Bitcoin Fundamentals Report #203

Commentary on the Blackrock adoption of Bitcoin and Stablesats. Plus price analysis including economic headwinds and mining sector news!

This Week

Commentary on the Blackrock adoption of Bitcoin and Stablesats. Plus price analysis including economic headwinds and mining sector news!

Jump to: Market Commentary / Price analysis / Mining sector

In Case You Missed It...

Join my new Telegram Channel! 30 live streams in 30 days! Members can find the link to the recordings here.

Watching and liking the YT videos shows Bitcoin Magazine you value the contrarian takes and helps people find the videos!

- (Fed Watch) Calling the Globalist's Bluffs - Fed Watch 106

- (Fed Watch Clips) Multiple clips this week - Subscribe!

- (Bitcoin & Markets) Bitcoin, Ukraine, Taiwan, Richard Werner | Telegram Live Stream - E246

Listen to podcast here

Partnering with BitcoinDay.io

A traveling bitcoin conference. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Hesitant |

| Media sentiment | Neutral |

| Network traffic | High normal |

| Mining industry | Stable |

| Market cycle timing | Avoidance, stealth phase |

Blackrock Joins Fidelity Offering Bitcoin to Clients

BlackRock, the world’s largest asset manager with over $10 trillion in assets under management (AUM), is launching bitcoin trading services for institutional clients in a new partnership with Coinbase.

This news from Blackrock follows only 3 months after similar news from their competitor, and bitcoin ally, Fidelity.

There are two big takeaways from this news. First, with combined assets under management of nearly $13 trillion, if only 1% of that is put into bitcoin, that's $130 billion. With bitcoin's very limited supply and even more limited available supply, that could be enough to push the price of bitcoin into 6-digits. A spike in price in this macro environment could kick off a reinforcing cycle of higher prices.

