Bitcoin Fundamentals Report #228

Ordinals booming, Charlie Munger is old, macro developments, price considerations, mining sector and lightning news.

Snapshot of Bitcoin

Click headings to jump to section

| General Bitcoin Headlines | |

| Weekly trend | Consolidation |

| Media sentiment | Very Negative |

| Network traffic | Elevated |

| Mining industry | Recovery continues |

| Price Section | Market Pro tier |

| Weekly price* | $22,986 (+$271, +1.2%) |

| Market cap | $0.444 trillion |

| Satoshis/$1 USD | 4,347 |

| 1 finney (1/10,000 btc) | $2.30 |

| Mining Sector | |

| Previous difficulty adjustment | +4.6833% |

| Next estimated adjustment | -3% in ~5 days |

| Mempool | 16 MB |

| Fees for next block (sats/byte) | $0.65 (20 s/vb) |

| Median fee (finneys) | $0.39 (0.170) |

| Lightning Network | |

| Capacity | 5,402.39 btc (+1.4%) |

| Channels | 75,224 (+0.4%) |

In Case You Missed It...

Community streams

- Disbelief Stage, No Recession, Culture vs Technology - Daily Live 1.30.23 | E309

- Peak Oil Demand and a Defense of CPI - Daily Live 1.31.23 | E310

- Important Takeaways From Fed's Rate Hike - Daily Live 2.1.23 | E311

Fed Watch

⬇️ Check out the video below ⬇️

Listen to podcast here

Headlines

Bitcoin

- "Ordinals" Remain the Big Debate Within Bitcoin

Last week, I introduced the debate on Ordinals. To be honest, I didn't think it would become this big of a topic, but against this week, it is the main debate in the space.

