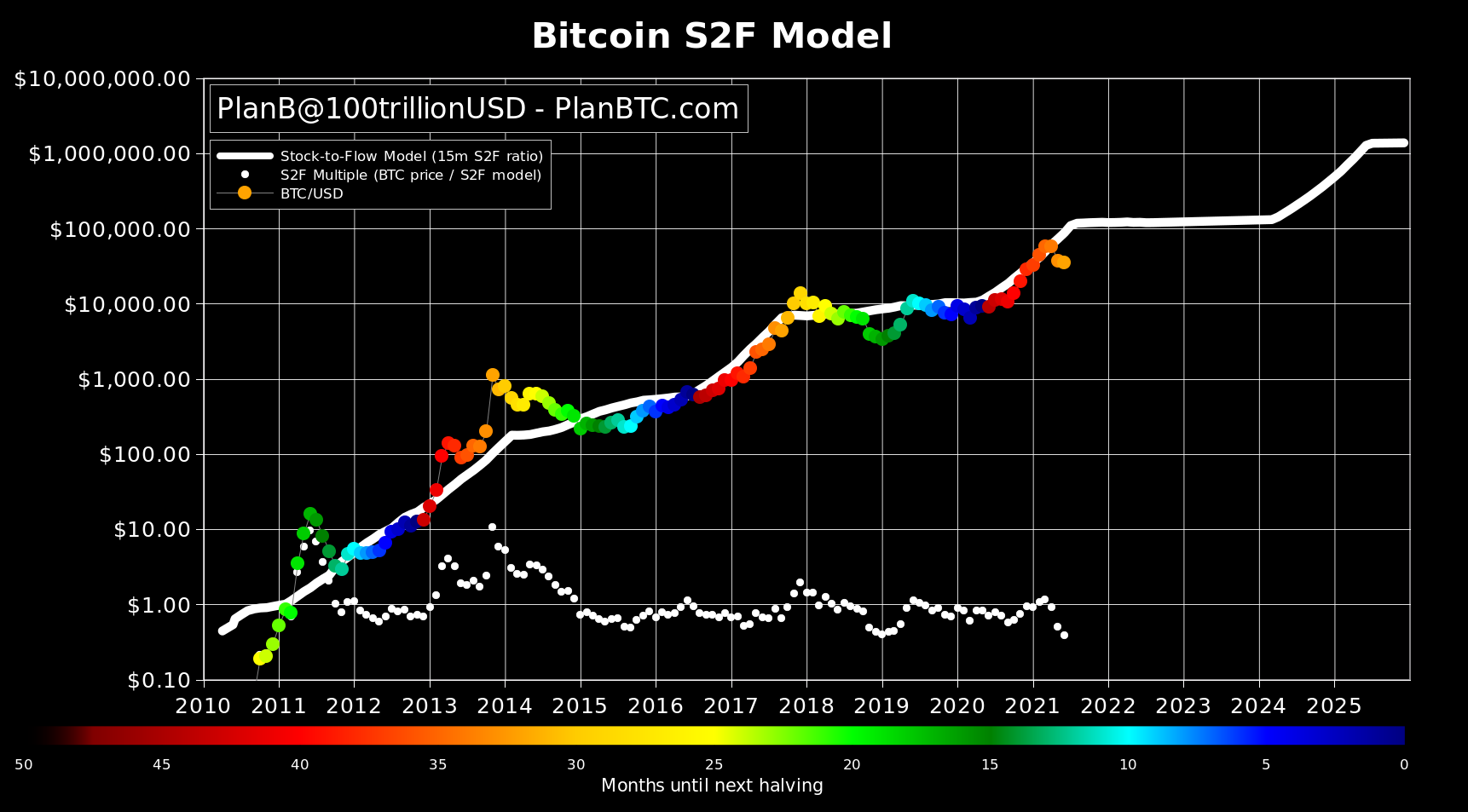

The price on Plan B's monthly S2F chart is about as far below the model's trend line as it was in January 2019. We believe bitcoin will have a monster second-half of the year, ending up saving the S2F model. But if not, we will consider the model as invalidated at the end of the year.

PlanB agrees, stating in a tweet:

June closing price $35,037 .. as far below S2F model as in Jan 2019. Next 6 months will be make or break for S2F (again).

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

July 2, 2021 | Issue #148 | Block 689,408 | Disclaimer

Meme by @fintechfrank