Bitcoin Fundamentals Report #267

Binance fined, bitcoin ETF in-kind vs cash creates drama, the increase in piracy, bitcoin price analysis, mining sector news, and Lightning wallet delisted from Apple and Google stores.

November 27, 2023 | Block 818,742

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Attempting to breakout |

| Media sentiment | Positive |

| Network traffic | Very High |

| Mining industry | Growing rapidly |

| Days until Halving | 141 |

| Price Section | |

| Weekly price* | $37,009 (-$574, -1.5%) |

| Market cap | $0.723 trillion |

| Satoshis/$1 USD | 2,701 |

| 1 finney (1/10,000 btc) | $3.70 |

| Mining Sector | |

| Previous difficulty adjustment | +5.0700% |

| Next estimated adjustment | -2% in ~12 days |

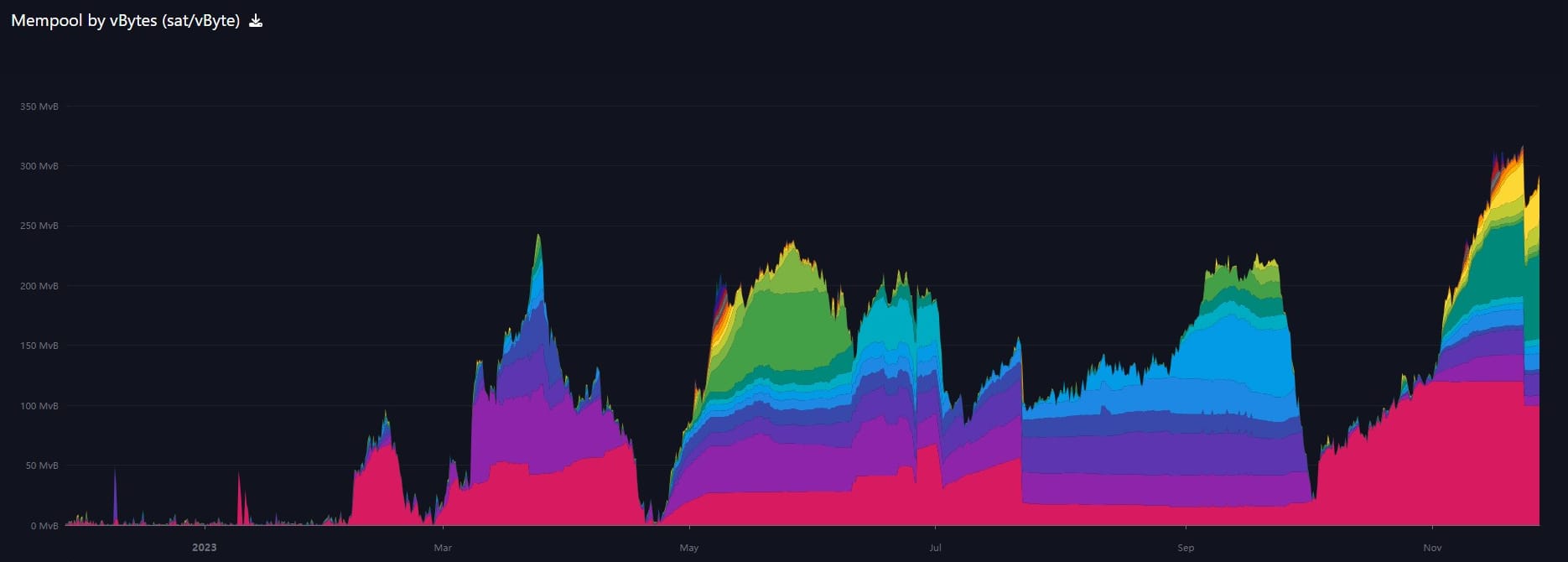

| Mempool | 298 MB |

| Fees for next block (sats/byte) | $2.95 (57 s/vb) |

| Low Priority fee | $2.80 |

| Lightning Network** | |

| Capacity | 5416.40 btc (+0.4%, +21) |

| Channels | 60,785 (-1.3%, -818) |

In Case You Missed It...

