Bitcoin Fundamentals Report #175

This week... Russia's proposed bitcoin ban, Ukraine war, US Congress meeting on mining, price analysis, ATH hash rate and difficulty, and NFTs.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner

This week... Russia's proposed bitcoin ban, Ukraine war, US Congress meeting on mining, price analysis, ATH hash rate and difficulty, and NFTs.

In Case You Missed It...

- (Podcast) The Powell Pivot ft Dylan LeClair - FED 77

- (Livestream) We are now livestreaming Fed Watch on Tuesdays

- (Op-Ed) The Real Reason Federal Reserve Chair Powell Retired "Transitory"

Visiting the content on other sites helps tremendously, like bitcoinmagazine.com and YouTube! The best way to support is by sharing to family, friends and social media groups, or becoming a paid member!! Thank you for reading.

Get the Bitcoin Dictionary now on Amazon!

Market Commentary

| Weekly trend | Breakdown, looking for bounce |

| Media sentiment | Distracted |

| Network traffic | Low |

| Mining industry | Booming |

| Market cycle timing | Middle of 4-year cycle |

Hello dear reader,

Things are starting to get crazy. Multiple countries all of sudden started talking about adopting or banning bitcoin, Bitcoin mining is being attacked in front of Congress while making ATHs in hash rate, price is crashing, Ukraine is red hot; something big is coming.

Let's hit this week's top stories and fundamental developments...

Russia Proposes Bitcoin Ban

The fulcrum of most international news this week, including important developments in macro, energy, and bitcoin, is Russia. We should get used to this for bitcoin, it will increasingly be at the center of many of the upcoming revolutionary events in the world.

For bitcoin, the big news causing the sell off overnight is that the Russian central bank has proposed a ban on "cryptocurrencies" including bitcoin. IMO this is much worse for altcoins than bitcoin. For bitcoin, it should prove to be only a hiccup. Bitcoin is more geographically distributed, with a center of gravity in the US, while many altcoins are scams dreamt up in the dark corners of the internet. Altcoins are often financed by a few very rich scammers, and Russia has a history of that kind of activity.

Russia also has many very rich bitcoiners, therefore, this ban is not a slam dunk. Power politics might be at play here with Ukraine. The latter nearly legalized bitcoin in October last year, and it is reported that Ukrainian officials personally hold billions of dollars in bitcoin.

This proposed ban draws obvious comparisons to the China ban last year. However, Russia is not a pivotal location for bitcoin like China was, much more so for altcoins. In short, this was an overreaction by the market, and will likely be short-lived.

Ukraine tensions

This is not a geopolitical newsletter, it is focused on bitcoin. Macro and geopolitics are included only as far as they are related to bitcoin. Granted, the global economic situation is very much on topic, and what is more important to free trade, the free movement of goods, and money than war? That is why I take so much time to understand and relate to readers what is happening now, and what will happen in the near future when it comes to geopolitics.

Someone might tell you that XYZ is going to happen, but nowhere in their analysis is a contingency for regional warfare or geopolitical concerns. That should tell you their analysis is woefully incomplete.

Here is a very good video summing up the most recent intel on the situation from a military perspective.

Economically, Ukraine is the poorest country in Europe. It has very little energy industry compared to Russia or even Kazakhstan. They are an important pipeline route to Europe, and a hub along the soon-to-be ill-fated Belt and Road Initiative. But a Russian invasion of Ukraine does have huge significance for trade, mainly due to increased tensions in Europe and Central Asia.

Russia's overwhelming geopolitical goal is "strategic depth". They want to push their borders out, to make invasion of the Russian heartland too logistically difficult to even contemplate. Therefore, it is a no-brainer that Russia would love to control most of Ukraine.

For Europe, however, they are terrified of an encroaching Russia. Even if Russia has zero desire to march into Poland, Hungary, or the Baltic States, they will oppose any military operation by Russia as a matter of principle.

