Bitcoin Fundamentals Report #208

This week, commentary on tomorrow's US CPI, the SEC and Gensler, price analysis with headwinds and tailwinds, mining sector news like the Biden EO.

Jump to: Market Commentary / Price analysis / Mining sector

In Case You Missed It...

Join my new Telegram Channel! Members can find the link to all past live stream recordings here.

Watching and liking the YT videos shows Bitcoin Magazine you value the contrarian takes and helps people find the videos!

- (Fed Watch) Making Sense of the European Crisis - FEDWATCH 111

- (Bitcoin & Markets) Deglobalization, Depression, Depopulation, and Deflation - E250

- (Blog) Dollar Index DXY versus Broad Dollar: Death of the Euro

- (Fed Watch Clips) New clips coming soon!

Listen to podcast here

Partnering with BitcoinDay.io

A traveling bitcoin conference. Check the schedule for a city near you!

Market Commentary

| Weekly trend | Pumping |

| Media sentiment | Negative |

| Network traffic | Low |

| Mining industry | Surging |

| Market cycle timing | Bottoming |

Dear Reader,

Welcome to the first Monday edition of the Bitcoin Fundamentals Report. This will be a slightly smaller issue, because I was traveling over the weekend to Bitcoin Day Nashville and I've been out of the news cycle for much of that time.

This is going to be an action packed week of macro related to Bitcoin. Join the telegram (link above) to stay up to date.

Ansel

Will August be the second month in a row of 0% CPI?

First up, this week will be the US CPI data being released tomorrow.

Economists are predicting the consumer price index—a key inflation metric—to have fallen by 0.05% in August (emphasis added)

"Experts" are forecasting month-over-month CPI to be slightly more NEGATIVE than last month. It might surprise people to learn that the month change in prices in July, reported widely as 0%, was actually -0.019%. If August is -0.05%, not only is it two months in a row of, it is increasingly negative, albeit very slight.

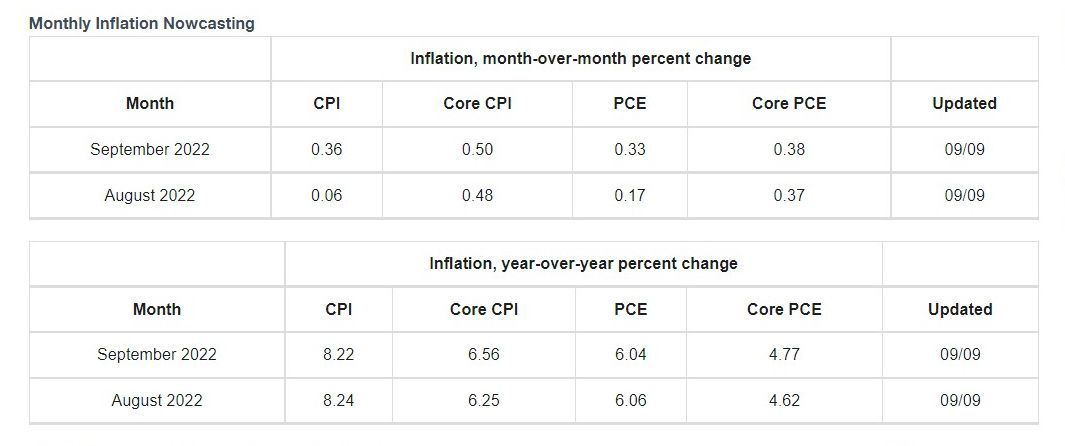

The above article also points out however that Core CPI, excluding food and energy, is expected to increase. From the Cleveland Fed which produces the "Inflation Nowcast" below, we see their forecast for August at +0.06% MoM with the YoY number decreasing to 8.24% from 8.48% in July.

I must stress that the YoY number, the one typically in the headlines everywhere as "inflation", is very misleading here. It is simply a compounding sum of the last 12 month-over-month changes. That is okay most of the time, because the MoM doesn't change very much in normal times, 0.1 or 0.2% is about the flucuation we get MoM, but it's different right now, when we had some crazy single months in the past year.

