Bitcoin Fundamentals Report #164

Recent bitcoin ETF and what to expect next. Plus, what to say when people ask if they should buy bitcoin, network metrics going crazy, and altcoin scams.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner

In Case You Missed It...

- (Podcast) Powell Under Fire, Renominated or Replaced? - FED 67

- (Op-Ed) Understanding the Interest Rate Fallacy: The Risk of Holding Fiat

- A member Bitcoin Pulse was delayed this week, scheduled to come this weekend!

Visiting the content on other sites helps tremendously, like bitcoinmagazine.com and YouTube! The best way to support is by sharing to family, friends and social media groups, or becoming a paid member!! Thank you for reading.

Get the Bitcoin Dictionary now on Amazon!

Market Commentary

| Weekly trend | All Time High!! |

| Media sentiment | Positive |

| Network traffic | High value, low # or transactions |

| Mining | Strong |

| Market cycle timing | Second half of bull market |

US Bitcoin ETF Launched

If you have been subscribed here, you didn't missed a beat in the build up to the ETF launch. Last week, I said the approval by the SEC was "imminent". Just an hour after I sent the newsletter, right before COB Friday, the SEC announced the approval of two futures-based ETFs; Proshares which started trading on Tuesday under the ticker BITO, and Valkyrie which began trading today on Nasdaq under the ticker BTF.

The price reaction has been interestingly so far, but more on that in the Price section below.

We can expect this to be the first of many approvals by the SEC for derivatives based bitcoin ETFs, and perhaps by the end of the year we will see a spot bitcoin ETF will be approved.

This first week of trading for the ETFs has seemed to be a retail investor affair, with the big boys sitting on the sidelines watching what happens. BITO did have the second largest launch of any ETF in history at nearly $1 billion in volume the first day. That's a good sign, but these buyers are not likely to hold through the first significant dip, which is taking place now.

The real effects of these futures-based ETFs will only be felt when bitcoin's beautiful volatility kicks into high gear. Price dumps will sort ETF shares into the hands of dedicated holders, while spikes will squeeze overleveraged shorts and under-hedged market makers.

Should I Buy Bitcoin Now?

I bet you have heard this question in the last week. I can't tell you how many friends and family contacted me over the years asking this exact question. Happens every time during big news events and breaking the ATH.

Since I've struggled for years finding the most concise and convincing way to answer this question, I thought you might be in the same boat. That's why I wanted to write a few of my thoughts about this perennial problem for bitcoiners.

You might be thinking, 'My friend or family member is finally starting to think there is something to this. I have to seal the deal and convince them.' Bitcoin has a way of triggering that evangelical impulse in all of us; we want to share what we know and help those we care about.

It took me 5-6 years of full emersion in the space and community, 20 years of researching monetary theory and economic history, and 15 years as a husband and father, to develop my current answer to this question. You will probably be quicker than I, but my answer may surprise you.

First, you must realize bitcoin adoption is a force of nature and anything you do to plan or manipulate the natural course of things will almost surely have net negative effects. Don't try to convince them of anything. Central planning doesn't work, whether its a communist regime, a central bank, or an individual. Things must take their own course. If they need convincing they aren't ready for the rollercoaster.

I'm not saying don't share information (for example, sign them up for this newsletter ;)) or have long serious conversations with people who are truly interested to learn and grow. This is what I'm doing with my content on a weekly basis, sharing information and providing a gateway for self-improvement for myself and others.

Everyone is on their own path and not everyone needs to buy bitcoin. The rollercoaster and a low time preference lifestyle, where you are holding through 85% drawdowns, isn't for everyone. The fact is, the same people asking when they should buy probably won't ask your advice when they sell. Most people buy the top and sell the bottom, and won't hold long enough to make a difference in their life anyway.

There is a big difference between someone asking, "Should I buy bitcoin?" and asking, "Will you explain bitcoin to me?" The latter is more accepting of shifts in time preference and world outlook.

My overall investment advice to most people who ask about buying bitcoin is, 'you should invest in what you know', an asset or industry where you have asymmetric knowledge or an advantage over other people. Also, invest in yourself. Not necessarily education, but mental and physical peace and health, too.

Hope that helps.

