Bitcoin Fundamentals Report #174

This week... billionaire Bill Miller, Argentina, Rio de Janeiro, Tonga, Central Asian geopolitics, bitcoin mining, price analysis, developer legal defense fund, and NFTs.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner

This week... billionaire Bill Miller, Argentina, Rio de Janeiro, Tonga, Central Asian geopolitics, bitcoin mining, price analysis, developer legal defense fund, and NFTs.

In Case You Missed It...

- (Podcast) Big Trends of 2021 and 2022 - FED 76

- (Livestream) We are now livestreaming Fed Watch on Tuesdays

- (Op-Ed) The Real Reason Federal Reserve Chair Powell Retired "Transitory"

Visiting the content on other sites helps tremendously, like bitcoinmagazine.com and YouTube! The best way to support is by sharing to family, friends and social media groups, or becoming a paid member!! Thank you for reading.

Get the Bitcoin Dictionary now on Amazon!

Market Commentary

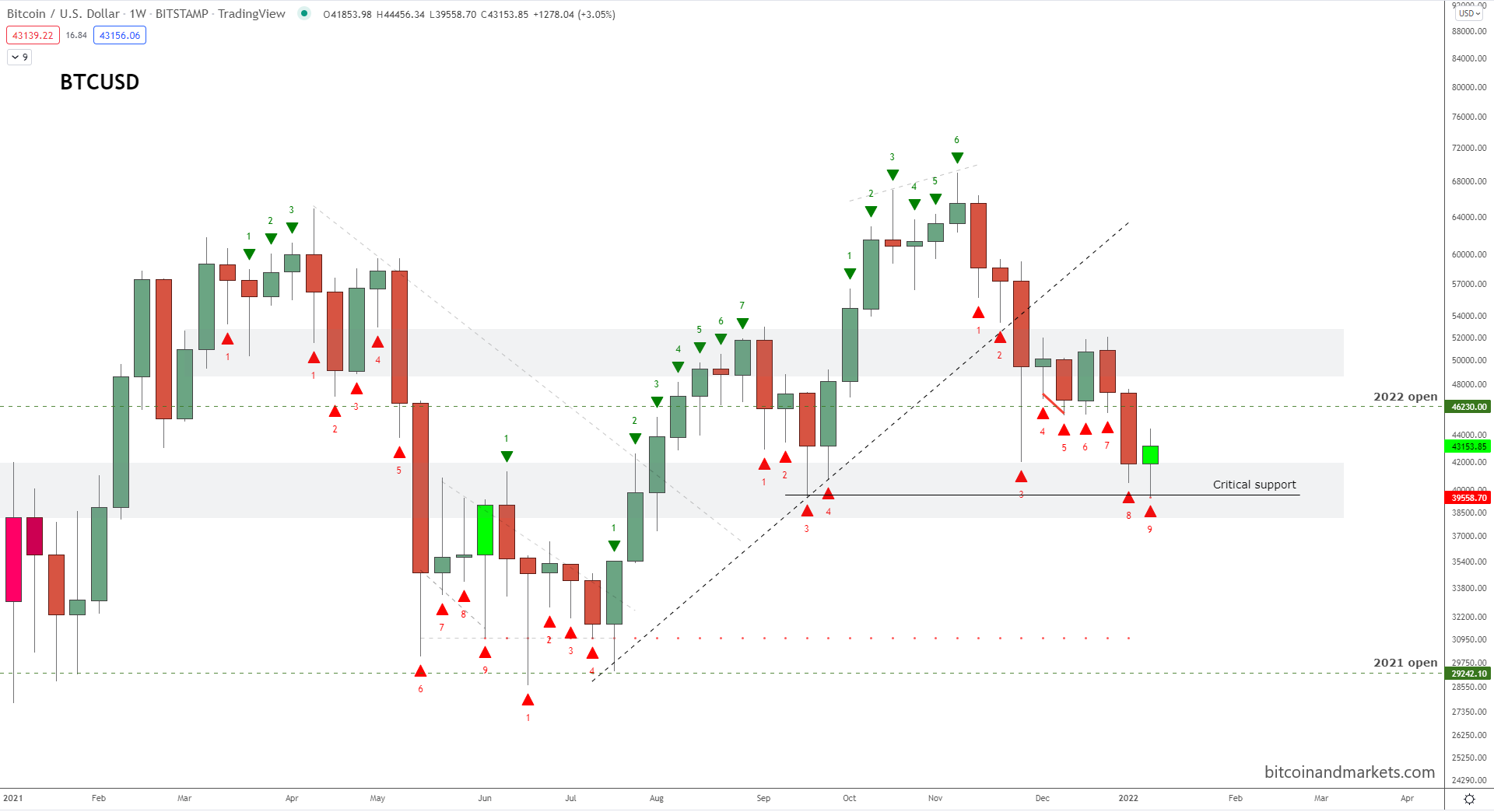

| Weekly trend | Do-or-die support level |

| Media sentiment | Distracted |

| Network traffic | Very low |

| Mining industry | Tense but growing |

| Market cycle timing | Beginning new 18-month cycle? |

Hello dear reader,

After two months of eye-gouging boredom in the bitcoin news cycle, this week things started to pick up steam. To the outside world, or those not deep into the bitcoin community, it might seem as if bitcoin is dead. Looks can be very deceiving. Instead, bitcoin is consolidating and making sure people who are not truly committed lose interest before the next leg higher.

Typing that last sentence makes me feel a little cultish. Let me explain. In speculative markets like bitcoin (although it is fast becoming more stable) the trend is your friend. Whales will milk the downward trend for all its worth, and only when a fundamental floor is found where true holders hold the line, will whales participate in flipping the trend back to price increases. There is only so much money to be made in any direction, and true committed believers put a floor in the negative direction.

Anyway, let's hit this week's big stories and fundamental developments...

Legendary Investor Bill Miller's Portfolio is 50% Bitcoin