Member

Community streams and Podcast

Blog

- Communism Works Better than Markets With Today's Compute? (made public)

- Demographic Collapse: Why Should We Care?

Bitcoin Magazine Pro

Headlines

Binance, the world's largest crypto exchange, faces U.S. charges of failing to maintain a proper anti-money laundering program, operating an unlicensed money-transmitting business and violating sanctions law, according to a Tuesday court filing.

The company plans to settle the long-running U.S. Department of Justice case in a deal to be announced later Tuesday, a person familiar with the situation told CoinDesk. Binance will pay a $4.3 billion fine, The Wall Street Journal reported.

To be honest, I watched this whole drama but never followed it that closely. I do not use Binance are assumed they were dirty, but not as insolvent as FTX. CZ has now plead guilty to money laundering charges, is fined $50 million personally, while Binance is fined $4 billion. This was not a repeat of FTX.

Many commentators have said that the SEC has been waiting for all the worst elements to get pushed out of the industry before they approve a spot bitcoin ETF. Binance and CZ were the last of those bad actors, the theory goes.

Whatever they case, they issued and traded total scam ponzis, so I don't feel sorry for them. In the end, everything is good for bitcoin and this is no exception.

The sell-the-news meme is getting some major play this week. Many are comparing the imminent spot ETF launches to the CME launch of bitcoin futures, which happened to coincide with the 2017 top.

The sheer size of the applicants, which include the world's largest asset-management company BlackRock along with fellow giants like Fidelity and Franklin Templeton, means any approval would be far more influential than earlier milestones, such as the Chicago Mercantile Exchange introducing crypto futures in 2017 or Coinbase (COIN) going public on Nasdaq in 2021, said Pantera Capital managing partner Dan Morehead.

Those developments were “buy the rumor, sell the news” events, wrote Morehead Monday. “This time is different,” he said, well aware of the red warning flag typically raised upon utterance of that phrase. Neither of those events, he argued, had any impact on the actual demand for bitcoin. A BlackRock ETF, on the other hand, "fundamentally changes access to bitcoin … It will have a huge (positive) impact."

I don't put much weight on the sell-the-news narrative. Bitcoin is just starting this cycle, and the ETF applications were filed because there was a ground swell of demand from clients of these firms. Blackrock and other didn't just think to themselves, 'let's launch a bitcoin spot ETF that'll be fun to fight the SEC.' No, they had massive demand from their clients. These clients was an approved product to invest in.

All ETF applicants together have $20+ trillion of assets under management. If 1% of that comes into bitcoin over the next 2 years, which is a conservative amount, that is $200 billion. Remember, higher price for bitcoin drives higher demand.

Last week, Blackrock met with the SEC to explain why they want in-kind creates, in contravention to the SEC instruction to switch to cash creates.

Another sup-plot in this never-ending drama: BlackRock and ARK standing firm on in-kind creates (bc better for invs w spreads and tax) while word is that the SEC said you need to do cash creates (to avoid ppl using unregistered brokers) if you want to get out in the first batch https://t.co/BWE7I9kUkd

— Eric Balchunas (@EricBalchunas) November 22, 2023

I've discussed the difference as I understand it on previous streams and newsletters. In-kind means the buyer of the ETF approaches Blackrock with bitcoin and they turn it into an ETF share, where the bitcoin is held by the ETF custodian. This makes taxes much more simple and the redemption process (taking delivery of the bitcoin backing the shares you own) much more simple, but it forces many wealth managers and brokers to be in the market to buy bitcoin. In-kind creates, therefore, naturally make the spread to NAV tighter as bids are more dispersed.

Cash creates are where the ETF shares are bought with dollars and then the issuer goes out to buy the bitcoin. This is simpler from a regulatory perspective. There are regulated buyers and holders. It is also very convenient for brokers and individual investors, because they can use dollars. However, this makes the job of the issuer more complex, the tax implications more complex, and redemption more complex.

Samson Mow will be talking to new Argentina President Javier Milei on forming an Argentine plan for bitcoin.

"Not every country needs to do exactly what El Salvador did," Mow says. "There are many ways to enable bitcoin adoption," pointing to Milei’s campaign promise to allow private money to be used in the country.