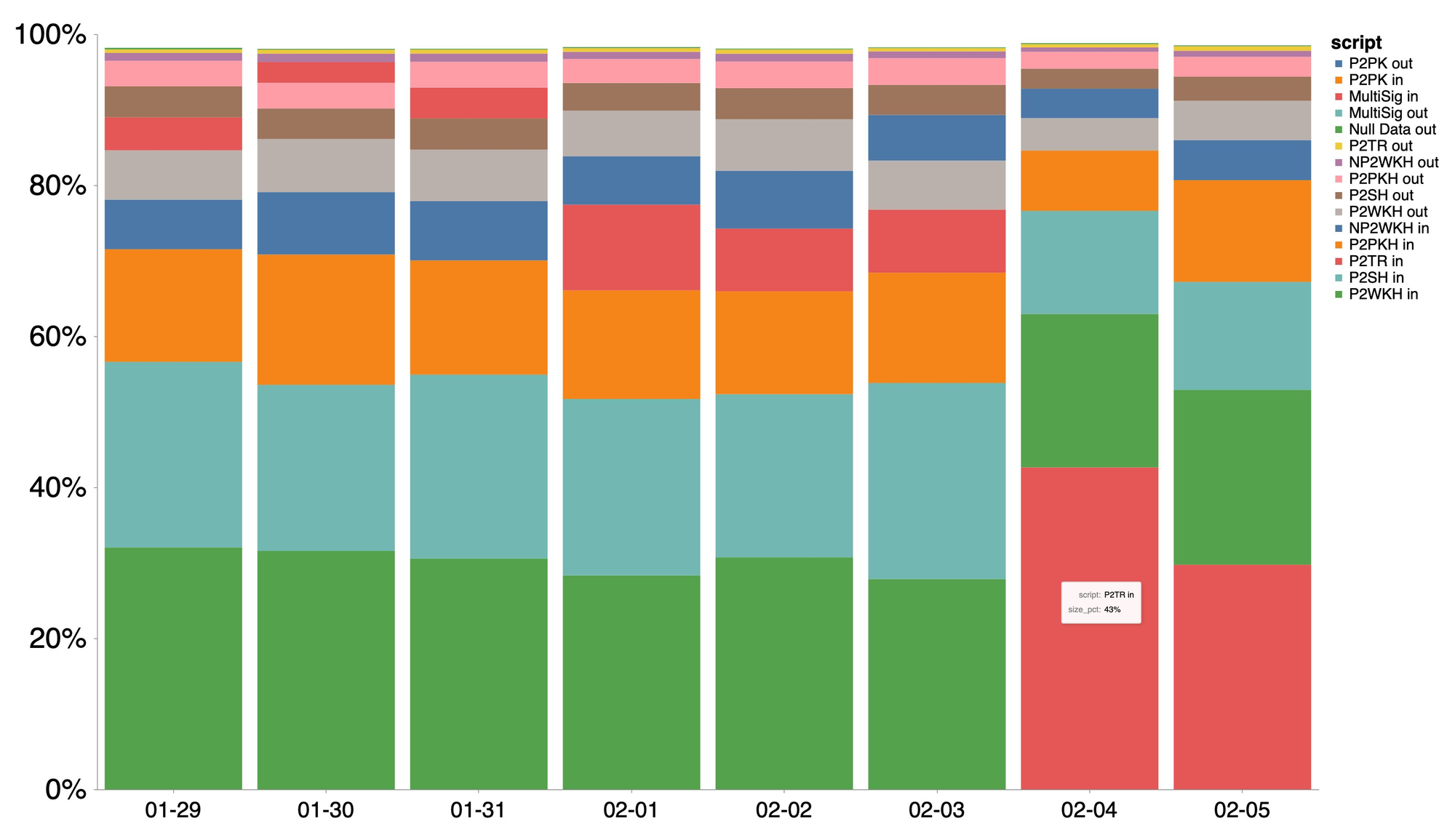

Almost overnight, the Ordinal-ready input type became the dominant one on Bitcoin.

I'm getting 2016 Block Size War vibes...

I was confident back then that Segwit would be adopted via the User-Activated Soft Fork, and it was. Now, I'm confident this is NOT a major threat to Bitcoin. What it will do is kill the non-Bitcoin NFT market, and then people will realize NFTs are nearly worthless.

Here are a couple videos from the Ordinal creator himself describing his invention.

Video #1: Ordinal Theory Explained

Video #2: Ordinal Inscriptions: NFTs on Bitcoin

- Charlie Munger, of Berkshire Hathaway Fame, Says Bitcoin is Stupid and Calls for Totalitarianism

Macro

- US Jobs Report Headlines Miss the Signal for the Noise

At first glance, the US has the lowest unemployment in 54 years. However, when we look into the numbers a little more, a different picture emerges.

This article summarizes the Jobs Report in more detail.

The same number of skilled and full-time jobs, many more part-time jobs. Also, the Bureau of Labor Statistics (BLS) updated their calculations, which has adjusted the numbers of employed up, closing a gap that led to "missing employed" which the Fed and others like myself, have talked about in recent months.

There's still some problems with jobs in the US, but it does appear the Federal Reserve has not been able to create the recession they wanted.

- Chinese "Spy Balloon" Story is Bonkers

The fact that the NON-STORY of the weather balloon was so big this week, signifies just how slow of a news week it was.

If you aren't up to speed on the story, here's quick twitter thread that summarizes it pretty well.

For me, the main takeaway is the growing distrust among Great Powers in the world. It was a simple weather balloon but people couldn't believe that easy explanation with the only evidence, they had to invent nefarious theories.

We cannot go back to the world of globalization and trust.

Price Analysis

I have started a new membership tier and newsletter. Instead of a long price section on this free weekly post, I'm creating a new offering for people that want to stay ahead of the price. Check out Premium Market Pro!

I've been extremely accurate in my forecasts over the last couple of years, and know there is a ton of value in my charts and price predictions. However, most casual readers of this free weekly post, are more interested in general news updates and a very brief price summary. So, I'm splitting them up to better fit the needs of my subscribers and create a new source of revenue for Bitcoin & Markets.

Daily chart

Bitcoin has been following my expectations and forecast quite closely this week. I did call for the Daily RSI (bottom on below chart) to reset to roughly neutral (50) before the next leg higher in this bull market.

The bull market has started but that doesn't mean it will go up in a straight line. Many bitcoin beginners think it just goes up in a bull market, and are surprised when we see periodic consolidations and mixed messages from both the mainstream financial press and bitcoin-focused press. It's all part of it.

That being said, this consolidation is close to being over. On the next dip, bearish voices will become amplified, and that's when we know it's time to squeeze them again on the way up.

Phugoid Cycle

On the Telegram, we had a brief discussion on what the character of this bull market will be. There's a growing cadre of bitcoiners that think this cycle will be vastly different than previous cycles. Their forecasts center around an idea called the Phugoid cycle, where bitcoin's price explodes higher to ATHs and beyond, like $100-200k, only to dive back down to $50k or lower.

I'm not in this camp. Its main proposition, that volatility will INCREASE in the bitcoin price, is directly counter to my long-term understanding of bitcoin. I believe bitcoin's volatility (measured in dollars) will DECREASE in the next decade, not increase.

