Bitcoin Fundamentals Report #163

In this post we get up to speed on the Bitcoin ETF news, price action, US now mining leader, G7 CBDC meeting, and more!

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner

In Case You Missed It...

- (Podcast) Valuing Bitcoin Using Sovereign Credit Default Swaps with Greg Foss - FED 66

- (Blog) Religious Exemption Exemplars and Information

Visiting the content on other sites helps tremendously, like bitcoinmagazine.com and YouTube! The best way to support is by sharing to family, friends and social media groups, or becoming a paid member!! Thank you for reading.

Get the Bitcoin Dictionary now on Amazon!

Market Commentary

| Weekly trend | Stepping higher |

| Media sentiment | Positive |

| Network traffic | High value, low # or transactions |

| Mining | Strong |

| Market cycle timing | Second half of bull market |

US Bitcoin ETF Imminent

Last week, I wrote about all the rumors flying around about a Bitcoin ETF approval in the US. Since then they have become deafening.

Biggest news up front, an official SEC twitter account tweeted about being careful when investing in a bitcoin ETF. Why, if there's no US bitcoin ETF?

Before investing in a fund that holds Bitcoin futures contracts, make sure you carefully weigh the potential risks and benefits.

— SEC Investor Ed (@SEC_Investor_Ed) October 14, 2021

Check out our Investor Bulletin to learn more: https://t.co/AZbrkpfn8F

Then this morning, at 2 AM EST, Bloomberg published a story (archived) from an anonymous source familiar with the issue, "The regulator isn’t likely to block the products from starting to trade next week."

It seems very likely this is it, a bitcoin ETF will finally come to the US. At this point, the first will hold futures contacts, not actual bitcoin. But it is still a very huge deal and will affect the spot price dramatically.

Currently, there are 19 applications for bitcoin ETFs sitting on SEC Chairman's Gensler's desk. According to the way the process works, two ETFs based on futures contracts will have a decision on 18 Oct 2021 and one other on 23 Oct 2021 (however, I have seen other similar dates and they do change throughout the process). That means that there could be 3 bitcoin ETFs by the end of this month.

Futures ETF Explained

An ETF is a financial product that you can buy a share of, that, instead of representing partial ownership of a company like a stock, it represents a claim on a share of the ETF's underlying asset. An ETF based on futures contracts simply means the fund isn't holding actual bitcoin, it is holding futures contracts as exposure to the price of bitcoin.

Here's how it works. Futures contracts are an agreement to buy or sell a certain item in the future, say the end of the month or quarter. They differ from options in that with options, you are buying the right to buy or sell, not actually agreeing to buy or sell.

How will it affect the bitcoin price? I must relate a story from 2017. At that time the CME was starting to trade bitcoin futures, and a very well-known exchange owner and father of modern high-speed trading, Thomas Peterffy warned that bitcoin could collapse the CME (which is the largest exchange in the world btw). His warning wasn't bearish though; he didn't think the price would go down, he thought the price would go up and bankrupt the exchange as a clearing house.

In futures markets there is a buyer and seller of every contract. Most investors in products like bitcoin futures, want to get exposure to bitcoin's price without holding the asset itself. Therefore, they are usually on the long-side of the contract; they are the buyer.

So who would sell to them, and if the price of bitcoin goes up year after year, why would they go short? In this case, the sellers are usually market makers, they take the short-side and hedge possible losses 1-to-1. They are short, but not really, because they go long in other markets. They do this to harvest the fee they take to make the short-side of the contract. In bitcoin, short-side market makers will go out and buy spot bitcoin in order to have nearly zero risk and take the fee as profit.

With a bitcoin ETF buying up billions of dollars in bitcoin futures, market makers will need to go out into the spot market and buy up bitcoin as a hedge. It's just one step removed from the ETF buying actual bitcoin.

Buy the Rumor, Sell the News?

Many people are worried that this could be a buy the rumor, sell the news event. They are concerned that the price increase will happen in the build up to the launch and then at launch the price will crash again.