If you are interested in future trends, I recommend watching the MoM rate, it is what is happening to prices right now.

Supporting articles

Here are a couple articles that reinforce a slowing economy. When the economy slows, credit creation slows (aka actual money printing). The first article talks about the world's second largest appliance maker, Electrolux, who stated:

"market demand for core appliances in Europe and the US so far in the third quarter is estimated to have decreased at a significantly accelerated pace compared with the second quarter, driven by the impact of high inflation on consumer durables purchases and low consumer confidence."

The next article is from the NY Times with the headline

Goldman Sachs Prepares for Layoffs as Deal-Making Slows

(their site doesn't embed links very well, use Archived access )

Goldman reported in July that its second-quarter profit had dropped nearly 50 percent from a year earlier, to just under $3 billion. Revenue from Goldman’s investment banking division fell 41 percent from the same period in 2021. The firm said its backlog of deals fell, but did not say by how much. At the time, the bank said hiring for the rest of the year would slow.

Deal-making in the United States so far this year has totaled about $1.2 billion, compared with $2 billion a year ago, according to the data firm Dealogic. Initial public offerings raised about 95 percent less through the first half of the year than the first half of last year, according to EY, an advisory firm. The number of deals has fallen about 73 percent. [...]

But for now, Wall Street banks may simply have too many deal makers.

“They just don’t need as many bodies as they have,” said Chris Connors, a vice president at Johnson Associates, a compensation consulting firm. “Production has fallen off a cliff.”

The bottom line is the economy is slowing rapidly, and "inflation" or CPI has rapidly fallen. These things have countervailing effects, so where we end up is not certain. I'm leaning toward a long and mild recession, but time will tell.

SEC Makes Big Move in the space

Archived (so you don't have to give outlets that promote scams your clicks)

Gensler is notorious for never confirming that he thinks Ethereum is like bitcoin, and not a security. They have given "unofficial guidance" to that effect, but contrary to most people's beliefs, no official word has ever been given as far as I know about the official status of Ethereum. Many bitcoiners think the SEC will one day come after Eth.

Here's what he said, he supports handing the Commodity Futures Trading Commission (CFTC) the power to “oversee and regulate crypto nonsecurity tokens and related intermediaries.”

Notice the carefully chosen term "nonsecurity tokens". He believes that 99.9% of tokens are securities, and has only ever given the nod to bitcoin as being a commodity like "digital gold".

He continued: “Let’s ensure that we don’t inadvertently undermine securities laws underlying $100 trillion capital markets,” he said. “The securities laws have made our capital markets the envy of the world.”

You have to know this industry, the technology and its battles, in order to read between the lines. What he is saying is he wants to hand off bitcoin to the CFTC (the agency that regulates commodities), because that would send a clear message that everything other than bitcoin is a security. He doesn't have the manpower to charge 1000's of individual projects with securities fraud at this time, especially because their is no precedent set.

My best guess at an SEC strategy right now against scams in the space, is to set that precedent with the Ripple lawsuit. The Howey Test, which they have used for decades to determine if something is a security, needs a refresh for "crypto", and that is made in the courts, just like the original Howey case.

This understanding flies in the face of most bitcoiners' view of the agency. Many of us think the SEC is horrible and overreaching. There is only one reason they wouldn't crush altcoins, because they threaten bitcoin's rise. I don't think that is the case. The SEC legitimately doesn't know what their legal power is over these scam coins, so they are trying to get the precedent set that they want, to clarify the situation.

If they lose against Ripple or settle? That puts the ball back in Congress' court. They will have to pass regulation specific to altcoins/bitcoin, which is more dangerous for bitcoin in my opinion.

🔥 Who would you want making regulation in this space, your typical Congressman idiot in a partisan bill, or a Professor from MIT that taught a bitcoin course who loves Satoshi with court precedent?

A new report investigating why the U.S. Securities and Exchange Commission has denied 16 companies' bitcoin ETF applications, which revealed the refusals are most likely due to a "larger political agenda" on "Mornings with Maria" Monday.