In a recent interview, Bill Miller said:

Half of his personal investment portfolio is allocated to bitcoin and Bitcoin-related companies including bitcoin miner Stronghold and software intelligence company MicroStrategy.

This is huge. There is a large number of billionaires that are heavily invested in bitcoin. A stark contrast to 4-5 years ago, when influential players like Jamie Dimon of JP Morgan were bashing bitcoin left and right, making fun of it. Ha ha, our last laugh is coming.

If a significant portion of the richest people in the world are heavily invested in bitcoin, we can be fairly confident there will not be strict draconian regulations passed in the next several years in the US.

That is exactly what I have been predicting for multiple years, and I've gone further in the last year, making the contrarian call. I think the US government will tacitly legalize bitcoin as a currency, and become a safe harbor for bitcoiners.

Few realize that the US is a major tax haven for the rest of the world. In fact, it ranked third behind Switzerland and Hong Kong for many years, but with the recent CCP takeover of HK, the US should currently be the #2 tax haven. As for bitcoin, there is major incentive to combine tax haven status, the strongest observance of law and order of any major economy, the reserve currency status of the dollar, and the potential of bitcoin. And don't forget, the US is already becoming the bitcoin mining capital of the world.

Argentina, Rio de Janeiro, and Tonga Racing into Bitcoin

Jack brings bitcoin to Argentina

I remember when Jack Mallers burst onto the bitcoin scene. Right away I recognized him has an incredible spokesman for bitcoin. We have Michael Saylor for the serious billionaires, Max Kaiser as the eclectic billionaire, and Jack Mallers to speak to the hip younger generation.

Big news out of Jack's Strike, they are now opening up Argentina to the power of bitcoin. Strike is an impressive app that puts all the complexity of bitcoin in the background. You can send fiat with Strike and receive bitcoin, or vice versa. Getting approval for the Argentina market is huge, considering they are perpetually racked by very high inflation.

