Bitcoin Fundamentals Report #188

This week... Dangers of inflationary thesis for bitcoin commentary, latest articles, bitcoin price analysis, mining news, and NFTs die.

This week... Dangers of inflationary thesis for bitcoin commentary, latest articles, bitcoin price analysis, mining news, and NFTs die.

In Case You Missed It...

- (Fed Watch) Central Banks Losing Control?? - FED89

- (Podcast) Bretton Woods 3 is Silly, Here's Why! [Reaction] - E240

- (Members) Bretton Woods 3 is Silly (Video) - E240

- Macro update coming out later today. Stay tuned!

Sharing is caring!

Partnering with BitcoinDay.io

Bitcoin Day is a chance for the local community, business professionals, newbies, and cryptocurrency leaders to gather under one roof to inspire, socialize, and learn from each other. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Testing support |

| Media sentiment | Negative |

| Network traffic | Extremely low |

| Mining industry | Stable and strong |

| Market cycle timing | Early stage of new bull cycle |

Hello Reader,

The financial news cycle is a bit slow this week. There are some big headlines, but nothing seems to move the market except for the Fed signaling a big rate hike coming. Bitcoin has been slow since the Miami conference, almost as if the industry is in a bit of a hangover still.

I picked out a couple articles for bitcoin, but first a message about a danger I see in tying bitcoin to inflation. Enjoy.

The Danger of an Inflationary Thesis

The extent of most people and pundits' framework is that 'bitcoin is a hedge against inflation and is a risk asset.' That makes it difficult when massive news events happen and price is generally sideways for many weeks. Or when CPI is taking off and the bitcoin price is stable.

Since the Ukraine invasion on Feb 24 and the subsequent embargos on Russia, which should be a time of risk off and a huge threat of recession, bitcoin is up 8%. Yes, consumer prices have increased in the last year too, but that alone does not distinguish between monetary inflation vs supply shocks.

It is dangerous to have a bitcoin investment thesis that relies only on inflation and risk appetite, because recessions happen. There is little reason to hold bitcoin if recession and deflation are looming in that case.

My analysis goes much deeper and often rubs people with the above view the wrong way. We need to understand, why after 12 years of QE (what we are supposed to believe is money printing), was CPI so restrained until April of 2021? For the whole life of bitcoin, inflation was sub-3%, except a brief period in 2011. It still did alright!

In the above chart, I tried to match up the CPI YoY change with the bitcoin price. The black arrows are where they did not agree, and the green arrows are where they did agree.

There is no apparent evidence that bitcoin is a CPI hedge. Just look at the last ~2 years. Can you honestly look at the chart below and say that higher inflation is a factor in the bitcoin price???

I'll grant, the inflationist investment thesis for bitcoin is partially true. I don't mean to say that bitcoin wouldn't act as a hedge against inflation. However, if CPI starts falling and we go back into recession this year, where does that leave your investment thesis? What about all the bros on Wall Street holding bitcoin as an inflation hedge because that's what he learned from the bitcoin media/educational community? He'll sell.

The recent CPI spike since April 2021 is temporary. The long term trend of lower rates and lower growth is still intact. Where does that leave bitcoin?

The inflationist thesis won't cripple bitcoin in the coming recession, but it can cripple people who believe it so much they sell. So, what is a better investment thesis for bitcoin?

Bitcoin should go up as CPI goes down. In a credit crisis you want to hold things without counterparty risk.

Bitcoin's ecosystem continues to grow: mining, wallets, trading, stablecoins, media, savings, lending, collateralized loans, etc. Demand for bitcoin in financial products is growing, while the rest of the system is stagnating or crashing.

MBS (mortgage backed securities) are effectively manufactured collateral-grade instruments. By bundling a bunch of mortgages together, you have a safer instrument. They proliferated prior to the Great Financial Crisis (GFC) because there was a dearth of quality collateral to sustain an expanding global credit system (collateral shortage).

