Bitcoin Fundamentals Report #191

This week, Terra debrief and reaction, bitcoin price analysis, path to recovery, big mining section today, mempool is slammed, and China in free fall.

This week... Terra debrief and reaction, bitcoin price analysis, path to recovery, big mining section today, mempool is slammed, and China in free fall.

In Case You Missed It...

I appreciate all the clicks and views. Please check out Fed Watch playlist on YT as well as the podcast feed.

Sharing is caring!

Partnering with BitcoinDay.io

Bitcoin Day is a chance for the local community, business professionals, newbies, and cryptocurrency leaders to gather under one roof to inspire, socialize, and learn from each other. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Capitulation |

| Media sentiment | Very negative |

| Network traffic | Very busy |

| Mining industry | ATHs, very strong |

| Market cycle timing | Recovery from capitulation |

Terra Luna Demise

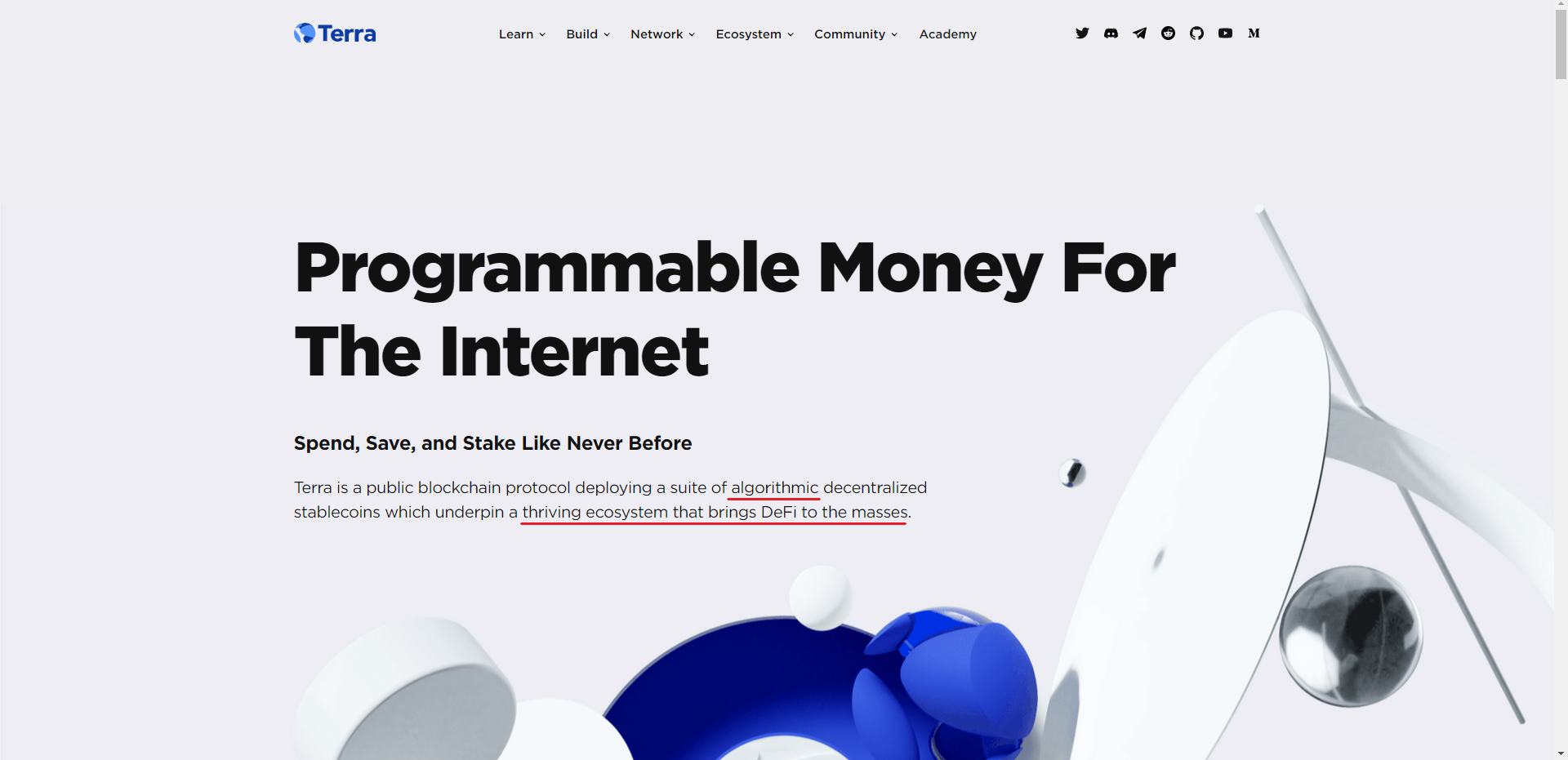

Just to recap: #8 coin with $28B market cap (peak $40B), second biggest defi platform, only second to eth, goes to $0 in under 5 days. Gotta love it. 😆

- Xan, from our discord server

Of course, the biggest story this week is the collapse of the Terra/Luna. I'm not sure what to even call it because they had two tokens that were existentially linked. Their website is still up at the time of writing with a, now epic, intro video.

Readers of this newsletter are probably aware of what happened, so I don't have to cover all the of details of the crash. Suffice it to say, a major altcoin and associated altcoin ecosystem blew up, going from $120 ($40 billion market cap) to zero in a matter of days. What it means for bitcoin is the thing we need to think about.

First and foremost, bitcoin maximalists saw this coming and tried to warn people about the Ponzi scheme's imminent explosion. This is a great summary video from just 2 months ago, looking into and explaining the accusations of being a Ponzi.

His final verdict is classic altcoin copium:

If you ask me, I see merit to both sides. I'm definitely concerned that the system is fragile in multiple places and I think critics are right to point out that. Early versions of the system were Ponzi-like, but what I think they're missing is that the team has actively shored up defenses and tweaked different levers to improve their resilience. So, while its early form may have indeed been a Ponzi, I think it's evolving towards a much different state that could actually be sustainable. Either way, I recommend all investors to proceed with caution just because it has survived thus far doesn't mean it can't come crashing down all of a sudden. [emphasis added]