I don't have to tell you that trade between Europe and Russia is very important for the global economy, especially energy. If there is an outbreak of hostilities in the region, you can be sure that the free flow of goods and services will be severed. With Russia in marginal control of Central Asia and good relations with China, if Europe and Russia get into a conflict, the effect on the global economy could be monumentally disastrous. Especially, given that everyone is in a credit bubble.

US Congress' First Bitcoin Mining Hearing

Yesterday, a Subcommittee in Congress heard testimony on the energy usage of bitcoin mining. In short, it was a minor hearing and wasn't as bad as many bitcoiners are portraying. There were 5 witnesses, only 2 of whom displayed sound understanding of mining. A couple witnesses had direct conflicts of interest as founders or in leading roles in Proof-of-Stake altcoins.

Many were appalled at the display of unchecked FUD that passed for valid testimony. I was less concerned. Politicians lie for a living. They spew FUD and BS all day long, everyday. They know these witnesses were misrepresenting the truth. Hell, they probably handpicked these witnesses to push the ESG garbage.

I must note that most central banks are pushing the ESG thing as well. However, the Fed has, once again, not given into the Davos sponsored narrative. So, even if progressive globalists in Congress want to push this false narrative about bitcoin mining, at least the Fed doesn't buy it. That means the Fed doesn't buy the benefits of CBDCs or a central bank's role in climate initiatives, putting them in complete opposition to the ECB and others.

Overall, the meeting was an example of the new attack on bitcoin. In the past, most criticism centered around the idea that the US government would just ban bitcoin, make it illegal, simply stop it in its tracks with their magical powers. That silly narrative is gone, most people realize it's impossible, so they're moving on to specific lines of attacks, like energy usage. That's a very good sign IMO.

Lots of scholarship has gone into refuting the energy attack vector for years! We are ready. Congress is a slow moving animal, and believe it or not, they are getting slower and less hostile to bitcoin as time goes on.

Here's a thread from my friend CK to a discussion on this topic you might want to bookmark, with links to much of scholarship Bitcoin Magazine has spearheaded over the last couple of years on bitcoin mining and the energy FUD.

After today’s cluster fuck of a hearing, it’s time to set the record straight on common Bitcoin misinformation.

— 37 sats (@ck_SNARKs) January 20, 2022

Join @level39, @LudiMagistR, @AsILayHodling, @DavidZell_ and I as we tackle the Bitcoin FUD. https://t.co/IlaRLPvnw0

SHARE our content with friends and family!

Quick Price Analysis

| Weekly price* | $38,320 (-$5,080, -11.7%) |

| Market cap | $0.726 trillion |

| Satoshis/$1 USD | 2,603 |

| 1 finney (1/10,000 btc) | $3.84 |

Become a paid member to access our much more in depth technical analysis on the member newsletter.

In the last 24 hours, bitcoin has sold off fairly aggressively. The big driving factors are the proposed ban from the central bank of Russia (which I stated above is an overreaction) and the Congressional meeting on bitcoin mining FUD (which I stated was not as bad as many are portraying).

When those two bitcoin specific news items are taken in the context of a stock market sell off and the bitcoin price struggling with some weak technical indicators, it's not a huge surprise that price sold off like it did.

As of now, the area of support for the price I have been pointing out for a while is still holding.

Bitcoin Daily Chart

Sentiment is very bearish right now, with many analysts calling for $30k as the next stop. I'm an inherent bitcoin bull though and fundamentals like mining, infrastructure, and adoption are better than ever. Price will go the direction of most pain, so be prepared for a wick down to $30k.

My base case, however, remains stubborn support and a slow incremental climb over the next few weeks. Price must break through the diagonal resistance in order to do so. Remember, if all signs are bearish, that means things can only change in the bullish direction.

Get more price analysis, Sign up for the Bitcoin Pulse!

