Bitcoin Fundamentals Report #165

Today I touch on macro, Bitcoin price, the state of mining and mining news, Defi hacks, Ethereum hard forks and nodes, and US government comments on bitcoin!

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner

In Case You Missed It...

- (Podcast) Bonds, Inflation, and Bitcoin with Sam Rule - FED 68

- (Member) Post-ETF Dip, Rally to Continue - Bitcoin Pulse #120

- (Blog) Bitcoin Vital Signs: 26 Oct 2021

- (Op-Ed) Understanding the Interest Rate Fallacy: The Risk of Holding Fiat

Visiting the content on other sites helps tremendously, like bitcoinmagazine.com and YouTube! The best way to support is by sharing to family, friends and social media groups, or becoming a paid member!! Thank you for reading.

Get the Bitcoin Dictionary now on Amazon!

Market Commentary

| Weekly trend | Consolidation near highs |

| Media sentiment | Positive |

| Network traffic | Stable, slightly higher |

| Mining | Surging |

| Market cycle timing | Middle, second half of bull |

Events are Heating Up

Today, is a big post, lots going on. I touch on macro, Bitcoin price, the state of mining and mining news, Defi hacks, Ethereum hard forks and nodes, and US government comments on bitcoin!

What a week for bitcoin and macro news. Events just seem to be piling up, most of it negative, and it feels as though something has to give here soon.

My intent here is to give you my characteristic optimistic view of things. The news seems negative, but when the enemy is in charge and there's tons of negative news, that means they are losing.

Bitcoin

It was a very nice, solid week of consolidation for bitcoin. The ETFs got their footing, with BITO being the fasted ETF in history to reach $1 billion in assets. It only took them 2 days. The previous fasted was the gold GLD ETF which did it in 3 days.

The biggest news this week is from within the industry of scams forming around bitcoin, AKA "crypto", and that's the pump of Shiba Inu. This coin is a spin off of Dogecoin, who's mascot is a Shiba Inu dog and this old coin was made famous from Elon Musk trolling. The Shiba Inu coin is technically irrelevant and completely worthless from a long-term monetary potential standpoint, it is unquestionably a flash in the pan scam, but the spike of over 1000% this month is real. Of course, trying to sell any portion of those gains will crash the price again.

There is very little correlation between these mega-scam pumps and bitcoin, other than bitcoin bull markets attract these type of shenanigans, but we can only hope that a few smart SHIB sellers buy bitcoin with their gains.

Supply chains and inventories

Let's detour from bitcoin really quickly into macroeconomics, supply chains and inflation. I will be putting out a Macro Update this week for more detail.

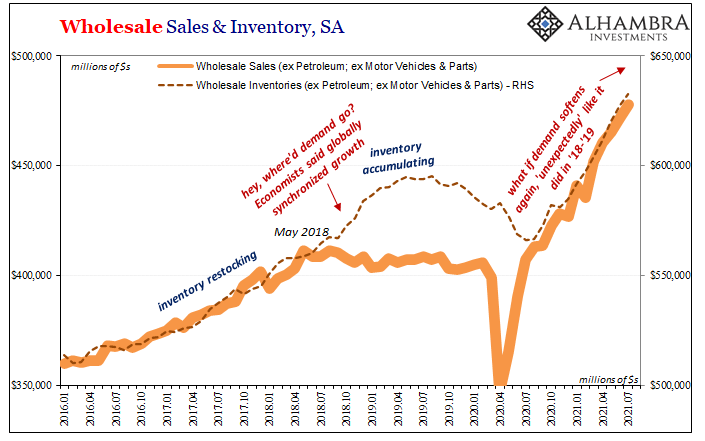

Supply chains continue to be out of whack, with container ships still unable to unload fast enough in Los Angeles. People see a couple empty shelves at the grocery store and get really worried that prices will continue to climb. However, this isn't a problem with making the products, it's not a shortage, wholesale inventories are bursting at the seams.

