Bitcoin Fundamentals Report #153

In this issue: Background and update on the Senate Infrastructure Bill! As well as price analysis, mining stats, and a Fed governor blasting the idea of CBDCs.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

This week's Bitcoin & Markets content

- (podcast) Why The Bitcoin Price is Down - FED59

- (blog) Why Bitcoiners Aren't Worried About Tether - a reaction to a gold bug's FUD on Tether

Get the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $42,625 (+$3,592, +9.2%) |

| Market cap | $801 billion |

| Satoshis/$1 USD | 2,348 |

| 1 finney (1/10,000 btc) | $4.26 |

| Median fee confirmed (finneys) | $0.49 (0.115) |

| Market cycle timing | Beginning second half of bull market |

| Weekly trend | Bullish |

| Media sentiment | Negative |

| Network traffic | Low |

| Mining | Increasing |

Market Commentary

At the time of writing the US Infrastructure Bill is catching fire. We are now living in the era where fights between Senators, the White House, and the Treasury are happening over a few sentences pertaining to bitcoin and it is holding up a major infrastructure bill!?!? Let that sink in.

For a down-and-dirty recap, here you go. Earlier this week, in the dark of night, a new amendment was added to the Infrastructure Bill in the Senate, supposedly penned by an anonymous person associated with the Treasury Department. It was highly highly suspicious and turned out to involve a complete gutting of the Bitcoin industry in the US. All miners, wallets, exchanges, businesses, everyone that touched bitcoin would be hamstrung by regulations making it impossible to operate.

"any person who (for consideration) is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person."

It was added under the pretense of new taxes but the burden would be so high it'd effectively kill the industry (note: it wouldn't harm bitcoin, just the businesses and people in the US. It could actually increase the price of bitcoin because it would become more difficult to acquire. Think - price of illegal drugs. Also, note they are going after people not trying to control the network which they know to be impossible.).

Industry and Senate Reaction

The community exploded immediately. It is easily the most controversial and discussed provision of the whole 4,000 page bill, thanks to the intelligence of most bitcoiners.

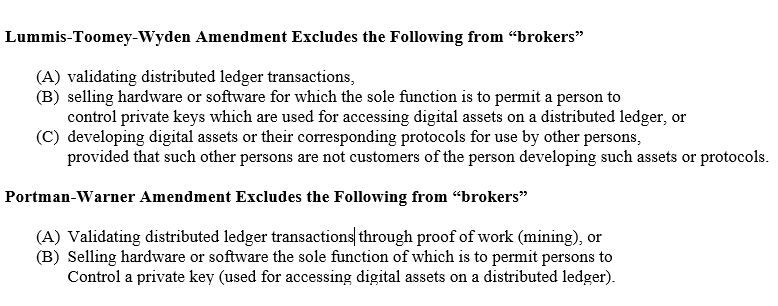

Several Senators have jumped into action. Ted Cruz proposed an amendment that would scrap the provision completely (why this has been lost in the debate is beyond us). Then we have the competing new amendments. On one side is Coin Center with Senators Wyden, Lummis, and Toomey and on the other side Senators Warner, Portman, and Sinema. The two amendments are very similar, the only major difference being the Warner-Portman-Sinema amendment only exempts Proof-of-work mining as found in bitcoin.

This means that Proof-of-stake, the consensus mechanism used by many altcoins, and is the subject of the #1 altcoin, Ethereum's long-term upgrade plan, would be taxed and heavily regulated, perhaps out of existence. Ethereum also houses most other altcoin activity through tokenization, so, that could be a deathblow to much of the altcoin sector and leave bitcoin relatively unaffected.

UPDATE: As we are writing, an article from the Washington Post just dropped that details the inner workings of this process so far. It seems Yellen was involved in the shadowy "crypto" language and is lobbying against the Wyden-Lummis-Toomey amendment. Working with the White House, they are responsible for the Warner-Portman-Sinema amendment, the one that includes the Proof-of-work language. That means the White House is currently fighting to enshrine PoW and tax PoS. If you would have said that last week, we would have called you batsh*t crazy.

