Bitcoin Fundamentals Report #213

This week, 3 big conferences show signs of life, BNY Mellon clients demand bitcoin, Altcoin hacks, 20th Party Congress, price analysis, mining news, and Lightning

Jump to: Market Roundup / Price analysis + Price Conclusion / Mining sector / Lightning Network

In Case You Missed It...

- (Podcast) Ethereum vs Bitcoin Issuance Arguments - E252

- (Fed Watch) Federal Reserve vs UN and OPEC - FedWatch 115

- (Members) Five live streams this week PLUS EXCLUSIVE E251 podcast on the EU, all uploaded to the Member Drive!

Join my Telegram Channel for all-day updates on bitcoin and macro!

⬇️ Third hour of the below video ⬇️

Listen to podcast here

Market Roundup

| Weekly trend | Very stable |

| Media sentiment | Very negative |

| Network traffic | Slightly elevated |

| Mining industry | Surging |

| Market cycle timing | Trying to start rally |

Bitcoin Headlines

The success of 3 large bitcoin industry conferences this week, headlined by Bitcoin Amsterdam, show that interest in the industry continues to grow as the price remains stable.

Now that all the leverage and froth of the hyper-financialized Ponzi schemes in the altcoins has been mostly cleared out, meaningful development is getting attention, like on Lightning Network. Plus, banks are getting involved in a big way, and financial repression is on many people's minds.

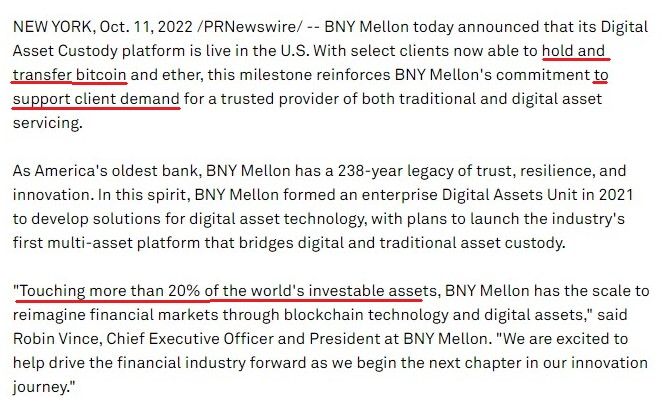

BNY Mellon was formed by the 2007 merger of Bank of New York and Mellon Financial Corp. It is the world's largest custodian bank and securities services company, with $2.4 trillion in assets under management and $46.7 trillion in assets under custody as of the second quarter of 2021.

Watch what they do not what they say. #Bitcoin pic.twitter.com/WV2YtXhCkX

— Magoo PhD (@HodlMagoo) October 11, 2022

1/ After four hacks yesterday, October is now the biggest month in the biggest year ever for hacking activity, with more than half the month still to go. So far this month, $718 million has been stolen from #DeFi protocols across 11 different hacks. pic.twitter.com/emz36f6gpK

— Chainalysis (@chainalysis) October 12, 2022

The favorite target of these hacks are the "cross-chain bridges". Bridges are a cryptographic technique to shift balances between networks. This is the role of DeFi protocols, which makes sense then why they are almost all of the hacks.

DeFi, once again, proves what critics like myself have been saying for years, that the trade-offs required for their schemes to work make they inherently insecure.

4/ Cross-chain bridges remain a major target for hackers, with 3 bridges breached this month and nearly $600 million stolen, accounting for 82% of losses this month and 64% of losses all year. pic.twitter.com/lQySX2ljKt

— Chainalysis (@chainalysis) October 12, 2022

Macro headlines

The 20th Party Congress is the biggest political event in China in 50 years, hence it is one of the biggest events in macro in that time.

From Xi's speech, the main points for me (without a transcript of the full remarks yet) were the red flag repetition of "income distribution" and the sadistic and barbarous adherence to central planning.

"We will keep income distribution and the means of accumulating wealth well regulated."

