Bitcoin Fundamentals Report #210

Jump to: A case for optimism / Why be bullish bitcoin now? / Italian elections / Price analysis / Mining sector

In Case You Missed It...

Join my new Telegram Channel! Members can find the link to all past live stream recordings here.

- (Fed Watch) Fed Policy and European Energy Crisis ft. Andreas Steno - FED 113 (Full Video)

- (Members) A week's worth of live streams uploaded to the Member Drive!

⬇️ Third hour of the below video ⬇️

Listen to podcast here

Market Commentary

| Weekly trend | Spartans Holding the Line |

| Media sentiment | Very negative |

| Network traffic | Low |

| Mining industry | Stable/strong |

| Market cycle timing | Looking for bottom confirmation |

A Case for Optimism

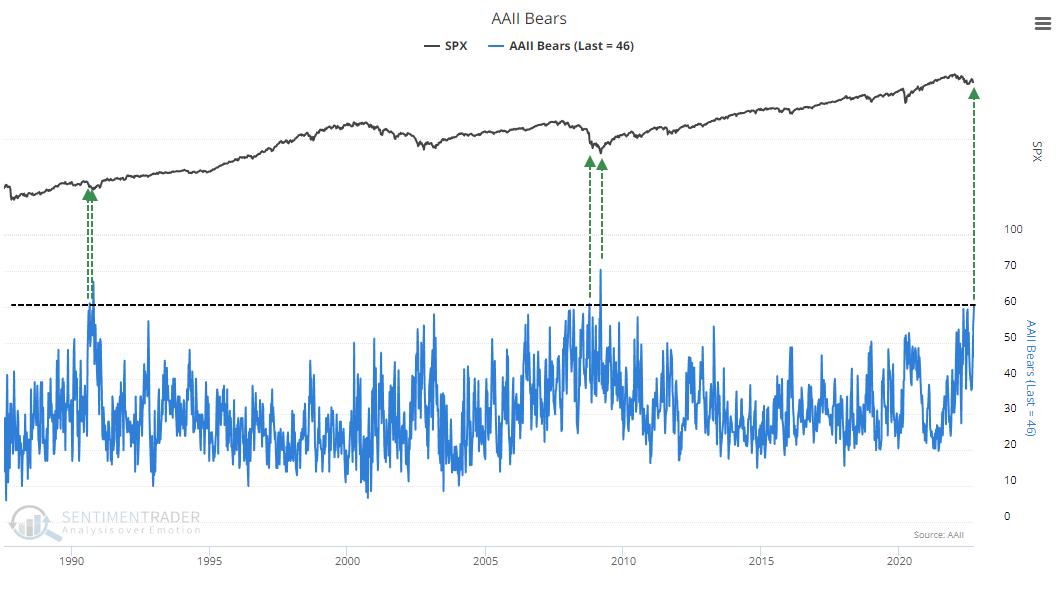

One would be excused for being extremely bearish on the economy right now. When I look at my timeline, all I see today is bearish tweets getting thousands of likes, while quasi-optimistic takes similar to mine, are left cold with no traction.

This does not mean that the economy is going to crash in the immediate future. All it means is people are finally feeling the way they should given the economic numbers from several months ago. Their sentiment is backward looking.

Back then, I was on my podcasts and twitter, in March of this year and earlier, saying, "We are in recession right now." The dollar was relatively weak, oil was relatively strong, and called for the reversal of these trends. I expected a strong dollar and weak oil because we WERE ALREADY IN RECESSION.

What a strange concept, that we can predict market sentiment months in advance with a little data and the proper framework. Now the data is starting to shift. Sentiment is at extreme bearishness, but that is with a lag of 6 months of market conditions.

What we are experiencing today, is everyone coming to grips with what I have been talking about for months. Seemingly everyone thought "inflation" was here to stay, not knowing that for persistent "inflation" to be the case, we need a way to pay for higher prices, else higher prices just lead to recession and lower prices.

It's all connected. Higher prices were caused by a supply shock, so we couldn't afford the higher prices. If higher CPI was really caused by money printing, the economy could afford the higher prices because there would be more money. The fact is, there was no Biblical flood of money printing, it was a supply crunch. Higher prices could not be sustained, the economy crashed and CPI came back down (now at 0.6% annualized in July and August). I've been saying this would happen for literally over a YEAR!!!

