Bitcoin Fundamentals Report #211

Bitcoin headlines, GBTC discount, SEC, Powell on DeFi, UK and Credit Suisse, price analysis section, mining and Lightning Network.

Jump to: Market Roundup / Price analysis / Mining sector

In Case You Missed It...

- (Fed Watch) Bank of England Pivots First ! - ft. David Lawant - FED 114 (Full Video)

- (Fed Watch Clips) Two new clips this week! Like Zoltan Pozsar is Wrong, Bitcoin Wins

- (Members) A week's worth of live streams uploaded to the Member Drive!

Join my Telegram Channel! Members can find the link to all past live stream recordings here.

⬇️ Third hour of the below video ⬇️

Listen to podcast here

Market Roundup

| Weekly trend | Fighting and stable |

| Media sentiment | Very negative |

| Network traffic | Low |

| Mining industry | Surging |

| Market cycle timing | Looking for bottom confirmation |

Bitcoin Headlines

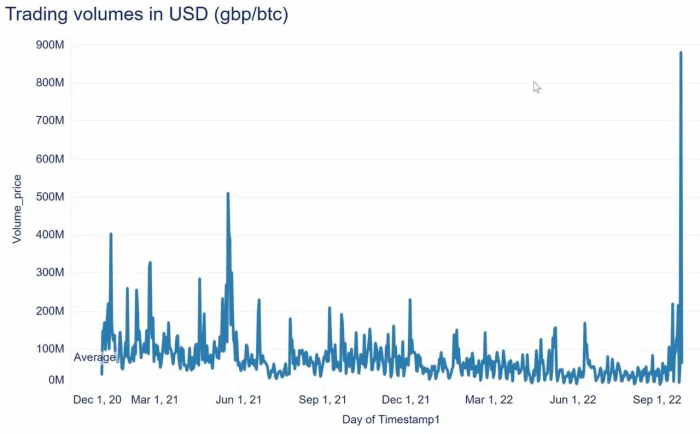

Right as the UK was experiencing massive financial stress, the volume of bitcoin traded against the Pound spiked. This could be the start of people realizing bitcoin offers a safe haven against currency weakness.

Of course, bitcoin's recent show of strength despite other risk assets like stocks sliding, it a very big vote of confidence.

Grayscale is undoubtedly backed by real bitcoin. This is a huge opportunity to invest in bitcoin at a 35% discount. I expect this spread to disappear rapidly when bitcoin's reversal is confirmed.

"The law is clear on this. I believe based on the facts and circumstances most of these tokens are securities," says SEC Chair Gary Gensler. "When a group of entrepreneurs is raising money from the public and they're anticipating a profit, they need disclosure." - @SquawkCNBC

Central bankers talk about DeFi on a video conference. The message is clear, it can and will be regulated. The main points are that DeFi is not decentralized (as we all know, it's just a marketing trick for scammers), in fact it is centralized to major exchange houses that provide liquidity and other services.

This does not really affect Bitcoin currently. But any regulation around DeFi today, will inform future building of legitimate platforms using Bitcoin.

Macro headlines

According to @SecBlinken, the Nord Stream pipeline bombing "offers tremendous strategic opportunity for the years to come." Too bad that this tremendous opportunity for DC bureaucrats will come at the expense of everyone else, especially this coming winter. pic.twitter.com/T2eacQUuBF

— Aaron Maté (@aaronjmate) October 1, 2022

Secretary of State Anthony Blinken answers the question, Qui Bono?, who benefits, from the Nordstream pipeline sabotage. It is the perfect way to separate Germany from future Russian dependence/influence in the wake of the upcoming US failure in Ukraine.

The Bank of England makes a 180 degree turn on monetary policy. They have been hiking rates aggressively like the Federal Reserve, but this week something broke for them. Interest rates on their government bonds broke loose and shot upward. The market rapidly put massive pension funds in danger of liquidation!

The speculation now is if the problems in the UK will have a contagion effect on the rest of Europe and the US. Damn right it will. People have already started looking at Credit Suisse and Deutche Bank as possibly the next banks to go bust.

I personally think it will have contagion, but it'll take a while to build to crescendo. Most likely it will be another sovereign/central bank though. The big major banks are actually quite well capitalized, and they have an implicit backstop from the central banks.

