Bitcoin Fundamentals Report #189

WEF FUD, more countries adopting #bitcoin, Fidelity starts retirement account stampede, price analysis, mining sector news, and bitcoin shortages on exchanges.

This week... WEF FUD, more countries adopting #bitcoin, Fidelity starts retirement account stampede, price analysis, mining sector news, and bitcoin shortages on exchanges.

In Case You Missed It...

Multiple pieces of content this week. I appreciate all the clicks and views. Please check out Fed Watch playlist on YT as well as the podcast feed. There's no direct way to subscribe to just the FW playlist on Bitcoin Magazine's channel, but you can save the playlist or search for #fedwatch to help you find it.

Sharing is caring!

Partnering with BitcoinDay.io

Bitcoin Day is a chance for the local community, business professionals, newbies, and cryptocurrency leaders to gather under one roof to inspire, socialize, and learn from each other. Check the schedule for a city near you!

Market Commentary

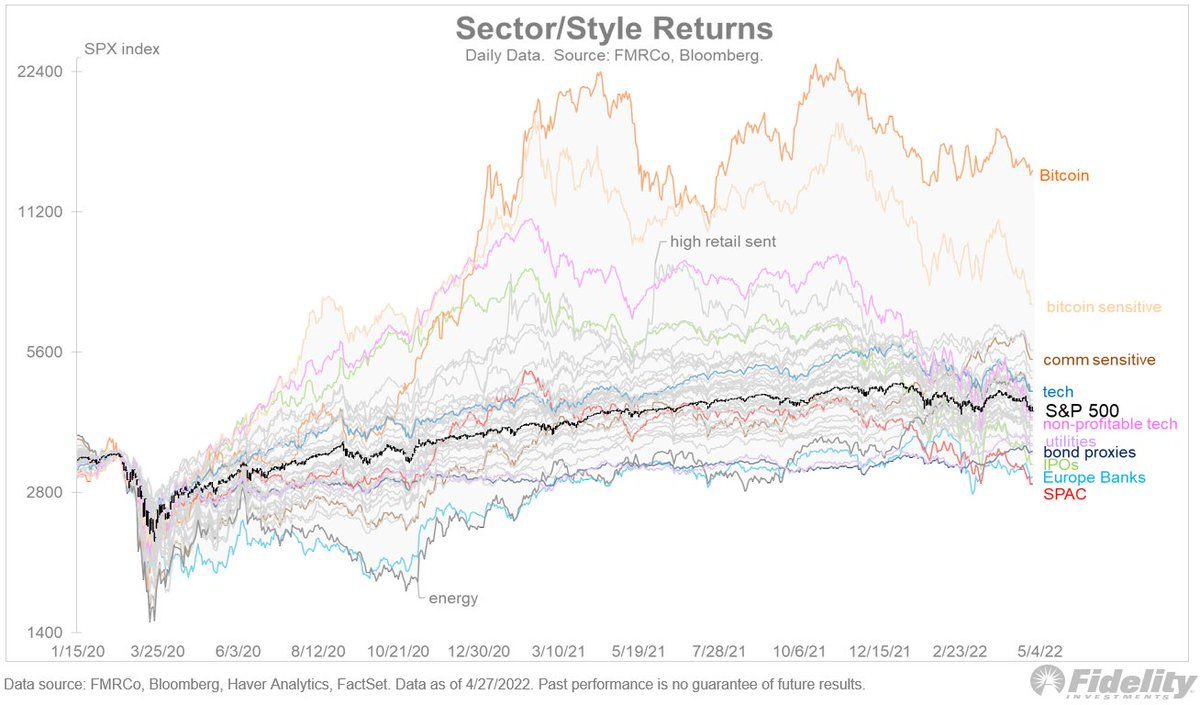

| Weekly trend | Do or die support |

| Media sentiment | Negative |

| Network traffic | Slightly elevated |

| Mining industry | ATHs, very strong |

| Market cycle timing | Next bull cycle imminent |

Hello Reader,

Thanks for subscribing and sharing my content. I'm really excited by all the new listeners to Fed Watch over the last few weeks. Our FED 90 episode for example, released on Wednesday this week, has 6,500 views already!