Where I'm in agreement with the Phugoid cycle is on the upside. I expect price rises to take place is smaller windows of time. If you aren't holding and in when price adjusts, you will likely miss most of the move. There will then be periods of boredom, as the price consolidates and tricks people into thinking the whole move is over.

Mining

Headlines

Several headlines about Core Scientific

- Core Scientific to hand over 27K rigs to pay $38M debt

- Core Scientific bitcoin production grows 6% sequentially in January

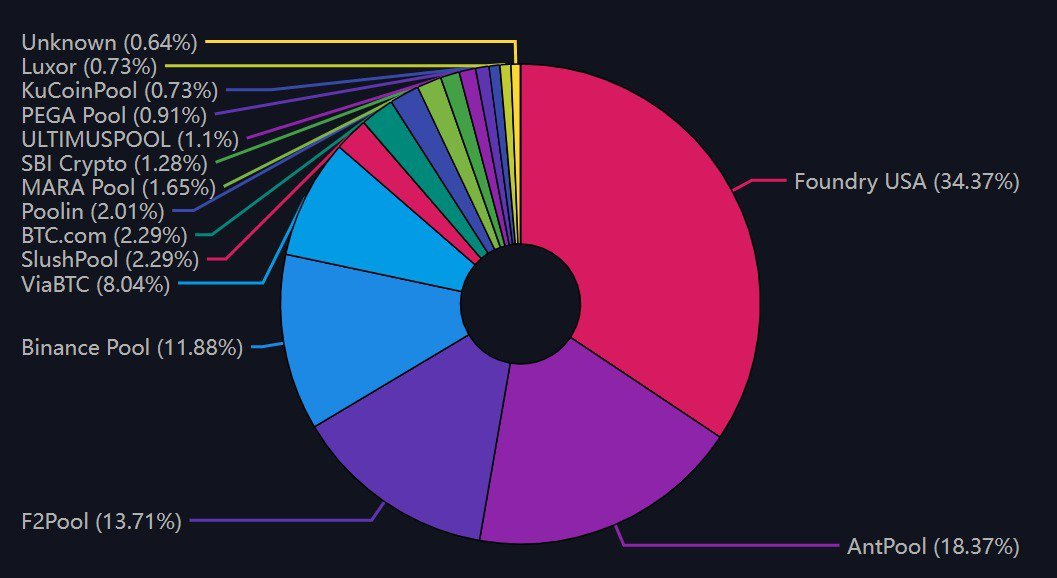

There is some worry building around Foundry USA's share of bitcoin mining.

- Foundry's share of hash rate continues to grow

For beginners, this is a pool made up of many smaller miners. This is not one megalithic miner, it is only the pool. So, this isn't a serious centralization concern, but does bring up the topic of mining centralization.

All that is needed is for individual miners to point their hash rate at a different pool. If Foundry gets any bigger, I think that will start to occur.

This has happened before in Bitcoin. In 2014, Ghash.io reached >50% of the mining hash rate. The centralization scared the market and the pool was quickly abandoned, so much so it closed in 2016.

