Bitcoin Fundamentals Report #193

This week, JP Morgan loves bitcoin, central bankers in their own words, large price analysis section, glimmer of hope, bitcoin mining news, and Tether MXN.

This week... JP Morgan loves bitcoin, central bankers in their own words, large price analysis section, glimmer of hope, bitcoin mining news, and Tether MXN.

In Case You Missed It...

I appreciate all the clicks and views. Please check out Fed Watch playlist on YT as well as the podcast feed.

- (Fed Watch) History of Davos - FED 94

- (Bitcoin & Markets) Energy Crisis and Recession | A Reaction to Peak Prosperity - E243

- (Blog) Macro Update - 20 May 2022

Sharing is caring!

Partnering with BitcoinDay.io

Bitcoin Day is a chance for the local community, business professionals, newbies, and cryptocurrency leaders to gather under one roof to inspire, socialize, and learn from each other. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Trying to put in bottom |

| Media sentiment | Very negative |

| Network traffic | Back to normal |

| Mining industry | Equity struggles, mining stable |

| Market cycle timing | Capitulation |

JP Morgan Prefers Bitcoin to Real Estate

This announcement by JP Morgan is major news, but for some reason it has flown under the radar. It only took about 24 hours for it to drop out of the news cycle.

So, what exactly did JP Morgan say? I couldn't find a direct link to the report, but there are many news outlets reporting this news. JPM has moved bitcoin ahead of real estate, to top their list of preferred "alternative assets". That means that clients of JPM should look to add bitcoin to their portfolio before investments in any other asset class other than stocks or bonds.

Many "crypto" people latched onto the use of the term crypto in the investor note, but the examples given were all based on bitcoin's price action and JP Morgan's assessment of its fair market value.

The investment bank’s strategists, led by Nikolaos Panigirtzoglou, said in a Wednesday note that they believe Bitcoin, the world’s leading digital asset, has “significant upside potential” after its recent fall.

- Fortune

So, this is not a "crypto" recommendation, it is a bitcoin one.

JPM downgraded real estate as an alternative asset class because of recent rising rates, and upgraded bitcoin due to its recent price action appearing like a capitulation not driven by fundamentals.

While Bitcoiners agree with JPM's assessment, many don't celebrate it. CEO Jamie Dimon hates bitcoin, famously calling it a "fraud" back in 2017. That along with JP Morgan's and Goldman Sachs' reputation for fleecing retail clients, leaves many somewhat skeptical.

I, however, think this is major news that will have massive consequences. I agree with JPM's downgrade of real estate for the rest of the year, with rates climbing and access to second mortgages very difficult. This could give people the confidence to pull the trigger and invest in some bitcoin.

Also, the investors who will notice this change in recommendation from JPM are high net worth individuals. They can drop a quarter or half a million dollars into bitcoin, and really move the needle.

Of course, it remains to be seen what the effect of this and other recommendations from other major investment houses do for the price of bitcoin, but announcements like this are starting to stack up.

Central Bankers

I want to point out two interesting comments made by central bankers this week. The first is an on-stage interview with ECB President Christine Lagarde. You have to watch this video.

In the span of two minutes Christine Lagarde brings to life two Principal Skinner memes. Quite impressive. (1/2) pic.twitter.com/xhtmbel8Yj

— Marty Bent (@MartyBent) May 25, 2022

She is speechless and stammering. The interviewer shows a chart of the ECB balance sheet and asks, "Isn't this a huge bubble?"

Lagarde: "You have to think of it as a counterfactual. If we would not have done this [...] we would have been in a devastated situation."

Interviewer: "But how do you get it back?"

Lagarde: "It will come. It will come. In due course."

An eerie silence follows for multiple seconds. The crowd is waiting for something more, but Lagarde has nothing. How could she be completely unprepared for that question? It's unbelievable.

Next, they talk about bitcoin and cryptocurrencies. She says her son bought some "crypto". Not surprising. But what would he say about his mother pushing regulation to make his investment worth much less?

The Bernanke

Ben Bernanke, former Chairman of the Federal Reserve, spoke at the Brookings Institute this week to launch his new blog it seems. He was quoted as saying that "Monetary policy is 98% talk."

Here's the full quote from Ben Bernanke's talk today at Brookings:

— Heather Long (@byHeatherLong) May 23, 2022

"I think monetary policy is 98% talk and 2% action, and communication is a big part."

(He was speaking about his new book: "21st Century Monetary Policy.")