Via the Wall Street Journal:

Warehouse availability in the U.S. fell to record lows in the third quarter, according to figures from real-estate firms that show industrial space is all but disappearing near some of the country’s busiest distribution hubs.

If the ports are backed up working 24/7, and the wholesale inventory space is maxed out, why are the shelves going empty. This is not a shortage, it is a transportation bottleneck that we keep applying pressure to in order to clear the obstruction. What happens when the transportation issues get worked out or even start easing? A rush of inventory out to the retailers will be met by slowing demand, and a massive bust in prices will follow.

As of now, it seems that there will be effects on Christmas. Black Friday, the biggest shopping day of the year in the US, and the day most businesses cross into the black for the year, is setting up to be a huge disappointment. Things will get worse before they get better.

Is that optimistic? I think so, it means this period is temporary and the US will come out better for it. Prices coming down is usually seen as a good thing for consumers, but there will be damage to producers and the whole market. What we will be left with is more incentive to shorten supply chains and get control of supplies. Deglobalization, Made in America, more solid economic footing for the economy are the second order effects of this supply chain mess.

Strikes and Mandates

We've heard a lot about a labor shortage in the US. Businesses are cutting back hours or even having to close their doors because they can't find enough people. Minimum wage jobs in some places are paying double or triple the minimum wage just to keep people. At the same time, the vaccine mandates are forcing 100s of thousands of professionals to choose between their personal beliefs and their jobs, an many of them are quitting.

The push back against the vaccine mandates going on in the US and around the world is fantastic. And the science coming out around the world about the limited results seen from the vaccine are having an effect.

A few stories that cannot be ignored by the MSM, are Southwest and United rolling back strict mandates, 50% of police in Chicago striking, Governors passing laws in their States to make the mandates illegal, massive protests around the world over vaccine passports, and the biggest one of all that didn't get much coverage, is the largest protest/rally in NYC since the 1960's, with police and firefighters marching across the Brooklyn Bridge in the 10s of thousands.

Keep up the good fight. Don't quit. Get your exemption. Join a class action lawsuit if necessary. It's making a huge difference!

Fauci On the Outs

The man needs a Nuremburg trail for the evils he has done. This week, the National Institute of Health (NIH) came out and said they actually were funding gain-of-function research in Wuhan on coronavirus. They said they didn't know about the exact nature of the research of then the Eco Health Alliance, the organization that the NIH was attempting to throw under the bus, came out and said, 'no, we showed you details 2 years ago in this report.' Uh oh.

Then it hit the news waves that Fauci had also funded evil research on puppies. (Dog coins and puppy research this week I guess).

The obsession with defending Fauci -- rather than confronting the moral atrocity of government-funded, medically worthless, gruesome experiments on dogs -- is a sign of how sick our pundit class is. They have zero values or functions beyond mindless partisan bickering: https://t.co/fHB1AJGUBa

— Glenn Greenwald (@ggreenwald) October 27, 2021

I believe this was to give Fauci something acceptable to resign over. Like Cuomo, not resigning over sending covid positive seniors back to nursing homes to kill thousands of elderly. He waited until the sexual harassment allegations, because they are more palatable than being a mass murder. Fauci can resign now due to outrage over the puppies and not due starting the pandemic or lying to Congress.

Even the mainstream liberal media are now calling for his resignation, masked in the rationale that it will help Brandon, I mean Biden's approval numbers.

China

The situation in China continues to spiral out of control. The Evergrande situation has stabilized for the moment, but stabilized in a distressed state, barely making an interest payment after a 30-day extension. They have missed payments selectively to foreign lenders and are facing one debt payment after another, each a new struggle to get through. They have been unable to sell ANY assets of major value, not even their headquarters building. And contagion is spreading.