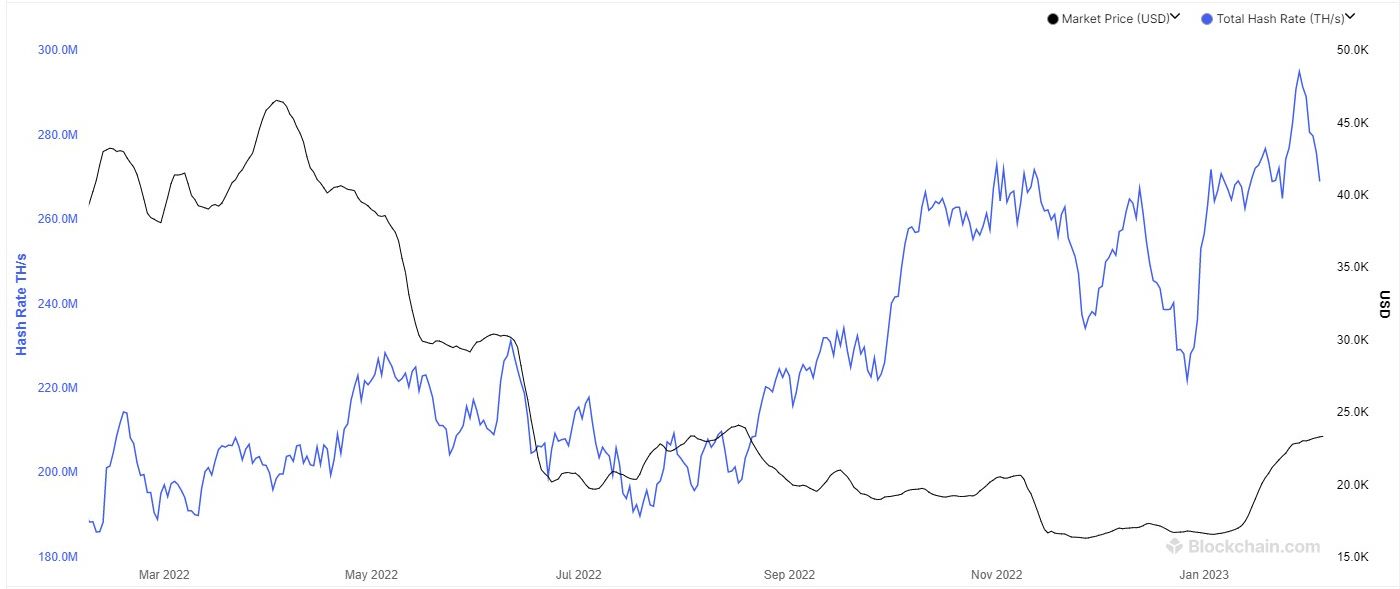

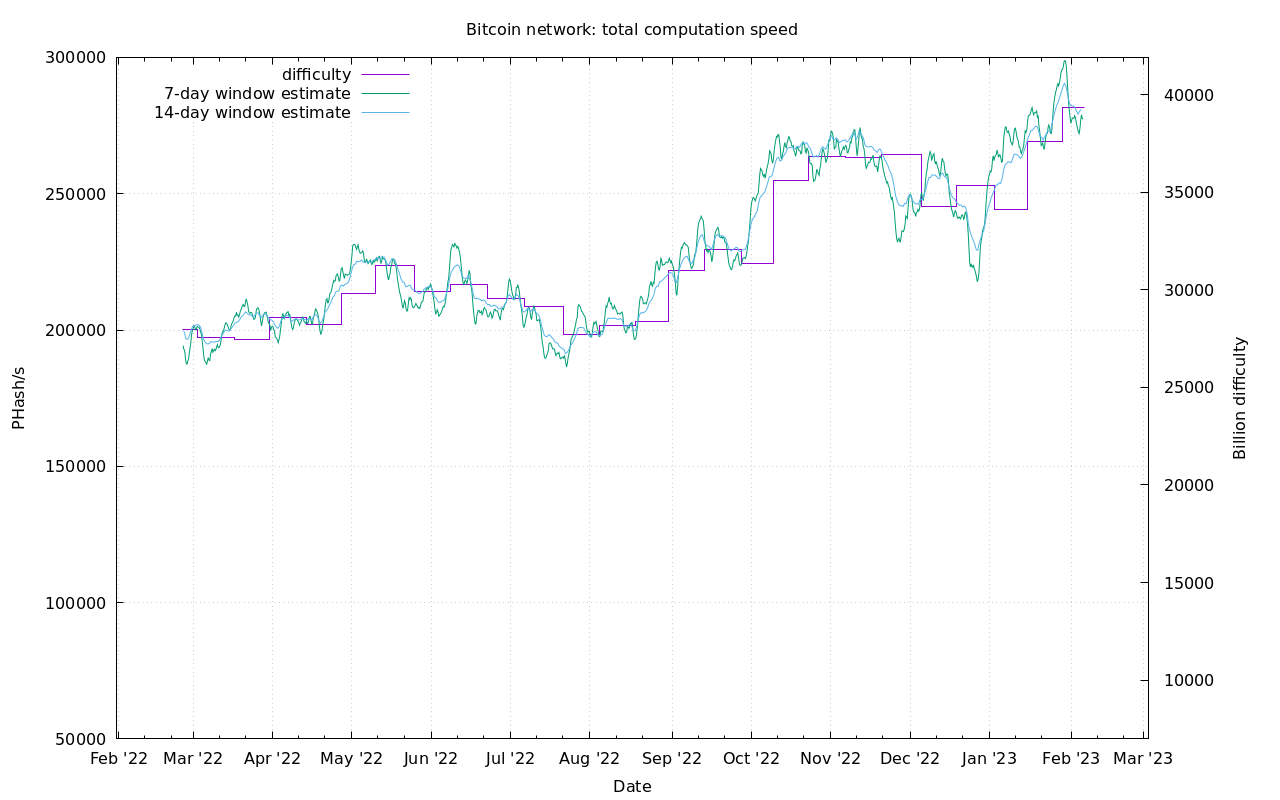

Difficulty and Hash Rate

Bitcoin's hash rate has come back slightly this week, but still near ATHs. Overall, bitcoin miners are consolidating during a bear market, yet the industry is booming. Of course, this is despite the price being near the lows.