Perianne Boring, Chamber of Digital Commerce founder: "our best guess and our conclusion is that this has little to do with the industry not being able to meet the SEC standards to bring an ETF to market, but it has a lot more to do with a larger political agenda."

Of course, I've been saying this for years, that they simply don't want to approve a bitcoin ETF for political reasons. However, Perianne blames Gensler himself, which I disagree with. He has shown nothing but support for Bitcoin. If it were up to Gensler, he'd approve a bitcoin ETF today. The SEC falls under the executive branch, so ultimately it is the President, or the President's handlers, who are against the bitcoin ETF.

Now that makes a lot of sense. The globalists control Biden and Yellen, they manipulated Trump. It is the technocrat globalists that are holding this back, but it won't be for much longer. The tide is changing.

Quick Price Analysis

| Weekly price* | $22,389 (+$2,414, +12.8%) |

| Market cap | $0.429 trillion |

| Satoshis/$1 USD | 4,463 |

| 1 finney (1/10,000 btc) | $2.24 |

Last issue I concluded:

Overall, the risk of a dramatic sell off remains low. I expect the bitcoin price to continue sideways to slightly lower this week, but to find some footing very soon. By the end of the month, I think bitcoin has its reversal.

I also spent a lot of time on that last issue showing the 3 impulse behavior. We got the "timid" 3rd impulse lower I was expecting, and boom! It shot upwards. That is a 20% rally off the bottom folks. That's huge in this environment.

Daily chart

An interesting look on the daily chart above. You can see the black dashed line at the bottom showing price did not reach new lows.

The red dashed line is a significant level at $22,500. It served as resistance on July 8th, support on August 4th, and now is providing a little resistance.

The two solid black lines above the price are previously reported levels of interest, $29,000 and $31,500. They are important because of horizontal levels and trading volume there.

Price surged right into the 50-day moving average, breaking through relatively easily actually. The 200-day moving average is showing a nice convergence with our level of interest at $29,000.

Above the areas on the right hand side is the volume at those particular price levels. These areas tend to draw attention like a Schelling Point, attracting trading orders. We are approaching the first zone of volume resistance around $23,000. The next zone is $29,000.

Headwinds and Tailwinds

Ethereum is a major headwind.

The Ethereum Crisis recap for readers. I know some of you read this newsletter to get a summary of the goings on in the space, and you might not know what the Ethereum Merge is. I don't have the room here, so I wrote a quick post on my other blog to explain things a bit more. Check it out if you need a speedy explanation of the Merge.

The estimated merge date is in two days. Lots of ink has been spilled on calling it a "sell the news" event, but I'm not so sure. The first half of that saying is "buy the rumor", and we haven't seen much of that.

My intuition is saying that the upgrade will initially work, with a few minor fires put out on the first day of the merge. Then a week later or so, big problems will appear. Price won't crash, but it will be a controlled exit of Ethereum. - Last week

Whether or not the Merge has issues, just getting passed the uncertainty of it all will be good for the bitcoin price. If the Merge goes okay initially, like I expect, the ether price should rally becoming another added tailwind for bitcoin.

Stock Market

Last week I said, "the correlation between stocks and bitcoin could turn from headwind into tailwind this week." I think it is doing just that. Here's the US S&P 500. (Also, note that European and Japanese stocks are also rallying.)

This was one hell of a call. The stock markets bounced right in the "Golden Pocket" that I have been pointing out for weeks as the possible bottom. The first little resistance level (red line) has affected price today, but it isn't very strong, and I don't expect it to stop the stock rally for long.

The stock market should continue to rally, because the fundamentals remain the same. Record cash on the sidelines, stock buyback season, CPI coming down and an increasing chance of a Fed pivot, and the Red wave in mid-terms will be seen as stopping some of the uneconomic globalists policies and bring back the "Trump economy".

