Bitcoin Fundamentals Report #159

This week's newsletter, we discuss Gensler's testimony to Congress, the vaccine mandate, deglobalization and China, price action, and the Solana attack.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner and Jeff See

In Case You Missed It...

- (Podcast) August Bitcoin Review with Dylan LeClair - FED 63

- (Blog) Macro Chart Rundown - Sept 16, 2021

- (Op-Ed) The Fiat Dollar System is No Privilege: The Burden and Why the US Will Adopt Bitcoin MUST READ!!

Visiting the content on other sites helps tremendously, like bitcoinmagazine.com and YouTube! The best way to support is by sharing to family, friends and social media groups!! Thank you for reading.

Get the Bitcoin Dictionary now on Amazon!

Bitcoin in Brief

| Weekly price | $47,735 (+$2,173, +4.77%) |

| Market cap | $895 billion |

| Satoshis/$1 USD | 2,095 |

| 1 finney (1/10,000 btc) | $4.77 |

| Median fee confirmed (finneys) | $0.81 (0.17) |

| Market cycle timing | Second half of bull market |

| Weekly trend | Breaking higher |

| Media sentiment | Negative |

| Network traffic | Low |

| Mining | Stable |

Market Commentary

SEC Chairman Gary Gensler testified in front of the Senate Banking Committee this week where he reiterated his belief that nearly all "cryptocurrencies" (he thinks bitcoin is unique) are illegal securities and need to be regulated.

Our big takeaways are that Gensler is highly focused on investor input with calls for public comment on many issues and getting more manpower and budget to take on more altcoins. If they can't get to all the founders of these altcoins, they will eventually come after some of the big investors, like the exchanges and venture type funds. He even had some choice words for Coinbase specifically, to paraphrase, 'We've talked to them and they are selling illegal securities.'

On another executive branch front, the IRS has changed their language because Bitcoin is now legal tender in El Salvador. There are rules around taxation of foreign currency, which will be very interesting in the coming year or two, on how it is taxed in the US.

IRS - How it Started / How its Going https://t.co/scV6fsWXkShttps://t.co/kYWHG3FI8c pic.twitter.com/oaWTo44HPz

— Brian Cohen (@inthepixels) September 14, 2021

US Vaccine Mandate

Our intention is not to make this a political newsletter, but we have some comments on the recent US vaccine mandate that Biden has announced.

First and foremost, this topic is not new. Informed consent is the bedrock of all medical care and enshrined in the Nuremburg Code of 1947. It has been addressed under international law for decades for very good reason. These mandates are clearly counter to informed consent.

The voluntary consent of the human subject is absolutely essential. This means that the person involved should have legal capacity to give consent; should be so situated as to be able to exercise free power of choice, without the intervention of any element of force, fraud, deceit, duress, overreaching, or other ulterior form of constraint or coercion; and should have sufficient knowledge and comprehension of the elements of the subject matter involved as to enable him to make an understanding and enlightened decision.

Second, there is also Supreme Court precedence about vaccines in general. You might have heard this case being thrown around, Jackobson v Massachusetts. In this case Jackobson refused a small pox vaccination requirement. People claim this demonstrates the right of the government to impose a vaccine on the public. However, the court found him guilty and he was forced to pay the fine of $5, not get the vaccine. It also lays out a very high bar for proof of a risk, which the current disease doesn't meet.

It is unclear if the current loophole (through the Occupational Safety and Health Administration OSHA) is legal under US law. Recently, Biden has shown a complete disregard for legality as with the moratorium on rent. When he knew the moratorium was unconstitutional and illegal, he did it anyway, saying it would take a while to get through the courts.

The vaccine mandate could be a similar play. Just mandate it and hope it moves the needle in the mean time, while it is fought in the courts. The mandate ups the pressure on people for a period, even though is ultimately illegal. We are not lawyers obviously, but it is clearly against informed consent and several different laws in the US.

Third, employers must offer exemptions, both religious and medical (some also offer a philosophical exemption). The religious exemption is big enough to drive a bus through guys. It doesn't have to be denominational or according to some official sanctioned religion. Religion is your own personal beliefs. If the vaccine is against your own personal beliefs you can get a religious exemption. That's what it's there for.

Lastly, don't be intimidated. Get your exemption or make them fire you and join the resulting class-action lawsuit. Robert Barnes has an example letter to give your employer (we've provided a copy here) to use if you are under pressure. Delay, delay, delay, at every step, don't stand in line! Governments are inefficient, so, any roadblocks you can throw in their way will add delays and perhaps helpful scientific findings or court rulings will be forthcoming.

Deglobalization Heats Up

We wrote about this in the Macro Chart Rundown yesterday, but two huge events are happening right now on the deglobalization front. First is Evergrande, the massive Chinese real estate company. They are at the center of at least a $300 billion credit collapse. The debt is nearly worthless and they sit at the center of the Chinese economy. The important thing is that Evergrande is not unique. The exact same practices and balance sheet maladies run throughout their entire economy.