Altcoiners never examine the root arguments, they blindly trust in complexity they don't understand and actively resist warnings of bitcoin maximalists. You can't polish a turd to turn it into revolutionary tech.

Algorithmic stablecoins will never work long term. They are a medium-length con, usually blowing up in 2 years or so, because they are simply insecure and cannot maintain their peg.

The community members, self-proclaimed "Lunatics", actively fought against the explicit warnings from bitcoiners. I have a hard time feeling sorry for most of them. I am, however, very saddened to hear of the 8 reported suicides because of this and the people who have lost everything. It's a tragic thing. We failed and the scammers won. What can we do differently in the future to get through to these people in time??? A very important question.

Who's Responsible?

Rumors began immediately flying that this was a coordinated attack by large players, like Blackrock and Citadel. They both quickly denied it. What is clear is a large whale dumped a lot of Luna and Bitcoin on the market, kicking off an algorithmic feedback loop, as well as a confidence feedback loop, that crashed the value of Luna and Terra to zero.

Bitcoin was caught up in this because Terra had recently added bitcoin to their list of reserve assets. They thought the bitcoin would add confidence and perhaps even support from large bitcoin holders. They didn't expect was a whale willing to crash bitcoin and Luna simultaneously.

Upon hearing the news that Terra was collapsing, I immediately suspected the founder Do Kwon. As in murders, the spouse is always the first suspect; in altcoin attacks, the founders or employees of the project are always the first suspects. Many of these attacks are sophisticated from a technical programming level, who else would be intimately familiar with the workings of their code and know their bugs? Anyway, hilarity followed.

six months ago: the guy from Terra mocking the idea of *the precise attack that just happened* pic.twitter.com/F8rsEgLLQb

— your #1 source for absurdist true crime 🐍👑 🌷 (@davidgerard) May 11, 2022

Apparently, just days before the crash, Do Kwon dissolved the Terra company in Korea, and formed a new company called Liquidator 🤣.

