Bitcoin Fundamentals Report #219

Lowery thinks he's taking on bitcoin maximalists (shrug), panic subsidies, China imploding, price analysis and prediction, miner capitulation, LN news.

Jump to: Market Roundup / Price analysis + Price Conclusion / Mining sector / Lightning Network

In Case You Missed It...

- (Podcast) Daily Live streams are going out on podcast apps, Rumble and Odysee. Find links to them here.

- (Article) Ghost money article I wrote for Bitcoin Magazine

- (Fed Watch) Resistance and FUD in Bitcoin, FOMC Minutes, and Foxconn Riots - FED 120

- (Fed Watch Clips) Full, Fed Watch only video this week

⬇️ Check out the video below ⬇️

Listen to podcast here

Market Roundup

| Weekly trend | Unease |

| Media sentiment | Very Negative |

| Network traffic | Normal |

| Mining industry | Financial trouble |

| Market cycle timing | Attempting to form bottom |

Bitcoin Headlines

Bitcoin's seemingly toxic nature is a free market defense against scammers. It's not a hard test to pass, all it take is a little humility and competence, however, scammer cannot deal with it.

This week Jason Lowery, who I have talked about recently on some podcasts, faced this challenge over what he called Proof-of-work's inherent "violence". It's actually the exact opposite, it negates violence, but to a party with the monopoly on use of violence, the State, it can only be interpreted as violence against the State.

He was invited onto Marty Bent's podcast to discuss. At the time of writing, this discussion is happening live.

Monday. 1pm CST. The Internet.

— Marty Bent (@MartyBent) November 25, 2022

- No major bankruptcies or blowups this week!

Granted, I've been offline for much of the holiday weekend, but I did have time to peruse the headlines and watch some news at night.

There has not been any more developments on the Digital Currency Group or Genesis story. GBTC's discount has recovered slightly from -46% to -40%. Still not good.

Macro headlines

Taken alone, it is understandable to see why some people still believe in the commies abilities to turn this situation around. However, it is not the only thing wrong with China. Here's a list:

- Hardcore communist resurgence

- Real estate collapse (sector accounts for 30% of GDP, 70% of personal wealth)

- Low-middle income country, unreliable domestic consumers

- Trade wars

- Exports plunging

- MASSIVE credit overhang

- Utterly devastating demographics

- Now add riots

The mass protests breaking out across China against the draconian lockdowns are both courageous and historic. The people have had enough. Authoritarianism never ends well. History has taught us that. The Chinese protestors are creating their own history.pic.twitter.com/y1aLGswuZU

— James Melville (@JamesMelville) November 28, 2022

- World Cup demonstrates tense global political climate

First, it was the ban of LBGT flags on uniforms in Qatar. Then it was found that China was blurring the stands of maskless faces and even cutting close-ups of the stands. Just today, Iran is furious with the US for deleting the Islamic symbol from their flag on a social media post, demanding the US be disqualified.

The Olympics should be fun in 2024.

As companies joined the boycott, commentators gleefully announced the “death,” “collapse,” and “demise” of the social media company with some mocking Musk risking billions of dollars for free speech principles. New figures, however, appear to show that the public is solidly with Musk on the free speech issue. New signups at Twitter are at an all-time high with two million new signups per day.

Musk has not been perfect, but has successfully pushed back a lot of the worst abuses. Compare that to the state of Chinese social media. FTX has been almost exclusively reported on via Twitter as the MSM protects SBF. Chinese riots this week are not blocked as they would have been in the past. People getting unbanned.

This is a HUGE deal if it continues. The globalist propagandists are finished if we have a free speech platform.

Price Analysis

| Weekly price* | $16,238 (+$383, 2.4%) |

| Market cap | $0.312 trillion |

| Satoshis/$1 USD | 6,155 |

| 1 finney (1/10,000 btc) | $1.62 |

4-Hour chart

Nothing has changed on bitcoin's 4-hour chart. No action in the last week. It is slightly higher, but we are still waiting for demand to kick in.

Daily chart

The daily chart doesn't look all that good. I've thrown in the volume by price indicator to show the massive amount of resistance starting at $19,000. That resistance, however, can also act as a magnet, as bears relent for a time and bulls push price briefly higher into more bear shorts sells. If we break through that resistance though, it could mean a rocket up to $30k.

