Bitcoin Fundamentals Report #259

Bitcoin spot ETF reshuffle, Macro climax update, bitcoin price, mining and layer 2 news.

October 2, 2023 | Block 810,330

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Slow build to spike |

| Media sentiment | Positive |

| Network traffic | Moderate |

| Mining industry | Consolidating |

| Days until Halving | 197 |

| Price Section | |

| Weekly price* | $28,056 (+$1,740, +6.6%) |

| Market cap | $0.547 trillion |

| Satoshis/$1 USD | 3,565 |

| 1 finney (1/10,000 btc) | $2.80 |

| Mining Sector | |

| Previous difficulty adjustment | +5.4842% |

| Next estimated adjustment | -0.3% in ~15 hours |

| Mempool | 31 MB |

| Fees for next block (sats/byte) | $1014 (29 s/vb) |

| Low Priority fee | $1.06 |

| Lightning Network** | |

| Capacity | 4513.41 btc (-4.8%, -228) |

| Channels | 63,092 (-5.8%, -3908) |

In Case You Missed It...

Member

Community streams and Podcast

- Futures Trading Controls Bitcoin Price?? - E373

- Shadow Banking Secrets: Collateral Multiplier - E374

- Plus live streams that haven't made it to podcast

Blog

- The Coming Multipolar World

- Demographic Collapse: Why Should We Care?

- Demographic Collapse: Several Case Studies

Bitcoin Magazine Pro

Headlines

- Bitcoin Spot ETF Delays and Update

We had a very non-standard week in regards to ETFs. Very interesting developments occurred due to the threatened government shutdown in the US. The SEC was concerned their "skeleton crew" of essential personnel would not be able to address on the ETF filings on their docket in October. They approved the ETH futures ETFs and delay the Bitcoin Spot ETFs.

The SEC also broke with tradition. They didn't just delay last minute this time, they delayed early due to the shutdown and also gave applicants some comments to address regarding the filings.

As Eric Balchunas says, the timeline is not at all clear. IDK if the early delay moved up the clock on the subsequent timeline.

Price action this morning might be in response to the ETH futures ETFs launching or a change to market expectations around the bitcoin spot ETFs.

The House Financial Services Committee questioned Chair Gensler this week. I personally thought it was a nothing burger. Many Congressmen are very upset on Gensler's treatment of scams, but as I pointed out in a tweet, they can't even form a coherent question, yet the crypto bros go crazy as if it is a "gotcha."

Gensler reiterated that Bitcoin was a commodity, but was logically unwilling to say anything else was. The meeting was preceded by a letter signed by all bipartisan members of the Committee that Gensler approve the Bitcoin spot ETF immediately.

Overall, this testimony was a positive influence on the ETF potential, and might mix with the new developments above, to increase the odds of quicker approval.

You can view the video here.