Just spit-balling here, but what if, in this coming crisis, when people flee to the safety of collateral and dollars once again, there was a Bitcoin Backed Security (BBS)? Idk how it might look, perhaps just straight bitcoin or bonds sold by bitcoin miners. It's something to think more about.

The second part of a better bitcoin investment thesis, other than bitcoin being counterparty free in a credit crisis, is its network effects. It has a long way to go, with huge asymmetric risk. Price will flucuate around a mean growth rate as we've seen in bitcoin's past. And it's about time for the next rally.

Bitcoin benefits from deflationary pressure due to no counterparty risk, and inflation due to limited supply. It is a market of green shoots that is just getting started.

Ripple Complains that asking questions is "tribalism" and wrecking "crypto"

“I own bitcoin, I own ether, I own some others,” Garlinghouse said. “I am an absolute believer that this industry is going to continue to thrive.”

Bitcoin “maximalism” has meant the crypto industry has “fractured representation” in Washington, D.C., according to Garlinghouse.

LOL, it must have slipped his mind that he owns billions of dollars in Ripple.

That second sentence is key. He's making the argument that Bitcoin's expert technical and monetary arguments, and our insistence on showing empirical evidence of the past 10 years in the industry of scam after scam properly diagnosed by these arguments, is turning regulators against altcoins. This is a very good sign that many in DC are starting to understand altcoins are scams. Or am I reading too much into it? I don't think so.

Clown world

Ukraine makes bitcoin legal and then makes buying it with Ukrainian currency illegal within 2 months.

BOOST SIGNAL : PLEASE SHARE !!

Quick Price Analysis

| Weekly price* | $39,450 (-$840, -2.1%) |

| Market cap | $0.751 trillion |

| Satoshis/$1 USD | 2,533 |

| 1 finney (1/10,000 btc) | $3.95 |

Bitcoin Daily Chart

Not much has changed since last week on the price. There was a little excitement when it break the 50-day moving average (orange line), but that quickly faded.

Bitcoin is currently sitting at the bottom of the ascending channel once again, and is spending most of its time in the bottom half of that channel. As I write, it's still above last week's low price. Let's see if it holds.