This is extremely interesting in light of my analysis of central bank monetary policy tools. I've been saying for years now that their primary policy tool is jawboning and forward guidance. Bernanke confirms it here.

QE is not money printing, it is just an accounting trick to make banks look more healthy, hoping they will then lend more. The Fed "buys" US Treasuries from banks and gives them "reserves". They do not print dollars, they print reserves. You cannot spend reserves, they are not money. All the banks can do with reserves is count them on their balance sheet, giving them more room to expand the money supply through lending.

Again, QE is not money printing, and it doesn't directly affect the market in anyway other than through, what Bernanke calls "talk", and what I call confidence or expectation management. "Don't fight the Fed" is beaten into us, making most people believe the Fed is all powerful.

BOOST SIGNAL : PLEASE SHARE !!

Quick Price Analysis

| Weekly price* | $28,890 (-$360, -1.2%) |

| Market cap | $0.557 trillion |

| Satoshis/$1 USD | 3,461 |

| 1 finney (1/10,000 btc) | $2.89 |

Bitcoin Daily Chart

Another very slow week in the bitcoin price, and we are headed into an important 3-day holiday weekend in the US.

Last week, I offered a bearish and a bullish chart. This week, there is no bullish chart. It's nasty out there.

Weekly chart

This weekly chart is sickening. RSI is about to touch oversold (so can keep falling), MACD is accelerating down, there is a huge void in volume by price down to $19k, and we are on our record 9th red weekly candle!!

You can't get much more bearish on the weekly, and every time I look at it, I get worried of near term price action.

Daily chart

The daily is a little more bullish. There is a divergence on the descending wedge, both bullish signs. The RSI and MACD agree on this bullish divergence.

But that's as far as my bullish chart goes. Right now is the most bearish the charts have been at any time in the 10 years I've been following bitcoin. Whether that means we truly crash lower here, or that it is darkest before dawn, I don't know.

Price has been grasping onto that last line of defense, the horizontal support going back 18 months now. If that goes, it could get ugly. I hold out hope for a fake out though. Breaking that support and then quickly reversing.

Similar Previous Situation

Here is a situation I found that is nearly identical to our current situation. In December 2021, we had a descending wedge, and a bull div on both the RSI and MACD on the daily. Bitcoin faked a breakout and then continued falling. It doesn't bode well.

Bitcoin and Stocks Diverge

There has been a lot of talk over the last few months about the growing correlation between stocks and bitcoin. All along I've been saying that it was only a short term correlation that will break soon enough.

Well, this week, stocks put on an impressive rally, and bitcoin did not.

If bitcoin can hold on to this correlation, that should be a positive sign. Or it might be that stocks are in a bull trap and bitcoin is the correct signal in the noise.

The former is more likely IMO, because I've been calling for a bounce in stocks due to the US being relatively the largest, most attractive capital market in the world that is least affected by the global recessionary environment. Money should flow into the US, and bitcoin as well.

