Bitcoin Fundamentals Report #172

This week... bitcoin mortgages, taper U-turn coming, Russia and China de-dollarization?, price analysis, mining news, and NFT cycle timing.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner

This week... bitcoin mortgages, taper U-turn coming, Russia and China de-dollarization?, price analysis, mining news, and NFT cycle timing. SHARE SHARE SHARE

In Case You Missed It...

- (Podcast) Deep Dive on Bitcoin Cycles ft Dylan LeClair - Fed 74

- (Livestream) We are now livestreaming Fed Watch on Tuesdays

- (Op-Ed) The Real Reason Federal Reserve Chair Powell Retired "Transitory"

- (Blog) Macro Chart Rundown - 6 Dec 2021

Visiting the content on other sites helps tremendously, like bitcoinmagazine.com and YouTube! The best way to support is by sharing to family, friends and social media groups, or becoming a paid member!! Thank you for reading.

Get the Bitcoin Dictionary now on Amazon!

Market Commentary

| Weekly trend | Scary consolidation |

| Media sentiment | Neutral |

| Network traffic | Elevated off floor |

| Mining industry | Stable |

| Market cycle timing | Later consolidation before repricing |

Hello dear reader,

Lots happening in macro and in bitcoin, too, even if it doesn't seem like it. Bitcoin is burying its tentacles deeper into the financial system, it is positioning itself to be a lifeboat for the global economy as it cracks and sinks around us.

Let's dive in to this week's general news.

Lending Business, Ledn, begins making bitcoin backed mortgages

Ledn announced a funding raise and their new product offering this week.

We’ve secured $70 million at a $540 million valuation in our Series B funding, led by 10T. We will use this new capital to support the rapid growth of our lending business, including our newest product - the world's first #Bitcoin Mortgage.https://t.co/6YrXjLhxkN pic.twitter.com/C7eoH3ee2O

— Ledn (@hodlwithLedn) December 15, 2021

Via coindesk:

With its bitcoin-backed mortgage loan, Ledn clients will be able to purchase real estate and use an equal amount of bitcoin and property collateral as part of the mortgage loan. Ledn intends to make the product more broadly available to clients in the U.S. and Canada early next year.

“Most people that hold extensive wealth in Bitcoin still can’t utilize their assets to qualify for a mortgage at a bank,” Ledn’s co-founder and CEO Adam Reeds said in the statement.

Holders of bitcoin don't want to sell their bitcoin in order to use it. This could offer quite a bit of support the price as it diverts sell pressure during market rallies. People will feel more comfortable holding bitcoin because they can use it elsewhere. And this is a big use case for bitcoin gains. One of the first things people want to spend their new wealth on is a home.

Federal Reserve Speeds Up Taper

Much of my news feed this week was dominated by the Federal Reserve and their announcement to speed up their taper of QE. That is the podcast after all, watching central banks and talking about what they are up to and how it will affect bitcoin. Also, my post on Bitcoin Magazine this week is all about Powell retiring "transitory" and how to interpret it.

At the FOMC meeting this week, the Fed decided to increase their rate of taper, because they are apparently worried about inflation (great narrative for bitcoin btw). They are looking at unemployment, wages and supply-side constraints, and are predicting inflation (price increases) will continue to be a problem. I think that is highly unlikely.

"Is there too much money, or is there not too much money?"

If they could measure money, they'd just do that. Instead they use voodoo equations with magic variables they change all the time, like r* (full employment), job openings, CPI prices, and other unscientific metrics that they pull out of their bias. We have the worst supply-side constraints in 50 years, nuff said.

Interest rate inversions are everywhere signaling something very wrong in the financial plumbing; China's real estate market (largest asset class in the world) is collapsing, energy crisis in Europe with Russian troops on the border of Ukraine. The economy is about to go the other way, and way too far. The Fed might have to go from speeding up the taper to jacking it right back up again.

Russia and China Payment Network

The Holy Grail for so many dollar haters out there, those who've been calling for the death of the dollar for decades, they jump on any story that has a whiff of other countries ditching the dollar. (In the next breathe they'll also say just how all-powerful the Fed is in the global economy. But anyway.)

This week a story made its rounds about Russia and China setting up an independent trade network to route around the US-led financial system. It always makes me chuckle when people take this kind of story seriously.