This information is brand new and opinions vary widely. We believe that the difference in language around Proof-of-work shows the target by Yellen (and perhaps the SEC) is the altcoin casino. They don't want to go after each centralized coin and group of founders individually, so they will hobble the scams by going after Ethereum.

However, they are hesitant to fight bitcoin directly, because it is the 1000-ton elephant in the room, it's decentralized and hard to kill. They haven't been able to kill decentralized file-sharing like Tor, and they know bitcoin would be even harder. They'd just look silly attempting it. The plan is likely to regulate bitcoin through the energy angle by mandating ESG compliance for miners around clean energy and so forth. We are joined in this opinion by others in the bitcoin space:

Look at the language in the draft @RepDonBeyer bill. They are going after anything that's PoS. This move out of the White House last night matches the language in the Beyer's draft bill. The person really calling the shots behind the scenes is @GaryGensler.

— Preston Pysh (@PrestonPysh) August 6, 2021

.

Bottom line: this is an epic day for Bitcoin. It was at the very center of the highest form of power politics and financial regulation, and it seems the bitcoin industry will come out unscathed for the most part.

The altcoin market, that we have warned is centralized, dishonest, and a den of scammers and thieves, is about to get rekt if the current top amendment gets passed. If these altcoins were truly decentralized like they claim, there would be nothing to worry about.

We aren't happy the government is crushing private enterprise, even centralized altcoin scams, but we aren't surprised. This is exactly why bitcoin is decentralized and built the way it is. These other coins thought they could roll the dice, hide their dishonest marketing, money printing and false claims under a "cryptocurrency" umbrella guarded by bitcoin's strength. They were mistaken.

— Ansel Lindner (@AnselLindner) August 6, 2021

The amendment will be voted on tomorrow. Nothing is final as of yet, but it is looking disastrous for altcoins and okay for bitcoin. It could however, end with the passing of the Lummis amendment, saving altcoins almost completely. After the amendment is passed the whole bill must be passed, then it goes to the House, where the amendment can be challenged again. If it gets through the House, it won't take effect until 2023, so there's lots of time.

There are also plenty of other ways to attack this law, if it passes. The developer protections which doesn't appear in the White House/Yellen amendment is protected under the First Amendment as free speech. Other things like that could be fought in court by rich bitcoiners or altcoiners. This is a long way from final, but it gives us a great glimpse at what the next couple of years has in store.

Make sure to follow us on Twitter @AnselLindner and join the Discord for more updates.

SHARE our content with friends and family!

Quick Price Analysis

Weekly BMI | 2 : Bullish

Become a paid member to access our much more in depth technical analysis and member newsletter.

The bitcoin price bounced nicely on the 12 hour 50 EMA, which is quickly becoming the best timeframe and indicator of this move. The breakout above the fibonacci line and resistance area is very bullish. This should result in a quick move to the next level of interest, $47-48,000.

There is very little bearishness to speak of in the chart other than volume. Volumes across the market including fundamentals like number of transactions and size of blocks have been very low recently. Last week, we said to expect volume to pick up as the breakout continued, but we have yet to see that confirmation. Volume isn't a deal breaker, but it is concerning and raises the possibility that this rise does not have the legs we expect.

