Bitcoin Fundamentals Report #185

This week... changing proof-of-work, EU trying to ban bitcoin wallets, price analysis, mining news, yield curve inversions, oil and ruble drop?, and Ukraine update.

This week... changing proof-of-work, EU trying to ban bitcoin wallets, price analysis, mining news, yield curve inversions, oil and ruble drop?, and Ukraine update.

In Case You Missed It...

- (Fed Watch) A National Bitcoin Strategy ft. Matthew Pines - FED 88

- (Podcast) Bitcoin's Performance Under Recent Stress - E238A

- (Podcast) Coming out ASAP My Model to Make Sense of the Market - E238b

- (Livestream) We are now livestreaming Fed Watch on Tuesdays

Sharing is caring!

Partnering with BitcoinDay.io

Bitcoin Day is a chance for the local community, business professionals, newbies, and cryptocurrency leaders to gather under one roof to inspire, socialize, and learn from each other. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Breakout consolidation |

| Media sentiment | Negative |

| Network traffic | Low |

| Mining industry | Stable and strong |

| Market cycle timing | Beginning a new bull cycle |

Hello Bitcoiners!

This was a slightly slower week than last, but plenty to cover. It looks like attacks are back, and we might even have our next bitcoin hard fork on the way. Price jumped and macro cooled off a bit.

Let's jump into this week's top stories...

Consortium to Change Proof-of-work

An absolute disgrace of critical thinking. We know they want to attack bitcoin, but this is lowbrow high school stuff. Will never work.

The “Change the Code, Not the Climate” campaign will attempt to lobby institutions in the Bitcoin industry that pledge an environmental, social, and governance (ESG) agenda, buy ads in leading publications and appeal to communities allegedly suffering from bitcoin miners’ noisy activities to try and convince investors that Bitcoin could use a different consensus protocol that is supposedly both better for the environment and enables a similar degree of security.

The typical counterarguments to hard forks go as follows. The first usually is, if you change Bitcoin's PoW, you undermine the very thing that makes Bitcoin beneficial and unique. The second argument you usually hear is, Bitcoin benefits renewables and will lead to an efficient, clean and sustainable energy future as it is.

While those are correct, my opinions are less conciliatory. I argue that it is impossible to change Bitcoin at all! And perhaps the best response is, "go for it."

Regardless of the companies you convince, the politicians you bribe, or the miners you have on board. As long as there is a status quo Bitcoin option, the original will be known as bitcoin and get all the value.

How can I say that? Game theory. It was not lucky or surprising that Bcash crashed and burned in 2017. It was the only logical outcome.

In a Prisoner's Dilemma, both players will defect, even when the best outcome is cooperation! It's called a coordination failure. It cannot be avoided so long and an intolerant minority is present. Even with the weight of a large country or a majority of bitcoin miners wanting a change, it is the intolerant minority that makes coordination impossible. Hard forks will only create altcoins.

In the case of a bitcoin hard fork (a compatibility breaking change like this proposal), defection is maintaining the status quo. The choice is not 1) PoW or 2) PoS, it is 1) competing PoW and PoS versions, or 2) only PoW. This is because the intolerant minority stand in the way of 100% coordination.

Europe Moves to Ban Private Bitcoin Wallets

(Archive link here)

The European Union is making a hasty decision by apply draconian KYC requirements broadly to bitcoin. Just when it looked as though cooler heads were prevailing in Europe with the defeat of the bitcoin mining ban a couple weeks ago, this new regulation will apply strict KYC to all bitcoin transactions, effectively making many transactions impossible in the EU. So far, this new proposal has only passed the first phase in becoming new law, but a troubling development all the same.

It seems as though this is an ignorant attempt to protect the struggling Euro. The legislation may stem from a basic misunderstanding of push versus pull transactions.

Bitcoin is a push payment system, unlike credit cards or other electronic payments. The sender is the one who signs the transaction and broadcasts it to the worldwide network. Where in traditional centralized system the recipient gets your permission to reach into your account and "pull" the transaction.

The former makes bitcoin "private" by default. Any account can push satoshis to your wallet. Indeed, there have been many cases where very small transactions have been pushed to famous wallets, like the US Marshals and politicians. These people didn't request the payment, but they were sent nonetheless. The later inherently needs the sender's personal information to reach in and pull the payment out.

Not only does this raise the expense of having to KYC all sources (and likely sources of sources) of funds, but it also imposes a burden to identify people and securely store their private information.

IMO this also raises the question of the Lightning Network. In the LN, payments are routed through a web of connected nodes to the recipient. Will all these nodes have to KYC everything they route, the original sender and the ultimate recipient? That is flatly impossible. LN is a mix of a push/pull transaction. The recipient provides an "invoice" to the sender, which they pay, each hop in the route gets pushed to the next hop.

