Bitcoin Fundamentals Report #202

Commentary: Rate hikes do not matter, Recession is backwards looking, my outlook for the rest of the year, plus bitcoin price analysis, and mining sector news.

This Week

Commentary: Rate hikes do not matter, Recession is backwards looking, my outlook for the rest of the year, plus bitcoin price analysis, and mining sector news.

Jump to: Market Commentary / Price analysis / Mining sector

In Case You Missed It...

Join my new Telegram Channel! 30 live streams in 30 days! Members can find the link to the live stream recordings here.

Watching and liking the YT videos shows Bitcoin Magazine you love my content!

- (Fed Watch) Defining Recession - FED 105

- (Fed Watch Clips) Special Guests | Recession or Depression Subscribe!

- (Blog) Fedimint vs Sidechains

- (Bitcoin & Markets) Fear Hustlers and Alarmist Pimps - E245

- (Member) E245 Member video

Listen to podcast here

Partnering with BitcoinDay.io

A traveling bitcoin conference. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Optimism |

| Media sentiment | Neutral |

| Network traffic | Normal |

| Mining industry | Big rebound |

| Market cycle timing | Despair, avoidance |

HUGE Week for Macro

There is so much to cover this week in macro. Let's start with the Federal Reserve and the FOMC policy decision that came out Wednesday, then jump to GDP, and my outlook for the rest of the year.

FED RAISES RATES 😱

If you follow this blog and my content, you know what the Fed decided this week. They raised their Fed Funds target range 75 bps to 2.25 - 2.5%.