None of that has changed. In fact, some of those things are getting even stronger. I'd also like to add in here, that many market metrics are very bearish in the economy, and most people are waiting for the other market-crash shoe to drop. But what if this is simply a crash in nominal GDP? Yes, there is pain going from 6.6% rate in Q1, and 7.8% rate in Q2, to maybe 3-4% in Q3, but CPI is also dropping quickly.

The resulting recession might be characterized by a long, but only slightly negative recession. In essence, the US economy will return to the post-GFC normal of low growth and low inflation, and that environment is good for asset prices like stocks and bitcoin.

Price Conclusion

Bitcoin received a surprise boost of adrenaline this week. Price has approached the first level of resistance, if it breaks, I expect the rally to continue much higher.

The uncertainty from the Ethereum Merge Crisis is nearly over. The most likely outcome in my opinion is initial success (or maybe better put as a lack of failure right away). Either way, it should be positive for bitcoin's price as the market uncertainty is diminished. The only outcome that would negatively effect the bitcoin prices is an immediate and chaotic failure.

Stocks have rebounded while economic metrics are starting get more negative. Many people expect a horrible recession, but I think the odds are more likely that the deteriorating economic numbers are just a signal that GDP is slowing from a very high nominal print in H1. When matched with crashing CPI, perhaps we only get minor negative prints for GDP.

Overall, it appears the bottom for bitcoin is in for now. Supply is drying up fast. Who would sell bitcoin right now? No one, that's right. The most likely path for the bitcoin prices is higher, aiming at the level I've been talking about for months, $29,000. Perhaps we get there this week.

Mining

| Previous difficulty adjustment | +9.2603% |

| Next estimated adjustment | 3.5% in <1 day |

| Mempool | 3 MB |

| Fees for next block (sats/byte) | $0.16 (5 s/vb) |

| Median fee (finneys) | $0.03 (0.013) |

Mining News

I had the opportunity this weekend to speak with an expert from the mining industry in Nashville at Bitcoin Day. He had some interesting things to say.

He is was extremely bearish on the price of bitcoin and the mining sector specifically. He said that there is a major miner capitulation event each cycle and that has not happened yet.

Sure, some miners have sold a bunch of bitcoin, but the next step is selling their miners or closing their doors, in his opinion.

I have reported here on a couple stories of miners selling their miners, and certainly miners will go out of business, but the mining sector is much more robust today than cycles in the past. They have access to capital that simply wasn't there before. They can borrow to make ends meet. Plus, the hash ribbons are showing capitulation over.

Also, when miners go bankrupt their mining equipment doesn't disappear, it gets picked up cheap by new miners, or home miners or anyone. So even if they capitulate, hash rate will not disappear for long.

Lastly, we should weigh the effect of miner capitulation less and less each cycle naturally, because the mining reward is getting cut in half each cycle. The first cycle, miners had a much higher percentage of coins that they would dump on the market when they capitulated. In the beginning, they mined 7,200 coins a day. Now, it's only 900/day. Capitulation by market selling their bitcoin is less impactful.

White House Executive Order about Bitcoin

So many critics over the years have said the US government would come after Bitcoin. Okay, so here it is, the long awaited executive order, using input from many government agencies. Surely it is horrible for bitcoin right???

Nope. Via Bitcoin Magazine:

U.S. President Joe Biden signed an executive order (E.O.) on Wednesday that actively calls for policy on Bitcoin and other cryptocurrencies as well as “urgent” action towards developing a CBDC. The order outlines a “whole-of-government” approach, where a significant amount of regulatory agencies are called to collaborate in the research and development of digital assets and related regulation.

They are obsessed with a Central Bank Digital Currency (CBDC). Or, more specifically, the globalist Marxists in charge of the White House right now, and the EU, are obsessed with a CBDC.

The Federal Reserve knows well, what's up with CBDCs and doesn't want them. Former Vice Chair Quarles has said it bluntly, as well as Minneapolis Fed Governor Kashkari recently said something to the effect, paraphrasing, "I see no need for a CBDC. It is a solution in search of a problem." Chairman Powell himself has been underwhelmed by reasoning for a CBDC, stiff arming it every time it is brought up.