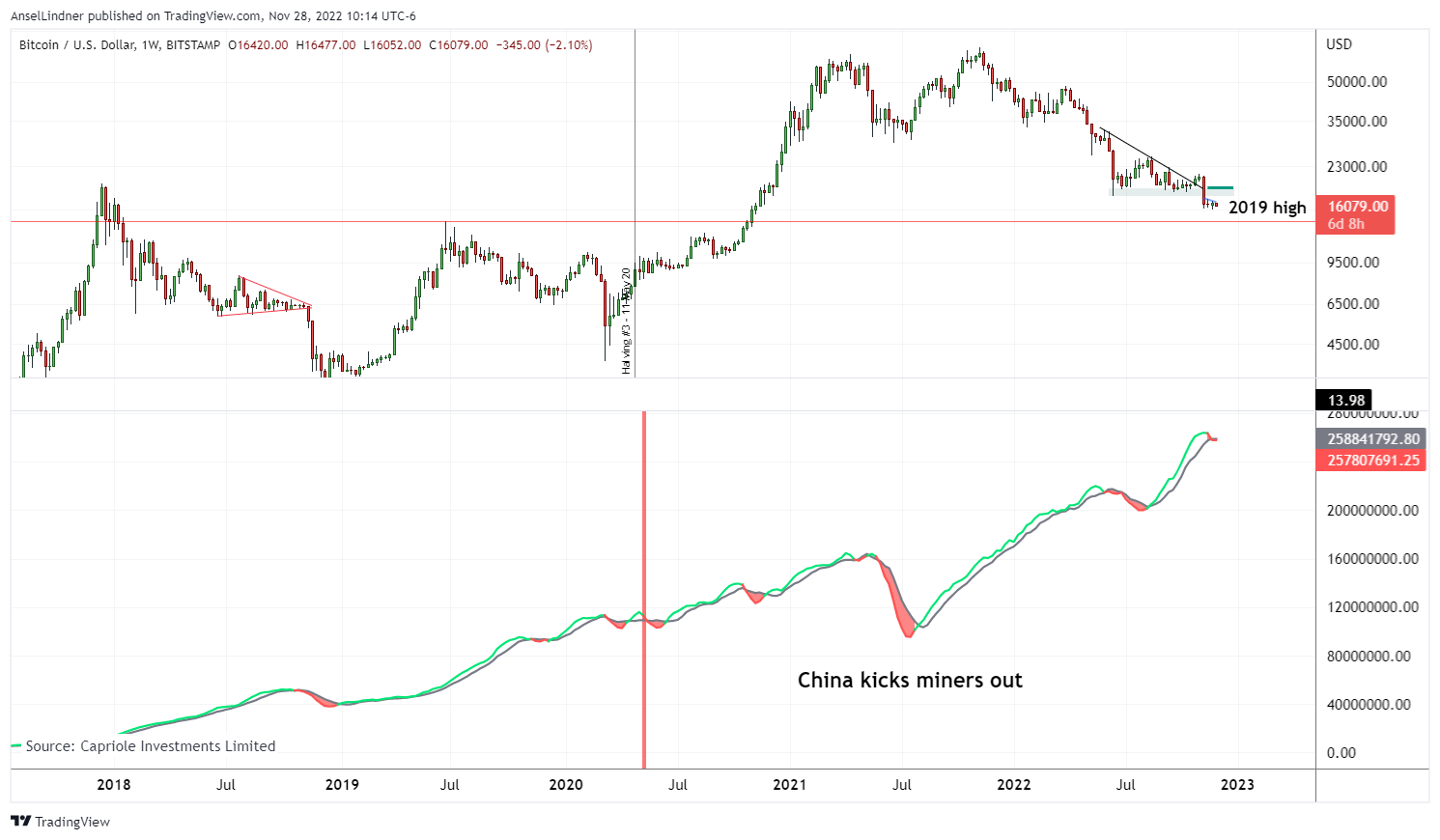

Weekly Charts

This zone on the chart is close enough to count as testing the 2019 high (previous high if you don't go with the 2017 high). It could sink a little more still and then springboard from there, but anything in this zone is a retest of the 2019 high IMO.