Price Analysis

| Weekly price* | $19,514 (+$273, 1.4%) |

| Market cap | $0.374 trillion |

| Satoshis/$1 USD | 5,126 |

| 1 finney (1/10,000 btc) | $1.95 |

Last week:

We have until late October for the squeeze of the chart pattern to force a choice, up or down. Perhaps we go sideways all the way until then.

Daily chart

One look at the daily chart and the stability of the bitcoin price is striking! This whole period with the price hanging around $19,000 to $20,000 has been an amazing 121 days since June 18th! That stability is despite all the volatility in traditional markets, the drama surrounding "inflation" and the Fed "breaking something", and the global energy crisis and war in Ukraine.

In the chart above, we clearly see the descending triangle formed by the red trend line and the gray support zone. Descending triangles typically are bearish patterns that signal distribution, but can form reversals on false breakdowns.

As price bounces along the bottom of the triangle, bids are eaten by bearish momentum until a final breakdown on volume that pushes the price through support. The "on volume" part is key, watch closely on any breakdown if volume picks up. If not, be ready for it to be a quick fake out.

If we look at this descending triangle's CMF, we see a major difference between the 2018 descending triangle and today. Chaikin Money Flow is an oscillator that measures buying and selling pressure over a set period of time. Back in 2018, prior to the breakdown, as is typical, the CMF turned negative. However, today, the CMF is positive and might be accelerating to the upside.

Weekly Charts

TD Sequential is a time-based indicator, showing the psychological time in a trend. The indicator maxes out at a count of 9 in a trend, which tends to be followed by a reversal, either a complete change or at least a correction.

I pointed out the possibility of a Red 9 last on last week's newsletter, and again this week, we can see that the Red 9 locked in. It is a sign of the exhaustion of the bearish momentum, meaning the chance for a reversal is much higher right now.

Bullish Divergence and Oversold

On the weekly timeframe, bitcoin is beginning its recovery from the MOST OVERSOLD in history, and has the FIRST EVER bullish divergence.

Monthly Chart

There has been three times where the price has dropped below the 20-month moving average in bitcoin's history. Each time, one the price reclaimed this level, it marked the beginning of the next bull market rally (with the exception of the March 2020 corona crash).

I'd like to draw your attention to the slope of the 20-period moving average (green line) during these times the price dipped below. Back in 2015, the slope turned negative, but not in 2019. Currently, the 20 MA is beginning to slope downward, which says something about the intensity of the dip, and might lead to a stronger reactionary move back up.

From the cross of the 20-month MA in 2015, the bitcoin price rose 54x ($350 to $19000). In 2019, this was only 9x ($7100 to $65000).

I believe that bitcoin is on the edge of some major moves. Perhaps, there is not as much room for bitcoin to climb 54x like back in 2015, but more than 9x is possible. Therefore, if the price regains the 20-month MA at $35,000, a 20x rise might be possible this cycle, getting price to $700,000.

Historic Volatility

Volatility is at its lowest since the start of the bull market rally up to $65,000 back in 2020. Calm bitcoin makes it more attractive to investors, and can even shift the bucket it's thought to be a part of (eg risk versus safety).

Headwinds and Tailwinds

End of Q3 has passed

The end of Q3 is historically the most risky time of the year. Most market crashes and acute financial crises happen in the 4 weeks surrounding the end of Q3. This is largely due to previous importance of the end of the growing season and its associated futures contracts, as well as it being the end of the government's fiscal year.

The end of this quarter has more settling of books than other times of the year, and can expose losses to banks and other systemically important entities.

We've passed this period with only the UK Gilt market blowing up, so my estimation is that financial stress will improve slightly.

Stock Market

The weekly stock market chart, which bitcoin has been highly correlated with over the last year, also shows some signs of bottoming. As with bitcoin, the S&P 500 weekly chart shows us a strong double bullish divergence and a Red 9 (not shown because it would be too busy).

