Bitcoin Fundamentals Report #190

Fed rate hike debrief, BIP119 CTV intro (more to come), bitcoin price analysis and typical rate hike reaction, bitcoin mining news and hash rate charts.

This week... Fed rate hike debrief, BIP119 CTV intro (more to come), bitcoin price analysis and typical rate hike reaction, bitcoin mining news and hash rate charts.

In Case You Missed It...

I appreciate all the clicks and views. Please check out Fed Watch playlist on YT as well as the podcast feed. There's no direct way to subscribe to just the playlist on Bitcoin Magazine's channel, but you can save the playlist or search for #fedwatch to help you find it each week.

Sharing is caring!

Partnering with BitcoinDay.io

Bitcoin Day is a chance for the local community, business professionals, newbies, and cryptocurrency leaders to gather under one roof to inspire, socialize, and learn from each other. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Struggle to bounce |

| Media sentiment | Negative |

| Network traffic | Slightly elevated |

| Mining industry | ATHs, very strong |

| Market cycle timing | Next bull cycle imminent |

The Fed Hikes Rates by 50 bps, The Largest Raise in 22 Years

As expected the Federal Reserve raised its target range for Fed Funds to 75-100 bps in a very well-choreographed move. In times like these, when people seemingly reach to news out of the Federal Reserve, it is important to remember that the Fed's influence is nearly all mental. Therefore, raising their target range like this doesn't actually do anything.

It only took the market about 12 hours to figure out nothing changed. Can you pick out the days of the two rate hikes this year on this S&P 500 chart?? Don't peek at the second chart. Be honest, what jumps out at you on this chart as an important day, anything?

Here they are. As you can see the days of the rate hikes are not pivotal. What I'm trying to show is that the rate hikes themselves so not do the work of the Fed. They are not the policy tool. Talking about hiking rates is the tool, and fostering the belief that the magic of the Fed is extremely important. Even then, the Fed is not in control.

If the Fed was in control of anything, they could deftly manage the economy, which they obviously cannot. You can't have it both ways, that the Fed controls the economy in the ways claimed and that central planning doesn't work.

