Bitcoin Fundamentals Report #221

Jump to: Market Roundup / Price analysis + Price Conclusion / Mining sector / Lightning Network

In Case You Missed It...

Daily Live streams

- Weekly Report Summary and Chat on Credit - Daily Live 12.5.22 | E275

- The Great Retirement Boom and Deglobalization - Daily Live 12.6.22 | E276

- Global Macro, a Holistic View - Daily Live 12.7.22 | E277

- "Crypto" is Low (T)oxicity, Bitcoin is High T - Daily Live 12.8.22 | E278

- Free Form Friday, Everything Bitcoin, Ethereum, and Macro - Daily Live 12.9.22 | E279

- Mortgage Your House for Bitcoin? - Daily Live 12.12.22 | E280

- Live CPI Reaction, Key Insights - Daily Live 12.13.22 | E281

- Anti-Bitcoin Bill is a Joke and DOA - Daily Live 12.15.22 | E282

Article

Fed Watch

- $80 Trillion in Shadow Banking - FedWatch 122

- Massive Week in Macro Review- FED 123 (not yet released in podcast form, but make sure you are subscribed! and Check it out below on video)

⬇️ Check out the 30 min mark in the video below ⬇️

Listen to podcast here

Market Roundup

| Weekly trend | Attempting to bottom |

| Media sentiment | Extremely Negative |

| Network traffic | Normal |

| Mining industry | Consolidating |

Bitcoin Headlines

Bitcoin's detractors really piled on this week.

- Macro commentator and YouTuber George Gammon slams bitcoiners

Not sure if George really dislikes bitcoiners, or he is engagement hunting, but he tried to call out Michael Saylor on Twitter this week, then made a video about it. He pretty much exposed himself as believing the mainstream media spin of bitcoin.

I did a podcast about this, check out episode 280 above.

The bill calls for all node operators be classified as "financial institutions" and must: 1) register as such, 2) KYC all incoming messages to your node, 3) develop a specific AML program that can block transactions if the node operator suspects funds are related to a crime, 4) file reports of users without a need for a warrant or probable cause, and 5) custodians and node operators are banned from using any privacy tool whatsoever.

Needless to say, this bill is DOA. There is zero chance this gets passed, and zero chance it stands up to legal scrutiny.

I made the point in the podcast that covered this, an interest angle to focus on is that this is what a CBDC would do, and exactly why a CBDC is not coming to the US.

- A bank run on Binance picks up speed

It's hard to keep up with this fast moving story. People are worried Binance is insolvent, so this week up to 2,000 bitcoins an hour were drained from Binance's reserves via customer withdrawals. So far, no major issues.

There are some questionable activities that resemble FTX and others, like offering very high returns on staking your coins with Binance and their Binance Token price appreciation this year. However, these are not proof positive of any fraud, comingling of funds, or being fractional reserve.

I personally don't have a firm belief either way, but I tend to think it is more likely they are solvent. I recommend never storing more than a minimum trading amount on any exchange, and be ready to withdrawal at the first sign of trouble. If you had money on Binance, the time with withdrawal was weeks ago, get it off asap.

Macro headlines

- US CPI continues to plummet

The month-over-month CPI number for November was 0.1%, a HUGE miss below the expected 0.4% consensus forecast.

This once again shows that the CPI rise was transitory, especially in the US. European CPI rises would also be as transitory without the system ending sanctions they've decided to place on Russia.

I expect December CPI to be around the same mark. In fact, I think CPI has ALREADY returned to the 2% Fed target level right now. Concentrating on the year-over-year CPI is going to prove extremely stupid.

- Federal Reserve slows rate hikes, raises 50 bps

At their December meeting, the Federal Reserve decided to raise rates by only 50 bps, in a continuation of a slow motion pivot. In November, they changed some of their rhetoric, December they slowed their rate of increases, and I believe at their February 1st meeting, they will fully pause, with a slight chance they will cut rates then.

