Bitcoin Fundamentals Report #184

This week... Russia accepting bitcoin for oil?, a new Ponzi scheme buys bitcoin, price analysis, mining news, and some macro charts of inversions, dollar, and RRP.

A weekly newsletter summarizing important sectors in bitcoin

by Ansel Lindner

This week... Russia accepting bitcoin for oil?, a new Ponzi scheme buys bitcoin, price analysis, mining news, and some macro charts of inversions, dollar, and RRP.

In Case You Missed It...

- (Fed Watch) Lessons Learned from a Canadian Trucker, Rate Hikes, and More ft. Benjamin Dichtor - FED 86

- (Podcast) Bitcoin's Performance Under Recent Stress - E238A

- (Podcast) Coming out ASAP My Model to Make Sense of the Market - E238b

- (Livestream) We are now livestreaming Fed Watch on Tuesdays

- This week was a vacation week, more strong content coming up!!!

Sharing is caring!

Partnering with BitcoinDay.io

Bitcoin Day is a chance for the local community, business professionals, newbies, and cryptocurrency leaders to gather under one roof to inspire, socialize, and learn from each other. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Bullish breakout |

| Media sentiment | Positive |

| Network traffic | Low |

| Mining industry | Stable and strong |

| Market cycle timing | Beginning a new bull cycle |

Hello Bitcoiners!

What a week for bitcoin! Things starting to move very quickly. Let's hit this week's top stories...

Russia might accept gold and bitcoin for oil

The below video made its rounds in the bitcoin community this week, where the Chairman of the Energy Committee of the Russian government supposedly said that Russia might accept bitcoin for oil.

NEW - Russia to accept #Bitcoin as payment for energy exports, says Pavel Zavalny, Chairman of the Energy Committee.pic.twitter.com/wUEOzX8Kfz

— Disclose.tv (@disclosetv) March 24, 2022

I say supposedly, because it's in Russian and is not clear exactly what he's saying. He definitely doesn't have the sole authority to make such a proclamation.

I've heard and read a couple different translations. It appears his main point is they will not accept Euros or dollars anymore. Those unfriendly nations will have to pay in rubles (and mentions gold). Friendly countries can pay in their own currency or even bitcoin if they want to.

There are not a lot of oil companies or countries that own any bitcoin, so it'll be hard for them to offer to pay with it. It would have to be the seller who requests bitcoin, in this case Russia, to be as earthshaking as people seem to think this is.

However, this story is of huge importance because it is firmly resetting the Overton Window for bitcoin. We can now very seriously talk about bitcoin used to buy oil and gas. But again, from a physical perspective, it is not going to immediately change anything.

Terra buying bitcoin to back its stablecoin Luna

This is an interesting story that some rookie altcoiners seem to think is brand new and very important. It's not new to use bitcoin as collateral for a coin. The premier example is Ethereum launched by taking bitcoin in their ICO.

A company called Terra, which is an ethereum copycat, has a network stablecoin called Luna. I'm not super familiar with this particular scam, but it appears Luna is algorithmically balanced to remain at $1, like DAI. That means the company buys and sells Luna in order to keep it pegged. It is a highly insecure system, and is also freezable by Terra.

Anyway, Terra announced it will be putting billions of dollar worth of bitcoin in their reserves to stabilize the peg and give them a secondary currency to buy and sell Luna with. No mention of how they can afford it or who will hold it and secure it.

$UST with $10B+ in $BTC reserves will open a new monetary era of the Bitcoin standard.

— Do Kwon 🌕 (@stablekwon) March 14, 2022

P2P electronic cash that is easier to spend and more attractive to hold #btc

Ethereum folks are gullible. In the thread below from some random .eth guy, he thinks Bitcoin "maxis" will have to eat humble pie and support this altcoin garbage because it holds bitcoin. LOL

#Terra announced that they are going to start buying #Bitcoin as a reserve asset. 🔥

— pothu.eth (@pothuEth) March 23, 2022

This is huge for $LUNA. Here’s everything you need to know.

A thread 🧵👇 pic.twitter.com/kFdSoTVJkY

Of course, it's logical an altcoin would want to use and hold bitcoin. It is the best collateral/money in the world and the founders can always disappear with it.

Some bitcoiners are concerned that all this btc in an insecure protocol could dumped on the market if things go sideways for Terra. I don't think that is very likely at all. It is much more likely that the founders simply run off with it, or the smart contract holding the bitcoin will be conveniently "hacked".

