Bitcoin Fundamentals Report #236

The general themes this week were zero price action, de-dollarization, more hit pieces on bitcoin, mining and lightning news.

Jump to section: Bitcoin headlines / Macro / Price / Mining / Lightning

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Intense flatteness |

| Media sentiment | Negative |

| Network traffic | Moderate |

| Mining industry | Steady |

| Price Section | |

| Weekly price* | $28,593 (+$522, +2.0%) |

| Market cap | $0.552 trillion |

| Satoshis/$1 USD | 3,507 |

| 1 finney (1/10,000 btc) | $2.85 |

| Mining Sector | |

| Previous difficulty adjustment | +2.2295% |

| Next estimated adjustment | -0.3% in ~10 days |

| Mempool | 98 MB |

| Fees for next block (sats/byte) | $0.64 (16 s/vb) |

| Median fee | $0.52 |

| Lightning Network** | |

| Capacity | 5,467.99 btc (+0.4%, +19) |

| Channels | 73,052 (-0.0%, -27) |

In Case You Missed It...

Market Pro

Community streams

- Greenpeace Self-Own with Skull of Satoshi - Daily Live 3/24/23 | E334

- Governments Attacking Crypto NOT Bitcoin - Daily Live 2/27/23 | E335

- Refining Bitcoin's Elevator Pitch - Daily Live 3/29/23 | E336

- Plus live streams that haven't made it to podcast yet!

Fed Watch

Headlines

Bitcoin

Another intensely quiet week for bitcoin and the global economy as a whole. The general themes this week were zero price action, more attacks on dollarization and bitcoin, and cracks appearing among globalist elites.

The NY Times has a new hit piece on bitcoin mining. Pierre Rochard pointed out a typo in the before the first line of the story. The image was originally labeled "Rockland" when it is Rockdale. Also, the skies in Rockdale are very clear. The image used was hazy enough to be considered purposefully altered.

Other real journalists immediately jumped on the story as having blatantly false data.

This article is stunningly naïve about recent history, bitcoin and money.

A gold-backed digital currency would create an alternative and allow individuals and businesses to avoid a CBDC.

There have been many gold-backed digital currencies, past and present. Liberty Reserve for starters.

At the root of the move toward a CBDC is “the war on cash.” The elimination of cash creates the potential for the government to track and even control consumer spending.

While true, it gives the government more control over the supply and use of money, it is not a war on cash, a CBDC is "cash". It is a new form of cash that attacks the banks' control of the supply and use of modern credit-based money.

The US remained in its position as the leading country with the most significant mining power, as it generates 3-4 GW of mining capacity.

After Russia with 1 GW, the Gulf countries follow as the third-largest mining power in the world with around 700 megawatts (MW) of combined power.

There’s a new protocol in town: Bitcoin Stamps 📮

— Trust Machines (@trustmachinesco) April 4, 2023

They’re a new way of storing images directly on Bitcoin, but they’re very different from Ordinals.

Here’s why their transactions look like this 👇

🧵… pic.twitter.com/F3GLDxiV6L

My initial thoughts: More bloat than Ordinals, one transaction forming many UTXOs filled with data. AFAIK, Stamps can't be easily transferred (as in traded), if at all, because data is transaction dependent. Also, if a UTXO from the stamp collection is spent, it destroys the stamp and then can be pruned.

Macro

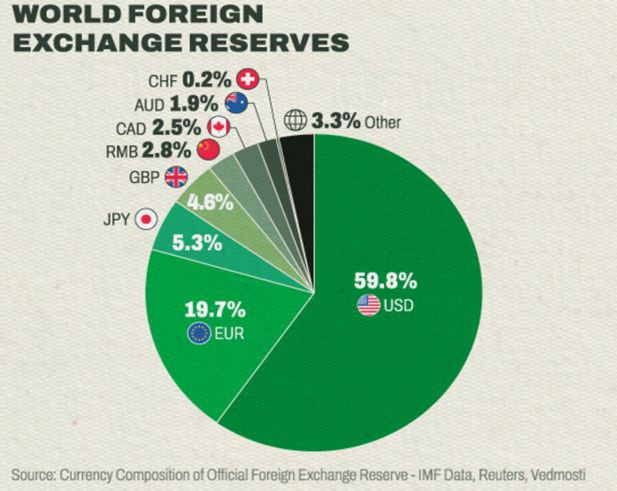

- De-dollarization Derangement Syndrome (DDS) hits new ATH

The dollar is stuck in a deflationary devolution. It will tend to strengthen against other currencies in a fatal fashion, until it takes the only medicine that can work, to change the backing of the dollar.