On to the news. So much to cover today. I don't want to waste words at the top, let's just dive right in.

World Economic Forum (WEF) being moronic

A change in the way bitcoin is coded could almost eliminate its environmental impact.

— World Economic Forum (@wef) April 27, 2022

Learn more: https://t.co/5apG8qv7hh pic.twitter.com/KCJPIeunET

Here's the words on the video and my reactions:

Experts have found a way to cut bitcoin's carbon footprint by 99.9%

This isn't new. Proof of Stake ideas predate bitcoin and have never worked at scale.

They say a change in the way bitcoin is coded could virtually eliminate its environmental impact

Is that a good thing or a bad thing? We cannot concede that bitcoin's environmental impact is negative. Bitcoin makes the whole economy more efficient, including eliminating waste from financial infrastructure and energy production in general.

The world's most popular cryptocurrency uses more energy than Denmark

Bitcoin is more than the "most popular". It is the only viable distributed consensus. The term cryptocurrency is a blanket term to falsely compare contradictory things. Nothing is like bitcoin.

Bitcoin alone could help push global warming above 2°C, if it becomes widely adopted

2D analysis. Bitcoin increases the efficiency of the entire market, decreases waste and corruption, and opens the way to massive innovation in energy and technology. We cannot concede this either. Bitcoin will lower human affects on the climate.

Bitcoin's huge energy demands stem from the way its transactions are verified

Not really, transactions are verified by all nodes regardless of mining. Nodes even verify the miners' work. Proof of Work (mining) is essential for picking who orders those transactions into blocks in a decentralized way. Mining enables bitcoin to not have a rule keeper since all nodes only obey something that cannot be faked, proof of work.

Nothing is a substitute for PoW. Everything else can be faked or gamed.

Powerful computers compete to solve complex math problems, in a process called 'mining'

The winner is reward with bitcoin

The price of bitcoin has soared in recent years

Okay.

This has incentivized miners to buy more and more powerful computers that consume increasing amounts of energy to run and cool

This one is provably false. As miners get more powerful, they get more efficient not less. Each computation is done more efficiently through time. Early mining was horribly inefficient.

The reason energy consumption by miners has risen is because it's profitable. Period. The market values this use of energy more than other uses. Bitcoin, being a new technology, also unlocks previously unusable energy, like distant hydro and gas flaring in oil fields.

A new campaign, Change the Code, says this doesn't have to be the case

This tagline is new, but the campaign is a repeat of previous attempts to subvert bitcoin

And instead of using computers to crunch numbers miners could stake their own bitcoins to verify transactions instead

They can, but...

Eliminating most of the network's energy demands at a stroke

What they cannot do is eliminate the PoW version of bitcoin. The choice is not between Proof of work or proof of stake, it is between PoW or PoW+PoS. You cannot stop the network from continuing to function as it is, all they can do is create an perverted version (altcoin) that must compete.

The campaigners say this could be achieved with a basic change in coding, along with the buy-in of around 30 key figures in the bitcoin universe

Misunderstanding of how bitcoin consensus and verification works.

Rival cryptocurrency company Ethereum has pledged to switch to this approach, which it says is 2000 times more energy-efficient than mining

Yep, Ethereum is a company and they have not yet been able to shift to PoS. Not so easy. "Rival" is a bit much. Is a pink sheet stock a rival to gold?

Mixed messages as Central African Republic passes bitcoin legislation

News broke on Wednesday that Central African Republic (CAR) added bitcoin as legal tender. It came out of the blue from a totally unexpected country, one with very low internet penetration (11%) and high levels of corruption. Initial reports now seem to have overstated the importance of this law.