DO KWON KNEW IT WAS COMING. TERRAFORMLABSKOREA(INC) was DISSOLVED ON APRIL 30TH, 2022. Registered on May 4th. LIQUIDATOR: KWON-DO-HYUNG #Terra #Luna #UST #Ponzi pic.twitter.com/WM2XsJmkJz

— Ryunsu Sung (@realryunsu) May 11, 2022

This is the most likely thing that happened. Do Kwon rug pulled the whole thing. But I'm entertaining 3 other possibilities about who did this.

1) USDC (Circle's stablecoin from all around scammer Jeremy Allaire) was behind it. I've suspected USDC being behind most of the Tether FUD going back years. They want to be the de facto US stablecoin one day, so they have an interest in destroying all competition. And they are big enough to pull this off.

2) Rich bitcoiners and/or altcoiners didn't want such an obvious Ponzi getting too big and taking down the whole industry. They struck prior to it getting too systemically important. Or they did it because Do Kwon ran his mouth a lot. Either way, the large industry players could have ganged up and done this.

3) Covert government action. I'm least sold on this idea, but I can see the government either providing money or incentivizing this attack, as a way to open the door for regulation. They could even have been working in conjunction with Circle.

Fallout

Whoever did this, the fallout is absolutely devastating for the altcoin ecosystem. Just take a look at the reach that Terra had.

Altcoins won't go away, but I think this event will sour people to altcoins for a significant amount of time. We should expect Ethereum to hold on, and maybe separate itself from the altcoin pack even more. Somehow altcoiners still do not see the similarity between Ethereum and Terra.

Wonder how Luna / UST failing will affect Ethereum's The Merge given it's probably 100x more complex and fragile, with 100x more value at risk.

— old bitcoin maximalist (@notgrubles) May 13, 2022

Ahh who am I kidding. They're going to jam it in as soon as possible without any care for others' money.

Bitcoin should benefit as well. I had the most likes on a tweet ever for me, saying just that.

Lots of #Bitcoin maximalists were minted today.

— Ansel Lindner (@AnselLindner) May 11, 2022

This is a huge opportunity for bitcoin to separate itself from "crypto". It must do that in order to take the next step to becoming global money. Crypto is not bitcoin, bitcoin is not crypto, is the central concern of the next 5 years, in my opinion.

Inviting regulation

The collapse of the Terra/Luna has focused the attention of regulators in the US. Where they once only voiced concern about the Wild West aspects of altcoins and stablecoins, they are now going to be laser focused.

I'll keep you updated on this newsletter about things as they develop, but don't be too worried. While not necessary to bitcoin's success, this will go a long way to separating bitcoin from "crypto". Bitcoin also has allies like Gensler, Powell, and, believe it or not, Yellen. They all view bitcoin differently than the altcoin scams.

BOOST SIGNAL : PLEASE SHARE !!

Quick Price Analysis

| Weekly price* | $30,075 (-$5860, -16.3%) |

| Market cap | $0.555 trillion |

| Satoshis/$1 USD | 3,435 |

| 1 finney (1/10,000 btc) | $3.01 |

Bitcoin Daily Chart

What a horrible week for price. The one good thing we can point to is, that on nearly all indicators and metrics, bitcoin is extremely oversold. There will be some sort of bounce here.

I went on the record on Fed Watch this week, making the very contrarian call that we were in the neighborhood of the bottom. Since that aired live, price did crash from $30k down to $24.5k, but rapidly regained $30k. I'm crossing my fingers, but I think it's going to prove to be a great call.

I thoroughly disagree with the idea we are just beginning a prolonged bear market here, where price falls to $20k or even $12k (repeating the cyclical norm of an 85% drop). That is not going to happen.

For starters, we didn't have a 20x rally like previous bull markets, so the following bear market has less exuberance to work through. The altcoin market is totally rekt, savagely rekt, that should take some of the pressure off bitcoin to drop. Bitcoin is also at historic oversold conditions already, even for bear markets. The impetus for the crash is dead in Terra. Lastly, bitcoin's role in the global macro situation, along with the future path for the US economy, is very misunderstood.

Bitcoin and the US Economy are Linked

What's good for the US economy is good for bitcoin right now. The US is home to a majority of bitcoin holdings, many of the top bitcoin businesses, and has the largest share of Bitcoin mining. Bitcoin's destiny, for the time being, is definitely more connected to the US economy than any other. In other words, bitcoin is temporarily like an American tech company.

