Bitcoin Fundamentals Report #277

Bitcoin's price is taking all the headlines, but I talk ETF flows, Macro update, price analysis with warning, mining industry news and stats.

February 12, 2024 | Block 82x,xxx

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Positive inflows |

| Media sentiment | Neutral |

| Network traffic | Moderate |

| Mining industry | Surging |

| Days until Halving | 72 |

| Price Section | |

| Weekly price* | $49,904 (+$7,142, +16.7%) |

| Market cap | $0.977 trillion |

| Satoshis/$1 USD | 2,003 |

| 1 finney (1/10,000 btc) | $4.99 |

| Mining Sector | |

| Previous difficulty adjustment | +7.3335% |

| Next estimated adjustment | +9% in ~2 days |

| Mempool | 206 MB |

| Fees for next block (sats/byte) | $7.68 (110 s/vb) |

| Low Priority fee | $3.56 |

| Lightning Network** | |

| Capacity | 4742.94 btc (-3.8%, -187) |

| Channels | 56,961 (-2.9%, -1714) |

In Case You Missed It...

Member

Community streams and Podcast

Blog

Bitcoin Magazine Pro

Headlines

- "Price is all that matters", Bitcoin Breaks $50,000

I've been saying this about bitcoin for 10 years now. If price were to constantly go down, or even sideways forever, there is very little reason to hold bitcoin, develop on bitcoin, back the economy with bitcoin. Bitcoin's technology is Number-go-Up. Right now, we are experiencing the power of this tech. A positive feedback loop of price and demand.

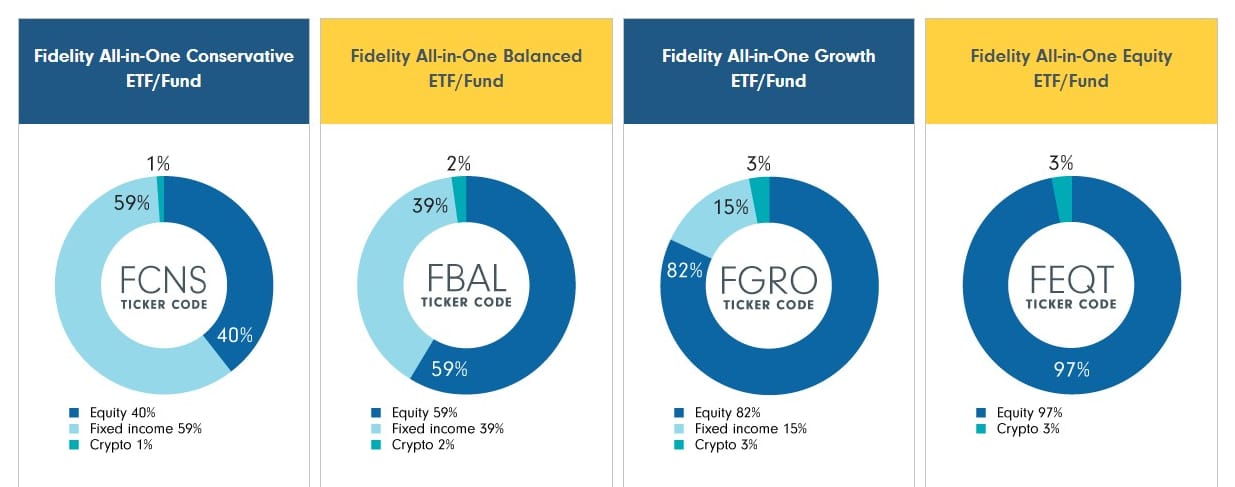

- Fidelity Adds Bitcoin to their All-in-one ETFs in Canada

These are Canadian ETFs, but if this kind of thinking spreads, it is HUGE. If bitcoin becomes a part of all balanced portfolios as high as a 3% allocation, that is hundreds of billions of dollars coming into bitcoin with a multiplier as high as 100x.

