Bitcoin Fundamentals Report #256

Update on Fortress Trust and Ripple, bitcoin's security budget as a cult movement, G20 vs BRICS, upcoming week, price analysis and more

Jump to section: Bitcoin headlines / Macro / Price / Mining / Lightning

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Flat to down |

| Media sentiment | Neutral |

| Network traffic | Elevated |

| Mining industry | Solid |

| Days until Halving | 218 |

| Price Section | |

| Weekly price* | $25,161 (-$746, -2.9%) |

| Market cap | $0.490 trillion |

| Satoshis/$1 USD | 3,976 |

| 1 finney (1/10,000 btc) | $2.51 |

| Mining Sector | |

| Previous difficulty adjustment | -2.6452% |

| Next estimated adjustment | -1% in ~8 days |

| Mempool | 223 MB |

| Fees for next block (sats/byte) | $0.77 (22 s/vb) |

| Median fee | $0.77 |

| Lightning Network** | |

| Capacity | 4790.57 btc (+0.8%, +34) |

| Channels | 67,295 (+0.8%, +547) |

In Case You Missed It...

Member

Community streams and Podcast

- BIP300 Debate and Other News, Weekly Bitcoin Update - E369

- The Dollar Wrecking Ball is Back - FED159

- The Truth about Bitcoin's Security Budget - E371

- Plus live streams that haven't made it to podcast

Blog

- The Coming Multipolar World

- Demographic Collapse: Why Should We Care? (public for everyone)

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Headlines

- Slow week for bitcoin headlines

Another slow week for bitcoin headlines. There was a story over the weekend about someone mistakenly sending 10 bitcoins as a fee that went viral for 24 hours. That's how slow this space has gotten.

On the bright side, this gives us more time to explore topics related to Bitcoin & Markets thesis of deflation, deglobalization, depopulation, and how bitcoin is the answer. I just made my last demographics post public, you can access that in the link above. I'm working on part two at the moment, expect that in a the next week.

- Bitcoin's Security Budget

There has bee a lot of talk over the last couple of weeks about Bitcoin's security budget. It was on last week's newsletter and I did a podcast episode about it.

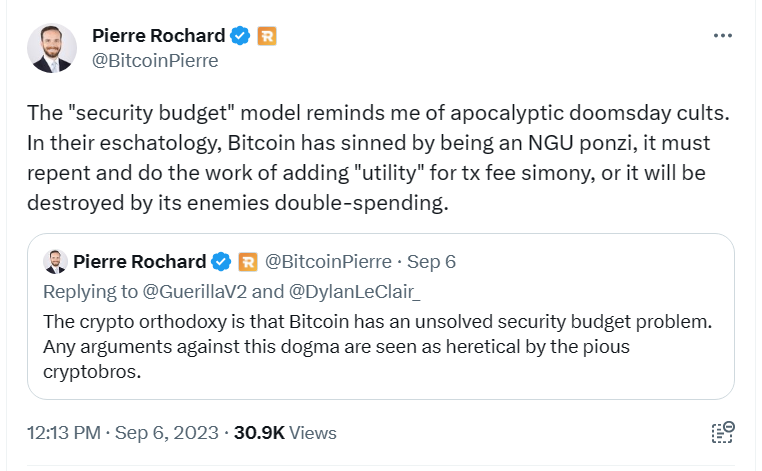

What has started sticking out to me is the gnostic/Marxist aspect of these attacks, the Drivechain attack being only the most recent. This cult-like behavior is characterized by someone saying they know the real gnostic truth and if you follow them they'll take you to heaven on Earth/utopia. A glaring example of this is climate alarmism, but the same framework is at play in the Drivechain debate.

The bad actors leading this attack are the only ones clear enough of mind to see the coming disaster of bitcoin's "security budget". They created a problem that only they can see with their superior wisdom. Then they claim their preplanned solution to the problem that doesn't exist is the only way forward. It's a Hegelian dialectic and the favorite tool of Marxists.

I'm not the only one to notice either:

"Crypto" not bitcoin requires this kind of cult thinking to function. It naturally places a founder or influencer as the gnostic source of hidden wisdom. Even though everything looks like a scam, that's only because we don't have the right consciousness. We bitcoiners are simultaneously closed-minded and ask too many questions to see the true utility of altcoins. "Crypto" shielded and nurtured these types because that's all they ever had to sell people, false narratives. LOL

“Conversations accelerated last week following the security incident via a third-party analytics vendor, but this opportunity makes sense for Ripple in the long term,” said a spokesperson for Ripple, who clarified that the company — already a minority investor in Fortress — had discussed a potential acquisition with Fortress previously.