The first question you have to ask yourself is, who wants rubles or yuan? The Chinese don't want to hold rubles. We don't know the exact breakdown of the PBoC's foreign currency reserves, but I can guarantee you rubles are less than 1%. Russian on the the other hand is more open. In 2020, they were down to 22% USD in their foreign currency reserves, and up to 15% yuan. But I'll note, Russia is under extreme sanctions from the US and they still hold more dollars than yuan?

No one wants to hold rubles or yuan. Now, I do think that Russia is doing the best that can be expected for a country in its position, but there is zero threat that the world will dump dollars for rubles. Laugh that idea out of the room. As for the Chinese yuan, it isn't as ridiculous but it is still not a serious idea.

Look, the USD isn't perfect but it is the reserve currency of the world. If a place de-dollarizes they are locked out of international trade. Those businesses that would do business in rubles, cannot turn around and use it in business in other countries. They must change those rubles into dollars to use them with Japan, or Vietnam, or Saudi Arabia. At this point, the only thing that de-dollarizing does is handicap your economy. So, feel free to do it Russia and China.

SHARE our content with friends and family!

Quick Price Analysis

| Weekly price* | $46,316 (-$1,958, -4.06%) |

| Market cap | $0.876 trillion |

| Satoshis/$1 USD | 2,157 |

| 1 finney (1/10,000 btc) | $4.63 |

Become a paid member to access our much more in depth technical analysis on the member newsletter.

The bitcoin price is currently fighting to maintain the 200-day MA, very near oversold territory, one week away from the monthly, quarterly and yearly CME close.

I see little impetus toward a strong reversal until the new year, but also no strong impetus toward a major crash. Hopefully, price will hold strong where it is. Be aware of the possibility of a fake out, a dip breaking lower only to reverse quickly and go up steadily (see bottom on 20 July earlier this year).

There are no headwinds right now like there were back in July with the Grayscale unlock. The inflation narrative is going strong, big buyers keep buying, regulatory threats are relatively light, there's no huge FUD out there.

The general feeling in the market is apprehensive, in my opinion because NFTs and altcoins have been dropping and the end of the year usually brings extra bills and year-end selling.

The next week or two, are likely to be a back and forth battle for the price, if the cycle is finished (which I doubt) there is going to be a bull trap in coming weeks, then price will continue to trickle down as we bulls remain convinced. That is unlikely but we must remain aware of our biases.

My conclusion is a repeat of last week,

The most likely scenario is sideways to down for the next week.

Bitcoin Daily Chart

Get more price analysis, Sign up for the Bitcoin Pulse!

