Bitcoin Fundamentals Report #169

Big week... Podcast banger about European troubles, bitcoin/dollar correlation, Nu variant, price analysis, explaining the empty mempool, India regulation, US Comptroller clarification, and volcano bonds.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner

Big week... Podcast banger about European troubles, bitcoin/dollar correlation, Nu variant, price analysis, explaining the empty mempool, India regulation, US Comptroller clarification, and volcano bonds.

In Case You Missed It...

- (Podcast) Fed Breaks Ranks with ECB, European Debt Crisis 2? - FED 71

- (Op-Ed) Understanding the Interest Rate Fallacy: The Risk of Holding Fiat

Visiting the content on other sites helps tremendously, like bitcoinmagazine.com and YouTube! The best way to support is by sharing to family, friends and social media groups, or becoming a paid member!! Thank you for reading.

Get the Bitcoin Dictionary now on Amazon!

Market Commentary

| Weekly trend | Scary consolidation |

| Media sentiment | Negative |

| Network traffic | Low |

| Mining industry | Hash rate pause, investment surge |

| Market cycle timing | Second half of bull market |

Hello dear reader,

Happy Thanksgiving to all! I wish you all health and prosperity as we enter even crazier times in the near future.

Let's dive in to this week's issue.

Big Podcast Episode

This week's Fed Watch podcast was a banger. It is our most downloaded and watched episode yet. 4,000 views on YT for the clip about Europe, plus 2,000 views for the whole episode, plus our audio downloads that I haven't seen yet, but they are usually 2-3x our YT views.

For each episode I do a big write up on Bitcoin Magazine. Check out the full post here, and I'll summarize a little bit below.

Powell was re-nominated

Powell got re-nominated as Fed Chairman in a rebuke of global central bankers. Powell has been stiff-arming CBDCs and a digital dollar instead preferring the market's digital dollars in the form of Tether and USDC. Europe has no choice than to push for a CBDC, because the market is not providing a digital Euro in competition (money is convergent with network effects). Therefore, they want "internationally coordinated action" in order to keep the Euro relevant. Powell and the Fed are not playing along.

Euro Regulation

“The Eurosystem will use the new framework to oversee companies enabling or supporting the use of payment cards, credit transfers, direct debits, e-money transfers and digital payment tokens, including electronic wallets. The PISA framework will also cover crypto-asset-related services, such as the acceptance of crypto-assets by merchants within a card payment scheme and the option to send, receive or pay with crypto-assets via an electronic wallet.”

–ECB Press Release

Perfect Storm in Europe is Bullish Bitcoin

We went into depth on the many headwinds facing Europe right now. Of course, it has inflation, but it also is facing the Fed turning its back; supply chain disruptions and trade volumes shrinking; a rising case count of COVID-19, despite the authoritarians forcing shots under duress, new lockdowns and restrictions in many countries; and an escalating energy crisis that places Europe in the palm of Russia, right at the time Russia is massing troops on the border of Ukraine. It’s a perfect storm that is resulting in capital fleeing Europe for the dollar and hopefully for bitcoin.

As capital flees Europe it will spike the dollar, which everyone knows is bad for the global economy, because most high-powered debts are denominated in dollars. Therefore, bitcoin offers an alternative for capital flight that won't perpetuate the ups and downs in the dollar. I suspect this dynamic to pick up pace over the next year, which we can observe in the correlation between DXY and bitcoin that is already forming.

Nu Variant

The next round of fearmongering has starting, and the timing is not a surprise. Concern over this new variant is hyped right as the global economy is rolling back over into recession. Ironic? I think not. They will blame the virus instead of their authoritarian destruction of the economy.

The common factor in all these variants is that it is a mutation of the spike protein, that grabs human cells and injects the virus. It is also the vector by which the gene therapy shots work, by exposing the body to the spike protein without the rest of the virus. The body then has a single-dimensional immunity against a specific spike protein (natural immunity has a multi-dimensional immunity to the whole virus).