SHARE our content with friends and family!

Quick Price Analysis

| Weekly price* | $60,930 (-$643, -1.0%) |

| Market cap | $1.143 trillion |

| Satoshis/$1 USD | 1,640 |

| 1 finney (1/10,000 btc) | $6.10 |

Become a paid member to access our much more in depth technical analysis and member newsletter.

What a huge drive to a new ATH! It was a very strong and fast move through all resistance. The fact that price is going through some consolidation now, should not be a surprise. It has rallied 130% from the summer lows and 65% since September 29th.

It would be nice to see some cooling off in the price before continuing on to $100k+. We don't want price to get out over its skis. The people that jumped on the new ETFs won't get a free ride. The market will test them and try to shake them off before the next breakout. I predict a week or two of consolidation here.

Bitcoin Chart

Bitcoin Coins on Exchanges

I've noticed this chart of bitcoin on exchanges is starting to circulate again, and I wanted to address it quickly.

First and foremost, price is set at the margin. That means it doesn't matter how many trades were made the price is set by the buyer and seller.

Volume by price is an important indicator of likely levels of support and resistance but isn't complete. This is especially the case when we have record on-chain volume and very low on-exchange volume. A logical conclusion is that important price discovery is happening elsewhere and not on exchanges.

Second, the value of the on-exchange bitcoin is more important than the number of coins. According to the above chart, there were ~2.45 mil bitcoins on exchanges in Sept 2018 and today. However, in 2018 that was ~$15.68 billion and today is ~$150.7 billion. The total value of the bitcoin that is on exchanges today is 10x more than this chart would lead you to believe.

I think this chart is uninformative or worse.

Extra Price Charts!

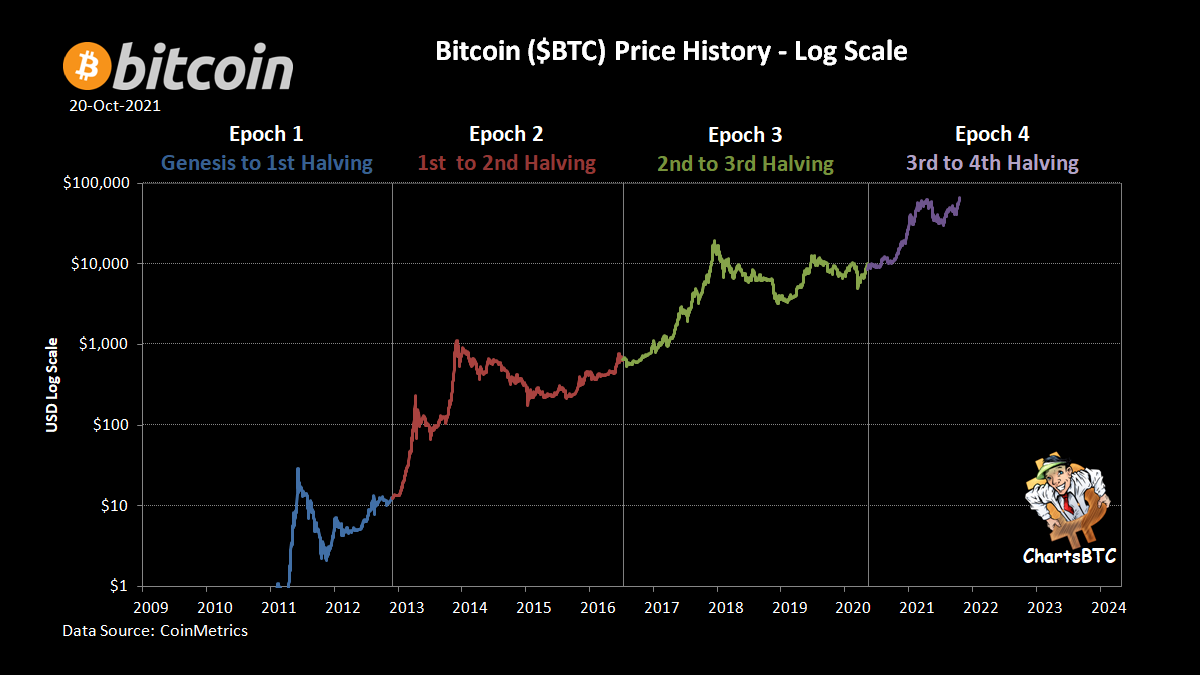

Bitcoin is programmed to go up. This cycle is looking more and more like 2013!