Incrementum Chart Book

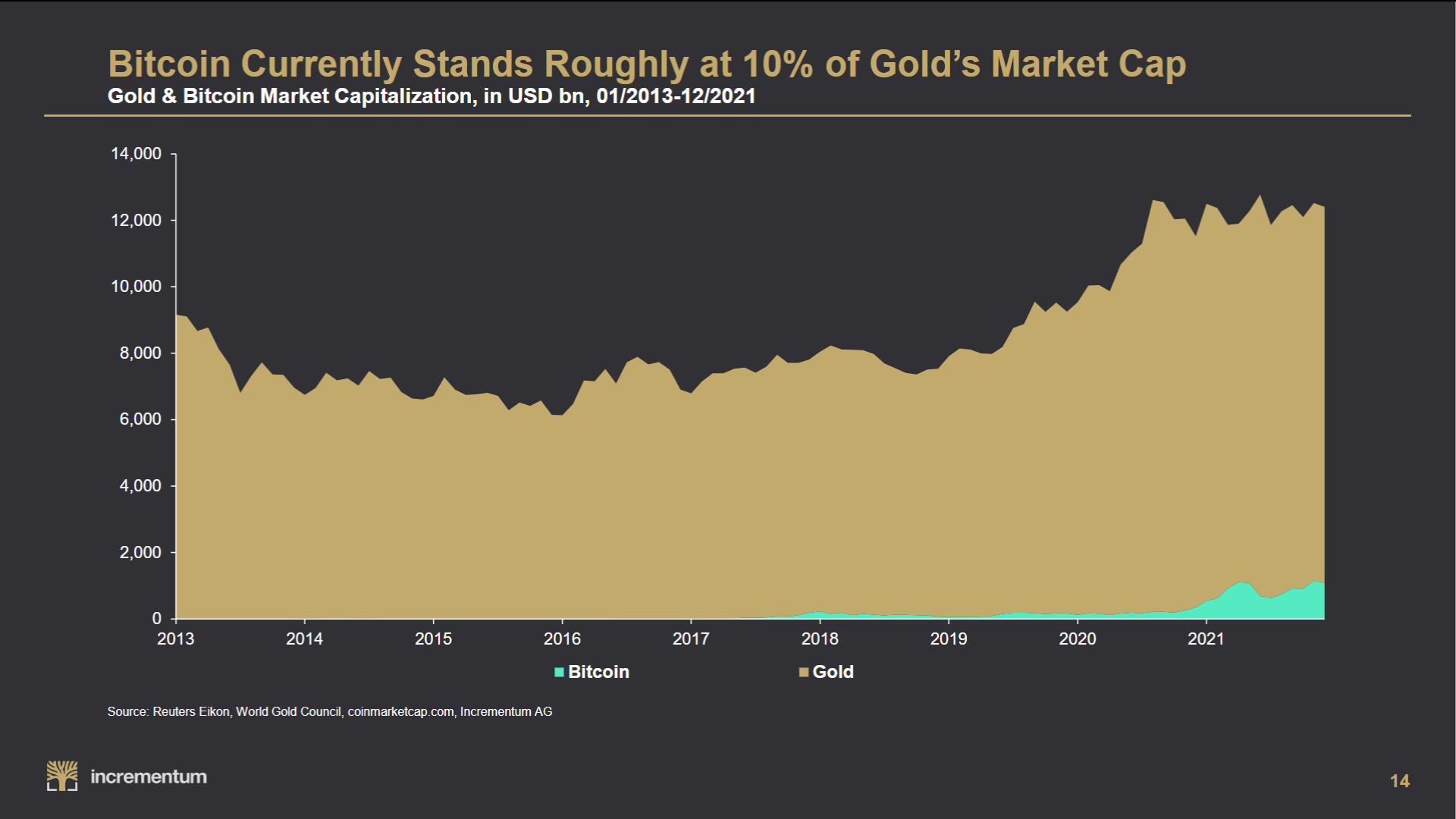

A set of charts crossed my radar this week via Tuur Demeester on Twitter. It's from a wealth management group called Incrementum and I'm impressed. I'm only including one chart here, but will write a blog post soon talking about many more.