If this were to occur, it would be similar to what happened in 2017, when the CME futures contracts were launching. They were announced on 31 Oct 2017 when the price was $6000, and by the launch date of 17 Dec 2017, the price had climbed to $19,500. That's more than 200% gain in 6 weeks. The launch of the CME futures marked the top of that 4-year cycle in bitcoin. A definite buy the rumor, sell the news event.

I do not think that will happen this time. Of course, there is always a chance, but the situation is much different today with the ETF. The price is not at All Time Highs currently (but close), and there hasn't been a build up of 6 weeks. There is still no official announcement, and they might start trading next week!? That's very different from the CME futures contract launch.

This event likely marks the start of the final leg of this cycle. Those who have experienced bitcoin's 4-year cycles before, have been waiting for a major top in December this year, or early next year. I'm not convinced that it will happen exactly like that, but next couple of months should see a very significant rally.

SHARE our content with friends and family!

Quick Price Analysis

| Weekly price* | $61,573 (+$7,515, +13.9%) |

| Market cap | $1.162 trillion |

| Satoshis/$1 USD | 1,624 |

| 1 finney (1/10,000 btc) | $6.16 |

Become a paid member to access our much more in depth technical analysis and member newsletter.

From last week's issue, still very valid ! :

A note on the ETF affect on price. If the ETF announcement comes in the area of the price breaking the ATH, price action could get very explosive and volatile. If you are trading, have targets and stop-losses placed. A $10,000 green day is in our future, but so is a $5,000 down day.

The possible bitcoin ETF approval makes price prediction seemingly easy here, but it's not. Of course, if the ETF gets approved, price should spike and continue to rally with periodic pull-backs through the end of the year. However, if the ETF doesn't get approved, price could drop. That interplay is going to lead to high volatility in the price over the next week.

I was convinced back in 2017 that a bitcoin ETF would be approved then. When it was rejected we saw 40% volatility from top to bottom in a single day. Therefore, I cannot say an ETF is 100% certain this month, though the chances today are even higher than 2017, but whatever happens price is going to be volatile.

Volatility around ETF rejections in 2017

Current Bitcoin Chart

All technical indicators are extremely bullish, along with fundamentals of the network and industry. A new Bitcoin Pulse letter will be coming out for members in the next few days to go over the charts in detail.

Mining and Development

| Previous difficulty adjustment | +4.71% |

| Next estimated adjustment | +4% in ~3 days |

| Mempool | 7 MB |

| Fees for next block (sats/byte) | $1.00 (12 s/b) |

| Median fee (finneys) | $0.90 (0.15) |

US Becomes World's Largest Bitcoin Miner

For years bitcoiners have had to suffer the naïve criticism that bitcoin was controlled by China because it was home to the most bitcoin mining. It didn't matter that historical events disproved the claim that miners control bitcoin at all (miners are simply service providers paid by users and beholden to customers).

Bitcoin miners are like any other capitalists, they tend to flow where they are treated best. China has very few energy regulations and subsidized communist energy production. Electricity was dirt cheap there due to the common failing of communism, price insensitive overproduction things, in this case energy. Since China basically ended their relationship to the future by banning bitcoin mining earlier this year, miners have fanned out across the world looking for a new home. Many have settled in the US, making it the new leader when it comes to bitcoin mining.

