Bitcoin Fundamentals Report #201

This Week

Commentary: Coinbase in hot water and Fedimint, plus price analysis with charts and headwinds facing price, and mining sector news including a job well done by Texas bitcoin miners.

Jump to: Market Commentary / Price analysis / Mining sector

In Case You Missed It...

I had a busy week! Lots of content for you.

Join my new Telegram Channel! Will be live streaming often!

Watching and liking the YT videos shows Bitcoin Magazine you love the content!

- (Fed Watch) Alarming China Financial Crisis | Credit-based Money Trap and Bitcoin - FED 104

- (Fed Watch) 3 New Fed Watch clips Subscribe!

- (Blog) Fear Hustlers and Alarmist Pimps

- (Bitcoin & Markets) Fear Hustlers and Alarmist Pimps - E245

- (Member) E245 Member video

Listen to podcast here

Partnering with BitcoinDay.io

A traveling bitcoin conference. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Optimism |

| Media sentiment | Less negative |

| Network traffic | Normal |

| Mining industry | Making statement |

| Market cycle timing | Despair, avoidance |

Coinbase Insider Trading

The biggest story in the second half of this week has been the charging of several employees of Coinbase with insider trading. Are you surprised?? I'm not.

The DoJ's complaint alleges Ishan Wahi made Nikhil Wahi, his brother, and Ramani aware of pending token listings ahead their launch on Coinbase on at least 14 occasions. After delivering the information, all three allegedly used anonymous Ethereum wallets to buy the crypto assets before the listing and sell them for a profit afterwards.

They bought the tokens they knew were about to get listed. Wow, so surprising. This kind of thing is part of the culture at Coinbase. CEO Brian Armstrong bought into Ethereum before offering it on Coinbase, as well as Litecoin founder, Charlie Lee, who worked at Coinbase and got his own coin listed there.

Coinbase is an altcoin casino (criminal casino?), preying on uninformed retail customers. But it's even worse than that, Coinbase actively MISINFORMS their customers through what they call "education" videos. These videos are, in fact, just an altcoin marketing operation. They "teach" people about why blockchain-everything is so amazing, and, oh BTW we have the most exciting tokens for sale!

SEC Says Coinbase Selling Securities

On top of the insider trading scandal, the SEC is alleging Coinbase is selling, at least, 9 tokens that are unregistered securities. Again, not a surprise for bitcoiners. It's only 9, but it could be 90 if the SEC had more manpower to go after them.

"A digital token or crypto asset is a crypto asset security if it meets the definition of a security, which the Securities Act defines to include ‘investment contract,’ i.e., if it constitutes an investment of money in a common enterprise, with a reasonable expectation of profit derived from the efforts of others," the SEC wrote in a complaint filed today against a former Coinbase employee accused of insider trading.

For years we've known that universally altcoin scams meet the definition of securities, meaning they are stocks and must be registered the SEC. Of course, that brings liability to the founders, who don't want that. The founders of these coins want to be able to dump their insider shares on unsuspecting victims.

For the record, I don't like that the SEC has to do this, but I don't argue with gravity either. We warned that these things were scams and people would lose money, AND that the SEC would come for them eventually. Now we are supposed to feel sorry for them?

Anyway, Coinbase is in a whole lot of trouble, but I expect to get a slap on the wrist. I hope this situation makes the altcoin casinos think twice about pumping obvious scams.

Fedimint vs Sidechains

This came across my radar this week, mainly because CK mentioned it on Fed Watch. I have not done any research on it yet, that will come in the next couple of weeks. I did however read through their website, which gives you a quick intro to the idea.

Fedimint is not an altcoin, it is software very similar to a sidechain, but without blocks. So, let's do a quick and dirty intro to sidechains first...

Sidechains conceived by Adam Back as a way to expand the functionality of Bitcoin. The money used in the sidechain is bitcoin, or more precisely, it is a token pegged 1:1 with bitcoin. Sidechains still have a block chain but can have new rules. For example, the most popular sidechain today is Liquid, that enables confidential transactions, complex smart contract execution, minting of NFTs and other tokens, all using bitcoin has its money.

I still have a lot of hope for sidechains in the future, even though they have not taken off in popularity yet. They are isolated environments for different properties and rules, while still using bitcoin. They would be perfect for countries who would like to use the monetary unit of bitcoin, but under their own unique rules.

One of the defining characteristics of sidechains is that they are still block chains. For example, Liquid has one minute block times versus Bitcoin's 10 minutes, and Liquid doesn't use miners, they use a federation of centralized players to sign off on all blocks. That's okay, because decentralization is really only useful in this sense to create a neutral and scarce digital asset. Since that is accomplished by Bitcoin itself, sidechains being federated is a way to alleviate many trade offs in design and function.

