Bitcoin Fundamentals Report #156

In this issue we comment on Jackson Hole and the Fed's dilemma, Kabul as a sign of global economic shifts, price analysis, Ethereum network bug, and more!

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

- (Member) 2020 Parallels - Bitcoin Pulse #117

- (Blog) Macro Chart Rundown - 22 Aug 2021

- (Latest Podcast) Taper Talk, Repos, China, and Bitcoin Advocacy - FED60

Podcast update: There was a problem with the podcast editor at Bitcoin Magazine for our latest episode. It has been delayed until next week I'm told.

Next major article: coming very soon! on Bitcoin Magazine about the reserve currency status of the dollar as a burden not a privilege.

Get the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $48,430 (-$355, -0.7%) |

| Market cap | $909 billion |

| Satoshis/$1 USD | 2,067 |

| 1 finney (1/10,000 btc) | $4.84 |

| Median fee confirmed (finneys) | $0.34 (0.07) |

| Market cycle timing | Second half of bull market |

| Weekly trend | At resistance |

| Media sentiment | Neutral |

| Network traffic | Low |

| Mining | Expanding |

Market Commentary

Very slow news week for bitcoin. As a macro outlet concentrating, not only on Bitcoin but the US and world economy as well, the main news items happening right now are the Kabul airport attack and the virtual Jackson Hole meeting. They aren't as unrelated as you think.

Powell at Jackson Hole

Jackson Hole is an economic symposium put on by the Kansas City Fed branch every year at this time. It is a general central bank gathering, with representatives from all over the world. This year it was changed to a virtual meeting at the last minute, because the hotel where it is held required the change.

This year's meeting was set for fireworks. Everyone is screaming about inflation and the cries for taper are deafening. Even amongst voting members of the Fed Open Market Committee (FOMC) the calls for taper are growing by the week. Powell is personally adamant that inflation is transitory, but he is coming up for re-appointment in February, so he doesn't want to go against the consensus too much right now.

Calls for taper are contrasted with the economy generally slowing down. Many places in the world are rolling back into recession, and the US isn't far behind. According to conventional wisdom (likely wrong by the way), if the Fed tapers QE it will negatively affect the economy.

So, the mainstream opinion is that the Fed is stuck between inflation requiring tighter monetary policy (in this case taper) and a slower economy requiring looser monetary policy (in this case more QE). Of course, this is wrong. The market doesn't deal in paradoxes.

As it turns out, Powell didn't announce taper but spoke very favorably about taper by the end of the year. Basically, he didn't say much of anything.

The Market Doesn't Deal in Paradoxes

So what's going on? The market doesn't contradict itself so do we have inflation or not?

This confusion is based on a wrong definition of "inflation". Inflation is not rising prices! Prices can rise for many reasons, including what we have in this case, economic contraction, AKA a deflationary environment. That single tweak to your understanding of inflation and deflation as a supply of money question not a prices question, will align this apparent dilemma between taper and a slowing economy.

The overriding factor right now is the slowing economy. As supply of things gets cut, and before demand has an ability to adjust, prices will increase. The Fed is actually delaying this process of healing and adjustment by trying to get people to think they are making things better. They are effectively telling the people, "Don't change what you are doing. We're on it. Everything will be back to normal soon."

This keeps people from making the necessary adjustments to their behavior, the opposite of what they should be doing. The global economy is quickly weakening, and that ties into the Kabul incident.

Kabul Airport

We haven't been following the debacle as closely as many, because to us it isn't about the exact events. This whole thing should be framed in the context of the end of globalization and US withdraw to isolationism.

This is not a collapse of the US, but a realignment of priorities and the entire global economy.

The US military has completely botched this retreat. It looks very bad for the US. But it is a visible sign of the much larger general trend in all aspects of international markets. We didn't hear about the Russia withdraw debacle, the German debacle or even the Chinese debacle. Why? Because they aren't at the level to be an occupying power. The US is the world's sole superpower, it is the only country that is going to make superpower mistakes.

The US left behind $83 billion in military equipment and shrugs. That's more than 125 countries' GDPs. Only 65 countries' GDPs are above that amount, and it's a rounding error for the US. Think about that.

