Bitcoin Fundamentals Report #237

Bitcoin mining as zero-emission, the coming recession, and de-dollarization dominated the news cycle this week.

Jump to section: Bitcoin headlines / Macro / Price / Mining / Lightning

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Breakout, back test |

| Media sentiment | Very negative |

| Network traffic | Low to moderate |

| Mining industry | Steady |

| Price Section | |

| Weekly price* | $29,471 (+$878, +3.1%) |

| Market cap | $0.570 trillion |

| Satoshis/$1 USD | 3,394 |

| 1 finney (1/10,000 btc) | $2.95 |

| Mining Sector | |

| Previous difficulty adjustment | +2.2295% |

| Next estimated adjustment | -0.8% in ~2 days |

| Mempool | 54 MB |

| Fees for next block (sats/byte) | $0.12 (3 s/vb) |

| Median fee | $0.12 |

| Lightning Network** | |

| Capacity | 5,486.37 btc (+0.3%, +18) |

| Channels | 72,983 (-0.1%, -69) |

In Case You Missed It...

Market Pro

Community streams

- BRICS Destroy Dollar, plus Bitcoin and National Security - Daily Live 3.31.23 | E337

- Evolution of the Financial System plus Bitcoin Market Update - Daily Live 4/3/23 | E338

- Plus live streams that haven't made it to podcast yet!

Fed Watch

Headlines

Bitcoin

We have entered another quiet period for the Bitcoin news cycle. There are several major themes dominating macroeconomic and bitcoin discussions right now, de-dollarization, the coming recession, and zero-emission bitcoin mining.

- Pierre Rochard and Riot Platforms fired back on the NYT's hit piece

Bitcoin mining has zero carbon emissions. pic.twitter.com/dOO4wZpSW6

— Riot Platforms, Inc. (@RiotPlatforms) April 10, 2023

The reasoning and science in the video is sound and conclusive, bitcoin mining emits zero CO2.

Of course, the climate activists lost their minds, but they've dug themselves this hole. They can't get away from their own troupes now. If EVs are zero-emission, bitcoin mining is, too.

The viral nature of this post makes me think it was definitely a milestone/turning point in the whole discussion. Bitcoiners are extremely smart and are light-years ahead of the attackers.

- Hillary Clinton exposes elites are worried about bitcoin!

[Bitcoin] "has the potential [...] to undermine the US dollar [and] to destabilize nations."

Can't play below video (here is the tweet).