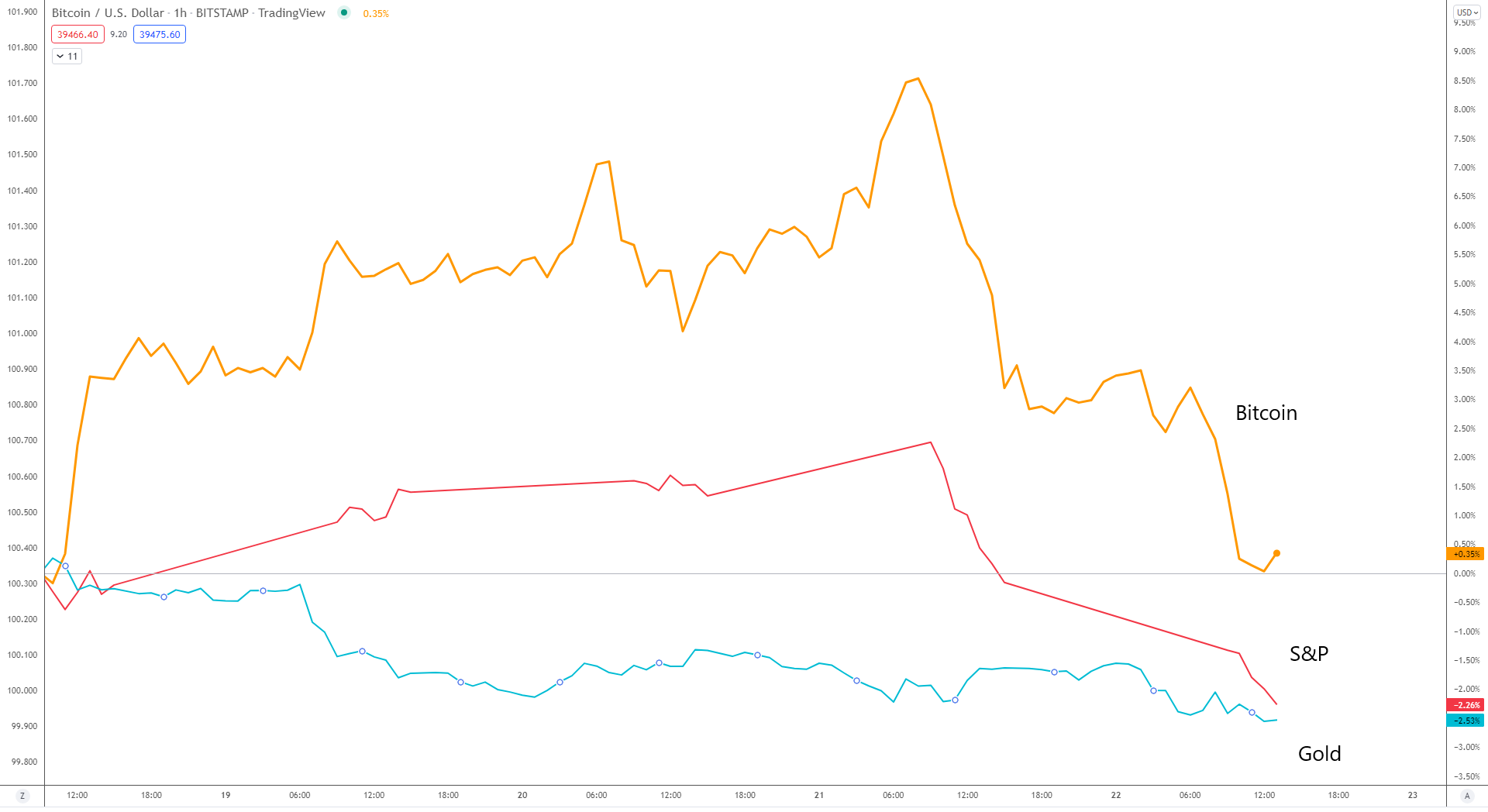

Related Markets

The stock market and gold are puking and the dollar is spiking. However, bitcoin tends to not drop as much as others. So, while the correlation still exists for the time being, bitcoin is coming out ahead on each round. Below is from the opening bell on Monday.