However, when you mass vaccinate in an active pandemic (never done before), this provides huge evolutionary pressure on the spike protein to mutate and get around the single-dimensional immunity. Is it then a surprise we see the spike protein mutating so much, 32 mutations to be exact in the Nu variant? No. The mutation pressure is coming from the vaccinated, not the unvaccinated and naturally immune.

IF this variant spreads rapidly, the vaccinated are not going to be protected. The Nu variant is going to rip through the population of people without natural immunity. While one would hope this would snap idiots out of their forced vaccination policy, it will probably lead to more lockdowns in countries that tend toward authoritarianism. And we are seeing it already as the vaccines are failing.

High energy costs, high food costs, cold winter, recession, and lockdowns are going to be very socially explosive around the world. This is going to be the Winter of Global Discontent.

How will all this affect bitcoin?

This is the key question for bitcoiners. We are a hardy bunch who can hold through a lot, but we are also a bit uneasy about the price not taking off after the recent ATH and are not immune to a global recession.

The above dynamics will definitely affect the price of bitcoin. There will be an added pressure to sell amongst people that need to tap their bitcoin savings during this trying time. But there will also be a large buying pressure, as capital flees Europe in general, and large pools of capital look for a safe harbor. Lastly, much of the bitcoin ecosystem is consolidating to North America right now, which will be less affected by the coming storm.

Therefore, my 30,000 ft prediction based on these events is over the next few months we'll see forces cancel each other out for the most part, resulting in a relatively steady price of bitcoin, perhaps slightly skewed to the upside. As the safe haven bid gets popular and stimmy check start rolling again, we'll see the price take off to the upside early next year.

SHARE our content with friends and family!

Quick Price Analysis

| Weekly price* | $54,039 (-$3,802, -6.6%) |

| Market cap | $1.021 trillion |

| Satoshis/$1 USD | 1,848 |

| 1 finney (1/10,000 btc) | $5.41 |

Become a paid member to access our much more in depth technical analysis on the member newsletter.

Bitcoin Daily Chart

Last week:

The obvious place for a bounce is at the bottom of the channel with other support around $52,500.

Price has dipped right into the red box I identified last week. There is growing worry about the price here, and bears are becoming more prominent. That tells me it's almost time to bounce.

It is also, running into the support of the channel and horizontal support. I like the comparison to the previous bottom in the black box.

Bonus chart: Other important indicators here are the daily 100 MA and the weekly 20 MA on the chart below. Price touched the 100 daily MA and might move toward the 20 week MA in the next few days. I've also highlighted the similarities to September 2020, which I think might serve as a blueprint for the next few weeks.

Overall, there is slightly more risk to the downside here, but price should remain relatively stable in the low $50k's until it decides to breakout again.

Get more price analysis, Sign up for the Bitcoin Pulse!

Mining and Development

| Previous difficulty adjustment | +4.69% |

| Next estimated adjustment | -0.9% in ~1 days |

| Mempool | 1 MB |

| Fees for next block (sats/byte) | $0.08 (1 s/b) |

| Median fee (finneys) | $0.08 (0.014) |

Mining News

There is not much new in the mining world this week. The call to ban bitcoin mining in Europe from Sweden and Norway, which I wrote about last week, has been reprinted 100 times, and mining companies continue to expand aggressively.

Mining companies based in the US and UK have been raising money quite easily. This week saw, Griid raise $500 million and talk about going public via a merger. Lending business Celsius has invested $300 million into its North American miners after raising $400 million in equity funding last month.

Hash Rate and Difficulty

The hash rate surge that we've seen over the past few months is starting to slow. The estimated next difficulty adjustment taking place tomorrow is slightly negative (-0.9%), which would be the first negative adjustment since July.