We're not saying this to support it or to excuse it. We're saying this to put the superpower status of the US in perspective. This event didn't damage the US. What it did was damage the role of the US in the world, while simultaneously strengthening the financial outlook for the US. We need to separate those two concepts, 1) the US as globalization provider and 2) the US as an economy.

The Kabul disaster is a sign of things to come. It is an exclamation point on the end of globalization. As people wake up to the fact that the last 50 years are over, that things aren't going to continually get better for them year after year, that the current economic depression is the new normal, they're going to be pissed. They will likely look to take wealth from neighbors. When people see the pie as rigidly fixed, they fight over slices.

The Fed has not even considered major shifts in the structure of the global economy. They think they can fix things and get things back to the way they were. But we aren't going back, only forward.

SHARE our content with friends and family!

Quick Price Analysis

Weekly BMI | 0 : Neutral

Last week's analysis worked out very well.

We have now broken through $48k on our way to $51,000. Weekends typically are slow because professional traders are still used to their legacy trading hours. We expect the weekend to be slow, but perhaps see a significant breakout Sunday evening when futures reopen.

We were perhaps slightly too bullish on the timeline for the next few months. It does seem that price is going to struggle a bit longer with this level. The last time price was here, it acted as support for 60 days. We don't think the resistance offered will be that long, but 30 days might be appropriate.

We've changed our BMI assessment to Neutral, because it is equally as likely to see another dip before further upside. We see no threat of a trend reversal or anything of that nature, it is simply how long will it take bulls to break back up to highs.

In the Bitcoin Pulse letter that went out today as well, we looked at many indicators, with a concentration on volume. Volume has continued to decrease as price has vaulted higher the last few weeks. This is a warning that to find liquidity and increasing volume, price might need to find it lower before we go up.

Become a paid member to access our much more in depth technical analysis and member newsletter.

Mining and Development

| Previous difficulty adjustment | 13.23% |

| Next estimated adjustment | +5% in ~11 days |

| Mempool | 2 MB |

| Fees | 1 sat/byte |

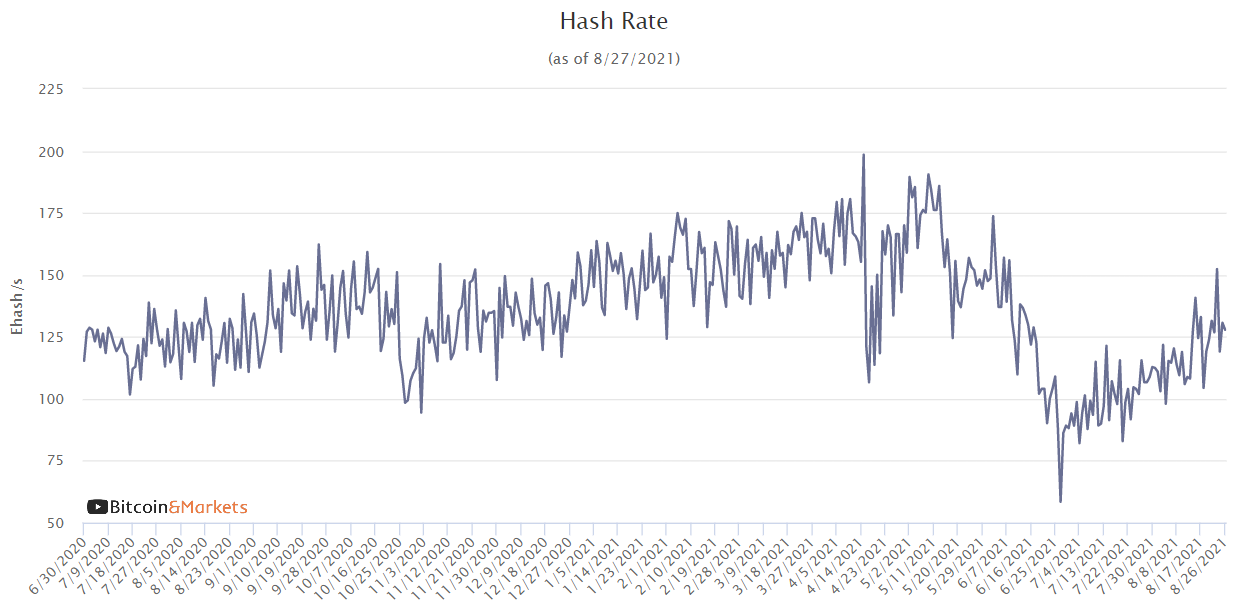

The difficulty adjustment on August 25th made it +13.2% harder to mine bitcoin, and the network is trending toward another +5% in ~11 days.