The US has been in recession since at least January. The Q1 GDP number was negative, and the Q2 number is going to be more negative. It is not a surprise then that bitcoin and stocks have struggled during that exact same time. However, the US stock market is oversold at this time, and the market sentiment is at a low extreme.

We are in a recession, but the US economy will not crash by 20-30% like Europe or China will. US stocks are pricing in that kind of severe drop, mainly driven by the hawkish Fed. It's overdone.

As CPI naturally falls, the Fed will fold to global pressure and pivot, just as the capital fleeing Europe and Euro denominated assets, as well as the capital that can get out of China, is bidding US assets. Interest rates in the US will come down, stocks and bitcoin will recover.

Price Conclusion

There is a growing chance that bitcoin dips first, before the coming rally. - Issue #189

It feels worse than it is.

Issue #190

Oh boy, that second one seems crazy, but I stand by it. If you are a holder, with longer than a few month time horizon, this dip will seemingly resolve itself quickly. There has been very little damage done to the "bitcoin" ecosystem and industry, all the damage occurred to the altcoin-pretenders.

I expect a steady recovery for the next 4-8 weeks, at which time CPI will be firmly on the decline, GDP will print an official recession (in retrospect), and the Fed will pivot/pause. This sounds bad for stocks, but it isn't necessarily, because they are already overdoing it and the rest of the world will be worse, making capital flee here.

In a major update to my prediction for the bitcoin price, I now do not see us challenging $46k until late-July. And the soonest we will bump up on the ATH is October. We could be shaping up for a replay of 2020.

👉 Become a member! 👈

Get more price analysis

Mining and Development

| Previous difficulty adjustment | +4.8892% |

| Next estimated adjustment | +1% in ~11 days |

| Mempool | 101 MB |

| Fees for next block (sats/byte) | $0.97 (23 s/b) |

| Median fee (finneys) | $0.84 (0.279) |

Mining News

The SEC is going after NVIDIA because it knew people were buying their chips for mining and failed to disclose it. This is not bitcoin mining! The chips in question are GPUs used for altcoins. Once again, getting involved in altcoins and get rekt.

The report says, “During the second and third fiscal quarters of 2018, as certain crypto asset prices rose, users of NVIDIA’s GPUs were increasingly performing crypto mining. NVIDIA had information indicating that crypto mining was a significant factor in the year-over-year growth in revenue from the sale of GPUs that NVIDIA designed and marketed for gaming. The company, however, did not disclose this in the company’s Forms 10-Q for these quarters as required.”

Archived link to not support scam pushers at Coindesk

The letter calls on the U.S. Environmental Protection Agency (EPA) to implement stringent reviews on proof-of-work (PoW) mining operations; the Office of Management and Budget to create a registry of PoW miners to improve the industry's transparency; the Department of Energy to institute energy efficiency standards for PoW operations, study how to implement power density limits and how to protect "low-cost public power allocations" from being "siphoned" to PoW mining operations "at the expense of local ratepayers"; and financial regulators to require greater transparency on miners' electricity use and climate pollution, limits on their environmental impact and fight "misleading claims" of bitcoin mining's environmental impact.

This is a good thing. Let the regulators look into bitcoin mining. They'll fall in love.