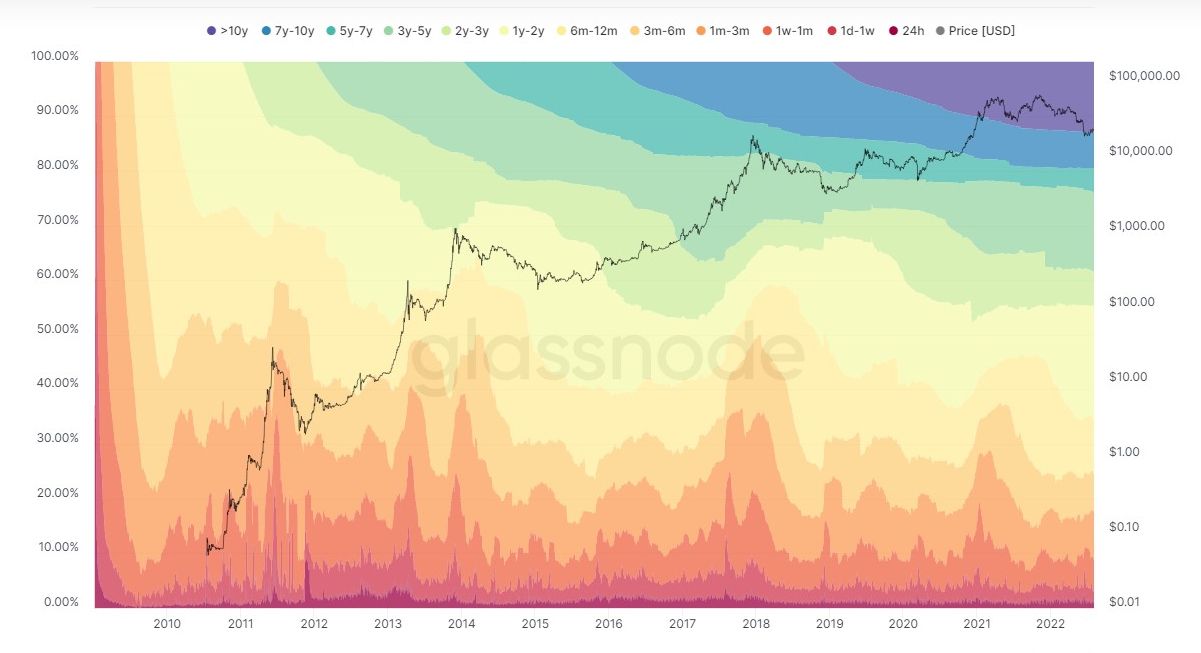

The Hodl wave measures bitcoins movements by age. Only 6.76% of bitcoins have moved over the last 3-6 months, despite the massive sell off YTD. If we use that as the number of coins the $130 billion could buy, that's only 1.3 million bitcoins. On a linear relationship, which we know would not happen (the first coins bought would be much cheaper than the last coins), it would put the price per bitcoin at exactly $100,000. Realistically, it would be much higher than that.

The second big takeaway would have to be the moat this puts around bitcoin in a legal sense. With massive numbers of people owning bitcoin in their retirement accounts, and huge companies with tentacles in most major public companies. This news effectively puts the chance that the US could ban bitcoin outright at zero.

On that same line, however, since Blackrock is using Coinbase for custody, and it doesn't seem withdraw of the bitcoin to be initially possible, it could perhaps increase the chances of further pressure against self-custody. That would be a long battle in Congress and the courts though, with States such as Wyoming already precluding it with State protections.

Stablecoins of a sort come to Lightning Network

Known as “Stablesats,” [it] is a completely new way for using U.S. dollars on Bitcoin. While representing a U.S. dollar on the Bitcoin network, there is no need for creating a new token.

The initial reaction to this new product was quite positive on Twitter. What Galoy are building is a micro-bank. Each user will setup an account with an exchange, so when they swap into the stable-USD balance, they open up a short contract on the backend with the exchange using their bitcoin balance. It's seamless to the user, but they have to set it up first.

As the price of bitcoin goes up, the short contract will lose value in bitcoin terms. As the price of bitcoin goes down, the short contract will gain value. All along, keeping the stablesats locked at a USD value.

The claim that "there's no need for creating a new token" is technically correct, but perhaps not being misleading. You are creating an entry on a trusted third-party database (the exchange in this case) very similar to an altcoin. As such, many things can potentially go wrong. The exchange could get hacked, or the market could enter a very bearish period where short contracts would have to pay the funding fee. (I'm not sure how they are working the funding fee issue out actually.) Lastly, they could freeze your exchange account at the behest of government authorities.

It's an interesting idea for sure. The future addition of a decentralized exchange in the backend would make it even more interesting. It would become more censorship resistant.

I also like the fact that this is a lightning add-on. It puts the concept of stablecoins in bitcoin's orbit, which severs the false assumption in people's mind that stablecoins are an altcoin thing.

Quick Price Analysis

| Weekly price* | $23,011 (-$874, -3.7%) |

| Market cap | $0.440 trillion |

| Satoshis/$1 USD | 4,347 |

| 1 finney (1/10,000 btc) | $2.30 |

The bitcoin price has been very quiet this week. Despite stocks continuing their rally, bitcoin held back, struggling with the 50-day EMA (50-yard line). However, if it can get its feet under it this week, we could see the run up to $29k I've been looking for.

Daily chart

From a basic chart perspective, it's crunch time. Do something, bitcoin! If it picks higher, the price should easily rally up to $29k.

Bear Flag

Though we are seeing higher highs and higher lows, there is a growing likelihood that we are forming a bear flag. We are in desperate need of a solid green candle through the top of this channel.

I don't want to alarm anyone, because what I'm about to say is unlikely and would require massive selling pressure which I don't think is available, but a measured move off this bear flag would result in a drop to $12k.

Weekly chart

Price is still hanging around the volume-by-price spike at $23k. It's essentially sitting on the fence. The way is clear above, and there is more support below.