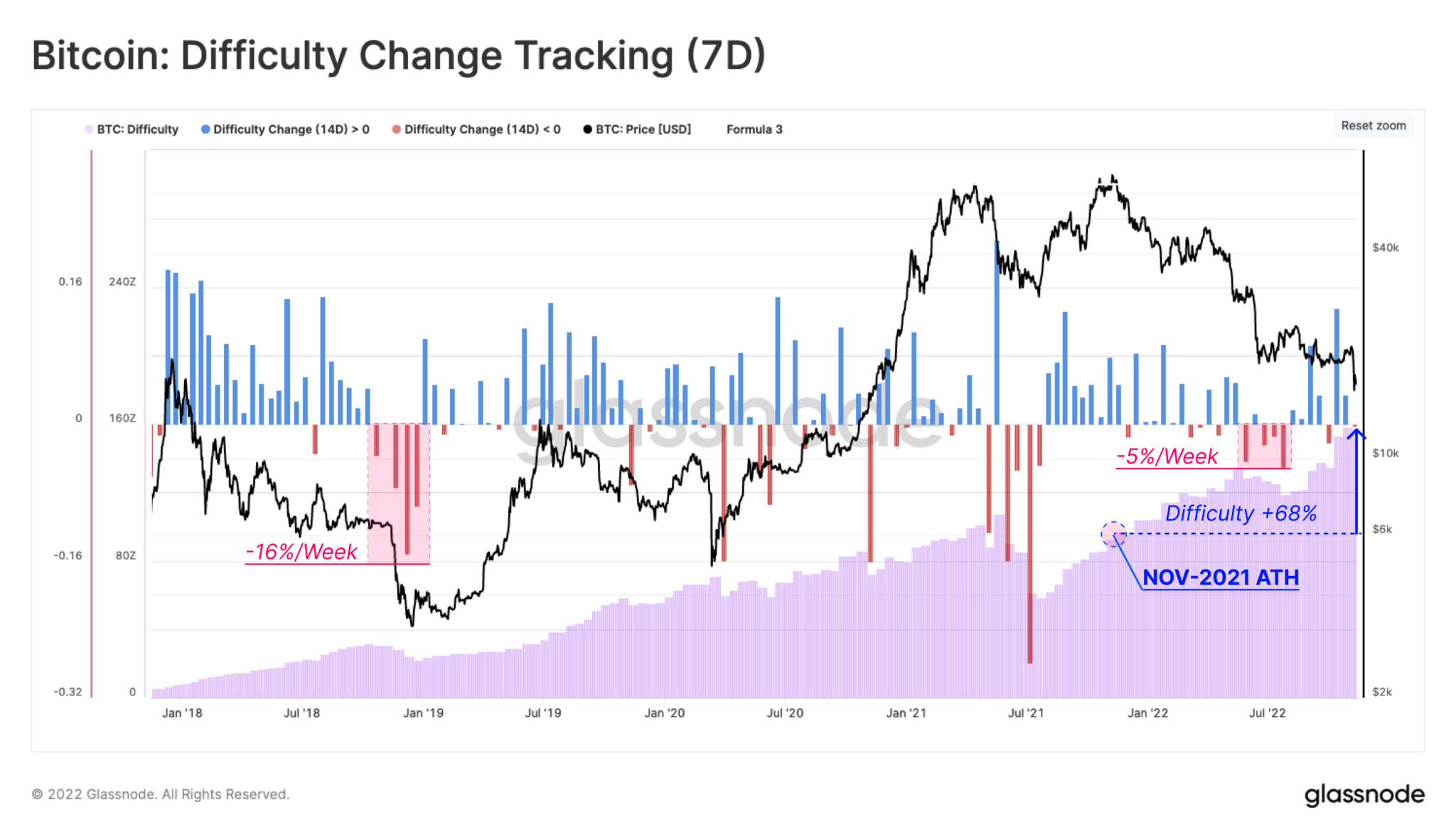

Hash rate has begun capitulating to lower prices. So far, despite the price, the depth of the miner capitulation is still small. Looking back a few years, we can see the capitulation in 2018, a few more around the coronavirus crash and halving, the miners being kicked out of China registers as a capitulation but it really wasn't, and the previous capitulation earlier this year.