Versus Altcoins

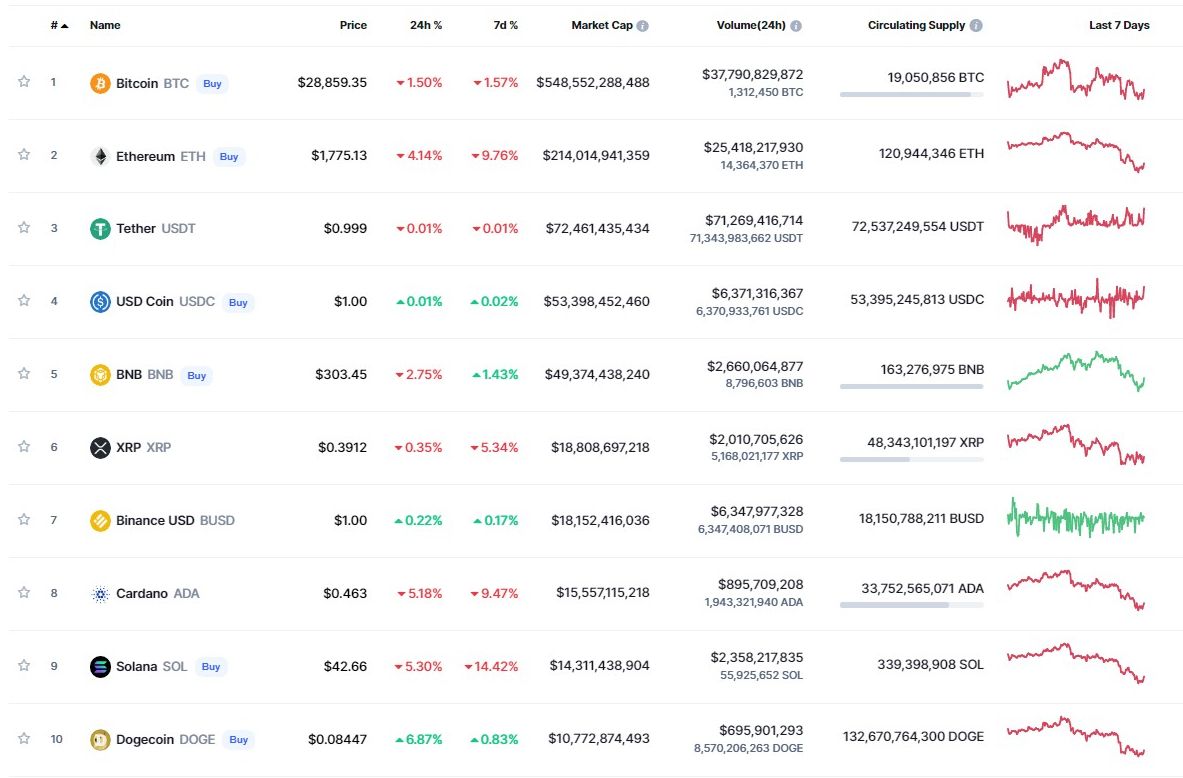

Bitcoin is not crypto, and crypto is not bitcoin. But I wanted to show bitcoin's performance versus the pretenders people lump bitcoin in with. Note the 7 day change.

Minus the stablecoins (which now make up a whooping 4 of the top 9 altcoins), the crash in altcoins this week has been crazy. Ethereum is down 10% against bitcoin, Ripple somehow stronger at only 5% down, Cardano down 9.4%, Solana down 14%, and silly Doge up 0.8%.

I'm worried that this collapse in altcoins will continue and negatively affect the bitcoin price. Ethereum, the King of scams, could be collapsing. They are in an existential crisis as I detailed last week. If Ethereum collapses like Terra, wow, bitcoin could drop to $19k quite easily. It would be deep but brief.