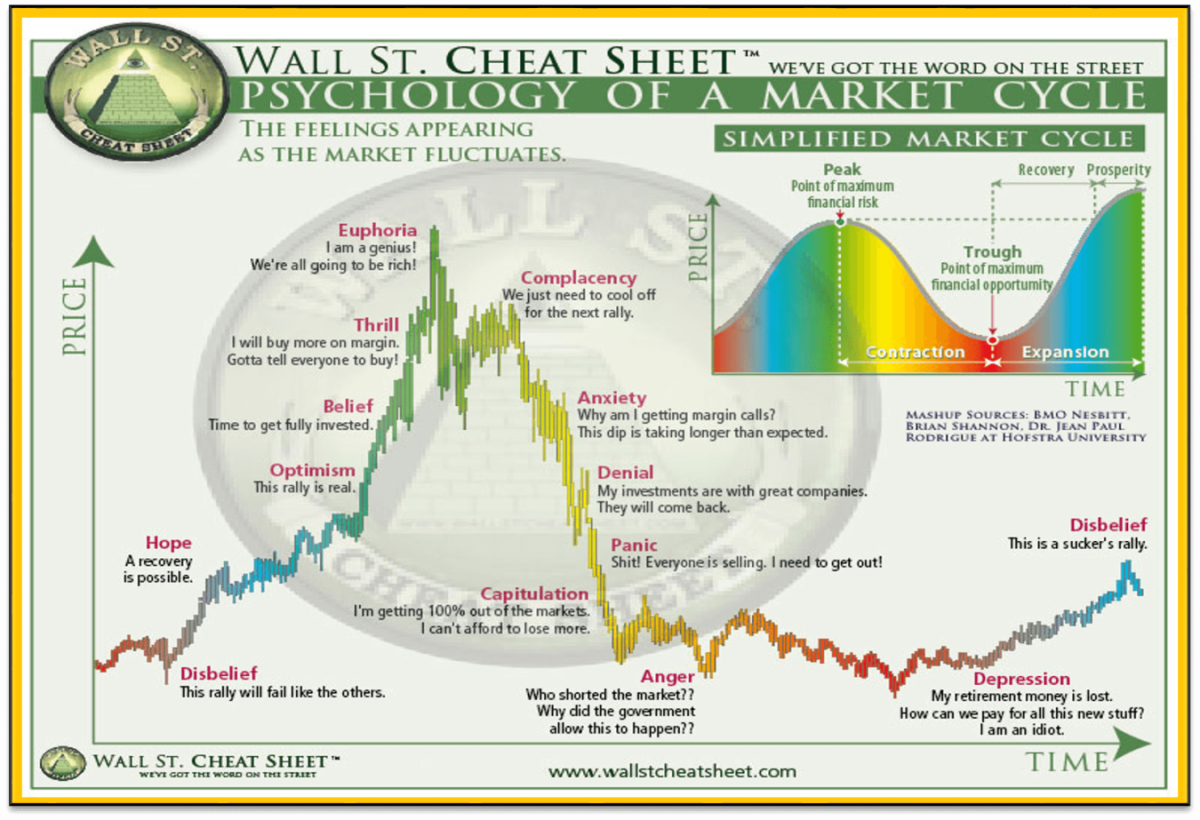

- Sentiment is bottoming

I saw this post today and it beautifully summarized the feeling out there in the space IMO. The author is lamenting over the conflicting memes in bitcoin.

But in the last few months I am suffering a crisis of faith. Of faith in humanity, or perhaps in bitcoiners themselves. These are the things that are happening that are disturbing me and making me lose sleep:

He goes on to discuss things like "stack" vs "spend", non-custodial vs large-scale adoption, and long vs short adoption timelines. I agree with much of his frustration. I feel it sometimes when I think about my age in relation to the length of time this fight could take. But then I remember that the pressure to change the system is exponential.

Six years ago, Janet Yellen was still saying bitcoin wasn't a concern at all. Today, Hillary Clinton is saying it could "destabilize nation-states." On an exponential scale, what is next?

I could go into much more detail, but I want to touch on how this informs our cycle timing. This kind of post is a sign of the bottom.

Macro

- De-dollarization is still the macro topic de jour

You can't go a day without reading a headline or article about the impending collapse of the dollar. Many countries are signing bilateral trade agreements in their own currencies. The US appears to be getting weaker diplomatically and economically.

If you think about these arguments for a second, you'll realize there is no meat on the bone. They are almost entirely based on emotion and headlines, not an understanding of the market, money or human nature.

Now, a decade after its rollout, observers say the ambitious strategy to build infrastructure trade links across Eurasia and beyond is losing steam, with some questioning the ongoing viability of Beijing’s mega-project.

“Beijing went on a lending spree and issued thousands of loans worth nearly a trillion [dollars] for big-ticket infrastructure projects spread across 150 countries” over the decade, said Bradley Parks, executive director of AidData, a research group at the College of William and Mary in Virginia.

“Now, many borrowers are having difficulty repaying their infrastructure project debts to Beijing,” according to Parks. “In 2010, only 5% of China’s overseas lending portfolio supported borrowers in financial distress. Today, that figure stands at 60%,” he told CNBC.

“We never force others to borrow from us. We never attach any political strings to loan agreements, or seek any selfish political interests,” a [Chinese] spokesperson said. “We have always done our utmost to help developing countries ease their debt burden.”

Doesn't sound like very sound banking practices. These are types of horrible business decisions made by a central politburo.