Argentines always try to hold a big portion of their wealth in US dollars or gold, now they will have easy access to bitcoin. Big game changer.

Rio de Janeiro will put 1% of city funds in Bitcoin

Rio is becoming the first Brazilian city to buy bitcoin as a store of value. They are also looking to give a 10% discount on city taxes when paid in bitcoin.

Miami embracing bitcoin is having deep influence all over Latin America, like on Rio Mayor, Eduardo Paes. He announced his bitcoin intentions on stage with Miami Mayor Suarez at Innovation Week in Rio. Of course, their adoption won't happen right away, they hope to have many of these policies in place as early as this year, once the legalities are worked out.

Tonga to make bitcoin legal tender

Christian and I mentioned Tonga making bitcoin legal tender in our 2022 predictions podcast. Only a week later, we have a statement from a former MP in Tonga @LordFusitua. He is predicting by this coming Sept/Oct for the Bitcoin legal tender bill to be passed, and several weeks later launched. So, by the end of the year, we will definitely have a second country with bitcoin as legal tender.

1. Sept/Oct Bill goes to Parliament. Passed.

— Lord Fusitu'a (@LordFusitua) January 12, 2022

2. Sent to Palace Office for submission to His Majesty for Royal Assent.

3.<A month - HM as advised by Privy Council assents to Bill.

4. 2-3 Weeks Gazetted by Govt activation date set.

4. On activation date #BTC becomes legal tender. https://t.co/TNjQjeEbjN

Granted, Tonga is even smaller than El Salvador, but these are the small dominos from the GIF above. Soon, it'll be a mid-size country, then a major financial market, then maybe even the US gives it the nod.

The Central Asian Ring of Fire

People are familiar with the Pacific Ring of Fire, the region around the rim of the Pacific Ocean where much volcanic and earthquake activity occurs. Well, I'm calling the developing situation in Eurasia, from China to Belarus, the Central Asian Ring of Fire.

I wrote about Kazakhstan last week:

Destabilized countries on your border is a huge expense. Russia now has two. They have their army on the border of Ukraine in a stare-down with NATO and the EU, and now Kazakhstan. Russia has Europe under control, but multiple fronts at once is not smart. They will probably look to get Kazakhstan wrapped up quickly by force.

It didn't take long to light the flame of chaos after the US left. What most people refuse to accept is that threats, destabilization, and war are the normal state of affairs in the world. It is only the leadership of the US, and the international institutions it built, that allowed 99% of the world to be at peace for the last 75 years. Who else is going to spend trillions of dollars to keep the peace? No one. Everyone will be left to deal with their neighbors on their own.

Geopolitical expert, Peter Zeihan, came out with a video podcast a couple days ago speaking about specific worries involved in the destabilization of Kazakhstan. The major one IMO is the effect on western oil companies in the country if under de facto Russian control. They might be forced to leave depending on how sanctions affect them. Kazakhstan fields produce roughly 1.5 mil barrels of oil per day (bbd).

If Kazak output is curtailed it could have a significant impact on global energy prices. However, the reduction of supply must be considered alongside the effect on global demand that will result from widespread unrest.

The importance of this Central Asian Ring of Fire cannot be overstated for the immediate trajectory of the global economy. I've felt like I'm yelling into the wind in recent months, but finally, others are starting to grasp what it means. Today, from Zerohedge: Is Geopolitics The Big Market Risk We're Missing? YES!

We cannot understand macro, the dollar, or bitcoin without grasping the fundamental shifts taking place in geopolitics. That is why I have been talking about it for a year on Fed Watch.

SHARE our content with friends and family!

Quick Price Analysis

| Weekly price* | $43,400 (+$1,822, 4.4%) |

| Market cap | $0.816 trillion |

| Satoshis/$1 USD | 2,319 |

| 1 finney (1/10,000 btc) | $4.31 |

Become a paid member to access our much more in depth technical analysis on the member newsletter.

