Bitcoin Fundamentals Report #217

This week, FTX fallout and rumors, regulations are coming, macro headlines of the week, price analysis, mining and lightning news, and mempool exploding.

Jump to: Market Roundup / Price analysis + Price Conclusion / Mining sector / Lightning Network

In Case You Missed It...

- (Podcast) Daily Live streams are going out on podcast apps and my Rumble channel.

- (Article) Ghost money article I wrote for Bitcoin Magazine

- (Fed Watch) Jerome Powell Contradicts Fed's Own Statement, Chaos Ensues - FED 118

- (Fed Watch Clips) Full, Fed Watch only video this week

⬇️ Third hour of the below video ⬇️

Listen to podcast here

Market Roundup

| Weekly trend | Panic |

| Media sentiment | Very Negative |

| Network traffic | Extremely high |

| Mining industry | Financial trouble |

| Market cycle timing | Attempting to form bottom |

Bitcoin Headlines

So much can happen in a week. On last week's newsletter I wrote about rumors that FTX was insolvent. Flash forward to this week, FTX, Alameda, BlockFi, and likely Crypto.com are bust.

I'll include several of the juiciest headlines about this debacle, but it is important to understand that this is 1) not the only news in bitcoin or macro, and 2) it does not affect bitcoin's fundamentals or future prospects, it strengthens them.

- Must watch video summarizing the whole debacle

- Jack Posobiec threw gasoline on the fire

It is increasingly looking like the Democrats 2022 campaigns were funded by kickbacks from Ukraine funding using FTX as the pass-through vehicle

— Jack Posobiec 🇺🇸 (@JackPosobiec) November 13, 2022

No wonder dude is scared for his life after ripping off these people https://t.co/Te5iqmpMqj

This particular angle is sensationalized. They don't need FTX to launder money, they can use any bank.

- FTX and Sam Bankman-Fried investments

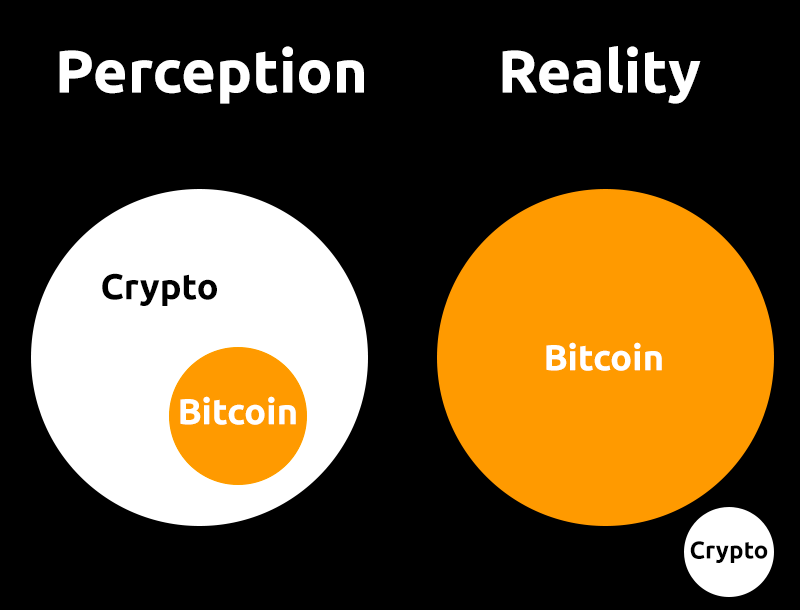

SBF was invested in 10's of pure scams. This week we also heard the claim that FTX was an inside job to destroy bitcoin. My question is, if this was a conspiracy to harm bitcoin, why did he only invest in pure scams. Not a single Bitcoin investment!?

Zero #Bitcoin investments

— Satoshi's Pet (@PetSatoshi) November 11, 2022

100% shitcoin investments#SamBankmanFried #ConsenSys #Messari #Lido #Solana #Polygon pic.twitter.com/pK29FBpIkN

- Ethereum/Altcoin folks breaking down

NONE of the altcoin space market cap comes from a utility value. They've fooled themselves into thinking trading cartoon dickbutts was the future because it was mooning. DeFi is dead. NFTs are dead. Altcoins are dead.

I'd answer this differently than Tuur. 'Ryan, you are searching for the toxic bitcoin maximalists. We've been here all along. We've never rug pulled anyone. We don't promote leverage. We don't trust, we verify.'