This proposal was made either, 1) without understanding bitcoin, or 2) maliciously to impose harsh costs onto bitcoin, in order to help the legacy Euro compete.

SHARE with those who need reliable bitcoin news !!

Quick Price Analysis

| Weekly price* | $46,322 (+$1,941, +4.37%) |

| Market cap | $0.880 trillion |

| Satoshis/$1 USD | 2,159 |

| 1 finney (1/10,000 btc) | $4.63 |

Bitcoin Daily Chart

Price was rejected right at the 200-day moving average, then bounced off the previous resistance trend line (black line). These are the types of moves that must frustrate people who don't believe in technical analysis.

There is still a few hours until the daily candle closes, but it is shaping up to be a huge reversal. It is a very bullish sign that the consolidation in price was unable to test lower levels into the $42k range. Indeed, my important price level of $46,000 has been retaken already.

The weekly chart is also looking very good. Price is now above the 50-week moving average and staring at blue skies. The last time price broke through this MA was back during the halving in 2020, and signaled a monster 600% rally in the next 40 weeks. If price were to have the same rally from here, that would put us at $325k by the end of the year.

On the daily and higher timeframes the upward trend is establishing itself. However, on lower timeframes like the 4-hour below, we can see this bounce is not yet complete. It stalled out just below previous support and could easily drop again from here. The 4-hour RSI (not shown) did break into oversold before the bounce, which is a sign that the dip might be over.

To summarize the 4-hour chart, it is less bullish than the daily and weekly, so traders should be watchful for a further dip.

Overall, I expect a slower week for price, but this strong daily candle tells me that the rise we've seen in the last two weeks is for real.

👉 Become a member! 👈

Get more price analysis

Mining and Development

| Previous difficulty adjustment | +4.13% |

| Next estimated adjustment | 0% in ~12 days |

| Mempool | 5 MB |

| Fees for next block (sats/byte) | $0.25 (4 s/b) |

| Median fee (finneys) | $0.19 (0.041) |

Mining News

After a couple months of neutral to positive news about mining, bitcoin's opponents have regrouped and are back on the offensive. In addition to the attack on Proof-of-work in general I wrote about above, there are several other stories to consider.

People are going after oil companies for partnering with bitcoin miners to capture stranded energy in oilfield flares. Never mind, that using this energy not only reduces the pollution of direct burning by 60% or so, the bitcoin profit can offset clean remediation technology, it also frees up on-grid energy that these people throw a fit when miners pay for and use.

These are whiny people, fighting against nature, not for it.