Macro

- Climax in Markets

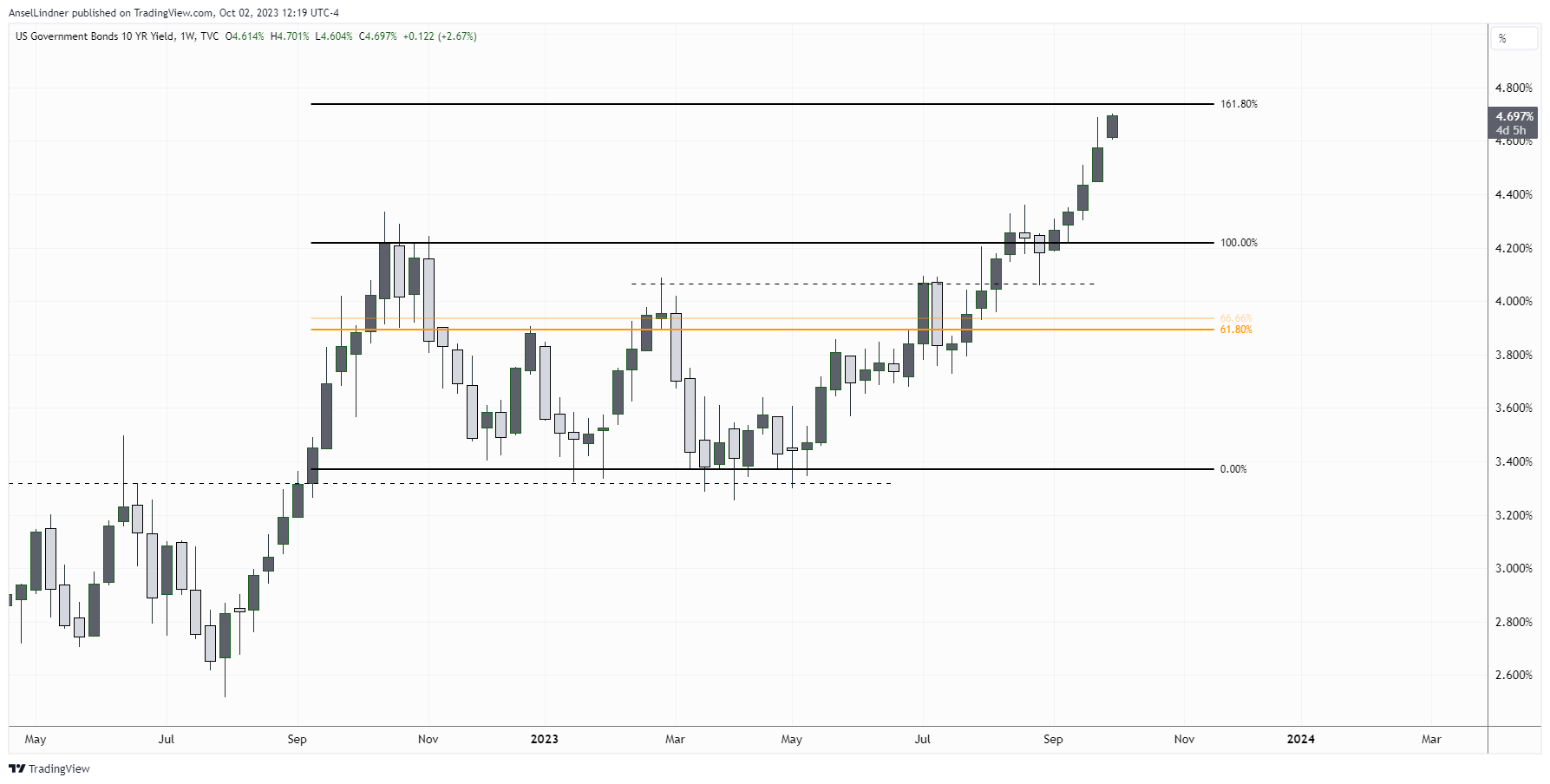

My content last week was dominated by a call for a climax in recent trends in macro. The dollar wrecking ball has returned, the US 10Y Treasury yield is shooting higher, oil looked like it could break out, and people generally are buying the higher for longer inflation narrative.

I've been pushing against this for a long time now. I tried to explain in my podcasts and writings last week why a reversal point in all these metrics is near. There are TWO RELEASE VALVES for this type of move, more money printing or major economic slowdown.

Most people think the former is more likely, that more money printing is coming to boost everything, plus yield curve control or some other omnipotent command and control solution, but they don't understand how the system works. We know better. The private sector is who prints money and central planners will always get beat by the market. We know the banks are NOT printing, therefore, the only release valve is economic slowdown.

What does economic slowdown entail? Lower oil prices and lower interest rates.

- Gold getting smoked

- Euro getting smoked

- US 10Y is crushing everything, approaching fib extension

- Oil is one thing perhaps starting to show the coming weakness, off highs of $95 down to $89