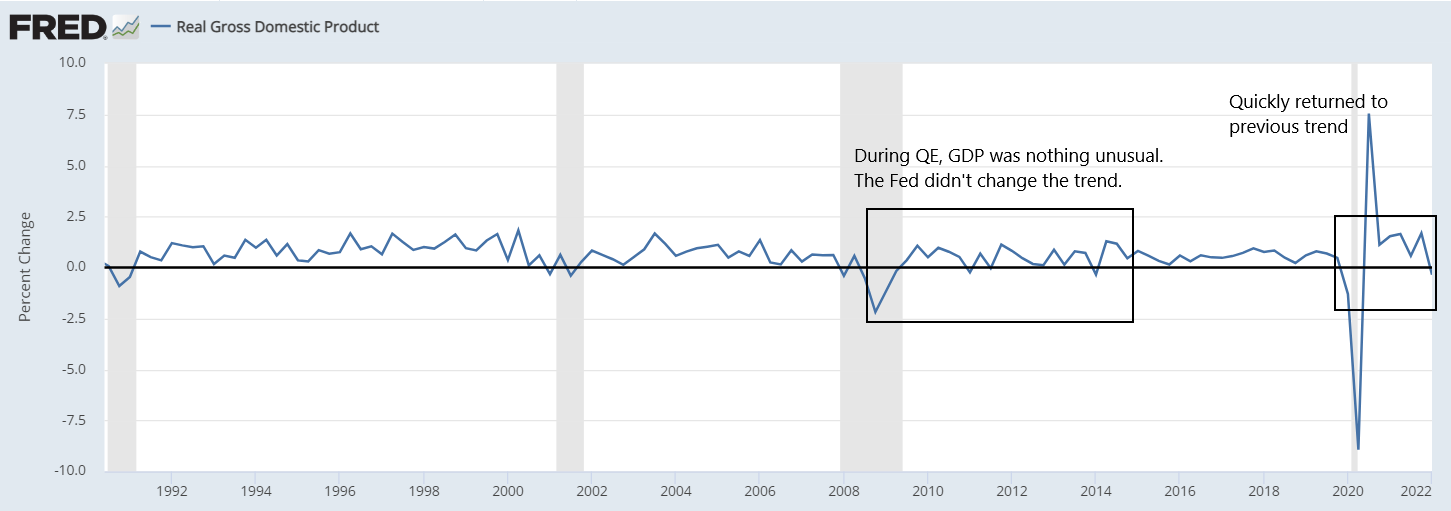

If QE was "quantitative" they wouldn't need to do it so many different times and at different levels, for uncertain timeframes. It is also very strange that CPI, inflation, and GDP could be kept in such a narrow band, for so many years, with basic round number intervention; $30 billion/month QE for example. Shocker, Fed control is an illusion.

It's is extremely difficult to break the Fed's programming because it's repeated like a mantra in the mainstream financial press, as well as the alternative financial press by the Austrian School of Economics folks, as well as the new Bitcoin media; "DO NOT FIGHT THE FED", "the Fed is all powerful".

What we have to do is flatly disregard everything the Fed does and only briefly listen to what they say. We should properly view them as followers, not leaders.

The economy is trending in the way that it is trending, regardless of the Fed. They can perhaps tidy up the edges and provide a narrative for the economy, but the market is sovereign. Here is just one example of how the Fed isn't in control of the economy or inflation. I can give many more.

As you can see, the price of gold was already moving up before QE started in Nov 2008. Then it crashed while QE was going full blast! Shortly after that, during no QE, gold bottomed and began trending higher. Only after gold broke out did QE begin again. Finally, gold crashed prior to QE ending earlier this year.

Without my arrows, could you tell where QE started and stopped, or would you get it backwards?

How about GDP? Did QE affect GDP in a noticeable way? I don't think so.

I know we are supposed to think QE and rate hikes and all of that make a meaningful impact, at least on stocks right? Not really. The S&P 500 is pretty much straight up during this era, no matter if QE was happening, or QT or rate hikes. Nothing mattered.

(I have this on the bitcoin chart in the price section.)

The financial press normies are starting to realize this. It is common today to hear people say things like, "QE is not inflationary, but QE + fiscal spending is." They are halfway there. Pretty soon the normies will come to realize that fiscal spending is pulling demand forward in time and leaving a landmine of low demand in the future. It's not money printing, it's manipulation, and ensures deflationary credit pressure will continue.

Forget about the Fed's 50 bps hike. The economy is doing what it's doing regardless. We are rolling into recession, if we are not already there. US GDP growth was negative in Q1, and the global economy is going to fall off a cliff. China is also in recession, Europe is at unofficial war. It's not looking good.

I've been talking about this for a very long time, the Fed has nothing to do with it.

The Fed will continue their hiking theater for another month or two, but the actual economy will force a narrative reversal.