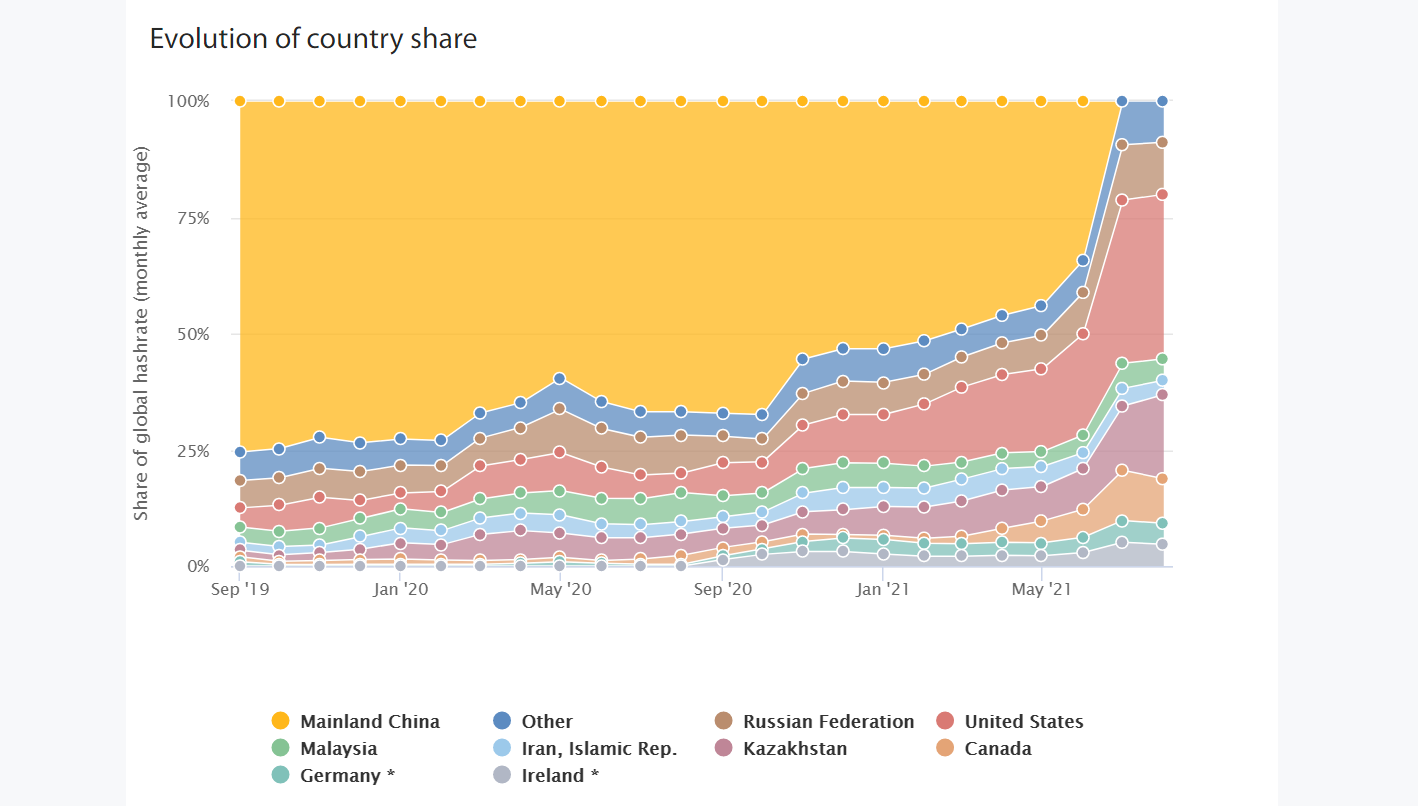

The US has increased their share of mining power from 10.5% of the total in January 2021 to 35.4% by August making it the largest bitcoin mining country. And since August, US hash rate continues to boom. Canada, too, has increased their share this year, from less than 1% in January, to 9.6%. The North American share of the total bitcoin mining computer power therefore is now 45%. If we add the other very close ally of the US in Japan (8.9%), you get to a majority of the hash rate (53.9%).

Other countries have also benefitted from the Chinese ban, namely Kazakhstan, going from 6% in January to 18.1% by August, now holding the second place spot behind the US.

Interesting visualization on how China lost its #bitcoin mining to the US pic.twitter.com/ogJKTaV0WZ

— Bitcoin Meme Hub 🔞 (@BitcoinMemeHub) October 15, 2021

Note: The effect of the mining ban in China to market uncertainty should not be discounted. It was a legitimate concern of many in the industry, of how the network would bounce back. Now that it has shown to be very resilient and fast moving, that worry is removed and will add to upward price pressure.