Read this thread:

🚨🚨 China Credit - Writing on the Wall - and How to Trade It. (9/15/21)👇👇

— TheLastBearStanding (@TheLastBearSta1) September 15, 2021

How this affects globalization is that China, the factory of the world, is really one big credit bubble, and it's starting to pop. Products will not be made, supply chains will whither, debt payments which companies globally depend on to meet their own obligations will not happen.

The second major story we will only briefly comment on, because it's covered at length in yesterday's macro update, is the US abandonment of the Persian Gulf. It seems the Arab nations are very concerned about the events in Afghanistan as an example of US commitment to the region as a whole. Their worries were solidified this week as the US unilaterally withdrew their Patriot batteries from Riyad. Patriot missiles are defensive air defense missile to shoot down incoming missiles and drones, whether from Yemen or across the gulf from Iran. This is a huge development for the region and the global oil market, as 20% of the world's oil comes from the Persian Gulf area (a lot of it headed to China).

SHARE our content with friends and family!

Quick Price Analysis

Since last week's dip, price has stabilized and regained some lost ground. It currently sits above a critical price level and two critical moving averages.

The daily chart just had a "golden cross" widely known as when the 50 simple moving average cross above the 200. Price is also sitting above the 50 week SMA and the 20 week. Despite the bullish position of the price, many are lining up on the bearish side as US government officials ready for battle with bitcoin. A small rally could add pressure to the shorts and perhaps begin a short squeeze.

Become a paid member to access our much more in depth technical analysis and member newsletter.

Bitcoin Chart

Mining and Development

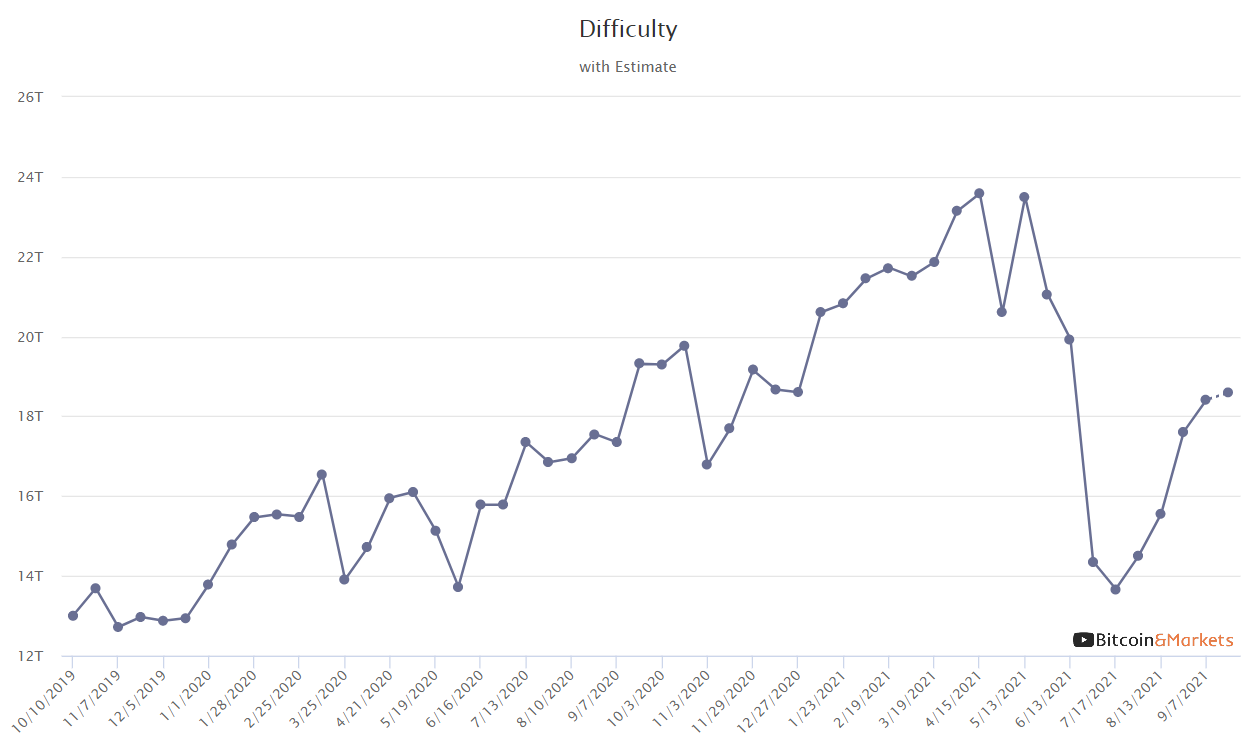

| Previous difficulty adjustment | +4.54% |

| Next estimated adjustment | +1% in ~4 days |

| Mempool | 2 MB |

| Fees | 1 sat/byte for next block |

There is still no end in sight to the microchip shortage, causing major manufacturers of retail goods are cutting back production. Toyota is the latest, cutting production targets by 300,000 vehicles in 2021. There's a great Odd Lots podcast episode on this continuing problem.