Price Analysis

| Weekly price* | $19,570 ($405, 2.1%) |

| Market cap | $0.375 trillion |

| Satoshis/$1 USD | 5,112 |

| 1 finney (1/10,000 btc) | $1.96 |

Last week,

Bottom line, now is not the time to be overly bearish, start looking for the reversal and BTFD if it comes.

Daily chart

This week has, once again, been quite boring on the daily bitcoin chart. We are staying above the lows and have a very slight upward trend. It has room to run to the red diagonal trend line, or dip to the gray support box.

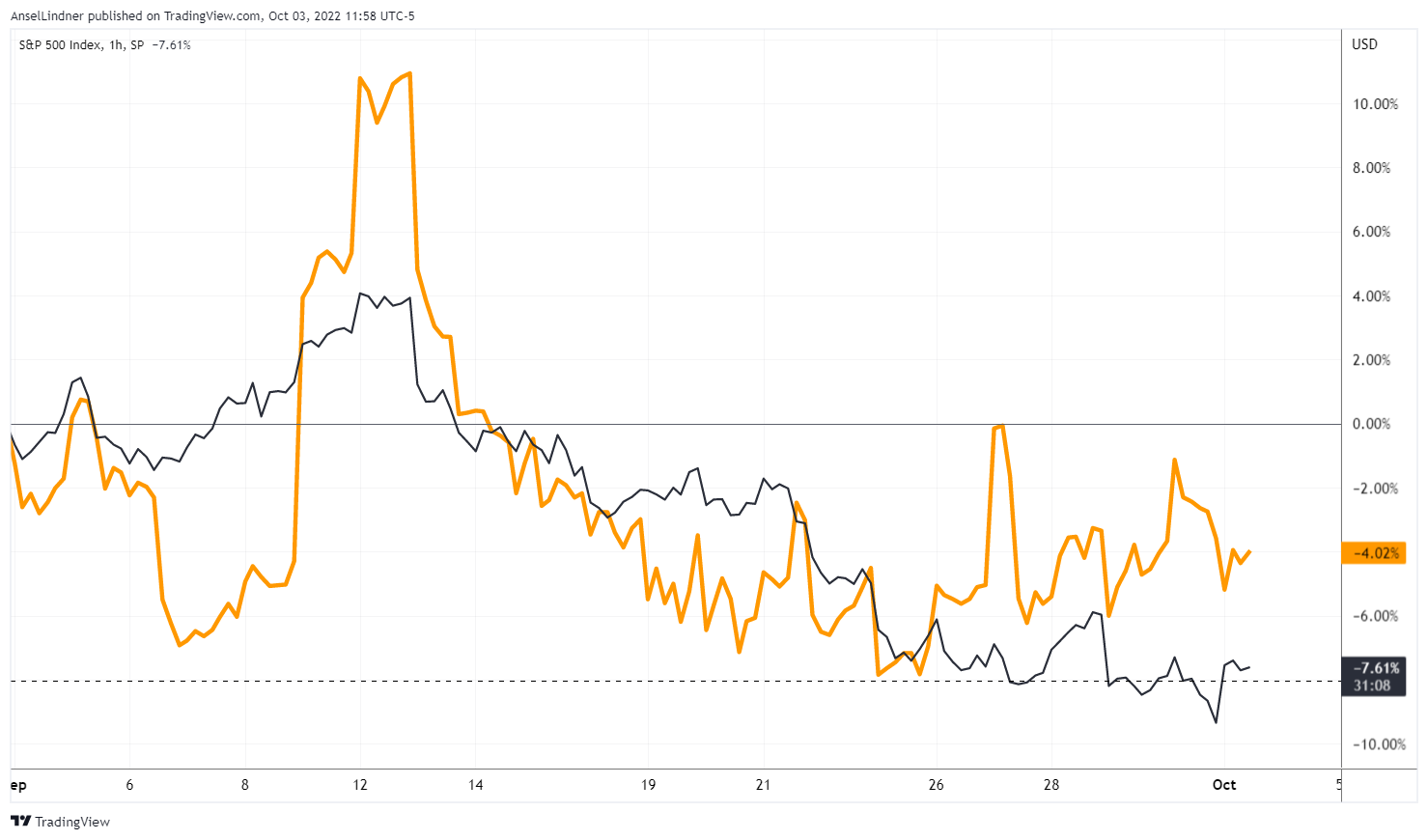

Over the last week bitcoin has really stood out, outperforming stocks. Below, the whole month of Sept showed bitcoin holding its own, actually dropping less in the month than stocks.