Other Charts

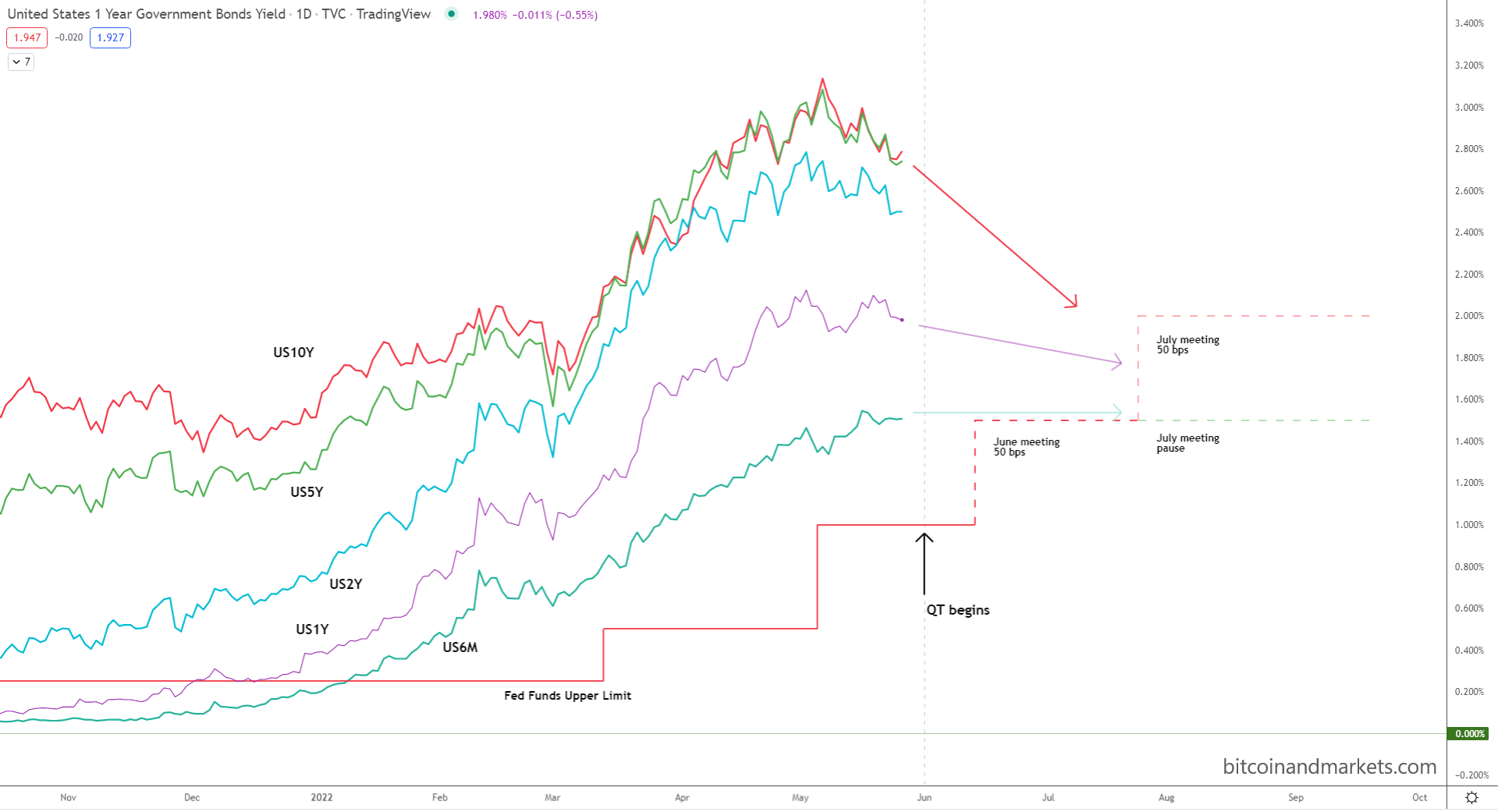

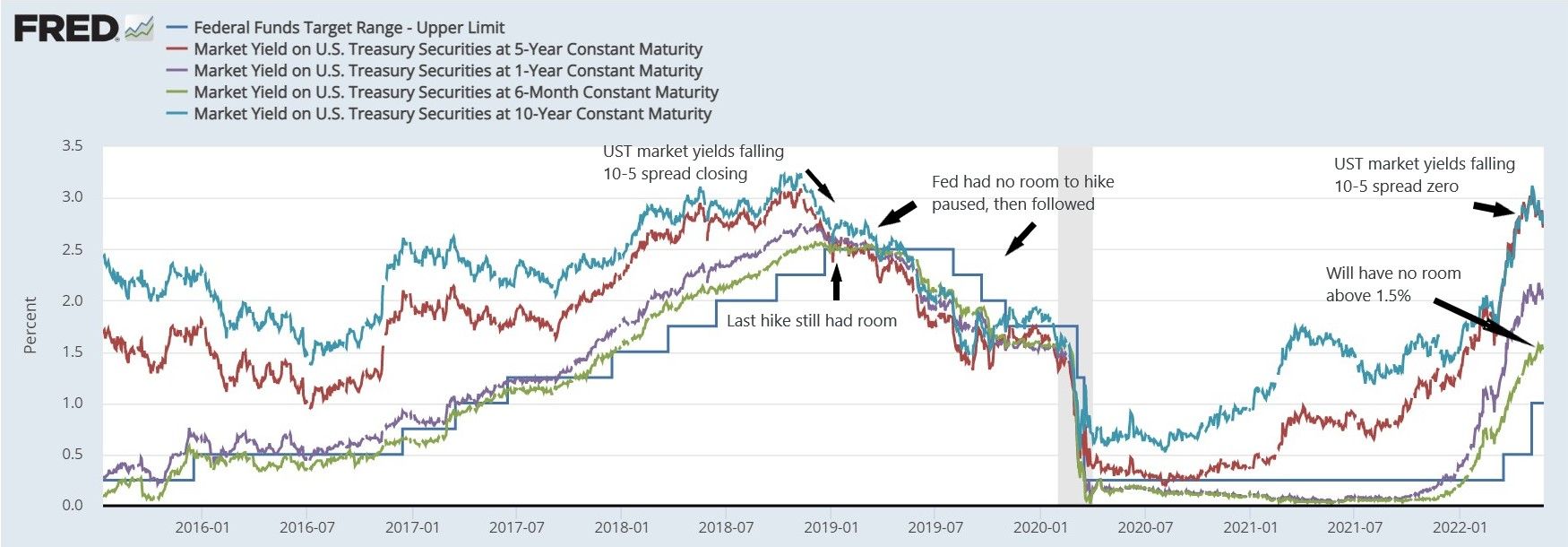

I published a few other interesting charts on Twitter this week. First up is the Fed's future policy path at the June and July meetings. What this shows is if rates keep falling, as I expect, it is going to be very hard for the Fed to tighten in July. That would send shockwaves around the market and lead to a major risk on rally.