"What this means is the Argentinian people can simply use whatever money they want, including bitcoin and [Tether's] USDT, which are massively popular in the country. I believe his concept would serve bitcoin just as well as making it legal tender."

Macro

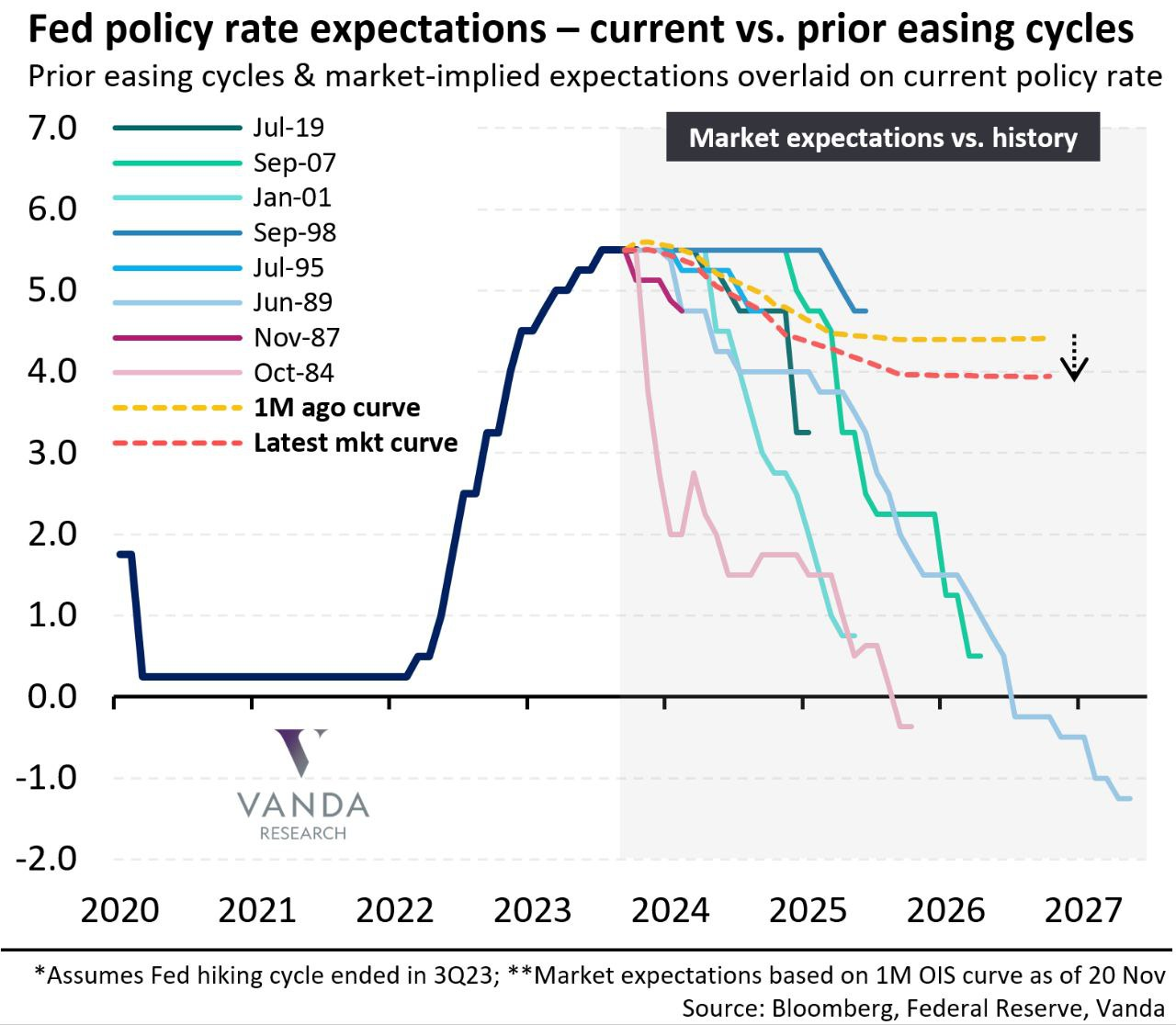

- People now guessing at first rate cut by the Fed

My my, what a difference a couple of weeks makes. The sentiment has completely flip-flopped from higher for longer, to wen rate cut?