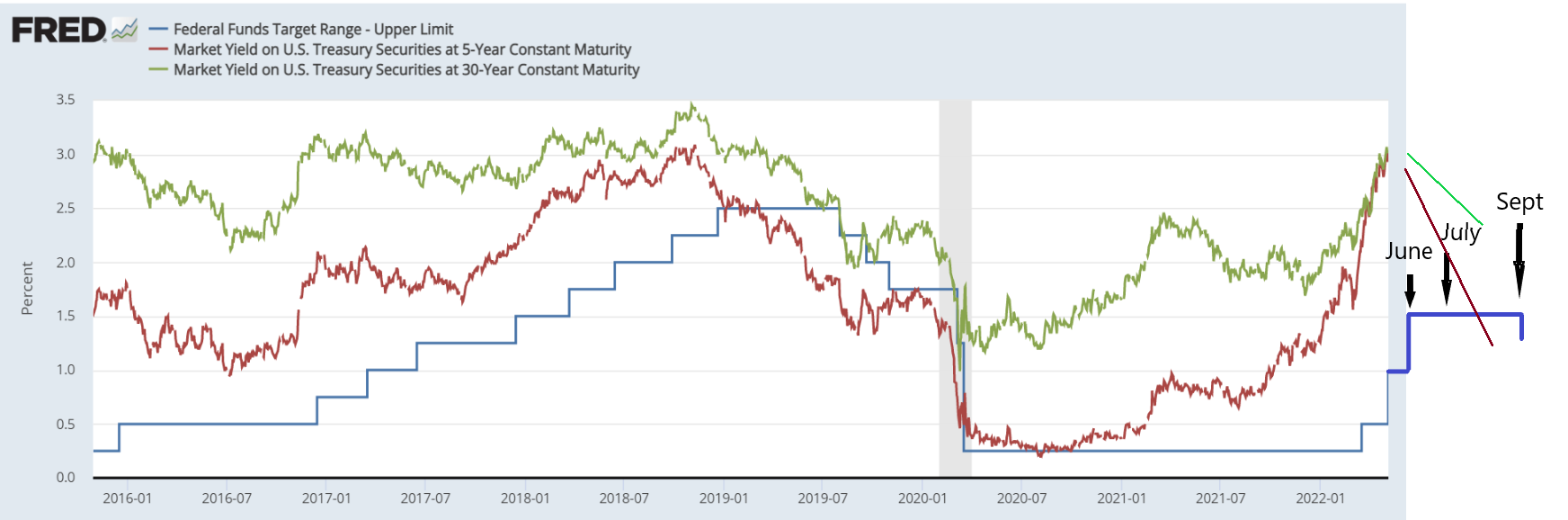

My prediction at this time, is the Fed will hike another 50 bps in June and then pause in July. They do not have another meeting after that until September, and since they drink their own koolaid, the Fed won't want to risk "doing too much" before that long break. Then by Sept, CPI will have come down and it will be obvious the narrative needs to change, so they lower rates 25 bps (there is a always stress at the end of Q3).

This chart is a bit sloppy but you get it. Interest rates will start falling soon, perhaps before June's FOMC. Not because the Fed did anything, but because the Fed's narrative can no longer put off the reality of recession.

BIP119 Controversy

A controversy over a new update to Bitcoin's software has started making headlines. I have to admit, I've not dug into this controversy yet, which I will be doing this weekend and have a big update for you next week. However, I thought my readers would want some resources, the resources I'll be starting from, to get up-to-speed on this issue.

Bitcoin Magazine also had a Twitter spaces conversation that they walked through the issue.

The conversation I've seen so far is there is some controversy over how to get this new change activated. I have a fairly good understanding of activation techniques, because it is game theory oriented, also that's how I originally became known in the space back in 2016 during the last activation controversy.

This would be a good podcast episode and blog post for the coming week. Make sure you are subscribed to the Bitcoin & Markets podcast!

BOOST SIGNAL : PLEASE SHARE !!

Quick Price Analysis

| Weekly price* | $35,935 (-$2315, -6.1%) |

| Market cap | $0.685 trillion |

| Satoshis/$1 USD | 2,779 |

| 1 finney (1/10,000 btc) | $3.60 |

Bitcoin Daily Chart

Depressing week for the bitcoin price. However, when we zoom out, it's not that bad. In the daily chart this week, I include volume-by-price and RSI. The price has made its way through half the volume bulge on the right, but the RSI has held a slight divergence. While almost everyone is reading the current action as bearish, I'm seeing hidden signs of strength and consolidation.

Also, on the chart if we go back to July 2021, the RSI behaved similarly. It reached oversold on the first move, just like the low at the end of this January. Then as price continued to bleed lower, RSI held a divergence. We see that same thing occurring today.

Does QE Affect Bitcoin?

Like the chart of gold in the first section above, I plotted QE during the bitcoin era. Bitcoin began trading after the US era of QE started in 2008. After QE ended in 2014, Bitcoin bottomed, $200-400, and then rallied 6000% in the absence of QE.