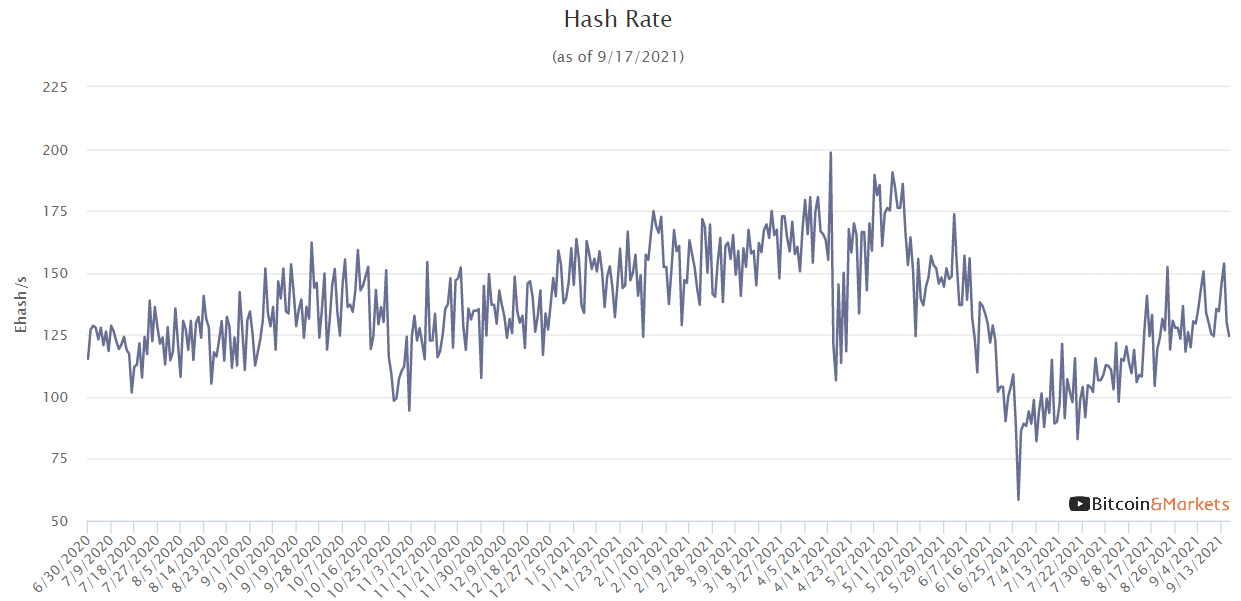

As for bitcoin mining, the hurdles are not only the chip shortage, but also the race to build facilities. Half of the mining equipment that left China earlier this year has yet to find a home because there is simply no place with existing capacity to move them.

The network however is extremely healthy and secure. At a time like this, malicious miners, too, will not be able to find hash rate with which to attack the network.

Difficulty is on track to edge higher by 1% in 4 days. Perhaps, as price rallies in coming months, people will breakout long mothballed miners to once again mine, so hash rate might takeoff again. We still expect a full recovery of the hash rate by the end of the year.

Bitcoin 0.22.0 is released

One step closer to activating Taproot, the latest version of Bitcoin Core software is released. Read the release notes and upgrade.

CBDC / Stablecoin / Altcoin

Typical Altcoin Failure

Altcoins are backed by unsubstantiated claims of decentralization and crazy capabilities. Solana is only the most recent to be proven as complete liars.

1/ Solana Mainnet Beta encountered a large increase in transaction load which peaked at 400,000 TPS. These transactions flooded the transaction processing queue, and lack of prioritization of network-critical messaging caused the network to start forking.

— Solana Status (@SolanaStatus) September 14, 2021

Solana is an ethereum clone that many people have started to use instead of Ethereum. We predicted this very thing, that Ethereum cannot scale and cannot prevent copycats from launching, which splits the investment case for any coin to eventual infinity.

The specifics of this attack are of a simple DOS attack, where someone flooded the network with too many spam transactions and crashed the system. This simple attack took down a $60B project!? No, it's a complete scam. The attack forced the central maintainers of the network to take it offline, update their software and relaunch it 18 hours later. This was not a decentralized process by any means, although the liars will never come out and say that. If it were decentralized, they wouldn't be able to take it offline or coordinate bringing it back online.