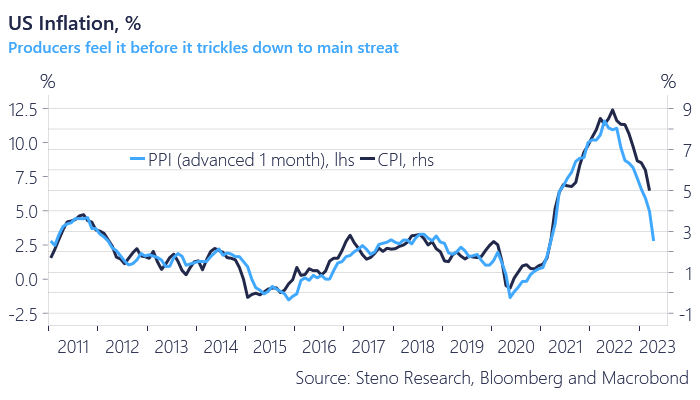

- CPI and PPI are crashing. It was transitory after all!

All signs are pointing to crashing CPI. I've made the prediction that would could see some month-over-month negative numbers on the CPI very soon, and a Y/Y crash to the 2% target by July.

The hard thing to piece together is what does a crashing CPI mean for the broader economy? Does it mean that private firms will have negative quarters? Not necessarily. The worst will be felt in the financialized part of the economy, IOW banking.

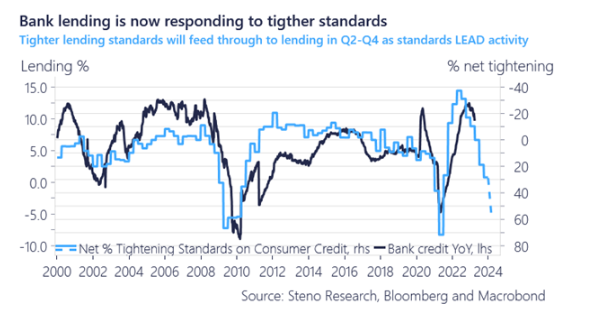

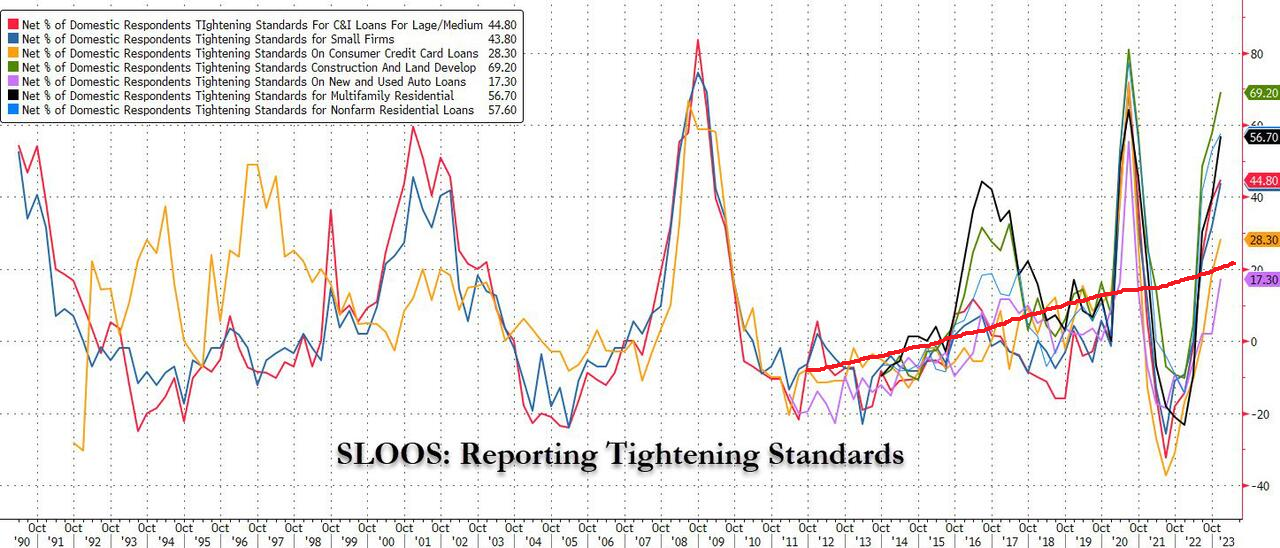

I realize my position can be unclear. I see and have reported on crashing credit conditions, this should mean a steep recession is just ahead. However, do a moving average on this lending data.

