Bitcoin Fundamentals Report #197

Bitcoin bailouts, USD stablecoins flippen Ethereum, huge price analysis section (price models, headwinds, and hopium charts), and bitcoin mining news.

This Week

Bitcoin bailouts, USD stablecoins flippen Ethereum, huge price analysis section (price models, headwinds, and hopium charts), and bitcoin mining news.

Jump to: Market Commentary / Price analysis / Hopium charts / Mining sector

In Case You Missed It...

I appreciate all the clicks and views. Please check out Fed Watch playlist on YT as well as the podcast feed.

- (Fed Watch) Central Bankers In Their Own Words - FED99

- (Bitcoin & Markets) Response to Jeff Snider's Criticism of Bitcoin - E244

- (Member) E244 Video

- (Community) New Telegram Channel

- (Blog) Yield Curve Comparison in Recessions

Partnering with BitcoinDay.io

A traveling bitcoin conference. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Trying to recover |

| Media sentiment | Very negative |

| Network traffic | Normal |

| Mining industry | Selling bitcoin |

| Market cycle timing | Capitulation |

After several crazy weeks, the bitcoin news cycle is much more quiet.

Leverage scams get a bailout

There are some reverberations in the altcoin leveraged lending world, but things have stabilized for now. It appears a bailout has occurred of the two largest scams by Sam Bankman-Fried, owner of FTX exchange. Hopefully, this leads to an orderly unwind.

For the banking history nerds out there, this kind of reminds me of JP Morgan stepping in to save the banks back in 1907.

Redenomination of Bitcoin

Archived (so you don't give "crypto scam pumpers" clicks)

Coinbase subsidiary FairX is offering a regulated "nano bitcoin future" product through the CME. It will be pegged to 1/100th of a bitcoin.

People in bitcoin have argued for years that exchanges should switch to a smaller denomination, because some new entrants may have "unit bias" against bitcoin and buy a scam token instead. A whole bitcoin is $21,000 but some newbies don't know you can buy a fraction of coin. I've come up with the denomination "finney" (after Hal Finney, the first bitcoiner) which is 1/10,000th of a bitcoin.

The finney is a nice round denomination because it is 10,000 sats (the smallest denomination of bitcoin) and 1/10,000th of a whole bitcoin. It also is a good midsized value. At $100k for the whole coin, a finney will be equivalent to $10. At a $1 million bitcoin, a finney will be $100.

I would love to see a finney-sized product and exchange rate in the near future. This product from FairX is a good start.

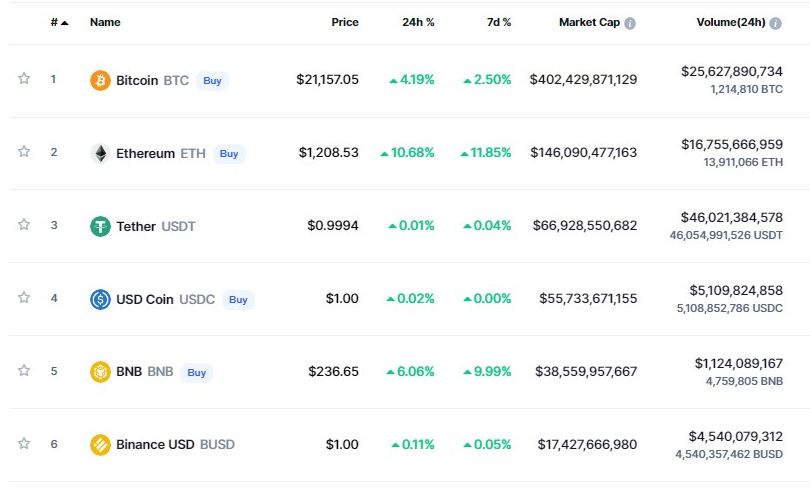

US Dollar Stablecoins Flippening Ethereum

I have said for years that Bitcoin's true competition is the US dollar, not Ethereum or Ripple or any blockchain scams.

Now we have a brilliant flippening in progress. "Flippening" is the term ethereum folks used to describe with Ethereum would flip Bitcoin out of the #1 spot. As it turns out, Ethereum has been flipped by USD stablecoins.

If you add up Tether, USDC, and Binance USD, you get a market cap of $140 billion. Yesterday, before the 10% rally today in Ethereum, its market cap was $132 billion. We are witnessing the flippening battle Ethereum never knew was coming.

Quick Price Analysis

| Weekly price* | $21,077 (+$619, +3.0%) |

| Market cap | $0.401 trillion |

| Satoshis/$1 USD | 4,745 |

| 1 finney (1/10,000 btc) | $2.11 |

"Price is the only thing that matters." - Ansel Lindner :)

Weekly chart

Price wicked into the Volume by Price support level and bounced, setting a new record oversold mark on the weekly RSI. Not shown, the monthly RSI is also the still at a record oversold level.

