Bitcoin Fundamentals Report #181

This week... bitcoin adoption rises, what Ukraine can tell us about the emerging new international order, Ethereum mistake exposes the extent that it is centralized and captured by legacy interests.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner

This week... bitcoin adoption rises, what Ukraine can tell us about the emerging new international order, Ethereum mistake exposes the extent that it is centralized and captured by legacy interests.

In Case You Missed It...

- (Fed Watch) Macro Deep Dive ft Dylan LeClair - FED 84

- (Podcast) A Little Bitcoin Game Theory - E237

- (Livestream) We are now livestreaming Fed Watch on Tuesdays

- (Op-Ed) With Sarah Bloom Raskin Up For Big Fed Role, Will Regulation Turn Against Bitcoin?

Sharing is caring!

Partnering with BitcoinDay.io

Bitcoin Day is a chance for the local community, business professionals, newbies, and cryptocurrency leaders to gather under one roof to inspire, socialize, and learn from each other. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Trying re-take support |

| Media sentiment | Negative |

| Network traffic | Low |

| Mining industry | Stable |

| Market cycle timing | Beginning new 2-year cycle |

Hello Bitcoiners!

This is the end of Bitcoin's latest training camp. It has been through hell the last couple of months. Attacked by Canada, now a focus of sanctions against Russia, price declines, and a global financial system in shambles. It's time for bitcoin to step into the ring and perform!

Let's hit this week's top stories...

Swiss city of Lugano will make Bitcoin legal tender

Via Bitcoin Magazine:

The city of Lugano, Switzerland, will make bitcoin legal tender and allow citizens to pay for public service fees or taxes in bitcoin, city director Pietro Poretti co-announced in an event livestreamed on Thursday alongside mayor Michele Foletti and CTO of Tether Paolo Ardoino. The city has already worked with over 200 merchants to propel the adoption of bitcoin and Lightning payments.

“This is probably the most important thing of this project,” Ardoino said, referring to “Plan ₿,” a city initiative being sketched and worked in collaboration with Tether to attract wealth, smart minds, and opportunities. Tether’s stablecoin USDT will also become a legal tender in the city.

Plan ₿ involves the creation of a physical venue in the heart of the city to function as a hub for Bitcoin and blockchain startups interested in making the city their new home, as well as the go-to place for networking events and hosting Bitcoin meetups and workshops.

Bitcoin continues to show it's important enough to sanction

If bitcoin were an insignificant play thing, it wouldn't need to be a part of sanctions. Just like in the Canadian case from last month (we haven't forgotten you Justin Castro), bitcoin is a serious player now and must be respected.

In the linked article, they mention that bitcoin does not have the liquidity to make a big dent in the effect of the sanctions. I somewhat agree, but they are missing the larger picture. For everyday people, that is true. However, for the oligarchs in Russia (and Ukraine btw, remember Ukraine very recently "legalized" bitcoin, IMO because the oligarchs there own a lot), whom own multiple millions of the dollars worth of bitcoin each, and whom some own billions of dollars worth of bitcoin, it can serve as a censorship resistant settlement.

The Department of Justice announced early Wednesday a new task force broadly designed to enforce sanctions. As part of that, it will target efforts to use cryptocurrency to evade U.S. sanctions, launder proceeds of foreign corruption or evade U.S. responses to Russian military aggression.

[...] Despite growing signs of crypto adoption — as well as dialed-up rhetoric from world leaders about banning sanctioned Russians from digital currency exchanges — crypto as a pathway to sidestepping sanctions isn’t really a viable option at scale. yet!

emphasis added :)

Bitcoin is 13 years old and it is already the focus of sanctions, task force teams, and targeted regulation. How far will it go in the next 13 years?

Perhaps the more important news is the last word in this sentence of the article.

Washington is reportedly trying out a new way to dial up the pressure on Putin: sanctions targeting cryptocurrencies like bitcoin and ethereum.

Ethereum is right now showing that it is captured by government actors at a core level. In a different story, ethereum's controlling leaders, have cut off Venezuelan residents from accessing their wallets. More on that below...

Ukraine and Russia, What is the Truth?

I think I have a good grasp on what is happening over in Ukraine, but I could be wrong. There is a massive ongoing propaganda campaign by the West and Russia is practicing military deception.