Now, people are being forced to accept reality, but the market consensus is always exactly late. The average investor sells at the bottom and buys the top.

So... the bear market is very close to over. When sentiment is record bearish, it is very likely to improve from there. We can't forget the trend is still your friend, inertia may drag markets a little lower, but that only makes things even more likely to improve in the future.

Why be bullish bitcoin here?

Bitcoin has been surprisingly resilient over the last several weeks. Despite a global risk-off environment, a severity of which we haven't seen since the Covid crash in 2020. The March 2020 crash was not sustained either. For a similar sustained global risk-off environment like today, we have to go back to 2009. Bitcoin was just being released then.

All assets are crashing. The classic 60/40 portfolio has been shellacked. It is the worst time to be an investor in more than 12 years, yet bitcoin has maintained its June low, around the previous cycle high. That alone shows bitcoin is MUCH more resilient than the talking heads on CNBC who missed bitcoin the whole time, want you to believe. It is extremely bullish. There is massive support at this level, and panic selling has been exhausted.

Bitcoin has also withstood several barrages by governments during this time. The EU is attacking mining, along with New York State, major exchanges have been more closely regulated, billion dollar Ponzi schemes in the altcoins have blown up, which did more damage than their actual size because they were highly leveraged, the Central Bank Digital Currency rhetoric continues to heat up, creating the false appearance of government competition to Bitcoin, and the White House fired their shot with the Executive Order outlining a Bitcoin framework which barely even concerned bitcoin at all.

The sum of all these events should have been extremely bearish for Bitcoin, yet it sits very close to $20,000 on solid support at previous cycle highs.

We've also had some major positive developments during this time, Blackrock will allow bitcoin trading through their Aladdin platform, and allow their clients to buy and hold actual bitcoin, through a custodian of course. Mining scored huge in the Texas grid emergency, proving bitcoin mining strengthens grids. Mining is also winning with monetizing flare gas, aligning the incentives of the large influencial oil and gas companies with bitcoin holders. Lastly, several countries have admitted they see a strong role for bitcoin as neutral international money.

Overall, bitcoin remains very strong despite the overwhelmingly bearish economic environment. What happens when things start getting better, which is closer than most think?

All in all, this is one of the most bullish times in bitcoin's history! Bitcoin has proven itself very strong and here to stay, and people are starting to get it in a very big way.

I Called Italy Perfectly!

I called this election weeks ago on my Telegram channel. People didn't believe it, but after I heard the speech from where the below clip was taken, I said, "She will be the next PM of Italy." If you can listen to this and not think we are winning versus the global Marxists, I don't know what to tell you.

I do not think Meloni will fight the EU head on. I don't think she'll even concern herself with the EU initially, and that itself will make them hysterical. Get ready for some hilarious globalists temper tantrums.

All it will take to topple the globalist agenda is to simply say, "No". If she takes common sense steps to secure Italians' prosperity and security, the EU will be forced into harsh retribution, sealing their fate sooner. She could fly to Moscow within a month to negotiate a unilateral trade deal for natural gas with Russia.

With the Italian conservatives in power in Italy, conservatives in power in Hungary and Sweden, that is a huge block to frustrate anything the EU, NATO or the globalists want to do.

Great thread here by Andreas Steno!

Initially, markets will be confused. What do the last days of the EUR and the EU mean? European markets could sell off violently at first, but once people calm down and see that conservatism in the EU means lower energy, lower regulation, and the national governments support of domestic businesses, things will get better quickly.

Quick Price Analysis

| Weekly price* | $19,165 (-$810, -4.1%) |

| Market cap | $0.367 trillion |

| Satoshis/$1 USD | 5,218 |

| 1 finney (1/10,000 btc) | $1.92 |

Last week,

I expect the bitcoin price to continue sideways to slightly lower this week, but to find its footing again very soon. By the end of the month, I think bitcoin has its reversal.

We did go sideways to slightly down, despite all the bears.

Daily chart

There is not much to say about the daily bitcoin chart this week other than it is still holding the June lows like a champ. Resistance above the price continues to increasing and diversify, i.e. volume by price, diagonals, horizontals, etc. Any breakout upward will mean we have broken some resistance zones by definition.