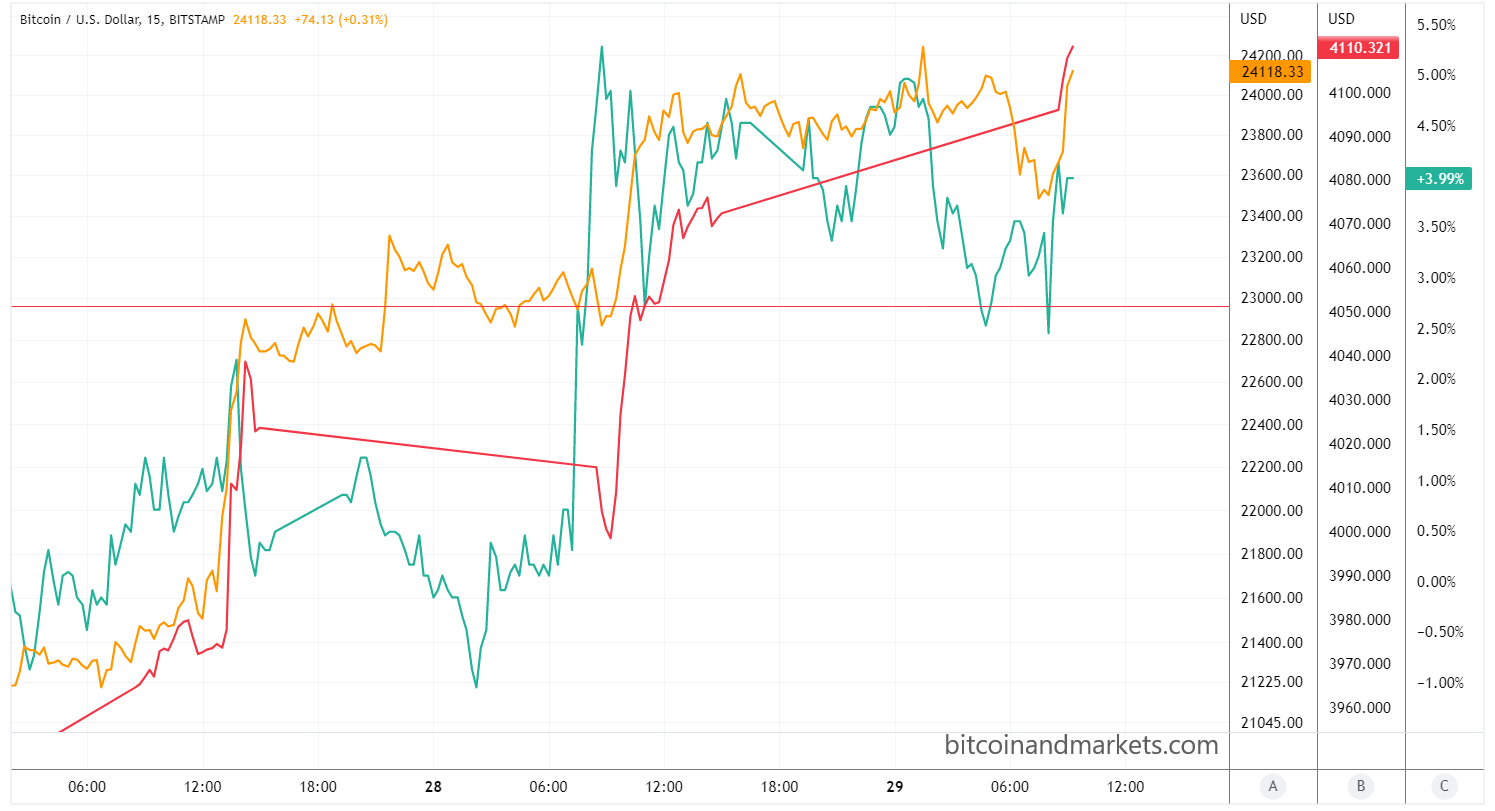

We are told - by almost everyone - that raising rates is supposed to be bearish. Yet, this week, stocks, bonds and bitcoin all rallied. Below is a chart since the Fed announcement (red is S&P500, orange is bitcoin, teal is inverted US10Y treasury).

How is this possible if raising rates is bearish? Well, most pundits will tell you, and I'm not kidding, it is because the market is irrational. Instead of questioning their premises from which they are reasoning, they feel it must be the market that has it wrong. The hubris.

Several years ago, I questioned my own assumptions about money and the system. I've done the hard work of calling the old me out on being wrong. I think most "macro experts" refuse to do this because they are too attached to their previous body of work, or their previous life and investing choices.

Anyway, back to the topic at hand. The Federal Reserve and their interest rate targets do not matter in a direct mechanistic way. I repeat, they do not matter. The way they work is through expectation management and controlling the narrative.

The Fed has been confused about what they are doing for a very long time. Back in 2005, then Fed Chair Alan Greenspan (AKA the Maestro LOL) had a "conundrum". Amazingly, this quote could be about today.

Long-term interest rates have trended lower in recent months even as the Federal Reserve has raised the level of the target federal funds rate by 150 basis points. This development contrasts with most experience, which suggests that, other things being equal, increasing short-term interest rates are normally accompanied by a rise in longer-term yields.

The simple mathematics of the yield curve governs the relationship between short- and long-term interest rates. Ten-year yields, for example, can be thought of as an average of ten consecutive one-year forward rates. A rise in the first-year forward rate, which correlates closely with the federal funds rate, would increase the yield on ten-year U.S. Treasury notes even if the more-distant forward rates remain unchanged. Historically, though, even these distant forward rates have tended to rise in association with monetary policy tightening.

In the current episode, however, the more-distant forward rates declined at the same time that short-term rates were rising. - Alan Greenspan (emphasis added)