Watch the linked Fed Watch episode above for more details.

Price Analysis

| Weekly price* | $16,833 (-$97, -0.5%) |

| Market cap | $0.324 trillion |

| Satoshis/$1 USD | 5,940 |

| 1 finney (1/10,000 btc) | $1.68 |

Last issue

Once again, last issue was very accurate.

Overall, the risk of further capitulation, minus a major company like Coinbase or Binance collapsing, is low. The risk of slightly lower prices remains elevated. I'm expecting more sideways to higher this week.

Since we've seen Binance come under extreme pressure, causing price to pull back in the exact zone of resistance we predicted.

4-Hour chart

On the short-term chart, bitcoin has shown some signs of strength. It broke above the immediate FTX trend line in blue, then the extended trend line (you see better in more charts below), and headed into the resistance zone.

Bitcoin sympathetically fell while in that resistance at the FOMC announcement. Most recently, new Fear, Uncertainty, and Doubt (FUD) reporting around Binance, as well as other "risk assets" sold off, price has fallen further.

Daily chart

Looking at the daily chart, we can see the little pop into the resistance and subsequent rejection. I've labeled the major market events this year. This chart is not as weak as it has been in previous weeks.

Pivots last issue:

The daily pivot is at $18,000, so it is highly likely we test there at some point soon.

As you can see, we come up perfectly into the pivot, and bounced down.

Weekly Charts

The weekly chart is not much different than last issue. This weeks candle does not look very good, turning back red, but we still have the weekend to turn it back green.

The unprecedented bullish divergence, now double, is a bullish sign as well.

On the Ichimoku cloud on extended setting for the weekly, we see an interesting timing comparison to the 2018 bottom. First, on the current chart, notice the proximity to the cloud twist, green to red. This can be thought of as an area of lower resistance.

Now, back in 2018, this is where the price really took off. My interpretation of this is the timing and resistance is right for the bottom to be confirmed.

Headwinds and Tailwinds

Dollar

The dollar is only ever-so-slightly lower than the last issue. 105.1 then, compared to 104.7 now. It has been hanging out around 104 - 106 for 5 weeks or so.

Recession talk

Recession odds are about the same as last issue. More people jump on the recession bandwagon every day.

I expect the Q4 real GDP to be positive following a positive Q3. These are very slightly positive readings, but what is important is that without being negative, there is no chance this period will be classified as a recession.

Will there be a recession in H1 of 2023 is the question. I find that unlikely, since the "inflation" rate is going to be dropping so quickly. The Fed predicts 0.5% growth for 2022 and 2023, which I think is about right, only due to the "inflation" variable crashing so much.

The economy is definitely slowing rapidly, but so is the "inflation" rate, meaning GDP will flucuate around zero, but never being bad enough to be called a recession.

Therefore, 2023 will be PAINFULLY STAGNANT but we avoid a massive official recession.

Stock Market

What a difference a couple days make. The stock market (S&P 500) was breaking out above important levels, and then did an about face with the Federal Reserve FOMC meeting.

Stocks are diving through supporting moving averages, shown are the 200 in yellow, the 100 in red, and the 50-day in green. This is a very bearish development.

There is also a huge $4 trillion options expiration today, the second largest in dollar terms in history, which will cause some volatility as traders close out positions.

I do expect stocks to rally into the end-of-year. Traditionally, December is very positive month for stocks, and December 15th, is the average lowest day of the month, meaning we normally see a "Santa Clause rally".