Daily Chart

Included on the daily chart below is the TD Sequential indicator (time-based indicator), RSI (momentum) and MACD (momentum).

TD sequential flashed a Red 9 which is the signal for a reversal or at least a consolidation. We saw a Red 9 back in early May as well.

The RSI is recovering from it's major oversold condition. But I need to see it over 50 to say we have truly bottomed and are heading up for good.

MACD is crossing bullish slightly more aggressively than early May.

Overlapping cycles

Some ink was spilled this week on the first time bitcoin's price has ever dropped back below a previous cycle high. But it's not that clear cut.

Depending on how you measure it, we can say that bitcoin had not come back to overlap the previous cycle. However, if we measure from the June 2019 high, which I consider a new 2-year cycle, we still have not touched that level.

Also, way back in April 2013, there was a mini-cycle high (red circle) which was also crossed back over in the 2015 low. All I'm saying is that it is not as clear cut as people think.

Price Headwinds

Headwinds for bitcoin have eased this week.

Altcoins

Over the last week, we did not see any of the big Ponzi schemes blow up. It seems as if the pressure has lessened. Perhaps the remaining scams will make it, or slowly deflate as people divest (and buy bitcoin instead).

Inflation hysteria

The half-life of inflation hysteria is only about a week. Major headlines and worries from the June 10th CPI release have dissipated, being outweighed by recession fears.

Remember, real inflation is not the CPI or Federal Reserve QE. Prices rose because of a supply shock/oil shock, an echo from the lockdowns and a direct effect of sanctions on Russia. A global recession can drop demand easily by 10% causing a massive drop in prices.

Broad economic slowdown

Recession worries are crystalizing. Fed Chair Powell spoke in front of Congress this week and was grilled about his policy inducing a recession.

Of course, this is pure theater, because it was Congress/President that allowed lockdowns and are now pursuing the damaging economic war on Russia. People are starting to realize that there will be an end to the rate hikes sooner rather than later.

A Macro post will be coming from me next week. Stay tuned...

Hopium Charts

I published this chart this week on Twitter. It has a 365-day moving average and measured price movements around that average. As you can see, the price has been advancing methodically by going above and below this trend.

I even think this is a little bearish because I did not bend the moving average up all that much. It still shows price getting to roughly $100k by the end of the year, topping out at around $150-200k by next April/May.

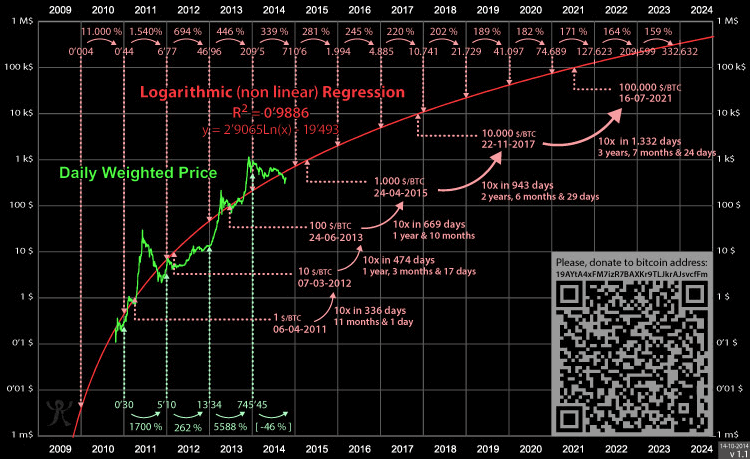

This is a channel I made several years ago. This is a "monetization" channel where price will fluctuate around a median with extremes falling around the edges of the channel as bitcoin is getting monetized in a steady fashion.

Most simplistic models for bitcoin involve some bending of channels, like the famous chart below.

Bitcoin has to get to a ~$20 trillion market cap ($1,000,000 per coin) for it to become a legitimate alternative to the dollar. Eventually reaching a $100 trillion+ market cap to serve the entire world.

My macroeconomic analysis tells me in the next 5-10 years, the dollar is heading toward complete stagnation in its current form, but my analysis also says that the US economy is returning to vibrancy after decades of being hollowed out. To square that circle, we must have a new money. That means we only have about 5 years to get to $1,000,000 where bitcoin is big enough to be considered an alternative.

It might sound far fetched, but when put on the chart, it looks pretty obvious. Above is one path to $1M by 2025.