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

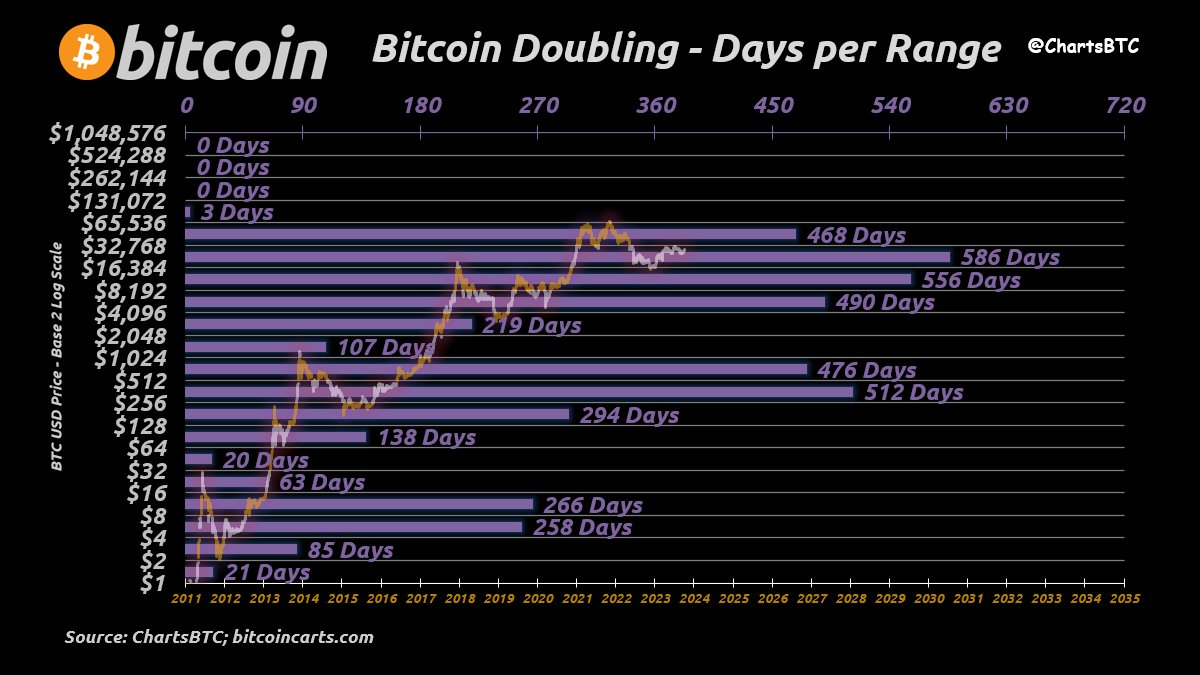

Fantastic new chart from @ChartsBTC. Bitcoin has spent more time in this doubling range than any other in its history. This is similar to Volume-by-Price but time-by-price.

This brings to mind the idea that it takes time for new levels of price to sink in psychologically. The price rapidly expands, and feels like an obvious bubble because it is 10x where it was before. When price first went to $1000, it didn't seem real and maybe that wasn't a fair price. Only after 1000 days did $1000 seem fair and then price could sustainably go higher.

That makes sense, too, in the respect that holders will have a bubble target in mind to take some gains. Even long time holders have a price that they are willing to part with a bitcoin, even though they likely think it will go to $1 million+. IOW you could look at the 4 year cycles are giant accumulation and distribution. The distribution happens around psychological bubbles, and the accumulation happens around "psychologically fair" prices.

It might take longer and longer for higher levels to sink in as fair, explaining why the cycles might lengthen out over time.

Lastly, the pattern is to spend a lot of time in clusters and then effectively skip some doubling zones. Like $32-$64 only has 20 days, and $1,024-$2,048 only has 107 days. Perhaps, up to $65,536 will catch the current level in days, but then up to $131,072 will only have around 100 days.

Bitcoin is currently battling with the 200-day ($28,040) and 200-week ($28,073) MAs. We shouldn't be surprised that the exact level where these two were the same that it would attract the price, since charting is a series of Schelling Points and this is a big one. Breaking both these important MAs at the same time would be massively bullish IMO.

All that being said, there is of course a chance price gets rejected here, but I predict that will be temporary. No technicals or fundamentals are calling for price crash. It would take a singularity event like the COVID crash for that to happen. However, for price to stay on schedule, and my broader macro thesis to play out, bitcoin will need to get going on its rally soon.

Get my short, medium and long term forecasts on Market Protons!

Bitcoin Mining

Headlines

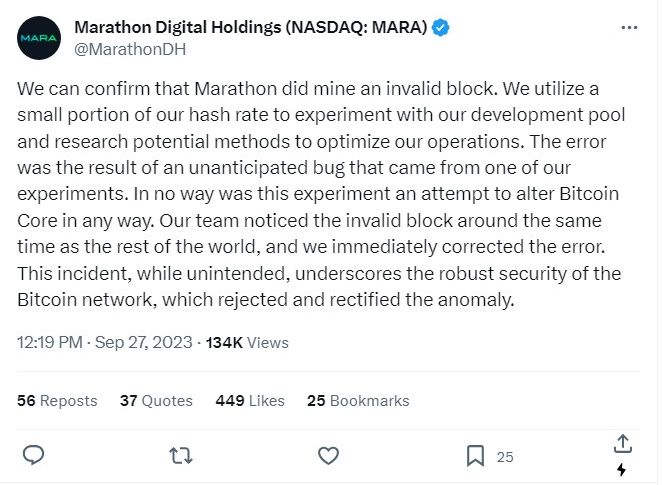

Marathon mined an invalid block this week. They mine with a few machines with experimental software and got lucky. In the block, some transactions were included in the wrong order, because they were included in ascending value order instead of time order. For example, one transaction spent the output of another transaction but was ordered before it, therefore it was an invalid block.