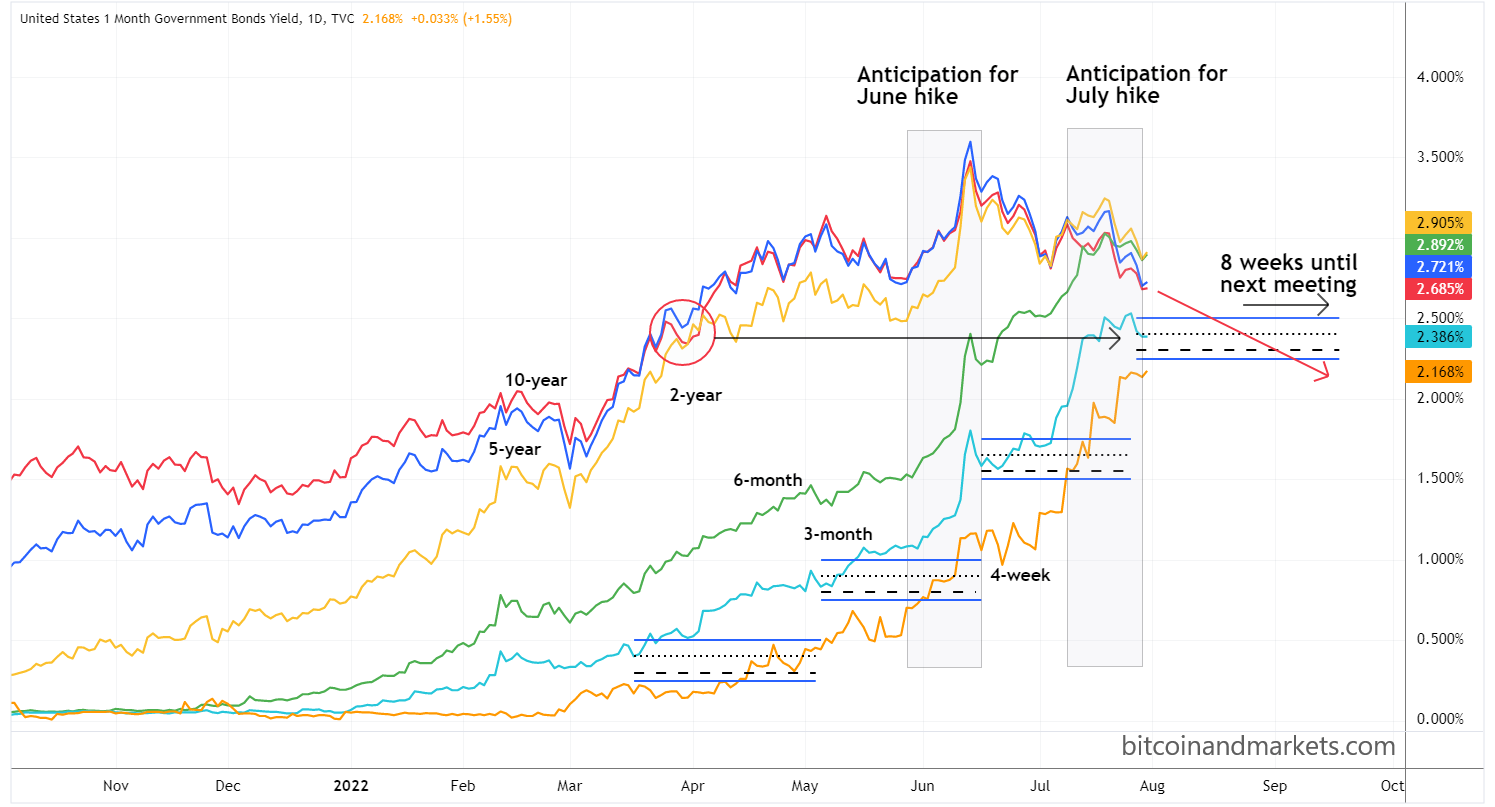

The chart below shows the situation today. The red line is the important 10-year Treasury, which has not responded to the sharp increase in the Fed Funds policy range.

That chart is a little busy, so I'll point out a few things.

1) The period before the last two policy changes were mirror opposites.

2) The 10Y inverted the 2Y back in March, around the same level as the current Fed Funds target range.

3) If rates continue as they have been, the 10Y will be BELOW the target range before the next policy meeting.