Analysts from Deutsche Bank and JP Morgan are quoted in this piece, both with somewhat positive outcomes for bitcoin from these events. DB claims this is the worst part of the ecosystem blowing up, and JPM says "we see the establishment of a regulatory framework as the needed catalyst to massively ramp the institutional adoption of crypto."

The shocking collapse of the once-respected cryptocurrency exchange FTX is proof digital assets markets need “very careful regulation,” US Treasury Secretary Janet Yellen said.

Regulation is coming. On my live streams this week, I've tried to hammer this point quite a bit. Almost certainly we will see stricter US regulation of exchanges and stablecoins. But if they don't send Sam Bankman-Fried to prison.

They cannot regulate Bitcoin's functionality or its use. Too many people are involved. Too many large companies, too many large lobbyists own bitcoin.

Macro headlines

- US elections fallout

The US elections were a huge disappointment in the fight against global Marxism. A Red Wave of biblical proportions turned into a splash. At this point, the Republicans will only take control of the House of Representatives.

- Ukraine open to negotiations

In a change from its previous stance of zero negotiations, Zelenskyy is now open to negotiations. Of course, he has some non-starter preconditions, but this does symbolize a huge shift in diplomacy.

This also comes in the wake that US and Russian diplomats are having behind the scenes negotiations and General Milley seemed to confirm what we all knew already.

The four-star general said during an appearance at the Economic Club of New York that a victory by Ukraine may not be achieved militarily, and that winter may provide an opportunity to begin negotiations with Russia.

U.S. Treasury Secretary Janet Yellen said some sanctions on Russia could remain in place even after any eventual peace agreement with Ukraine [...]

As Ukraine makes advances on the battlefield, Western leaders have started to contemplate how and if an end to the war may be negotiated with Russia.

Basically, the US is preparing for the end of this conflict, which will have big consequences on the markets.

Price Analysis

| Weekly price* | $16,635 (-$4,181, 20.1%) |

| Market cap | $0.321 trillion |

| Satoshis/$1 USD | 5,978 |

| 1 finney (1/10,000 btc) | $1.66 |

Last week:

Overall, the risk of a volatile move lower in bitcoin is slightly higher than previous weeks, due to the FTX and Alameda fiasco.

Yes, damage has occurred. A massive Ponzi scheme that invested in scam tokens not bitcoin, has blown up. People are sour on the space. But dear reader, bitcoin is only 4% lower than the June low! It has been extremely resilient in the grand scheme of things.

Hourly chart

In the below chart, you can see the destruction of earlier this week, and bitcoin trying to form some sort of defensive bottom. A rising wedge is technically a bearish pattern.

Price needs to clear the resistance zone and break $19k (green line) to be able to consider this dip over.

Daily chart

Price lost its battle with the 100-day moving average.

Weekly Charts

There is so much resistance above the price, it is hard to imagine it will be able to break the $19,000 line anytime soon. On the weekly chart, you can clearly see the major spike in volume right at the $19k level.

On a positive note, that should act like a magnet for the price to test that former support as resistance.

We also have another first in bitcoin. Never before have we seen a bullish divergence on the weekly chart, now we have two in a row.

Headwinds and Tailwinds

Dollar

The dollar has crashed again this week. As I pointed out last week, the dollar is likely to enter a new higher range for the coming years.

Below, you see the total collapse of the DXY in the last week. The gray box is my proposed new range, of course, the exact levels don't matter, it is the idea that is important. The pink line is a copy/paste of the pattern last time the dollar entered a new range back in 2015.

Stock Market

Stocks reacted positively to the CPI release last week. It has popped above the 50 and 100-day moving averages, and is approaching the 200-day, which previously acted as obvious resistance.

3-month to 10-year inversion

After un-inverting last week for a couple days, the important 10-year/3-month inversion is getting extremely inverted! Currently, at -44 bps, it was more negative during the Great Financial Crisis at -50 bps. However, a -44 bps is an extreme that signals dangerous recession just ahead.

CPI

CPI printed a huge miss of forecasts in October. Instead of the 0.76% m/m expected, it came in at 0.4% with half of that due to the massive lag in the shelter component.

Stocks rallied because lower inflation means the Fed will stop raising rates.

If bitcoin would not have had the FTX fiasco - that didn't even involve bitcoin itself other than a Ponzi scheme mentally associated with bitcoin that didn't hold any bitcoin blew up - it would have followed stocks higher. Perhaps, it would be sitting at $25,000 right now instead of $16,750.