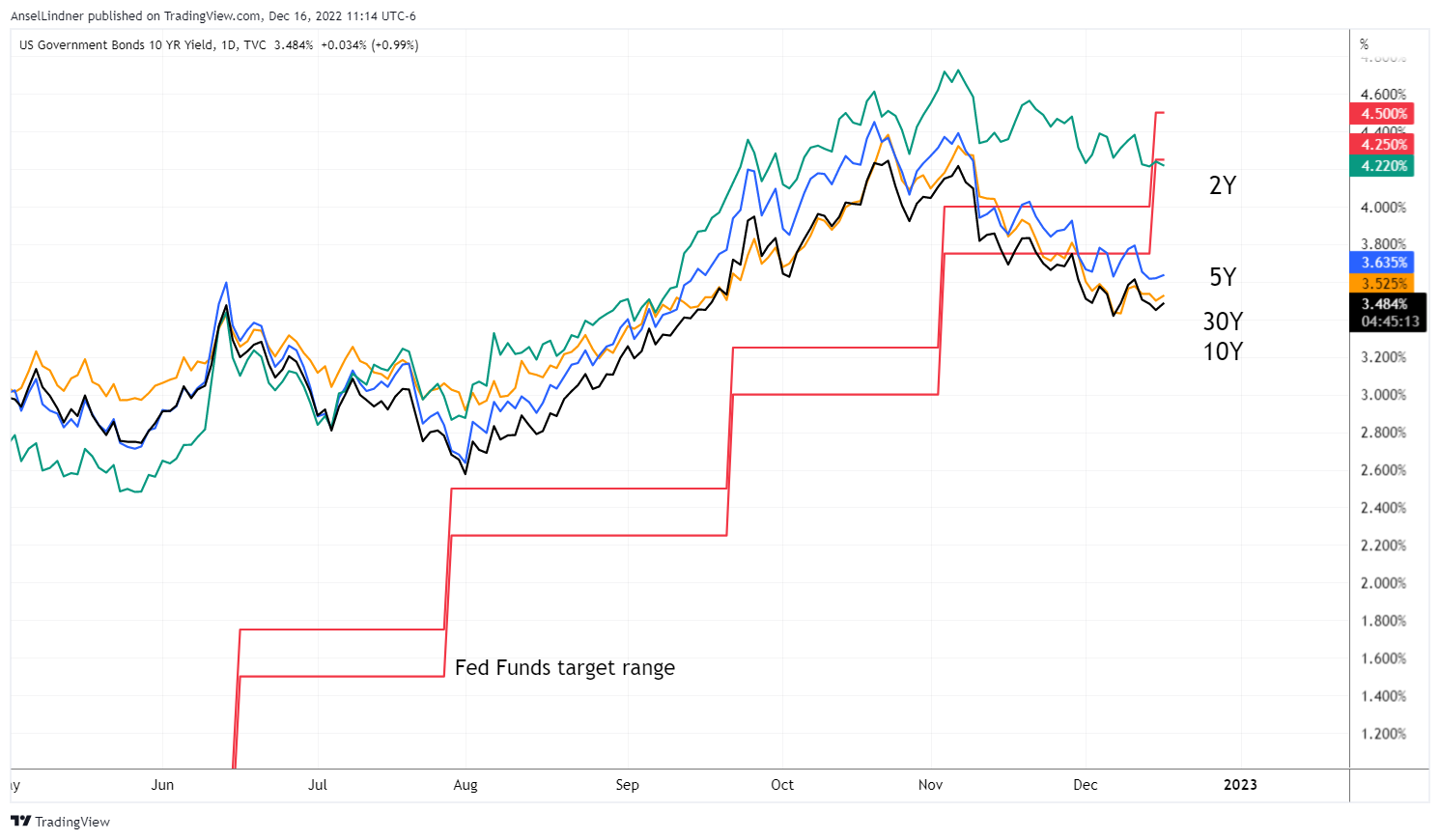

Treasury Yields

After this week's rate hike, the 2-year all the way to the 30-year treasury yield is BELOW the Fed Funds target range. This is the moment I've been waiting for. Will rates obey the Fed? Does the Fed have the power, or does the market?

There is zero reason to believe in the mythology of the Fed, if rates stay this low when overnight repo is at 4.3% and Interest on Excess Reserves is at 4.4%. The only way this condition is sustainable, is if the the Fed is NOT IN CONTROL mechanically.

