Bitcoin Fundamentals Report #178

This week... Russian acceptance of bitcoin, BitFinex hackers found?, Tallycoin for Freedom Convoy, Binance buys huge stake in Forbes, bitcoin price analysis, mining news, and transaction demand rising.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner

This week... Russian acceptance of bitcoin, BitFinex hackers found?, Tallycoin for Freedom Convoy, Binance buys huge stake in Forbes, bitcoin price analysis, mining news, and transaction demand rising.

In Case You Missed It...

- (Podcast) Bitcoin's 4-year Cycles Are Over - E234

- (Podcast) European Risks Rising - FED 81

- (Podcast) Friendly Inflation vs Deflation Discussion - FED 80

- (Livestream) We are now livestreaming Fed Watch on Tuesdays

- (Op-Ed) The Real Reason Federal Reserve Chair Powell Retired "Transitory"

- New article coming very soon to Bitcoin Magazine, stay tuned

Visiting the content on other sites helps tremendously, like bitcoinmagazine.com and YouTube! The best way to support is by sharing to family, friends and social media groups, or becoming a paid member!! Thank you for reading.

Partnering with BitcoinDay.io

Bitcoin Day is a chance for the local community, business professionals, newbies, and cryptocurrency leaders to gather under one roof to inspire, socialize, and learn from each other. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Bull flag after breakout |

| Media sentiment | Positive |

| Network traffic | High |

| Mining industry | Steady |

| Market cycle timing | Beginning new 2-year cycle |

Hello Bitcoiners!

There is so much news this week, and so much content from yours truly. I'll list a bunch of the major news items below, but don't forget to checkout the linked content above, too!

Let's hit this week's top stories...

Russia in the Bitcoin Headlines for a 4th Week

This is the 4th week in a row with Russia as a major news item in bitcoin. Perhaps, it's not a coincidence the timing also overlaps with rising tensions in Eastern Europe.

This week, Russia announced they will be "regulating" bitcoin, meaning they will not ban it. Lots of bitcoiners are excited about this news because many of us consider it a win for bitcoin. The thinking goes that other countries will now be pressured to make similar lax concessions.

My opinion of this Russian news is that this is a big deal by itself, but I'm less optimistic that countries will feel pressure to treat bitcoin similarly. Russia is in a peculiar circumstance. They are being threatened with some of the strictest financial sanctions in modern history, and Russia already faces strict sanctions from the US via the global financial system. It is no wonder that Putin is generally friendly to a technology that gives him a little more leverage against the West.

Bitfinex Hackers Found?

Back in 2016, the bitcoin exchange BitFinex was hacked, losing 120,000 bitcoins of customer deposits. (I am personally familiar with this case.) After 5 years I was under the impression that it was not being actively investigated anymore.

However, it is being reported that the feds were able to trace the bitcoins to a couple living in Manhattan, and were able to seize the bitcoin. The official story is less than believable, I would say. Extremely savvy hackers were holding private keys to $4 billion worth of bitcoin in a Dropbox? Very unlikely.

The couple comes across as unsophisticated and unable to pull off a hack like this. There is more to this story, but we'll have to wait for more developments.

The feds didn't miss the opportunity to mislead people the security of bitcoin. These keys were in a Dropbox, unsecured, yet the feds are making it sound like they can seize bitcoin anytime anywhere. Properly secured bitcoin (trivial to do) are perfectly safe from confiscation. Video in link below.

Blackrock to offer bitcoin investment services

Blackrock is the largest asset manager in the world, handling over $10 trillion in client and institutional funds. This week news broke that they will be offering bitcoin investment services to their clients very soon.

This move could be a watershed moment for bitcoin. If 5% of that money is invested into bitcoin (the number from last week's issue put forward by a well-connect wealth manager) that could be up to $500 billion coming into bitcoin via Blackrock.

Tallycoin Provides Uncensorable Donation Drive

First, it was GoFundMe confiscating $10M in donations for the Canadian Freedom Convoy. Quickly turning into refunds as US States' Attorney Generals got involved.