Price Conclusion

Summarizing...

Bitcoin's short term charts are heavily damaged from this week's action. It is hard to find a silver-lining.

Weekly charts are slightly less bearish in my opinion. We don't can see the June low more clearly, and the extent of this crash in relation to the rest of the year. We also have a double bull div on the weekly which must impact out projections here.

Most resistance is centered around the $19,000 level. It would also make sense to return to the $19k previous support to back test it as now resistance. Many things are coalescing around $19k, which could make it act as a magnet to price.

The dollar is no longer a headwind, with global dollar stress drastically reduced. This signals a reversal in direct pressure on the bitcoin price.

CPI came in much lower than expected, leading to a spike in assets correlated with bitcoin. If FTX would not have occurred this week, bitcoin's price would be upwards of $25k.

Yield curve inversions portend a steep recession is dead ahead. However, there could be a miscommunication due to the behavior of nominal vs real GDP. A crash in nominal GDP could be calculated as a steep recessionary slow down, when in fact it will be matched by a drop in CPI. This makes real GDP hover around zero, not deeply negative.

Overall, the risk of further major downside is low, the risk of slightly lower prices remains elevated. In the near term, this week, I'm expecting a move to test the resistance at $19k.

Fundamentals remain unchanged. In fact, liquidation of old leverage opens the door to a new cycle, and one with fewer alternatives in which to place new inflows.

Mining

| Previous difficulty adjustment | -0.1995% |

| Next estimated adjustment | 0.4% in ~5 days |

| Mempool | 161 MB |

| Fees for next block (sats/byte) | $0.70 (30 s/vb) |

| Median fee (finneys) | $0.54 (0.325) |

Mining News

Rough times continue this week in the Bitcoin mining sector.