Mining and Development

| Previous difficulty adjustment | +9.32% |

| Next estimated adjustment | 0% in ~13 days |

| Mempool | 5 MB |

| Fees for next block (sats/byte) | $0.38 (7 s/b) |

| Median fee (finneys) | $0.06 (0.07) |

Mining News

The Bitcoin Mining Council Q42021

The Bitcoin Mining Council is headlined by Michael Saylor. They released their Q42021 report this week "confirming improvements in sustainable power mix and technological efficiency."

I recommend reading the report, but my feelings on the Mining Council are mixed. Being an influential group formed to look directly into the energy questions around bitcoin mining, counterintuitively lends support to the FUD. The rationale would go as follows, 'if energy consumption was not a concern, why would some of the most influential people in bitcoin form a whole mining council to address it?'

As of now, it is a good thing to further scientific and rhetorical defenses against the ESG attacks, but that might change down the road.

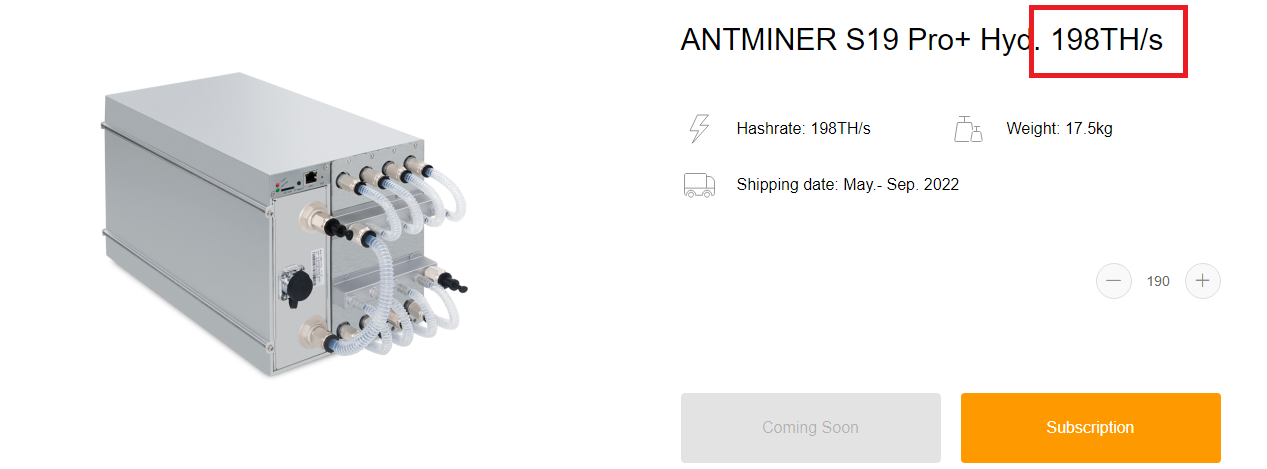

Bitmain Liquid Cooled Miners

198 TH/s! I'm not a miner myself, and don't know the hardware in and out. But I can look at the S19 Pro at 104 TH/s and the liquid cooled version at 198 TH/s and know this is a huge deal.

Chips have been pushed to their current physical limit based on the physics happening at such small dimensions of 7 nanometer circuits. The competition is now moving toward cooling, and once again, we see Bitmain taking the lead.

Their first liquid cooled product was the S9 Hydro, with a 50% performance improvement over the standard S9. This one is getting nearly a 100% improvement (from what I can tell right now).

With all the money flooding into mining, we could be on the precipice of a monstrous rise in hash rate, and traditionally that corresponds to price increases.