QT did seem to have some effect on the price of bitcoin, but if we measure from the top in Dec 2017 to the end of QT in Sept 2019, the price only fell 28% (not shown because it made the chart too busy).

Price Conclusion

There is a growing chance that bitcoin dips first, before the coming rally. - Last week's Report

Of course, I remain bullish. Sure, the price has dropped recently, and I've remained bullish through that, however, it is not significant damage yet to the chart. It feels worse than it is. The same goes for the stock market btw.

Where else do you put your money if emerging markets, China and Europe are all crashing and starting onto existential crises? Bitcoin, USTs, and US stocks.

👉 Become a member! 👈

Get more price analysis

Mining and Development

| Previous difficulty adjustment | +5.5569% |

| Next estimated adjustment | +4% in ~4 days |

| Mempool | 6 MB |

| Fees for next block (sats/byte) | $0.61 (12 s/b) |

| Median fee (finneys) | $0.45 (0.125) |

Mining News

I have an update to the new bitcoin mining moratorium bill in of New York, I wrote about last week. It appears it has received a lot of push back from the industry and the bill is stalled for this legislative session. It did not make it onto the discussion committee's schedule.

The bill is now being considered by the Senate Environmental Conservation Committee. Still, according to a schedule posted early Friday morning, the committee has opted not to take up the bill at its last meeting of the current legislative session.

I'm not sure when the next legislative session starts, if the bill will have to wait until 2023, but at least, this puts the issue to bed for a while.

It also shows that bitcoin mining bans are very unpopular. In a progressive supermajority State like NY, they couldn't even get a moratorium on power companies themselves mining bitcoin.

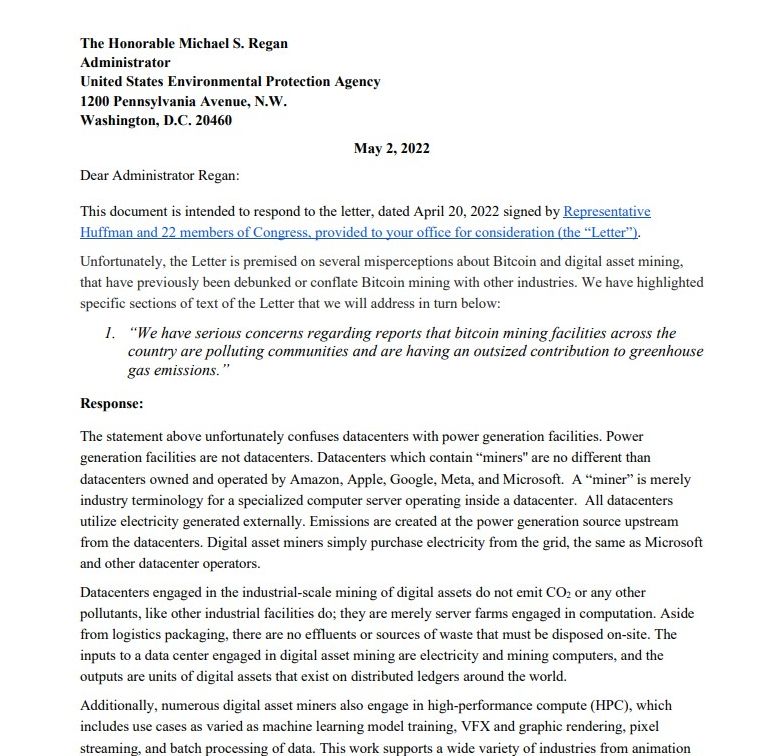

Some of the biggest names in bitcoin — including Jack Dorsey, Tom Lee, and Michael Saylor — have co-authored a letter to the EPA to refute claims made by House Democrats calling on the agency to investigate the environmental effects of crypto mining.

I highly recommend you read the letter here. This is a screenshot to show the tone of the letter. It is a master class in understanding the bitcoin mining industry!