Why will it be hard for the Fed to hike if rates are below the goal level? Because the Fed doesn't raise rates, they follow, doing token hikes when there is plenty of room under the curves. If they raise the Fed Funds rate above the market rates of US Treasuries, the Fed risks exposing their true impotence.

Also, times are different today than in 1980, the last time a Fed Chairman tried to be tough with the market. The fear that gripped the Fed during the Great Financial Crisis in 2008 has not gone away. There is a real risk that the economy could enter a feedback loop of credit collapse. The Fed will not risk that. They are talking tough but will reverse soon, to avoid losing control of the narrative to the downside.

For that reason, I expect a pause at the July meeting. Just like Powell paused in January 2019.

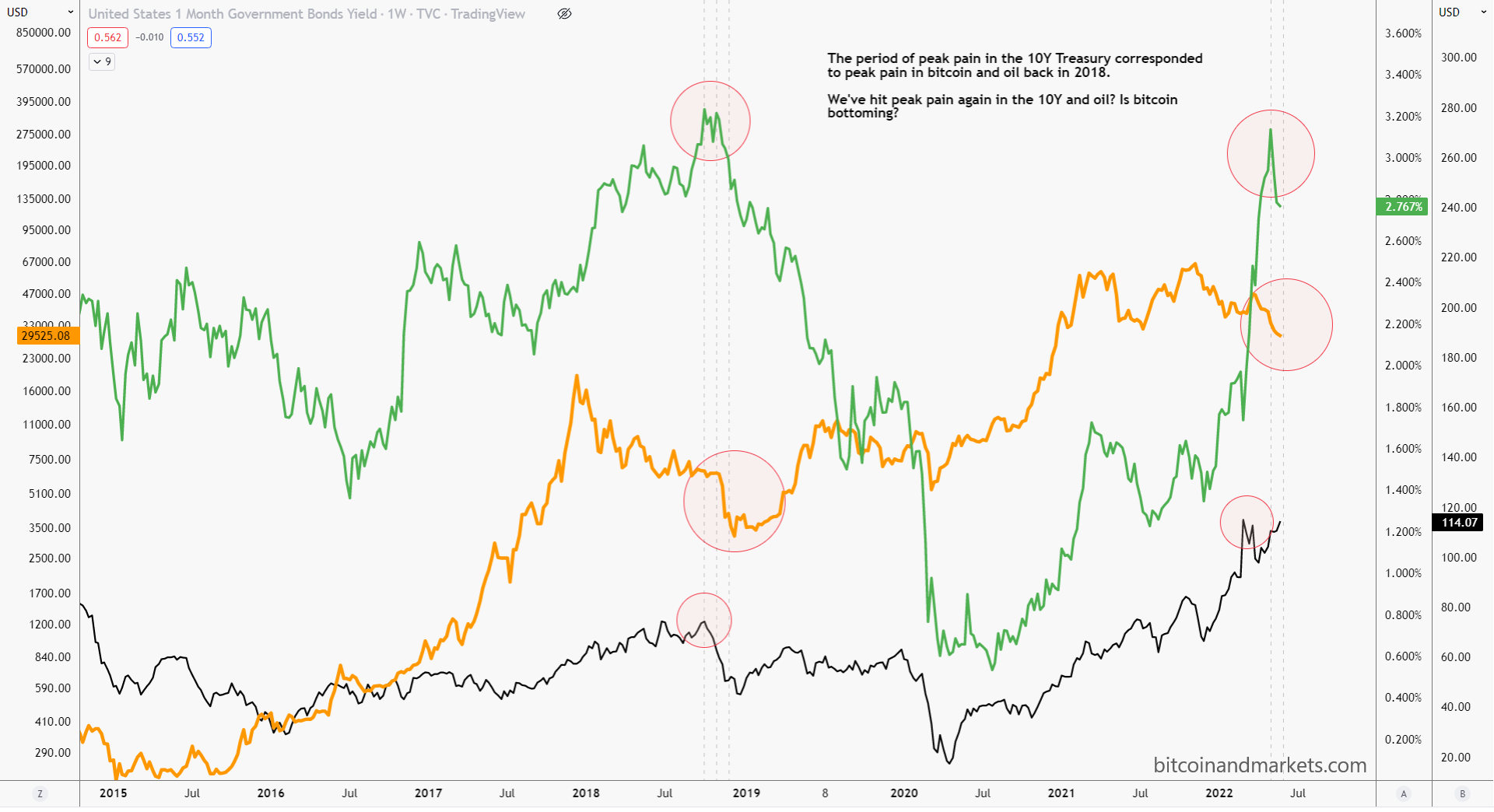

The next chart is bitcoin versus the US 10-year Treasury yield and WTI oil.