This is a great example of the nodes being in charge and a segment of the so-called security budget of bitcoin. The invalid block was rejected and that was it.

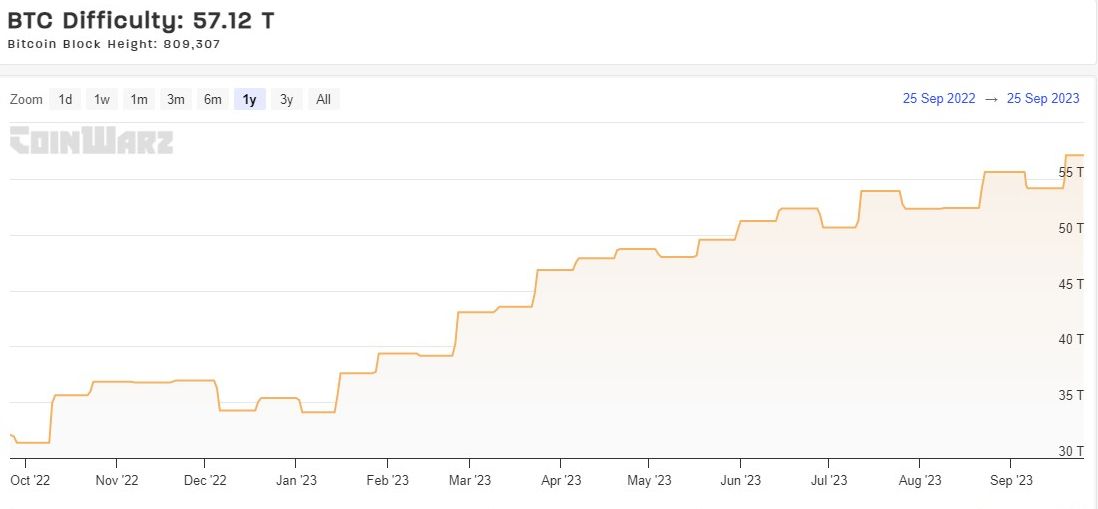

Difficulty

Bitcoin's difficulty adjusted up by two weeks ago by 5.5%. I'm publishing this right before the next adjustment in about 16 hours from now, when it is estimated to adjust slightly downward at -0.3%. That will move it slightly below the current ATH, but still extremely healthy. Mining has behaved as if we were near ATH prices for the last couple of months.