Adam Back makes a very important observation. The $10B figure is based on the rosiest of projections by the team, and it is possible they simply print Luna to buy bitcoin.

they don't have it yet. they had $1bil from VC/institutional and $1.2bil from selling recursive/premined tokens (future value of fractional reserve UST), and $800mil "to raise" and somehow they fractional reserve that up to $10bil so i guess 3.3x leverage (or more if stressed)

— Adam Back (@adam3us) March 22, 2022

It reminds me exactly of some of the most powerful buyers of bitcoin in the past, Ponzi schemes. Schemes like Bittrader, Bitconnect, and MMM have been huge parts of past bitcoin bull markets. Perhaps, Terra is a sign that a massive bull market like in days past will be coming next.

SHARE with those who need reliable bitcoin news !!

Quick Price Analysis

| Weekly price* | $44,381 (+$2,641, +6.3%) |

| Market cap | $0.842 trillion |

| Satoshis/$1 USD | 2,254 |

| 1 finney (1/10,000 btc) | $4.43 |

Bitcoin Daily Chart

Last week, "I expect price to test the high from March 9th of $42,600, and perhaps reach for the resistance zone at $45,900."

After bouncing between the 100 and 50 simple moving averages, price has made a decisive move higher into the resistance zone. Above is strong volume resistance, pattern resistance, and the 200 MA. We can go higher from here, but the shorter timeframes are looking overbought. Don't be surprised by a brief consolidation.

With that said, I think bitcoin has chosen a direction. The last level to break before we can be absolutely confident is $46, 000. At that point we could see shorts feeling the squeeze and bulls getting confident again. I expect much higher prices in the next couple of weeks.

On a consolidation dip, look for price to bounce on the 100/50 MAs around $42.5k.

👉 Become a member! 👈

Get more price analysis

Mining and Development

| Previous difficulty adjustment | -0.35% |

| Next estimated adjustment | +4% in ~5 days |

| Mempool | 2 MB |

| Fees for next block (sats/byte) | $0.44 (7 s/b) |

| Median fee (finneys) | $0.31 (0.070) |

Mining News

(Archive link here if you don't want to give altcoin pumpers your clicks)

The bill was put together under the auspices of the state's Climate Leadership and Community Protection Act, which mandates that New York's greenhouse gas emissions be cut by 85% by 2050, with net emissions being slashed to zero. It would effectively ban PoW mining – the energy-intensive process used to secure the Bitcoin (BTC) network – for a period of two years.

The legislation still requires passage by the entire New York State Assembly and the state's Senate, and then would need to be signed into law by the governor.

Earlier this month, a similar PoW ban narrowly failed to pass in an EU Parliament committee vote.