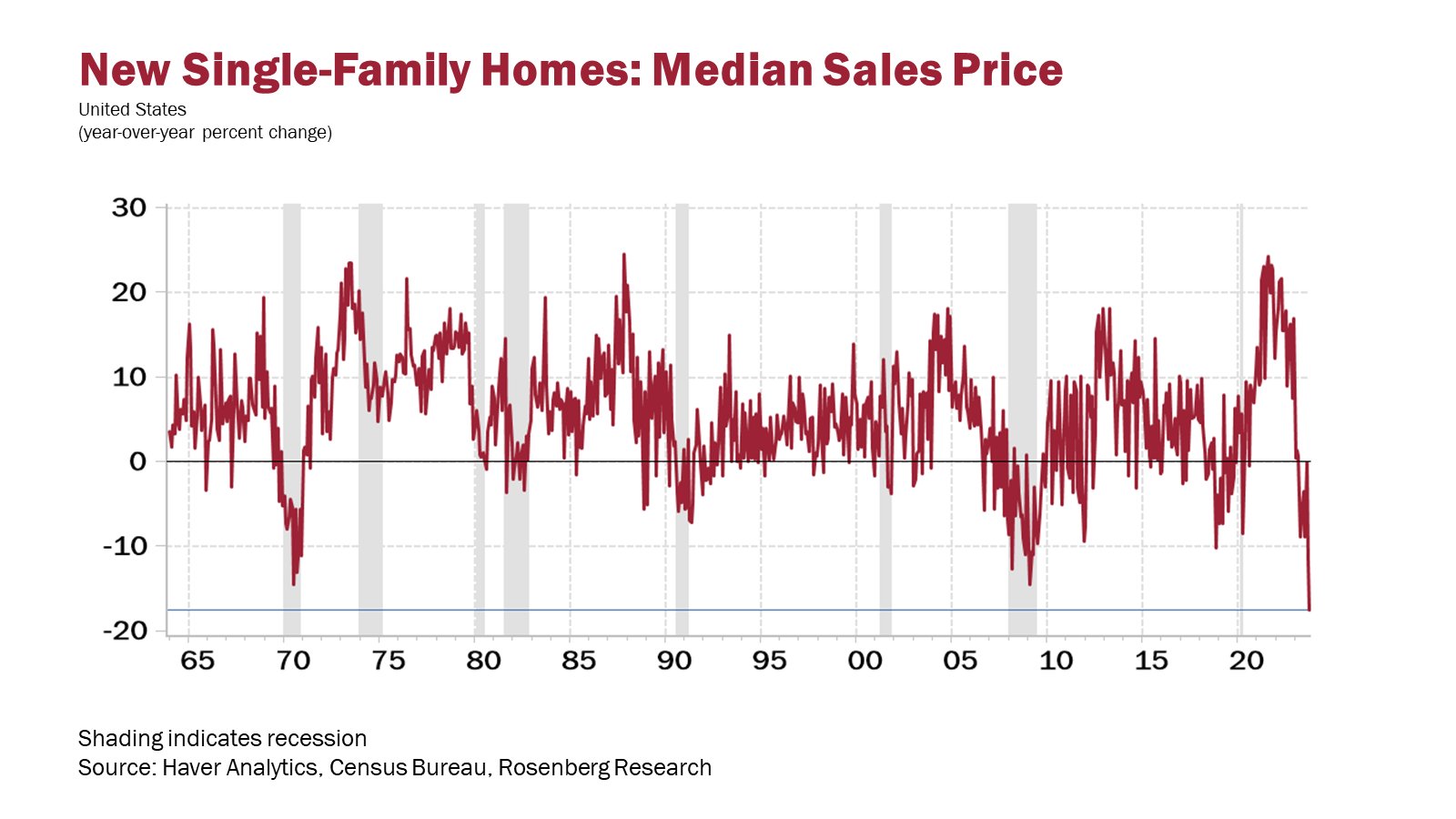

Another indication that CPI has topped hard. This is despite many tricks used by builders to offer financing with rebates, in order to keep sales prices up.