One thing I'm certain of is that Putin is not the evil unhinged man that he is made out to be. He is cunning and smart, and is being motivated by a deep belief in the rightness of his mission. He is pushing back against the decadent Davos elites, that are trying to pervert and destroy the religions and cultures of the peoples of the world.

Russia views this as a Spiritual War of sorts, but also as geopolitically essential.

Russia's overriding geopolitical goal, as I've written about on this newsletter before, is strategic depth. They want to control the gaps and routes into the Eurasian heartland that is their home. Russia must do this to protect their motherland and their culture. That is a powerful motivator, one that Europe cannot compete with.

Europe has hollowed out their culture and heart of their people with multinationalism, attacks on traditional families, attacks on national pride and self-sufficiency, attacks on strong masculinity and individuality (you can be yourself as long as it's not in the traditional mold of strong masculine or feminine patriots with inalienable rights).

Anyway, back to Ukraine. Russia is moving slowly because they want to control the area after the fighting is over (which should only be a few weeks). They don't want mass civilian casualties that will bolster a fierce resistance movement. They are methodically encircling Ukrainian military forces and cities, but haven't cut power or the internet, used electronic warfare, or massive bombing campaigns. They haven't used many modern weapons, not because they don't have them, but because their use would not help their objective.

The Russian military could sweep through Ukraine if they used all their weapons in a matter of days. Russia is treating Ukraine like it's fighting a child. The dad will put his hand on the kids forehead while the kids lashes out, even landing a few shots. Then with the minimum force, the dad will push the child away and make him fall to the ground.

The sanctions sting a little, but they aren't as suffocating as you are being led to believe. The West is still willing to buy Russian oil, meaning most of the coverage we see about this conflict is lies. The West is unwilling to really fight, they will use theatrics and misinformation to act as if they are fighting and doing everything they can, but in reality, Russia is moving unopposed, and the fighting is not as bad as being reported.

The Dollar is Surging, the Real New World Order

This week saw a monster move in the USD. It broke out to the highest levels since May 2020. A strong dollar will have dramatic consequences for economies around the world who have large dollar-denominated debts.

It's not just the strong dollar causing pain, the entire globe is facing massive supply chain disruptions and shortages of the bare necessities like oil, wheat and fertilizer. A few countries in the world are seriously threatened by revolution and starvation level events. That's not hyperbole. Options and time are running out. This is a rapid escalation of deglobalization.

What we are living through right now is not a failure of leadership (though we have that, too). It is a monumental shift in global organization, primarily driven by a US that has lost the resolve to play world policeman and to be the muscle for the Davos globalist elites. The US is self-sufficient, rich, secure, ethnically and culturally diverse, litigious and relatively free. We will reshape the international order into a few close trade ties and security pacts outside North America, like Japan, Australia, the UK, and maybe India. The rest of the world is free to take care of themselves.

The US is a non-interventionist nation at heart. It was only WWII and after that we took the lead, promoted free trade, established powerful international institutions, and provided fire suppression for many conflicts around the world.

It is naïve to think that if the US didn't fight the several wars of the last few decades, that there would have been no wars. What we are seeing today explodes that childish notion. We fought them all, so neighbors wouldn't slaughter each other and instead, the world could continue to trade.

The world, and specifically the Eurasian Rim, is an unstable tribal place. If left to their own devices, they'll be at nearly constant war. It's no place for sustained economic development, or even basic economic activity, without American imposed peace.

We have our own issues to worry about here at home, we are done propping up a system for a world that has forgotten what it was like just 80 years ago. They blame us for everything, although the US led order oversaw billions of people lifted out of poverty, and "3rd world nations" become "emerging markets". We are also done with providing the muscle for the Davos elites. Their system is rapidly eroding, with the EU, its shining accomplishment, on the verge of collapse.

All this doesn't weaken the dollar, it strengthens it. Do you want to use a currency of a far away stable, rich and peaceful USA, or your neighbor like China and Russia who are authoritarian and threatening? The only real competitor to the dollar from fiat currency world is the Euro, and the EU/ECB will cease to exist in 10 years.