If the 10Y drops below the target range prior to the next meeting, can the Powell raise rates further? Sure, he can raise rates, but doing so will expose that "they do not matter." The 10Y won't obey, it doesn't care what the Fed does, it is busy signaling actual things going on in the market. You'd be closer to understanding the market if you just forgot the Fed existed.

Falling and inverted rates mean there is a mad dash for collateral and safe and liquid assets. This will benefit Treasuries, the dollar, and even bitcoin.

GDP declines for second straight quarter

The second big piece of news this week was the Q2 GDP in the US was negative 0.9%, making it the second straight quarter of negative GDP, and a technical recession.

Of course, to save face politically, the administration is not calling it a recession. People have been fighting about this obvious change in definition, I even talked about it on Fed Watch this week. Once again, "macro experts" were so confused how stocks and bitcoin could defy gravity when the Fed is raising rates and we are in a recession.

Of course they are confused, because these "experts" wait for the-powers-that-be to tell them we are in recession. I called it near the beginning of the year. The market is not surprised by the Q2 decline, those experts are !!

At the end of the day, the recession label doesn't matter either. We've had two bad quarters of growth. "Had" is the operative term, past tense. Recession is a backwards looking label, while stocks are forward looking.

Stocks (and bitcoin) are sniffing out a few things:

1) The Fed will pivot, no question about it.

2) Europe will pivot on Russia sanctions to make it through the winter.

3) The most uncertainty of the recession is behind us already.

Another thing that most "experts" get wrong is thinking stocks are everywhere and always risk-on assets. This is not the case at all. Yes, some are, but others like blue chip stocks or the huge energy companies or FAANGMs are not. Also, stocks are relatively inflation resistant. Depending on the line of business, average earnings will tend to keep pace with inflation.

My theory is that stocks will tend to benefit from the end of the Great Credit Cycle, too. In a low growth environment, people will stash more of their disposable income away in their 401k, in the stock market directly, pay down debt, etc., instead of using it for economic activity outside the stock market.

Where am I going with this?

I'm trying to related the idea that the market has a mind of its own. It doesn't rely on the Federal Reserve or the administration labeling a recession. The market has been weak for the last 5-6 months as it has U-turned back to the post-GFC normal of low growth and low inflation.