Alex Gladstein brought up some concerns about this bill on Twitter and hosted a Twitter Spaces with several guys from around Africa to talk about it.

Apparently, the wording of the bill in French is very unusual. It is not straightforwardly making bitcoin legal tender. For starters it uses the term "cryptomonnaies" translated as cryptocurrency, not bitcoin. Below is a google translated Article 23 from the passed bill.

Before the entry into force of this law, the State guarantees through the Central Bank through the creation of a Trust, convertibility automatic and instantaneous cryptocurrencies into currency having legal tender of the alternatives provided by the State referred to in Article 8 above above.

So, it is not clear what has been passed in CAR.

There are also claims that the business man behind this bill in the country, who played a big role in pushing it through, is a well know scammer and Ponzi scheme fraudster.

Panama Removes Tax Hurdles from Bitcoin

/cloudfront-us-east-2.images.arcpublishing.com/reuters/EZVYENTGGNOTXIVJQKZ36LGUF4.jpg)

For starters, this is not a bitcoin only law. It says "crypto" all throughout. It also does not make bitcoin legal tender. The Panamanian government is forbidden by law to have a central bank or national currency. They primarily use the US dollar.

What this new law does is simply remove capital gains tax from bitcoin assets. While this is a good step and might attract bitcoin people and business to domicile in Panama, it is not in the league of El Salvador, that actually made bitcoin legal tender.

Investment Giant Fidelity allows bitcoin in customer 401ks

Link to the article for some email readers.

Fidelity, which manages employee benefit programs for nearly 23,000 businesses, is set to become the first major retirement-plan provider to allow bitcoin exposure in retirement accounts. The company has $2.7 trillion in assets under management in its retirement services division alone.

A 3% allocation to (midrange between 1-5%) of $2.7 trillion is $81 billion perhaps coming into bitcoin starting this year from Fidelity alone. This also starts the clock on other large players in retirement accounts to do the same.

BOOST SIGNAL : PLEASE SHARE !!

Quick Price Analysis

| Weekly price* | $38,250 (-$1200, -3.0%) |

| Market cap | $0.729 trillion |

| Satoshis/$1 USD | 2,605 |

| 1 finney (1/10,000 btc) | $3.84 |

Bitcoin Daily Chart

Price is virtually unchanged from last week at the time of writing. Very similar to last week. I did update the channel slightly based on the wicks of the prices. That could be because of my bullish bias, but it still does fit. So far, the support his holding very strong.

Support convergence

Several different sources of support are converging right at our current spot on the chart making it a very important level. While it feels more bearish than the previous times it tested the bottom of the trend it has much more support than before.

First support is the diagonal support trend line (bottom of the channel). Second, is the series of higher lows remains intact. Third, is the cycle timing. We are approaching the same length of time for this 2-year cycle as the one from 2019-2020, meaning the rally is coming. Lastly, volume-by-price still shows a massive amount of support below the price.