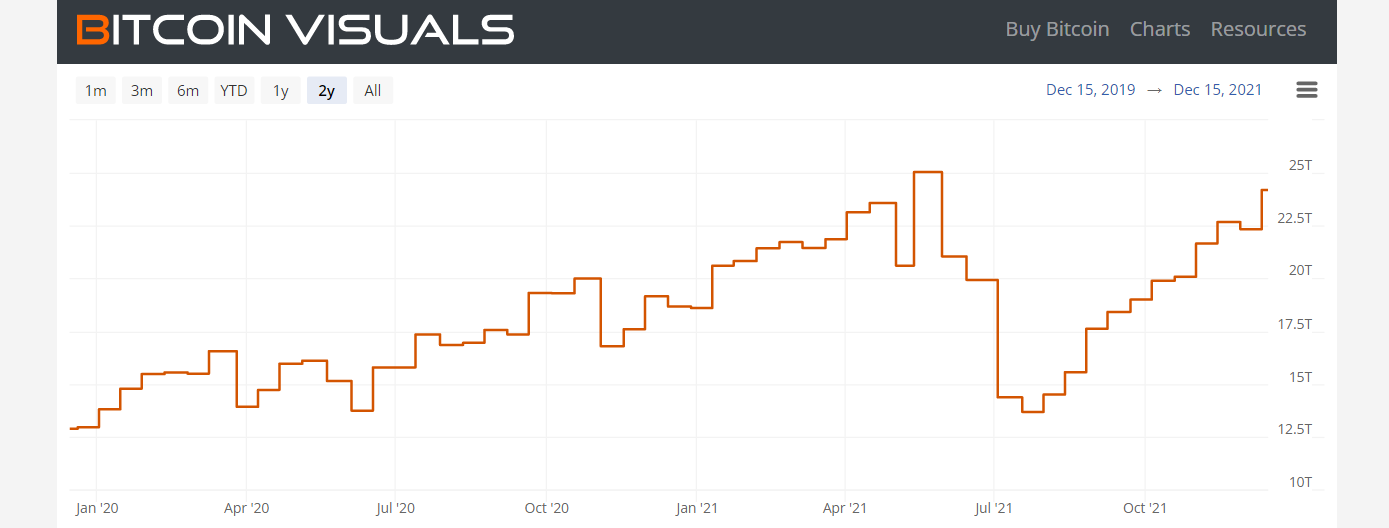

This particular chart was is interesting in light of what I wrote on last week's Report about bitcoin's near-term destination is the market cap of gold. This chart is showing it approximately $12 trillion. Therefore, if bitcoin is to get to that market cap with available coins, it would need a ~15x rise. I think that is possible within 4 years.

Mining and Development

| Previous difficulty adjustment | +8.32% |

| Next estimated adjustment | -2% in ~8 days |

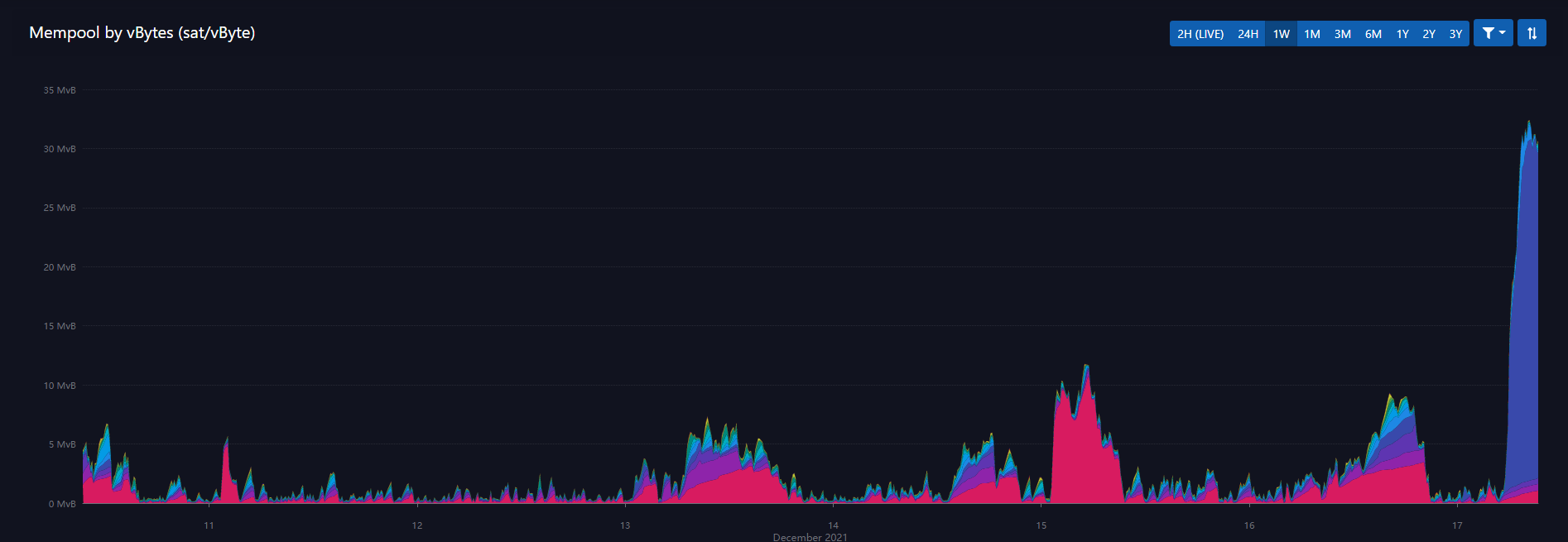

| Mempool | 30 MB |

| Fees for next block (sats/byte) | $0.40 (6 s/b) |

| Median fee (finneys) | $0.40 (0.09) |

Mining News

Former Marine and South Carolina Politician Raises $200M to Start Bitcoin Mining Company - Again, more mining in the US and North America. For those new to the report, North America is going to be the center of bitcoin mining for the next decade. Very bullish for the US economy.

Beijing court rejects monetary compensation in Bitcoin mining contract plea - At the same time as the US is welcoming, China is doing everything in its power to chase bitcoin miners out. Bitcoin does not fit the authoritarian model.