Become a paid member for more price charts in the Bitcoin Pulse.

Mining and Development

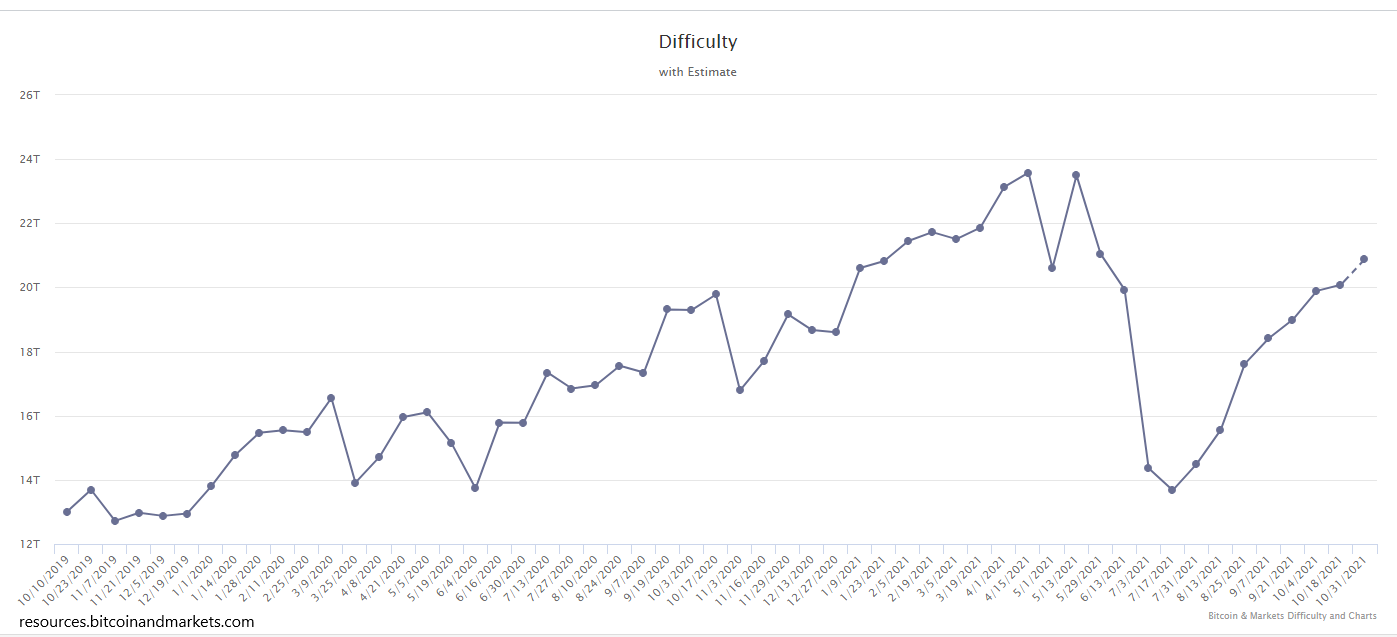

| Previous difficulty adjustment | +0.95% |

| Next estimated adjustment | +4% in ~9 days |

| Mempool | 3.3 MB |

| Fees for next block (sats/byte) | $1.00 (12 s/b) |

| Median fee (finneys) | $0.43 (0.07) |

Difficulty and Mempool

Difficulty increased by less than 1% in the last adjustment, after being on track for 4% earlier in the period. Although miner revenue has increased dramatically, hash rate has not responded.