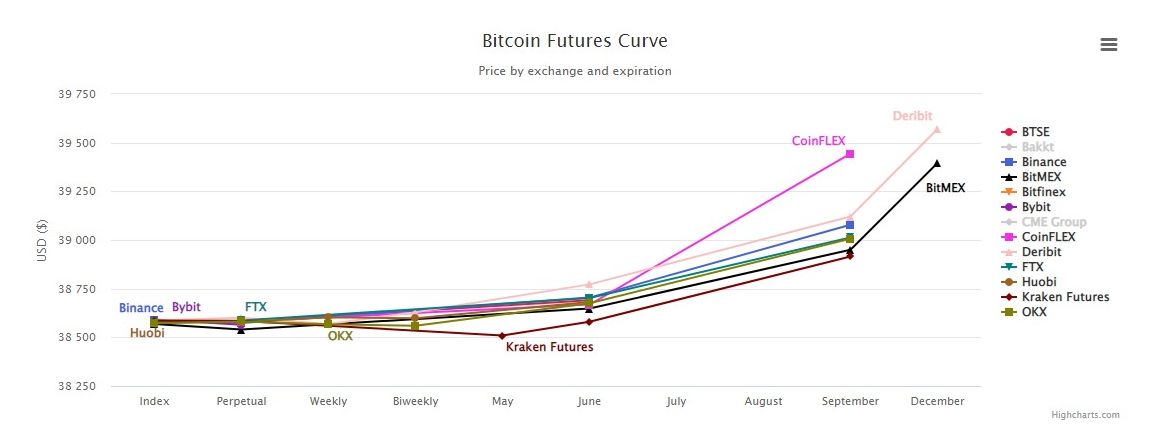

Bitcoin Futures Curve

The futures curve is very flat. What happens next is not obvious, so the market is waiting to see. We can say that there is no outsized bearish sentiment by traders.

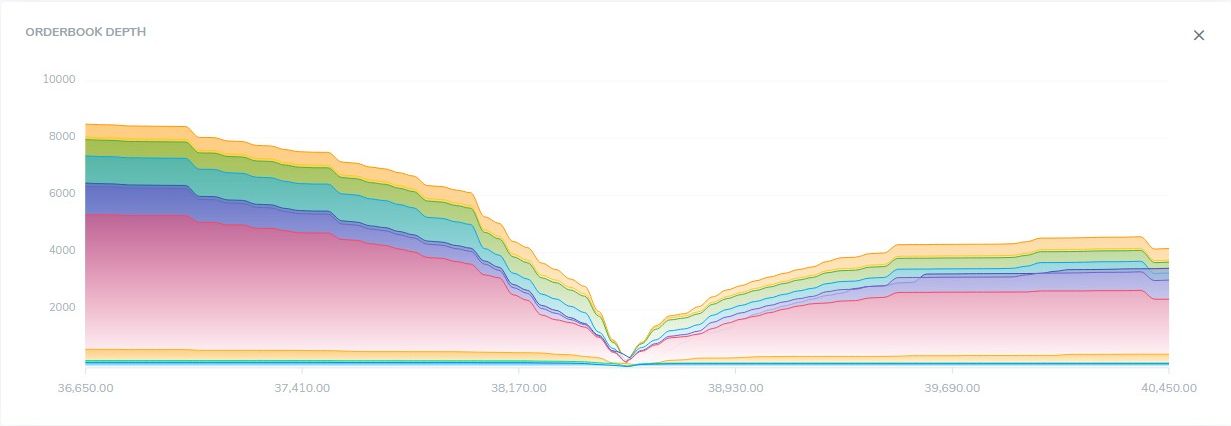

Orderbook Depth

Orderbook depth is something I've not written about in the long time, probably since I traded bitcoin years ago. Above you see the combined orderbook of the major exchanges. There are is about twice as demand to buy below the price than sell above.

This is the general picture all the way down to $30k and up to $50k, bids are roughly double the asks. Makes me think there is a lot of silent accumulation going on instead of being dominated by market making volume.

Price Conclusion

I've not changed my general outlook for the bitcoin market, that we are getting closer and closer to the next big rally. However, it is concerning that price is sitting on the bottom of the channel right now, with little sign of life.

There is a growing chance that bitcoin dips first, before the coming rally. However, I think it is more likely that support in the high 30's holds. I stacked sats this week for the first time in a couple of months. The timing looked and felt right, as a solid consolidation putting in a very strong floor at this level.

👉 Become a member! 👈

Get more price analysis

Mining and Development

| Previous difficulty adjustment | +5.5569% |

| Next estimated adjustment | +0.5% in ~11 days |

| Mempool | 10 MB |

| Fees for next block (sats/byte) | $0.48 (9 s/b) |

| Median fee (finneys) | $0.38 (0.099) |

Mining News

Three Bitmain Antminer S9 mining rigs will run 24 hours a day, seven days a week, in the climate-controlled information technology wing of Fort Worth City Hall. The city says the miners will be hosted on a private network to minimize the security risk.