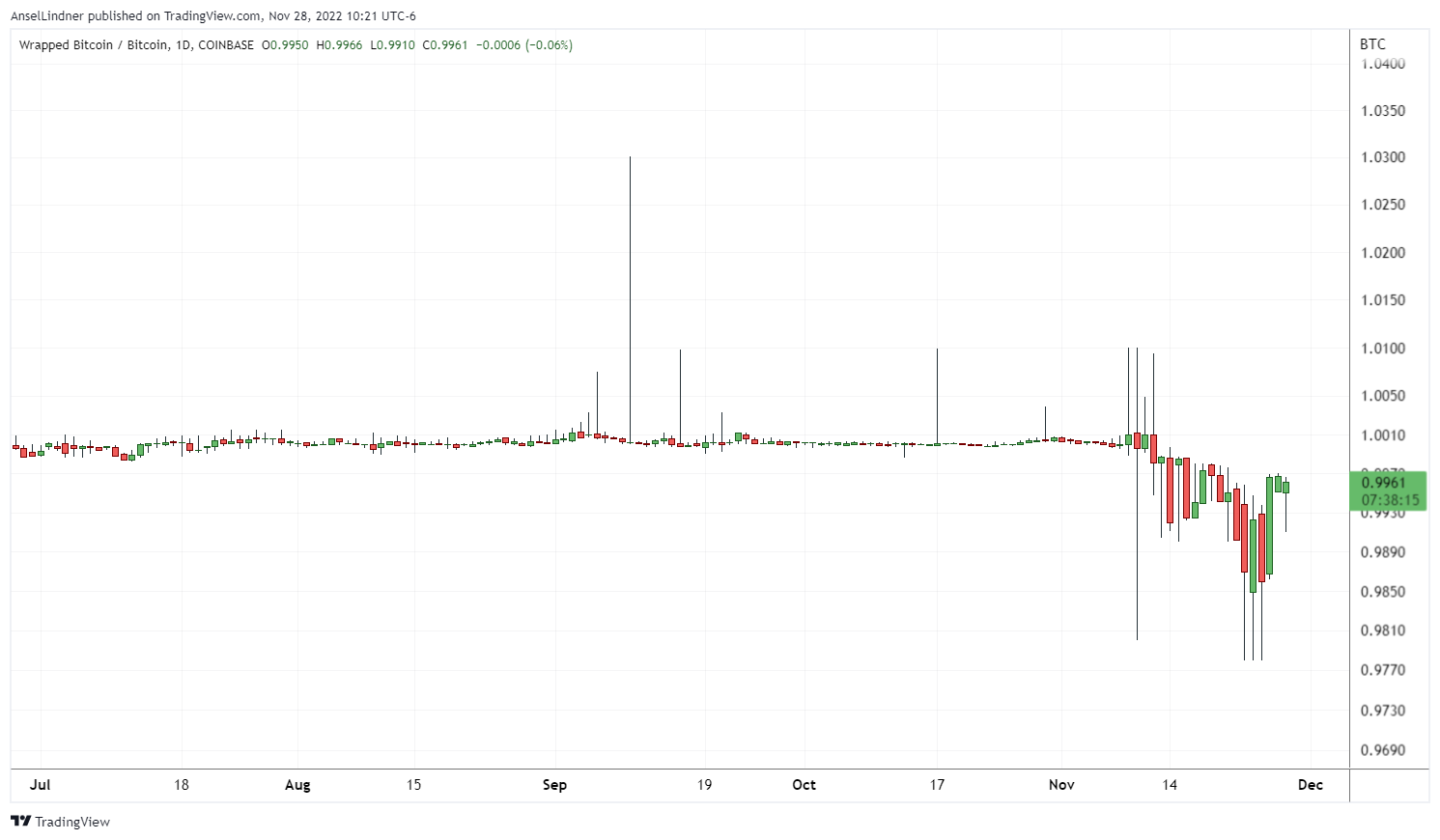

Wrapped bitcoin update. Reminder for beginners, wrapped bitcoin is bitcoin that has been encumbered by an ethereum smart contract, and is held in custody, typically by Bitgo.

The FTX insider/hacker/actor that stole a bunch of funds changed their Eth into wrapped bitcoin (smart move), and that put the spotlight on wrapped bitcoin itself. Is this smart contract solvent? Does Bitgo have all the bitcoins to back all the wrapped bitcoin?

I have confidence in Bitgo (famous last words maybe, lol). It appears they have the coins. The market peg has recovered to 0.995 wrapped bitcoin to real bitcoin.

While I'm at it, here is the Tether peg, too. 0.9995 to the dollar once again.

The FUD bred from the FTX the frustration spread to these products, which were never implicated in the rehypothication schemes. Interestingly, if these products were the next logical target for FUD, that makes be believe the serious damage is over for now.

Funny, Tether was hounded by the NYAG for years and still is, yet it was FTX that blew up. This supports the idea that the harassment of Tether was politically driven. It should also give us solace that Tether's role in the market is well-founded on demand.

Headwinds and Tailwinds

Dollar

The dollar is at 106 for the third report in a row, perhaps setting a solid floor for the new range. I not wedded to a specific bottom of the range as indicated in the chart by the shaded box, only that the dollar is in a new range and won't extend too much in either direction for a couple years.

Recession talk

The calls of recession are deafening. Where were they back in 2021 before the two consecutive quarters of negative GDP? I was there talking about recession, where were they?

Q3 2022 was positive at a 2% annualized rate. I think Q4 might be similar. The CPI is coming down very rapidly. As "inflation" comes down, nominal GDP doesn't have to grow, it can even decline, but if CPI declines more than nominal GDP, real GDP is positive. That's what I think we will see.