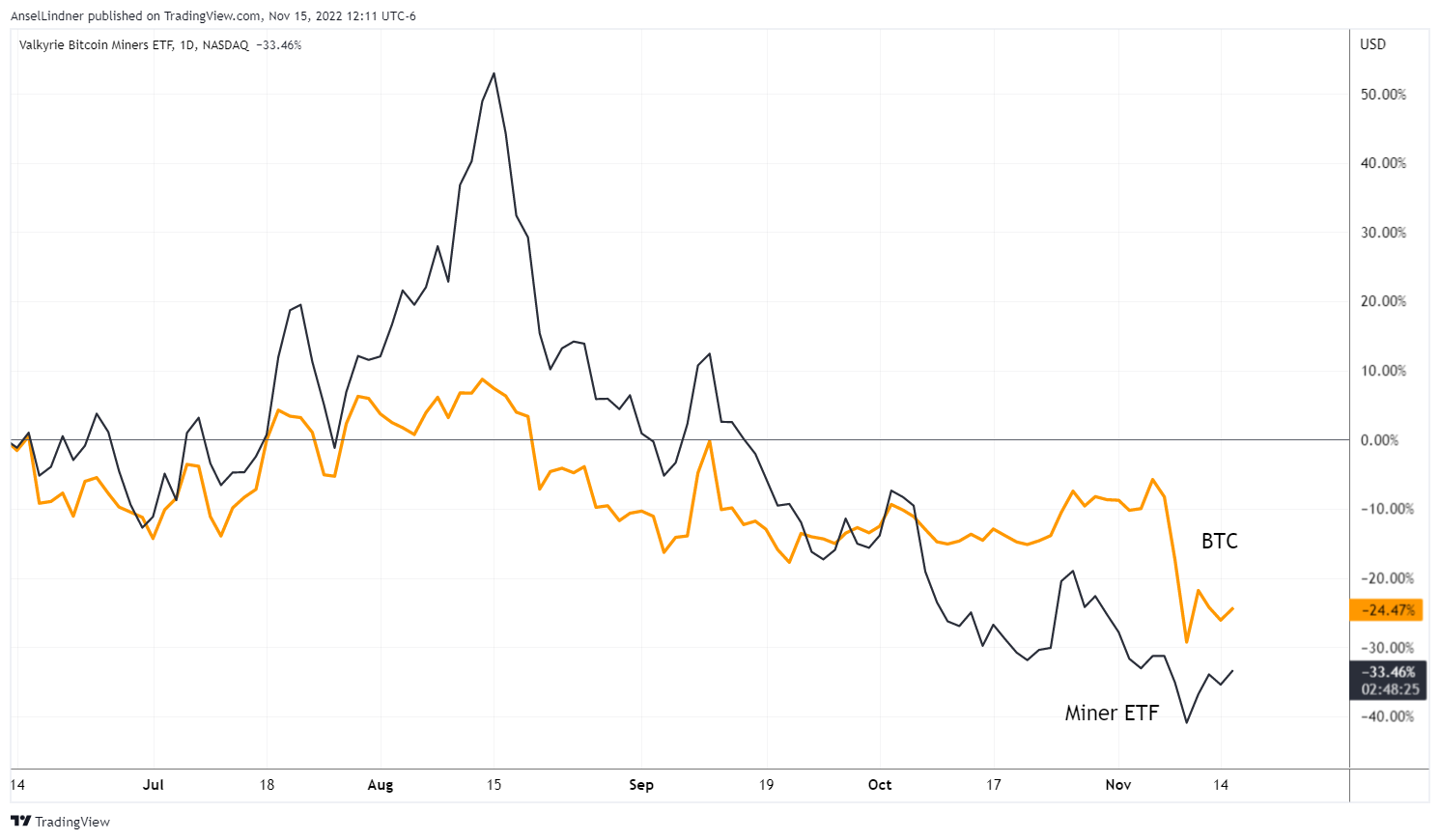

Valkyrie's bitcoin miner ETF, after an untimely launch at the start of this year's bear market, bottomed on the same day as price. It has been a volatile ride for public miners as they all struggle to make it through this acute market pain.

Below is a chart showing this Valkyrie ETF along with the bitcoin price since the June low.

Here is an educational breakdown of several public bitcoin miners. Great piece!