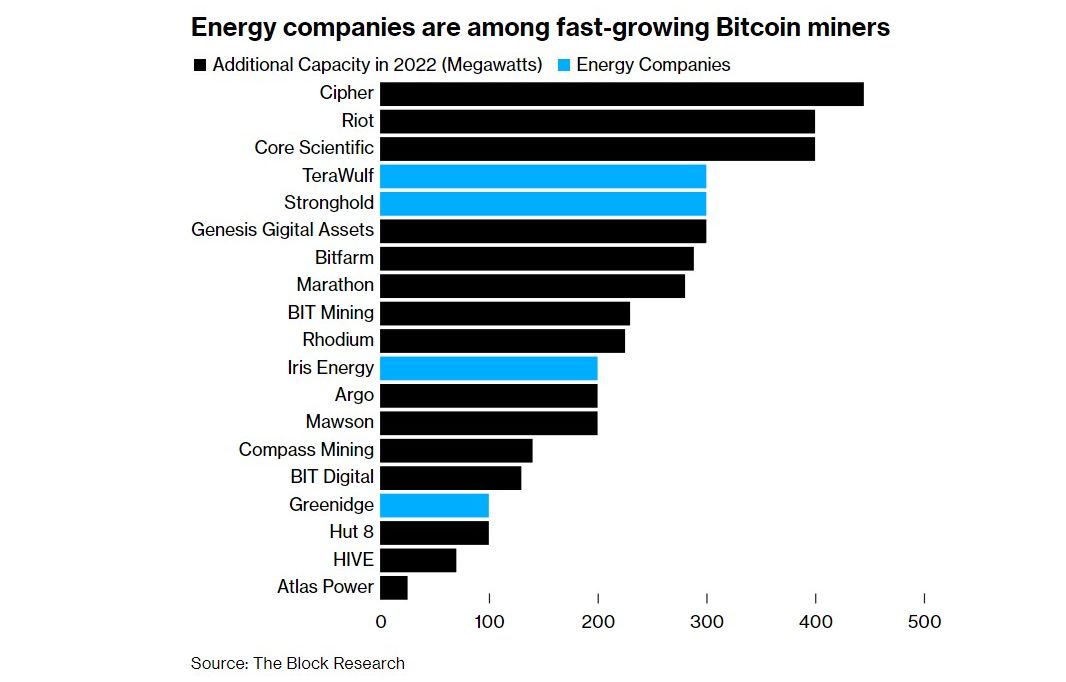

Margins of Up to 90% Give Energy Firms That Mine Bitcoin an Edge

This story from Bloomberg details how energy companies themselves are getting into the bitcoin mining game. They are discovering that they don't want to pay a mining company to use their energy, they will use the energy themselves to mine bitcoin and improve their efficiency and margins.

“If you are buying power from a producer and paying a third-party operator to manage the data center, you are going to have lower margins than those that do it themselves,” Beard said.

“It is not only the efficiency from the commercial perspective but it is from a risk perspective where we are better built to handle the downside,” Prager said. “When a transformer goes out on site, you are not calling a third party service firm to come in to repair it, putting in a change order, paying them overtime and hoping that in two to three weeks that transformer is repaired.”