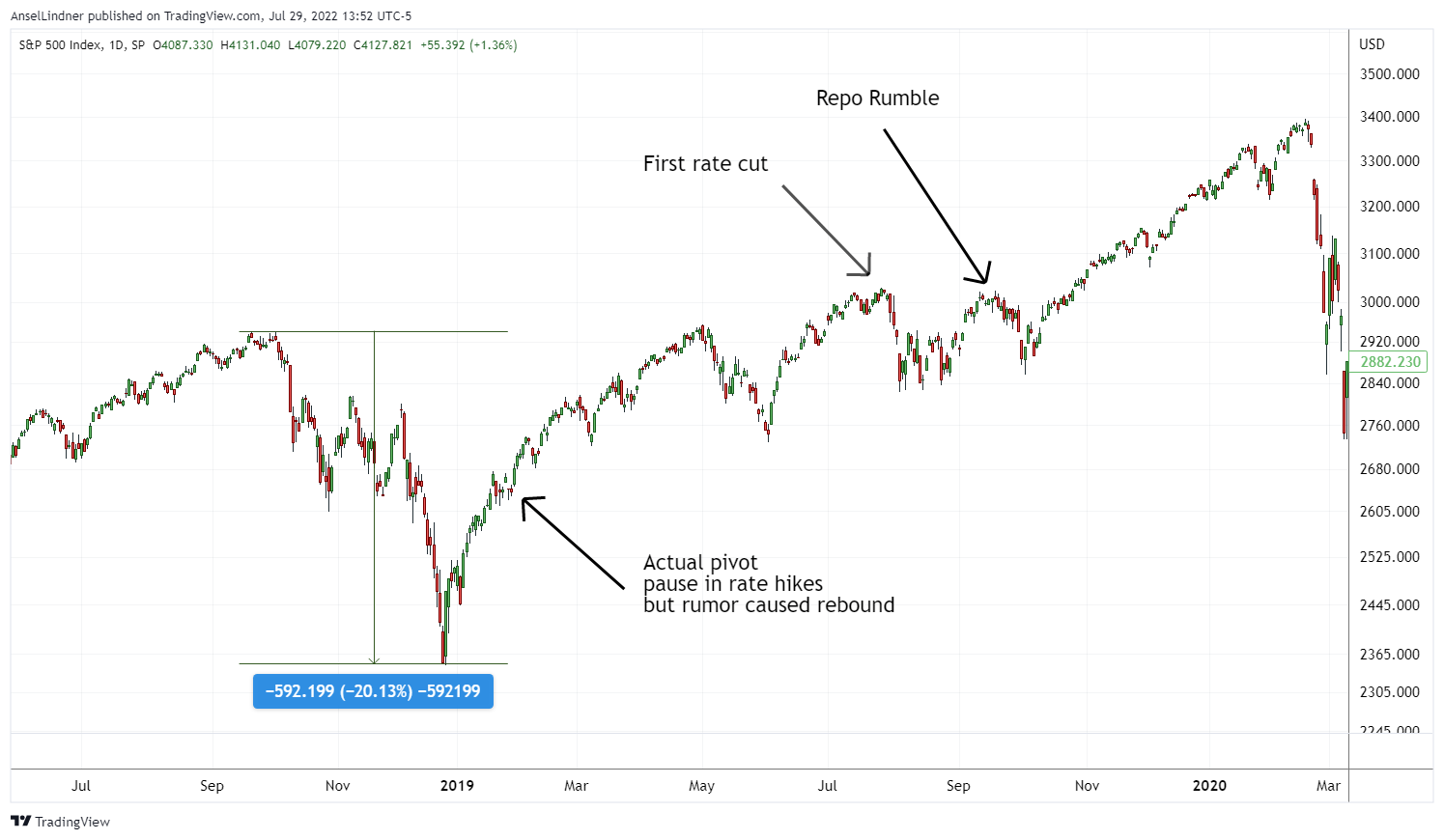

In the US, we will see something similar to 2019, the last time Powell pivoted. The Repo Rumble was an existential event, but it occurred deep in the belly of the credit market beast. It did not register in the stock market much at all.

A replay of 2019 for stocks and bitcoin, would mean we have already bottomed. Back then, stocks rebounded to an ATH rapidly and bitcoin rallied almost 250% in only 12 weeks. That would put the bitcoin price about $80k by November.

Most economic cycle indicators have bottomed (things like manufacturing indexes, U-Mich consumer sentiment surveys, etc.) And commodity prices have topped.

Quick Price Analysis

| Weekly price* | $23,885 (+$855, 3.7%) |

| Market cap | $0.457 trillion |

| Satoshis/$1 USD | 4,177 |

| 1 finney (1/10,000 btc) | $2.39 |

The bitcoin price closed above the 50-day exponential moving average for the first time since 7 April, and looks to have a date with the 200-day moving average by the end of August.

Daily chart

The charts are starting to look much better than they have in recent months. A series of higher highs and higher lows, while breaking the 50-day EMA.

Weekly chart

Again this week, I added the popular Volume-by-price indicator and highlight some points of interest.

Price has crept higher this week, making it above the volume resistance at $23k. It is now threatening to slide into the low volume area between $24-29k. It might take several weeks to fill that zone with some consolidation volume before the price attempts to breakthrough the next big chunk of volume in the $30k's.