We should want less efficient miners to go bust in bear markets, opening up market share for more efficient miners and new competition.

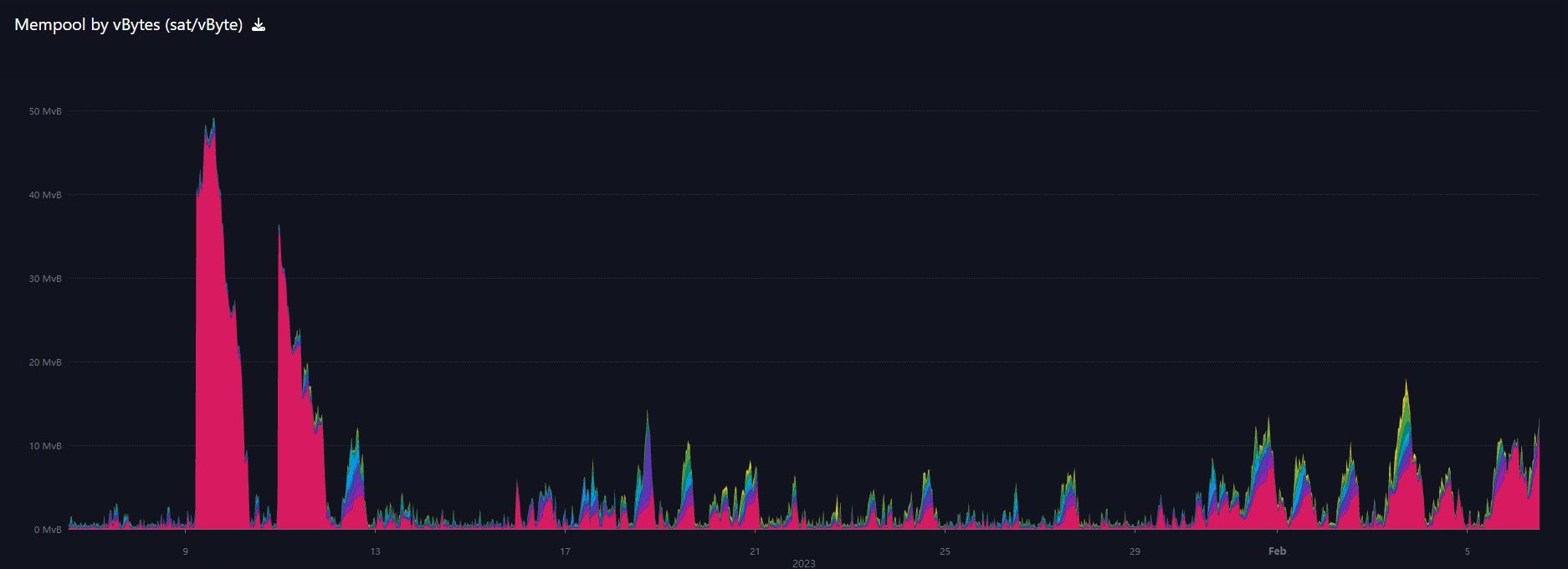

Mempool

The mempool consists of transactions waiting to be confirmed by miners and appended to the block chain. With Ordinals gaining in popularity, transactions are increasing in size. It is therefore logical they will affect the size of the mempool in this way.

As you see below, the mempool has started to increase and remain higher on a more regular basis. So far, however, fees are relatively unaffected.

Lightning Network

- Transactions in BTC on the layer-2 payments network have increased roughly 63% since January 2022.

This will allow for fast, secure and low-cost money transfers between the U.S. and the Philippines, which is one of the world's largest remittance markets. The Philippines relies on more than $35 billion annually in money sent from abroad, with over $12 billion coming from the U.S. alone.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

- More ways to support our content some don't cost a thing!

February 6, 2023 | Issue #228 | Block 775,339 | Disclaimer

* Price change since last week's report