Mayor Parker or Fort Worth, Texas is standing next to their 3 bitcoin miners. Very interesting photo, she's very confident and proud of being the first. I doubt she'll be the last.

The city will not make much money from only 3 miners, but it is a symbolic move. If 1000 cities across the world host 3 mining rigs, that'd be a very significant portion of the network hash rate. As with most utilities, cities of the future might be tasked with supporting the decentralization of bitcoin for their residents.

If the Bitcoin mining moratorium becomes law, it will be the world's most sweeping piece of legislation of its kind.

On Tuesday evening, the New York State Assembly passed a two-year moratorium on Bitcoin mining, pending environmental impact measurement.

The bill will now go to the State Senate, which is controlled by Democrats. If it becomes law, it will almost certainly be the most comprehensive legislation of its kind in the world.

There was some confusion about this proposed legislation. The language in articles like the above headline and quote, make it seems as though this is a complete ban on bitcoin mining. It is not.

The ban only applies to an "electric generating facility" (i.e., a power plant) that requires a permit from the NY Department of Environmental Conservation, so shouldn't have any impact on individuals.

— Jake Chervinsky (@jchervinsky) April 27, 2022

I have not read the bill, but it appears to be aimed directly at power companies mining bitcoin themselves. As I've reported on this newsletter in months past, this is a practice growing rapidly in popularity among power companies in the US as a way to add a baseline load that they can dial up and down. It enables them to operate at max efficiency while making a little money.

There are also companies that have bought old defunct power plants in the rust belt of the US and are trying to turn them into bitcoin mining facilities.

This moratorium is a very bad look for NY, that is already infamous for the NY bitlicense that keeps some bitcoin companies from even offering services in the State, let alone locating their startup there. If they can pass the bitlicense through unelected financial regulator and put a moratorium on mining, they can do anything. The regulatory risk of NY is similar to places like Kazakhstan, and stands in stark contrast to States like Texas, Georgia, and North Dakota.