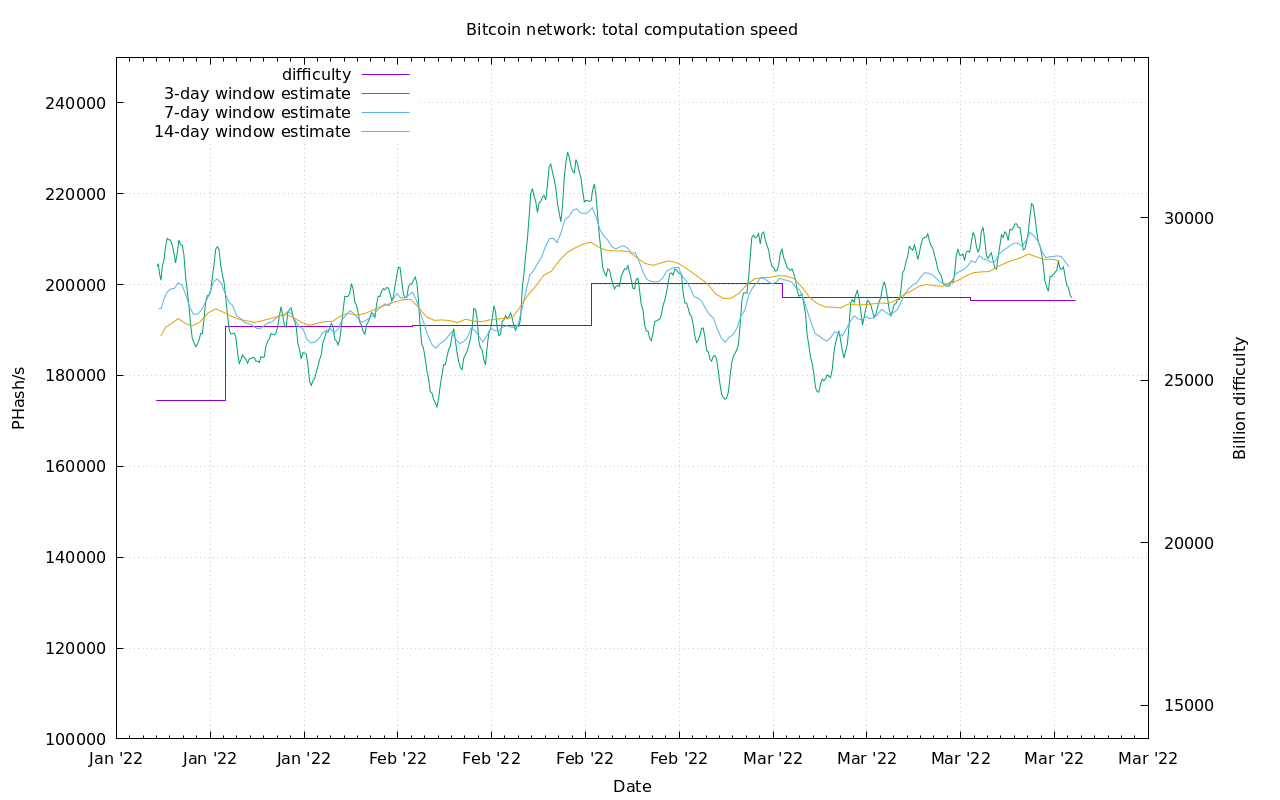

Difficulty and Hash Rate

Not much happening from a hash rate or difficulty perspective this week. Steady and stable near ATHs. Difficulty is estimated to rise by 4% at the next adjustment in 5 days.

Macro

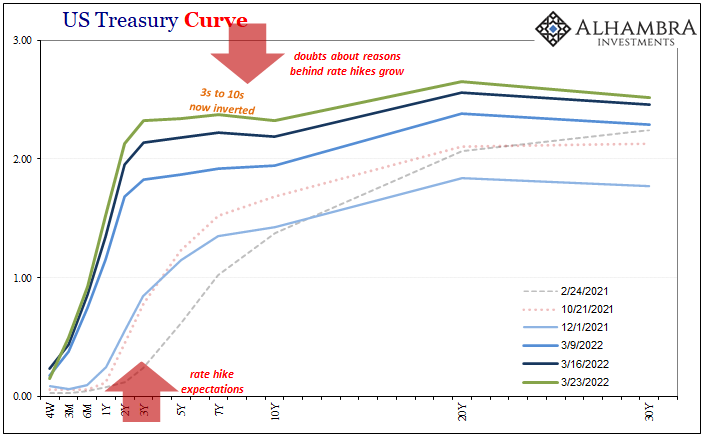

Inversions

I wanted to write a section on macro this week. I have not had the time to create a whole Macro Chart Rundown post (maybe this coming week, stay tuned).

I recorded a mid-week episode for Fed Watch on this subject, coming out on Monday. It's a must listen to get a background on why this is important. Suffice it to say here, inversion means the largest most sophisticated market on the planet is signaling a major slowdown.

The steep short-end means they believe the Fed will raise rates, the inverted/flat long-end means they are predicting recession and deflation is coming. A rapid and painful return to a recessionary economy is going to take most people by surprise, because they think inflation is not "transitory".