Second, donations streamed onto GiveSendGo, a freedom dedicated alternative, reaching $9M USD in short order. Then, yesterday, a Canadian court ordered GiveSendGo to freeze all funds. We don't know if they will, or what the fallout will be yet. There is a chance GiveSendGo, a US-based company, tells the Canadian court to pound sand.

Of course, bitcoin is tailor made for this, with no one able to freeze the funds, and no one to give a court order to. Tallycoin, a website that allows pass-through donation drives and which I even used back in 2017, has facilitated $1M in bitcoin donations (2,100,000,000 sats or 21 bitcoins). These donations cannot be stopped, and are a huge slap in the face to corrupt authoritarian governments. We don't have to rely on their rails anymore.

Binance Makes $200M investment in Forbes

This story flew a bit under the radar this week, though I think it is a huge one. Binance investing $200M into Forbes gives them access to a well-respected publication with which to evangelize "crypto".

Binance will pump out a lot of false information about "cyrpto", perpetuating Ponzi scheme in altcoins further than otherwise, but it sets a high bar for other bitcoin focused outlets to imitate. Soon enough, bitcoin will take over media, too, fixing MSM.

SHARE our content with friends and family!

Quick Price Analysis

| Weekly price* | $42,440 (+$1,724, +4.2%) |

| Market cap | $0.806 trillion |

| Satoshis/$1 USD | 2,353 |

| 1 finney (1/10,000 btc) | $4.25 |

A stratospheric CPI inflation print yesterday, 7.5% for January YoY, yet bitcoin crashes? What gives?

Gold had a similar reaction:

Maybe, just maybe, gold and yield curves know something you don't, but think you do based on a few #CPI prints. https://t.co/W6Fcu713AJ

— Ansel Lindner (@AnselLindner) February 10, 2022

The reality is, CPI does not measure money printing. Consumer prices are currently being driven, almost entirely, by supply chain issues. Once you accept that, prices cease to be contradictory.

Reports from critical links in the supply chain like Foxconn, "the assembler of BlackBerry, iPad, iPhone, iPod, Kindle, Nokia devices, PlayStation 4, Wii U, and Xbox One, among many another popular consumer electronics, is expecting significant improvement in sourcing semiconductors in the first quarter and an overall improvement in their supply chain by summer." That means supply-side pressures are about to reverse into the second half of the year.

Bitcoin Daily Chart

Below, you see price dipped 7% since the worst CPI inflation in 40 years. Before that, we broke higher, up 35% from the lows and looking really nice for a bullish reversal.

I would not be surprised to see price test $41k, before further upside. That is the most likely scenario at this point. If price refuses to fall and just reverses back into its rising trend from here, that is a very bullish sign.

Only the 4th time since 2011 for this metric, Bitcoin Dormancy Flow. I haven't dug into the details on this one, but looks interesting and matches with my fundamental reading of current price action. A major bottom is being set.

This level has historically called out macro bottoms.

$BTC reached this low level for only the 4th time since 2011,

Days Spent in the 🟢 Zone:

Last 2 times: Average 34 days

This time: 32 days

Bloomberg Misses the Point Again

In other price related news, Bloomberg says $38,000 fair market value for bitcoin at this point. They base their analysis on volatility and suffice it to say they completely misread this market. Typical, they badmouthed bitcoin for the first 10 years and 100,000% gains, now they see it 12% overvalued! LOL.

“The biggest challenge for Bitcoin going forward is its volatility and the boom and bust cycles that hinder further institutional adoption,” the strategists wrote.

Bitcoin's volatility is up. Imagine doubling your investment and saying the price is too volatile.

The biggest hurdle to bitcoin adoption is inflation, or perceived inflation by way of altcoin substitutes. Volatility is inversely related to adoption. As bitcoin gets more adopted, volatility will decrease, as we've seen in the first 12 years.

Get more price analysis, Sign up for the Bitcoin Pulse!