A note on models

I'm hearing a lot of shit-talking on models recently. Here's an example:

It is crazy how people (economists included!) believe it is possible to create *and publish* a model that preserves some capacity to predict prices. As if it was not more complex than fitting a model to historical prices. https://t.co/V4DlRhcMzl

— https://bitcoinhackers.org/@fnietom (@fnietom) July 29, 2022

Of course, not all models are correct, but it is equally as wrong to say that you cannot model price at all. You essentially have to believe the Efficient Market Hypothesis and random walk. Both those theories have been disproven completely, unlike S2F.

We can predict many things, like the length of the trading day, the number of bitcoins, the relative trend between assets classes, etc etc etc. Claiming no model works like Fnietom does above, is a prediction, too. It is a self-contradicting claim. To say no model can work, is itself a model of prices.

Plan B's big mistake was calling out a price and a date. Then, when it predictably failed, his model's detractors had something to disprove the broader model.

As far as I know, the Stock-to-Flow model does not claim to be perfect at all moments in time, only that the general price level, in the long-run, will be at a certain level due to monetary theory. Therefore, the price can deviate wildly from the projection from time to time.

The blue line is just a smoothed projection, nothing special about it. Did the two previous times that the price deviated greatly from the model disprove it? No. We could easily go to $100k by the end of the year. Will that prove the model? No.

The only thing that will disprove S2F is if the price of bitcoin does not rise in the long run and fails to react to halvings. For instance, if bitcoin remains under $100,000 into the 2030's.

Price Conclusion

The chart is looking the best it has in months, and we still have a ways to go to get to $27,000. It is highly likely, price continues up to $27-29,000 before it takes a break. It will take time to get above the heavy resistance in the $30k's. - Last week

I can see the price getting to $30k and then bouncing a couple times between $24k-$30k, within the volume gap. If that is the case, price will test the 200-day moving average by the end of the August with some bullish momentum. That could be enough to rocket bitcoin higher in September through the tough $30k's (as shown below).

Even though the charts are looking more bullish than they have in months, there is still the low likelihood of more downside. I want to see some solid conviction approaching $30k to prove that it won't just turn back over. In March when price tested the 200-day MA, it was after a 45% rebound off the then lows. This time, in August, it would be after a 75% rebound, and the 50-day EMA will be angled steeply upward.

That's a long way of saying, we need to see some conviction and large green candles to make certain we won't revisit the lows. The most likely path for price is up to $30k before some more consolidation.

Mining and Development

| Previous difficulty adjustment | -5.0089% |

| Next estimated adjustment | +3% in ~5 days |

| Mempool | 3 MB |

| Fees for next block (sats/byte) | $0.50 (15 s/b) |

| Median fee (finneys) | $0.47 (0.197) |

Mining News

I have been hard on Africa lately. I think there are many reasons that they are generally poorer than other continents, none of which is exploitation by the white man. Also, I've said that bitcoin won't do much to change their circumstances, but maybe I wasn't thinking about it properly.

Few things excite Bitcoin miners more than cheap, abundant energy. Considering Africa’s potential future as a regional mining hub, its abundant energy resources are key. Here’s an overview.

African countries have some of the largest untapped potential for large scale hydropower development in the world. It’s already the region’s main source of “clean” energy, and planned developments mean that is shows no signs of losing pace.

Bitcoin mining may be a unique fit for Africa. One of the continents' biggest problems is the lack of cheap transportation. They have a lot of resources, but they are prohibitively expensive to get to market. Bitcoin mining doesn't need roads, only an internet connection. I can see stranded energy being made profitable to build out by bitcoin mining, then later attracting more economic activity.

The issue is building energy resources is more expensive in Africa than other places, maintenance and repairs will be harder to do, etc. Investment in African bitcoin mining won't be primarily driven by foreign investment, it will have to come from the governments or people themselves. We will see.