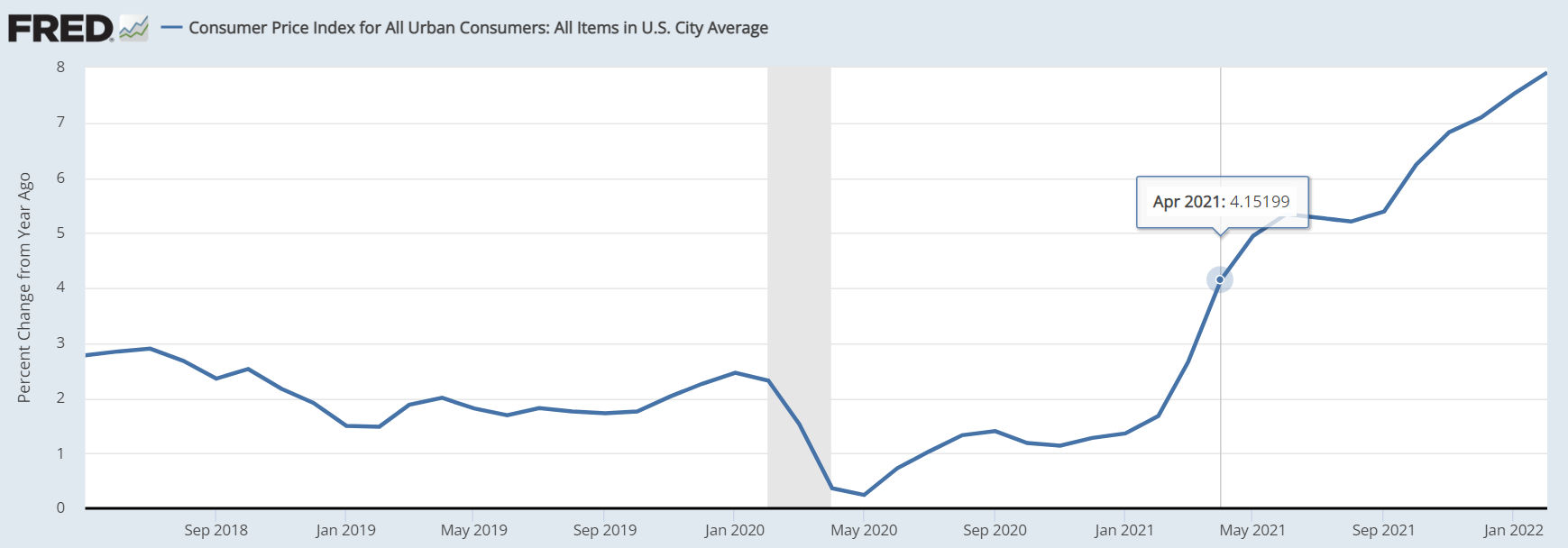

I've been expecting CPI to begin coming down in April for a while now, and said as much on Fed Watch. It was April of 2021 when CPI started to take off, coming in at 4%. CPI is Year-over-Year, making it more difficult to reason about.

In the above chart, each monthly reading is a movement from the preceding year's same month. Why did the CPI take off in April 2021? What happened in April of 2020?

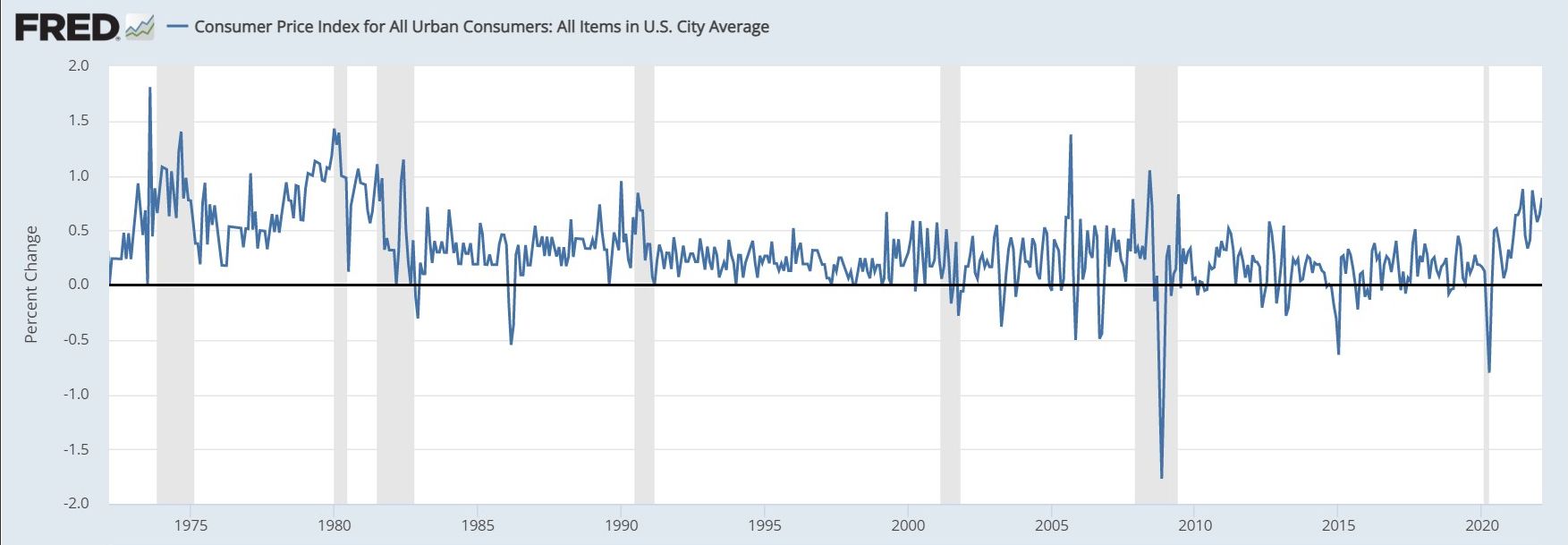

The Month-over-month CPI growth is less out of the normal and worrisome. MoM changes have stabilized, and should start coming down relatively quickly, since the yield curve is pricing in recession, and demand destruction is everywhere. March has been horrible for the supply crisis, so perhaps we get another high print on the CPI in March, but then it starts coming down from there. There's no "money printing", all the price rises are due to supply shock reasons.