This can be a very precarious position for price. The more times it tests support at a certain level, the more likely that level is to break, because the repeated tests suck up all the bids.

Per the chart above, we have tested this zone at least 5 times. There could be a marginal breakdown as a head fake, after which the price pumps. There is little volume of sellers to overwhelm buyers, it's just that people going to buy here have bought already. Bitcoin will find new demand a little lower, say $18,000.

Weekly Chart

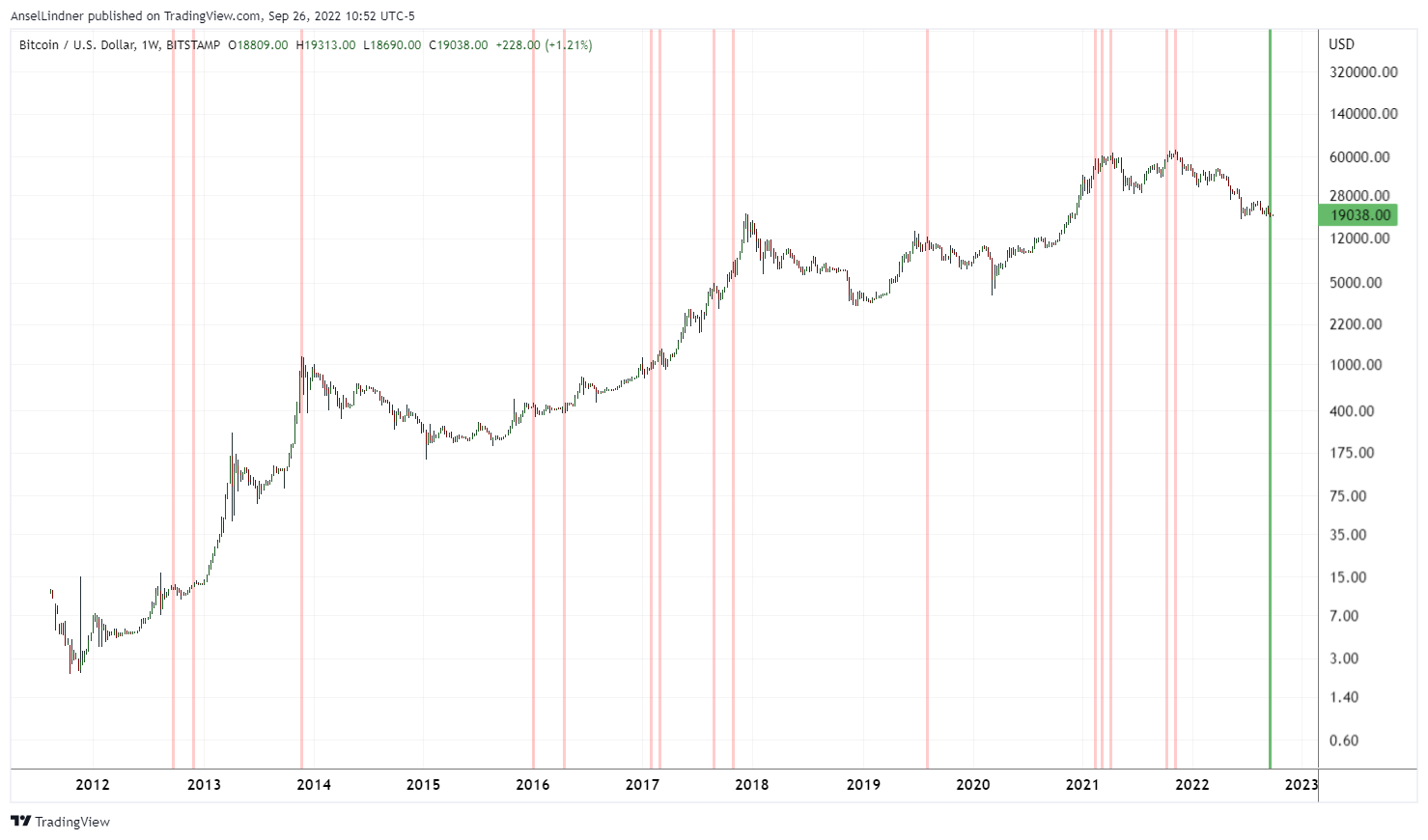

The real WOW moment in the charts this week is the weekly bullish divergence. This is the first weekly bullish divergence in Bitcoin's history!