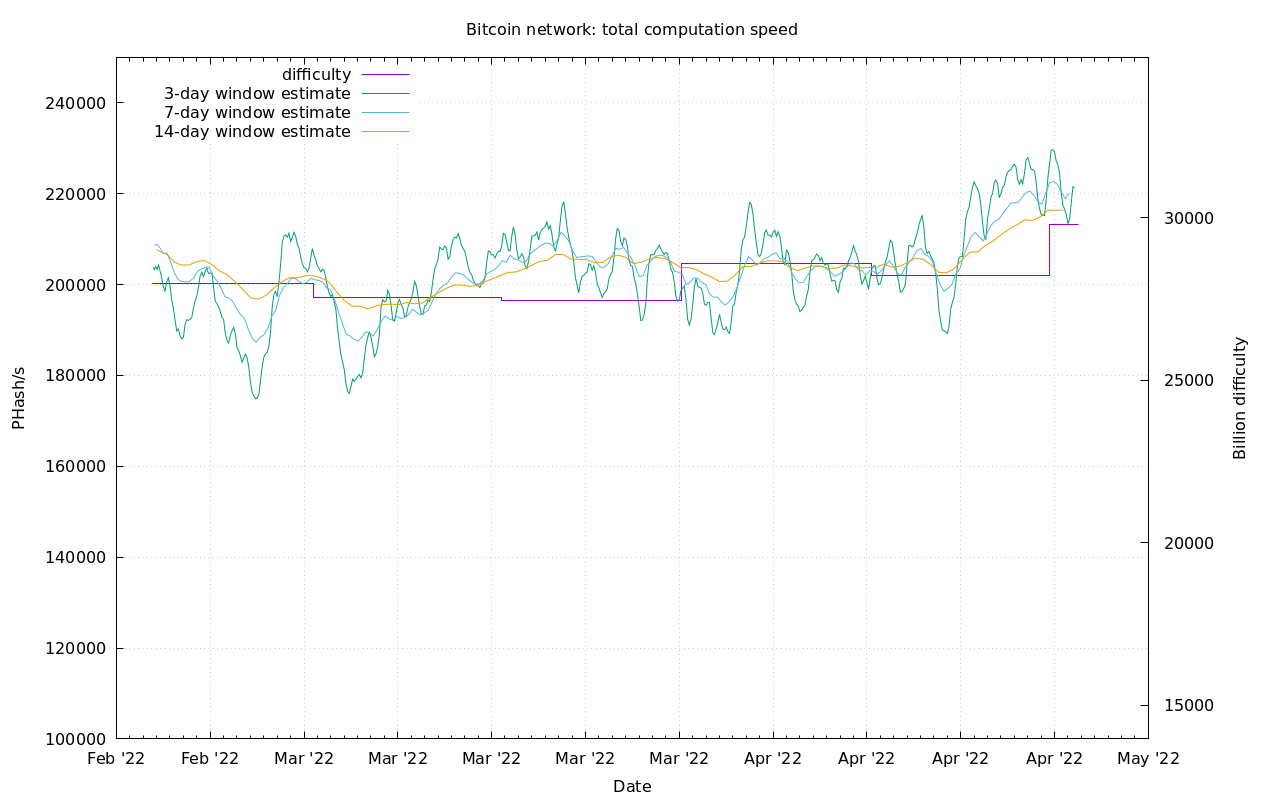

Difficulty and Hash Rate

Hash rate and difficulty spike to new ATHs. Despite the price slump as of late, miners are experiencing a boom. It is important to remember that

Miscellaneous

PSA: #BITCOIN ON EXCHANGES IS BEING REHYPOTHICATED.

— HODL🏴☠️Tarantula. Sovereign☣Maximalist (@HodlTarantula) April 26, 2022

I KNOW CAUSE THEY ARE REACHING OUT TO MINERS LIKE MYSELF FOR LIQUIDITY

MANY EXCHANGES ARE INSOLVENT.

RT IF YOU SUPPORT TRUTH, AND FFS LEARN TO SELF CUSTODY.

NOT YOUR 🗝🔑 NOT YOUR 🧀#PROOFOFKEYS or get REKT!!