If the MoM rate drops in the next two months, the YoY CPI will be set up to also drop. The peak MoM reading was in June 2021 at 0.87%. I expect CPI to be back to 5% by June, with MoM back to "normal" around 0.2%.

Dollar

Despite all the dollar fear-porn out there, it continues to rally. While true, it is in the upper band of its recent range, there is nothing standing in its what on the chart from racing to a 101.5 handle. If foreign economies aren't struggling badly, that'll get everyone. It also shows that CPI is not due to the dollar weakening.

Reverse Repo RRP rate from the Fed

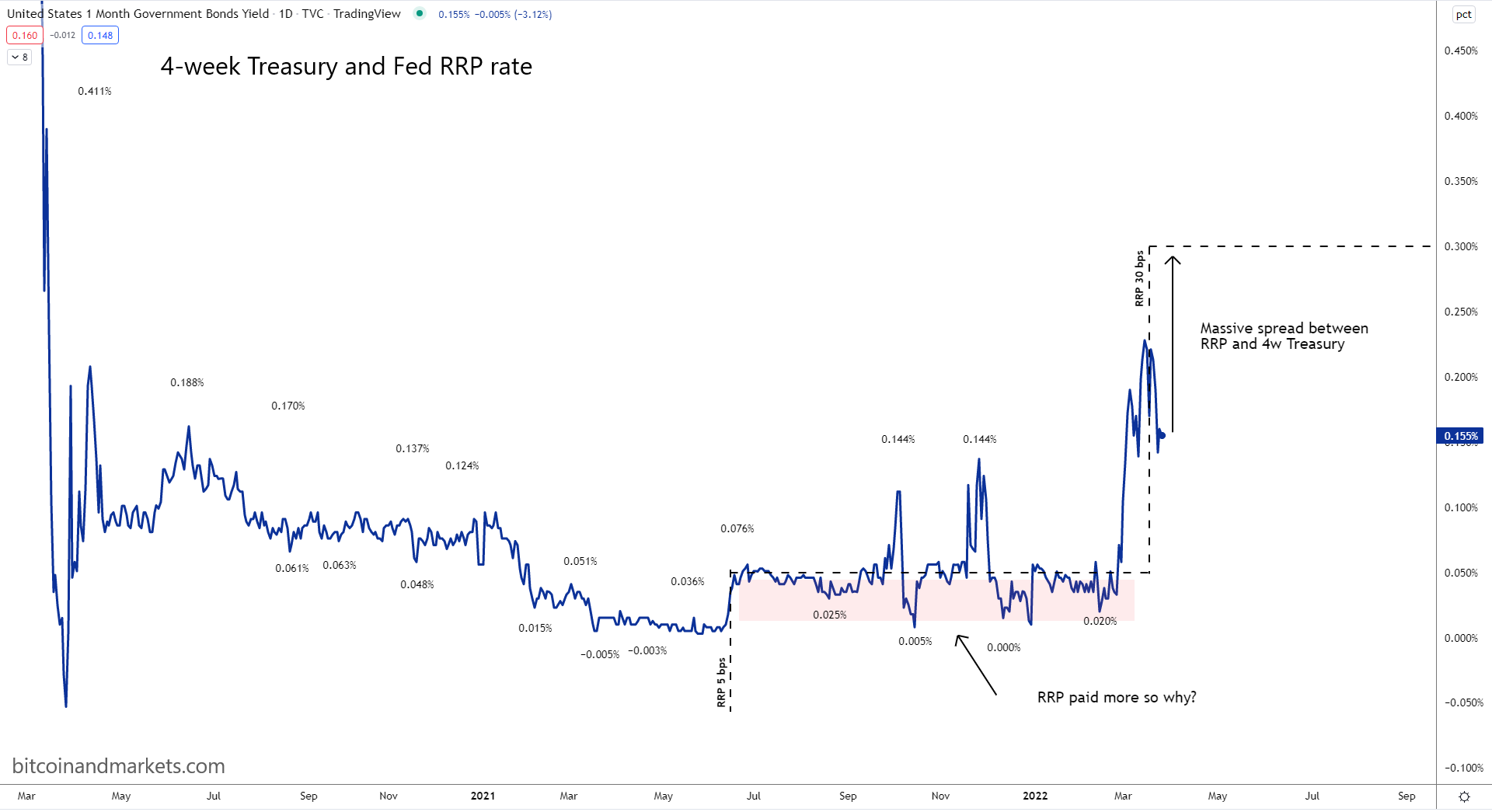

At the March FOMC meeting, the Fed raised the Fed Funds target range, but also raised the RRP rate. This means that the Fed is willing to pay financial institutions now 30 bps (annualized) to borrow dollars overnight. The institutions get collateral; pristine US Treasuries.