It's hard to overemphasize this point. Bitcoin has never had a weekly bullish divergence, ever.

What is a bullish divergence? It is where the price makes a lower low, but the momentum oscillator does not. This puts the two in divergence. It is bullish, because the momentum has turned toward the reversal, but the inertia in the price trend has not yet changed.

Below is the whole history of BitStamp, one of the early big bitcoin exchanges that is still in operation. Notice all the red lines, showing weekly bearish divergences. Then see the lonely green line on the right, the first ever weekly bull div.

A note of caution here. If the current weekly candle ends up red (a close below $18,810), that will invalidate the bull div. However, unless price has a dramatic crash, which I think is highly likely the RSI will remain in divergence, and the next green weekly candle will be the bullish divergence. In other words, whether it happens this week or not, a weekly bull div is almost certainly on its way.

One path I can see happening is throughout the week, the bitcoin price fakes lower, initially invalidating the bull div, then bounces and rallies by the end of the week to reopen the divergence. Anyway, just a thought.

Bitcoin adjusted for dollar strength

This idea came from a tweet by @Croesus_BTC. He writes,

This is BTCUSD*DXY, which normalizes BTC price vs. dollar strength. #Bitcoin. Sure looks like it's forming a bottom, in dollar-adjusted terms. Looks a lot like early 2019.

Very interesting that it held the previous cycle high as well.