Overall, despite the yield curve inversions I talk about below, I'm still not expecting a massive real GDP recession. What we are experiencing is a crashing GDP with "inflation" is crashing faster.

In other words, it is a problem with the metrics. I'm talking about the headline numbers above. If you ask about the actual economy? I think it is contracting right now after an even larger expansion than was recognized in the measurements.

Stock Market

The S&P 500 challenged the 200-day but didn't quite make it there. Today, the market is having a bit of a down day, driven mostly IMO by the China news.

I like when prices don't charge into resistance levels, like back in August. The stock market is consolidating here, and could have more energy to break through that 200-day when time comes.

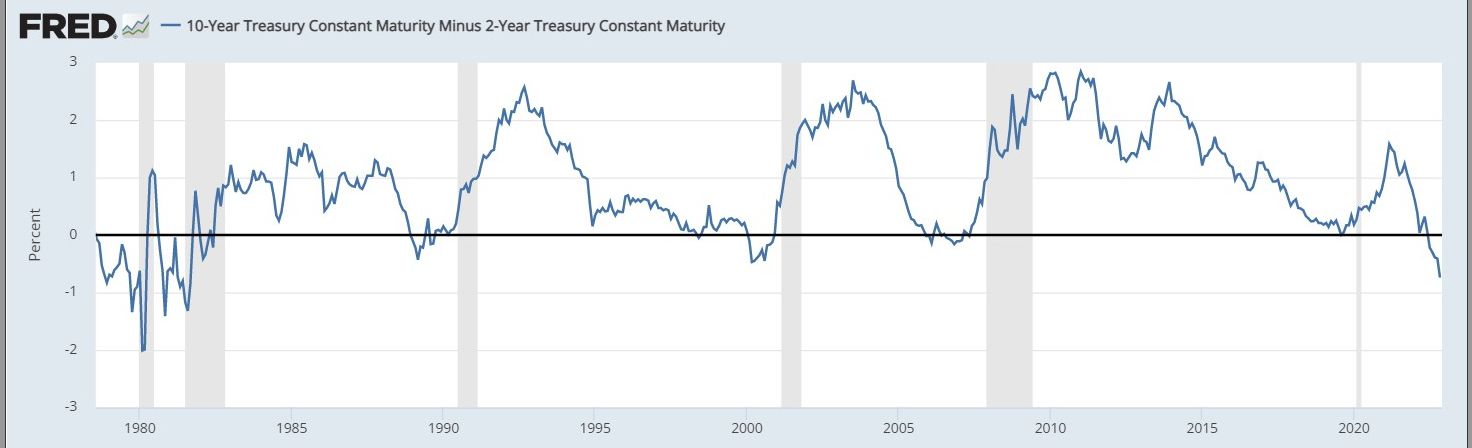

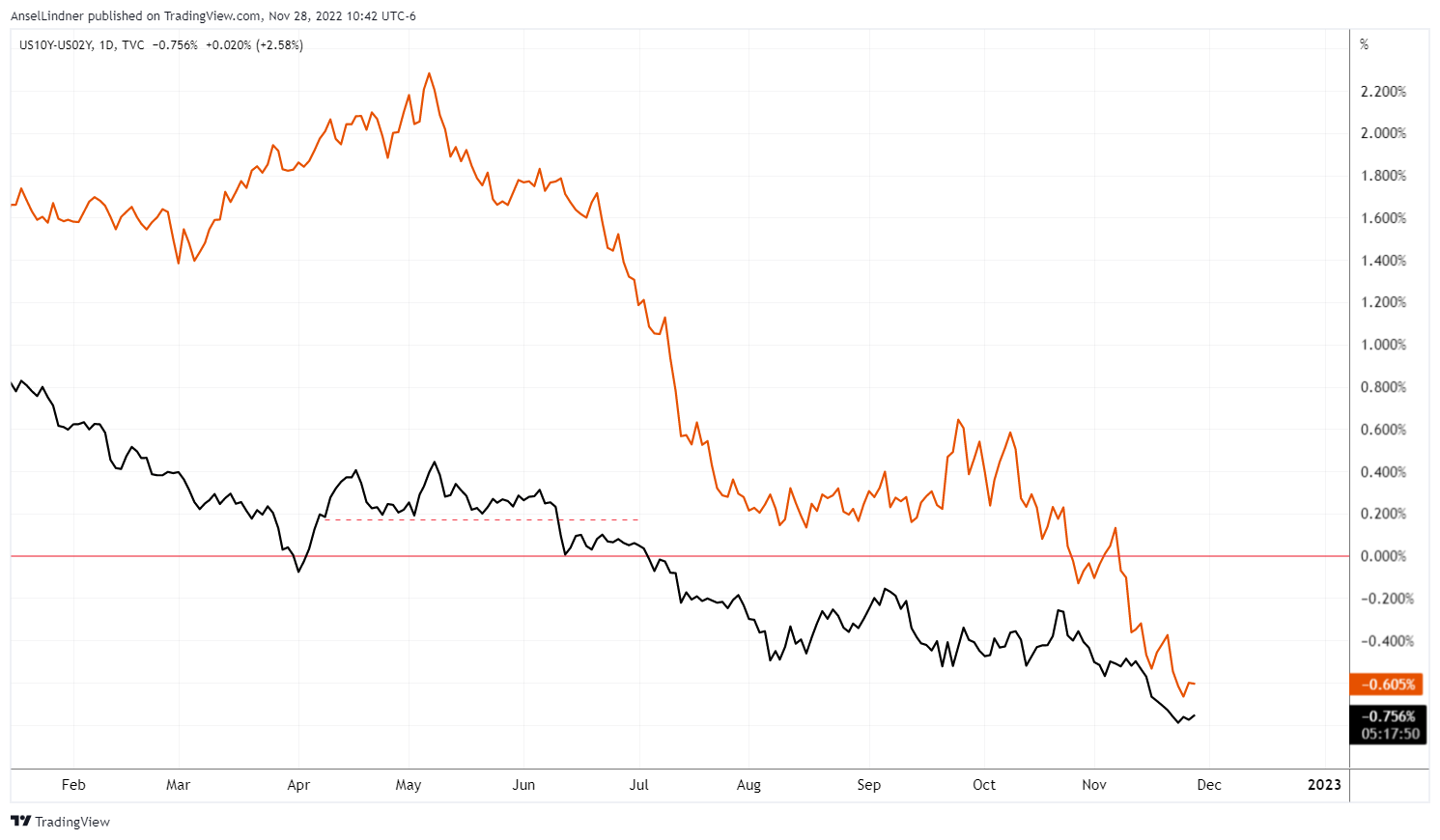

Yield curve inversions

The 10Y-2Y is at -75 bps!!! This is, again, the most negative since the 1981 recession. I'll also add that the 1981 recession was characterized by falling CPI as well. So, many things rhyme with today.

These inversions, however, cannot be ignored. In a typical market they would mean a massive and deep recession was imminent or underway. We cannot discount what they are telling us. Any positive economic development is far from sight.

Price Conclusion

Summarizing...

Not much has changed since last week.

Bitcoin's charts on all timeframes remain very bearish. This is the most universally bearish the charts have been that I can ever remember in my nearly 10 years of watching.

If you zoom out enough, the long term trend of bitcoin market cycles going higher is obviously still intact.