Below I drew a very crude line as an average. Notice, lending standards have been getting tighter for a long time. Gradually tightening lending standards is part of the "post-GFC normal". What we've seen recently is fluctuation around the mean.

Price Analysis

I've created a new and expanded offering for people that want to stay ahead of the price and macro developments. Check out Premium Market Pro!

Go to bitcoinandmarkets.com/pro50 to get 50% off your first month!

Daily chart

This week we finally got the breakout that we have been waiting for. It has, as of yet, not shown further momentum to the upside.

Zooming in to the 4-hour chart, we can clearly see the breakout, and the loss of momentum. Will we get a bounce as depicted?

We can also see a parallel channel forming that matches with the despicted path.

Same as last week, support is building below the price around $25-26k, with the 50-day MA currently at $26,300 and many other indicators consolidating around $25k. If we cannot hold this important level of $28,750, it likely goes to the 50-day MA.

It is extremely significant if we don't hold the 50-day this time. I'll write more about it on the Market Pro this week, but here is the ATH behavior.

There are some differences when we look at the 200-DMA though, so the situation is not as identical as the 50-day leads us to believe.

My overall forecast is that the bull market has begun. We will hold the 50-day and start up again. I'm am waiting for the next explosive move higher to $34-36k, but my ultimate target of the move over the next couple of quarters is $48-50k.

Much more on the upcoming issue of Market Pro!

Mining

Headlines

Good breakdown of all the different mining bills in the US States.

Bills in Arkansas and Montana that focus on crypto mining have passed in recent days, while legislation in other states remain in the ratification process.

While some of the proposed or passed pieces of legislation seek to protect the rights of crypto miners, others seek to put certain restrictions on companies operating in the sector.