The dollar doesn't have an adoption problem, it has a deflation problem. It doesn't function well enough as money anymore, the plumbing is clogged with a massive depressionary and deflationary debt overhang. There is no backing to the dollar to, well, fall back on. Many countries will default on the dollar debt in coming years, pushing the supply of dollars even lower.

The metamorphosis that the dollar must go through is a transition from credit-based money, back to a sound backing. Gold bugs have talked about this for years. Too bad for them bitcoin came along and fits that need much better (disclaimer I still own my gold). If and when the dollar becomes backed by bitcoin (perhaps at a $10 million/btc valuation) we will have a US led, global renaissance.

SHARE with those who need reliable bitcoin news !!

Quick Price Analysis

| Weekly price* | $40,840 (+$2,031, +5.2%) |

| Market cap | $0.774 trillion |

| Satoshis/$1 USD | 2,447 |

| 1 finney (1/10,000 btc) | $4.09 |

Bitcoin Daily Chart

Time to shine bitcoin. Price broke above the critical level of $39,700 I have been showing for weeks now, and is now testing it as support. I predict this level will hold and price will continue up. In the light of sanctions and a troubled financial system, bitcoin will shine. I am keeping the same large arrow this week as well for the longer term projection.

If support holds, price should pop through the 2022 open price and the 2022 high of $48,000. The next area of resistance to be aware of starts around $55,000.

👉 Become a member! 👈

Get more price analysis

Mining and Development

| Previous difficulty adjustment | -1.49% |

| Next estimated adjustment | 0% in ~12 days |

| Mempool | 7 MB |

| Fees for next block (sats/byte) | $0.74 (13 s/b) |

| Median fee (finneys) | $0.63 (0.154) |

I'm keeping this section very short this week because other sections are quite large. Mining news will return next week!