Mempool

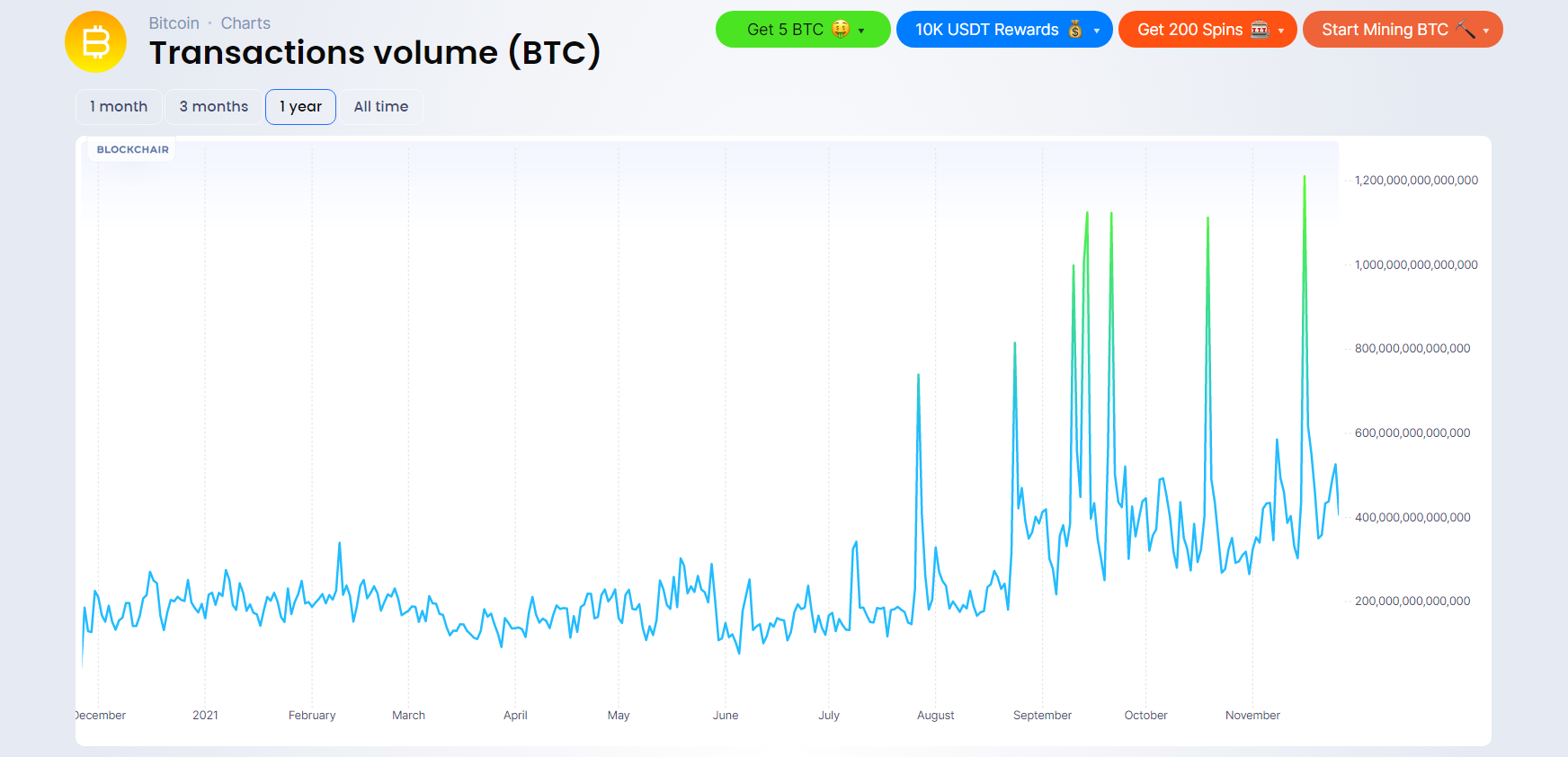

The mempool (transactions waiting to be confirmed) is extremely small, at less than 1 MB. This means that the transaction activity on the network is very low.