Difficulty and Hash Rate

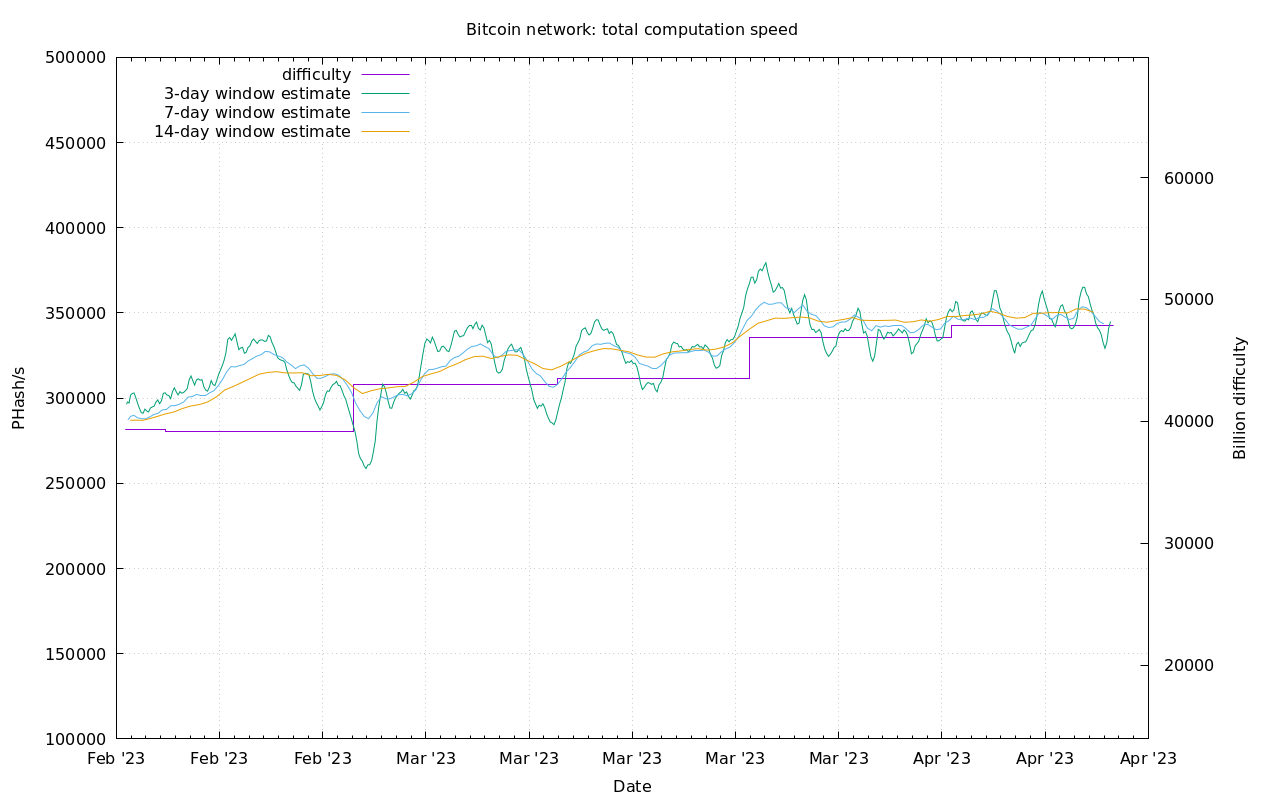

The computational speed of the network has been flat this week. Difficulty is estimated to increase by 0.8% in 2 days. Overall, a pretty steady healthy period, waiting for what's next.