Notice the red shaded area where the 1-month treasury bill yield was below the RRP rate, which doesn't make any sense! Why would a financial institution buy a Treasury for a 3 bps yield, when they can do the same thing and get 5 bps from the Fed? There's one answer: collateral shortage.

After the recent increase in what the Fed will pay up to 30 bps, the spread is even worse. These institutions are now willing to give up 12 bps of yield.

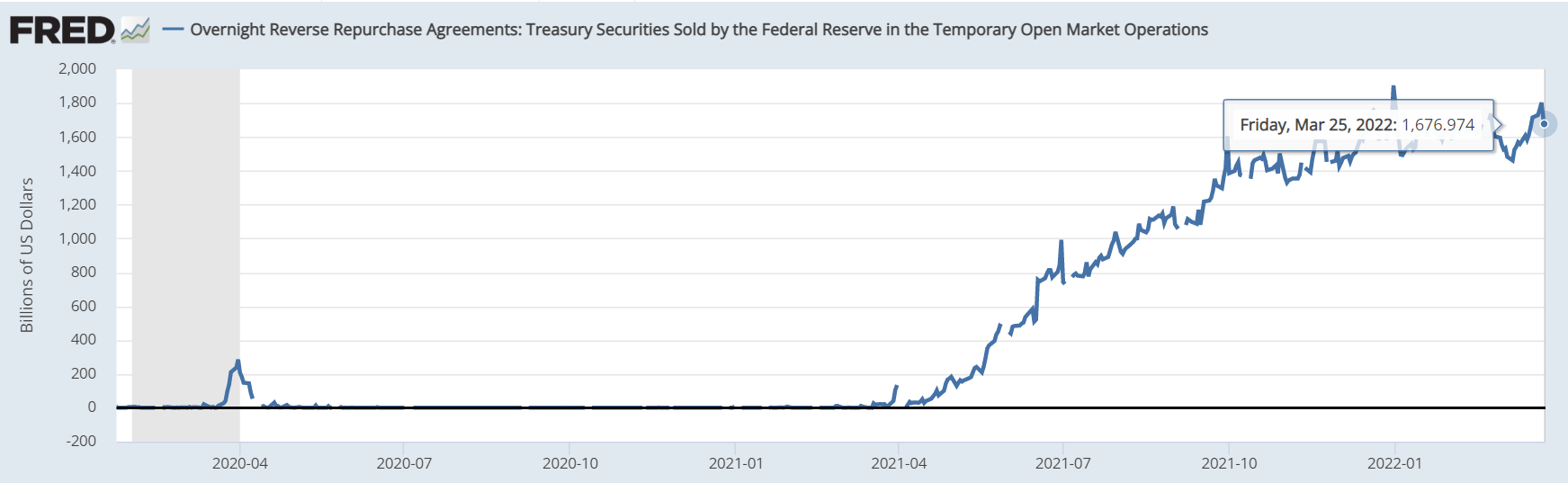

And the total volume of RRP remains near the highs at $1.6 trillion.

Remember, as institutions' balance sheets become more impaired and contagion spreads, they will need to bring more collateral to the table to get the same amount of funds in repo. Say a bank can use $1 billion in USTs today to access $900 million overnight cash. Tomorrow, they are deemed a worse risk, so now they need $1.1 billion to access $900 million overnight. They need more collateral to cover the same loan. If the entire market is doing that, it turns into a collateral shortage and they will source the needed collateral on the secondary market and push yields down.

I think it is fair to say that we are in a full blown collateral shortage, and starting to morph into the next phase, a dollar shortage. The Fed will not be able to tighten into this.

CPI will start coming down (naturally), recession will be obvious, and the dollar will continue to spike. That will give the Fed room to walk back their hawkish tone. I can see only 2 or 3 rate hikes this year.

That's it for this issue. Have a great weekend. See you next week!!!

A

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

March 25, 2022 | Issue #184 | Block 728,995 | Disclaimer

Meme via: Unknown

* Price change since last week's issue