Bitcoin Miners Who Flocked to Kazakhstan Now See ‘Zero Potential’ - One of the big winners from miners fleeing China earlier this year was Kazakhstan. Now, miners there are facing another government crackdown. Should have come to the US. This is also while Kazakhstan is finishing up a pilot program for a silly CBDC.

Mempool

Some action is happening on the transaction front just over the last day. As you can see in the chart below, there was a significant jump in transactions paying above a minimum fee. Usually when we see spikes, they consist of mostly the minimum fee.

There could be a sell off in the making here. The mempool typically spikes on price action, and with the price so droopy, it could support the case for more of a sell off.

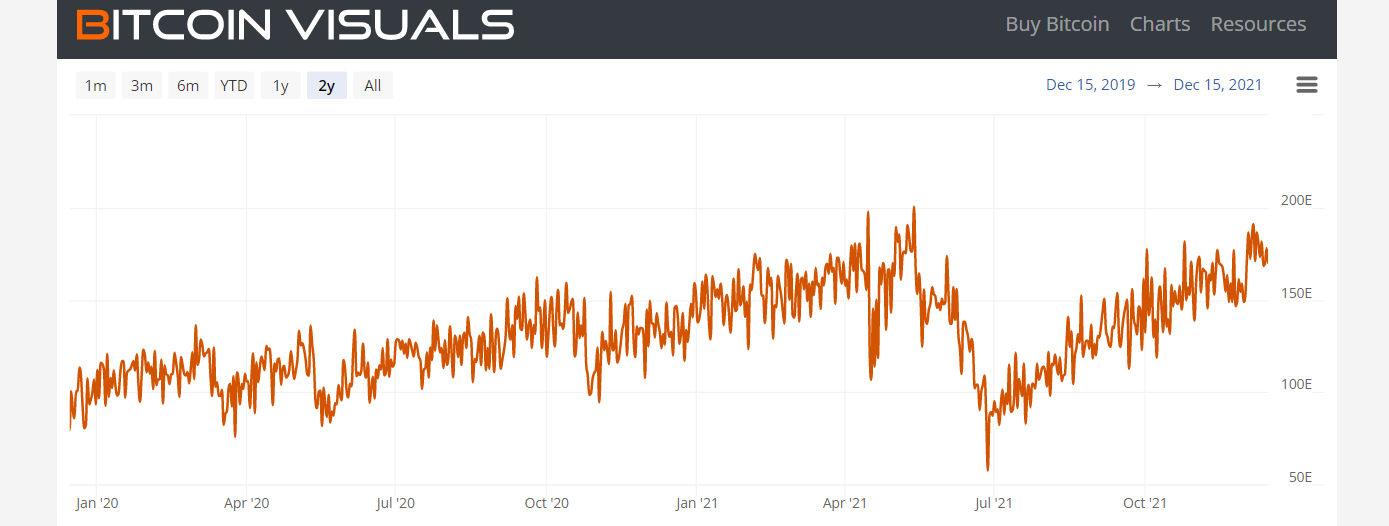

Hash Rate and Difficulty

Hash rate is stable, but could see a slight pull back during this price dip if it gets more serious.

Altcoins / CBDCs

Everywhere you look you see people jumping on the NFT bandwagon. Nike, Adidas, Melania Trump, White Castle, and Michael Jordan to name only a tiny few. It's gotten ridiculous out there. People wake up, these are jpegs!

The bubble has to be close to collapsing. The stimmy checks and greater fool year of 2021 is coming to an end. The economic problems this world is rolling into won't allow as much room for this type of unbridled speculation. From one side, it is the lack of productive economic opportunity and stagnation that is driving this (people are trading stupid monkey jpegs instead of picking up more hours on the job), and on the other hand it is the nasty economy that will stop it.

For NFTs to continue upward, they need ever increasing levels of participation and money. Very unlikely to happen.