Commitment of Traders

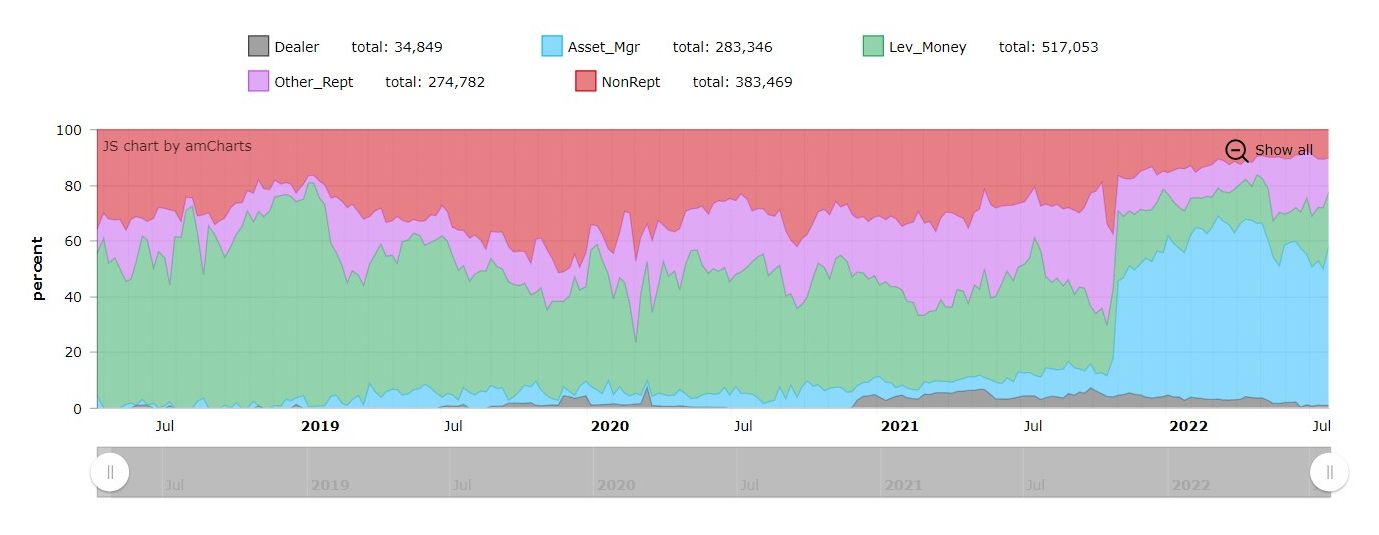

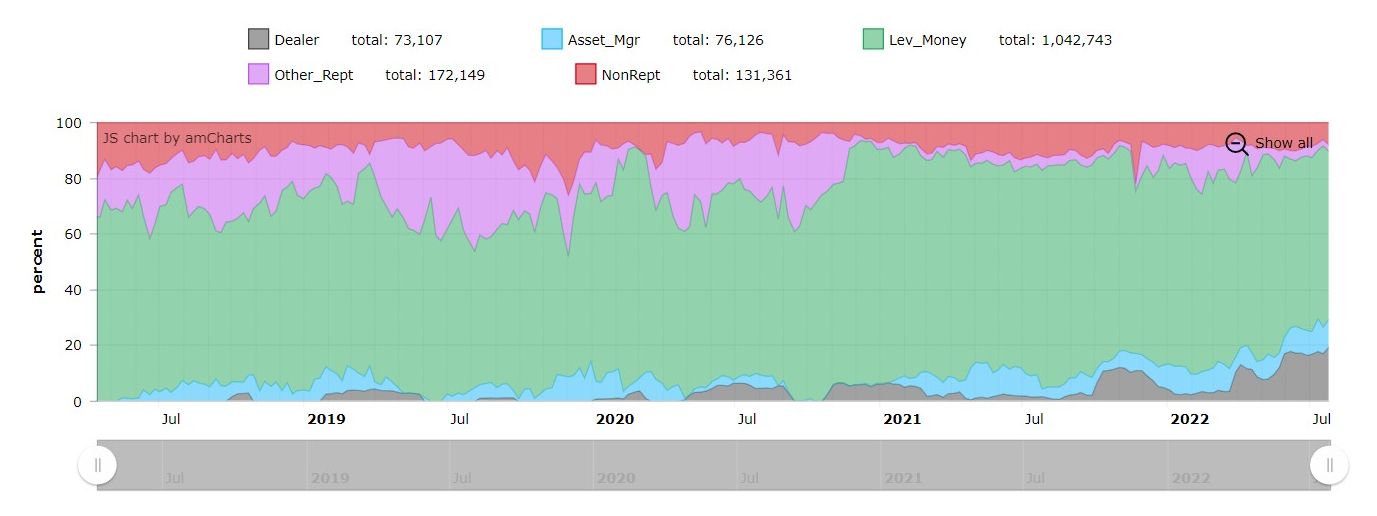

I have some new charts for you this week. Below is the commitment of traders from the CME, which shows the aggregate holdings of different participants in the U.S. futures market.

In the data, we can see and interesting change back in October. Asset managers became the largest holders of bitcoin longs, probably because that's when they started offering bitcoin exposure to clients. "Leveraged money" here is likely hedging activity.

My takeaway from these charts is the Asset Manager position being seriously long. Also, there is twice as much hedging short than long. Both these metrics mean the sentiment is bullish, but not overly so.

Headwinds

I'm bring back the headwinds section this week. Bitcoin is experiencing different forms of headwinds than in the last few months. What was once altcoin-based uncertainty, is now macro-based.

Jobs Report

The US Jobs report came out this morning. The market had been waiting for it for the last week. Stocks rallied toward long term resistance, just under the 50% retracement level (more on that later), and waited.

The jobs report was strong. The US economy added 528,000 jobs, beating the forecast of 250,000 by more than double. There is some confusion about the numbers though. The Household Survey (what the labor market participation rate is derived from) fell. If we dig into the numbers, the job gains in the Headline Survey is almost solely from people getting second jobs. Not the strong economic signal it is supposed to be.

Why is this a headwind for bitcoin and stocks? Well, according to the mainstream opinion, a hot jobs market will lead to more Fed rate hikes, which is seen as bearish for bitcoin and stocks. An assessment I disagree with.

This was an absolute monster of a report, a huge surprise. We can also add in the bearish comments by Federal Reserve board members over the last couple of days. It feels like a full court bearish press right now. Yet, stocks and bitcoin have barely moved?

This market wants to go higher, and if stocks can brush off the jobs report, bitcoin should catch up quickly.

Macro Headwinds

Europe and China are crashing much much worse than the US. I've been coving this at length on Fed Watch and all my content, so I won't go too much into it here.