Altcoins / CBDCs

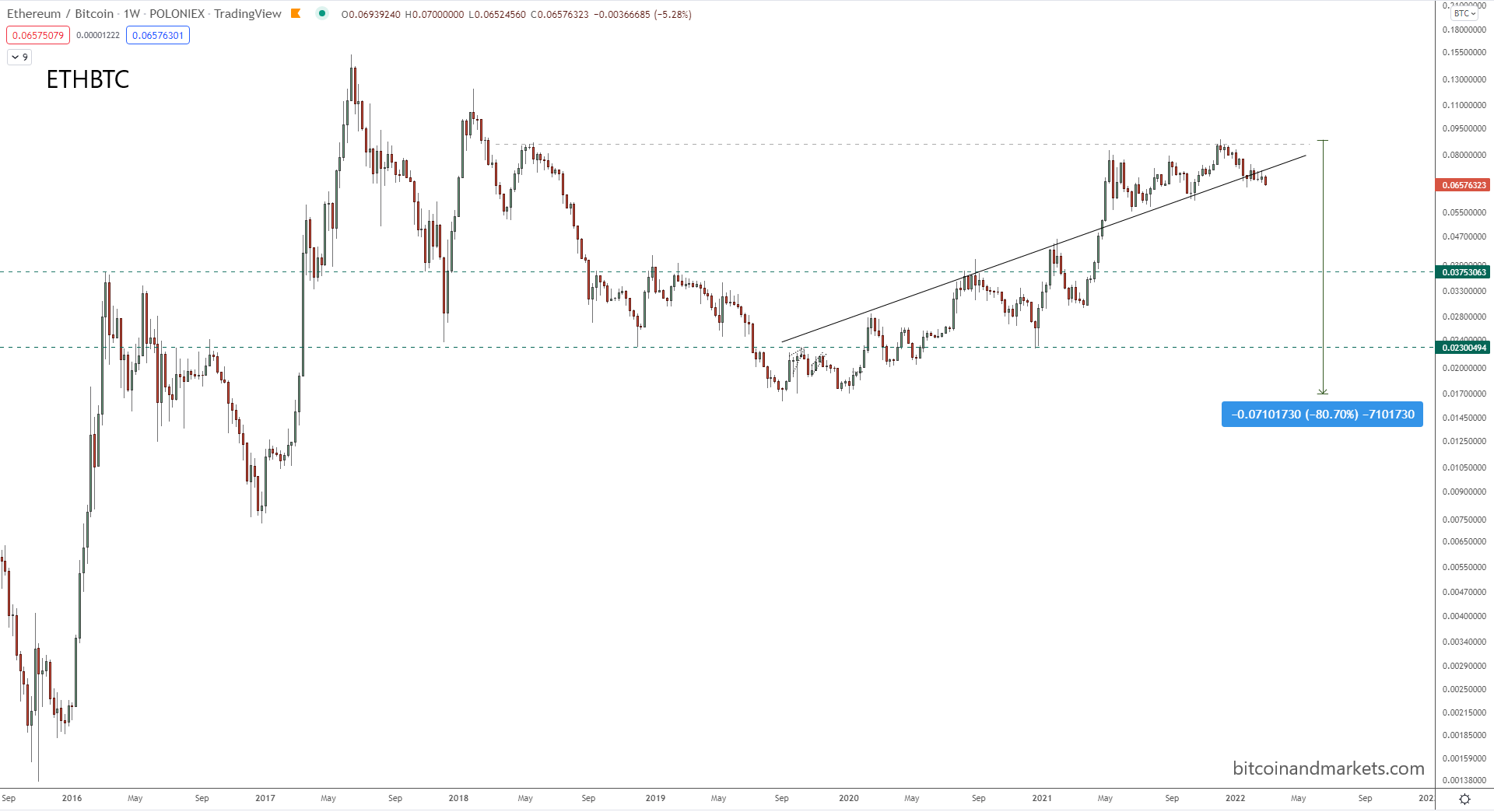

Ethereum has lost 80%+ of its value against Bitcoin 3 times in its short history. Since 2020, ethereum has suffered 5 separate drawdowns between 25 and 40% against bitcoin, with the smallest of 25% being the current one. I predict this current drawdown is not done, and it is likely to see another 80% drop sometime in the near future. Why? Read on.