The world is not, and will not, choose another inferior unbacked government currency. The de-dollarization we see is minor experimentation and forced use of alternatives, where a dollar shortage has changed the incentives.

People instinctively realize that the dollar system doesn't work, so they are using trial and error to find an alternative. The powers that be have not admitted it is the form of money that is the issue. Debt-based money is the problem. We need commodity-backed money (bitcoin).

Macron, ad-libbing at times, spoke twice as long as his host, which was seen as a breach of protocol. Xi looked impatient, heaving several deep sighs, and the end of the press conference couldn’t come early enough for him.

Who are Macron's handlers and are the French/European elites in open revolt, or at least turning, against the US and Davos?

“The paradox would be that, overcome with panic, we believe we are just America’s followers,” Macron said in the interview. “The question Europeans need to answer … is it in our interest to accelerate [a crisis] on Taiwan? No. The worse thing would be to think that we Europeans must become followers on this topic and take our cue from the U.S. agenda and a Chinese overreaction,” he said.

Price Analysis

I've created a new and expanded offering for people that want to stay ahead of the price and macro developments. Check out Premium Market Pro!

Go to bitcoinandmarkets.com/pro50 to get 50% off your first month!

Daily chart

Another flat week for the bitcoin price.

If we zoom into the 4-hour chart, we can see the complete sideways movement over the last week. The same black horizontal line in the red at $28,750 from last week is still providing resistance now. If we can break that, we are set to move higher.

Many people have been lulled to sleep over the last 3 weeks, although bitcoin has held extremely strong and is now building into a break out. The big news item to watch this week is the CPI coming out on Wednesday. If it significantly misses or shows slowing, expect bitcoin and stocks to rally.

There are several indicators I'm following that lead me to believe a break out is imminent. Support is building below the price around $25-26k, and resistance at $29k is being chipped away. This week could be the start of a new leg higher.

I will be detailing my views, charts and evidence in the Market Pro newsletter tomorrow, sign up for that and stay tuned!

Mining

Headlines

I touched on the major headline, the hit piece from the NY Times, above. There were a couple other noteworthy headlines.

These good news pieces don't get the attention they deserve, often losing position to hit pieces, and doom and gloom attacks on bitcoin mining. However, bitcoin mining is not unpopular really anywhere outside the radical leftist think tanks.

The bill proposes that a Bitcoin mining business may operate in the state if it complies with state laws concerning business guidelines and tax policies, any ordinances concerning operations and safety, any rules or rates for utility service provided by or on behalf of a public entity, and state and federal employment laws.

Ether folks are going all out promoting the upcoming Shanghai hard fork (April 12th) that will allow unstaking in Ethereum's Proof-of-stake (PoS) consensus mechanism. This step is seen as the final one to severe the last remnants of mining.

Price typically pumps going into a hard fork, and it becomes a sell the news event. Below is the ETH/USD price and the ETH/BTC price, leading up to the Merge and Shanghai.

PoS Background for beginners

PoS is an old idea that attempts to simulate the natural costs and benefits structure of Proof-of-work (PoW) mining. It has had weak outcomes so far, with the Ethereum experiment being the largest of its kind to date.

There are several attacks, which I outline in the Bitcoin Dictionary, like the Nothing-at-stake problem and Stake grinding. There is also a negative distribution effect that concentrates wealth, since new reward is assign in proportion to the amount staked. The only possible solutions to these problems is added complexity to the PoS algorithm, where PoW naturally takes care of all these issues.

It comes down to this, PoS is empirically inferior and the only reason for it to exist is the flawed climate argument.

The battle lines could not be more stark. Ether is a convenient tool of the Global Marxist camp. Out of one side of their mouth they'll praise PoS and demonize PoW, and out of the other side they will say all unbacked tokens are garbage and only a CBDC/State coin is viable.

Lyn Alden highlighted another front in this battle...