Oil

Oil might be my best call of the year. Wow, it is far below $80/bbl and showing no big signs of a rally. While everyone was fear-mongering about $200 or $300/bbl oil earlier this year, I was calling that the top of in, and oil was going much lower.

It does have plenty of room to rally back to $90/bbl or so, but much more expensive oil is not in the foreseeable future, at least 6 months out.

Price Conclusion

Summarizing...

This week is again slightly more positive on the bitcoin daily chart, while not much has changed on the weekly. The signs of life are real.

The dollar has weakened, but should be exhausting its consolidation and move slightly higher from here. Stocks are precarious, but the end of the year is usually good for stock prices. Oil is clearly signaling the end of higher CPI, barring major geopolitical events. Treasury rates are falling, calling the Fed's bluff.

There are major signs of global economic slowdown, but with US CPI coming down, it is unlikely to lead to massive negative growth. Slowly the market will realize we are returning to a post-GFC normal of low growth and low inflation. That is the perfect environment for asset prices and bitcoin of course.

Overall, minus a growing but still minority risk of a major company like Binance collapsing, I'm expecting the bitcoin price to regain its slight upward trend off the lows. The risk of slightly lower prices remains elevated and even with a Binance blowup, I don't expect a massive crash in the bitcoin price.

Mining

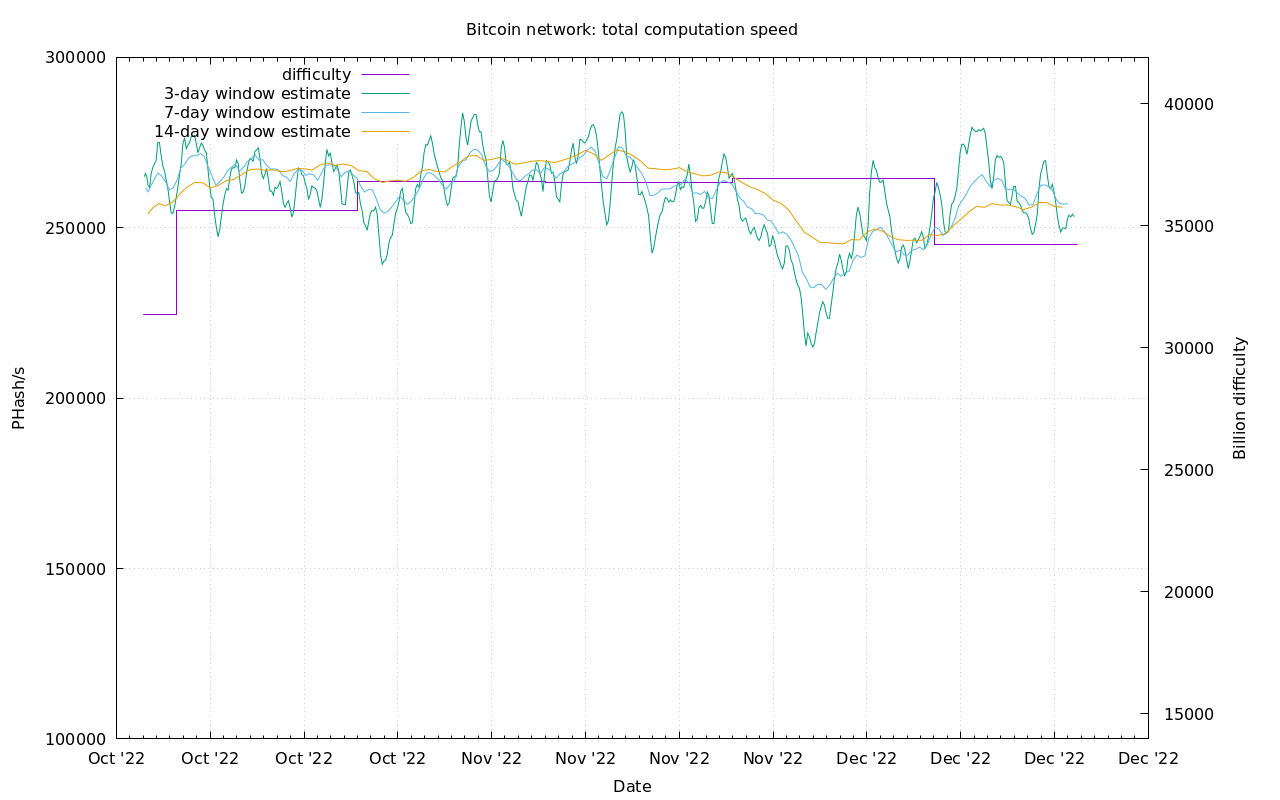

| Previous difficulty adjustment | -7.3238% |

| Next estimated adjustment | +4.5% in ~2 days |

| Mempool | 10 MB |

| Fees for next block (sats/byte) | $0.33 (14 s/vb) |

| Median fee (finneys) | $0.33 (0.196) |

Mining News

Tokyo Electric Power Company (TEPCO) Power Grid is partnering with TRIPLE-1, a local semiconductor designer and developer, to mine bitcoin with excess energy across the country. TEPCO is the country’s largest electric power company in total assets.

According to a translated version of a Wednesday statement by the Japanese energy giant, Agile Energy X signed a memorandum of understanding with TRIPLE-1 on November 11 to build a constructive strategic partnership. Through the collaboration, Agile aims to deploy distributed data centers throughout Japan that repurposes surplus electricity from renewable energy with semiconductors from TRIPLE-1.

Bitcoin mining makes it economical to expand power generation is poor countries!