Mining

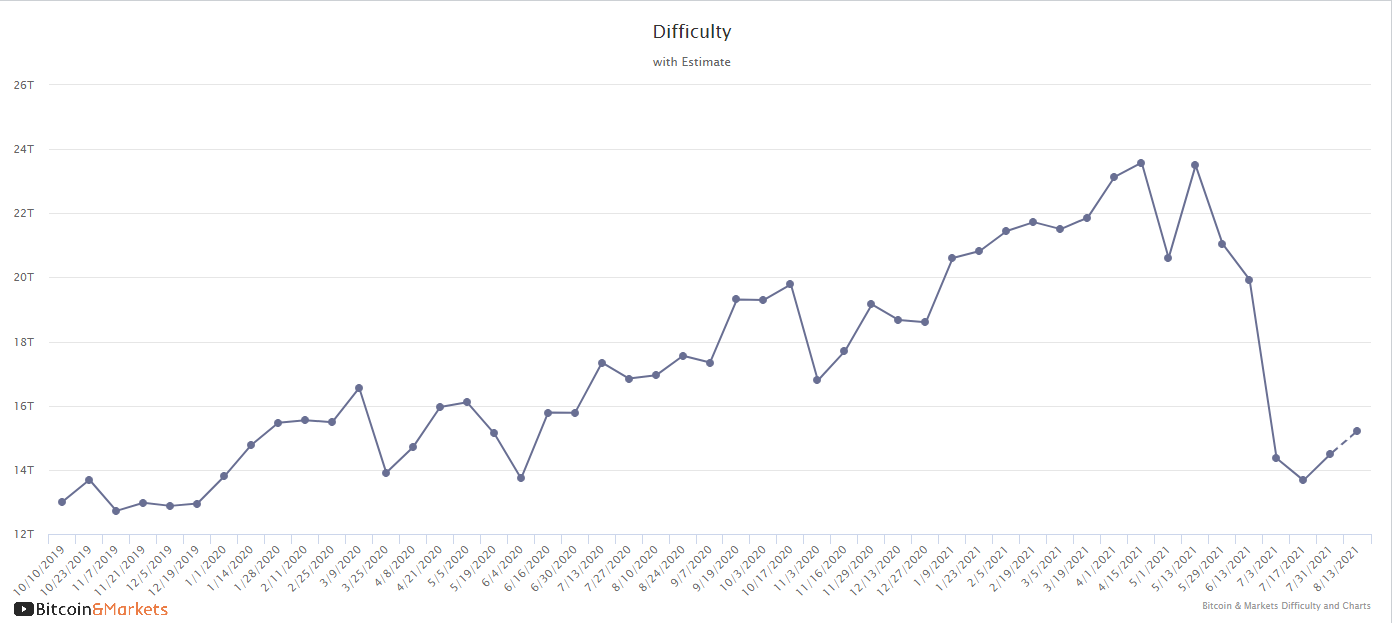

| Previous difficulty adjustment | 6.03% |

| Next estimated adjustment | +5% in 6 days |

| Mempool | 0 MB |

| Fees | 1 sat/byte |

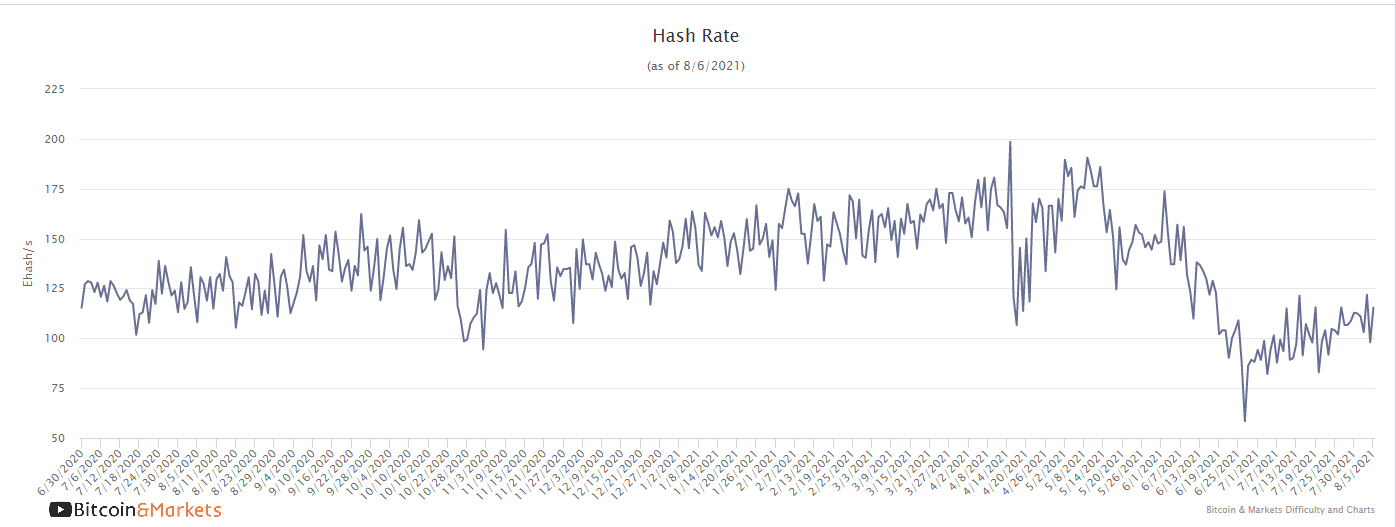

Hash rate has continued to rise in a stead manner. If you compare the recent slope of the recent rise to the typical slope from last year, you'll see it's roughly the same or slightly steeper. At the current rate of recovery, hash rate will be back to a new All Time High within 6 difficulty periods, or about 12 weeks.

Mempool

The mempool is still extremely low. This is the size in bytes of transactions that have been sent but not confirmed on the Bitcoin network. The more traffic there is on the network, the more transactions will be in the queue, and the higher the fees. A low mempool means cheaper, faster transactions (a plus), but because of low network usage (a minus). We will be digging into two theories of what's behind the drop in future posts, suffice it for now, here are two possibilities.

One possibility is that Chinese miners were running a coordinated spam attack on bitcoin, and now that they have been kicked out and have to move, the spam attack has ceased.

The second possibility is that blockchain.info (aka blockchain.com) started implementing the more efficient Segwit transactions in April. Blockchain is a company that attacked the Bitcoin network in 2017 over the Segwit upgrade and vowed to never implement it. Seems they capitulated.

Make sure you're subscribed, so you don't miss that report on the mempool!

CBDC / Stablecoin / Altcoin

Fed. Reserve Gov. Christopher Waller:

This is a fascinating listen. Gov. Waller is putting an exclamation point on Chairman Powell's more plain remarks. There is little chance of a Fed CBDC/digital dollar.

It's as if Waller has read our reports and listened to the Fed Watch podcast. We repeat that the only sober CBDC commentary from central banks is coming from the Fed. They understand that this is a huge threat to the smooth functioning of the financial system as a new form of money and does not offer any unique benefits. Waller uses almost the exact same words we've used previously when talking about CBDCs.