Several other real estate giants have now defaulted on bond payments are are facing imminent collapse, like Sinic, Fantasia, Modern Land and Ocean Wide. This won't stop. The credit bubble is popping, and with 70% of the country's savings in real estate? Uh oh.

China is also facing an energy crisis at the same time. Trade wars over coal imports from Australia stressed domestic sources, which were in turn mismanaged and are failing to produce even pre-crisis levels of coal. Chinese are turning to diesel to run generators during intermittent blackouts, and according to reports just today, many places are now facing diesel shortages, too.

Lastly, the scary second order effect here is on fertilizer (a petroleum product) and food production. China has 20% of the world's population and in recent years has started importing a much higher percentage of its food needs. Their position on feeding their population is very precarious, and a major crisis could tip the scales into some sort of emergency just to feed its people.

Why is this optimistic? China is not an economic power that is willing to go to war with the US. The worse things get in China, the more likely the CCP falls, the less likely a war with the US, meaning less threat to the world and the less support for authoritarianism in other nations.

SHARE our content with friends and family!

Quick Price Analysis

| Weekly price* | $60,930 (-$643, -1.0%) |

| Market cap | $1.143 trillion |

| Satoshis/$1 USD | 1,640 |

| 1 finney (1/10,000 btc) | $6.10 |

Become a paid member to access our much more in depth technical analysis on the member newsletter.

It would be nice to see some cooling off in the price before continuing on to $100k+. [...] I predict a week or two of consolidation here.

We've had a very nice consolidation back to the closest support (red line), which is a good sign that bears were unable to break the price lower. This is despite a major "fat finger" trade, seen below on the 15 min chart for context, but the 1 min chart shows the epic crash from $61,000 to $56,000 or 8% happening in a single minute candle.

The rebound showed massive support and demand!

Bitcoin Daily Chart

The arrow I drew last week has been working out. My thinking was the market needed to cool off, allow the bears a glimmer of hope, but not do any significant damage to the technicals of the rally.

I do not think price will breakout this weekend. Most price action in the next era of bitcoin will happen during traditional trading hours in my opinion. This is due to the rise of the traditional trading platforms and their share of volume. The CME and the ETFs will be where much of the action is for the next year or so. ETFs trade on typical stock market hours, while CME futures and options trade on extended trading hours, but still closed on the weekends (until Sunday evening).

Sign up for the Bitcoin Pulse!