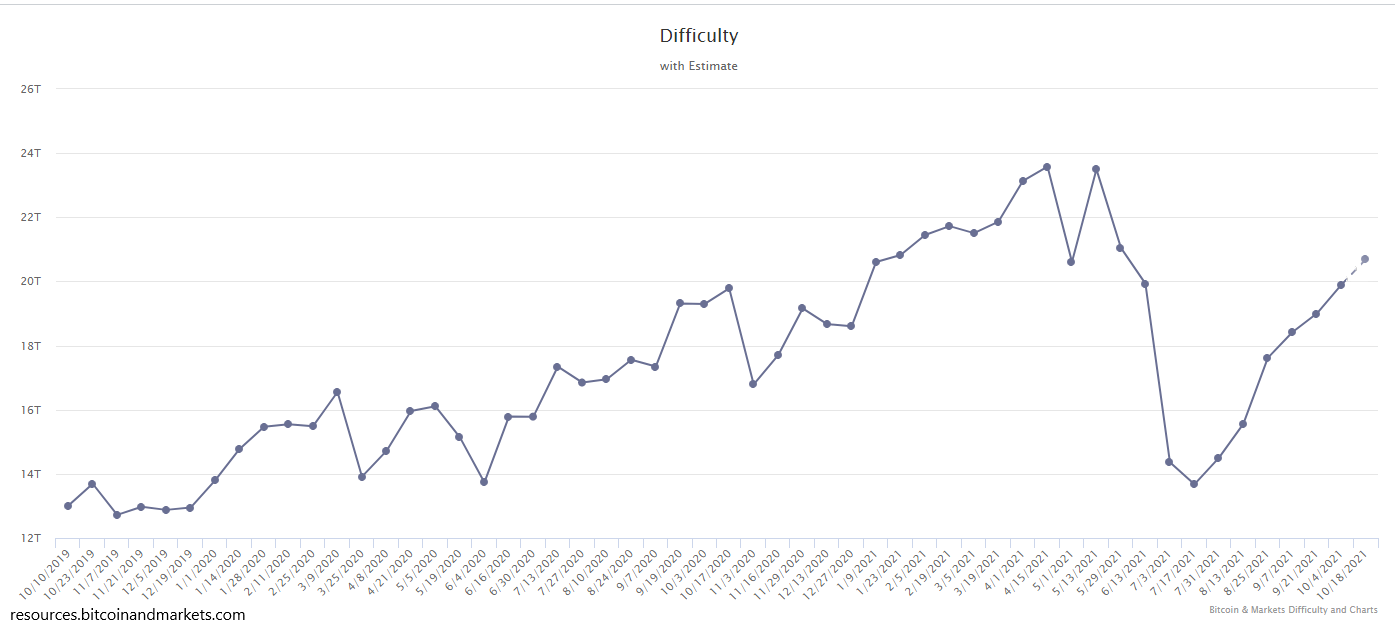

Difficulty and Mempool

Hash rate and difficulty in mining is very steady. On track for another 4% increase in 3 days, with the last 3 adjustments being 4%, 3%, and 4%. Steady and healthy in the mining department.