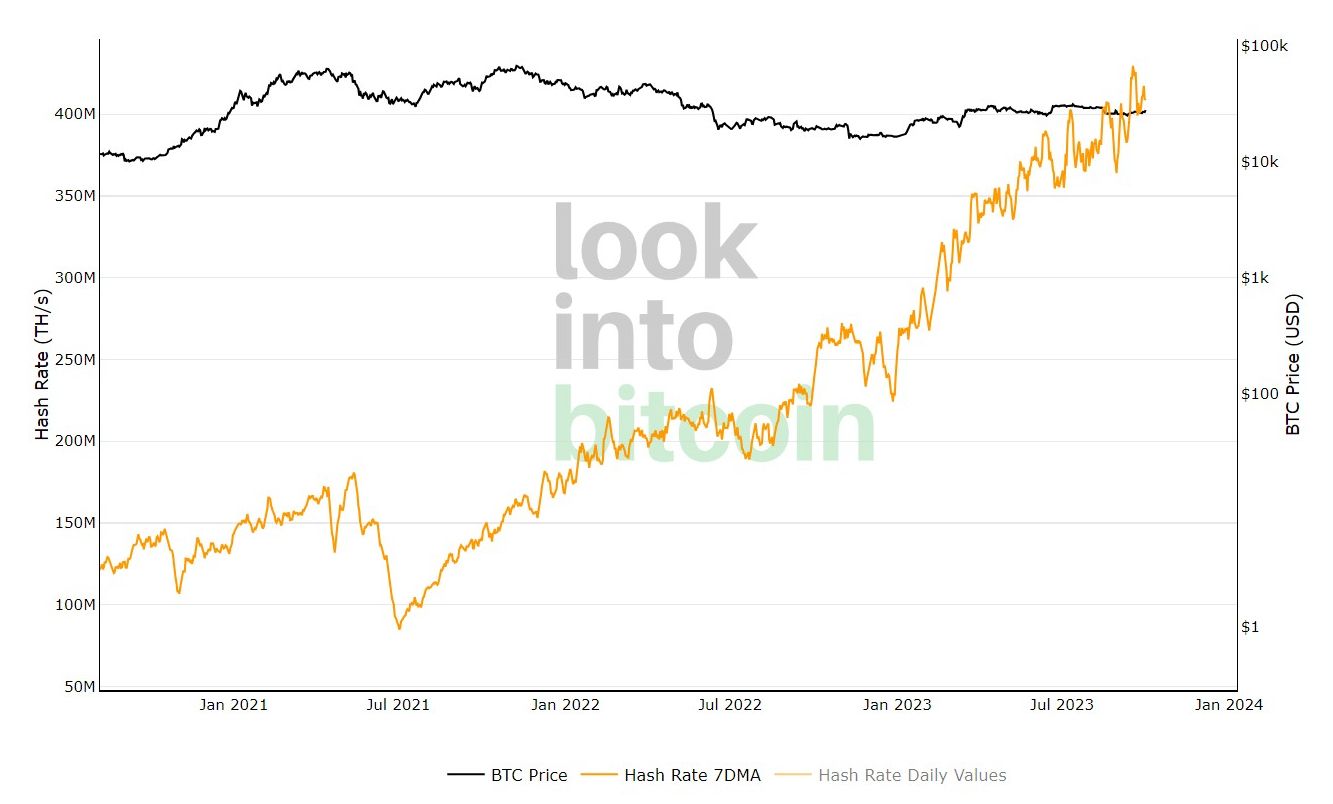

Hash rate

Bitcoin's hash rate maintained levels very near its ATH this week.

Mempool

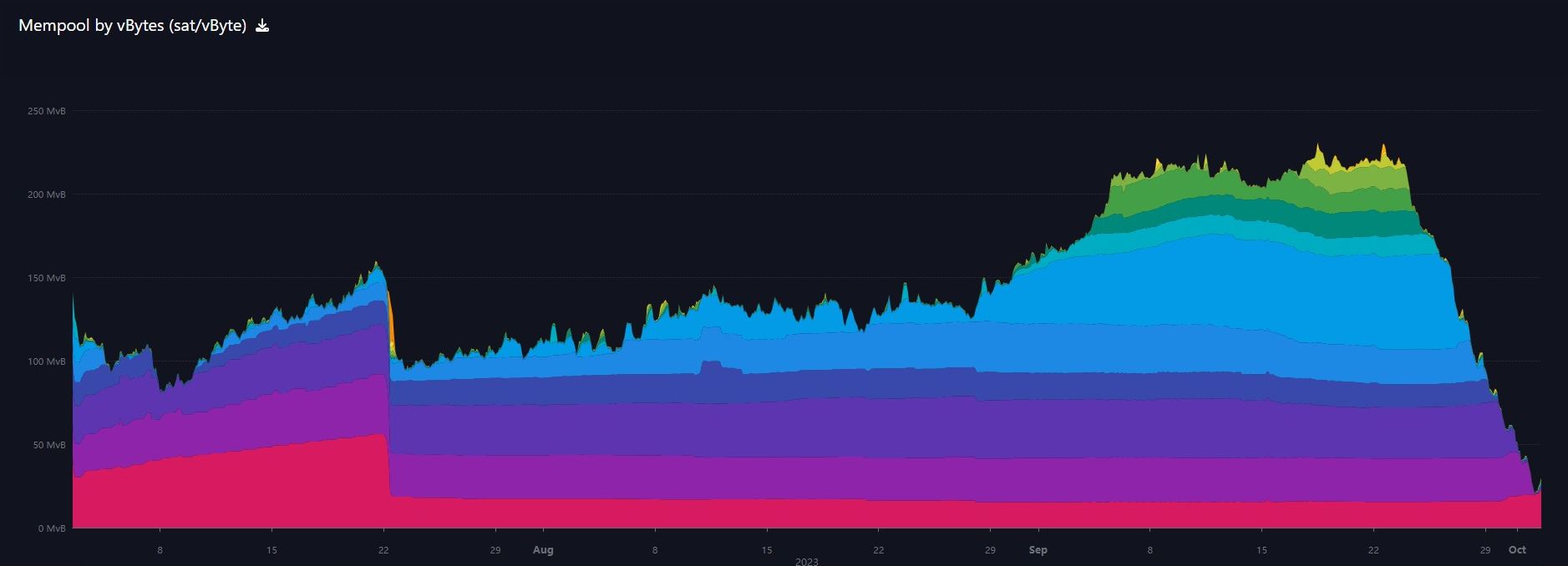

The speed of the mempool collapse has been epic this week, from 225MB down to 25MB.

