Bitcoin Fundamentals Report #150

This week we do a deep dive into the GBTC unlock and price predictions, as well as the return of bitcoin's hash rate. Big week ahead!

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

This week's Bitcoin & Markets content

- (podcast) The Fed Taper, CPI and Bitcoin - FED58

- (member) Models of Long-term Cycles - Bitcoin Pulse #114

- (article) How Bitcoin Will Impact El Salvador's Geopolitics

- Really proud of this 👆 one. Check it out and share please!!

Get the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $31,998 (-$2250, -6.5%) |

| Market cap | $601.4 billion |

| Satoshis/$1 USD | 3,116 |

| 1 finney (1/10,000 btc) | $3.21 |

| Median fee confirmed (finneys) | $0.77 (0.24) |

| Market cycle timing | Beginning second half of bull market |

| Weekly trend | Tightening range, decision time |

| Media sentiment | Neutral |

| Network traffic | Low |

| Mining | Stabilizing |

Market Commentary

People will realize hash rate is recovering in new more secure jurisdictions, at the same time they realize the GBTC unlock was just FUD. https://t.co/Wr4EBx1igZ

— Ansel Lindner (@AnselLindner) July 16, 2021

GBTC

Lots of stuff happening in the coming week. Last week, we wrote about GBTC and their upcoming unlocking. That is when their shares representing underlying bitcoin are available to be sold on the secondary market. This doesn't affect the spot market for bitcoin, except via hedging and arbitrage strategies.

There has been some build up around this unlocking event by some influencers in the space. We remain consistent that this will mostly be a non-event.

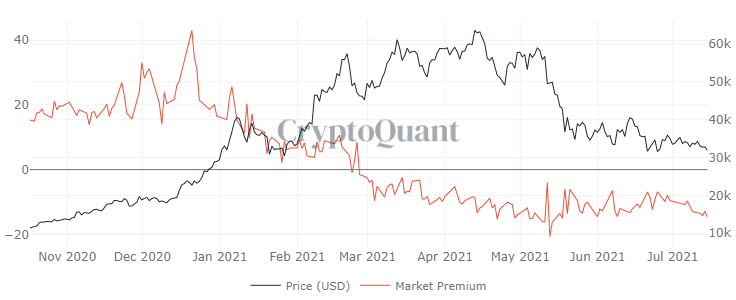

The claim is the discount, that is the % the GBTC share price is below the underlying value of the bitcoin, will hit 25%. Whales will then short spot and buy GBTC shares to harvest the spread.

At the time of writing, the discount is 15%.

The arbitrage strategy is sound, but that doesn't mean the bitcoin price has to go down. They are harvesting the spread as the discount shrinks. The only way the strategy loses money is if the discount grows. And now they've telegraphed the intention to use this strategy. Uh oh.

By adding more shorts to the spot market, a squeeze becomes much more likely. A short squeeze is when bulls force the price against overleveraged shorts, causing shorts to close or liquidate, adding fuel to a price rise.

Lastly, we'll mention the timing. Today is the last trading day for GBTC before the unlock on Sunday evening as markets reopen after the weekend. Unlike traditional markets where the underlying is also traded on old school trading hours, bitcoin is traded 24/7/365. That means the spot price could move significantly over the weekend, changing the discount and the calculus of the arbitrate trade. Stay tuned for some excitement.