Weekly Chart

The big news yesterday was the confirmation of the first weekly bullish divergence in Bitcoin's history! That means the price closed lower, but the momentum indicators closed higher, resulting an a high probability of a reversal.

I wrote about this last week, not much more to say here, other than this is not being talked about anywhere, and I think it is very significant.

Dollar stress and macro

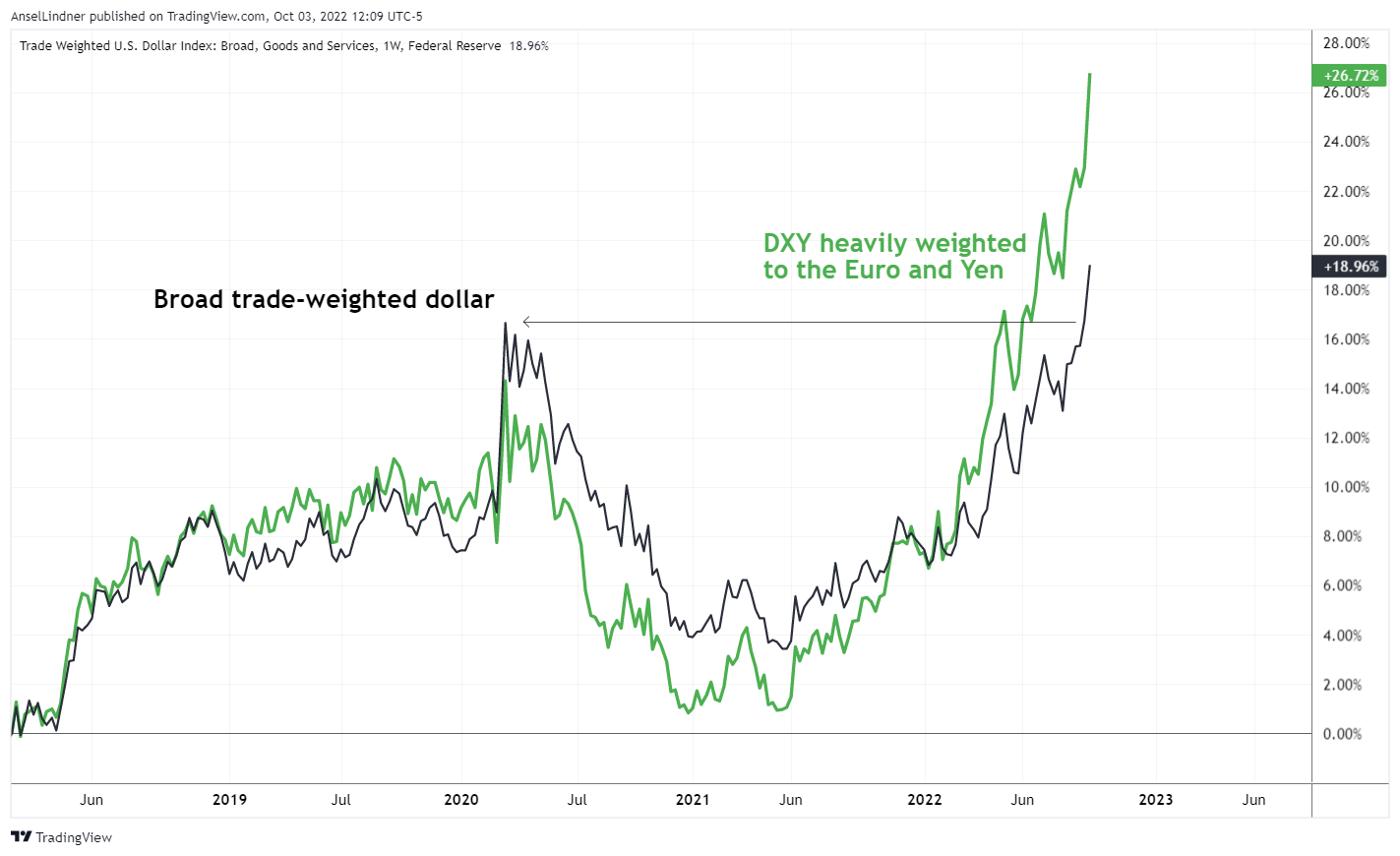

The DXY is still outpacing the broad trade-weighted dollar, but thanks to the Chinese Yuan, the latter broke out to new highs this week as well.