Here are a few ways to interpret the low amount of transaction activity. 1) Low transaction demand, low overall demand is a bearish sign; 2) on network transactions are being replaced by layer 2 transactions like the lightning network, demand shifting; 3) transaction characteristics are changing, larger transactions on chain, smaller transactions on layer 2; 4) Chinese miners were stuffing blocks to get higher fees.

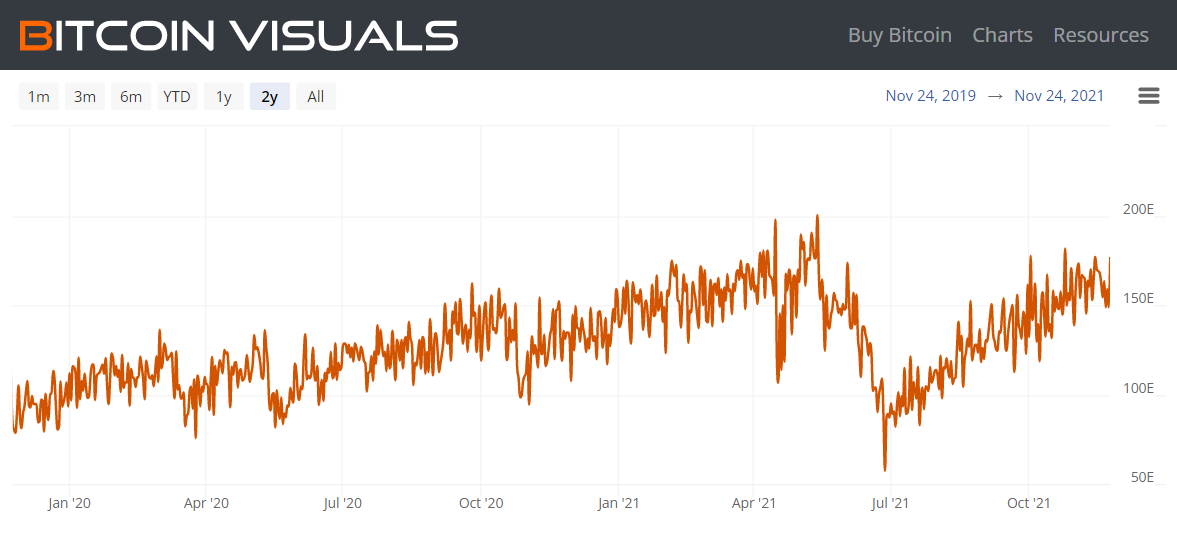

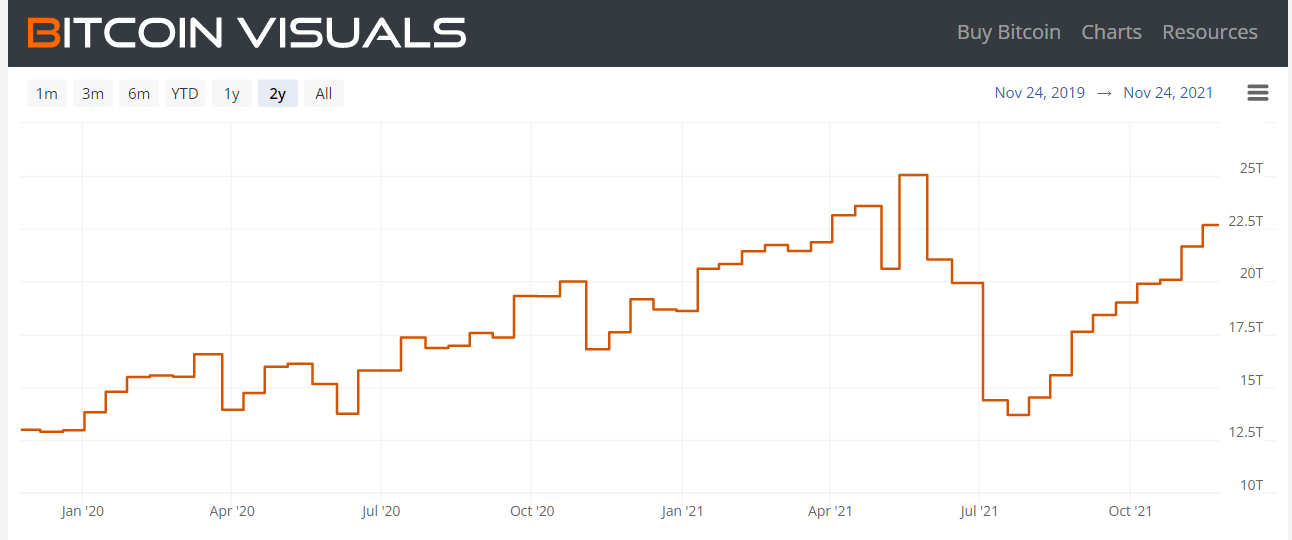

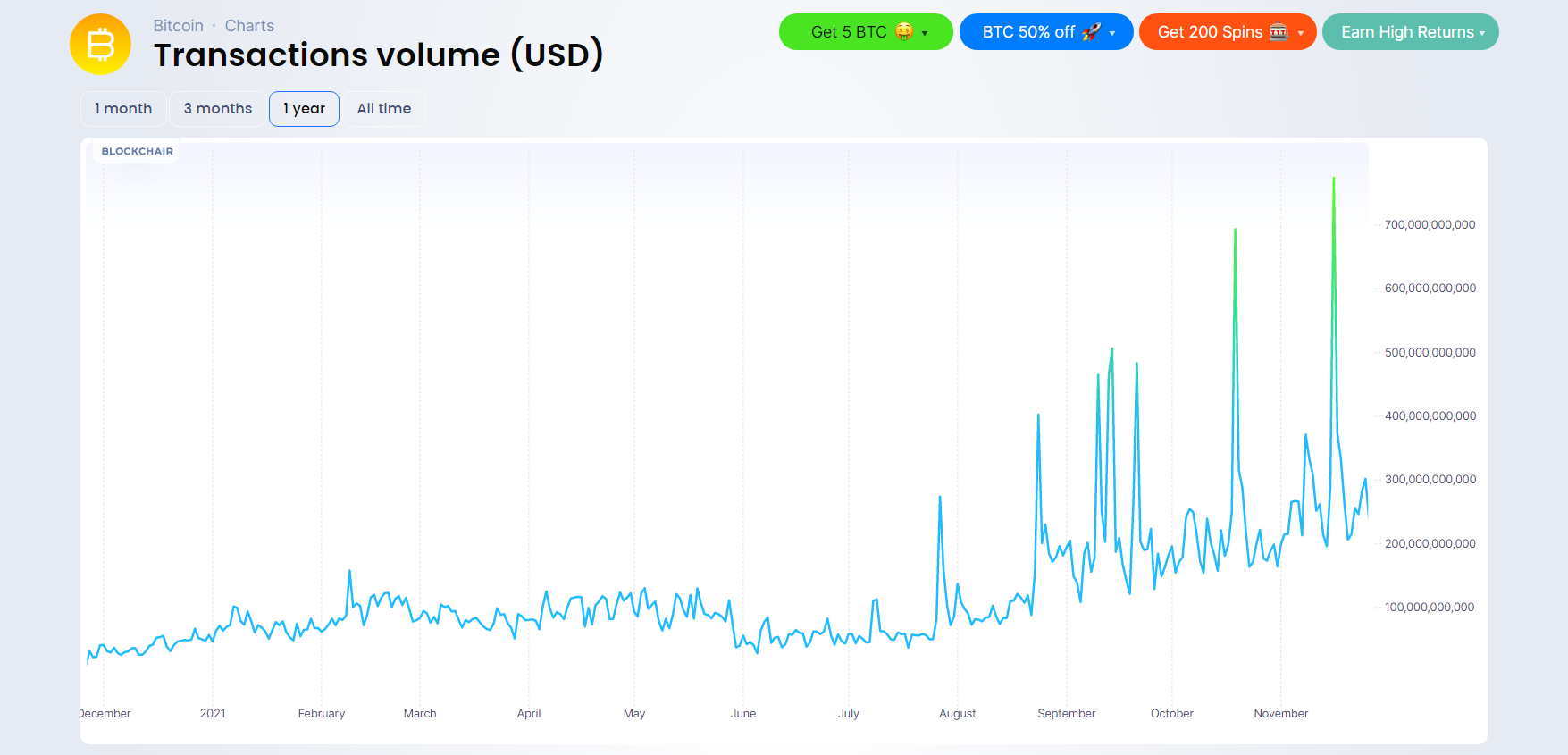

What we see by looking at the charts, the volume of both BTC and USD value is growing very quickly in the second half of the year.