The recovery of several pegged products like wrapped bitcoin and Tether show panic has abated. These products should give us a heads up prior to any further ecosystem collapses.

Also, if you add in some macro context, like a newly range bound dollar, stocks over the 50 and 100-day MA, bitcoin's fundamental correlations lean bullish.

The biggest level of resistance is at $19,000, and the largest support is down at the 2019 high at $14,000.

Yield curves are ugly and are signaling a hard recession. This is the one factor that doesn't quite match with my forecast, depending on your interpretation. I think a deeper fundamental point can be made about inflation vs CPI, in regards to nominal vs real GDP. A change in nominal GDP of -8-10% would be a very deep recession, but since CPI is crashing as well, real GDP would stay around zero.

Overall, the risk of further capitulation, minus a major company like Coinbase or Binance collapsing, is low. The risk of slightly lower prices remains elevated. I'm expecting more sideways to higher this week.

Mining

| Previous difficulty adjustment | +0.5122% |

| Next estimated adjustment | -9% in ~7 days |

| Mempool | 8 MB |

| Fees for next block (sats/byte) | $0.41 (18 s/vb) |

| Median fee (finneys) | $0.39 (0.241) |

Mining News

Bitcoin miners cannot catch a break. Great write up here about how miners are facing very hard times.

In this first chart, you can see during the 2018 market crash and bottoming, the difficulty fell 16%/week, but so far since the top in November 2021, difficulty is up 68% in this bear market, only experiencing a short period of -5%/week decline.

In this second chart from the Cryptoslate report, it beautifully illustrates the capitualtions of the past few years. Pain could increase dramatically for miners if this period is as long as 2018. I don't think it will be.