Okay, back to Fedimint

Fedimint is a form of a Chaumian mint (crypto-token printing with a peg). The types of mints have been around a long time but never caught on, because they were centralized and sitting ducks for regulators or other attacks. What Fedimint has done is to make a federated Chaumian mint, meaning many people or entities share signing authority. This federated design addresses the weaknesses of this type of mint, while retaining the benefits.

Sounds a lot like federated sidechains doesn't it. Sidechains use the same tactic for the same reason. However, where a sidechain has its own block chain that constrains design choices, Fedimint doesn't. Fedimint is a federated server protocol with pegged bitcoin tokens. So, it's not an altcoin or a sidechain. It is a simple and modular layer 2 protocol that you can use bitcoin with.

While federated sidechains have the possibility to scale to the size of an entire country's payment rails, Fedimint seems to have a different audience. It is targeting smaller networks between trusted agents, like a family, community, school or something of that size.

Sounds interesting, I'll be looking into it more in the future.

Quick Price Analysis

| Weekly price* | $23,030 (+$1940, 9.2%) |

| Market cap | $0.442 trillion |

| Satoshis/$1 USD | 4,333 |

| 1 finney (1/10,000 btc) | $2.31 |

Bitcoin started upward this week. Most indicators are showing room for continued upside, but will that be enough to break the bearish trend?

Daily chart

On the daily chart this week, you see the clearly marked red lines that denote similar patterns on the chart. The pink line is the 50-day exponential moving average, what is known as the 50-yard line for analysts.

As you can see, the first two times this pattern appeared price did not break out of the red line (denotes the top of the bounce after a large drop). It also did not break above the 50 EMA those other times either.

This time, we had a big drop and we've managed to break above the bounce level, and above the 50 EMA. If the red line does not hold now, and we drop back below the 50 EMA, it is likely we head right back to $20k. However, I think that is unlikely at this point.

Weekly chart

On the weekly, I added the popular Volume-by-price indicator and highlight some points of interest.

As you can see, there is a large "gap" in volume between current price and roughly $27,000. These volume gaps, tend to attract the price through them to the other side.

Price Headwinds

Headwinds for bitcoin remain about the same this week, low.

Altcoins

With each week that passes, the altcoin/crypto market gets weaker and weaker. Other than the granddaddy of them all, Ethereum, altcoins are not recovering. Market participants in altcoin scams has been reduced to the lowest common denominator now. You can tell because people pumping altcoins are sounding more and more like scammers.

Of course, the Coinbase thing (above) could add some uncertainty into the bitcoin market, but the scandal itself does not involve bitcoin, and I'm quite certain that coinbase is solvent.

Inflation and recession fears

If bitcoin was truly affected by CPI, we should expect it to be high right now and ready for a fall. It's just the opposite. Bitcoin is a hedge against depression.

Recession fears continue to escalate, but the markets, especially the currency markets, have moved a lot in recent weeks, so a cool off, consolidation period is in order. We can't all be on edge for multiple weeks in a row. Humans will naturally give themselves a break mentally, before the next leg in the crisis.

I think we are in one of these lull periods for the next week, both inflation and recession fears. The Fed policy announcement will be on the 27th this month. So that gives us 5 days of calm IMO.

Price Conclusion

The next several days are pivotal for the bitcoin price. If it fails once again and rolls over, I think we see new lows down to $15,750. More likely though, in my opinion, is making it back up to the red resistance line, at which time it is likely to fill the volume gap in the weekly chart, up to $27,000. - Last week

The chart is looking the best it has in months, and we still have a ways to go to get to $27,000. It is highly likely, price continues up to $27-29,000 before it takes a break. It will take time to get above the heavy resistance in the $30k's.