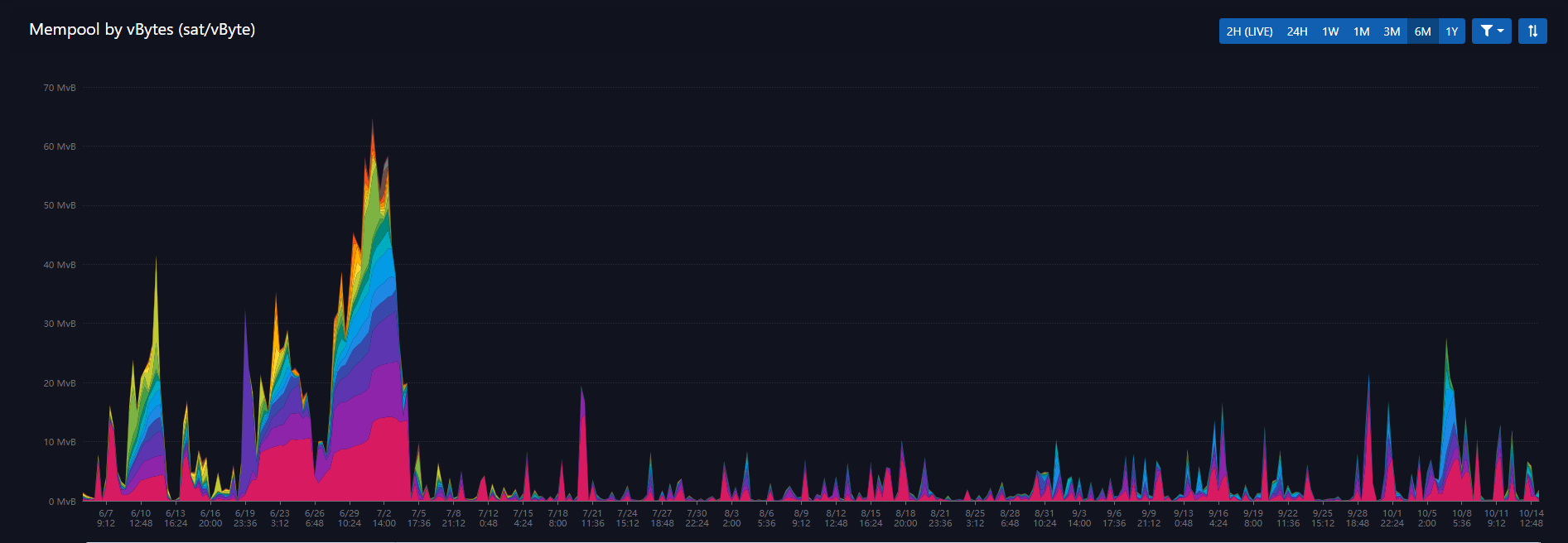

The mempool remains minimal and fees are extremely cheap. This is a factor that I will continue to watch closely, as it pertains to the growth of bitcoin ecosystem and layer 2 protocols. As bitcoin grows, it must have robust layer 2 growth (lightning, liquid, and other apps) in order for the incentives to work properly. As of now, the main network is being reserved for higher value transactions, as the below USD volume demonstrates.