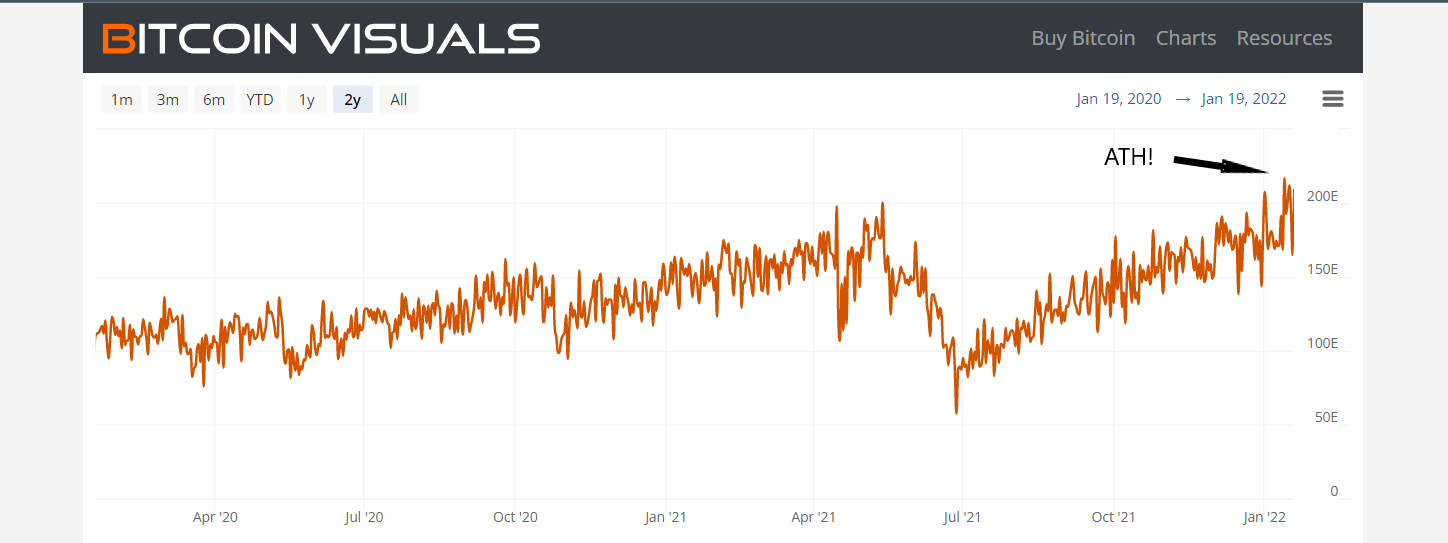

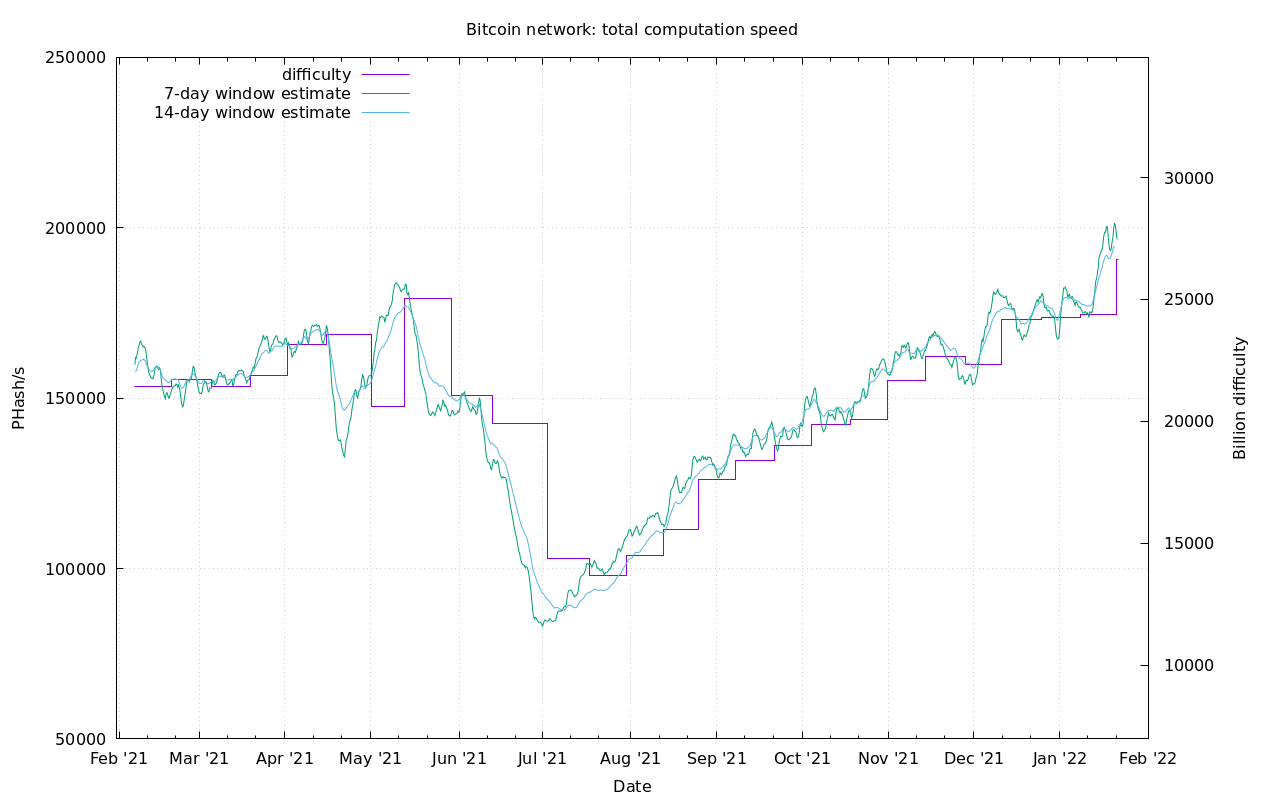

Hash Rate and Difficulty

Hash rate exploded to new highs this week. Despite the ongoing war against entrepreneurs, bitcoin miners continue to march forward. No sign of a bitcoin bear market here!!

Difficulty also ramped higher, with an adjustment yesterday of +9.32%. The 2021 average difficulty adjustment was 1.5%. I ran some simple math for price over 26 periods in 2021, and I got a 2.23% increase in price per difficulty adjustment period. IDK if that's valuable, but it's cool that the two numbers are close to each other.

My usual source for the image was not updated yet, so here is an old school all-in-one source. It's still great and worth a bookmark.

Altcoins / CBDCs

I'd love it if my call of the NFT mania top turns out to be correct. If you look back several issues of this report to #172, you'll see I've been calling this for more than a month now.

Some of the statistics can be gamed, so it's hard to say for sure what the volumes are, but we can get a good idea by trends and if the numbers match up. This is similar to a problem in bitcoin and altcoins for years, a high number of transactions on the network are seen as positive, and they can be gamed, meaning you should treat them with caution. People could simply send transactions to themselves or miners could fill up block space in an attempt to drive fees higher.