Mining and Development

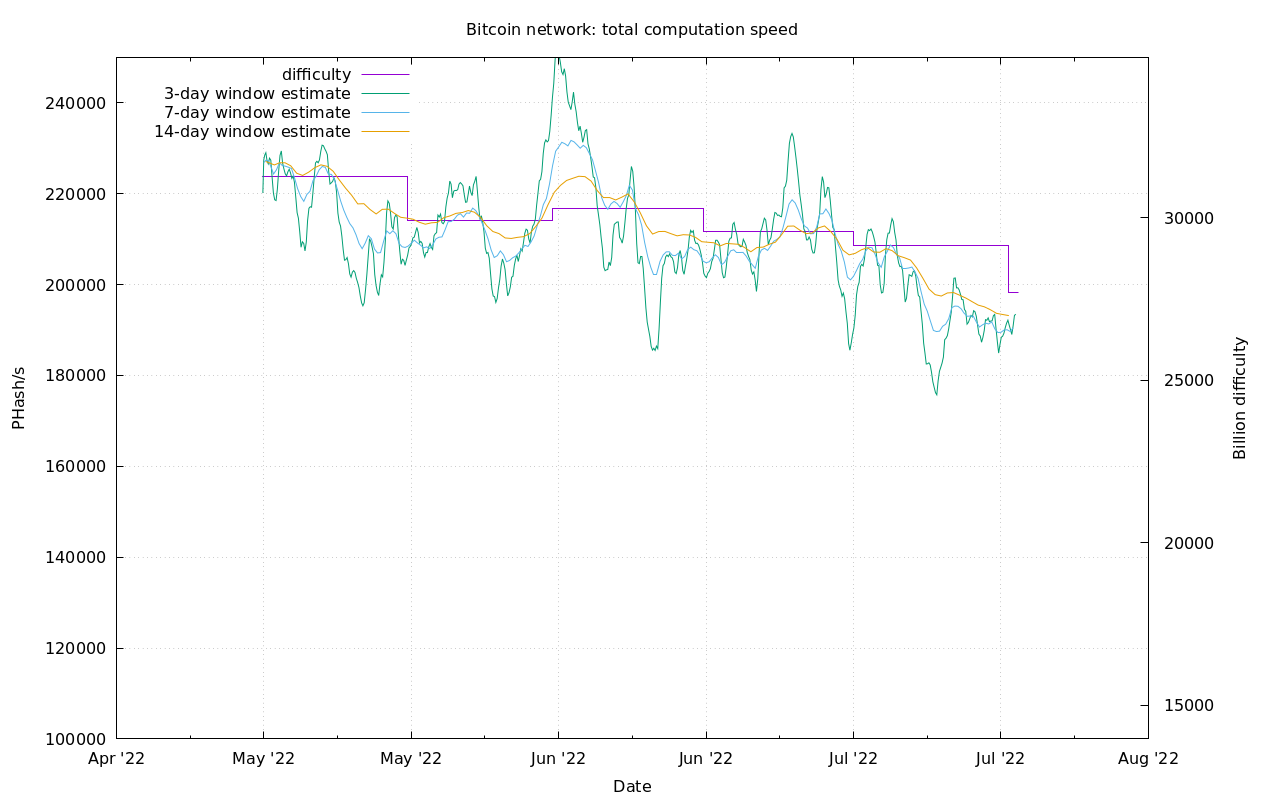

| Previous difficulty adjustment | -5.0089% |

| Next estimated adjustment | -2% in ~13 days |

| Mempool | 3 MB |

| Fees for next block (sats/byte) | $0.78 (24 s/b) |

| Median fee (finneys) | $0.42 (0.182) |

Mining News

Marty writes a good post for Bitcoin Magazine coving the recent slump in bitcoin hash rate.

With the global macro outlook deteriorating over the course of 2022 and the bitcoin market experiencing a mass deleveraging event in the wake of Ponzi blow ups with many lenders who were exposed to one particular Ponzi scheme — 3 Arrows Capital — getting completely wiped out and bringing the bitcoin price down with them, bitcoin miners have been feeling the pain.

The Texas bitcoin miners are back online after their live test of bitcoin balancing the grid. Last week, during a spike in stress to the electrical grid, bitcoin miners there voluntarily shut down their operations to help conserve energy.

The Texas experiment was a smashing success! Good work miners, thank you!

Bitcoin hash rate accounts for 1.3% of power consumption in Texas, so curtailing operations can make a huge difference in extreme conditions. Bitcoin miners have the unique ability to instantly adjust their power requirements, which gives grids the flexibility needed in extremes. The best part, however, is bitcoin mining also gives the financial incentive to build out capacity to better prepare for those extremes, whether that be renewables or traditional.

Difficulty and Hash Rate

The Texas miners just turned their rigs back on, so it will take about 12 hours for the data to represent the change. Hash rate is now about 25% off the recent ATH. Those miners didn't go away, they will get turned back on as soon as the price begins to rise again.

I've written in the past that hash rate is a lagging indictor and should be looked as as a confirmation of current price action, not a cause. In other words, a falling hash rate should tell us the miners are seeing something negative in the market. If price is stable or rising, but hash rate is dropping, that would tip us off to something not being right. If price is dropping, we likely already know what is up, and the drop in hash rate is less informative.

What we have seen over the last week is a bit different. Price has gone up 30% off the bottom, yet hash rate is still trend downward. If we were to apply my theory directly, we would be forced to conclude that the miners do not agree with current price range (mid-$20k's).

However, the last couple of weeks have been unique, in that Texas miners voluntarily withdrew their hash rate to save the grid. Also, it takes time for miners who do go broke, to sell their machines, and then for those machines to get turned back on by a new owner. A month might be too short a time.

Therefore, don't be too quick to draw a conclusion. I'm going to give the hash rate another week, maybe two, to confirm what it's telling me, that miners do not agree with this price range for one reason or another.

That's it for this week. See you again next Friday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

July 22, 2022 | Issue #201 | Block 746,054 | Disclaimer

* Price change since last week's report

Cover image: @SwanBitcoin