The chart above does not give us a lot of detail. Below, we see the dollar significantly off its highs, telling me that the pain inflicted by a strong dollar is somewhat easing right now. I expect this breather to last through the week.

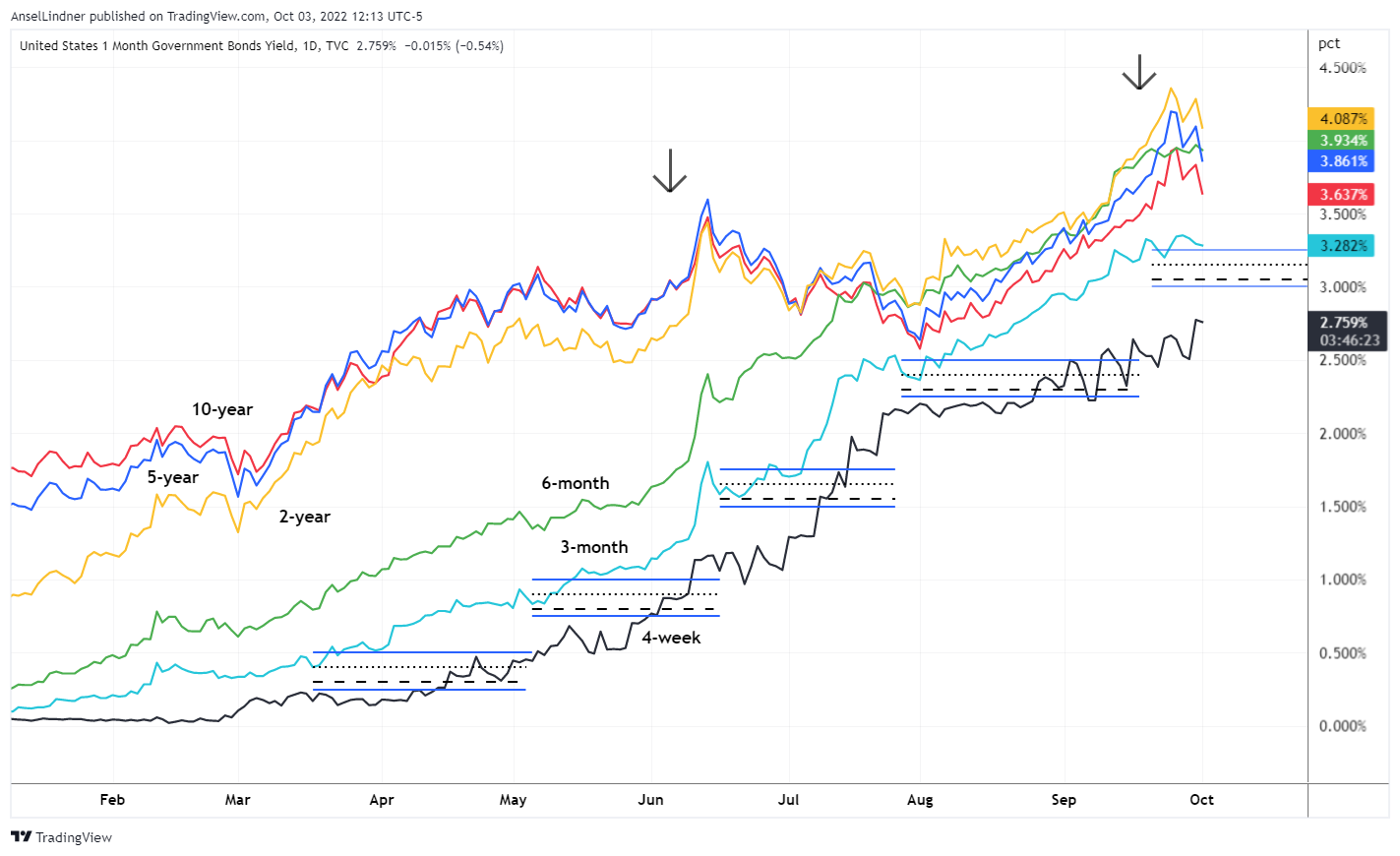

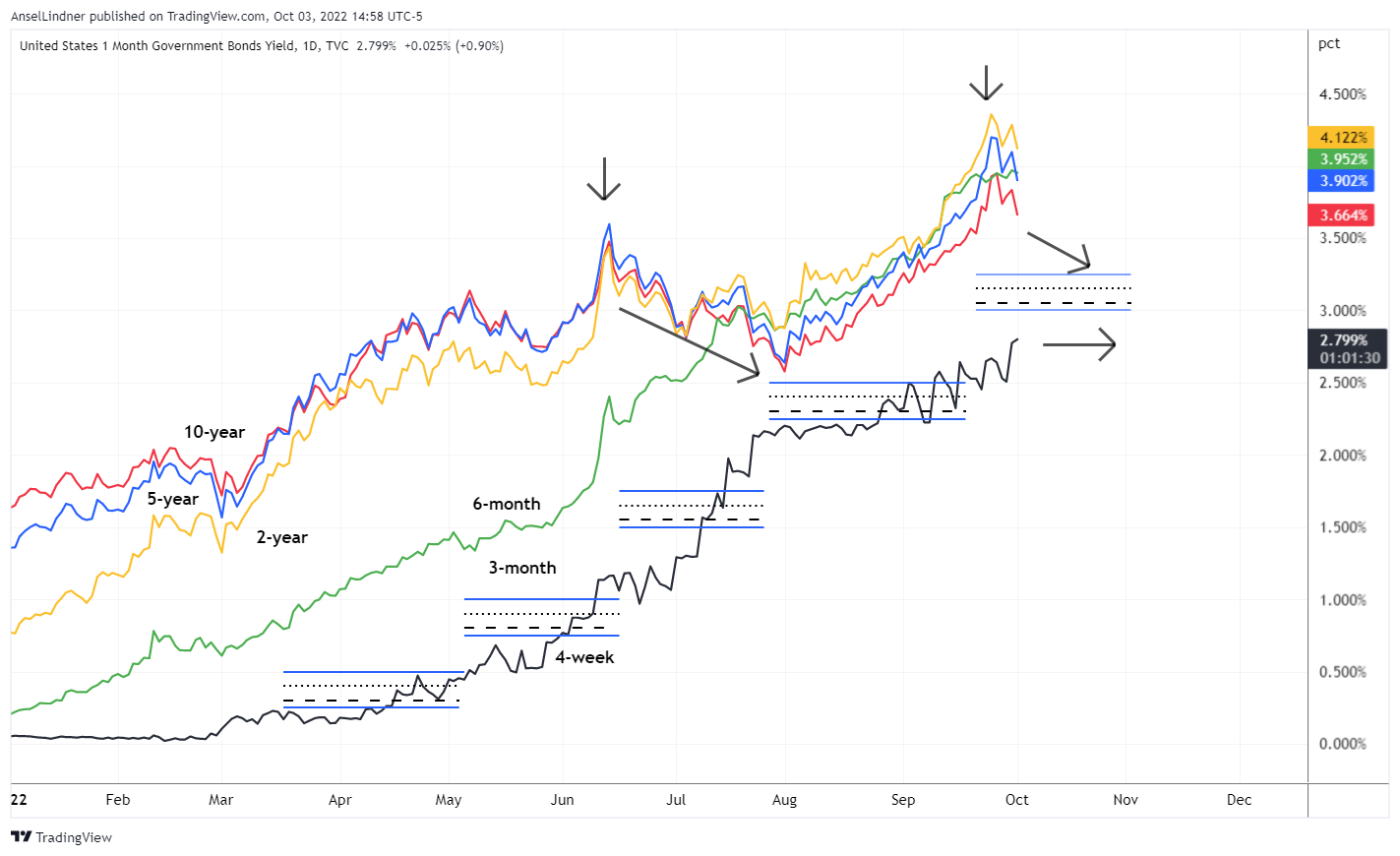

The yield curve is looking very weird. An inversion with rates climbing, looks VERY unnatural. I think that unnatural condition will right itself sooner rather than later. We already see rates starting to drop. This is the market calling the central banks bluff, or better, that the markets are reasserting their dominance over the central banks.

Compared to 2019, the last time Powell pivoted, the yield curve is in much worse shape. The curve crashed down onto the policy rate, at the end of 2018, without major inversions. Today, the 10Y is inverted below everything down to the 6M t-bill.

What I'm watching for this time is a collapse down to the policy range, and the stubbornness of the 4-week treasury bill to stay low. Those two things will force the Fed to pivot.