Mining and Development

| Previous difficulty adjustment | +0.95% |

| Next estimated adjustment | +8% in ~2 days |

| Mempool | 19 MB |

| Fees for next block (sats/byte) | $0.52 (6 s/b) |

| Median fee (finneys) | $0.55 (0.088) |

Hash Rate

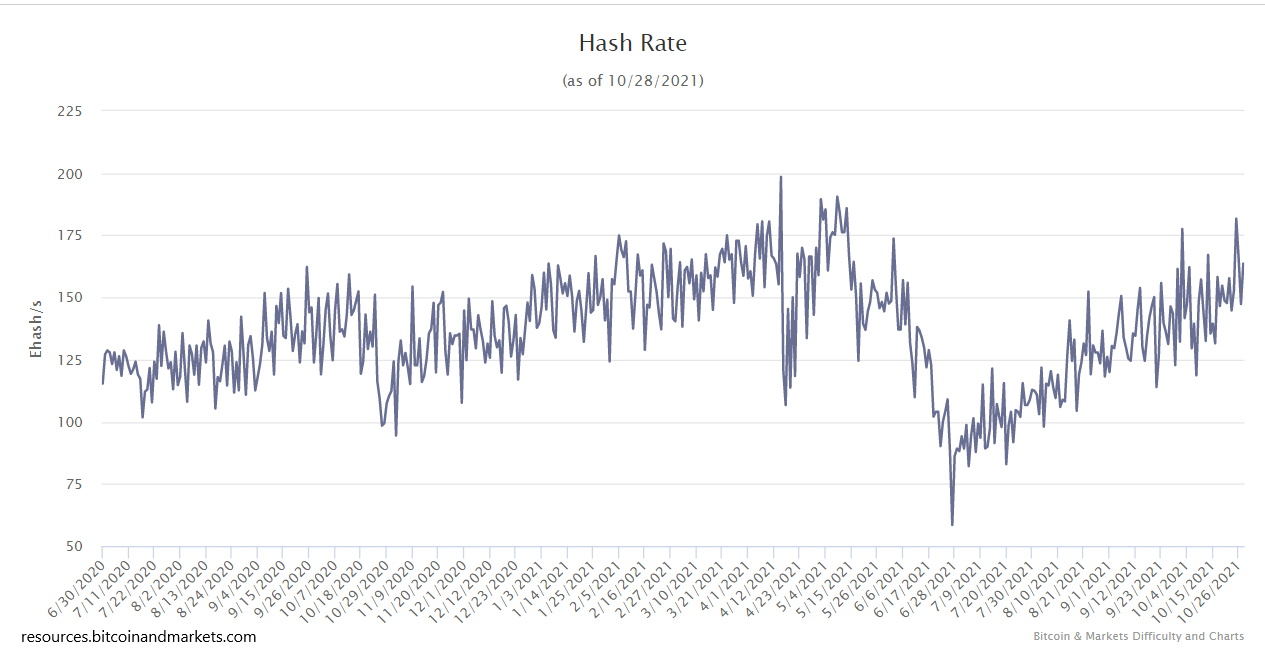

Computer power on the network continues to recover from the China ban back in June. At the time, I made the prediction that the hash rate would be recovered by the end of the year or sooner, and that is still on track. We can say it has basically recovered at this point, and looking for new expansion.

Bitcoin Mining Explained in Brief

For those unfamiliar with bitcoin mining, here is brief explainer.

Specially designed Bitcoin computers called miners race to find a random number that solves an equation. In doing so they all use electricity, or real world resources, or real world costs. When someone finds a solution they are awarded a block reward from the program itself. The system measures the speed of the network (hash rate), in order to keep the pace of solutions to an average of 10 mins.

Each reward must be earned by expending real world resources that cannot be faked. That is Proof-of-work, burning of energy in order to form an independent, verifiable, tamper-proof and universally accepted truth.

Once a solution (block) is found, all the computers race to find the next, to build on top of the previous block in a chain of truths (block chain -> blockchain). All participants can independently check the validity of the work done, and are programmed then to accept the latest valid block as the current true state of the network. In this way, Bitcoin randomly assigns block production and aligns incentives to constantly move forward.

Mining News

- Hive Blockchain Orders Another 6,500 Bitcoin Mining Machines From Canaan

This is in addition to the 10,400 miners it is buying this year. Hive is public Canadian company (NASDAQ: HIVE), once again we see North America starting to dominate bitcoin mining.

- Pennsylvania bitcoin miner jumps 52% in Nasdaq debut as bitcoin price hits record

Stronghold Digital Mining went public in the US on Oct 13th (NASDAQ: SDIG). Stronghold uses waste coal left over from centuries of mining in Pennsylvania to mine bitcoin, showing bitcoin is a major incentive to clean up or save marginal wasted energy. <cough> North America </cough>

Stronghold brings the waste coal from these sites to its two facilities, where it uses fluidized bed boilers to remove toxins. That helps produce power, which is then used to generate electricity for its bitcoin miners.

Altcoins / CBDCs

Defi Hacks

- Cream Financial, a "defi" lending protocol running on Ethereum, was hacked for the 3rd time this week, with the latest being for a total of $130 million.

- Indexed Finance, another "defi" protocol built on Ethereum, was hacked a couple weeks ago for $16 million. This was an interesting case, because they tracked down the hacker and demanded the tokens back. Very decentralized of them.