What I'm showing here is that back in 2018, max pain coincided in yields, oil and bitcoin, almost simultaneously. Today, the US 10-year looks to have peaked, oil likely peaked and lower demand in the global recession will cause price to fall, and bitcoin is in a max pain scenario.

Price Conclusion

I still think we are bottoming in bitcoin, but I'm less certain than previous weeks. Bitcoin is the remedy for much of the world's economic ills right now, and more and more people are recognizing it.

However, there are major tailwinds from altcoins imploding, remnants of inflation hysteria, and the broad economy is definitely in recession.

Again, this is the most unanimously bearish I can remember the charts in all my 10 years in bitcoin. It reminds me a little of late 2018, when the bottom just dropped out of the price. We have above normal risks in the altcoin market, specifically ethereum falling apart, and people starting to miss loan payments due to recession and CPI increases.

We are near peak pain in many markets, however, bad economic conditions are necessary for the market to repair itself. We should not wait for central planners to change their tune, but realize that their tune is dependent on the market and follows after a lag. By the time it feels like collapse, the market has already bottomed. It feels most bearish at the bottom.

I truly feel anything could happen in the next couple of weeks, but Bitcoin has always defied the odds in its quest for mass adoption, and there is no sign that has changed. Indeed, mass adoption looks more certain, all that's needed is for price to represent that.

👉 Become a member! 👈

Get more price analysis

Mining and Development

| Previous difficulty adjustment | -4.33% |

| Next estimated adjustment | -1% in ~11 days |

| Mempool | 4 MB |

| Fees for next block (sats/byte) | $0.64 (16 s/b) |

| Median fee (finneys) | $0.40 (0.138) |

Mining News

ExxonMobil [is] reportedly working with a bitcoin mining company in North Dakota to turn otherwise wasted gas into energy for mining operations.

ConocoPhillips is also supplying gas to bitcoin miners, which has been widely reported by various mainstream media outlets, including CNBC and Bloomberg.

Marathon Oil, a multi-billion-dollar oil company based in Houston, also powers co-located bitcoin mining operations with its gas.

EOG Resources, another American oil company, is also rumored to be dealing with miners by members of the industry, although official deals have not yet been reported.

And Texas Pacific Land recently signed a deal with two mining companies, Mawson and JAI Energy, to begin what JAI Energy co-founder Ryan Leachman called “the biggest bitcoin related announcement in oil and gas to date.”

A subsidiary of the Russian oil giant Gazprom has been planning and building its own bitcoin mining venture on its oil drilling sites since late 2020.

Below the equator, oil wells in remote areas of Australia are being used by Canadian gas company Bengal Energy to power bitcoin mining machines.

Tesla started delivery of Megapacks to their project they are building with Blockstream. This is an underreported story, probably because solar and battery bitcoin mining is not very efficient. But it goes a long way to helping the image of bitcoin.