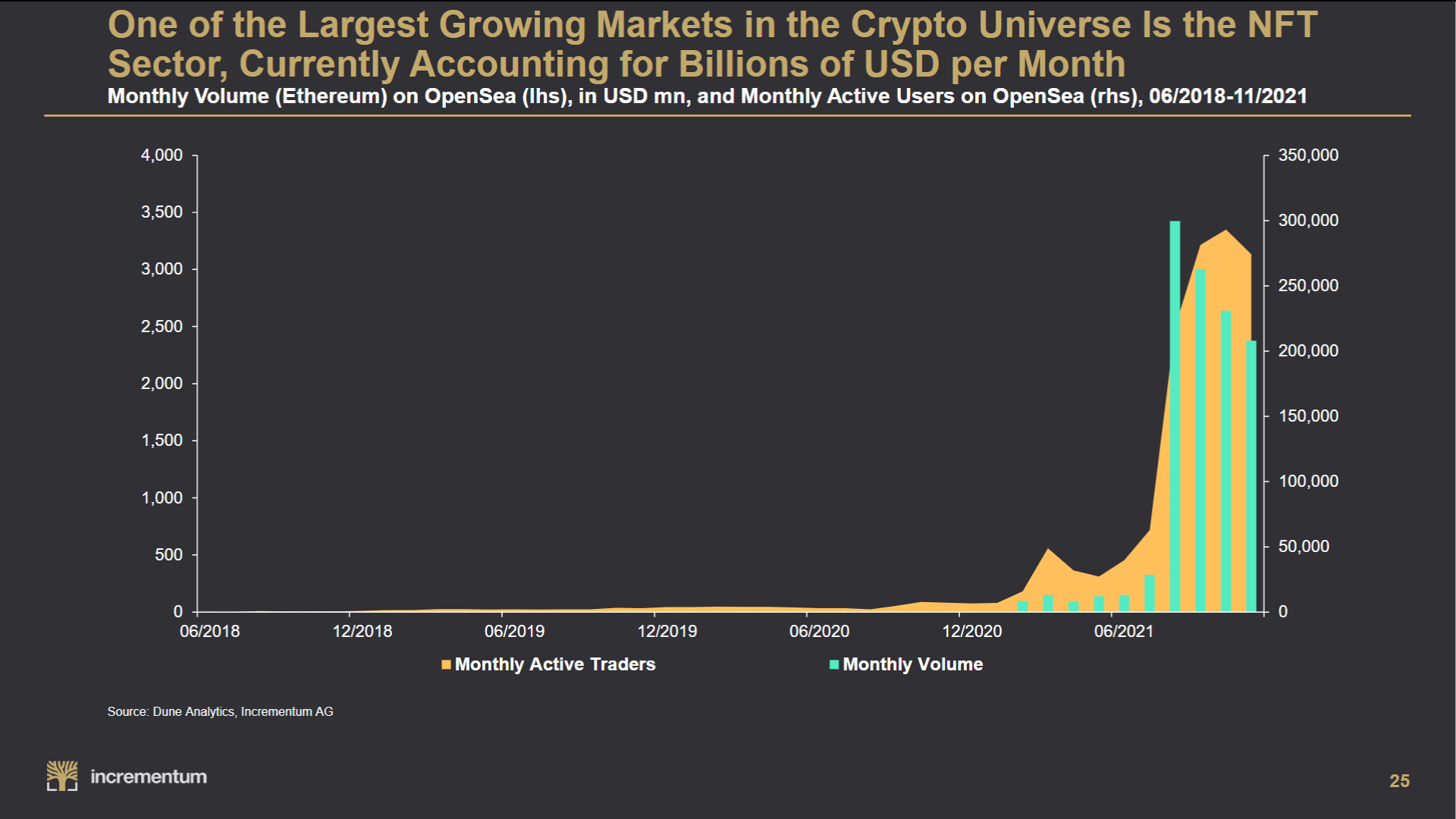

Another chart here from Incrementum, which got me going down this shallow rabbit hole, shows monthly volume continuing to decline, and monthly active traders starting to roll over. We might be witnessing the top.