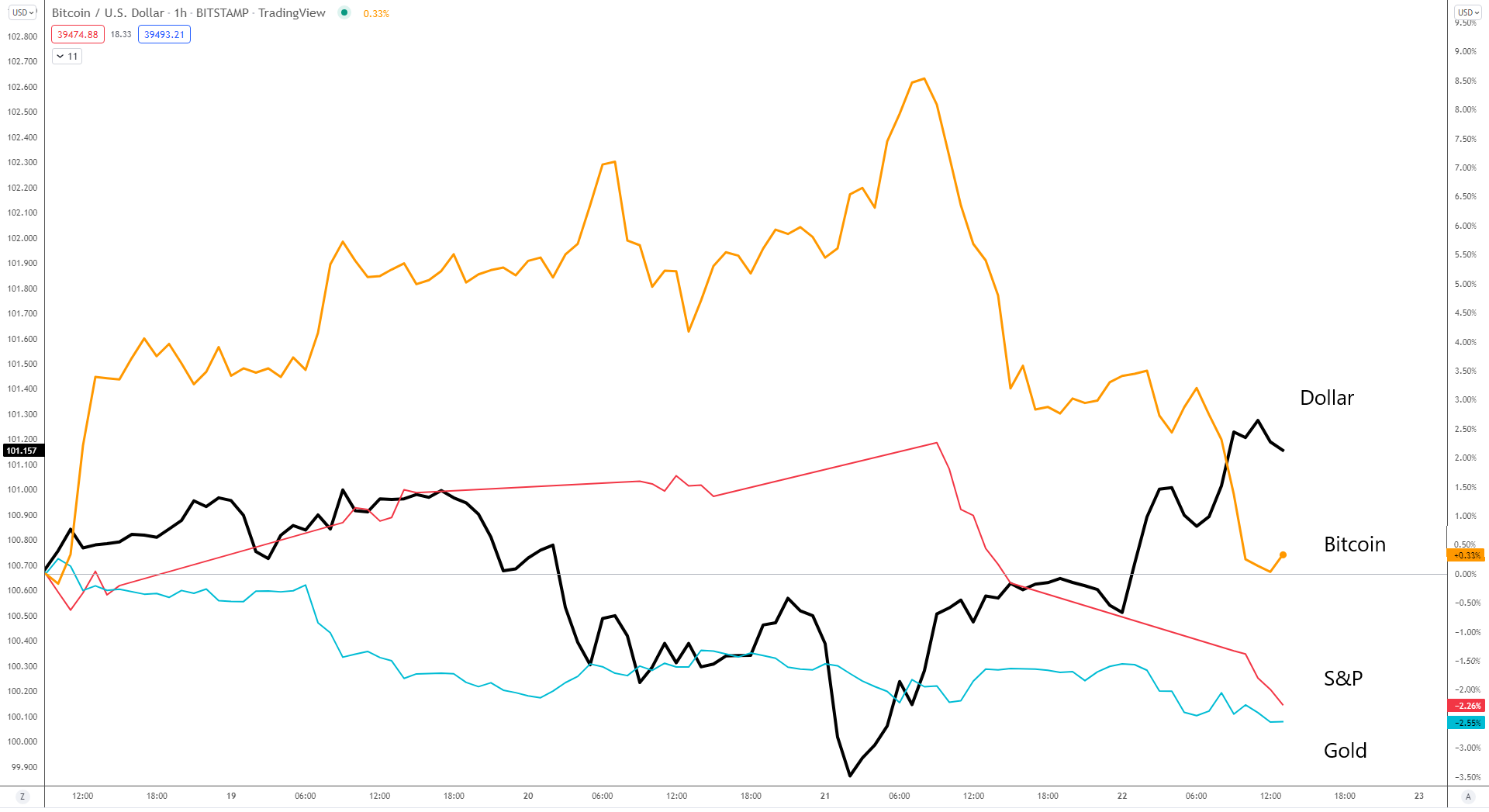

Despite the dollar (DXY) being marginally higher this week, so is bitcoin. The first part of the week, bitcoin rose along with the dollar. As the dollar fell mid-week, bitcoin continued up. Only at the market open Thursday, did some event cause the dollar strength as well as stocks and bitcoin to slide.

Bitcoin is the featherweight on that chart. It can be pulled around by larger competition. Bitcoin is mainstream, but without the mainstream market size. I'm as guilty as anyone in saying that bitcoin is in the big leagues now. Perhaps, I was too hasty.

Today's market action is a decent example of what I mean. We all know bitcoin is smaller and more volatile, so it drops faster than the S&P. However, stocks are a straight line down all day (1 hour left in trading), while bitcoin flattens out and starts wanting to go up.

Bitcoin is being pulled around by these larger market conditions, but it's not a perfect correlation. Bitcoin's more primary bullish fundamentals can be seen upon closer examination.

Price Conclusion

"Overall, I think we are getting closer and closer to the next major rally in bitcoin." It could happen any week from here on out. I think a move to the down side is unlikely.

A strong dollar has a minimal effect on bitcoin, less than the perceived correlation between stocks and bitcoin. I expect slightly higher prices next week as stocks struggle.

👉 Become a member! 👈

Get more price analysis

Mining and Development

| Previous difficulty adjustment | -1.2636% |

| Next estimated adjustment | +1.9% in ~5 days |

| Mempool | 11 MB |

| Fees for next block (sats/byte) | $0.61 (11 s/b) |

| Median fee (finneys) | $0.50 (0.127) |

Mining News

Crusoe Energy, one of the pioneers in using stranded natural gas to mine bitcoin, has raised $505 million in capital split among equity and corporate credit capacity [...]