It is clear the Fed does not want a CBDC, and hence, the US won't have one, despite what the President with dementia says.

The executive order also touches on illicit use of bitcoin ("crypto") which is a silly comment, because only 0.3% of transactions in bitcoin have been attributed to illicit uses, MUCH less than the dollar itself.

Lastly, it regurgitates the false environmentalist narrative. These globalist Marxists probably think this is a homerun against bitcoin. LMAO! They are so deluded. The world is rapidly turning away from the fake science and alarmism of climate change. Despite that, the strongest arguments that have been honed over the last couple of years for bitcoin is around its massive BENEFITS to the power grids and free market financing of alternative power uses.

It's as if the White House isn't paying attention. Typical. The market has basically ignored this executive order so far.

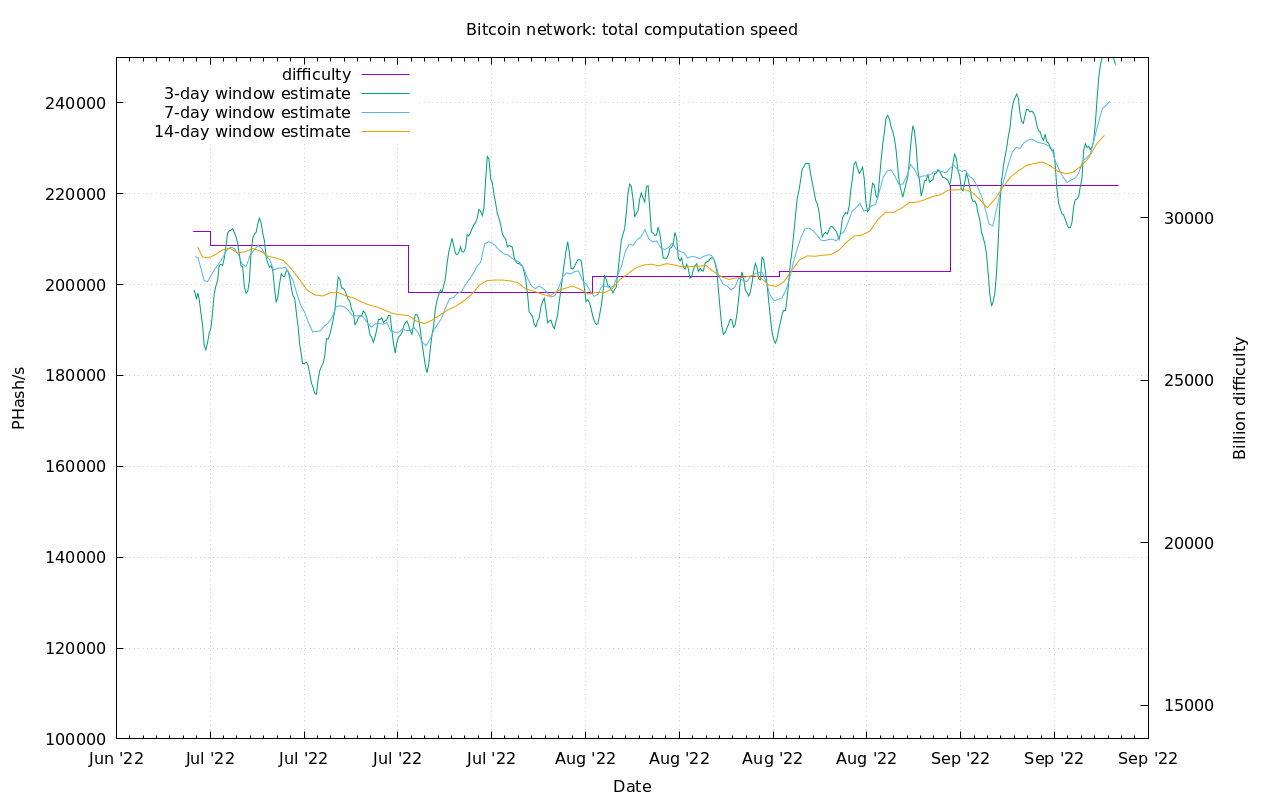

Difficulty and Hash Rate

Hash rate is literally off the charts this week. LOL It surged to an ATH, even at these prices!! The mining sector is extremely healthy.