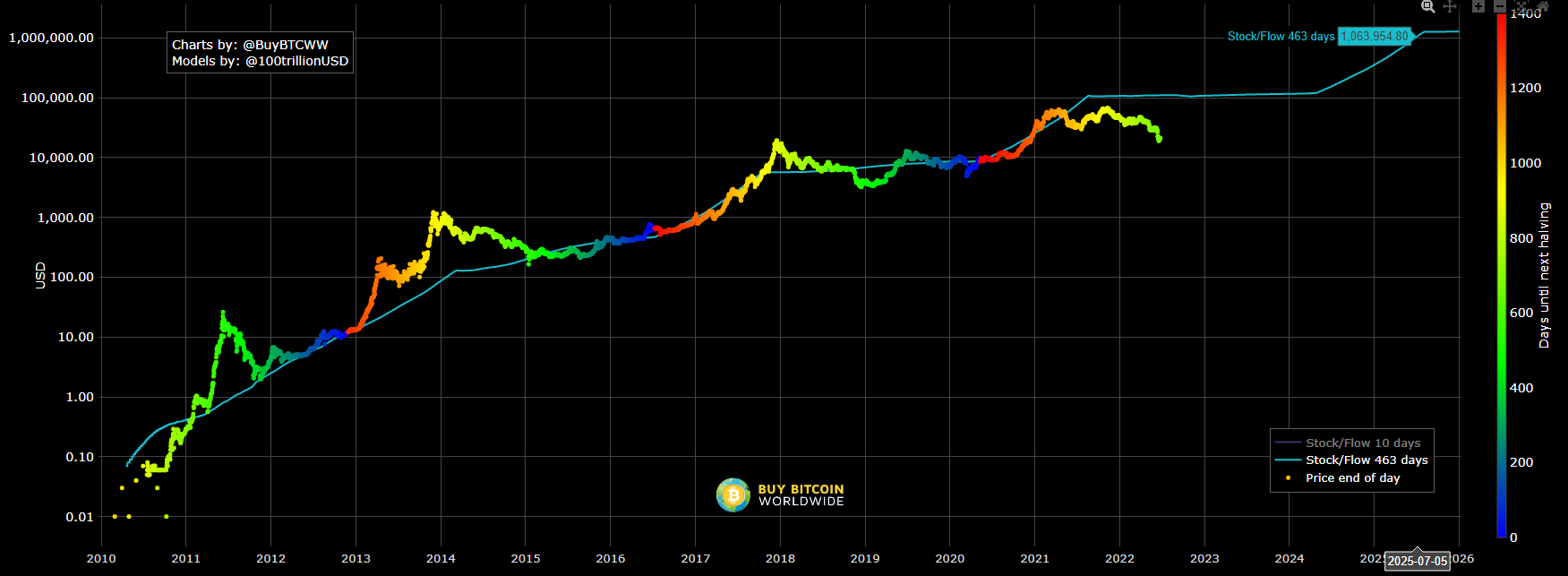

Stock to Flow

I know many people do not like the Stock to Flow model, some even HATE it passionately LOL, but I'm still convinced. It's true that recently the model has not been very predictive, but it's not supposed to be perfect all the time. It's just an explanation of the monetization trend. Most of its bad press boils down to the author, PlanB's, publicly failed prediction of $100k by the end of 2021.

The model is not meant to predict the price exactly. Other macroeconomic factors affect it. Price will still fluctuate around the path. That said, if this model is to hold in the future, price has to rally rapidly from here. This chart also shows a path to $1M by 2025.

Price Conclusion

We should not be surprised if price dips below the previous cycle high for the first time in any cycle. - Last week

Bitcoin is struggling to find its legs. It has experienced a historic bear trend, with 11 of the last 12 weeks being red. However, it has not dropped by as much percentage-wise as previous bear trends, 74% today versus 91%, 85%, and 83% consecutively in past cycles. So, despite bitcoin weathering the longest string of bearish weeks and the largest liquidation volume in its history, it remains strong.

The conflict in Ukraine is getting closer to a conclusion, and the globalist will quietly lift their sanctions in order to address the growing concern in Europe of a credit crisis and in the US of the mid-term elections. Nothing goes up or down forever in a straight line, pain comes and goes. There is a dovish surprise coming to markets.

If we can stay above $20,700, I think some bullish momentum will come back to bitcoin this week. If price drops below that level, I think it could test the lows again, at least on a daily close basis ($18,900).

When the this market turns, it will turn hard and fast to the upside. If the bailouts by Sam Bankman-Fried save the rest of the leveraged funds, the bottom might be in.