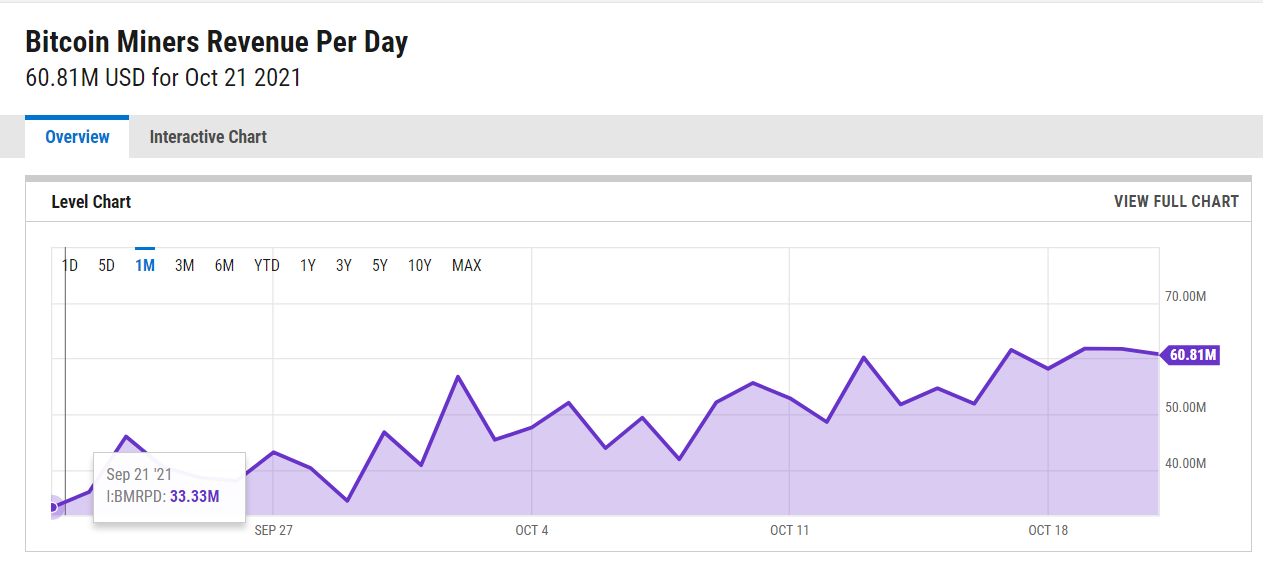

Miner revenue

Despite total miner daily revenue nearly doubling in the last month, from $33 million/day to $60 mil/day, hash rate has only risen by ~20% in the same time period.

I am positive this is due entirely to supply chain issues. There is no way to move these miners around the world with all the backlogs in shipping, and new miners are not being made nearly as quickly.

This also means governments, or other potentially malicious actors can't get new hash rate with which to attack the network now either.