The mempool continues to clear daily. We haven't heard much news on the mining front as far as new hardware being manufactured (micro processing chip shortage) or the relocation of miners. However, the continued hash rate increase is a strong signal that mining operators are successfully relocating the hardware.

CBDC / Stablecoin / Altcoin

No surprise for this section, we need to talk about two Ethereum developments that make it look like the perennial mess up in the family.

NFTs

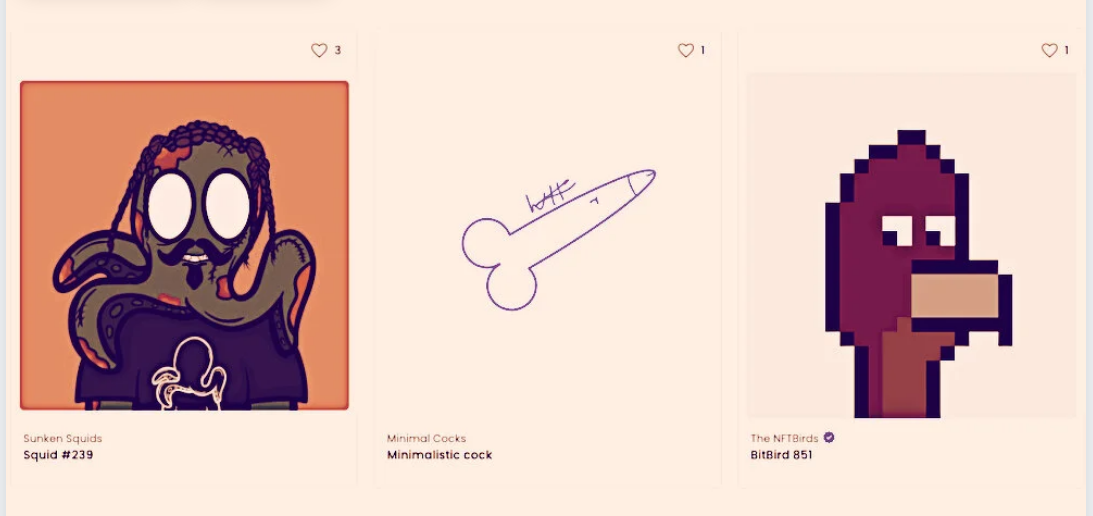

First up, some of the major companies that have jumped on the NFT bandwagon are getting trolled. In a story from the Block, Budweiser and other companies make their addresses public where they hold certain NFTs they are "investing" in. Of course, once people know the address they can send unwanted spam NFTs to it as well. That's exactly what is happening.

It's kind of funny and embarrassing but doesn't dramatically affect the network functioning. Though it could mean these types of pranks are taking up valuable blockchain space from other things, and forcing fees higher.

The NFT bubble is in full-effect. It is a fun game of hot-potato. And is propping up the altcoin market right now. We've covered several times in the past why these NFTs are cool, but don't fundamentally give value to a decentralized network. In fact, the detract from the value of the network. They belong on a centralized database like they have been for decades.

Eth Bug Causes Chain Split

Once again, Ethereum has a bug causing a chain split. This is where some of the nodes are unintentionally are forced from consensus due to a bug. They don't recognize the same blocks as valid, so the singular blockchain history splits in two more competing histories.

In this case, it affects 54% of all ethereum nodes. A major issue. If more than half the nodes split the chain, which chain is the real one? Just kidding, it's whatever chain Vitalik says. There's only 5200 nodes according to ethernodes.org, so this could drop node counts to 2500. That is very low considering many of the remaining nodes run on centralized services like Infura.

This split does not enable stealing your coins, but it can enable double-spends (fraudulent transactions). This bug can therefore affect all the "cross platform" interoperability protocols and coins, too. It's really an extremely fragile system.

A patch has been released for this bug, but it is a matter of getting node operators to upgrade.