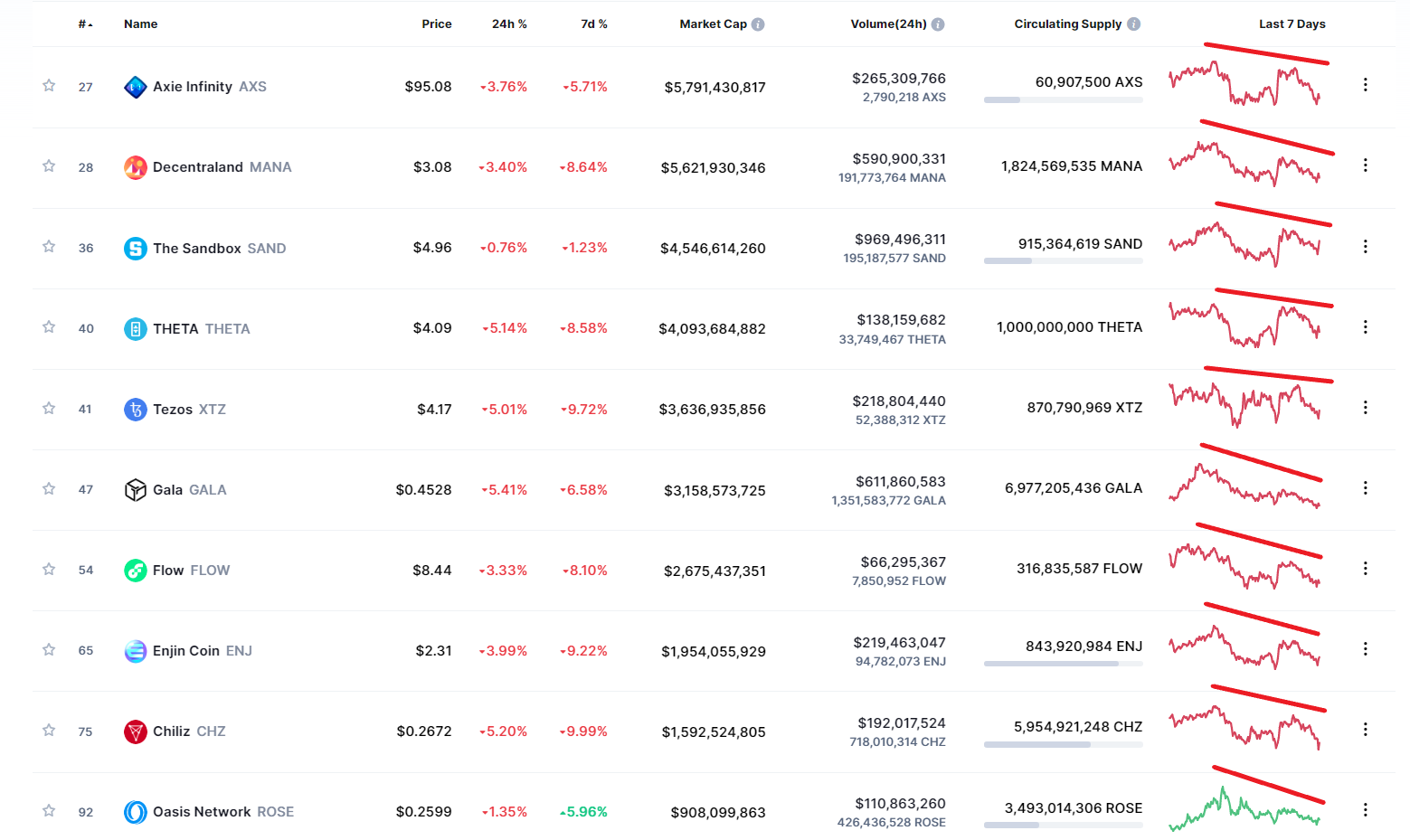

Below are coins for networks that are primarily used for NFTs. Crashing.