Finally, a green week! This last month has separated the boys from the men, the weak hands from the strong. Your dedication will pay off. Price has been mainly sideways as predicted, but that is coming to an end soon.

Bitcoin Daily Chart

Weekly TD Sequential

A very bullish sign is the weekly red 9 on the TD sequential indicator. This is a time-based indicator where a 9 indicates the end of momentum in the current direction. Back in Sept, it signified that the bottom was basically in. There was one last fakeout lower that coincided with the large GBTC unlock, but this time, we could see a better timed bottom and reversal because there is no similar big outside event that is applying bearish pressure.

My price prediction for the coming week is to hold strong. On the daily, we might reach back to the $41,500 level to form a bullish divergence, but will end the week higher once again. The next area of resistance is $45,500, which we could threaten to break through this week as well.

I did not get around to pushing out a Bitcoin Pulse last week, and this weekend is traveling with the family. But a Pulse is coming, thank you for being patient in this unusual month.

Get more price analysis, Sign up for the Bitcoin Pulse!

Mining and Development

| Previous difficulty adjustment | +0.41% |

| Next estimated adjustment | +5.2% in ~6 days |

| Mempool | 1 MB |

| Fees for next block (sats/byte) | $0.18 (3 s/b) |

| Median fee (finneys) | $0.06 (0.02) |

Development

This week, Jack Dorsey announced a bitcoin legal defense fund to protect bitcoin core developers who have recently become the subject of multi-front litigation. Great news, great effort.

The main purpose of this Fund is to defend developers from lawsuits regarding their activities in the Bitcoin ecosystem, including finding and retaining defense counsel, developing litigation strategy, and paying legal bills. This is a free and voluntary option for developers to take advantage of if they so wish. The Fund will start with a corps of volunteer and part-time lawyers.

Mining News

As Kazakhstan Descends Into Chaos, Crypto Miners Are at a Loss

As I covered extensively in last week's issue of the Fundamentals Report, the Kazakhstan situation is taking a heavy toll on bitcoin miners there. As usual, I'm about a week ahead of the mainstream news cycle.

The above linked article is a very eye-opening interview with a bitcoin miner in Kazakhstan on their current issues. They not only are without power during certain times a day, they are also being cut off from the internet as a whole.

During civil unrest these miners are having to hire extra security to just guard their machines, and when the power is out, they need to heat their facilities to keep the electronics from freezing! That is a huge cost! While US miners are profitable at much lower prices of bitcoin, like $15,000, the Central Asian political problems are making it so the miners there are barely able to breakeven at current prices.

To get an idea of the coming macroeconomic crisis, expand these types of problems in Kazakhstan to all countries in Central Asia. The living standards are about to be cut in half.

Bitcoin Mining Stocks Stumble as Optimism Wanes After Record Run

US bitcoin mining stocks are still struggling, following the spot price as it continues to slide. If this is the bottom for price (I think it is or very close), bitcoin mining stocks like MARA, RIOT, GREE, and SDIG, as well as MicroStrategy (MSTR) could be huge opportunities at current levels.

One thing is for sure, bitcoin price will recover. When it does these newly traded miners will shoot up in price.