Mempool

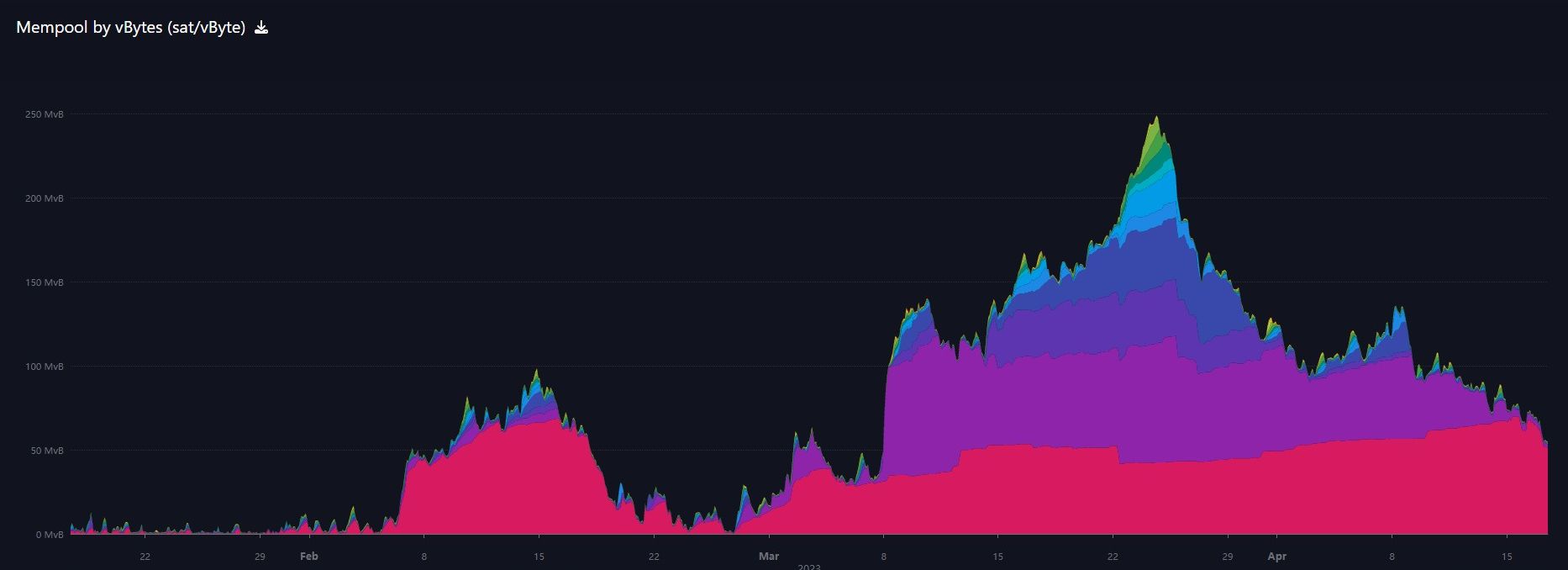

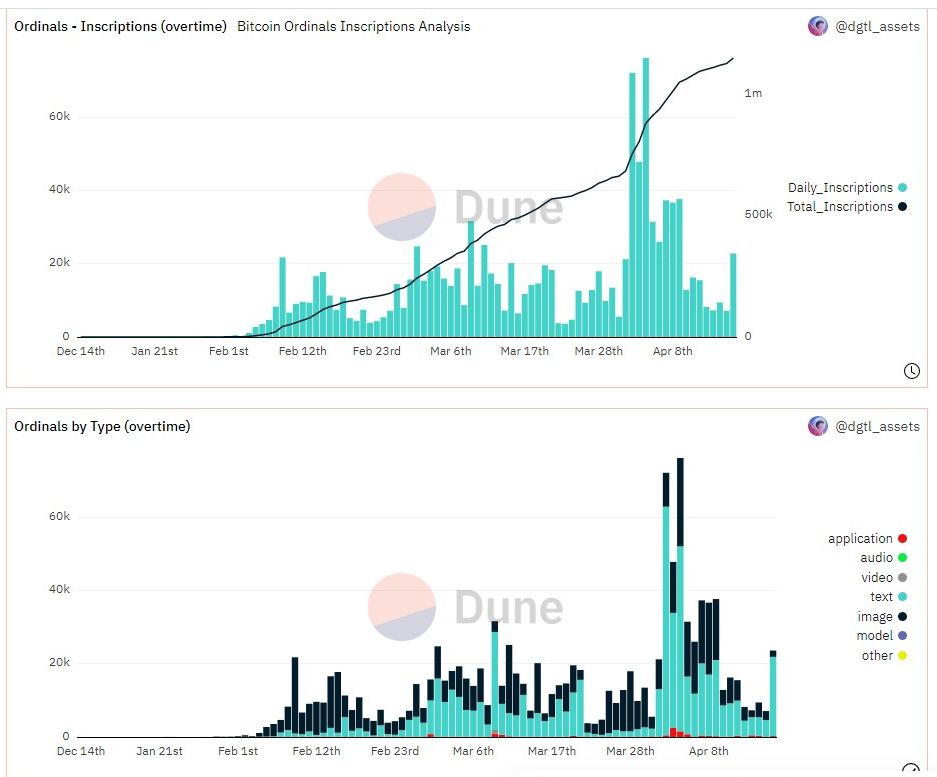

The mempool continues to shrink, virtually cleared of all transactions with >2 sat/vb fee attached.

This is despite a spike of ordinal inscriptions in April. What this means to me is the bitcoin network is handling the controversial use transaction types and anything the government attackers are throwing at it. There is apparently little connection between ordinals/inscriptions and the mempool.

Lightning Network

Hierarchical channels allow for flexible off-chain resizing of channels, enabling quick and cheap resizing, without on-chain transactions which add delays and costs.

This is a big leap in the development of bitcoin's lightning network. Lightning gives bitcoin the transactions per second and instant settlement needed to scale, but had its own limitations, that being opening, closing and rebalancing channels depends on on-chain bitcoin tranactions. Hierarchical channels appear to solve this limitation by enabling channel management without going on-chain.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

- More ways to support our content some don't cost a thing!

April 17, 2023 | Issue #237 | Block 785,830 | Disclaimer

* Price change since last week's report

** According to mempool.space