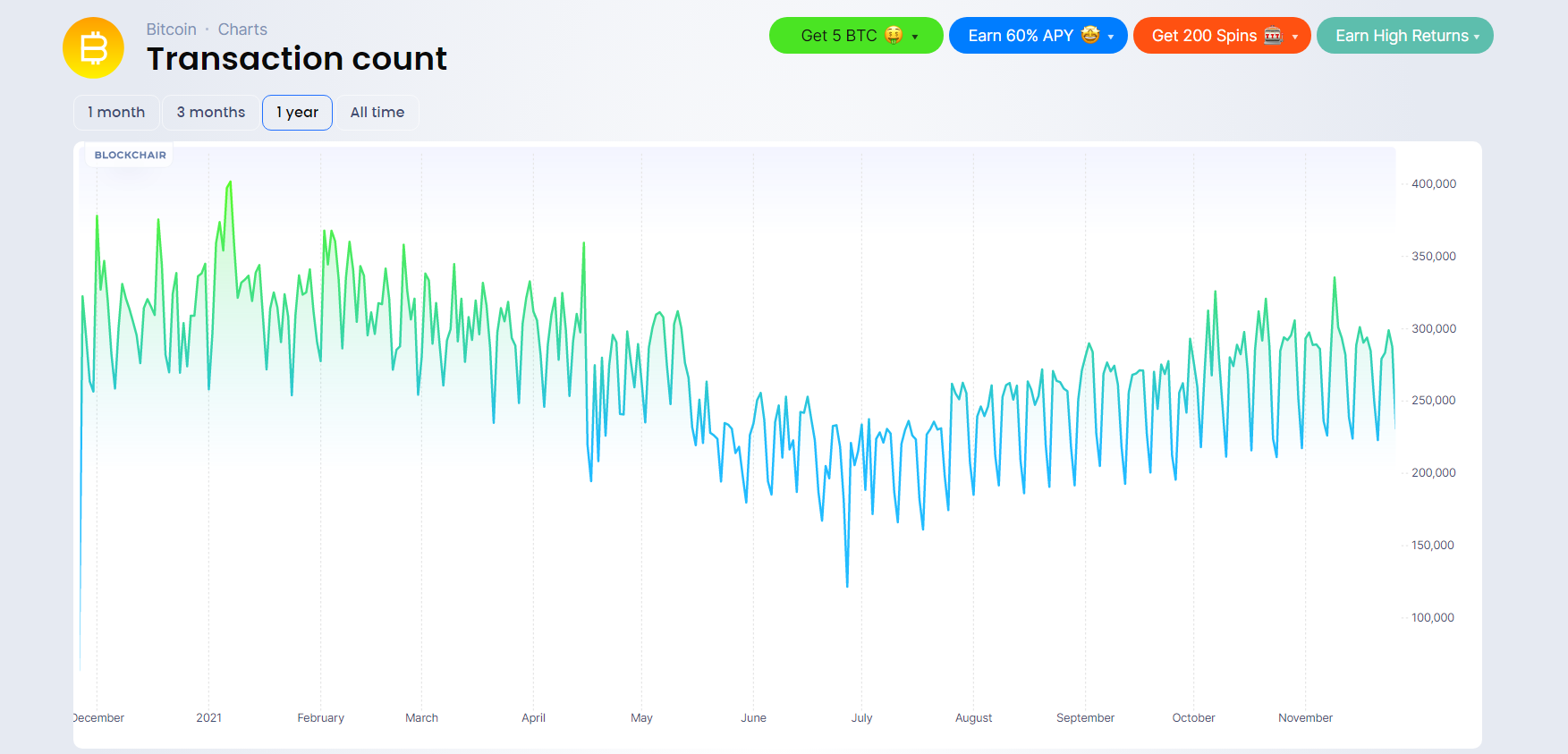

The number of transactions on the network has been increasing the second half of the year after the China ban.

The average block size is also very high and increasing since the China ban drop. This means space is being used more efficiently.

Overall, I conclude that the base-line volume of the bitcoin network is still growing at the historic rate or even a little faster. Many of the smaller transactions are increasing being done on the lightning network, while large transactions are happening on chain.

Altcoins / CBDCs

India Muddies Their Regulatory Waters

India has brought back the controversial bitcoin bill from earlier this year to its agenda for the upcoming legislative session.

JUST IN: 26 new Bills are listed for introduction in the #WinterSession, including three Ordinances, the Electricity (Amendment) Bill, 2021, and the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021.

— PRS Legislative (@PRSLegislative) November 23, 2021

Supplementary budget is also expected to be tabled.

1/

The controversy around this bill centers on the term "private cryptocurrencies". Some say that it would only affect privacy related coins like Monero and Zcash, while others claim it is targeting private company coins like Tether and USDC (digital dollars). Whatever the case, it will be far reaching and disrupt the bitcoin economy in India.

India has a long history with bitcoin regulation. In 2018, the Reserve Bank of India placed restrictions on banks' ability to service bitcoin exchanges. This roadblock remained in place until March of 2020, when a Supreme Court decision overturned that restriction. Then in 2021, this current bill to ban "private cryptocurrency" was debated and eventually defeated.