This is the first time for both these reversal indicators on the S&P since February 2016's bottom, and before that, the bottom of the GFC in March 2009!

Price Conclusion

Summarizing...

Bitcoin has been extremely stable despite all the economic and geopolitical drama.

The daily chart for bitcoin has hidden signs of strength in a bearish pattern. The weekly chart has the strongest indications of reversal in bitcoin's history! Historical volatility is very low levels, perhaps creating a growing safe haven bid.

Seasonal Q3 risk is ending.

Stocks are showing very strong reversal indications as well.

Overall, time is getting short for a resolution to chart patterns. Immediate short term is closer to 50/50, but 2 to 6 weeks looks increasingly bullish! Perhaps, we see a low volume fake breakdown, followed by a major bounce higher to $25,000. Risk of a cascading crash is low, so Buy The Dip.

Mining

| Previous difficulty adjustment | +13.5528% |

| Next estimated adjustment | +4% in ~6 days |

| Mempool | 8 MB |

| Fees for next block (sats/byte) | $0.35 (13 s/vb) |

| Median fee (finneys) | $0.33 (0.169) |

Financial innovation allowing bitcoin miners an alternative hedge:

The Oct. 10 launch of Luxor Hashprice NDF, a non-deliverable forward contract, will allow miners to hedge their exposure to Bitcoin price and the energy costs associated with mining.

The over-the-counter derivatives contracts are settled using Luxor’s Bitcoin Hashprice Index, and investors can choose to settle in dollar-pegged stablecoins, dollars or BTC. A primary benefit of the instrument is that contract sellers can lock in Bitcoin mining revenue, while contract buyers can tap into the upside potential of Bitcoin mining without the need for physical exposure.

Globalist Elizabeth Warren

Crazy Senator Warren, who gets triggered by bitcoin and private market solutions to problems, sent a letter to Pablo Vegas, CEO of the Electric Reliability Council of Texas (ERCOT) demanding information about bitcoin mining. She calls Texas a "deregulated safe harbor". Sounds pretty good to me.

The whole letter is economic illiteracy run amok. They attack the current demand for energy, the proposed massive growth in demand, the subsidies for shutting down in crisis, and environmental concerns.

Bitcoin mining adds demand and flexibility to the grid, in other words incentive to make the grid more robust. The subsidy to shutdown during emergencies is part of the profit derived from the unique nature of bitcoin mining. No other industry can provide the precise variable demand, that makes excess energy production capacity profitable the 99% of the time there is no emergency. Taking bitcoin mining away makes the grid more vulnerable.

It must be noted that the environmental concerns were downplayed massively in this letter, compared to the unhinged alarmism we are used to. That's something positive IMO.