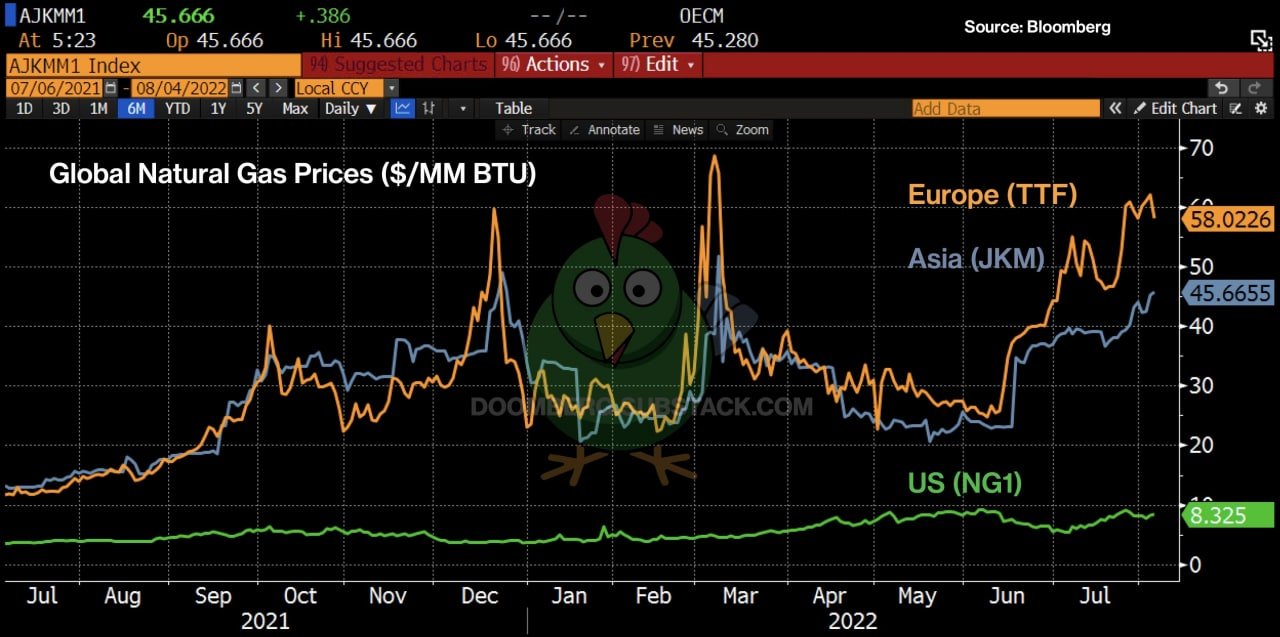

This chart says it all. How are the Europeans or the Chinese going to pay for these astronomical energy costs? They have two choices: 1) print money and devalue versus their dollar denominated debts (very bad), 2) go without, cut back on other economic activity (also very bad).

This directly affects bitcoin, because people in recession do not have extra money to put into savings. It also works through sentiment. People are mad as hell or depressed, not the climate for looking into a new form of money.

However, as this crisis continues, large companies, wealth management firms, or the 0.1% will diversify into bitcoin. We already see this with Blackrock and Fidelity offering bitcoin to client due to popular demand.

Altcoins

The effect on bitcoin from the altcoin den of scammers and thieves has gone way down over the last two weeks. There have been a couple of high-profile hacks this week, Nomad and Solana, with $100s of millions stolen and dumped, yet the bitcoin price did not react.

Ethereum is getting closer and closer to its planned hard fork upgrade. This has garnered some attention and a spike in price, especially since it is the last major altcoin standing. I expect it to go okay, but not be the shot in the arm they were hoping for. Price will come back down and bitcoin will not care.

Price Conclusion

Even though the charts are looking more bullish than they have in months, there is still the low likelihood of more downside. I want to see some solid conviction approaching $30k to prove that it won't just turn back over.

- Last week

Price has not moved much this week and bearish pressure has increased slightly. The chart shows a possible bear flag and there is growing concern over the Fed's reaction to US economic data. Additionally, global recession threatens to slow demand for bitcoin.

These bearish forces, however, are still outweighed by the bullish fundamentals. Increasing interest from investors, leverage is stable and favoring bulls, and altcoin headwinds have basically disappeared.

This week, I maintain my call for higher prices up to $29k, followed by consolidation.

Mining

| Previous difficulty adjustment | +1.7409% |

| Next estimated adjustment | +1% in ~12 days |

| Mempool | 9 MB |

| Fees for next block (sats/byte) | $0.51 (16 s/vb) |

| Median fee (finneys) | $0.51 (0.222) |

Mining News

Referencing the Doomberg chart once again, from above. He shows natural gas prices which directly effect electricity prices. This means that electricity prices have spiked across the world. In Germany, there are reports that electricity prices are 10x normal.

In that environment, where is bitcoin mining going to flow? Perhaps miners are very happy that China kicked them out last year, and relocating to the US, because this is where electricity prices are stable. Also, amid higher electricity prices, bitcoin miners are starting to be demonized, with countries like Kosovo banning mining to conserve energy.

New York State sued over mining ban

The lawsuit claims "protected speech by broadcasting blocks of data across a protocol’s network. In fact, Bitcoin’s pseudonymous creator, Satoshi Nakamoto, explained that proof-of-work miners are engaged in “publishing” data for the world to see on an immutable, distributed “timestamp server.”"