“Luckily, Ripple was in a position to act quickly to step in and make customers whole, and there have been no breaches to Fortress technology or systems. Fortress notified customers immediately of the incident when it happened — as they mentioned in their tweets,” the spokesperson continued.

This story is boring for me. I see it primarily as forced sale due to the hack, but also that Ripple is branching out because they know the ripple coin will be dead sooner or later.

Macro

At the G20 meeting a group of countries unveiled a new plan to form an economic corridor, from India westward through the Persian Gulf and out to the Mediterranean. The eastern half is planned to be building out ports in India and in the Gulf. The western half will be a series of new railways.

Notably, China is not a party to the deal. China's Xi Jinping stayed away from the G20 meeting this year, hosted by India. Most commentators thought it was due to less than warm relations between China and India, but perhaps, he knew about this new economic corridor plan and wanted to save face.

This new agreement is being touted as a reaction to the Belt and Road Initiative (BRI). I've talked in depth about the the ill-fated future of the BRI, and I have similar feelings about this new economic corridor. "Build it and they will come" is not a sound guiding economic principle. On top of that, this is probably the worst time in 100 years to try and build new relationships and economic partnerships. The global economy is going into the can and an artificial economic corridor will only be a drain on the respective economies.

The interesting part here is leaving the CCP out to dry.

Speak of the devil, more BRI loans go bad.

Belt and Road countries face mounting trade deficits, while hopes for increased access to the Chinese market fade.

Tough Chinese conditions on Belt and Road-related financing have also led to problems. Struggling to repay its debt, Sri Lanka granted China control over the Hambantota port on a 99-year lease. Countries are increasingly wary of falling into a "debt trap," though China rejects the idea.

The BRI grew because they lent money on optimistic terms. There is a reason many of these projects couldn't get funding in the year prior to BRI expansion and it wasn't because the West wanted to exploit these countries and keep them poor or anything. It is because they were deemed uneconomic, and/or the countries national credit rating, so to speak, was not good enough to get the terms they needed to build it.

Anyone thinking that China cracked the code on making these types of developments were woefully mistaken. The BRI is just another wasteful communist building plan.

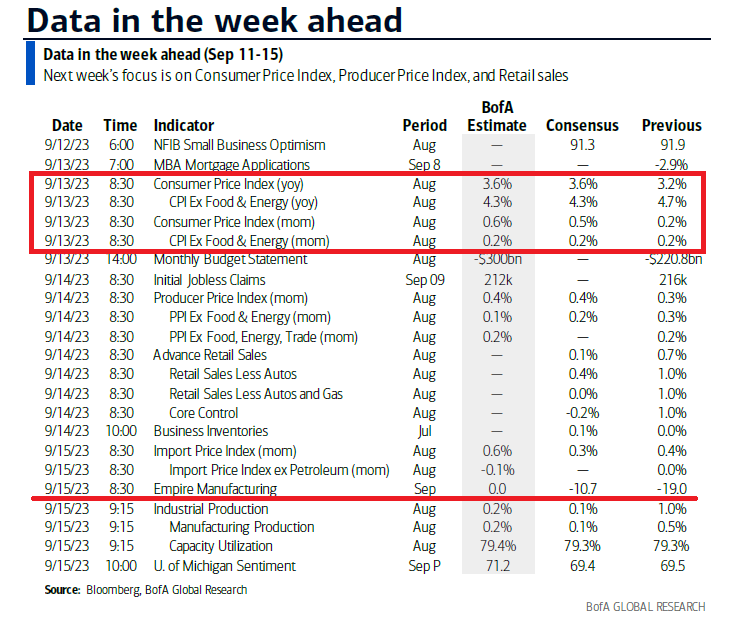

- Big week for US Economic data

Wednesday is the release of August CPI. Consensus is for a big month at 0.5% m/m. I think that is going to be high. I will do live coverage at 8:30 am ET. Tune in for that!

The data keeps coming with PPI on Thursday and Empire Manufacturing on Friday. After this week, we should get a more clear picture on how Q3 is going to turn out as a whole.

This is an important admission. Of course, it is what the realists have been saying since day one. I wonder if NATO Secretary General Jens Stoltenberg will be called a Putin sympathizer?

I haven't written much about the war in Ukraine. It has become stagnant for the last 6 months. Ukraine keeps throwing men against the wall. It's sad. The massive blitz Krieg Ukrainian offensive that was supposed to break through to the Sea of Azov has utter failed. We will have to wait and see if Russia has a counterattack.