At this early juncture in Fed discussions, I think the first order of business is to ask whether there is a compelling need for the Fed to create a digital currency. I am highly skeptical.

In all the recent exuberance about CBDCs, advocates point to many potential benefits of a Federal Reserve digital currency, but they often fail to ask a simple question: What problem would a CBDC solve? Alternatively, what market failure or inefficiency demands this specific intervention? After careful consideration, I am not convinced, as of yet, that a CBDC would solve any existing problem that is not being addressed more promptly and efficiently by other initiatives.

Youtube video: https://youtu.be/r1iBDidlck8

We pulled out a few other interesting bites here, but we recommend you listen to the whole speech. Emphasis added.

Since these problems are primarily technological, and there's no reason to think the Federal Reserve can develop cheaper technology than private firms, it seems unlikely that the Federal Reserve would be able to process CBDC payments at a materially lower cost than existing private sector payment services.

I see no reason to expect the world will flock to a Chinese CBDC or any other. Why would non-Chinese firms suddenly desire to have all their financial transactions monitored by the Chinese government? Why would this induce non-Chinese firms to denominate the contracts and invoice trading activities in the Chinese currency rather than the US dollar?

After exploring many possible problems that a CBDC could solve, I'm left with the conclusion that a CBDC remains a solution in search of a problem.

A CBDC could disintermediate commercial banks... and as cybersecurity concern mount, a CBDC could become a new target for those threats.

Miscellaneous

We wanted to throw a couple macro charts in here at the end. Price movements of the dollar and gold have been very interesting. We'll write about these more in an upcoming member post.

Gold is getting monkey hammered!

The dollar is breaking back above the all important 92.5 handle.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

August 6, 2021 | Issue #153 | Block 693,433 | Disclaimer

Meme by @AlistairMilne