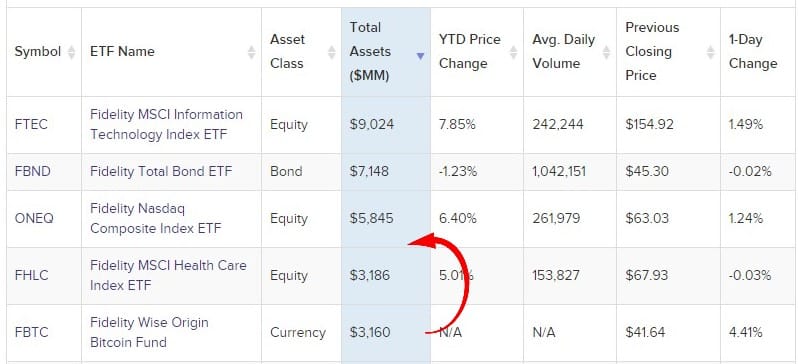

Fidelity's Bitcoin ETF is already their 4th largest. These numbers are as of Friday, bitcoin is up almost 6% since then, putting their Total Assets in the bitcoin ETF at $3.35 billion.

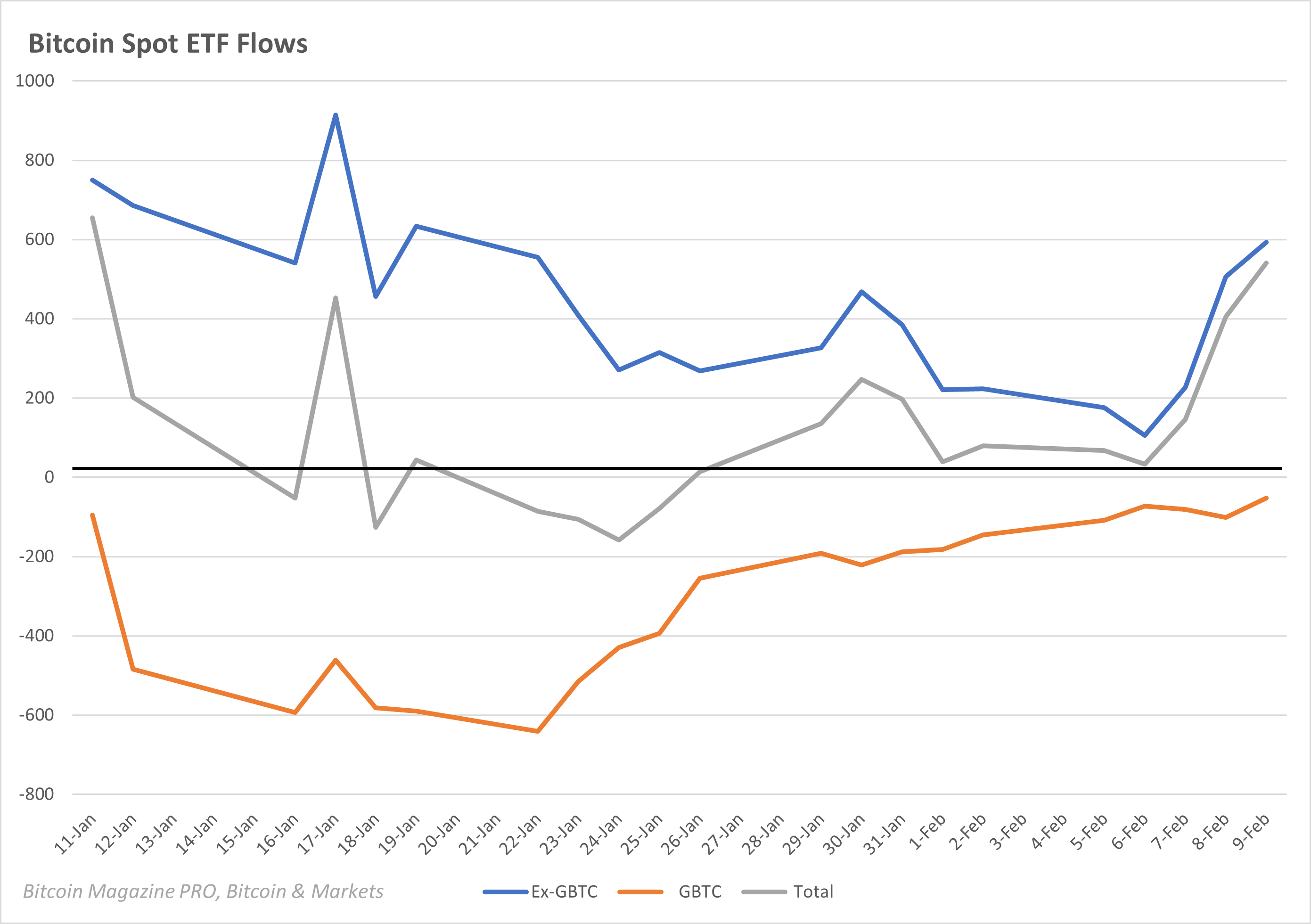

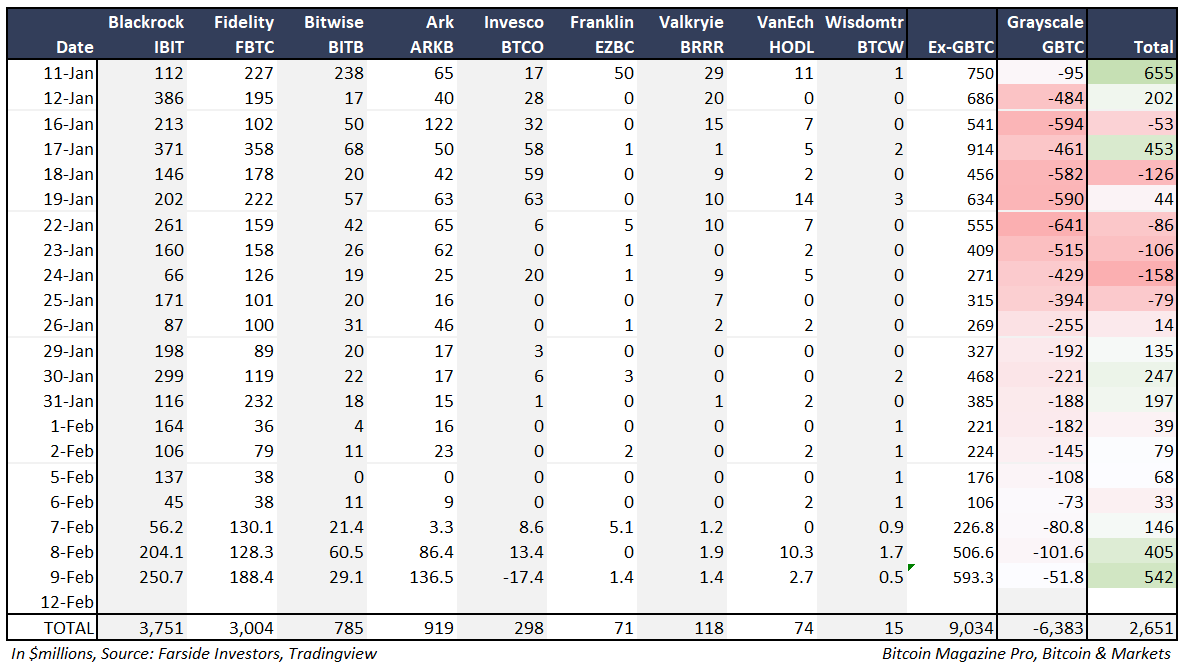

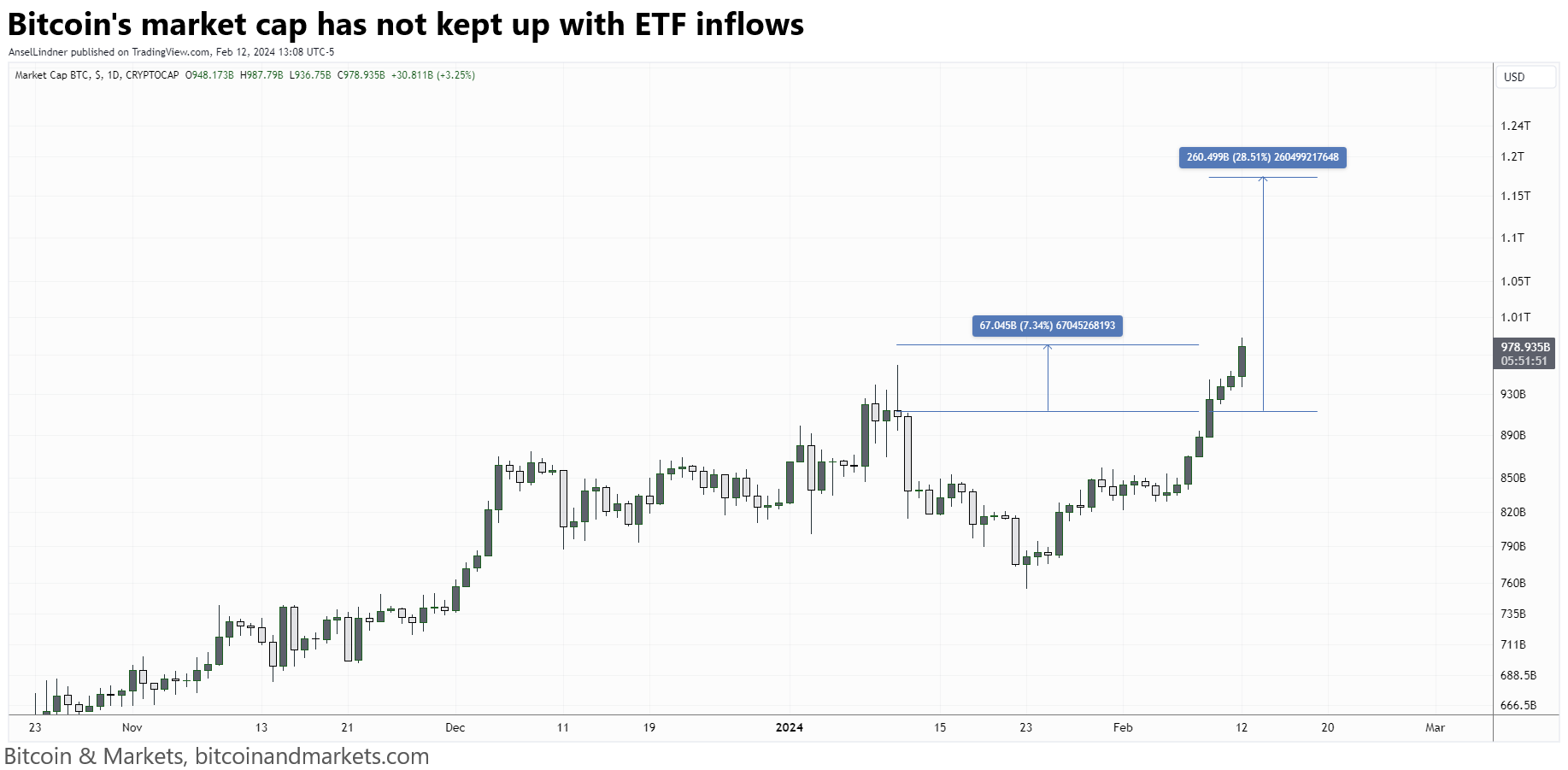

- ETF inflows explode higher

This chart is only through last Friday, but I expect flows to continue to grow as price rises due to FOMO.

Macro

- US CPI tomorrow

I will be live streaming the CPI release tomorrow morning at 830 ET.