Very interesting. I agree that this is a freedom of speech issue. I also believe that the wording of the law actually doesn't apply to bitcoin miners anyway, and the above article perpetuates this misunderstanding. Bitcoin miners do not use massive amount of hash rate to "validate" transactions, they use it to find and publish a hash. Nodes on the network validated transactions. This bill is aimed at proof-of-work that validates transactions, but nodes validate and proof-of-work finds and publishes hashes.

We'll see where this goes. I wish them luck!

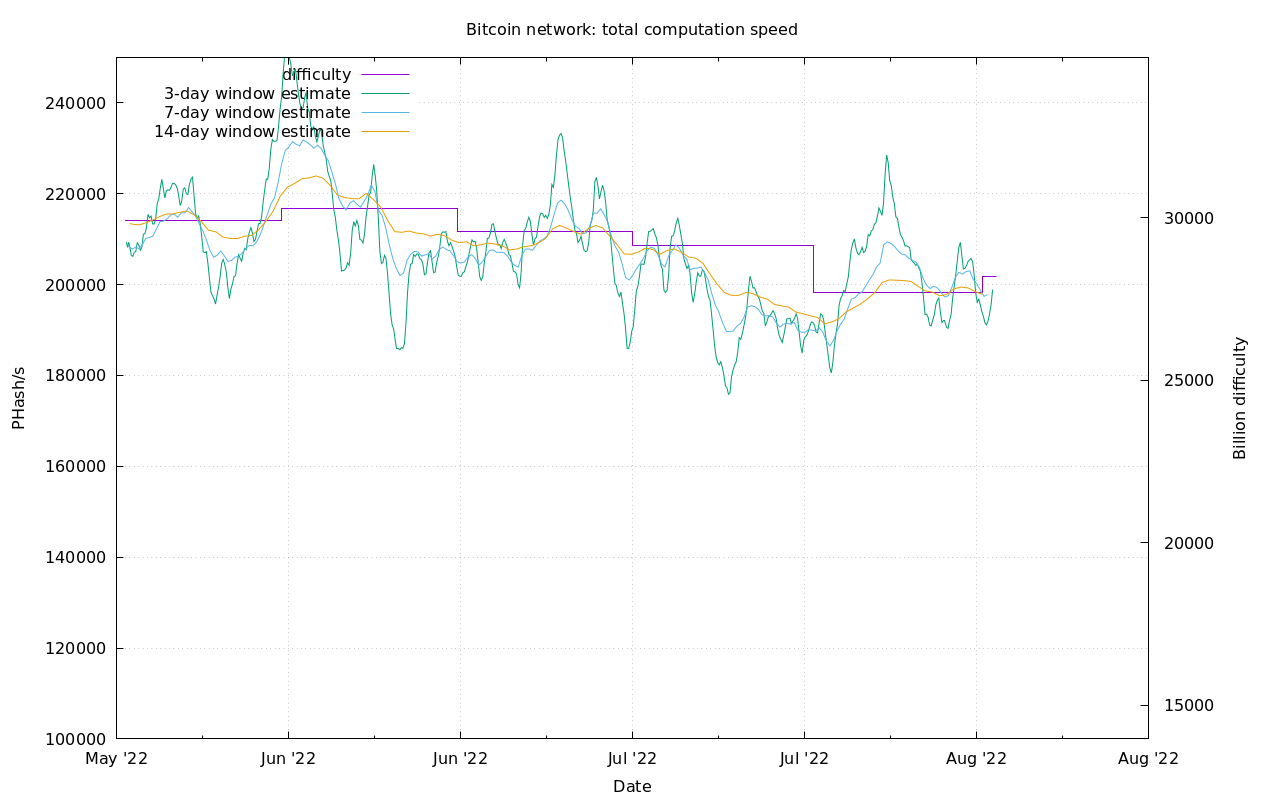

Difficulty and Hash Rate

This week saw a slight increase in difficulty by 1.74%, and at the time of writing the next adjustment in 12 days is estimated at another 1%.

Overall, mining has been stable the last week. If price takes off, expect the hash rate to do the same.

That's it for this week. See you again next Friday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

August 5, 2022 | Issue #203 | Block 748,103 | Disclaimer

* Price change since last week's report

Cover image: @BitcoinMemeHub