Miscellaneous

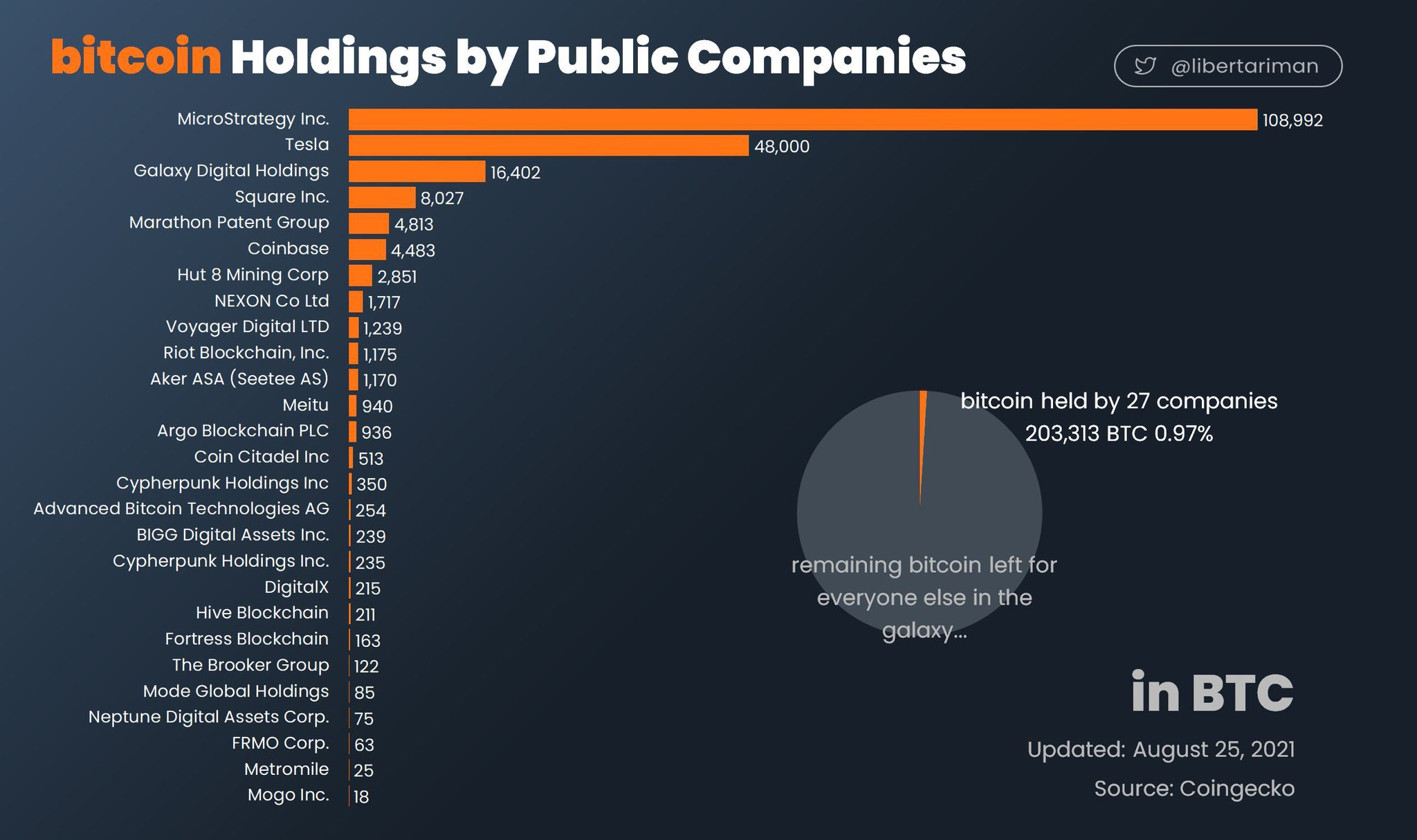

For our miscellaneous section this week we have a very nice chart from @libertariman. It's an ordered list of bitcoin being held by public companies.

People have pointed out a couple errors, like Cypherpunk Holdings listed twice (350 & 235 btc), and Hut 8 Mining claims to have almost twice as many coins, 4,240 btc.

Expect this list to grow rapid over the next couple of years. Taken together, these companies become sort of a proxy ETF for bitcoin, similar to MicroStrategy alone. The good news is there is enough bitcoin to go around for those who want it.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

August 27, 2021 | Issue #156 | Block 697,865 | Disclaimer

Meme by: @DocumentingBTC