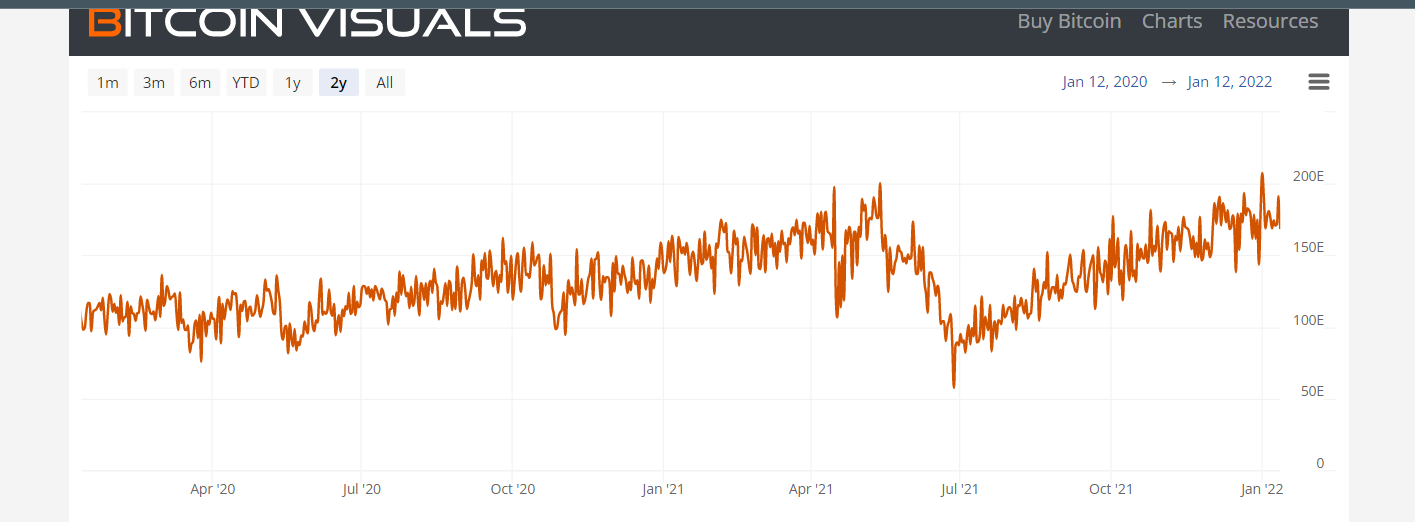

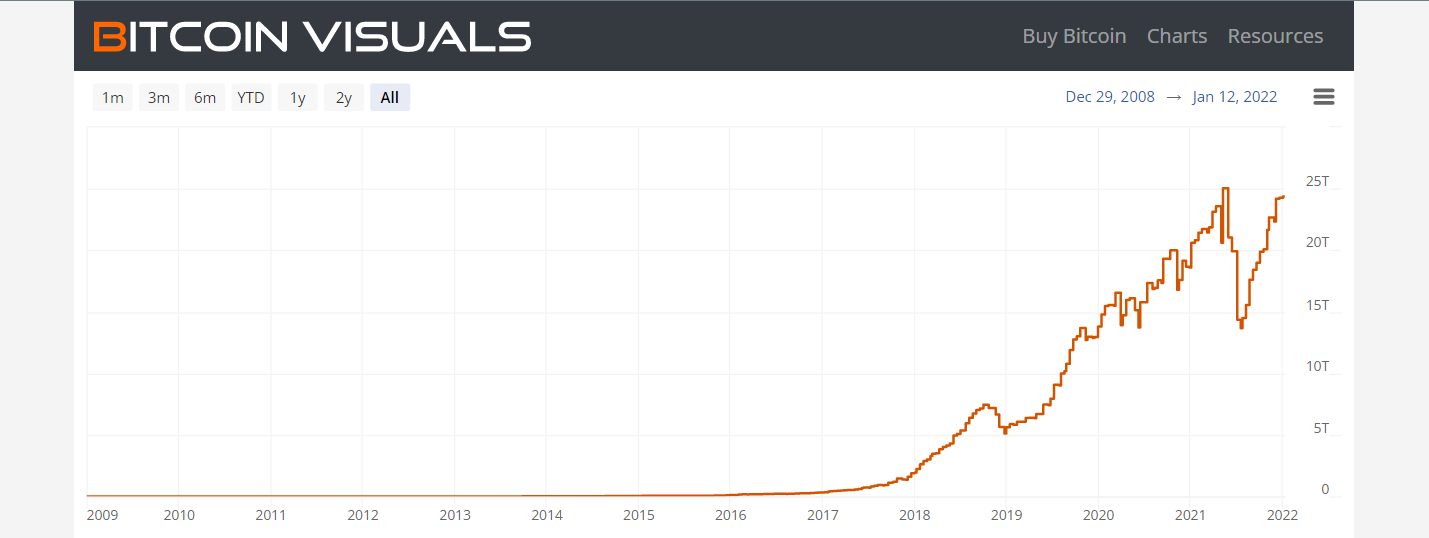

Hash Rate and Difficulty

Hash rate still shows very little effect from the Central Asian issues. This is likely because investment in new mining equipment from other miners in the US and elsewhere have started getting delivered.