India is one of the most active countries in bitcoin, probably due to its massive population. If a ban is put in place, it will greatly affect the altcoin market, and to a lesser degree bitcoin.

Maybe India ban FUD becomes the new China ban FUD.

US Office of Comptroller of the Currency

A few days ago, the OCC released a clarifying statement about their policy of how US banks can deal with bitcoin. In the release it states that banks must first notify the OCC of their intent to offer bitcoin related services and receive a non-objection letter back. This is technically a hurdle which could be used against some businesses, but it does not seem to be restrictive at this time.

It is part of my vision of wide bitcoin adoption that banks begin to hold bitcoin on their balance sheets. This clarification gets banks one step closer to the goal. So, I'd say this is bullish news.

Miscellaneous

El Salvador selling bitcoin bonds. This is innovative.

El Salvador to issue $1 billion through a bitcoin bond via Blockstream's @Liquid_BTC & traded on @BFXSecurities. Proceeds go to: 50% ES mining infrastructure, 50% BTC purchase. 1Oy duration, pays 6.5% interest. (not financial advice) https://t.co/2PYCed3gbx

— Tuur Demeester (@TuurDemeester) November 21, 2021

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

November 26, 2021 | Issue #169 | Block 7141,433 | Disclaimer

Meme by: @BitcoinMemeHub

* Price change since last week's issue