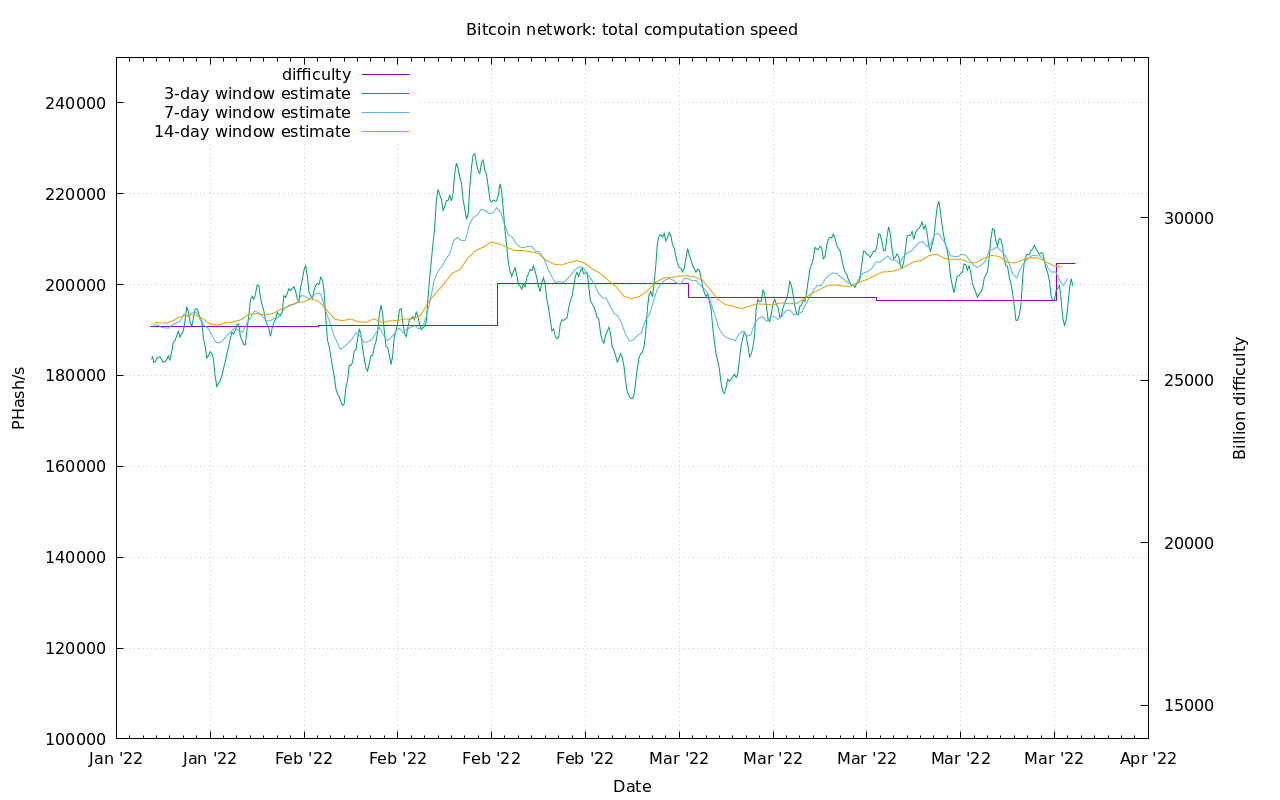

Difficulty and Hash Rate

Hash rate has been stable with a slight down trend over the last week. The average speed of the network remained higher enough for a 4% difficulty increase.

Macro

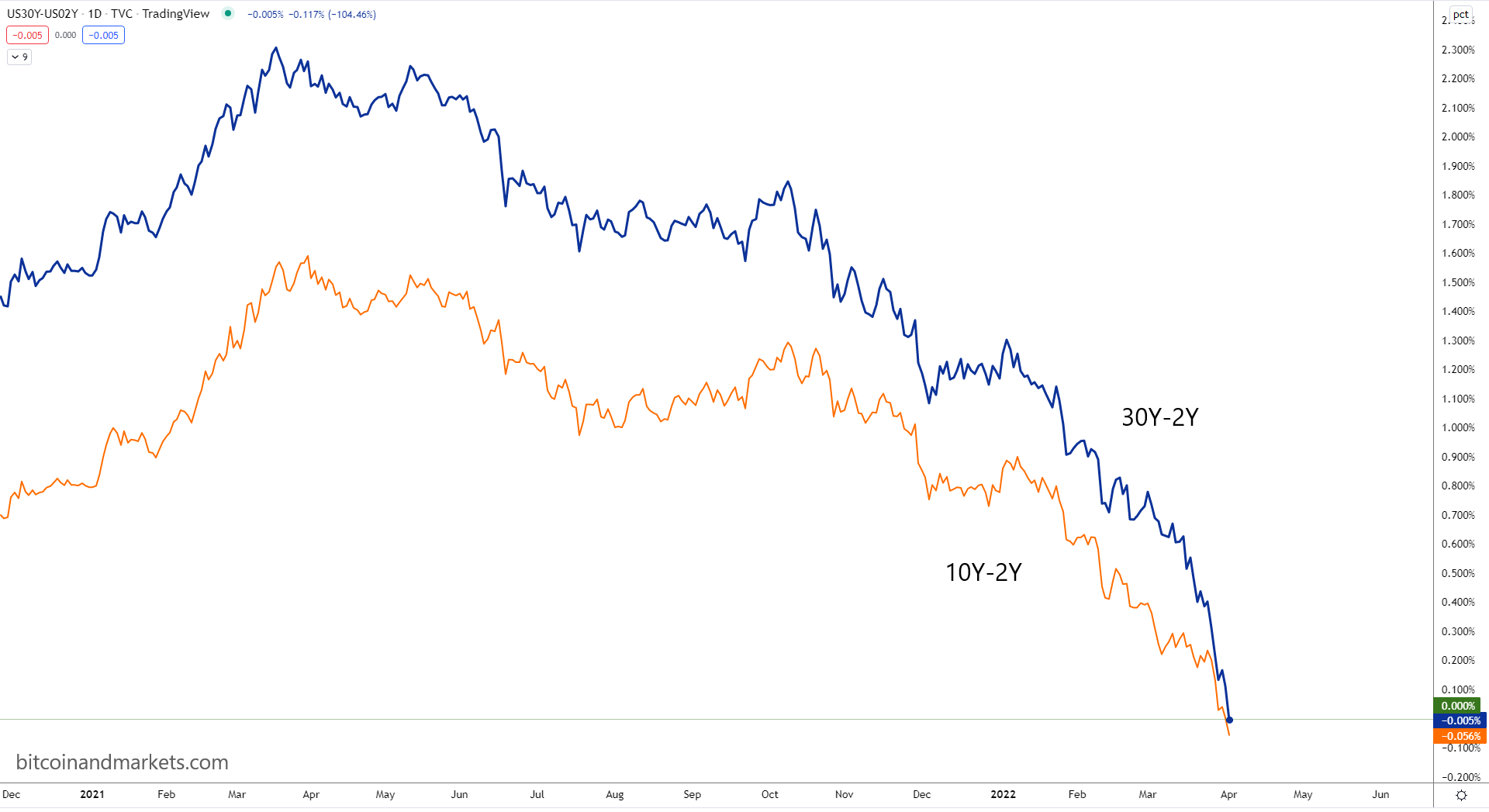

Inversion

The yield curve has officially inverted. The 10-2Y crashed into the negative yesterday.