Hash rate

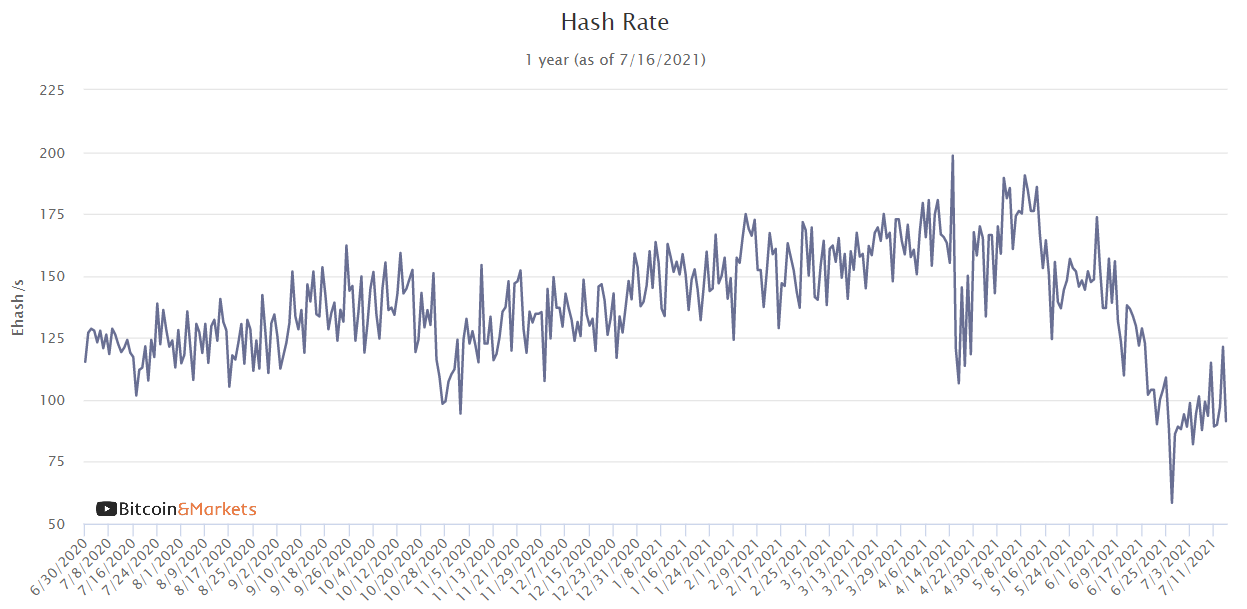

We cover more in the mining section below, but wanted to give an up front update on this as well.

Hash rate is coming back online as predicted. It is important to remember that Bitcoin was designed to be adjust to this kind of temporary shock. It might be concerning to see the hash rate drop by 50%, but it is well within Bitcoin's tolerance levels.

Despite the authoritarian crackdown on bitcoin mining in China, the network is perfectly healthy. There is no danger to the blockchain, transactions, or bitcoin's finality assumptions. That is the beauty of Proof-of-work mining - no one can capture required capital and rent seek. Miners must participate honestly to get paid. Unlike Proof-of-stake, where 50% of the stake being controlled would cripple the network.

This type of "attack" if you want to call it that, is precisely why bitcoin is decentralized. It is ruled by market conditions, and mining can be done anywhere with power and an internet connection.

There is nothing special about China. They rose to their prominent position in bitcoin mining because they stupidly built so much overcapacity in power production. That have power plants built for ghost cities that were left unused. Local officials got in on the game and could play the system. Bitcoin mining in China was a bubble that was inevitably going to pop. Now, Bitcoin can move forward and strengthen its geographic diversity.

SHARE our content with friends and family!

Quick Price Analysis

Weekly BMI | 1 : Slightly bullish

Become a paid member to access our much more in depth technical analysis and member newsletter.

Volatility is dropping fast. Price is approaching the end of a descending triangle, and even though this is usually a bearish pattern, right now in bitcoin it signifies decision time.