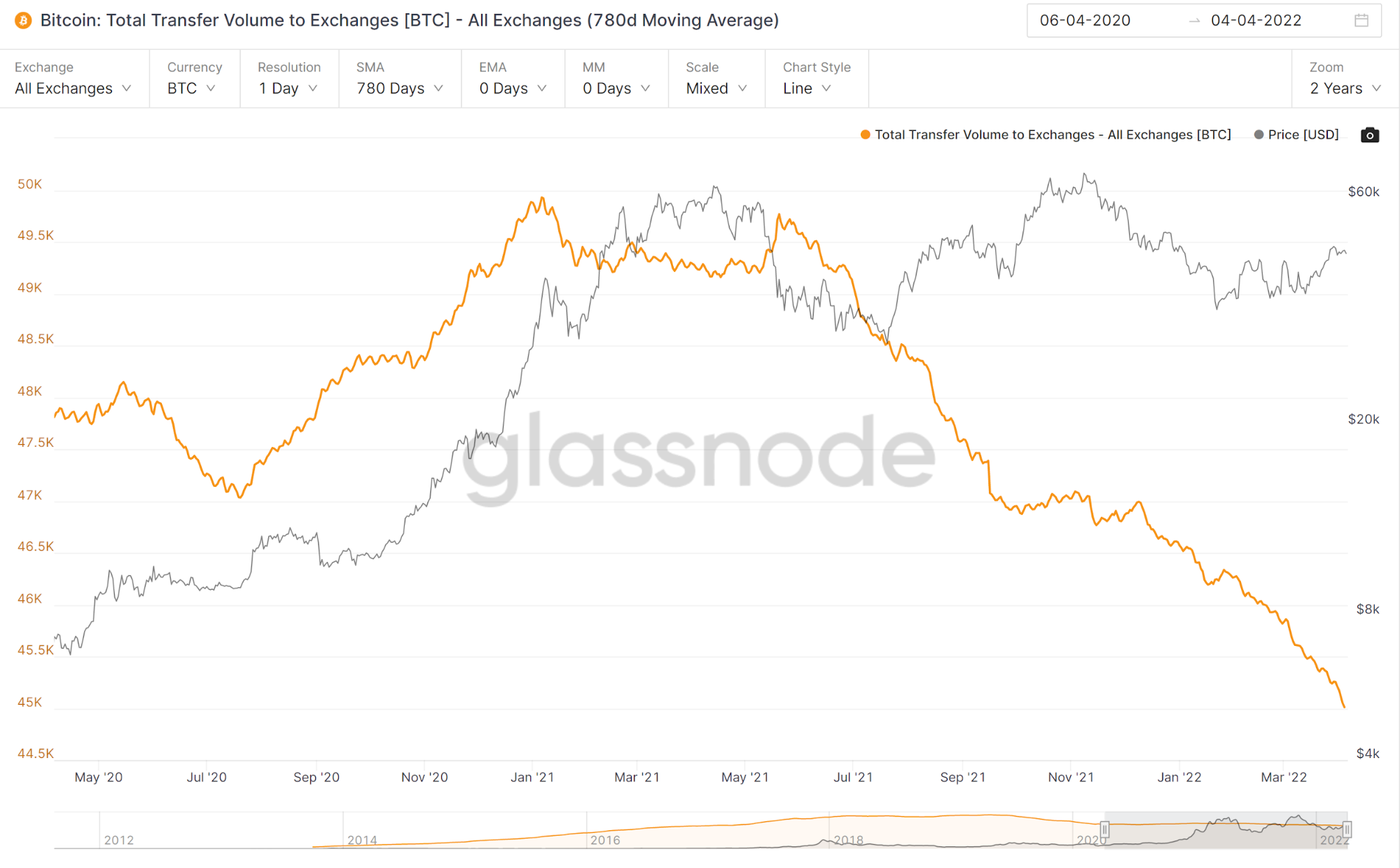

I ran across this tweet the other day talking about bitcoin exchanges getting increasingly desperate to source physical bitcoin from miners. I tend to believe this report, although not necessarily because they are currently insolvent.

There are a few possibilities. First, to get it out of the way, the exchanges could be running a fractional reserve scam. Meaning they sell more bitcoin than they have knowing that most people don't withdraw their coins. It's possible, and might happen to a small extent today, but I don't think that is what's happening here.

It could be that this insolvency stems from the Grayscale Bitcoin Trust implosion we witnessed last year, and continues to get worse. That product (GBTC) crashed from a 20% premium over spot to a now 30% discount. Exchanges' reserves could have been caught up in that. Again, I don't think that is what's happening.

A third option, and what I think is happening is simply the exchanges trying to meet minimum liquidity needs. At any one time, an exchange will want to have enough bitcoin to sell. But that amount will be a dollar value. For example, Coinbase might want to have $100 million in bitcoin ready to sell.

Add to this the number of coins held on exchanges has continued to drop.

So, if an exchange held $100 million in bitcoin for liquidity reasons, but the price continues to drop, they will need to source bitcoin prior to selling it, not after. They are trying to avoid a fractional reserve issue.

As they go out to their regular suppliers and those suppliers say, "sorry, we don't have any bitcoin right now." They will become increasingly desperate to source that bitcoin. This is what I think is happening, and it is very bullish.

That's it for this week. See you again next Friday!!!

A

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

April 29, 2022 | Issue #189 | Block 734,143 | Disclaimer

Cover image via: Fidelity

* Price change since last week's report