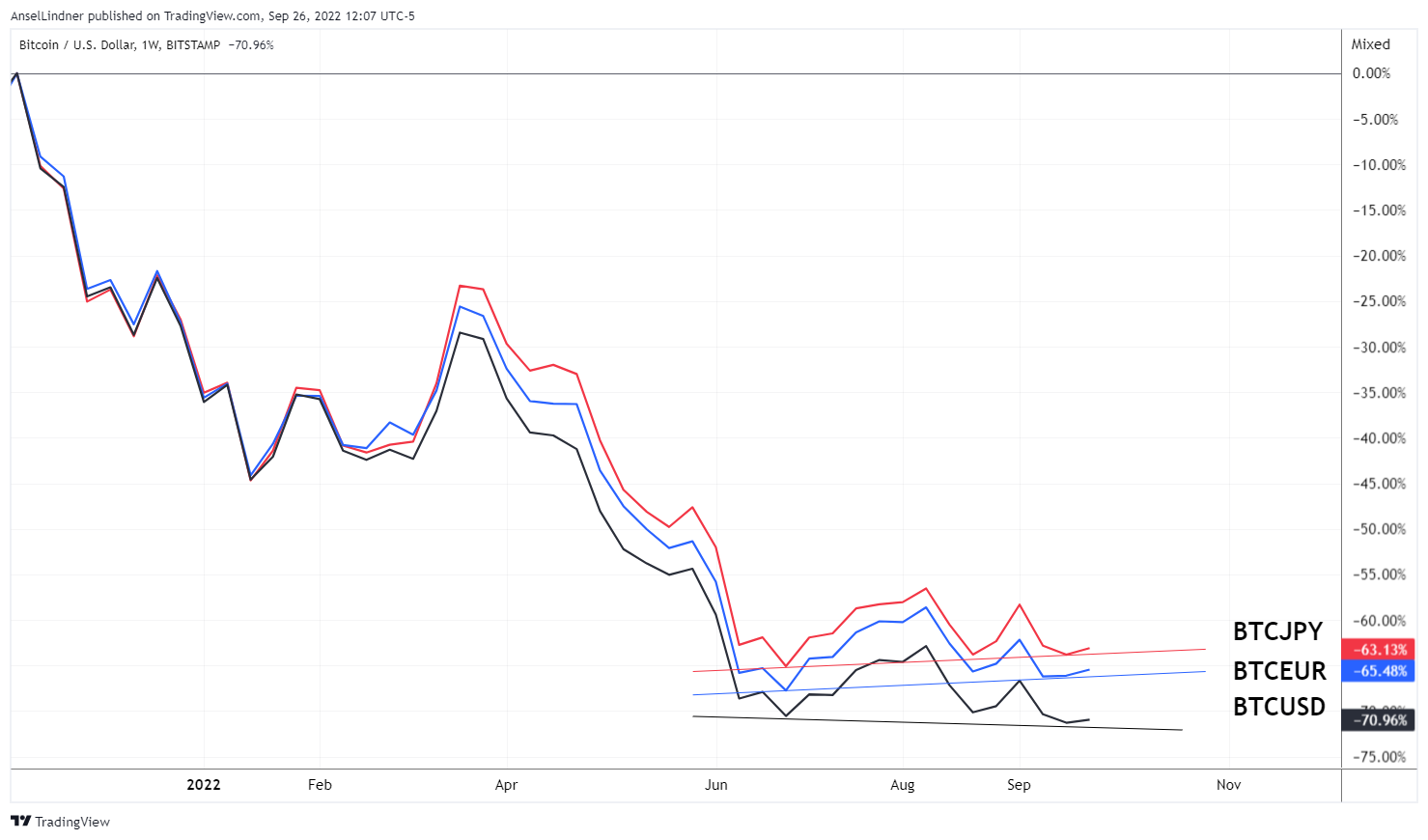

Bitcoin priced in other currencies which are crashing versus the dollar, could rise enough to kick off a bull market.

Notice below, despite the economies and currencies of the Europe and Japan experiencing crisis levels, bitcoin is trending higher. I think this point will be missed by people. If it is universally true that bitcoin sells-off along with other risk assets, why would it be trending higher versus currencies that should be more risk off?? This tells me that bitcoin is acting somewhat like the dollar versus these currencies!

Headwinds and Tailwinds

Ethereum is still chugging away, but has slipped into the background in the news cycle. They probably like that, because the SEC's rhetoric was getting a little hot for them, and now they can hatch their next pump marketing scam quietly.