Bottom line on "DEFI" is that it's a joke. It is not decentralized, their protocols are so shoddy that they can't be trusted with even a small amount of money. They suffer from the interoperability/oracle problem, meaning they have to work with other networks and tokens, but that the connection between those networks is always managed by a central point of failure, hence why their development teams are always at the center of these hacks.

Bitcoin is the real Defi. It is built on a battle-tested decentralized base layer, the Bitcoin network, with a tapestry of other protocols built on top, like the decentralized Lightning Network, or the Federated Liquid Network. The other layers to the Bitcoin technology stack have different trade-offs for different features, but they are well established and honestly stated.

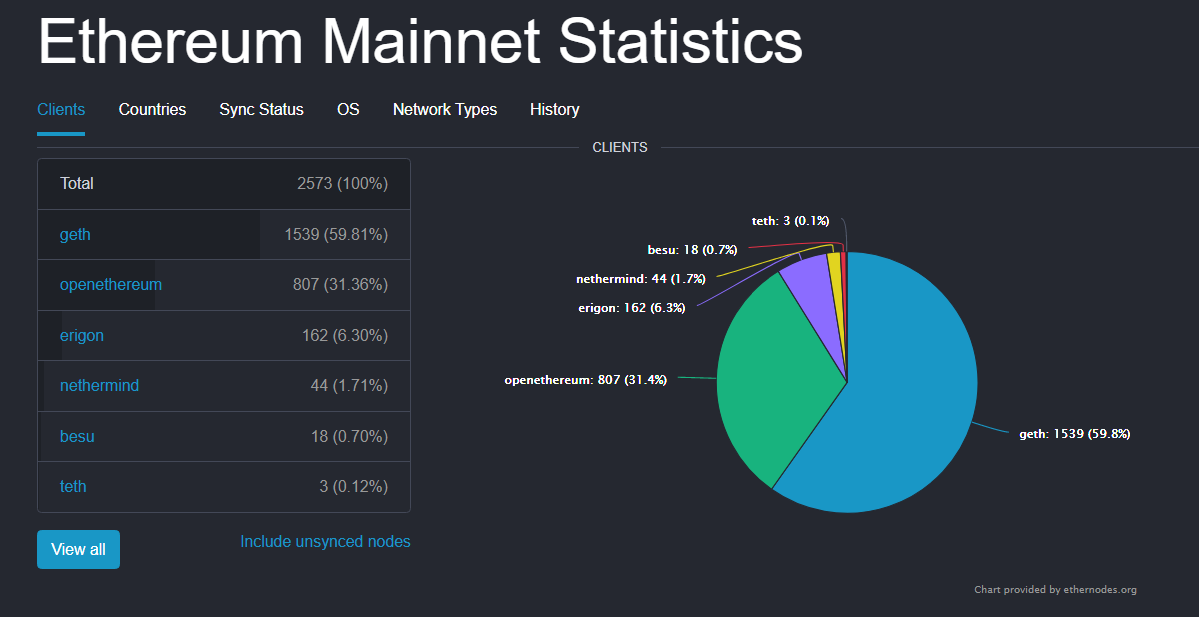

This differs from Ethereum-based Defi because Ethereum is by nature of hard fork scaling centralized to a small number of leaders, the most important being Vitalik and Joseph Lubin. Anything built on Ethereum must deal with the irreparable holes in Ethereum. They also are never honest about their level of centralization around team of developers, because that would destroy their fake value-prop.

Everything Defi can do, Centralized Finance can do better (except money itself, that's where Bitcoin comes in).

Ethereum Hard Fork

Speaking of Ethereum's hard fork scaling, they recently completed another hard fork called Altair. Uncharacteristically, it went off without marketing. That is out of their typical MO and makes me a little suspicious that they were less confident about this upgrade. The subtitle of the linked article even says, "developers are keeping watch to make sure no issues arise." That is, again, uncharacteristically modest for Ethereum.