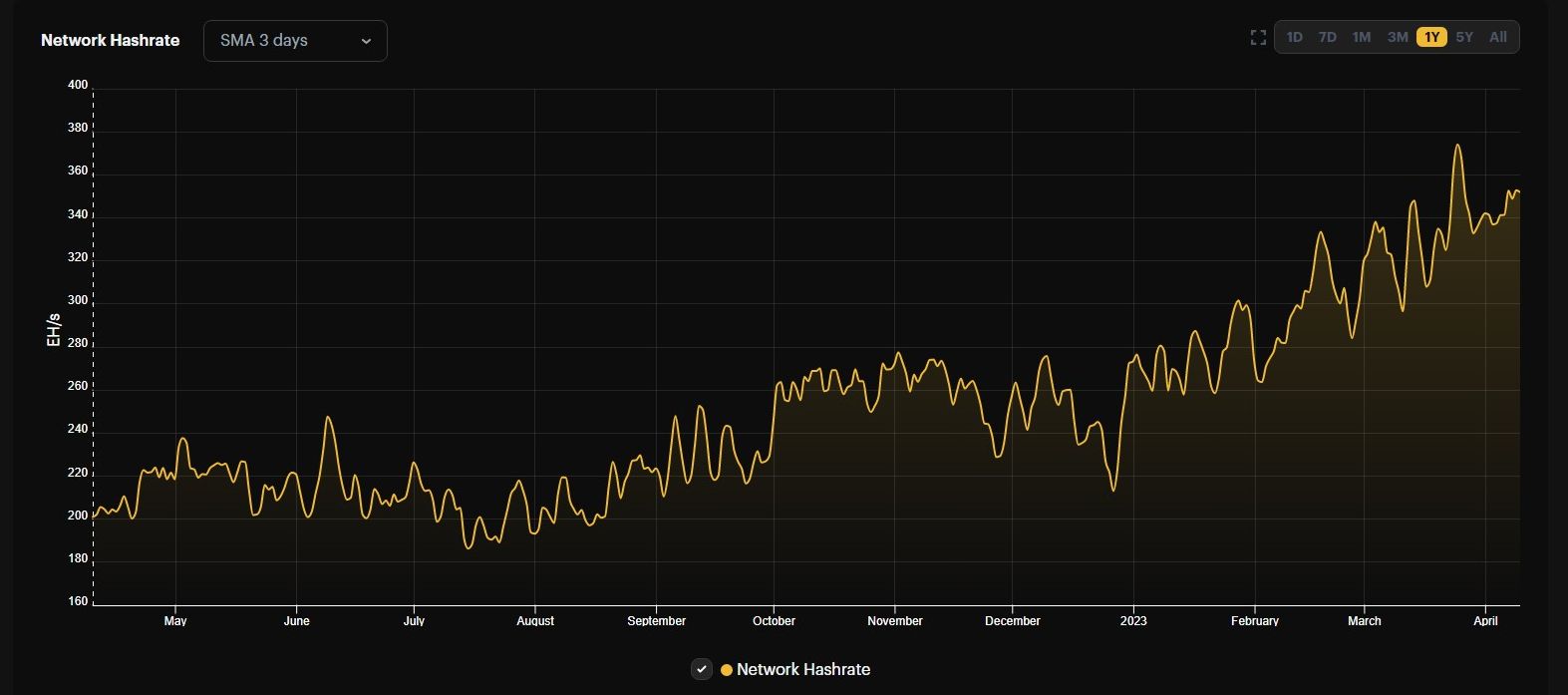

Difficulty and Hash Rate

The computational speed of the network rose slightly this week. Difficulty adjusted several days ago by +2%, and is estimated to decline by <1% in 10 days time. Overall, a pretty steady healthy period, waiting for what's next.

Mempool

The mempool (transactions waiting to be confirmed on the network) came down again this week, but at a slower pace than last week. Most transactions waiting to be confirmed have the lowest possible fees.

IMO, this signifies the network continuing to handle the traffic, but that traffic is picking up slightly into an upcoming price move.

Lightning Network

Although LN’s popularity and adoption are increasing, it features some risks users might be unaware of.

First, LN channels are fundamentally anonymous and decentralized, meaning the responsibility is shared solely by the parties involved.

Second, as all transactions are recorded off-chain except the last settlement, all funds may be lost if any participant closes the channel.

Third, there’s the risk of malicious cyberattacks that can disrupt transactions and increase network congestion.

And fourth, there’s the risk of the counterparty default.

Therefore, operators and developers must improve the user experience and security features of LN platforms going forward and introduce effective solutions to LN if they were to grow their adoption across other regions.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

- More ways to support our content some don't cost a thing!

April 10, 2023 | Issue #236 | Block 784,804 | Disclaimer

* Price change since last week's report

** According to mempool.space