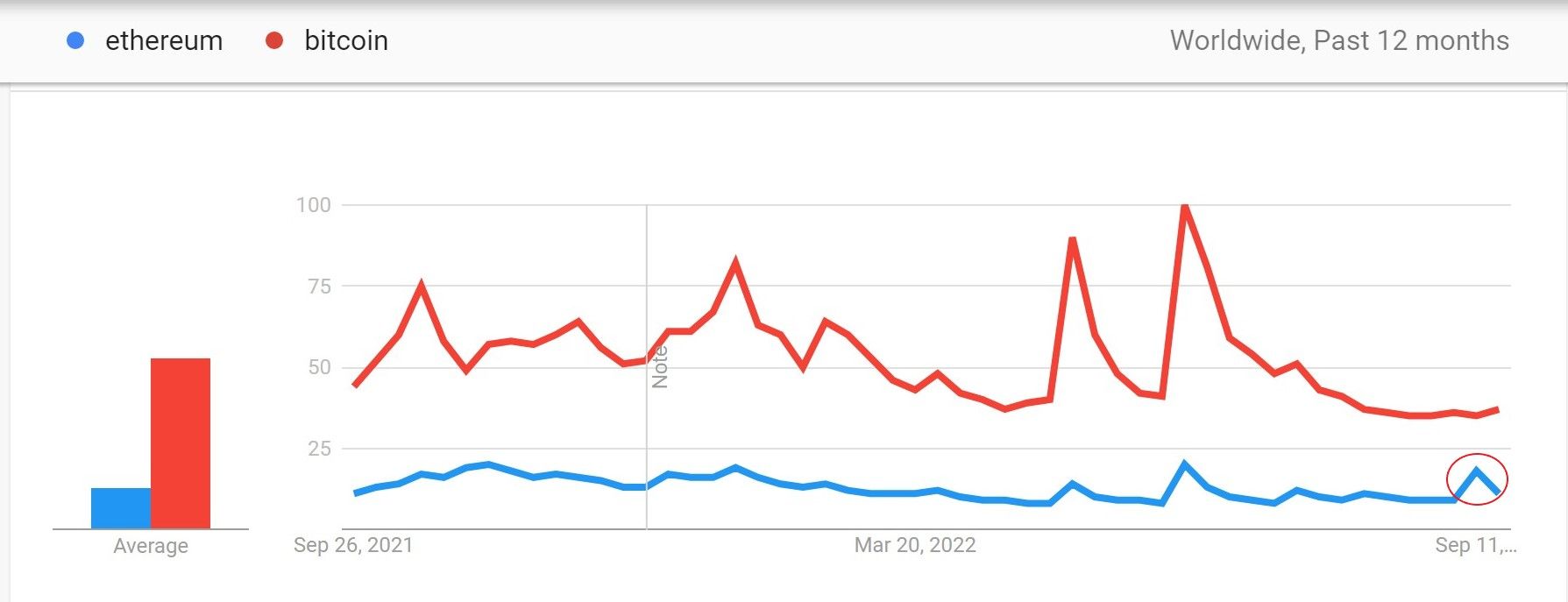

Despite what these altcoin scammers try to say Ethereum is where all the attention and action is, and bitcoin is old tech, we know that's crazy. Search volume is down for both Bitcoin and Ethereum, but after a tiny blip of interest around the Merge, Ethereum is again taking its place in bitcoin's shadow.

Ethereum has become less of a headwind or tailwind for bitcoin, but I thought to include it here, just to wrap up talking about it each week.

Stock Market

My call price call on the stock market was wrong, but my reasoning is still correct.

1) Recession is old news

2) CPI has peaked and the Fed will reverse, even they say it

3) Cash on sidelines waiting

4) Consensus is selling the bottom again

5) Post-GFC normal is bullish stocks because few other places to put your money

6) Capital flight to US assets

7) Populism is actually bullish (factually "Trump's economy" was better, and sentiment-wise populism makes people feel better)

Strong Dollar

Seems everyone is talking about the strong dollar wrecking ball, but where were they back in 2018 when I started talking about it? I saw a great quote today. McElligott, at Nomura Research said, "everything else is an emerging market."

The dollar has been on an incredible move. Today it hit 114.51. The Euro is at $0.96, the Yen $0.0069, and the Pound crashed overnight from $1.12 to $1.03!! The Forex market is wound so tight, the smallest whisper from the Fed just acknowledging the problems, would be enough for a month-long consolidation.

An energy crisis driven by sanctions and massive bids from European countries all at once, is one thing, but currency pressure is a whole other thing. An analogy might be between pressing a heavy weight versus getting shot. The former requires coordinated effort, but the latter requires instant evasive action.

Trillions of dollars can be wiped out over night, financial flows can freeze, a balance sheet daisy chain can explode.

This could be the "until something breaks" moment we've been waiting for. Pressures are peaking.

Price Conclusion

Summarizing...

Bitcoin is holding the lows still despite crazy bearishness. It weathered the Fed's rate hike well, once again.

Ethereum is disappearing from the conversation. Altcoins, wrongly viewed as substitutes for bitcoin are losing mind share.

Many reasons stocks could put in a double bottom.

The strong dollar crisis is coming to a head, which could force governments and central banks to act. CPI has peaked, but central bankers are still signaling more tightness as currencies implode.

Overall, the risk of a big sell-off remains elevated this week, but I expect past relative strength to continue. A fake-out lower followed by a bounce is a definite possibility. Bottom line, now is not the time to be overly bearish, start looking for the reversal and BTFD if it comes. I expect this week in bitcoin to be the most exciting in months. Hold on to something.

Mining

| Previous difficulty adjustment | +3.4487% |

| Next estimated adjustment | -1.6% in ~1 day |

| Mempool | 4 MB |

| Fees for next block (sats/byte) | $0.40 (15 s/vb) |

| Median fee (finneys) | $0.27 (0.141) |

Mining News

Archived (so you don't have give your clicks to altcoin promoters)

A couple weeks ago, when I traveled to Nashville, I had dinner with a group of industry people. Sitting across from me at dinner was a mining operator from a large bitcoin mining host, meaning they host your mining equipment for you. I can't remember his company, it might have been Compute North.

At dinner this engineer repeatedly said the bitcoin price had yet to bottom because there had not been the mandatory miner capitulation yet. I disagreed, there has been plenty of capitulation, but he was adamant.