Things are so ugly, the 30Y has now also inverted with the 2Y.

Oil

WTI oil has broken the 50-day moving average to the downside. Right now it is on a bounce, but recession is not going to be good for oil prices.

I'll repeat once again that we have not seen peak cheap oil. What we are seeing is supply slowly out stripping demand on a multi-year basis, as technology continues to advance but the global economy struggles in a slow-motion debt collapse.

Just like 2009, I expect oil has peaked for the cycle and will retreat in the opposite direction of inflationist warnings.

Ruble

LOL, just like oil, the Ruble has broken down below the 100 handle as well. This should tell you that Russia is not currently losing this war.

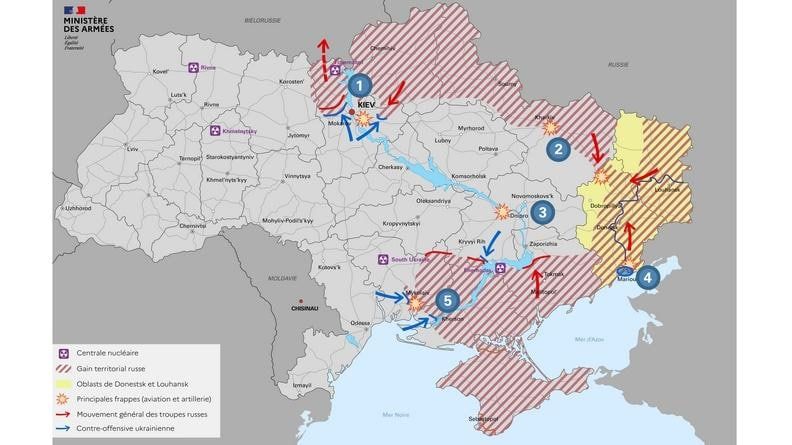

Ukraine Update

Just a quick Ukraine update for everyone. I know this is a divisive subject, so I'll keep it brief. I'd like to starting with my overall intention is to not take sides, especially when the sides are not clearly defined. I'm trying to understand the reality of the situation in order to inform myself and others.

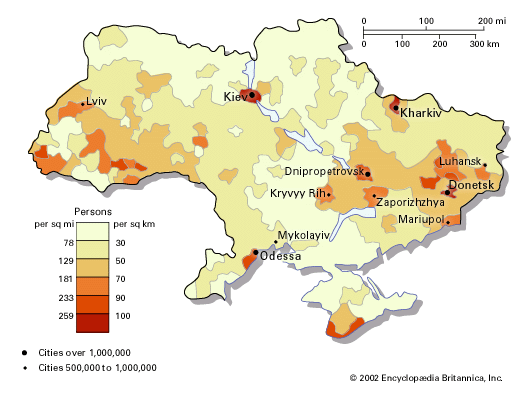

Anyway, what I have for you today is the most recent map of troop movement provided by French intelligence. I'd say this is a fairly reliable source, however, it does carry a slight bias toward Ukraine.

We are 36 days in, and nothing yet has stopped the methodical Russian advance. I have heard the reports of Ukrainian victories around Kiev, but that is for sure not the major concern for the Russians. I've also seen multiple reports on the Belgorod fuel depot, which I also consider a small win for Ukraine and not a sign of something bigger.

On the map, what you see around Kiev is the rotation of troops out of the area and new units pushing south on the eastern side of the city. IMO they are not trying to capture Kiev, and might never do that. They are moving around, keeping the Ukrainian units distracted.

In the south, where I thought there would be a more concerted effort to move west by Russian forces, there has been some engagement from the Ukrainians. The Russians however, have not lost any territory in that area for the last week that I've seen in daily updates by this source. It could be that those forces are providing cover for the eastern operation from Odessa based units, and the Russians don't plan to advance toward Odessa until a later phase.

The east remains where most of the fighting is occurring and where the best of the Ukrainian army is holding out. The now famous Russian "caldron" tactic of surround and turn up the heat, seen in Maripol, can also be seen in northwest Luganzk. I also expect the southern forces moving up the eastern bank of the Dnieper to maneuver to surround either Kharkiv or the central cities.

That's it for this issue. Have a great weekend. See you next week!!!

A

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

April 1, 2022 | Issue #185 | Block 730,024 | Disclaimer

Meme via: @naiivememe

* Price change since last week's issue