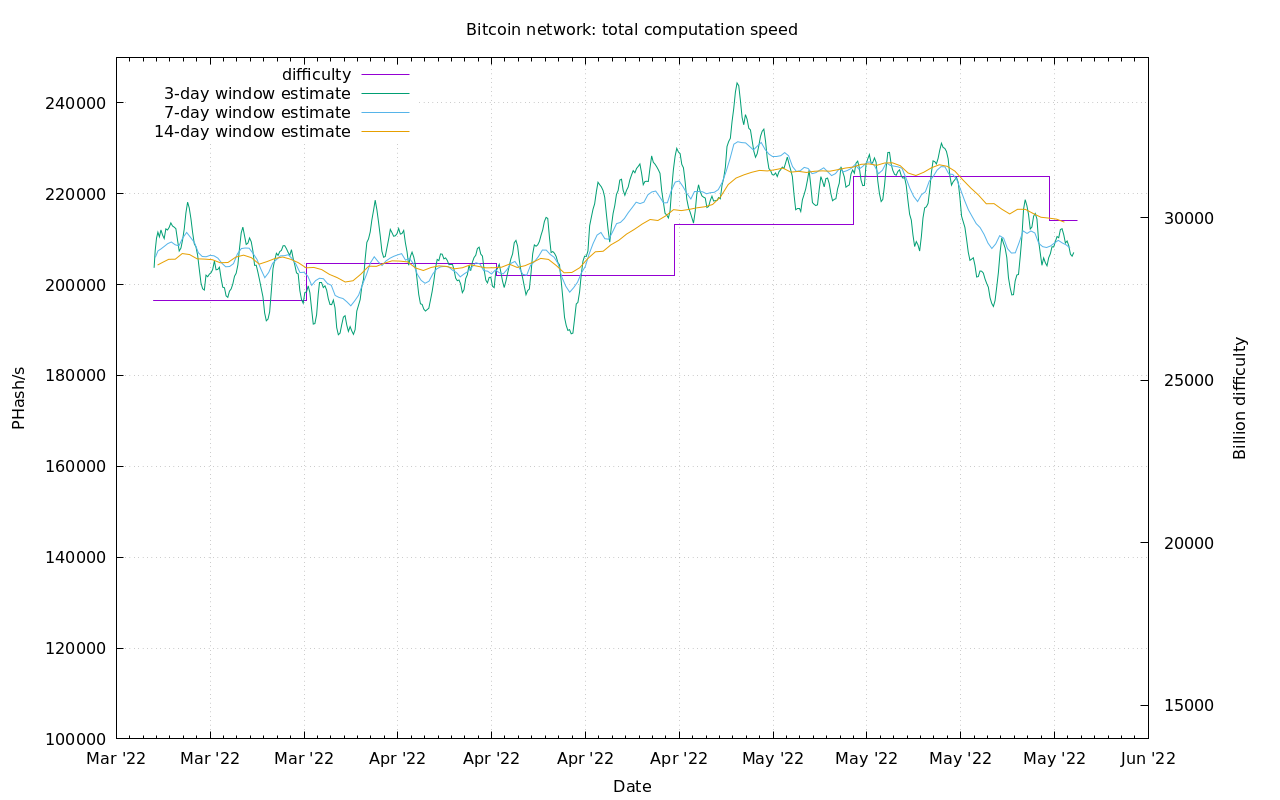

Difficulty and Hash Rate

Difficulty adjusted down 4.33% on the 25th. The largest decline since July 2021 and the Chinese mining ban.

There could be many reasons for the decline in hash rate. 1) It's becoming uneconomical for some small at-home miners, so they choose to turn off their miners for the time being. 2) The Cambridge research paper we reported on here last week, scared off some hidden Chinese hash rate. 3) Declining prices are affecting all miners' calculations and there is a broad based slowdown in hash rate.

I do not expect this fall to continue unless price drops significantly. If price drops to $19k as some are worried about, hash rate could take a big hit of 10-20%. Those drops would be temporary though.

The network is still only approximately 5% off the ATH in hash rate, which it can top in very short order.

Altcoins / CBDCs

Tether adds Mexican Peso stablecoin

Mandatory background on Tether hate: Tether has been the focus of a coordinated smear campaign for years. Reports of financial trouble are almost universally an altcoiner conspiracy theory. To date, there is zero evidence that they are in any financial trouble. To the contrary, they are probably one of the most profitable companies in the bitcoin industry.

There is so much ill will toward Tether, but none toward Circle and USDC. Interesting. The FUD against Tether also increased a lot right around the time USDC was launching. Interesting again. Another source of FUD is Ripple YouTube channels and trolls. Of course, Ripple has tried to market itself as a SWIFT alternative for years, and Tether does it way better.