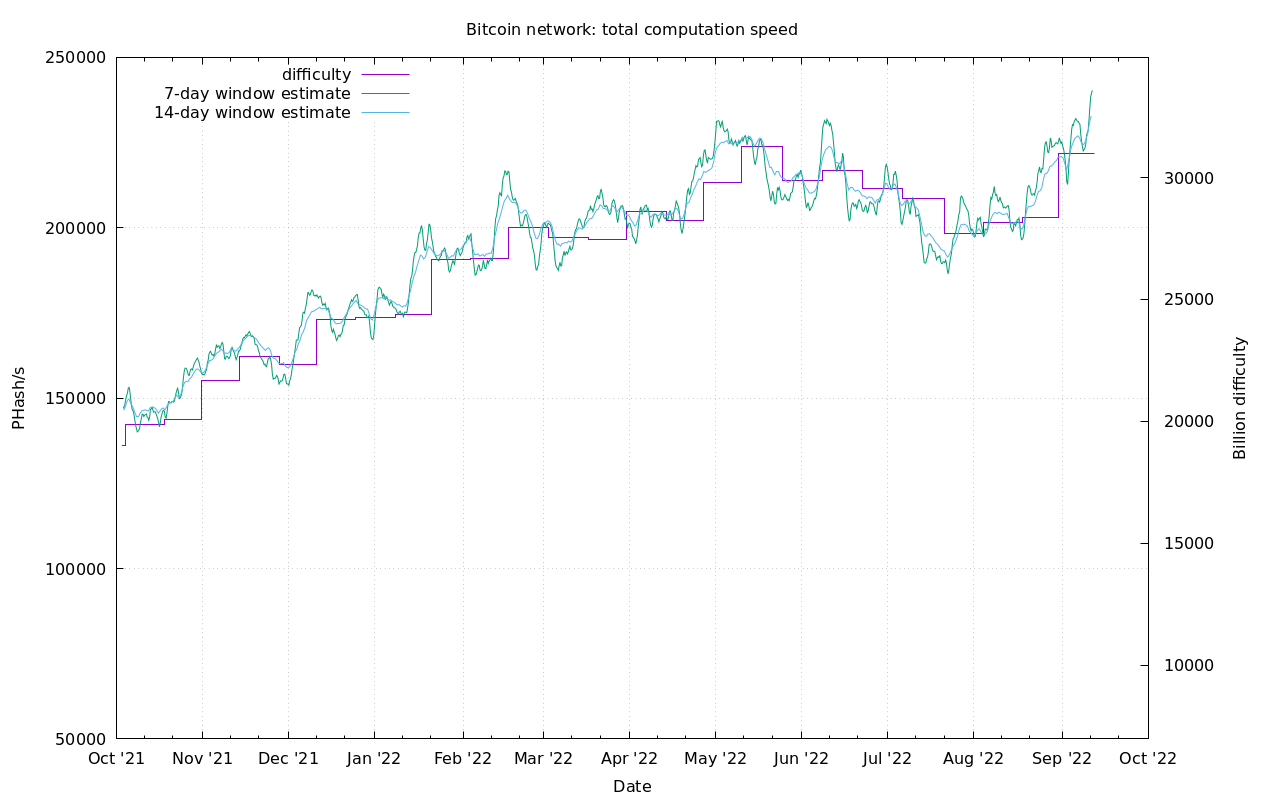

Let me zoom out a little...

The mining sector is extremely robust right now. Despite what the mining expert told me this weekend, I do not expect a miner capitulation - if it even happens - to be likely at all.

That's it for this week. See you again next Friday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

- Feedback is always welcome. Please contact me via Telegram or Twitter (both @ansellindner). I'm constantly trying to elevate my content and add value for my readers, listeners and community members.

September 12, 2022 | Issue #208 | Block 753,844 | Disclaimer

* Price change since last week's report