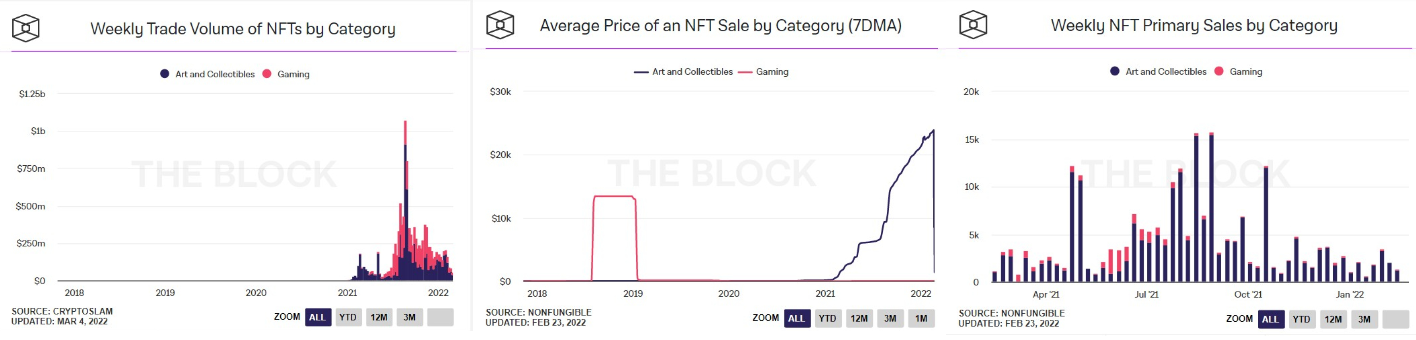

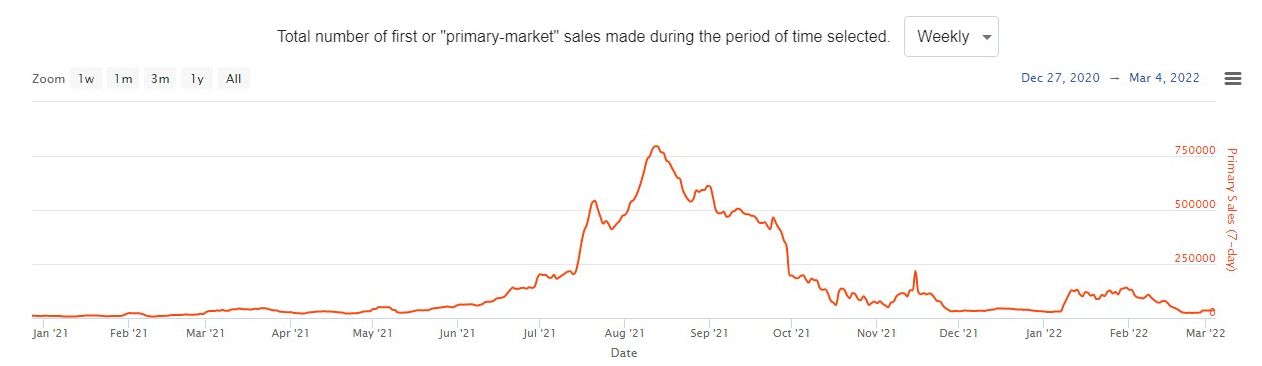

For several weeks recently, I concentrated on the NFT market topping. Let's quickly check in on that... (excuse the size, I didn't want to take up a ton of room).

Some of those aren't even being kept updated by The Block Crypto site anymore, even though they are huge altcoin lovers and NFT pumpers. Perhaps, the NFT market has recovered? Let's check another source.

Nope. The above is the source The Block Crypto is using, updated today. Dead. LOL.

This NFT bubble that ethereum went through is over. It was smaller than the previous ICO bubble that launched ethereum in 2017. Both will pass into history as temporary internet fads.

Ethereum has handicapped itself in several ways. 1) It is overly complicated and insecure; 2) it is centralized in leadership and execution with nodes centralized to Infura and code to the Ethereum Foundation; 3) Ponzi schemes like ethereum rely on expansion and inflation, which they clamped down on with their recent EIP1559 that burns fees in an attempt to be deflationary; 4) it doesn't do any single thing very well, so there is nothing to build a moat around to keep out clones.

In short, ethereum is bleeding, unattractive, and without any new blood. On top of that is the news from yesterday, that they have been captured by JP Morgan and government regulators. They cut off access to the ethereum network in Venezuela through MetaMask censorship.

BREAKING: a majority of Consensys shareholders demand audit under Swiss law "to investigate serious irregularities"

— Evan Van Ness 🐬 (@evan_van_ness) March 2, 2022

Group alleges MetaMask & Infura were secretly given away to a JPMorgan-backed entity via illegal transaction called "Project North Star"https://t.co/syQFV4gAKc

On the day this broke, MetaMask was inaccessible from Venezuela. As soon as it went viral, ethereum folks spun it as an "misconfiguration" on Infura's part. But that means it can easily be done if ordered.

Today was just a misconfiguration from Infura, but this shows why it's important to build blockchains that can be self-verified on a consumer laptop/phone. Ethereum/Celo are on that path. Other chains require huge servers to run their chain and will fall vulnerable to censorship. https://t.co/nXOlFkQBqG

— Hudson Jameson (@hudsonjameson) March 3, 2022

At least they have finally discovered the importance of self-hosting and keeping the consensus layer small and secure. Something bitcoiners have pointed out for years as ethereum folks said, "nah uh." A little too late though.

The issue here is with Consensys, the hugely important company at the center of Ethereum. It operates Infura, which hosts ~4500 out of 6300 ethereum nodes and most of the important services and apps using ethereum, and MetaMask, the dominant wallet that allows for people to interact with ethereum, the entire thing owned and operated by Joe Lubin CEO and co-founder of Ethereum. Together with the Ethereum Foundation, run by Vitalik, these two companies thoroughly control Ethereum.

Consensys raised a lot of money in 2021. At least 3 times from JP Morgan, along with other legacy stakeholders like Mastercard and UBS. JP Morgan at least has a significant interest in Consensys, that cannot be denied. How much we don't know. If Consensys, and hence Infura and MetaMask, are controlled by legacy interests, Ethereum is basically captured. If it isn't already, it will be soon.

Have a great weekend. See you next week!!!

A

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

March 4, 2022 | Issue #181 | Block 725,912 | Disclaimer

Meme via: Bitcoin Magazine

* Price change since last week's issue