GBTC

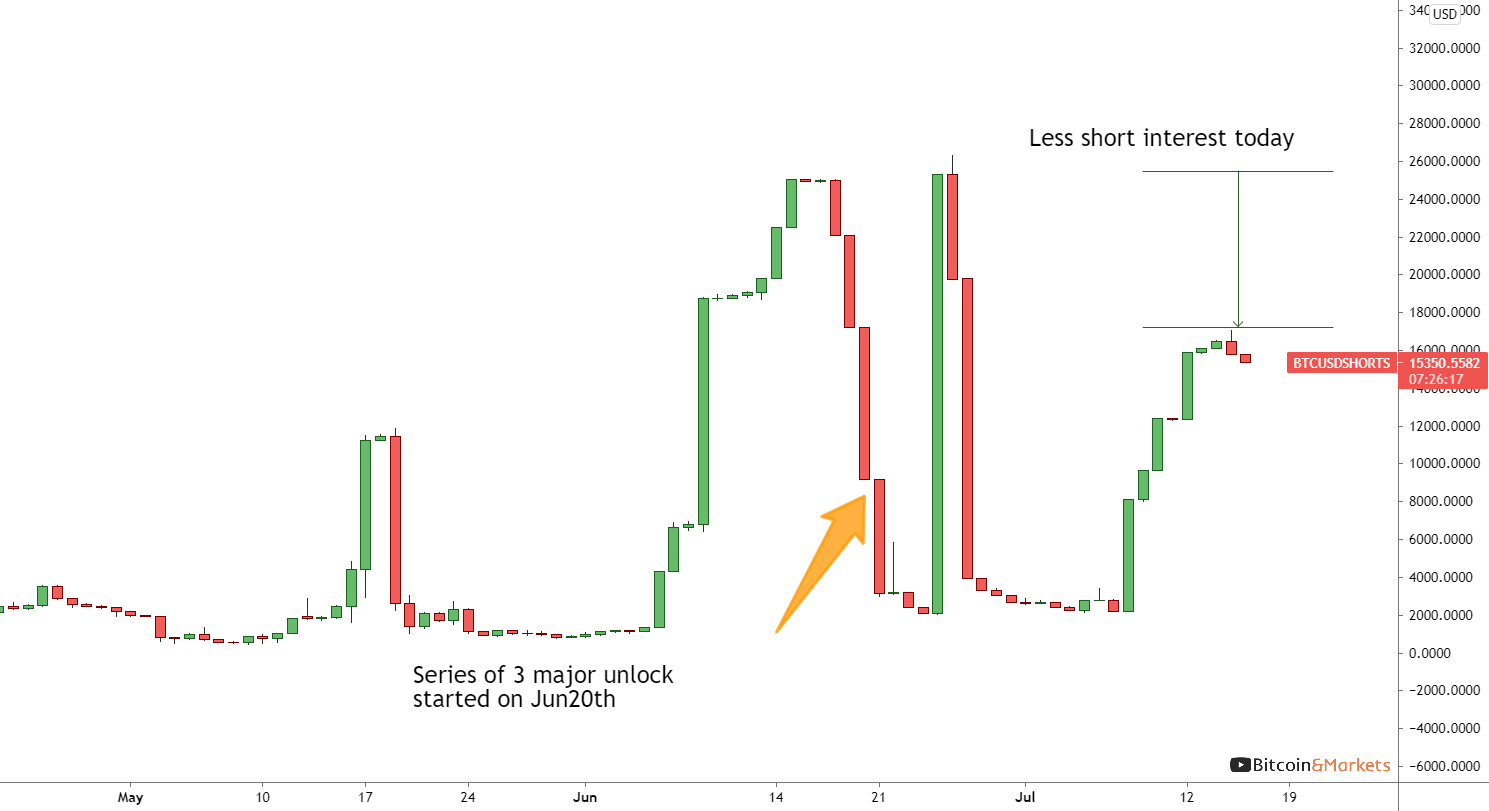

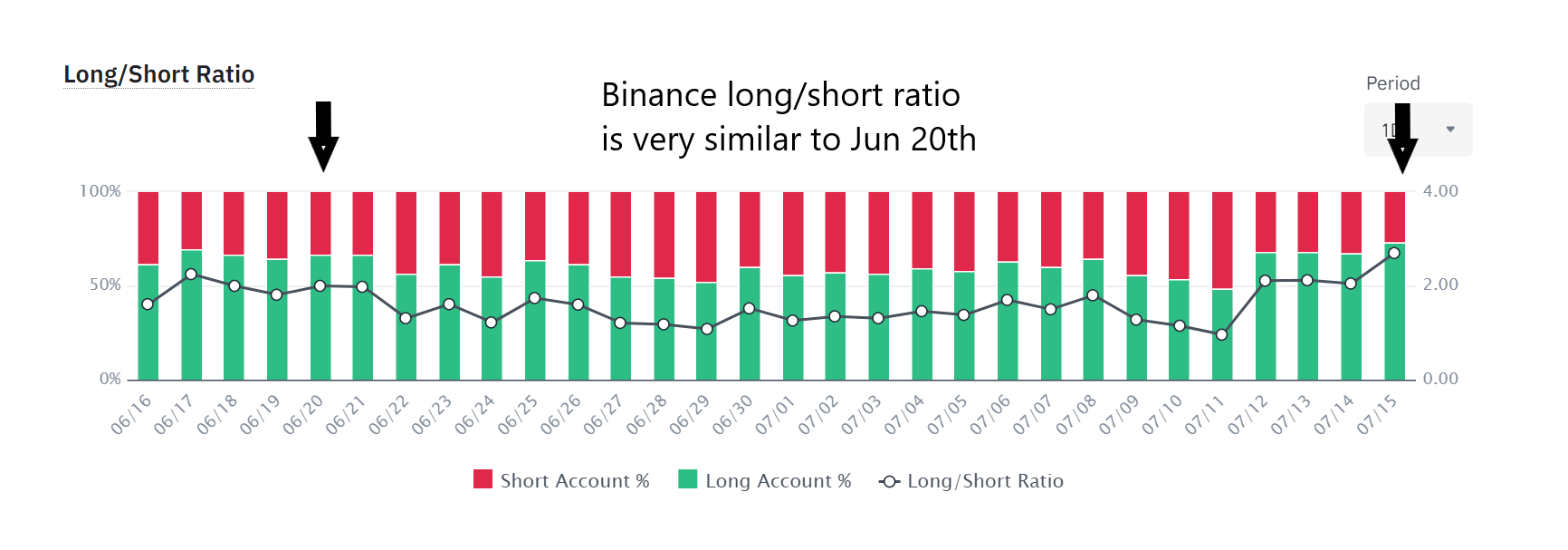

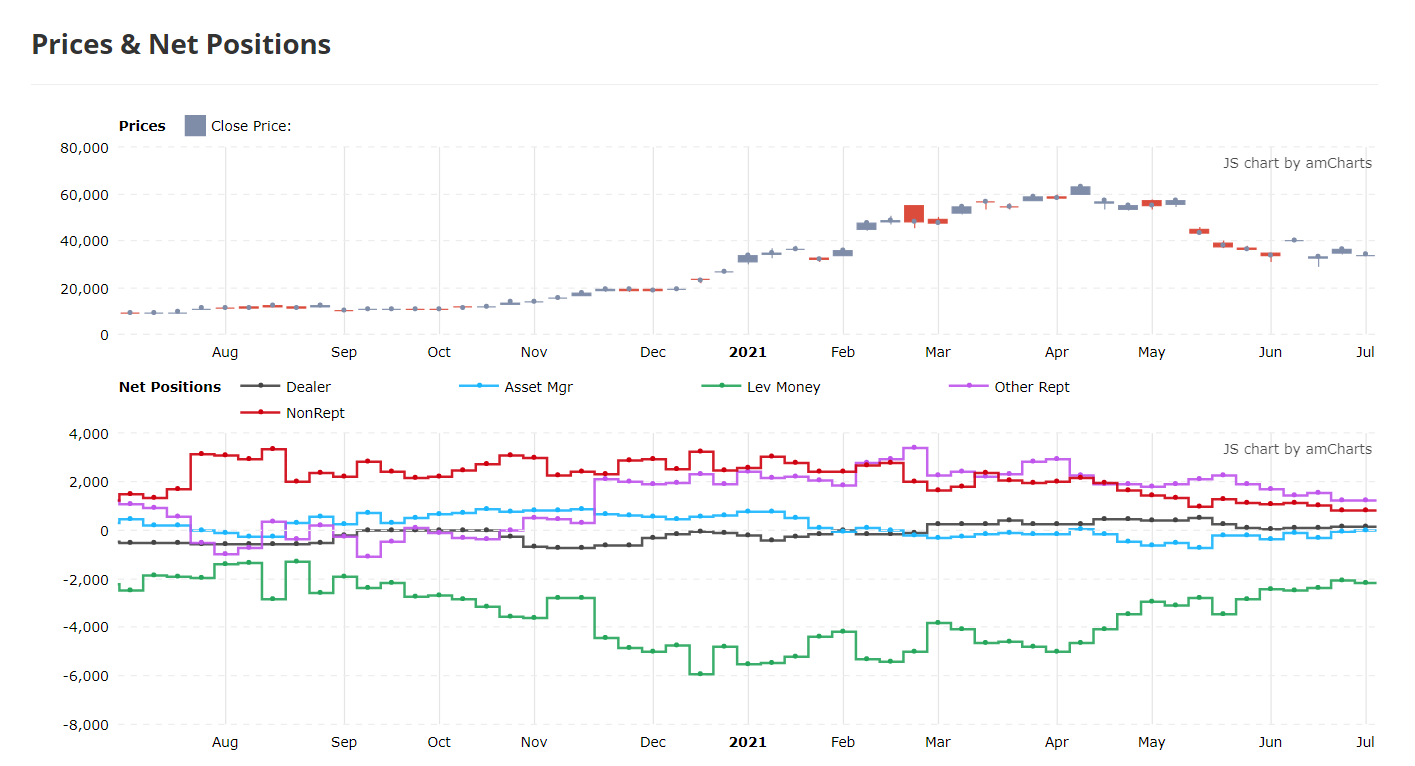

Following on from the GBTC discussion above, let's take a look at some charts. If the prediction that price will crash due to the arbitrage trade is true, we should see shorts increasing.