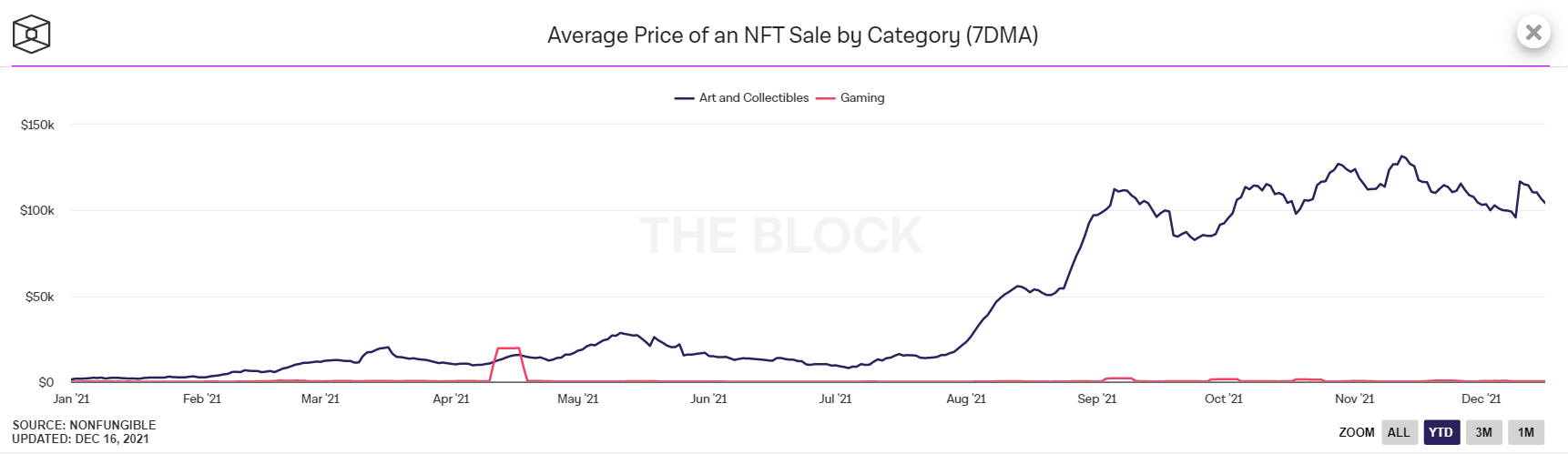

Average sale price has experienced its first lower high (art and collectibles).

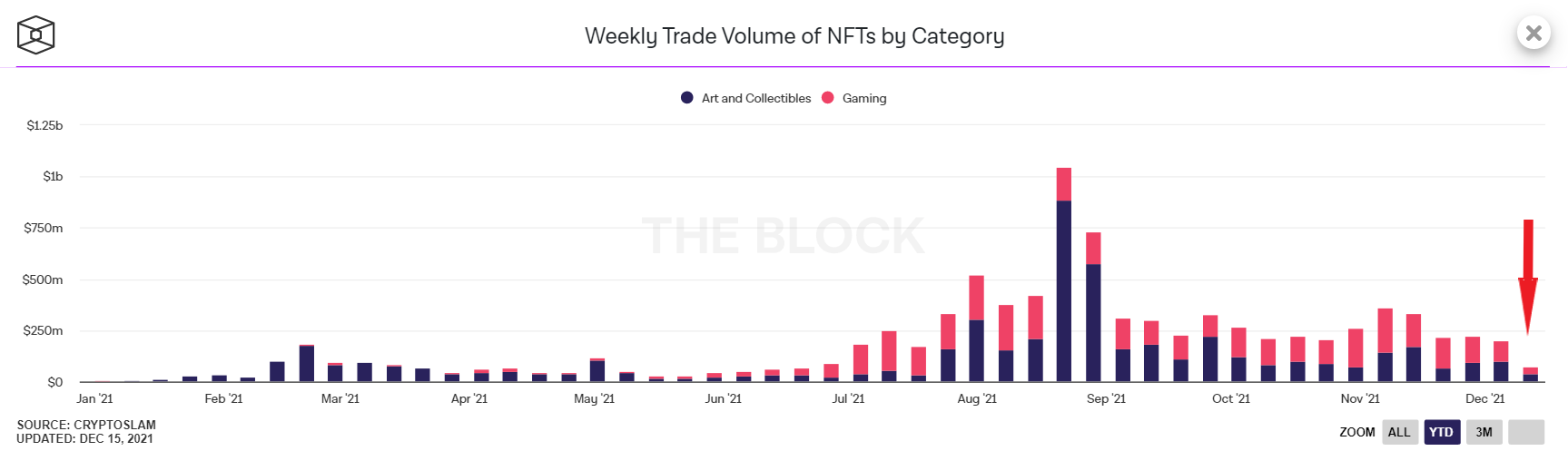

Weekly trade volume is falling off a cliff!

People with a vested interest in NFTs, like so many pop-up news websites and altcoin casino exchanges, are going to be all hands on deck to pump this market up. I want to be on the record with the call that 2022 is going to see the petering out of the NFT hype, just like the ICO hype died quickly in 2018.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

December 17, 2021 | Issue #172 | Block 714,576 | Disclaimer

Meme by: @SwanBitcoin

* Price change since last week's issue