Mining and Development

| Previous difficulty adjustment | +0.1777% |

| Next estimated adjustment | -2% in ~6 days |

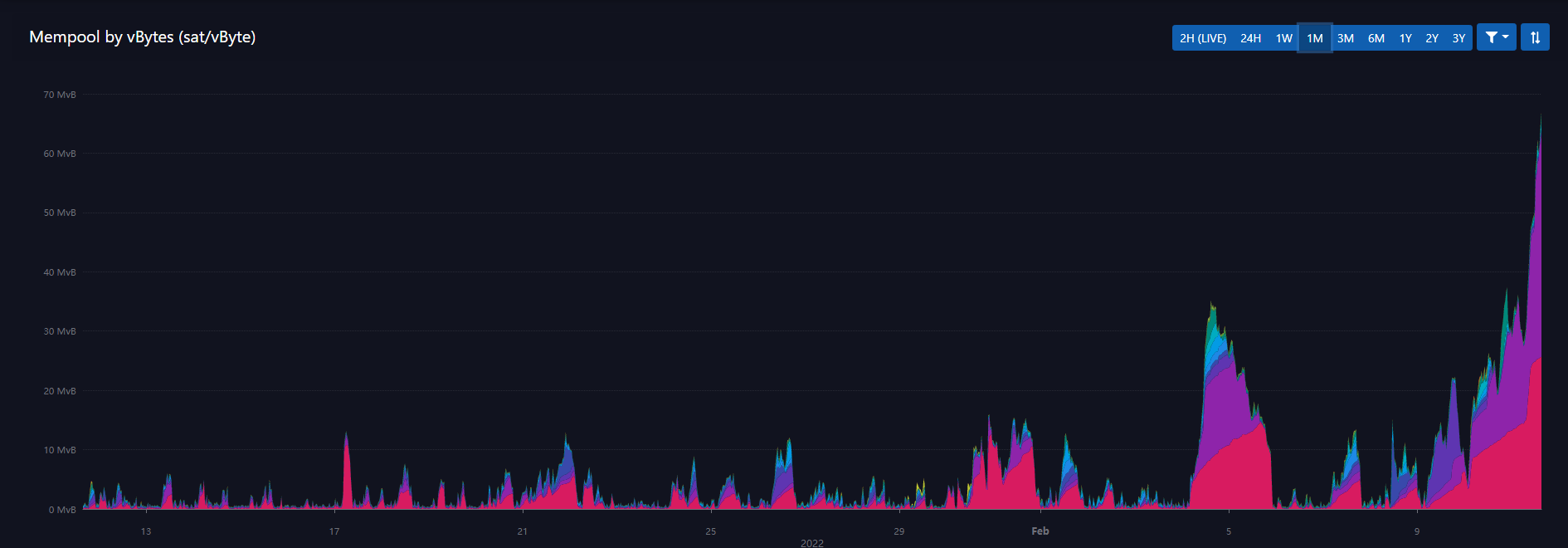

| Mempool | 68 MB |

| Fees for next block (sats/byte) | $0.66 (11 s/b) |

| Median fee (finneys) | $0.66 (0.16) |

Mining News

Intel is entering the Bitcoin mining game. They will set up a whole new division and start making bitcoin miners for choice clients. The first listed in the above article is Block (formerly Square, of Jack Dorsey fame).

While Texas is busy becoming the headquarters of the next great industry by attracting bitcoin mining, other States are shooting themselves in the foot. No surprise, it's happening in a blue city, Lansing, Michigan, where the democrat mayor won by 2/3rds of the vote.

Lansing City Council is speeding through a ban on bitcoin mining when a company that took over a defunct power plant announced plans to turn it into a bitcoin mine.

Mempool

The mempool (group of transactions waiting to be confirmed in a block) continues to grow. It is looking very healthy at this point with a good mix of fees (color based on the chart).

A busy mempool signifies growing demand for bitcoin transactions, and hence the demand for bitcoin on the receiving end. This is the busiest the mempool has been since miners left China in for good in July 2021.