On Bitfinex, we see more shorts but fewer than around the last big unlocking series.

On the largest bitcoin exchange Binance, 72% of accounts are net long, similar to that last unlock on Jun 20th.

CME commitment of traders is net short, but decreasing not increasing.

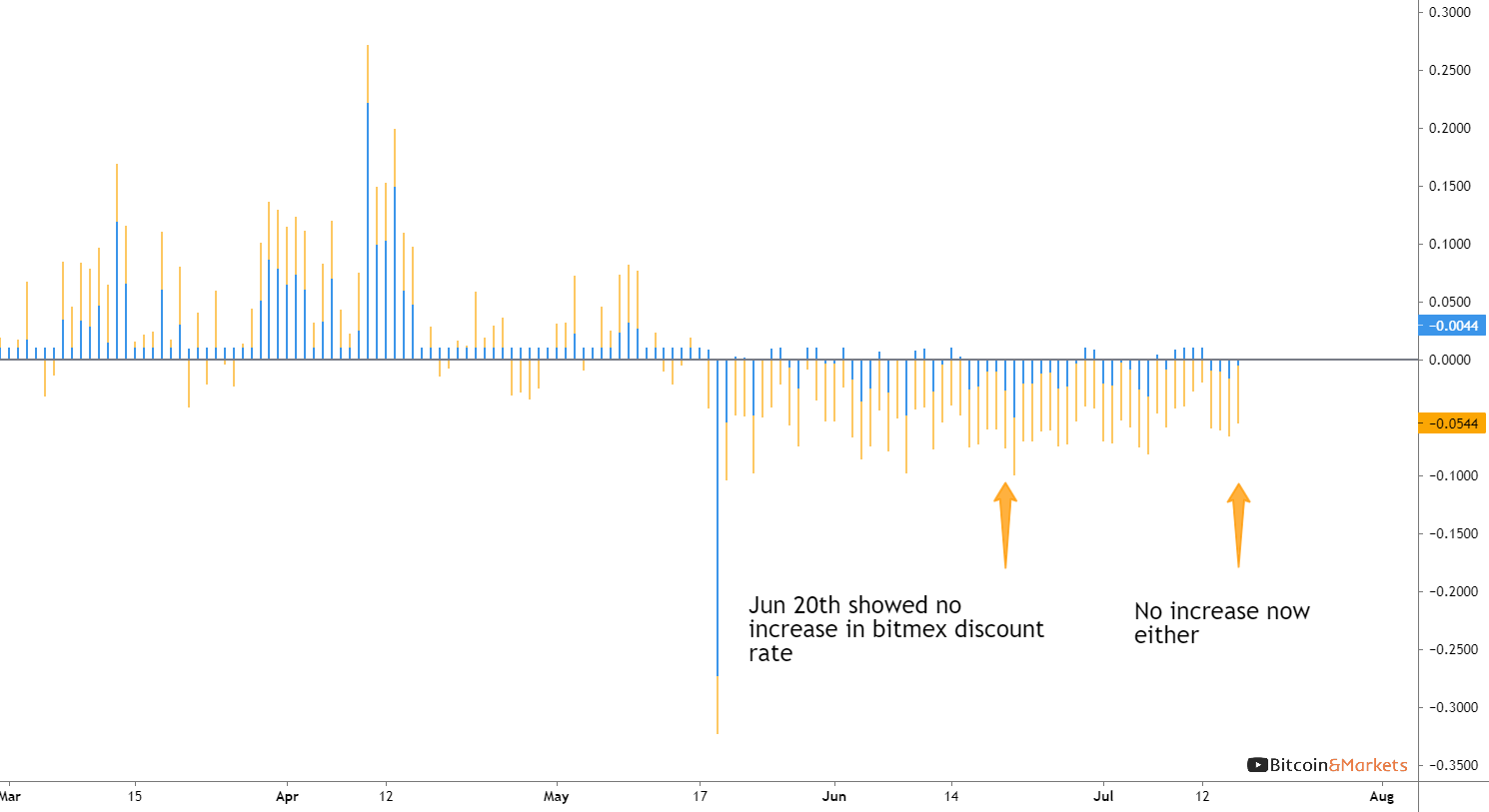

Bitmex funding rates are showing a bias toward shorts. They have been consistently negative (paying longs) since mid-May. But we don't see an increase in the negative funding, meaning shorts are generally flat.