Shelter is 1/3rd of the the CPI basket. Rents and Owner Equivalent Rent are what the Bureau of Labor Statistics uses to calculate that portion, New Sales only factor in as a trickle down effect. When new home sale prices fall this dramatically, OER and rents will follow with a lag.

This is a traditionally hard component to calculate. It is likely that the headline price tag will continue to fall until "affordability" - the amount you pay each month on a mortgage - comes back into historical trends and rates naturally fall.

Piracy is increasing as I predicted. This most recent pirate seizure of an Israel-linked ship is at least the second that we know of since the start of the Israel-Hama war on Oct 7th.

While no group immediately claimed responsibility, it comes as at least two other maritime attacks in recent days have been linked to the Israel-Hamas war.

Below is a video of another hijacking (original video). In the video, Houthis use a military helicopter to board a civilian ship in the Red Sea. Quite sophisticated.

As recession takes more of a toll around the world, people become more desperate and government don't have the tax receipts to keep control. As the US is psychologically weakened and retreating, piracy will become a big problem, like it was throughout human history until recently.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

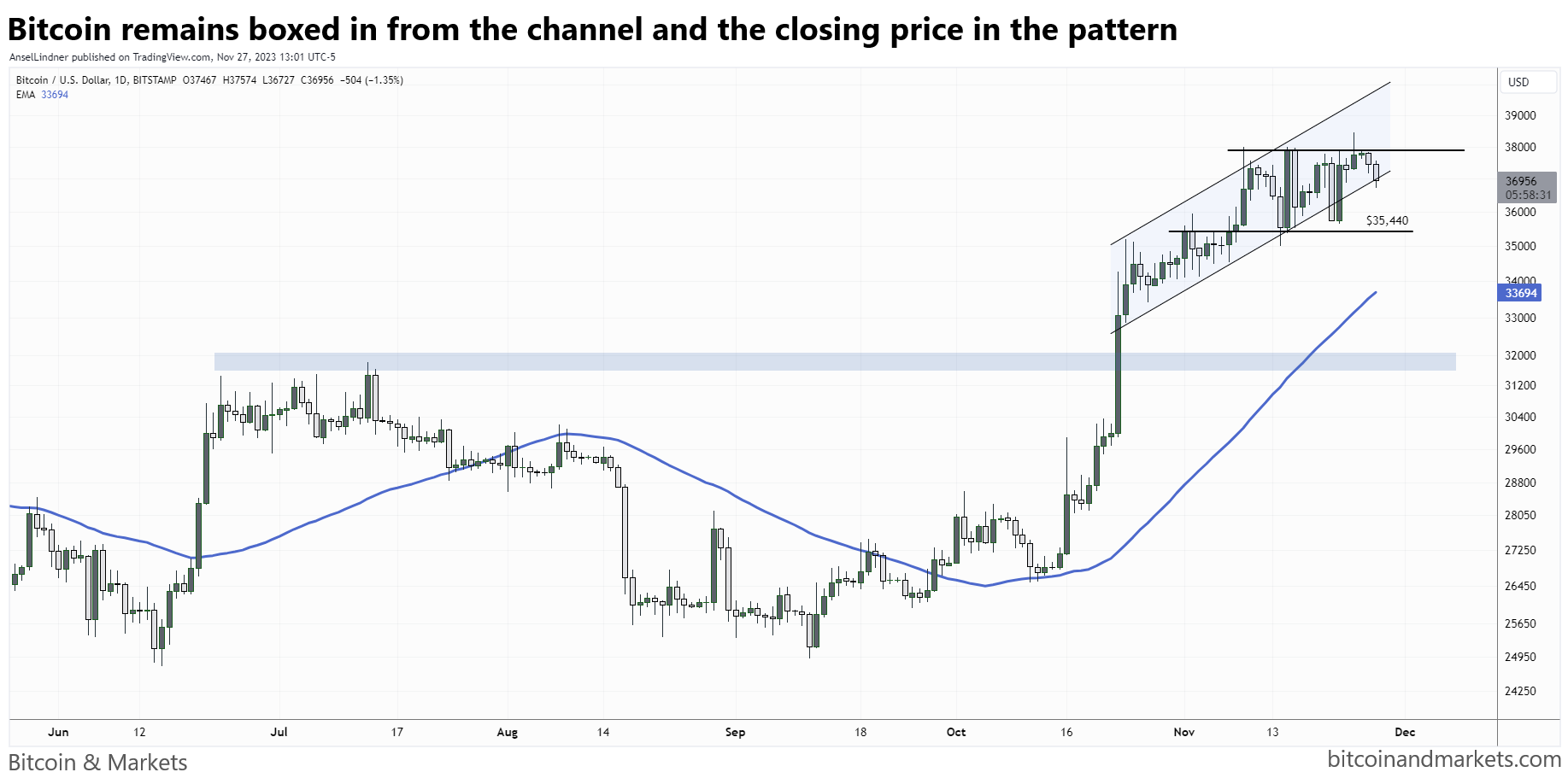

We've been watching this channel for several weeks now. I looked like it might break below the important $35k level be returned right into the channel. Then price experienced some resistance at the high close in the patter at $37.9k.

As it stands right now, we have to break the top resistance or the channel support by 1 December.

On the weekly timeframe, the Golden Cross is getting closer. I added in the volume-by-price to show once we get over this very near-term resistance there is almost no previous high-volume resistance until $48k.

I'll go on the record right now saying we will not never break $30k again. The support from the cross and volume-by-price will almost certainly make that area extremely strong support if price ever goes back down there.