Difficulty and Hash Rate

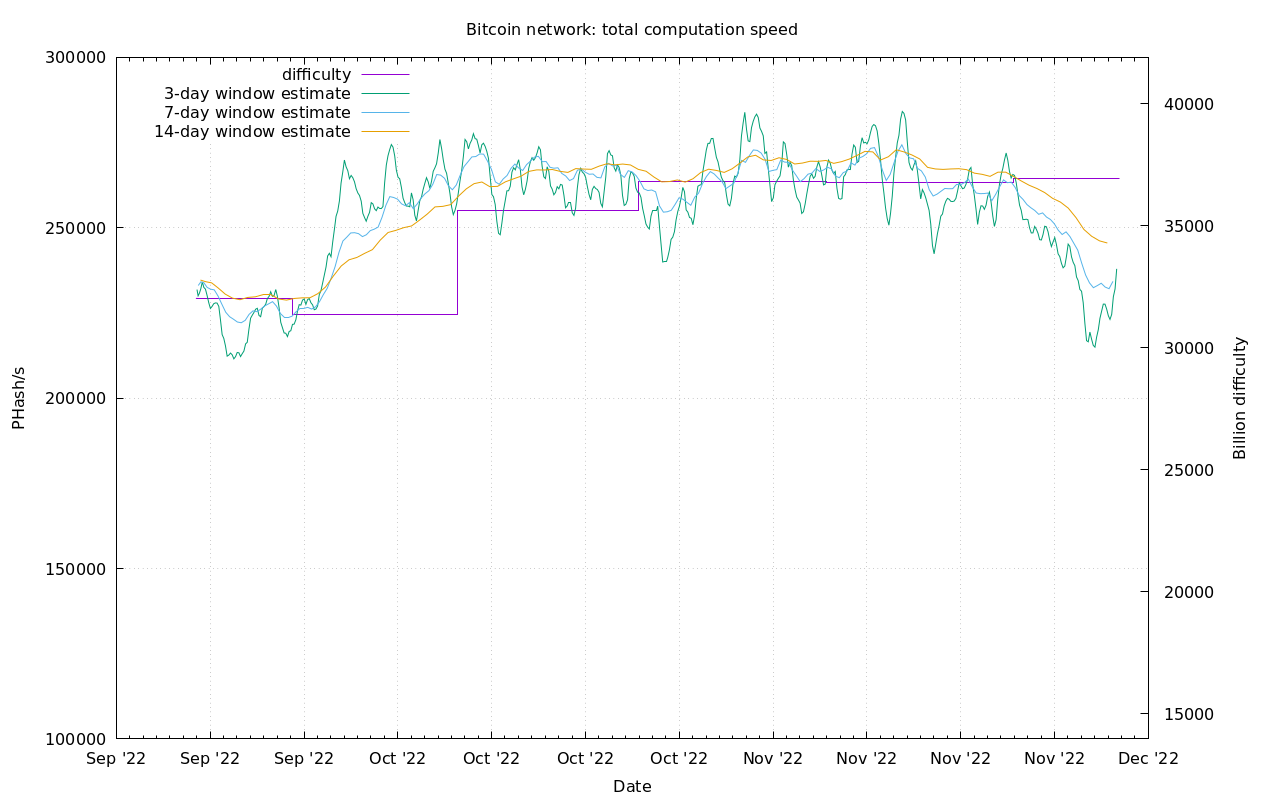

As you can see, hash rate (green line) is diving as miners pull their machines offline due to cost. Difficulty is estimated to drop by 9% in 7 days.

On the grand scheme of things, this is not a terribly large drop. We've see drops of 10-15% in the past as you can see in the first cryptoslate chart above there's been 3 since 2020.

This is not a terrible thing, it is just part of the cycle. The more the miners sell now at the bottom, the they have to sell on the way up, like we saw in Jan 2021 at $40k. In other words, a larger than expected miner capitulation today is pro-cyclical when price rises again.