Difficulty squeaked out a positive adjustment last week, coming in at 0.41%. Right now, it is on track for another increase of 5.2%! Despite the Kazakhstan drama and mining stock price crash.

Difficulty and hash rate are perhaps the most basic fundamentals of the bitcoin ecosystem. They would compare to short-term government bond prices in the traditional credit-based system. Price cannot go against the trend found in hash rate and difficulty for long. In today's particular environment, hash rate and difficulty are positive despite massive negative macro circumstances, telling me bitcoin's fundamentals are extremely strong.

Altcoins / CBDCs

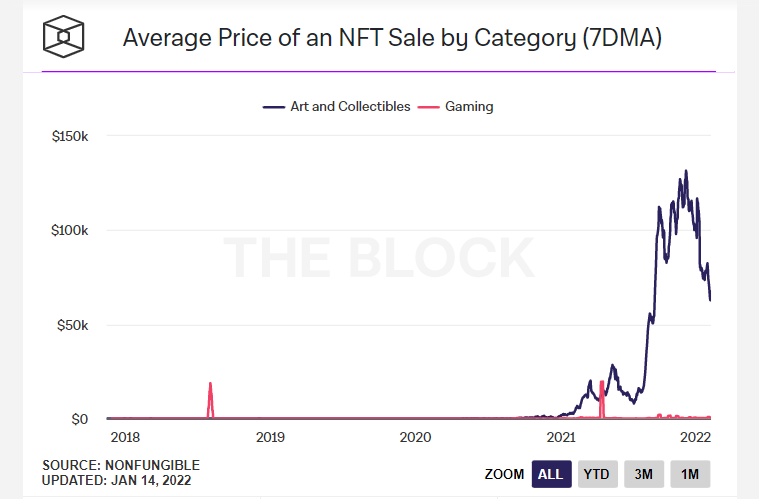

I've looked at NFT fundamentals in the last couple of issues of this newsletter. In mid-December, I said we might be witnessing the top and final slide of the NFT market. So far that is looking like a great call.

As the NFT market slowly bleeds out, we will see desperate new narratives floated in an attempt to re-inflate the hype. This week I laughed at a headline: The Future of NFTs Is Fungible.

Since NFTs are non-fungible, this headline is ridiculous. NFTs are inherently very illiquid, even for collections of similar NFTs like the "bored apes", which address the problem by forming a collector community of sorts. They are finding the market far too illiquid to maintain the stupidly high prices.

NFT communities are technologically and monetarily illiterate. People there think the problem NFTs face is one of "coordination", instead of realizing JPEGs have zero fundamental value. They think an altcoin will align their incentives because they don't understand altcoins to begin with. Adding an altcoin to an NFT community will only exacerbate the other inherent weaknesses. The value of this new token will come directly out of the NFTs it is meant to prop up.

There are some inconsistencies in some of the data, but the average sale price continues to crash.

We are currently witnessing the diffusion of the initial energy in this market. A flood of copycat JPEG collections are hitting the market (it just sounds silly) and the search is on for the next marketing trick. Whether that is altcoins for NFT communities, or defi with NFTs as collateral, both will only negatively affect the market as people realize there is nothing special about any of these things. Price will continue to slip, hurting a lot of people.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

January 14, 2022 | Issue #174 | Block 718,690 | Disclaimer

Meme by: Unknown

* Price change since last week's issue