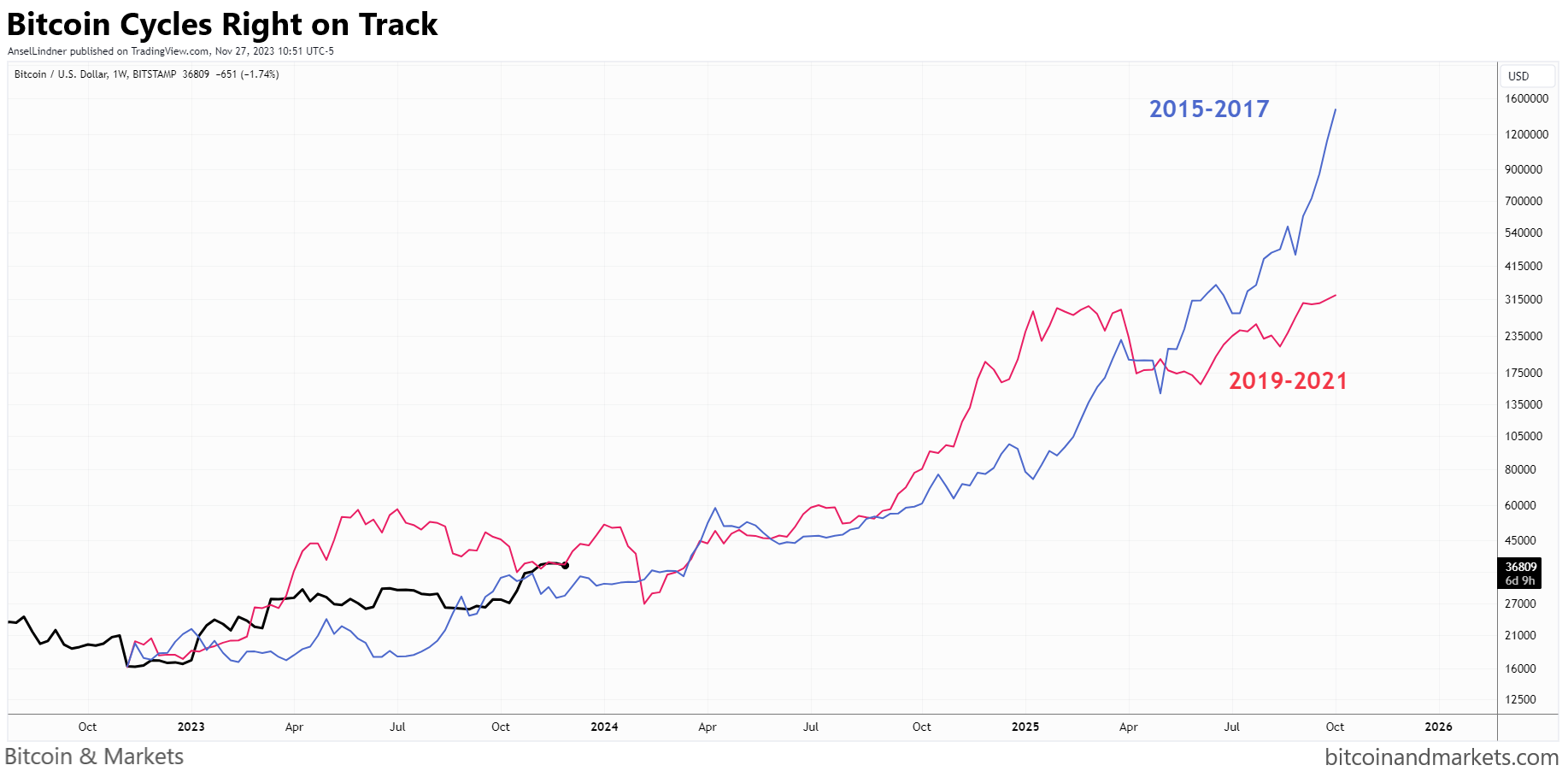

Cycles

Bitcoin cycles are a beautiful thing. If we follow the 2015-2017 path from bottom to top, price would peak at $1.4 million. Follow the 2019-2021 path, the peak is $325k.

Each cycle has had a unique complicating factor. The cycle that ended with MtGox blowing up was driven heavily by initial demand, bots on MtGox, and their programming to get the hacked bitcoin back through trading. 2015-2017 was dominated by the scaling debate and massive internal bickering. the 2019-2021 cycle it was COVID initially setting the rally back, then the leverage schemes of altcoins and exchanges.

The case could be made that in 2019 (red line), price was going to take-off but then COVID hit. That crash likely causes massive insolvencies around the industry, incentivizing the fraudulent behavior that followed to make those losses back, IDK. The red line obviously took off first in the cycles above, not once but twice. That cycle could have been just as big, but it was faster.

This coming cycle is right on track, but it looks cleaner and there isn't a noticeable anti-bitcoin narrative from inside the industry. This time, the opponents are outside, like Greenpeace and globalist politicians and lawmakers.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

Celsius is returning from the dead and going bitcoin-only after their shitcoin lending implosion. Don't be fooled, they didn't have a change of heart. Initially, after their bankruptcy they wanted to get back into the scam ponzi game with staking the SEC likely told them, 'umm, are you stupid?'

Celsius, whose restructuring plan had also envisioned the company earning "staking" fees by validating blockchain transactions and managing its legacy portfolio of cryptocurrency loans, said in a statement late Monday it had changed course after receiving "feedback" from the U.S. Securities & Exchange Commission.

I'm happy to see bitcoin mining getting started all over the world. I think the typical rapids and waterfalls in Africa near the coast in many countries could create a unique opportunity for bitcoin and Africans. If bitcoin mining changes the calculus for creating more hydro plants there, it will be a huge win for Africa.