Mempool

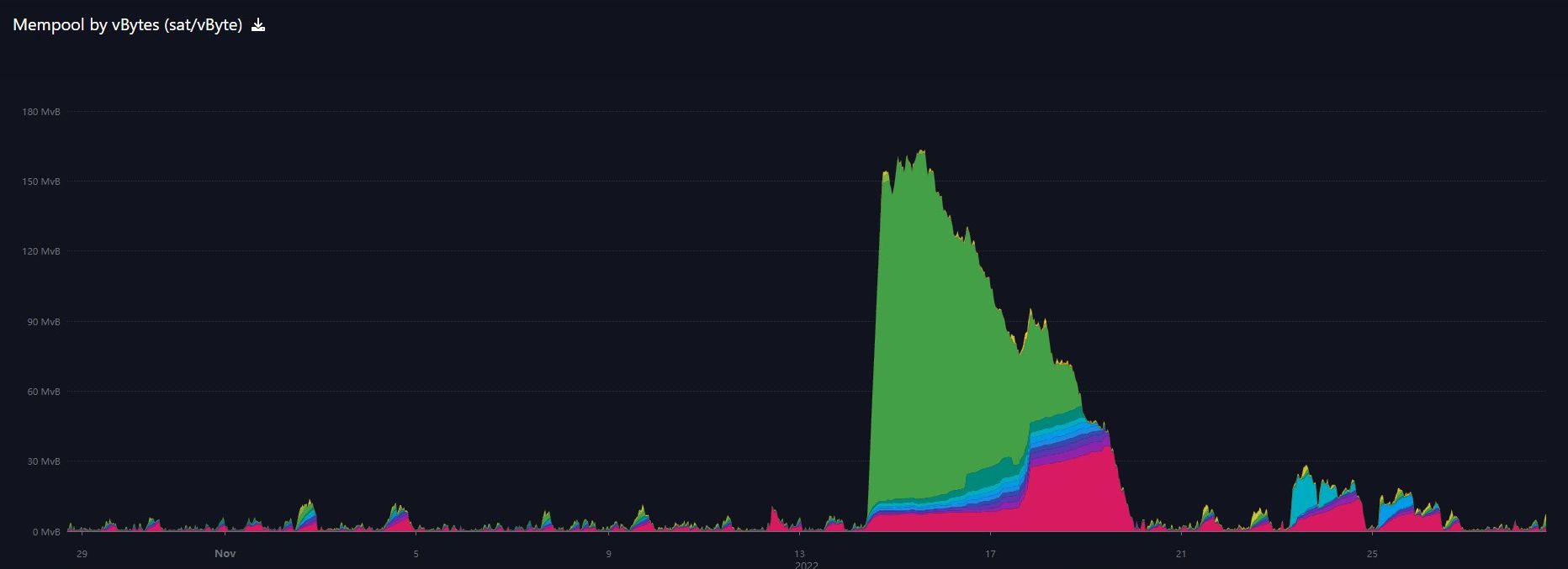

The mempool or network traffic is back to normal manageable levels after this month's excitement of the highest mempool since miners left China.

Lightning Network

Great article from Bitcoin Magazine and Stanislav Kozlovski.

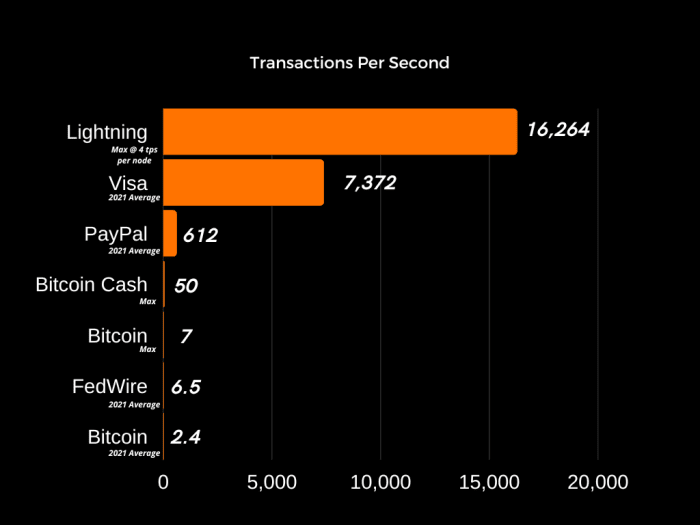

Visa saw 165 billion payments in 2021, PayPal saw 19.3 billion payments across its whole platform and FedWire saw 204 million. Respectively, these amount to 7,372, 612 and 6.5 payments per second on average for 2021. To put into perspective, Bitcoin did 2.44 payments per second in 2021 and scales up to a maximum of seven per second.

The study cited says that if lightning nodes were only capable of 4 transactions per second (tps), they'd out compete all other payment methods combined. And that is pretty simple, because lightning node theoretically can process 1000 tps.

It wasn't perfect. I did disagree with this framing of the scaling wars:

The decision was effectively made to scale Bitcoin through layers, introducing second layers that work separately from Bitcoin and checkpoint their state to the main, slower-but-more-secure network.

The route bitcoin took was circumscribed by the game theory. This was the only solution that worked. No decision was made, it's just how the incentives were aligned. In fact, the Bcashers also won, they got their hard fork bitcoin clone, they just didn't get the market's coronation as "Bitcoin".

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

November 28, 2022 | Issue #219 | Block 765,089 | Disclaimer

* Price change since last week's report