Headwinds and Tailwinds

Stock Market

Stock's effects are mixed this week. Sentiment is a headwind because it is so overly bearish, but a bounce could quickly turn into a tailwind. Despite everyone and their mother being bearish right here, I think it is a good risk/reward trade.

Markets seem to know that a Fed pivot is just around the corner. The private sector, so far, appears to be relatively stable, it is the sovereigns and the central banks that are in trouble.

Inflation and TIPS

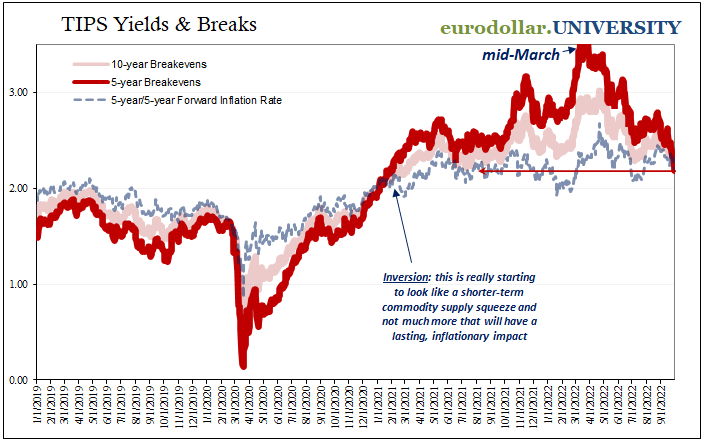

What about the 5y Forward and break evens? These are the gold standard for what is the mid-long term inflation expectations derived from the market. Welp, they are are all crashing.

These first two are the 5y5y forward, which shows what the market is implying about inflation in the future between year 5 and year 10. I used a chart with over 12 years to demonstrate since COVID the market has never bought into the inflation narrative. The zoomed in chart on the left says the same thing.

Next up, the 5Y and 10Y breakevens. Breakevens are derived from the difference between the constant maturity treasury and the Inflation Protected version, and implies the market's prediction for the average inflation over the period in question. As you can see the 5Y is implying 2.14% and the 10Y is 2.15%. That is the first time since March 2021 these two have not been inverted.

The major theme I have been stressing for two years is that the actual financial money printing (AKA credit expansion) in the economy was never all that elevated, and was always going to be temporary. The difference between actual market implied rates and the CPI headline number is all the other factors that can make prices move (eg supply chains and sanctions).

The expected credit expansion over the next few years continues to slide. While it is possible that these numbers temporarily bounce, I think that is unlikely given the deterioration of the global economy. As the wheels fall off the economy, credit expansion is put into reverse, and these money printing numbers are going to crash.

We can sum it up with this beautiful chart this week from Jeff Snider. He points out the 5-10Y inversion on breakevens, and says, "this is really starting to look like a shorter-term commodity supply squeeze and not much more that will have lasting, inflationary impact."

Price Conclusion

Summarizing...

The weekly chart has some strength, and bitcoin's relatively strong performance versus stocks in September, could be a sign the bottom is nigh or even in.

Despite the broad dollar index spiking this week to new highs, the DXY has come back a bit, telling me that the acute dollar pressure will likely ease this week.

If yields continue to drop, getting near the current Fed Funds target range, the Fed will not hike on Nov 2nd, and bitcoin and stocks will TAKE OFF. Perhaps the market starts pricing that in a little already!

Inflation continues to come down. The financial markets are implying an average inflation rate for the next several years at just above 2%. The breakevens and forwards tell us there was very little actual money printing in this era. Instead, we must look elsewhere for a boogeyman to blame for price rises. I blame supply chains and sanctions by globalists Marxists (and I think the majority of people do, too. That is why we see the populists winning elections).

Overall, the risk of a big sell-off decreases this week, and I expect past relative strength to continue. Do not be surprised by a jump up to test the trend line at $21,000 this week.