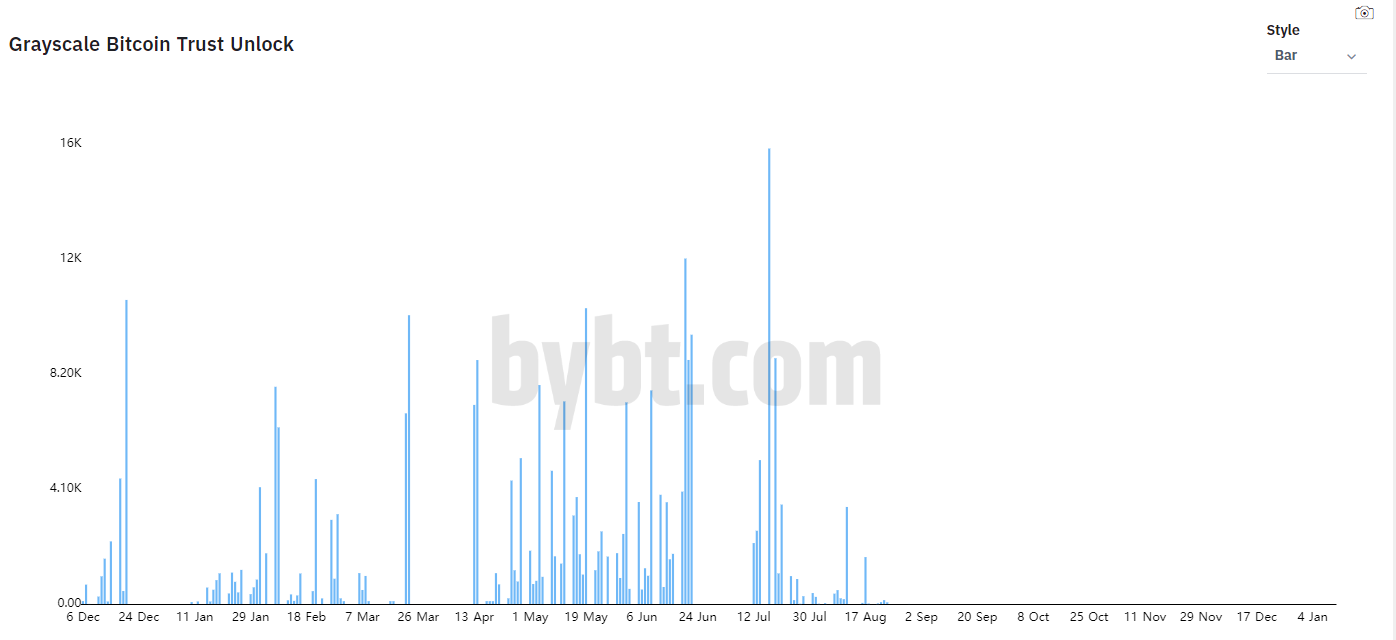

Lastly, the GBTC unlock schedule and our own price chart.

We've highlighted the period that corresponds to the huge series of unlocks from mid-April to the end of June. It does correspond almost perfectly to the period of negative price movement, but these numbers do not match with the prediction that billions of dollars have partaken in this trade and will partake again.

In conclusion, it is possible whales will do the arbitrage trade, and some evidence that it affected price the last two months. However, there is no evidence it is a primary market mover or that it will repeat this time. More likely, this last significant unlock has been priced in. What hasn't been priced in is the end of this process.

Mining

At this time last week, the next difficulty adjustment was estimated to be -9%, halfway through the adjustment period. Today, the adjustment is one day away and decreased to only -5%. This indicates the hashrate decline has stopped and started to returned to the network.

The mempool remains clear and transactions confirmed throughout the week with fees of 1 sat/byte (<$1). The mempool seems to be calm, corresponding to low volatility periods in the price, and busy in high volatility periods. Now is the time to do any UTXO management that is needed!

Video surfaced this morning of used ASIC miners being bulldozed in a parking lot and then a picture of a man in military uniform standing next to all the crushed machines. A second video is also making the rounds showing people carrying ASICs through tough terrain because vehicles are unable to make the trip.

Without knowing the context of the events in the videos we cannot jump to any conclusions. We do know propaganda is a real thing and these short videos, with no background info or context, have been shown to influence public perception in the past. In other words, this could just be an attempt at market manipulation. The market tends to overreact to these types of headlines, but the China mining FUD is likely priced in at this point. We'll wait to form any conclusions until more context is given.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

July 16, 2021 | Issue #150 | Block 691,312 | Disclaimer

Meme by @audioradiochris