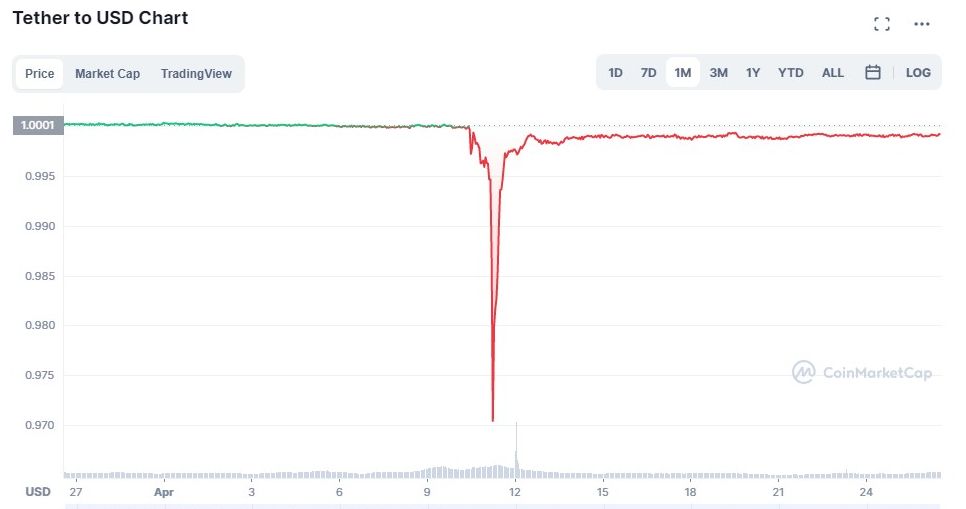

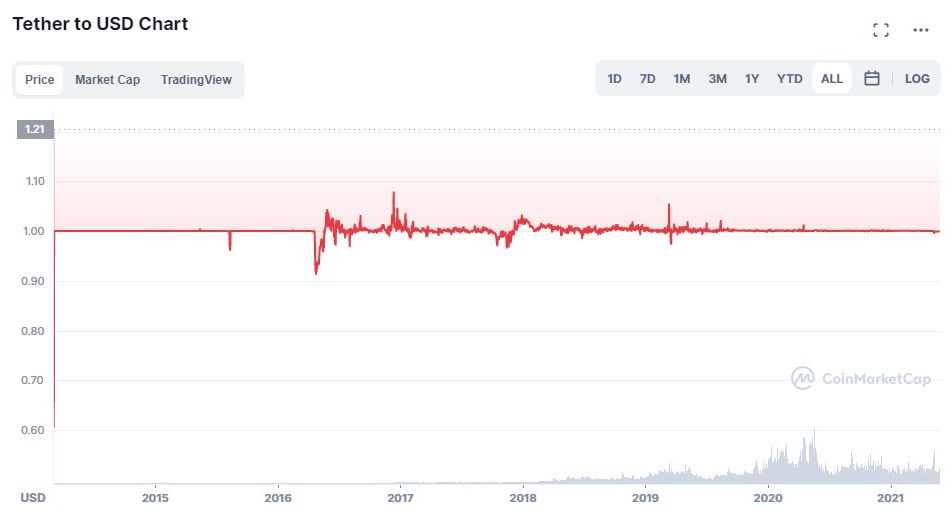

The recent FUD around the Tether peg is nonsense. You can always trade 1 USDT for 1 USD from Tether, but the secondary market price did dip a little this week.

Looks scary doesn't it? Well, it didn't even get to $0.97, and this is a secondary market. Here is Tether's all time history, and again, it's very important to note this is the secondary market, not the actual redemption peg from Tether themselves. The recent dip doesn't even appear.

Tether adds Mexican Peso

Tether has added yet another currency to their line up of stablecoins, and this one is kind of exciting, MXN.

Tether Launches MXN₮

— Tether (@Tether_to) May 26, 2022

Tether Tokens Pegged To the Mexican Peso 🇲🇽

Read the full press release ⬇️https://t.co/o732RTxc7T pic.twitter.com/fT1srEgeed

At the time of writing, this is the amount of different Tethers out there. Remember, one of my big theories is that the ECB is gung-ho about CBDCs because the market is not providing a competitive private digital Euro.

- USDT : $72.5 billion

- AUXT (gold) : 246,524 oz ~ $450 million

- EURT : €241 million ~ $250 million

- CNHT : ¥20.5 million ~ $3 million

- MXNT : no data yet

I think there is much more appetite for a stablecoin in Mexico than Europe. It will be welcomed by the government in Mexico City and attract capital from all over Latin America.

USDT and MXNT have synergies that EURT lacks. The US/Mexico border is the most trafficked in the world with nearly 1 million people crossing every day, and Mexico is one of the largest remittance markets in the world, trailing only India and China that both have 10x the population.

My initial reaction was that MXNT will quickly overtake the circulating supply of EURT, and I stick by that. I also think this will be very good for bitcoin in general. Probably not in a direct buying fashion but as indirect additional liquidity in the market. This will benefit the liquidity characteristics of bitcoin immensely for Mexicans and other regional economies that deal with Mexican Pesos.

That's it for this week. See you again next Friday!!!

A

Get our book the Bitcoin Dictionary now on Amazon!

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

May 27, 2022 | Issue #193 | Block 738,163 | Disclaimer

Cover image: Owen Slater Photography

* Price change since last week's report