Mining

| Previous difficulty adjustment | -2.14% |

| Next estimated adjustment | +4.1% in ~6 days |

| Mempool | 4 MB |

| Fees for next block (sats/byte) | $0.27 (10 s/vb) |

| Median fee (finneys) | $0.19 (0.179) |

Mining News

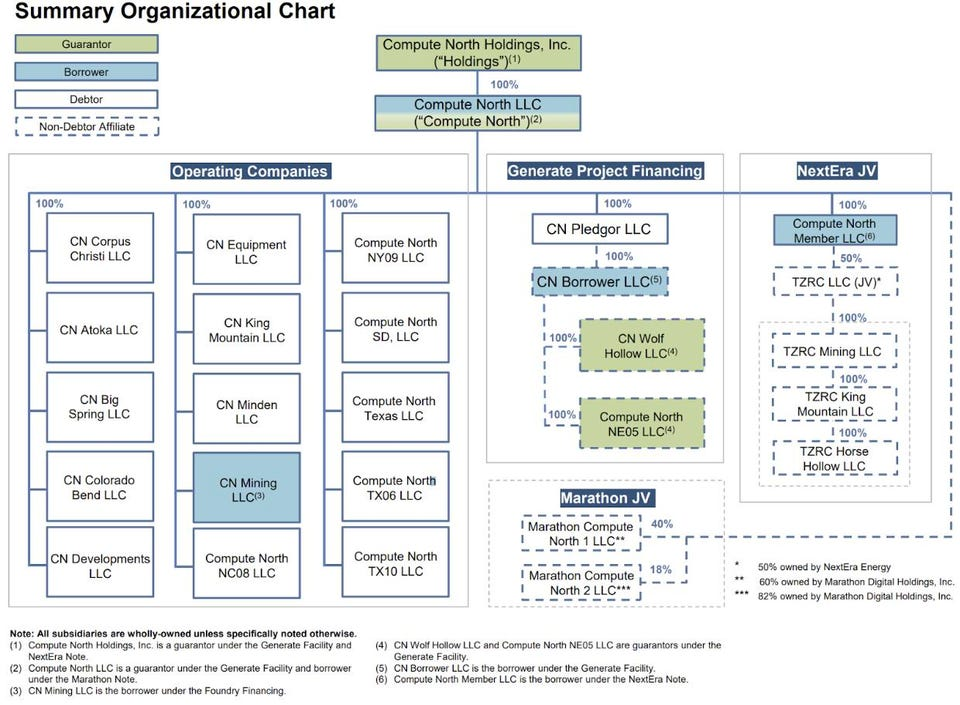

Compute North is still in the news for their bankruptcy.

Compute North, the second largest bitcoin mining hosting provider in the US, filed for Chapter 11 bankruptcy last week. The company swiftly followed this filing with another court order requesting a 363 bankruptcy sale to liquidate assets to cover the roughly $140 million of debt it has accumulated.

The bankruptcy is perhaps the biggest bitcoin mining news to emerge in 2022’s down market. Compute North provides hosting services for $700 million worth of equipment for some 84 mining entities, including publicly traded companies such as Marathon Digital Holdings.

This is an interesting organizational structure chart for Compute North showing how complex the mining industry is getting. Each of these subsidiaries would host mining equipment for Compute North clients.

Compute North’s contracts typically last 3-5 years and lock in a fixed power rate for the miner.

This is where they ran into trouble as energy costs increased and the price of bitcoin decreased this year. In February, CN opened a $300 million line of credit with Generate Capital. That was back when bitcoin was first overdue for its next bull market, and had dipped to roughly $40k.

As the price of bitcoin continued to dip, Generate Capital triggered a technical default by calling in its line of credit to Compute North.