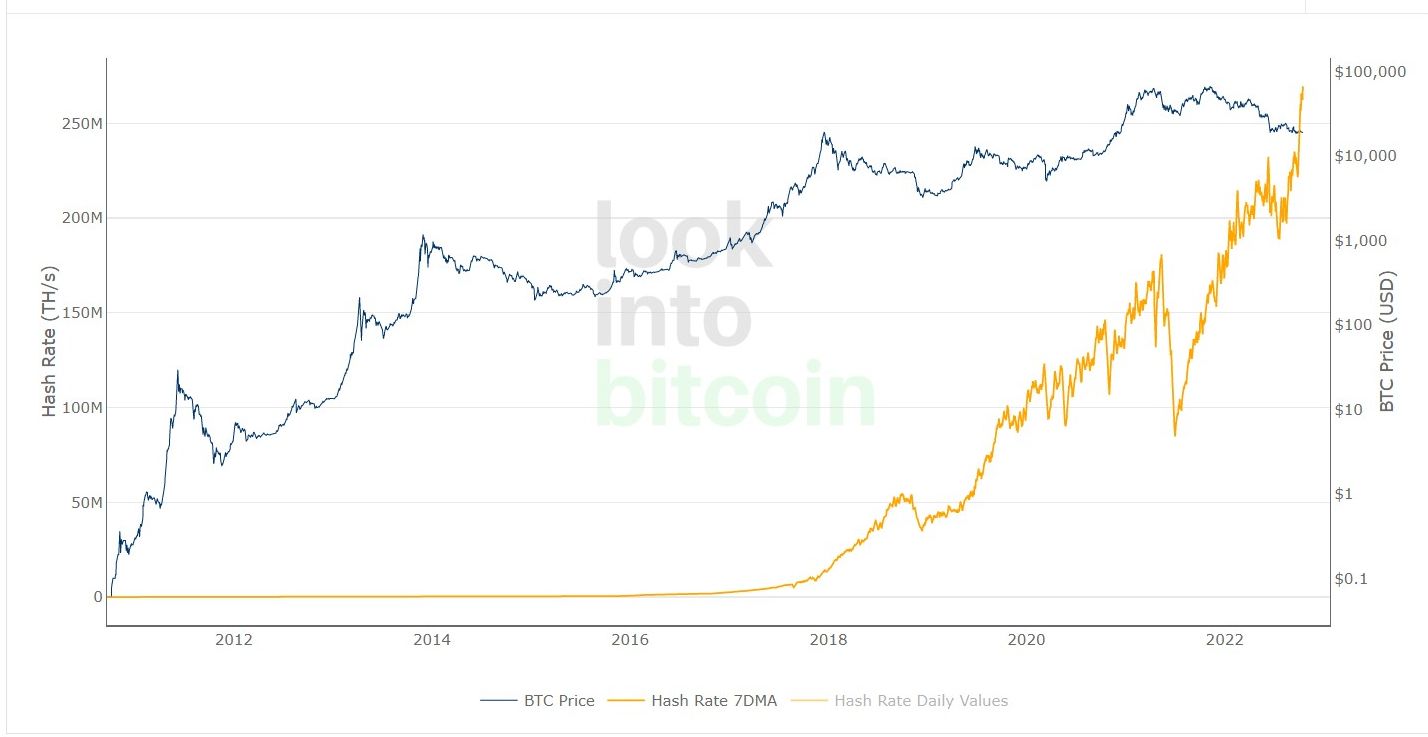

Difficulty and Hash Rate

Another HUGE week for bitcoin hash rate. After last week's monster difficulty adjustment of +13.5%, miners continue to add hash rate, now estimated to increase the difficulty another 4% in 6 days.

Miners are privy to unique information in the bitcoin industry. They are very close to traditional energy producers, bother power plants and oil and gas producers, deep pools of financing in raising funds for new projects, and wholesale bitcoin demand.

Right now, with the price as $19k, these unique sources of information are making miners as bullish as they ever have been. There is no slack in this market!

Lightning Network

STRIKE raises $80 million in funding round

Strike, a digital payments platform built on the Bitcoin Lighting Network, has raised $80 million in a funding round led by Ten31. It will use the funds to boost its payments services for merchants, financial institutions and marketplaces, according to a press release.

Strike recently launched its API to allow card networks to access the Bitcoin Lightning Network for cash-final payments with no legacy processing fees. NCR, Blackhawk and Shopify are some of the first partners to integrate the API.

Open Source Development Surging

ZEBEDEE, a bitcoin gaming company, has announced No Big Deal (NDB), a non-profit dedicated to furthering open source development for Bitcoin and the Lightning Network, per a release sent to Bitcoin Magazine.

“We basically created an entire suite of tools for the modern sovereign individual, from the client you’d use to set up a node, to the wallet you’d use to manage your funds in a self-sovereign way,” said Neves.

The company has focused much of its contributions thus far on hosted channel support and the Lightning Network. Hosted channels are used to make moving funds across Lightning easier and less capital intensive by removing the need to lock up funds.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

October 17, 2022 | Issue #213 | Block 759,111 | Disclaimer

* Price change since last week's report