The war has become a black hole for funding (mainly from Washington) which can't go on for much longer. Also, as Germany and Europe wake up to the deindustrialization plan that the Davos/Brussels Marxists have for them, they are probably hoping the bridge between Russia and Germany can be repaired. Washington doesn't like that.

Price Analysis

Join the Professional tier for in-depth price reports and actionable forecasts! Sign up today!

Bitcoin Charts

This morning we are finally getting a little price action. Not in the direction we want, but it's at least moving now. It tapped $25k and has so far held.

I'm a little surprised that the death cross did not have a more significant impact on price. Price tends to rally toward the cross, as I showed multiple examples of on last Friday's Market Pro.

I have been expecting a test of $25k, and even perhaps triggering stop-losses placed there. If that happens, price will drop rapidly and recover quickly.

Below is the BNB/USD chart. The theory is that Binance is defending the price of BNB to avoid harmful liquidations. Like FTX that used rehypothecation of their token FTT, it is assumed that Binance has done the same thing.

My opinion is that Binance might be doing some illegal things, some shady trading, but they are solvent, at least much more solvent than FTX was.

IF a stop-loss dip is aggressively bought today, we should expect a little upward price action in the death cross at least, and we go from there. I don't expect a sell-off to new lows that stays there. We should end the week higher than $25,100 where it currently is.

Get my short, medium and long term forecasts on Market Pro!

Mining

Headlines

Couldn't ask for a better understanding by a politician.

Senator Cruz spoke to the positive benefits bitcoin mining is having on the Texas grid this week on Fox News Radio. Cruz said that bitcoin mining can operate like a battery, describing bitcoin miner’s role in demand response programs.

Bitcoin miners are able to monetize the excess capacity that would go to waste on an average day, but that capacity can be curtailed in seconds, releasing the energy back to the grid when needed.

“It's essentially an emergency reservoir of power. I think that's one of the tools we can utilize to enhance resiliency in the grid,” Cruz concluded in the Fox interview.

Not surprised that air-head environmentalists can't grasp this. LOL

"This is absurd that we're paying this company $31 million to stop using electricity when you know... the rest of us all are not getting compensated for reducing their electricity use," Metzger, the executive director of Environment Texas, said.

Hey genius, it's called a demand response. What do you want to do, send everyone a text message or notification from ERCOT when they need to turn off their AC? Bitcoin miners can instantaneously respond to these kind of emergencies.

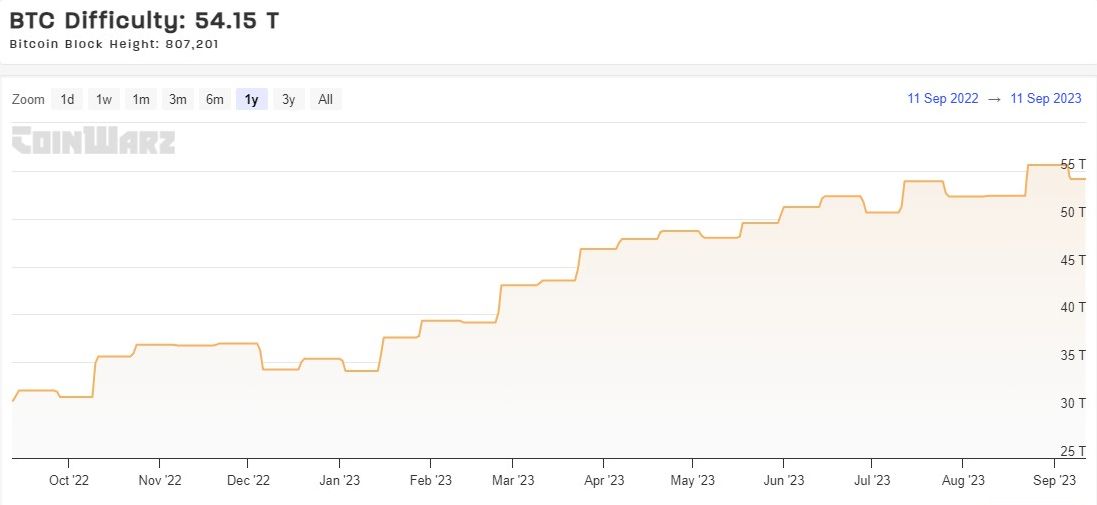

Difficulty and Hash Rate

Bitcoin's difficulty adjusted down -2.6% last week. This was less than earlier estimates of up to -6%, meaning the network hashrate rallied in the second half of the difficulty period.