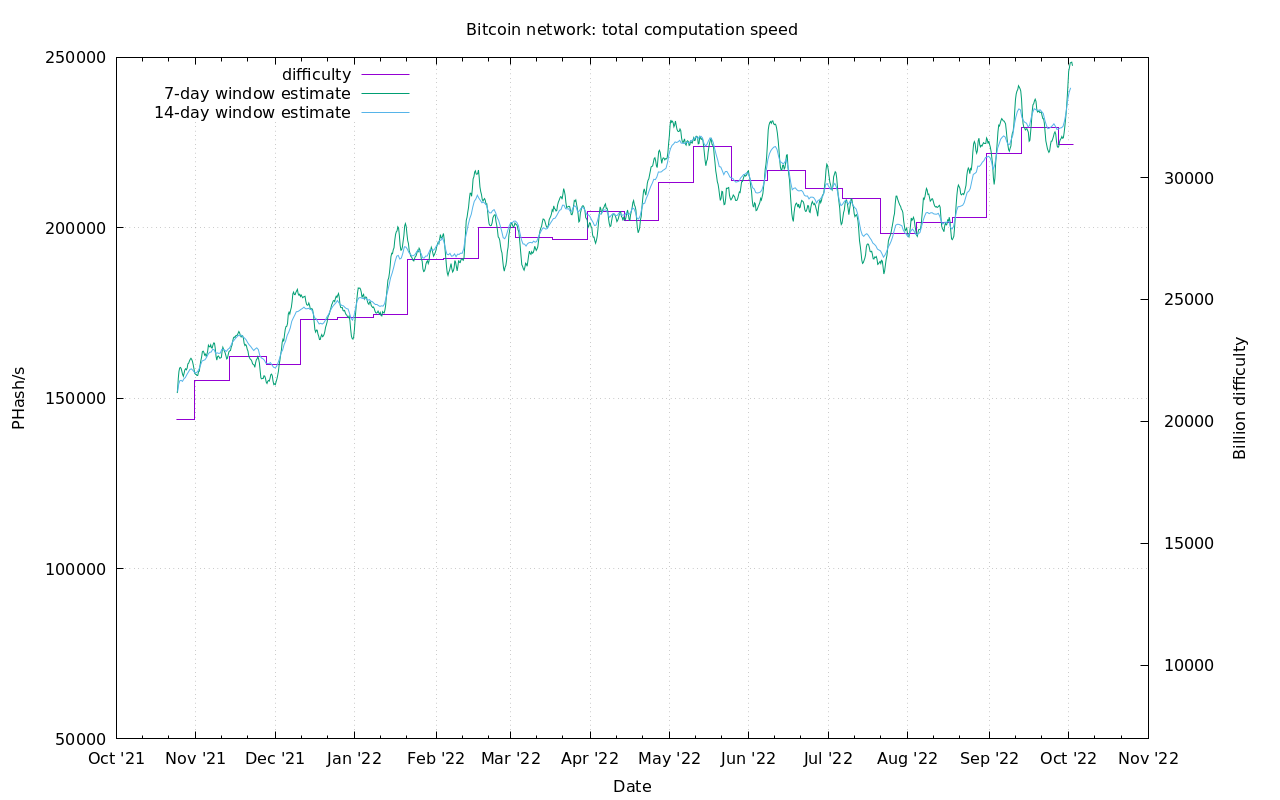

This situation came down to timing the market, and Compute North got it wrong. I do not think this type of situation is widespread in the bitcoin mining industry. On the contrary, I think most miners are extremely diligent and conservative with market forecasting, another reason that hash rate is a lagging and confirming indicator. When hash rate really starts to move, that means the industry is healthy and big miners generally perceive low risk.

Applying that right now, we can see below that hash rate is making new ATHs despite the disappointing price of bitcoin currently. That indicates the big miners are healthy and perceive relatively low risk in the market.

Difficulty and Hash Rate

Huge surge in hash rate this week after the small decline in difficulty. Hash rate flew up to 250 exahash.

Lightning Network

For those readers not up to speed on Bitcoin's lightning network, here is a brief intro. Lightning Network (LN) is a transactional network of nodes that are all connected via Bitcoin transactions. It uses special protocol rules and cryptographic techniques to enable small instant payments on top of Bitcoin. The transactions are cryptographically settled, but do not necessarily settle on the block chain until much later as a sum.

The LN is the answer to turn bitcoin into a true transactional currency, similar to our experience with credit cards or PayPal, instead of large lump sum on-chain transaction with high fees. It's been in development for years, but has yet to truly catch on like bitcoiners think it will.

Okay, now for the updates. The LN capacity is exploding! It has almost hit 5,000 bitcoins.

LN also remains mostly a North American and European thing. With all the talk about bitcoin, and specifically LN, being great for the unbanked, only 4 countries make the top 100 for LN, with the top African country being South Africa at #27. Nigeria, which has been the center of a lot of attention as far as African countries into bitcoin goes, is only #69 with an estimated 111,000 sats or 0.0001 btc on LN.

Lightning network supply is different than the mainnet bitcoin supply, because bitcoins have to be moved into the LN via transactions, we can measure how much the LN is growing and how much liquidity it has. Of course, for the LN to act as a global public payment protocol, it must have very high liquidity. One day, smaller transactions will likely be made on LN, while the actual bitcoin network will be reserved for high value transactions that are less fee sensitive.

Today's total liquidity on LN is $100 million. When it crosses the $1 billion mark, it will start getting the attention it deserves.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

October 3, 2022 | Issue #211 | Block 756,923 | Disclaimer

* Price change since last week's report