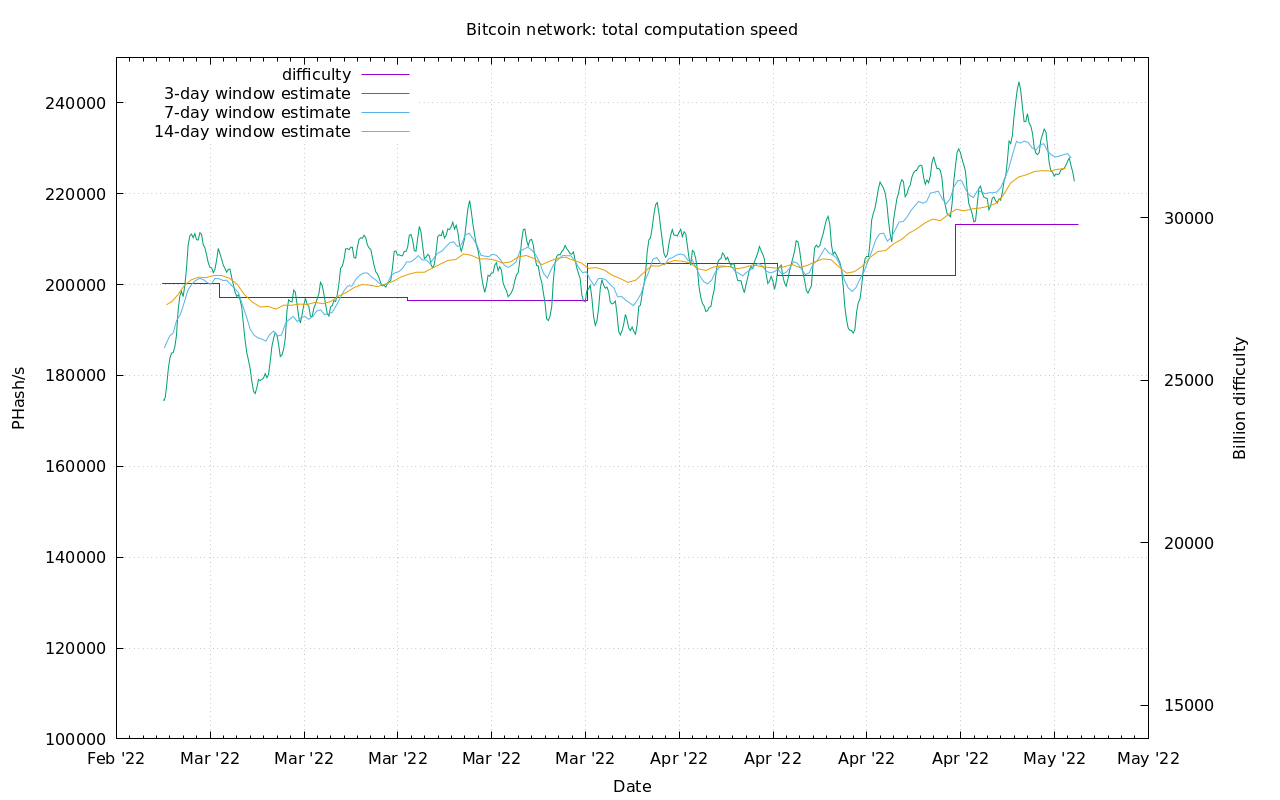

Difficulty and Hash Rate

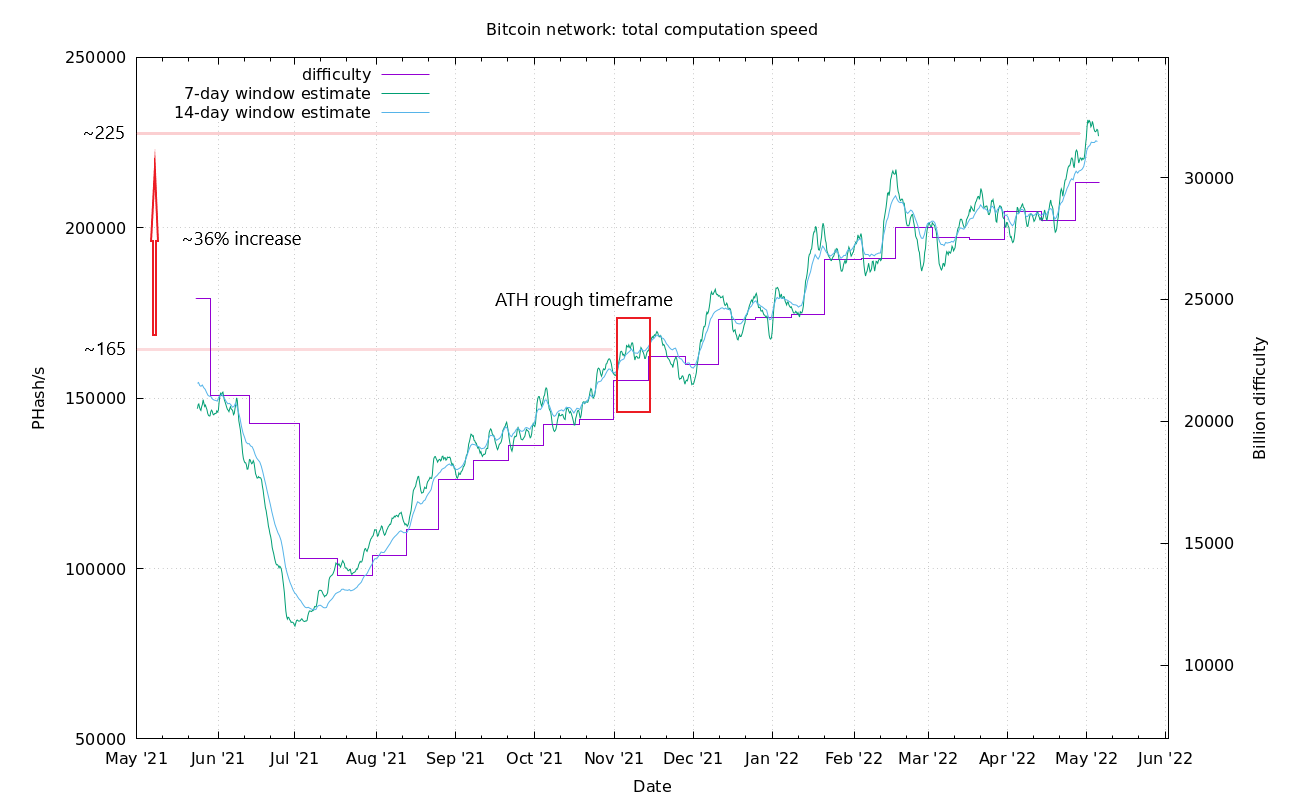

Hash rate continues to spike to new ATHs.

Since the ATH back on 10 Nov 2021, hash rate is up over 36%, while the price is down almost 50%. This goes a long way to show that the current price weakness is not due to fundamentals. And will not last long.

The mining industry is growing rapidly and is a capital intensive business to set up, maintain, and expand. They would not be investing and growing like this if there was a huge risk in well-connected investors' minds that the government was going to come down on bitcoin and bitcoin mining.

Hash rate is a confirming indicator of fundamental valuation multiples. The growth in bitcoin hash rate does not mean price must increase, but what it does say is this valuation range in bitcoin, that we've been in since we January 2021 is extremely secure.