Mining and Development

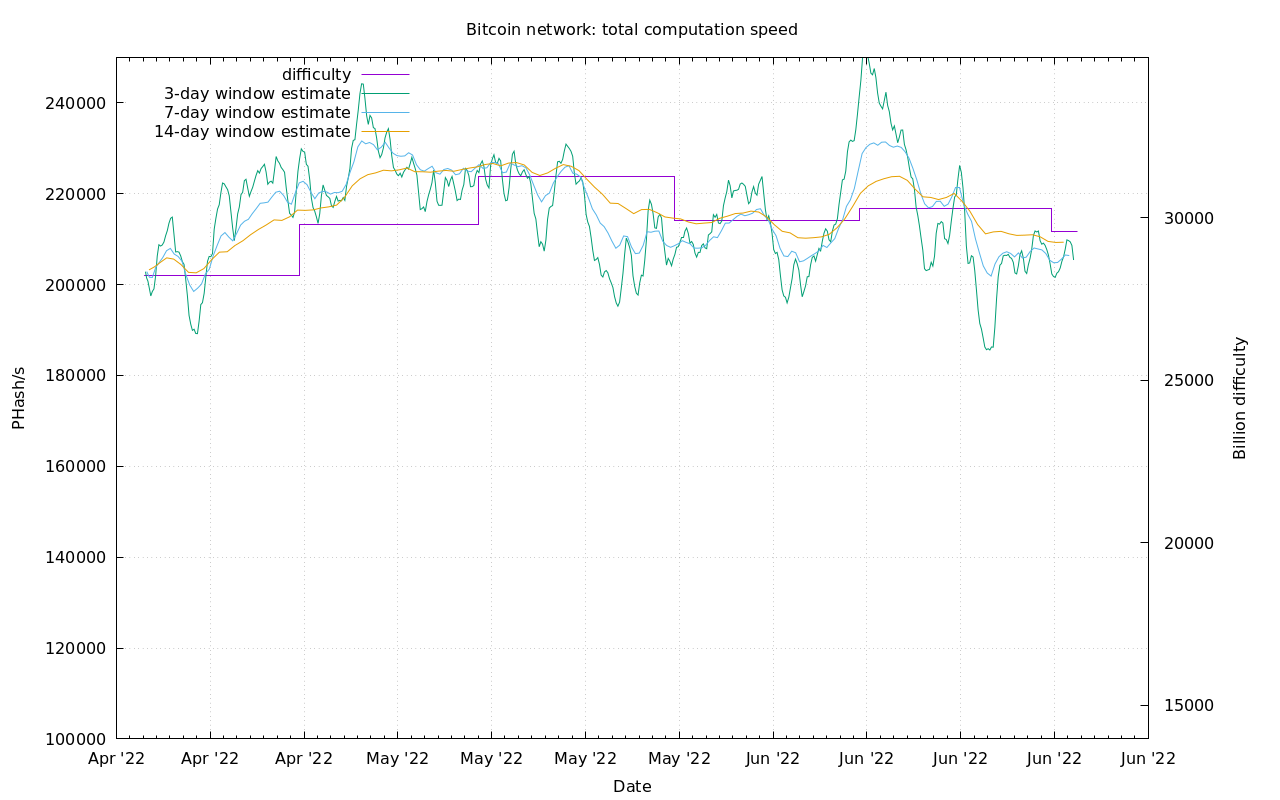

| Previous difficulty adjustment | -2.3548% |

| Next estimated adjustment | -1% in ~12 days |

| Mempool | 7 MB |

| Fees for next block (sats/byte) | $0.18 (6 s/b) |

| Median fee (finneys) | $0.12 (0.057) |

Mining News

Bitcoin (BTC) miners may have already sparked a “capitulation event,” fresh analysis has concluded.

“Our data demonstrate a miner capitulation event that has occurred, which has typically preceded market bottoms in previous cycles,” Moreno summarized.

If miners are selling now, they will be stacking later in the rally. I am generally unconcerned about the hash rate at this time, since we are so close to the ATH and have fallen so much in price. It makes sense. If miners were selling on a little 10% dip in price from the top, it would be concerning, because it would signify something going on in the market that the miners are seeing but everyone else hasn't yet.

Despite the bear market for crypto, Aspen Creek Digital Corp., a new bitcoin miner, has started mining at a six-megawatts solar-powered facility in the western part of Colorado.

Aspen Creek is also developing bitcoin mining sites across Texas. Its second facility, which is on track to be operational this summer, is a 30-MW data center capable of hosting 10,000 ASIC (application-specific integrated circuit) miners co-located behind-the-meter with an 87-MW solar farm. And a third project is a 150-MW data center, also co-located behind-the-meter, with a 200-MW solar farm.

Bitcoin mining is the perfect incentive to build out marginal sources of energy, and provide a real-world test bed for innovation in renewables. The only reason that activist environmentalists don't like bitcoin mining is because it is a market solution to their problems. They want the government to takeover and mandate industry, because they know best.

Difficulty and Hash Rate

Not much change in the hash rate from last week. It is still holding strong, within striking distance of the ATH. Difficulty did adjust downward this week by 2.35%.

That's it for this week. See you again next Friday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

June 24, 2022 | Issue #197 | Block 742,168 | Disclaimer

Cover image: @bobbyhundreds.eth

* Price change since last week's report