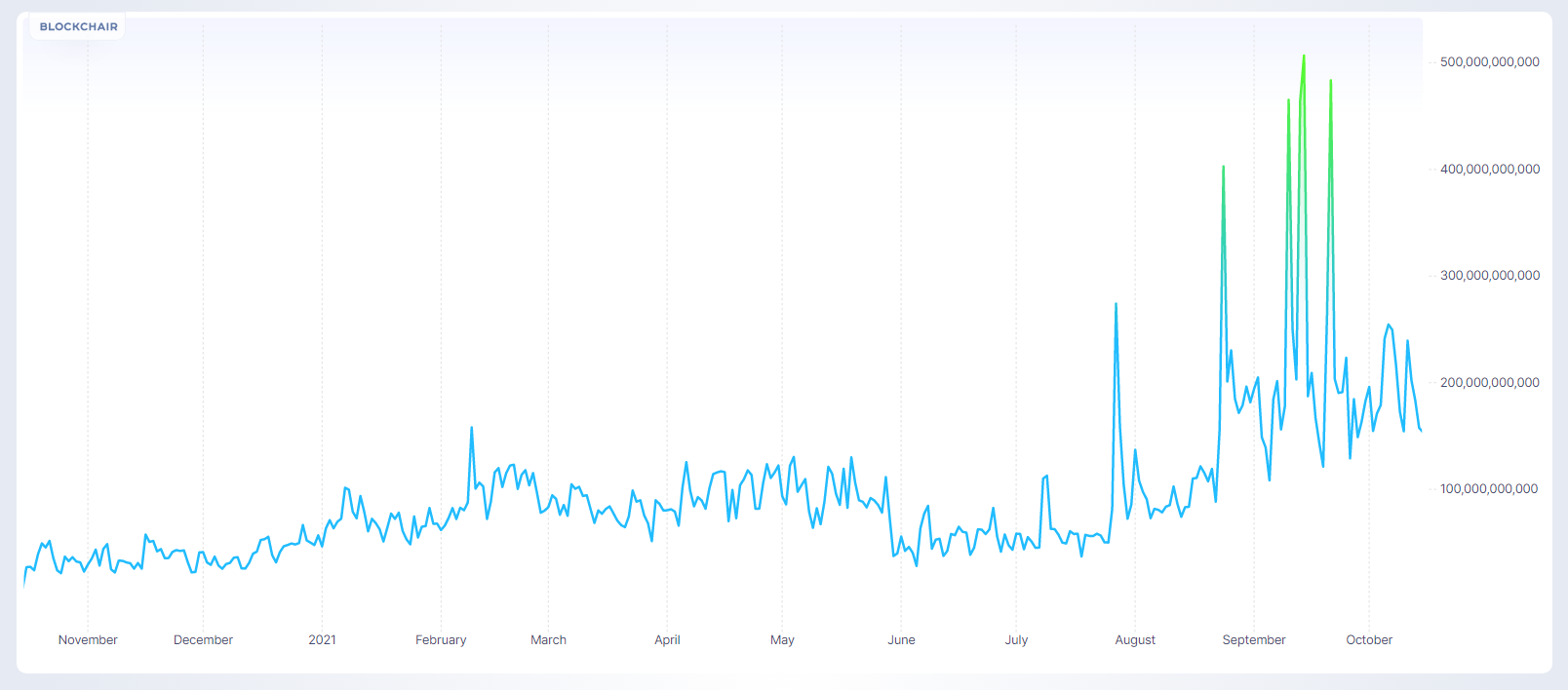

On-chain Volume in USD

US Dollar volume of the bitcoin flowing through transactions on the bitcoin network has sustained a high level recently, with the trend also positive. I've been writing about this more recently because it shows that high value transactions are taking over the main network, while smaller daily transactions are being moved to other bitcoin apps.

Altcoins / CBDCs

G7 finance officials endorse principles for central bank digital currencies

Central banks of major nations are still messing around with Central Bank Digital Currencies (CBDCs) . This week at a G7 meeting in Washington, they agree on 13

"public policy principles" to guide their CBDC efforts.

"Innovation in digital money and payments has the potential to bring significant benefits but also raises considerable public policy and regulatory issues," Group of Seven finance ministers and central bankers said in a joint statement.

"Strong international coordination and cooperation on these issues helps to ensure that public and private sector innovation will deliver domestic and cross-border benefits while being safe for users and the wider financial system."

Quick recap for new people: CBDCs won't work or bring benefits to countries that launch them. They are, by definition, worse than the existing currencies issued by these governments. However, currency issuers are threatened by the success of bitcoin and private USD stablecoins aimed directly at their monetary sovereignty, so they have to try to offer an alternative, even it it's doomed to failure. If they make these currencies open and interoperable, balances will quickly converge to the USD version. Therefore, they can't make them open and interoperable. They will by little costly silos of trackable, freezable, and seize-able tokens.

Also, that comment above about relying on "strong international coordination and cooperation", don't they know we are in an era of deglobalization and realignment. During the next decade or two, international coordination and cooperation are going to suffer, international rule-making bodies are going to lose power, and bitcoin is going continue to rise. If your CBDC efforts rely on all those processes stopping and reversing, GOOD LUCK!

Miscellaneous

So many people hate the Stock 2 Flow model because it reduces prices to a formula. But so far it has proven extremely accurate. I'm going to love to see haters "yeah, buts" and tears when the model proves out again.

Above is the most recent update from PlanB and you can see the colored dots representing price are again approaching the white model prediction line.

The typical behavior is for the price to overshoot and then undershoot the model line. Back in 2017, price overshot by 3x and then dipped 50% below the line. In that case, with the current model prediction showing $110,000 today, a price of $300,000 in this cycle is possible, followed by a drop to back to $60,000.

That action would place the top market cap at $5.5 trillion this cycle, still half that of gold but catching up quickly.

Looking further into the future, after the next halving the predition line is up to $1.3 million, and a 3x overshoot would put price at $3.9 million by the end of 2025.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

October 15, 2021 | Issue #163 | Block 705,161 | Disclaimer

Meme by: starfury

* Price change since last week's issue