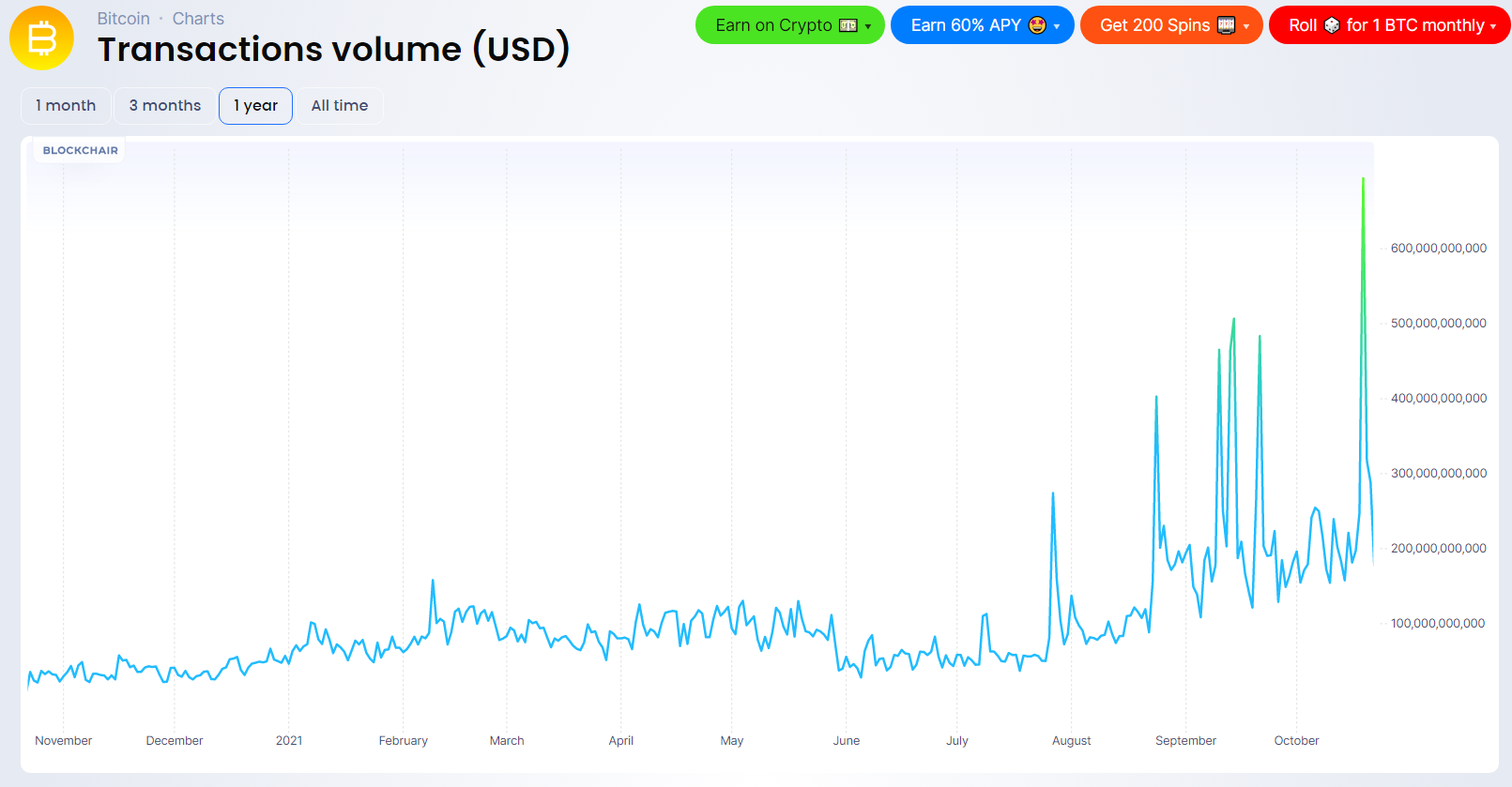

On-chain Volume in USD

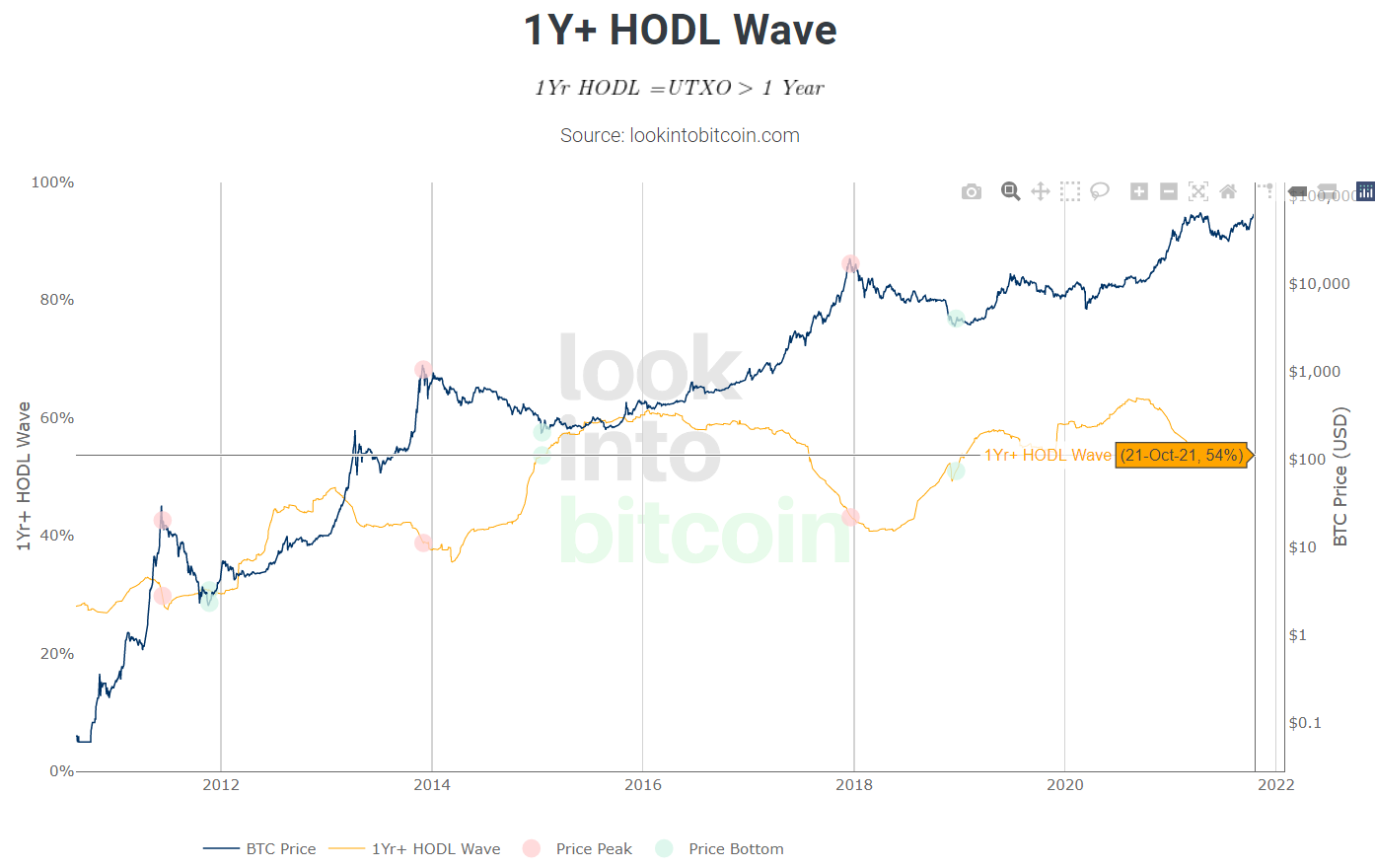

Bitcoin on-chain volume hit another record this week, at an unfathomable $694 billion in 24 hours (11.1 million btc). This is absolutely insane and must be whales sending coins in multiple transactions per day. We know this because coins which have been dormant for 1 year+ is 54% of total supply (see Hodl Wave below). Total supply is 18.85M, meaning only 10 million coins have moved in the last year.

Notice, above I highlighted exchange volumes being very low, but here we see on-chain volume is exploding. What can explain this? It's not whales looking to dump on retail, it must be something else. One good explanation is institutions (or governments) sourcing and accumulating coins in the over-the-counter market in the background.

Altcoins / CBDCs

Worldcoin Launch

Strike 1: Silicon Valley venture capital whales are marketing a new coin. These types have a history of pumping worthless altcoins and dumping on clueless traders. They are not to be trusted.

Strike 2: Crazy claims. Worldcoin's main marketing scheme is that it will be distributed "fairly" to as many people globally as possible. If that doesn't strike you as communist utopian thinking I don't know what does. Is a 20% share to early billionaire venture capitalists in SF their idea of "fair"? LOL

These types of scams always target a specific audience of suckers by the language they use to rope them in. Saying that distribution is "fair" will trick all the utopian socialists that don't have the ability to evaluate a project like this based on the technology or fundamentals. It's purely to prey on their childish beliefs.

Strike 3: It is an ERC-20 token hosted on Ethereum's unscalable network. This is not special or revolutionary, in fact, it follows the blueprint of countless scams of the past.

This screams scam on so many levels. It won't last 6 months. People tweeting about it as a "great project" and so forth have been paid and/or are early investors pumping their bags! Be careful out there.

Worldcoin is one of the most ambitious and uplifting projects I've seen so far in crypto

— Zhu Su 🔺 (@zhusu) October 21, 2021

Lots of ways to get involved https://t.co/rnfNuN1eC1

Miscellaneous

How is Google Trends for the "bitcoin" search term trending? It's headed up, but still a long way to go. Not in the shape of a blow-off top in price that is for sure. Only about half what it was in May this year.

But maybe it's because everyone knows about bitcoin already, so they are searching another term? How about "buy bitcoin"? This one has even more room to go up!

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

October 22, 2021 | Issue #164 | Block 706,212 | Disclaimer

Meme by: unknown

* Price change since last week's issue