Ordinals/Inscriptions

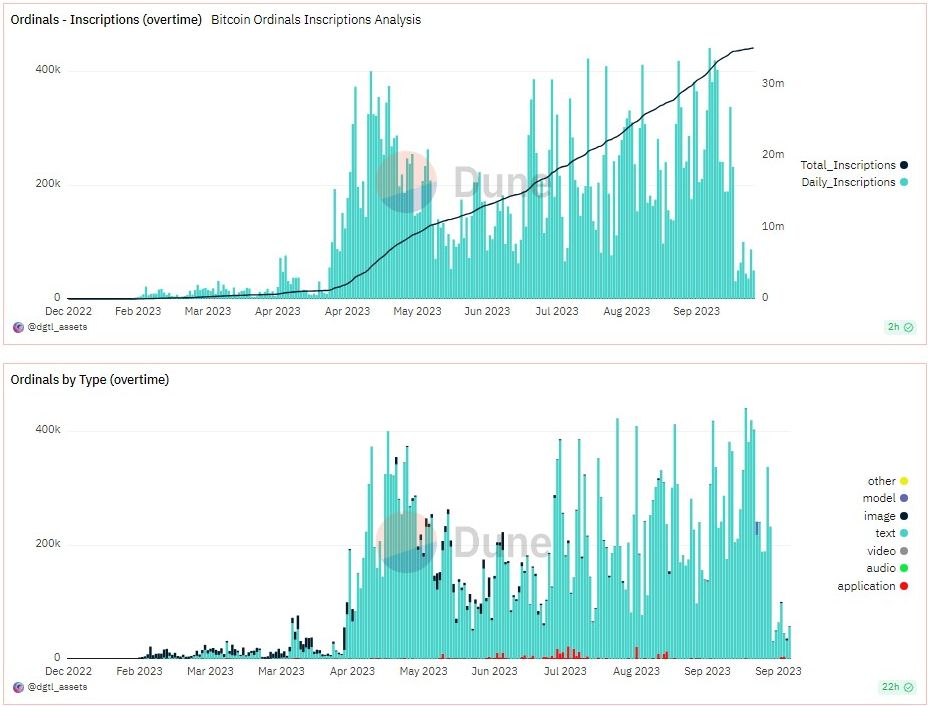

A lot of the decline in the mempool seems to have to do with inscriptions, so let's take a look there. It appears the number of inscriptions has dropped from an average around 300,000/day to 50,000/day.

I'm not an expert in ordinal theory, but from what I gather, there was a bug in the numbering system resulting in some ordinals to be "hidden." Ordinal creator Rodarmor called these "cursed ordinals" earlier this year. That bug has now been fixed and the fix is causing problems with the auto-inscribers people set up to spam bitcoin it seems.

As far as I know, ordinals are very very niche. The main use case is to be a nuisance to bitcoin and perhaps clog up the mempool.

Lightning and Layer 2

Tuesday of this week, Casey’s warm up was over. He unveiled a blog post introducing the idea for “Runes,” an alternative fungible token protocol on Bitcoin. In his words, Runes serves to mitigate UTXO proliferation and provide significant user experience benefits compared to other fungible token protocols on Bitcoin.

“Runes are harm reduction. BRC-20s create a lot of unused UTXOs. In order to spend Runes, you have to destroy UTXOs, which is good for the system as a whole. It’s also beneficial for users, enabling simpler PSBT-based swaps. Since a UTXO can only be spent once, you can create a set of transactions and then out of those transactions, you can guarantee only one of those can be mined. BRC-20 transactions can’t do this.” - Casey Rodarmor on Twitter Spaces

Runes are completely separate from the Ordinals protocol, which uses the Witness part of the transaction for data. Runes uses the much older OP_Return, made famous by the Counterparty project years ago.

I do not have a strong feeling about Runes or Ordinals either way, but I tend to think they are used by mainly malicious people. I don't think there is a large market for these things on Bitcoin's consensus base layer. Eventually, fees will price much of the hobbyist use cases out.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space