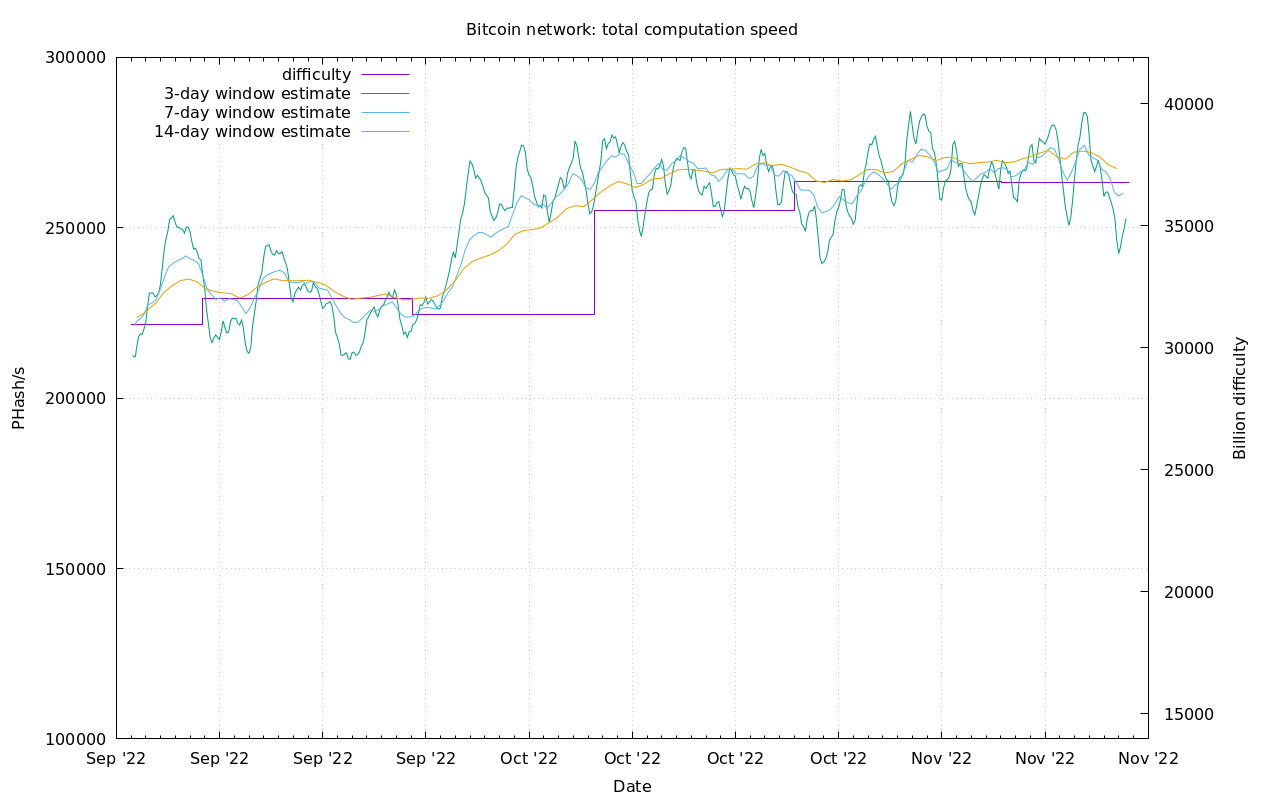

Difficulty and Hash Rate

Despite all the market drama and the drop in price, and the stuggles of bitcoin miners, hash rate is remaining high. It is now estimated to increase by 0.4% in 6 days.

Mempool

Bitcoin's mempool has exploded. For the beginner, the mempool is the number of transactions that have been sent and are awaiting confirmation on the base settlement layer of bitcoin.

As you can see in the 1 week chart below, it wasn't until yesterday that the mempool rocketed higher, it did not correspond to the FTX market crash directly.

Looking at a longer term view, we can see that this is the largest spike in transactions all year, dating back to April 2021 when China banned mining.

So far, it looks like this was a flood of medium fee transactions (10-12 sats/vb), so not a spam attack. This is people moving bitcoin, perhaps a large player breaking them up into smaller transactions, perhaps money running in the wake of FTX, we don't know.

In the past, spikes in the mempool have been correlated to price volatility. The little spike in May 2022 corresponded to breaking support at $30k. Being that support was broken days ago, I don't think that is the case this time.

Lightning Network

Named “#sats4stats,” the feature lets fans and spectators send BTC to players in real time through Bitcoin’s Lightning Network [...]

"Each player will have a Lightning QR code linked to their profile for instant boost from any lightning wallet in the world. #Sats4stats will allow fans to send sats directly as the action unfolds at the ballpark or via live broadcast feed. Fans will be able to send messages to their favorite players and retweet their ‘boosts’,” per the statement.

This is pretty cool. I can see this expanding into things like Fantasy Football leagues somehow or into a competition of its own. Imagine rating players based on cumulative lightning payments during a season. It gets your gears going. I can see Olympians wanting in on this as well, the Jamacian bobsled team would get lots of lightning support!

US Elections continued...

Before I continue, as a disclaimer, I don't vote exactly because they cannot be fair.

There are many reasons being floated out there as to why the conservatives did so poorly, but I personally stick to the basics. Ron DeSantis' win in Florida symbolizes the general shift in the country. He won by 20%. Even New York state swung by more than 10%, the democrat Governor still won, but it was very close.

There is shady business going on with early voting and counting of votes. I don't think they used the same tactics as last time, stuffing drop boxes and kicking people out of ballot counting places only to shove 500,000 hidden ballots through, like in Georgia. But the ballot harvesting and early voting ballots are still a huge attack vector.

Katie Hobbs looks like she will be declared the winner in Arizona, after she refused interviews, debates, drew no crowds, and was behind in polls by 10 points to charismatic Kari Lake!? Oh, and a week of counting 7 million votes, where the Katie Hobbs was in charge of counting, and Maricopa county recorder (underling counter in the biggest country) formed a PAC to keep Kari Lake out?!?

John Fetterman in Pennsylvania literally can't put a sentence together, but was elected to the Senate? If you don't think something is fishy about that, I have a bridge to sell you.

Ballot harvesting and mail-in voting is a joke. Any rational person would realize it is extremely vulnerable to cheating. On top of that, I also think there was an effort this time by dems to, instead of stuff the ballot box, to keep votes out. An example is in Maricopa county, where machines were not working in 20% of precincts in heavy Republican areas. Also, in Pennsylvania, voter turn out in Republican rural areas was surprising low, against to what polling indicated. Perhaps they just didn't count them all?

Even with the heavy cheating, anti-globalists conservatives should win the House.

The globalists keep digging themselves deeper while not making much of any headway domestically on their policies. They have to resort to international institutions which are losing respect as well. No rational person thinks a 7-day vote count is "normal", as the Maricopa country people put it. A 10-20% point shift toward conservatives this time, including Latinos and suburban women, will turn into a 20-30% swing in 2024.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

November 15, 2022 | Issue #217 | Block 763,320 | Disclaimer

* Price change since last week's report