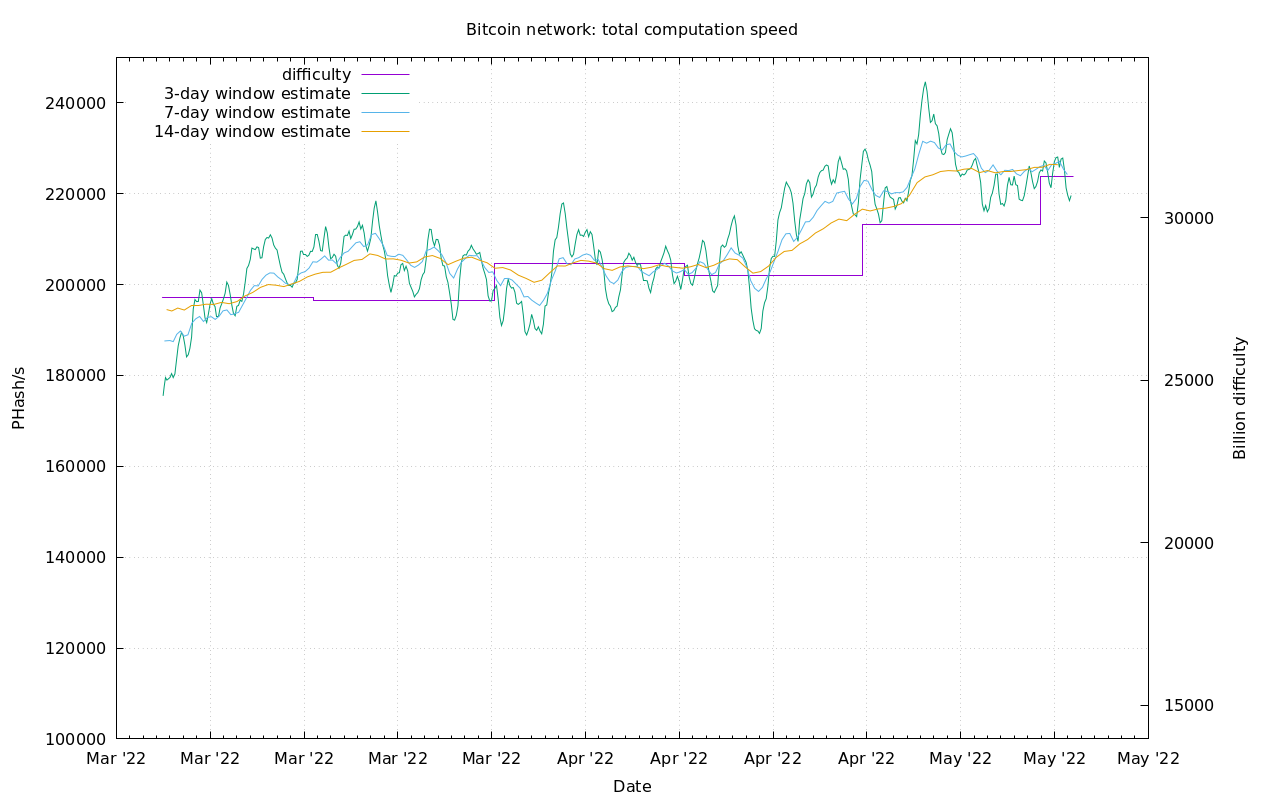

Difficulty and Hash Rate

Miner activity on the network was interesting to watch. The difficulty adjusted upward 4.9%, and despite the epic crash in price, hash rate continues to move slightly higher. It is early in this difficulty period, but the next adjustment is already estimated to be 1% higher.

For the last few months I've been trying to emphasize the correct way, in my experience, to interpret the hash rate relative to price.

On this week's Fed Watch, I said the following:

The hash rate is the result of a long term production process. It's not just getting a miner, plugging it in and starting to mine bitcoin. Most of these big operations now, are planning 2, 3, 4 years out. So, they are running the numbers.

When [the big mining operations] raise money for these new projects, the investors are also running the numbers, and fact checking and back checking and seeing if the predictions have played out in the past. So, mining is a lagging indicator, but it involves so much more. That's why I say, if the hash rate is rising, it means that the industry is healthy and bitcoin is priced approximately correctly.

Not to say that bitcoin is going to go up 5% today, or 10% over the next week, but that this area, say between $30,000 and $60,000 is generally a correct pricing for bitcoin at this time.

If the hash rate were dropping, then you could say, there's something wrong with the industry, something wrong with projections here, and maybe this isn't properly priced.

Mempool

Mempool is the transactions that have been sent, but not ordered into a block yet. They are waiting to be confirmed.

If you are trying to send a transaction, fees will be slightly elevated right now. However, they are still less than $1 for a typical transaction. It's very interesting how the network is handling this unusually high load, with the fees not moving up too much.

Miscellaneous

The Chinese economy is in free fall. However, I have also now seen a few headlines that Shanghai is about to open back up. This could also boost confidence in stocks and hence bitcoin.

That's it for this week. See you again next Friday!!!

A

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

May 13, 2022 | Issue #191 | Block 736,254 | Disclaimer

Cover image: @BoogieCrypto

* Price change since last week's report