The problem wasn't fixed. This is a weakness that cannot be avoided. All they can do is pay off would be attackers, fight back by attacking the attackers, or pray they don't get attacked again. It is our guess that the attack was done by those friendly to Ethereum, since Solana in one of its biggest cannibalistic competitors.

Treasury Recommendations on Stablecoins

The US Treasury is authoring a report for the President's Working Group on Financial Markets with recommendations for stablecoin regulation according to Bloomberg. There's not much to write on this one, it's a recommendation to a working group, who will write a report to a regulating body, who will then probably decide not to do anything.

Miscellaneous

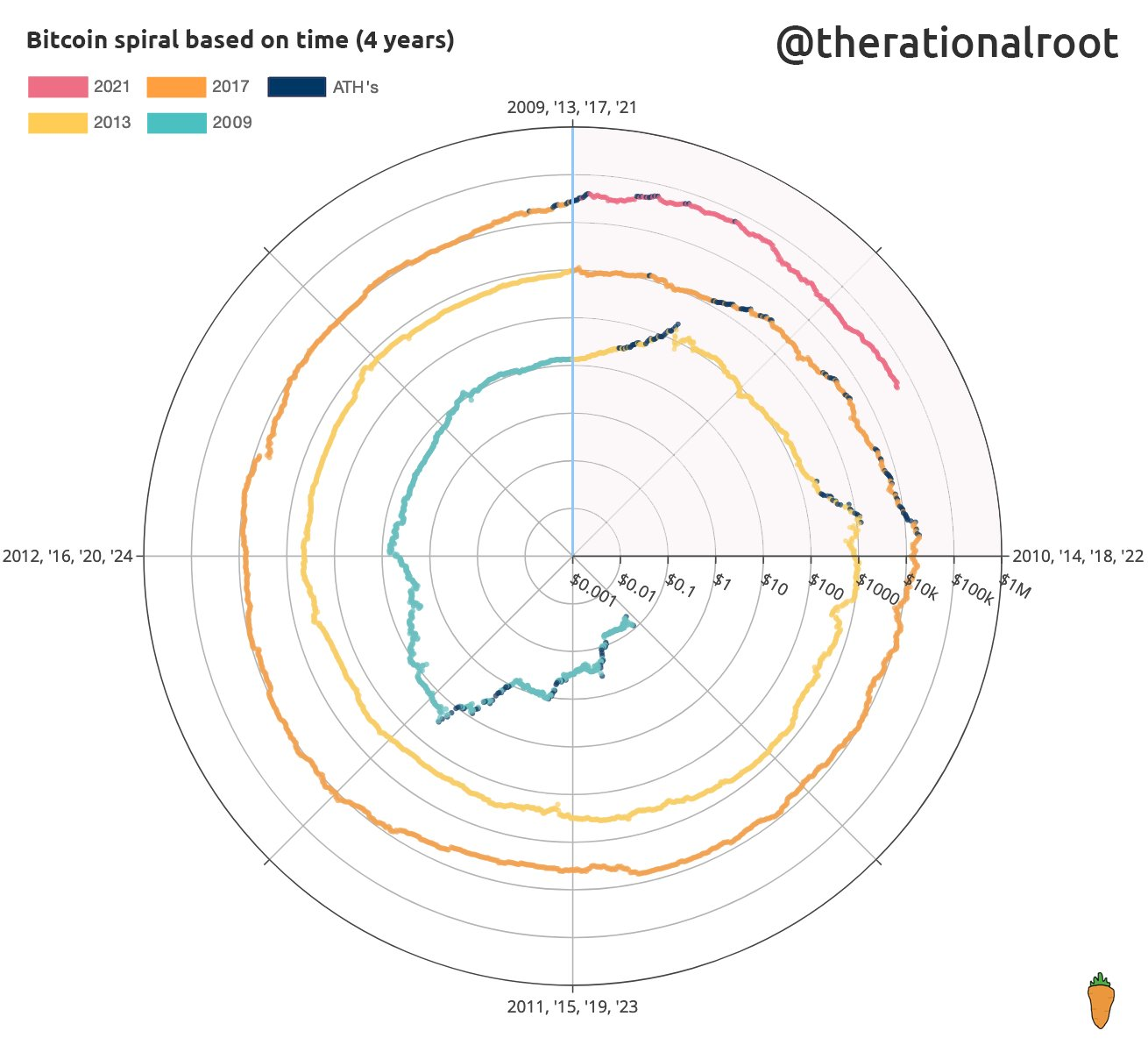

Here is another cool way price can be charted, brought to you by @therationalroot. Each turn of the circle is a 4 year cycle. The halvings are roughly every 4 years, 210,000 blocks to be precise. Notice the lines never cross, meaning each cycle is completely above the previous cycle. In the far future, we should expect this to continue, only each spiral being closer together.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

September 17, 2021 | Issue #159 | Block 700,985 | Disclaimer

Meme by: @omgitsbrad