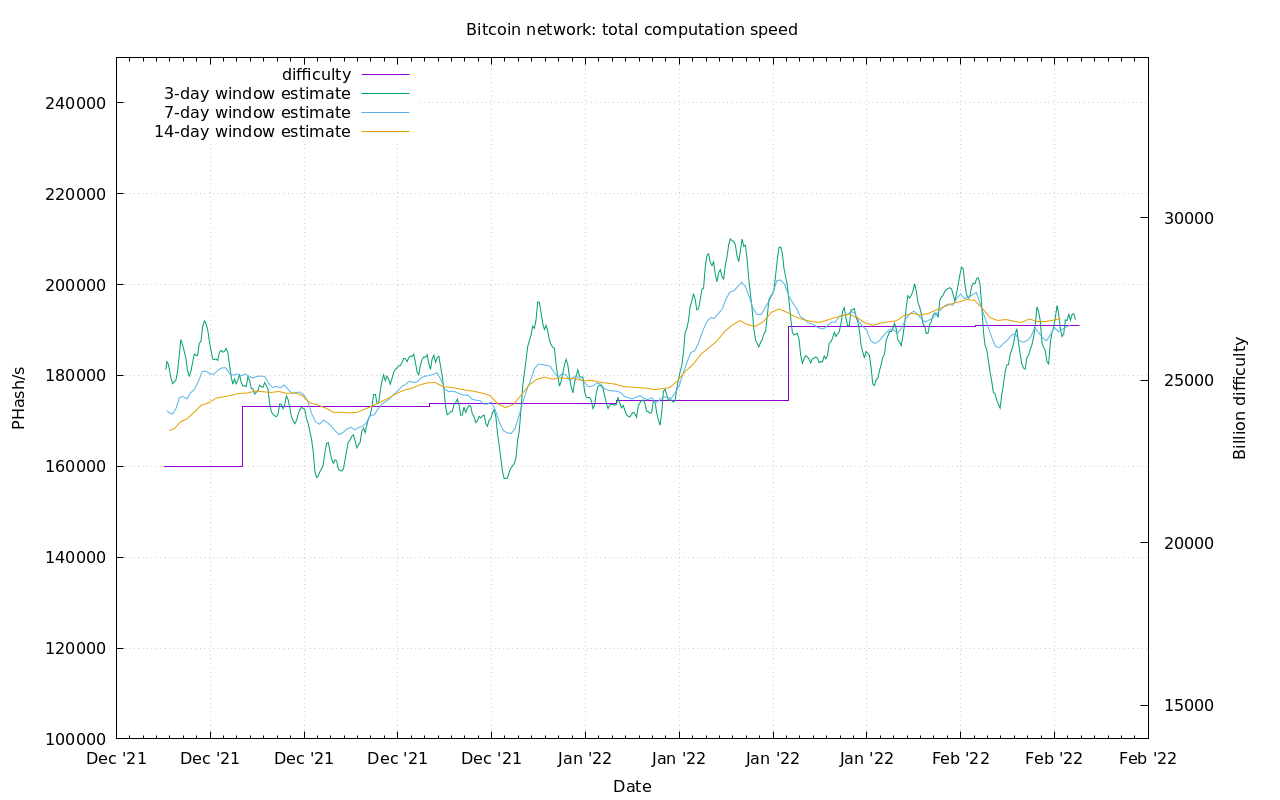

Hash Rate and Difficulty

Hash rate is still healthy, but has not responded yet to the recent increase in price. Hash rate has traditionally been a lagging indicator, with increases in computer power following price by several months. In this case, it will take a little while for American miners to get the equipment they've ordered, and bitcoin miners in Kazakhstan are being interfered with. These things make it the hash rate slower to adjust to the price.

Bottom line is that the mining sector is still strong and growing.

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

February 11, 2022 | Issue #178 | Block 722,815 | Disclaimer

Meme by: @BitcoinMemeHub

* Price change since last week's issue