“The capital provided in this Series C financing unlocks Crusoe’s ability to execute on key elements of our vision, specifically it enables us to expand and diversify our energy sources, computing workloads and vertical integration,” said Crusoe co-founder and CEO Chase Lochmiller, per the release. [...]

Denver-based Crusoe helps those companies capture otherwise wasted surplus gas from their energy production, convert it into electricity, and use it to power data centers and bitcoin mining operations. The firm estimates that bitcoin mining allows carbon dioxide-equivalent emissions to be reduced by over 60% compared to routine flaring.

Bitcoinist has been around a long time, and still they don't understand the economics or financials behind mining. They need an economist on staff [wink].

What this shows is how the stagnating price of bitcoin is putting miners’ profitability under intense pressure. Coupled with the fact that the total network hashrate has skyrocketed since the China ban on mining, it has also had a negative impact on mining profitability. And if this does not ease up soon, it will continue to put significant pressure on profitability. The only way to then offset this pressure would be for there to be an increase in BTC’s price.

Firstly, there is obviously some pressure put on bitcoin miners when the price dips, but it's not intense by any means. They are hedged so the current effect is minimal. They can short the price with any number of official big-boy financial products. Miners can also hold and take out loans or raise money in the interim, waiting for bitcoin to rise.

These companies would not be able to raise the money they are if they didn't make a tidy profit. The article's own chart shows that miners are likely clearing $31k out of every $40k bitcoin they mine. The price would have to drop below $20k to make a big effect, and below $15k to really worry them. Very unlikely.