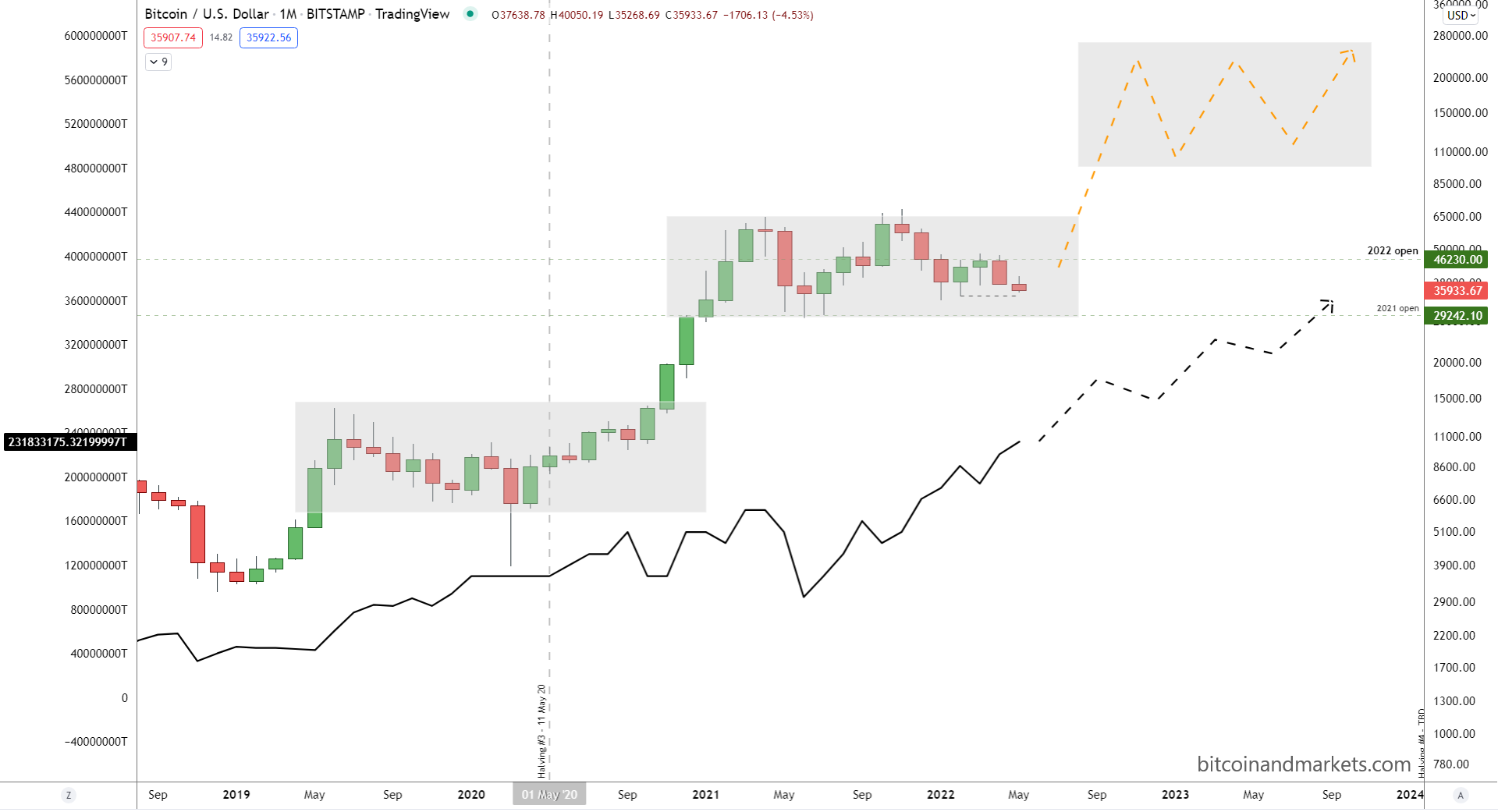

Above is a down and dirty image of what I mean. The bitcoin price has jumped in stages. Left gray box is $5,000-$15,000. Current gray box is $30-$60,000. And yet to be gray box is about $120,000 to $240,000.

If the market were unable to support these levels, what we would see is a flatline in hash rate or even a decline. If we see steady increases in hash rate 1-2 years after getting into a new price paradigm, that means the industry is healthy and can support the current price levels with organic economic activity.

Miscellaneous

China Update is a good channel that does daily reports out of China. The update today was especially important and I wanted to share it. It fits very well with the most recent Fed Watch episode, too.

That's it for this week. See you again next Friday!!!

A

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

May 6, 2022 | Issue #190 | Block 735,208 | Disclaimer

Cover image: by me

* Price change since last week's report