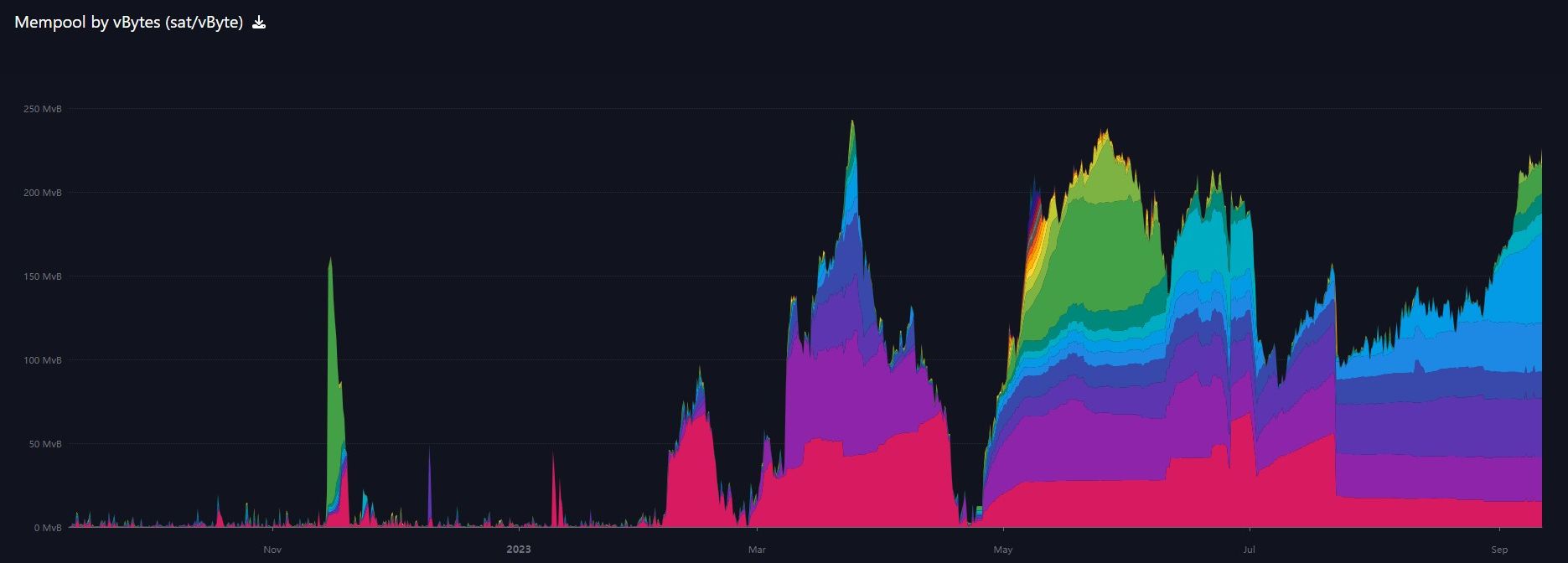

Mempool

The mempool has exploded this week close to 52-week highs. Despite that, the fees being paid have remained more subdued than the peak in the mempool back in May.

Lightning and Layer 2

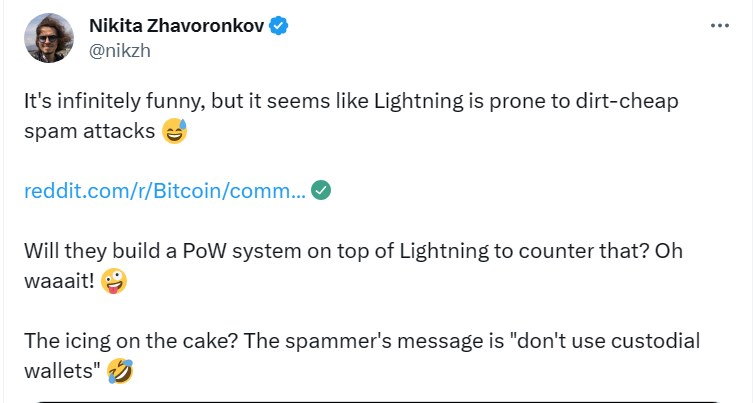

- Bcashers add to their Drivechain attack with FUD about Lightning

The coordinated fork attack via drivechains is being pushed directly by the discredited and humiliated bcash wing of the altcoin space. Here is one of their members trying to say Lightning is prone to spam attacks.

This is hilarious because this is how LN is designed to work. A few people responded to this false allegation on Twitter by posting a LN invoice and asking to be spammed.

That's it for this week. See you again next Monday!!!

DONATE directly on Strike or Cash App to support my work! You make this content possible! Thank you.

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

- More ways to support our content some don't cost a thing!

September 11, 2023 | Issue #256 | Block 807,207 | Disclaimer

* Price change since last report

** According to mempool.space