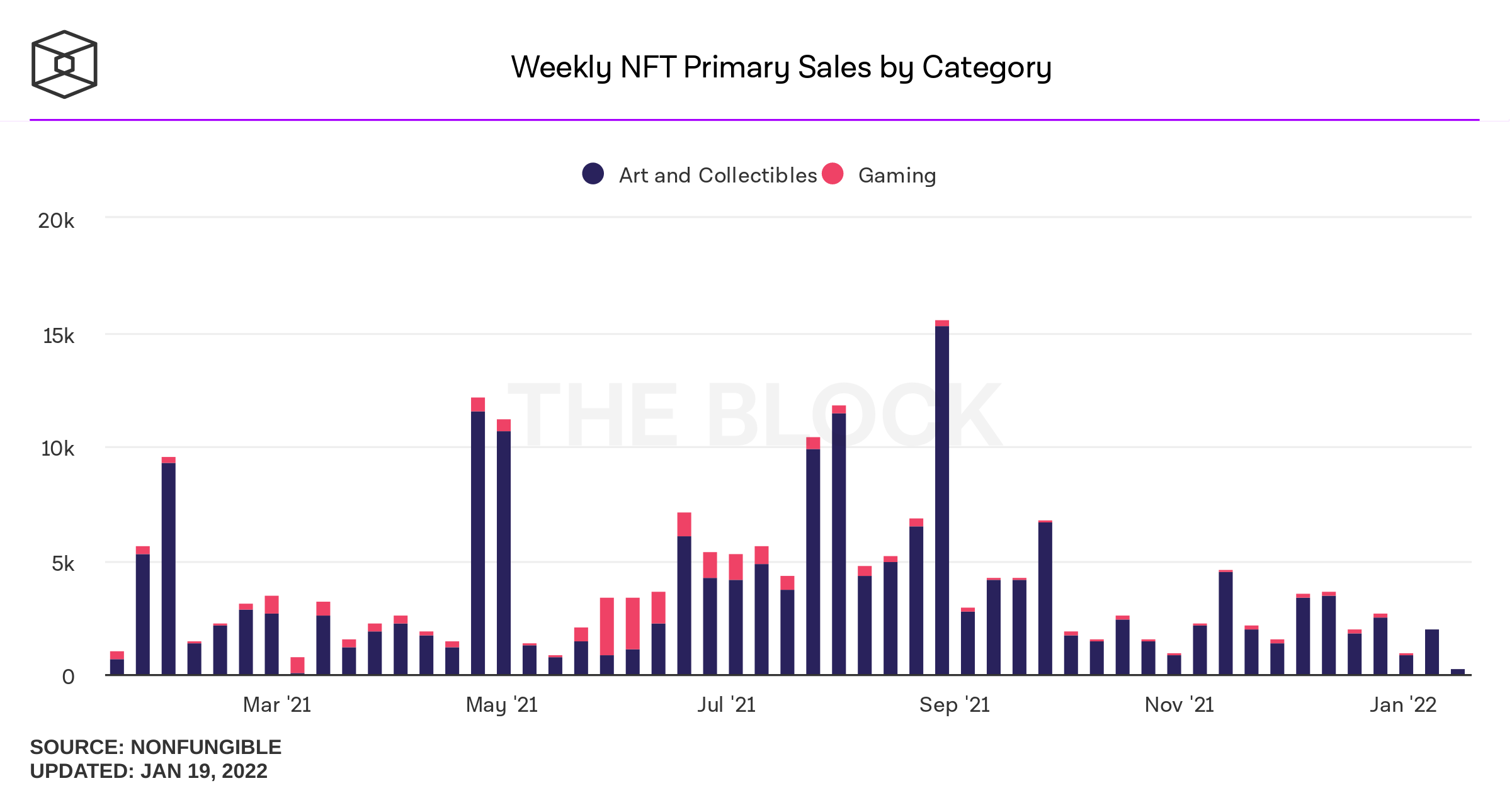

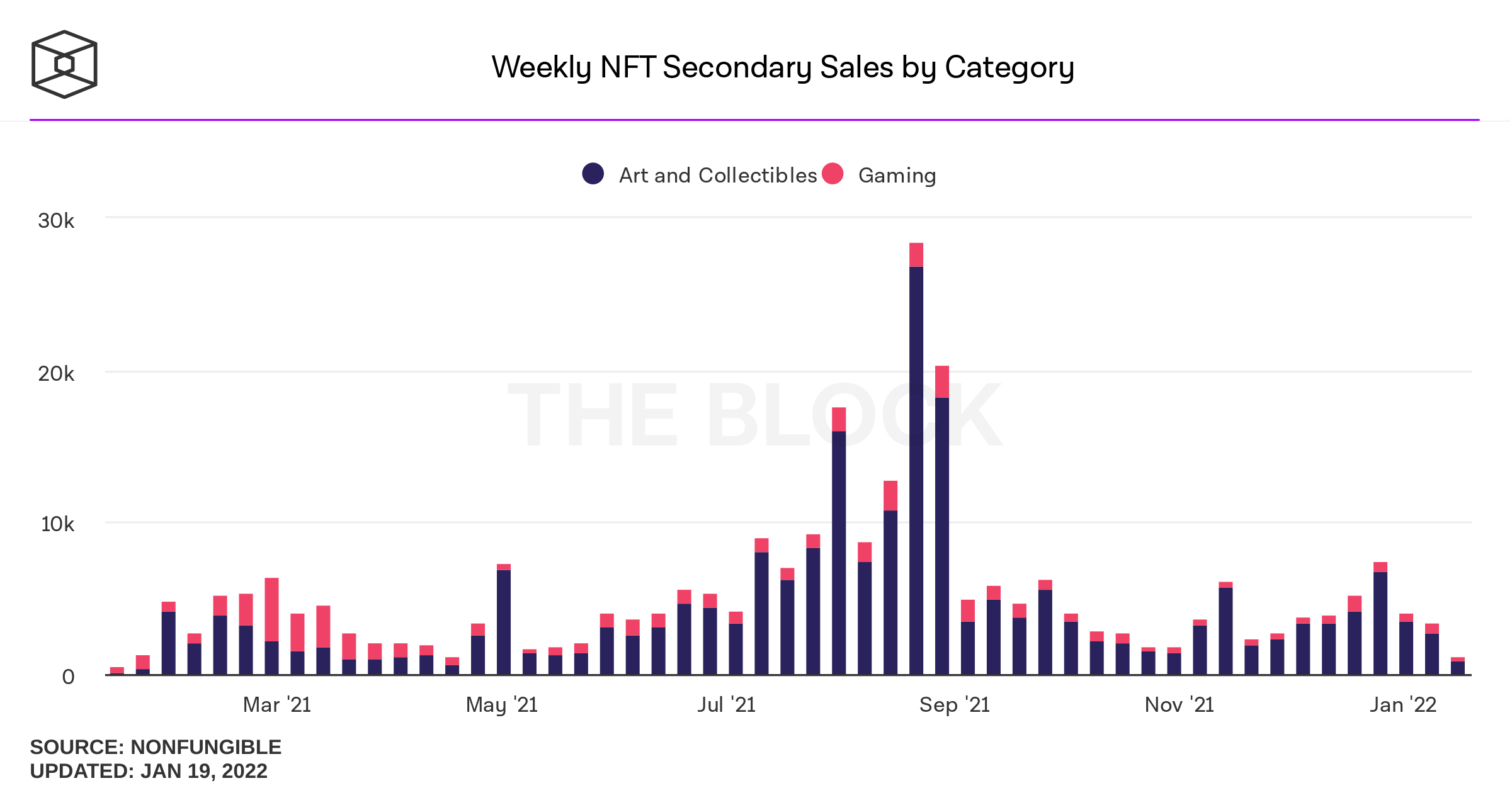

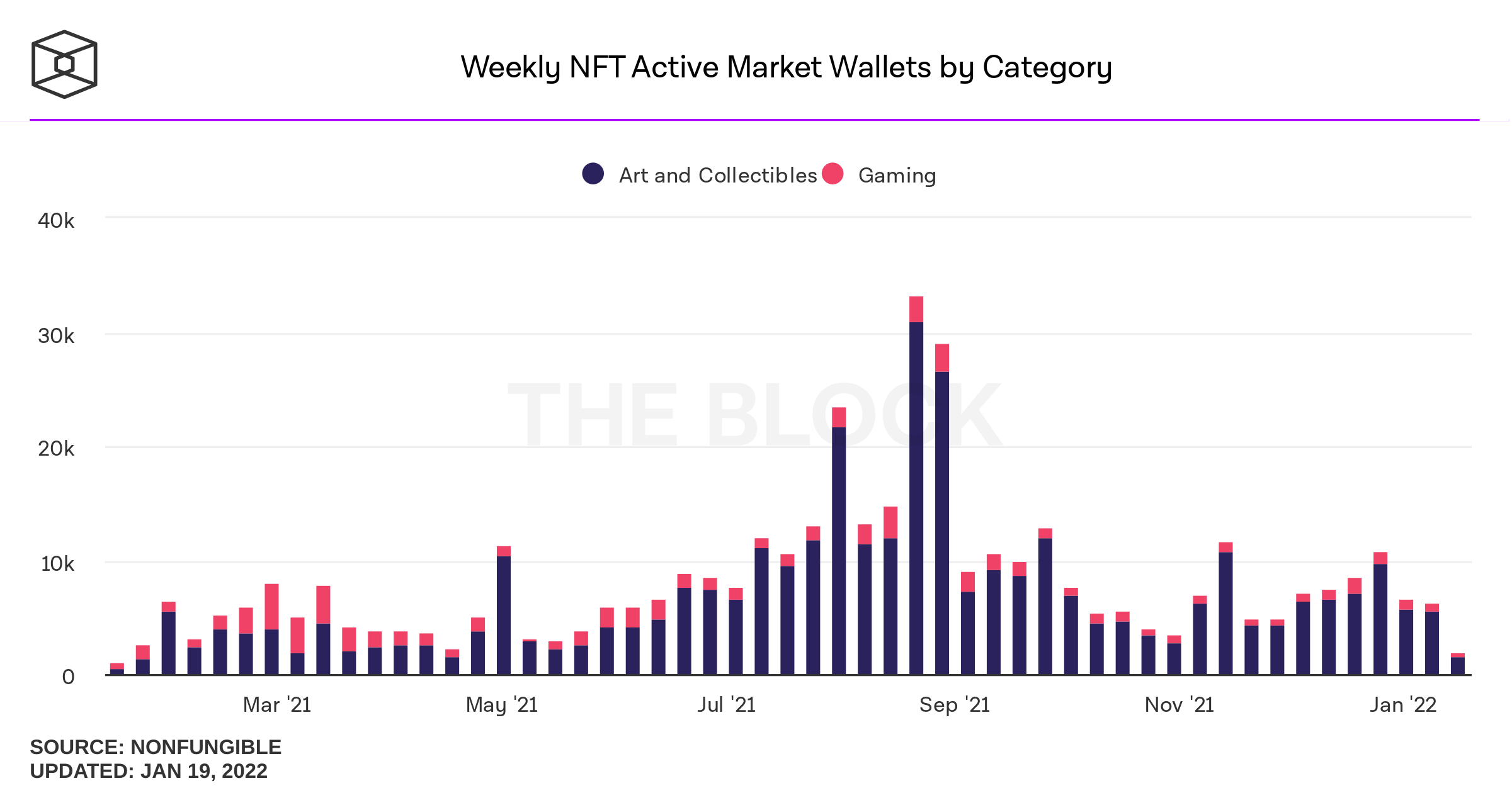

With that in mind, I've pointed out several stats the last few weeks. This week I'd like to show these three charts of primary and secondary sales, and active wallets.

These weekly bars update on Sundays. With two days left, this week follows on the trend of the last month and is a disaster if you think NFTs will be a "asset class" in the future.

The current week shows the active number of wallets at less than 2000! That's a tiny tiny market. Granted, some of these NFTs might be held on centralized services, but this this type of decline in active wallets, you have to conclude people are leaving in droves from NFTs.

Perhaps, another altcoin marketing scheme is biting the dust in front of our eyes? I expect there to be an echo pump in some of these numbers, as people highly invested in this made-up sector spend money to artificially pumping numbers where they can, in an attempt to paint the narrative.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

January 21, 2022 | Issue #175 | Block 719,803 | Disclaimer

Meme by: Unknown

* Price change since last week's issue