This upgrade was I guess the last planned upgrade to the "Beacon chain", the backbone of the brand new Ethereum 2.0 network they will transition to some day, maybe.

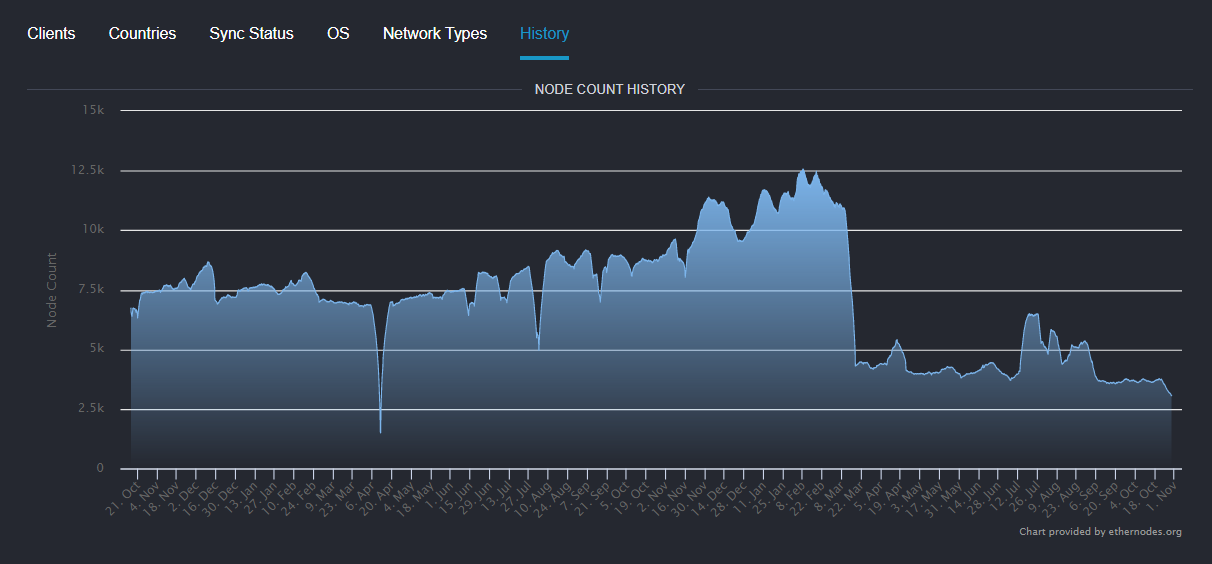

In researching this blurb for the newsletter, I checked the number of Ethereum nodes on ethernodes.org. I was not surprised to see that the total number of nodes has dropped to 3000 and only 2500 synced. With over 90% of nodes running either Geth or ex-Parity Openethereum. That is much lower than earlier this year when I last looked, at 12,000. Getting more and more centralized.

Miscellaneous

This issue is getting long, but I couldn't end it without commenting on two headlines out of the US government about Bitcoin this week.

FDIC, Banks holding Bitcoin

First is from the Chair of the FDIC (Federal Deposit Insurance Corporation), Jelena McWilliams, and other US regulators that are looking into the structure to allow banks to hold Bitcoin. This is the missing link IMO for Bitcoin to start taking over big-boy collateral roles on bank balance sheets.

Rand Paul Says Bitcoin could become world reserve currency

From Bitcoin Magazine:

Bitcoin could become the world's reserve currency if more people lose trust in the government, said Senator Rand Paul, who accepted BTC donations in its 2016 campaign. The Republican Senator was interviewed on Axios, discussing the future of bitcoin and fiat currency in the U.S. [...]

"I've started to question now whether or not cryptocurrency could actually become the reserve currency of the world as more and more people lose confidence in the government," he said.

Have a great weekend! Happy Halloween!!!

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

October 29, 2021 | Issue #165 | Block 707,319 | Disclaimer

Meme by: @BitcoinMemeHub

* Price change since last week's issue