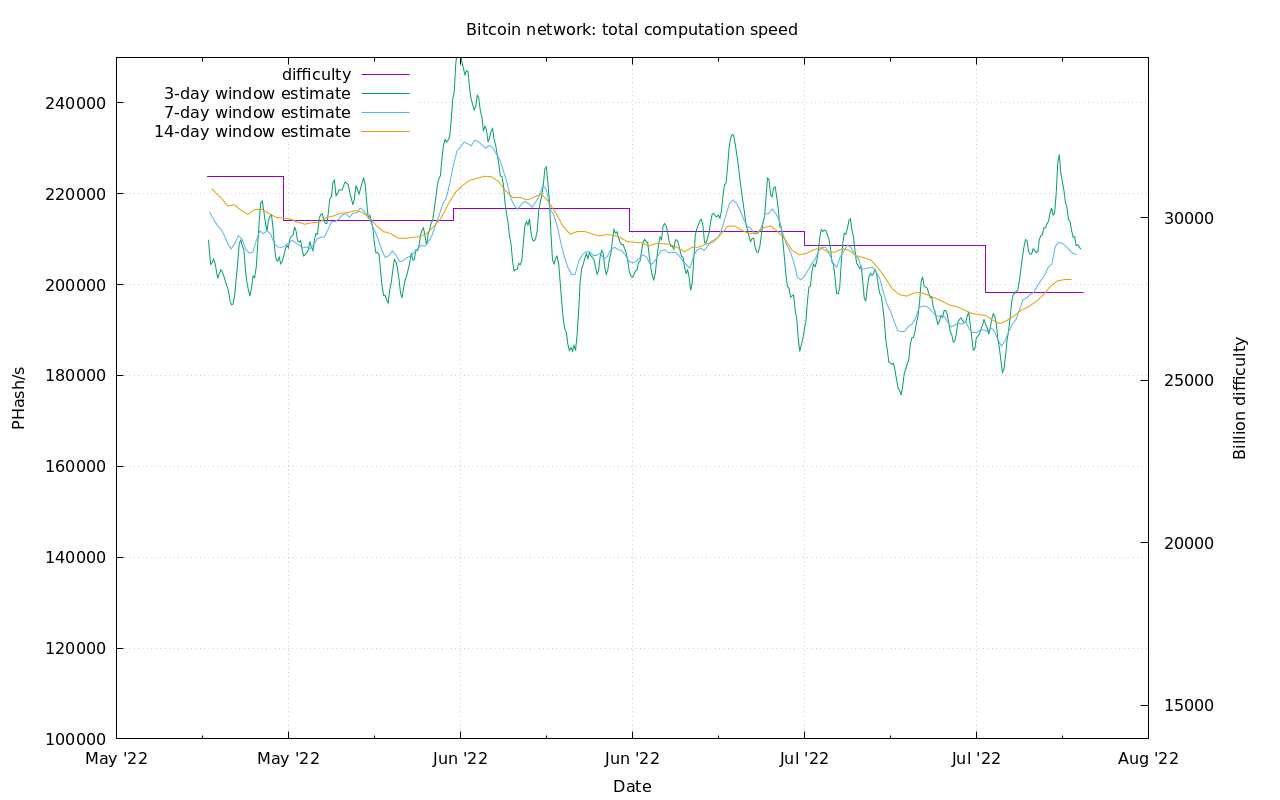

Difficulty and Hash Rate

Huge rebound in has rate this week after the Texas miners turned back on their machines. Also, the large difficulty drop of 5% could have effected many small miners' breakeven calculations. As difficulty drops, miners become more profitable.

I'm going to give the hash rate another week, maybe two, to confirm what it's telling me, that miners do not agree with this price range for one reason or another. - Last week

Last week, I had a small segment discussing the fact that price had rebounded 30% but that hash rate was still falling. I pointed out a couple unique circumstances like the Texas voluntary shutdown and the asset sales of bankrupt miners taking time.

Well, this week hash rate rebounded, telling me that miners don't see something we don't. They are confirming this price level is not overpriced.

That's it for this week. See you again next Friday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

July 29, 2022 | Issue #202 | Block 747,117 | Disclaimer

* Price change since last week's report

Cover image: ForeignPolicy.com