Powering a rural Kenya village and securing the #Bitcoin network with excess hydropower, all while lowering rates to 2000 people (500 families, ~$10/month to $4). 🇰🇪 @GridlessCompute pic.twitter.com/9GUlAU6265

— jack (@jack) December 9, 2022

Public miners struggling but finding support

Financial services platform B. Riley has offered Bitcoin miner Core Scientific $72 million in financing to avoid bankruptcy and preserve value for Core Scientific stakeholders.

B. Riley, a top lender to Core Scientific with $42 million in loans currently outstanding, outlined the terms of the financing agreement in a Dec. 14 letter noting it's prepared to fund the first $40 million “immediately, with zero contingencies.”

The finance platform suggested that the remaining $32 million would be conditional on the BTC miner suspending all payments to equipment lenders while Bitcoin prices are below $18,500.

Difficulty and Hash Rate

Hash rate has remained extremely strong despite all the hardships in the mining industry right now. As you can see, the purple line is the difficulty, dropping significantly in the last adjustment. Current estimates for the next adjustment are a +4%.

Lightning Network

Jack Mallers is at it again:

Bitcoin app CoinCorner said in a statement Monday that it had enabled Send Globally, a feature that lets foreign users instantly and cheaply send remittances to Africa, for its EU and U.K. customers.

The feat is made possible through a partnership with Africa-based Bitcoin app Bitnob, and comes on the heels of a similar team-up with Lightning payments app Strike.

Strike last week enabled Send Globally for its U.S. users, letting them instantly transfer money to bank accounts in Nigeria, Ghana and Kenya with minimal fees.

“BOLT 12 adds a ton of functionality to Lightning invoices. It also adds privacy,” said Jack Sweeney, communications manager at LN Capital, creators of Torq

BOLT 12 introduces “offers” to the Lightning Network. According to the official BOLT 12 website, “offers are a precursor to an invoice” that enable key functionality such as reusable QR codes, the ability to both send and receive payments and of course, enhanced privacy.

Reusable QR codes pave the way for use cases like recurring subscriptions and donations. Send and receive functionality can now be used for Lightning ATMs and private refunds. Finally, new features like route blinding, payer keys and Schnorr signatures will provide an extra layer of privacy.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

December 16, 2022 | Issue #221 | Block 767,700 | Disclaimer

* Price change since last week's report