Now it turns out that the large mining host Compute North has filed for bankruptcy. Maybe that is the capitulation he was adamant about?

Anyway, hosted mining has always been a pretty bad investment. They have a margin on top of self-mining, so during market down turns they will have big problems. In the past, mining hosts would simply disappear, or it was a Ponzi scheme from the beginning. At least now, these companies are more legit and file for bankruptcy.

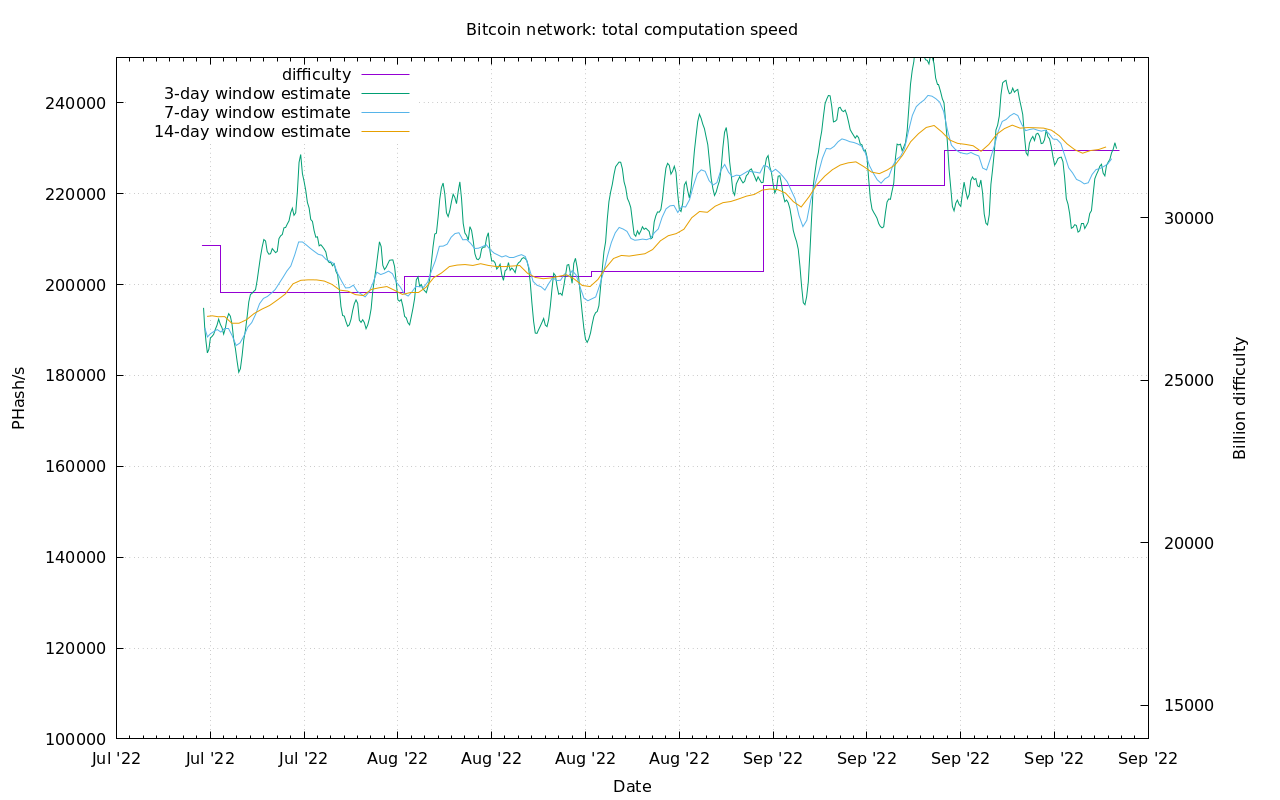

Difficulty and Hash Rate

Bitcoin hash rate is extremely stable, showing no signs of imminent price pressure. We are on schedule for a slight difficulty decrease tomorrow, which should relieve some marginal pressure on miners. However, if price does dip, new challenges could cause some miners to switch off a few of their machines, and or tighten their belts even more by trimming their workforce.

That's it for this week. See you again next Friday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

September 26, 2022 | Issue #210 | Block 755,829 | Disclaimer

* Price change since last week's report