Difficulty

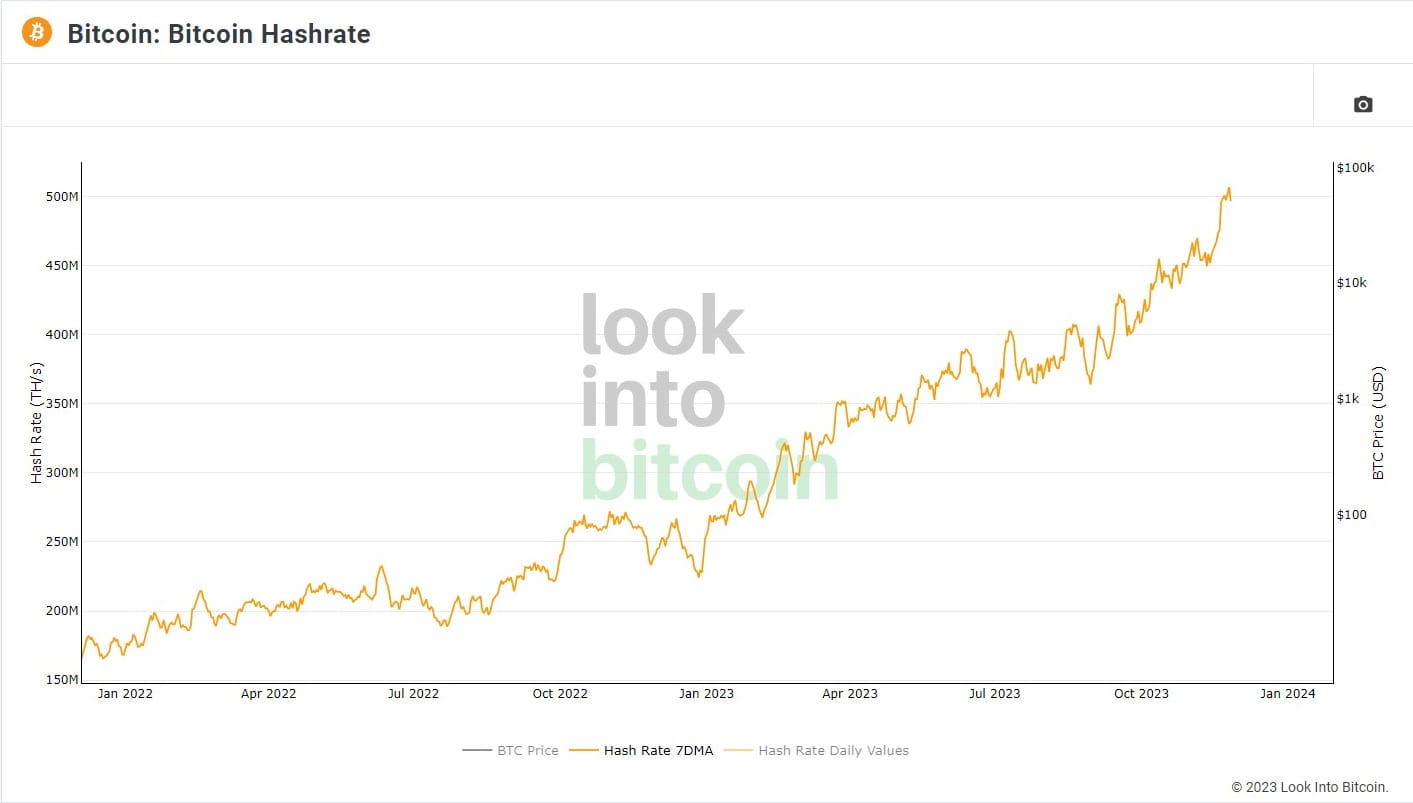

Bitcoin's difficulty increased by whooping 5% yesterday, despite hash rate already being at massive ATHs and price not taking off just yet.

If hash rate is held constant, the halving will come in 141 days. However, if hash rate continues to moon at this rate, we could see a halving 5% before than, so 134 days. It'll be here before you know it.

Hash Rate

Hash rate keeps mooning. There is a rush to get hash rate on before the coming rally and halving.

Mempool

The mempool is still extremely full, but did drop significantly this week. The ultra-expensive fees are not gone, and the network will have a chance to chew through the remaining transactions. Fees have remained manageable for all the largest Ordinals inscribing transactions.

Layer Two

To our valued Wallet of Satoshi community in the United States of America,

— Wallet of Satoshi (@walletofsatoshi) November 24, 2023

We've dedicated ourselves to providing the best Bitcoin experience with Wallet of Satoshi, being at the forefront of Lightning usability and adoption. However, we've made the difficult decision to remove…

We've made the difficult decision to remove our app from the U.S. Apple and Google app stores, and will not serve U.S. customers going forward.

This decision doesn't come lightly. Our commitment to providing a secure, user-friendly, and compliant platform globally is unwavering. Our top priority is the safety and interests of our customers and our company.

We understand this may be disappointing news and we share your frustration. We're hopeful that future developments will allow us to revisit and possibly resume our operations in the U.S.

For our existing users in the USA, rest assured that you have full access to your Bitcoin funds. You can seamlessly withdraw and transfer them to another wallet.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space