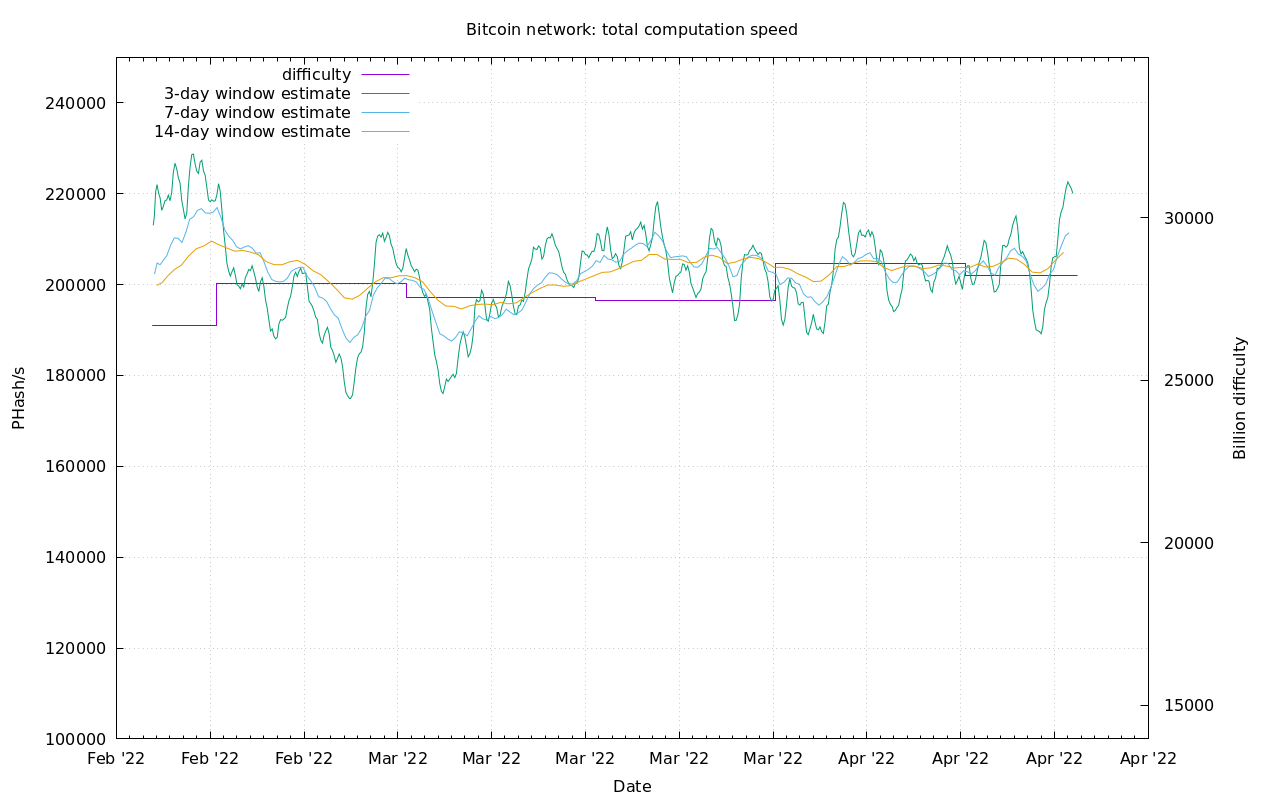

Difficulty and Hash Rate

Hash rate had a little jump this week. It made it just outside the recent historically calm range we've been in.

I remind the reader that hash rate is lagging and confirming indicator. The fact that it has been so steady at ATHs, and price has been relatively steady, we can deduce that there is little if any hidden stress in the market, specifically from the miners' perspective of long-term operations and financing.

Altcoins / CBDCs

The attempted re-auction of Jack's first tweet is a perfect representation of the NFT market in general. In a word, dead.

The NFT of Jack Dorsey’s 1st tweet, which sold for $2.9 million last year, failed to gain interest when it was recently put up for resale

— JACKIS.BTC.LUNA (@i_am_jackis) April 13, 2022

The auction closed with only 7 offers ranging from just 0.0019 to 0.09 #ETH ($6 to $280). Far cry from the $48 million sought by the owner pic.twitter.com/Kqnigrd5NO

If you are new here and found this newsletter because the SEO of the NFT headings, before we discuss why NFTs are not the next big thing, first you need to subscribe. You need these insights.

Okay, it's simple, NFTs are nothing more than a digital signature in pseudo-control of a token. A token that is not the object in question, in this case Jack's tweet. That tweet lives on Twitter's database (and the database of many archive sites), it does not belong to the digital signature or the token. They are two completely separate things.

What the token owner has is pseudo-control over a made up concept, a delusion if you will, that the token represents that outside object. I say "pseudo-control" because it can be revoked by the system admins, and has on many occasions in the history of NFTs.

The "NFT market" is a giant Ponzi. Prices can go up as long as the delusion is spreading at an increasing rate. In other words, more people must share in your illusion of value every day, else the price starts dropping.

I was able to call the top of the NFT market back on issue #172 on Dec 17, 2021, because it was obvious the rate that the NFT delusion was spreading had started to slow, and even as bigger and bigger names got in, the market continued to cool.

Everywhere you look you see people jumping on the NFT bandwagon. Nike, Adidas, Melania Trump, White Castle, and Michael Jordan to name only a tiny few. It's gotten ridiculous out there. People wake up, these are jpegs!

The bubble has to be close to collapsing. The stimmy checks and greater fool year of 2021 is coming to an end. The economic problems this world is rolling into won't allow as much room for this type of unbridled speculation. From one side, it is the lack of productive economic opportunity and stagnation that is driving this (people are trading stupid monkey jpegs instead of picking up more hours on the job), and on the other hand it is the nasty economy that will stop it.

For NFTs to continue upward, they need ever increasing levels of participation and money. Very unlikely to happen.

I'll temper total negativity by saying, there is room for a small niche market for NFTs in things like video games or trading cards. Though small, some people today make a living from playing video games. NFTs will takeover much of that market. They won't open up a whole new industry or asset class, they will simply supplement what is already there. We're talking a couple billion dollars in total, not the $1 trillion+ of people's delusion.

That's it for this week. See you again next Friday!!!

A

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

April 22, 2022 | Issue #188 | Block 733,060 | Disclaimer

Meme via: Me (adapted from @i_am_jackis)

* Price change take from Friday's close