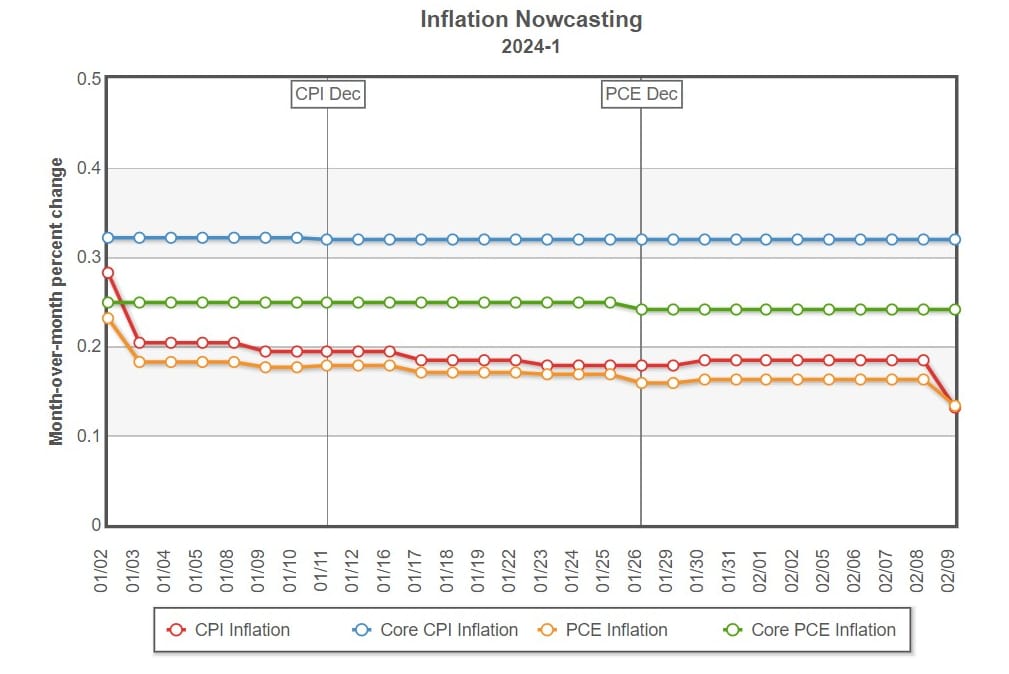

Current expectations by the Inflation Nowcast is 0.13% MoM. Personally, I always expect an undershoot, but that rate is 1.5% annualized, which is low.

Truflation is a new price CPI-like source gaining in popularity. It is a "blockchain" project with its own token, backed by Balaji and Coinbase amongst others, so take it with a grain of salt. Truflation updates daily.

They have a shitcoin but I think Truflation is closer to the mark than CPI due to the methodology around housing. I'm still expecting several negative prints this year.

According to the EU exeuctive's plan, "all sectors" need to now contribute to the effort - but the previously mandated 30% cut to agricultural production between by 2040 is gone. The revised draft has also excluded a mandate for citizens to make lifestyle changes - such as eating less meat, and a push to end fossil fuel subsidies, Politico reports.

The globalists don't have any defense against these types of protests. We owe the Canadian truckers a whole lot for showing us the way. Everywhere these protests have been tried, they've succeeded.

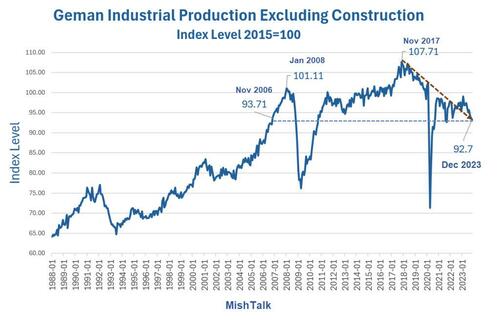

Amid the flickering of flares and torches, many of the 1,600 people losing their jobs stood stone-faced as the glowing metal of the plant’s last product — a steel pipe — was smoothed to a perfect cylinder on a rolling mill. The ceremony ended a 124-year run that began in the heyday of German industrialization and weathered two world wars, but couldn’t survive the aftermath of the energy crisis.

Manufacturing output in Europe’s biggest economy has been trending downward since 2017, and the decline is accelerating as competitiveness erodes.

“We are no longer competitive,” Finance Minister Christian Lindner said at a Bloomberg event earlier this month. “We are getting poorer because we have no growth. We are falling behind.”

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

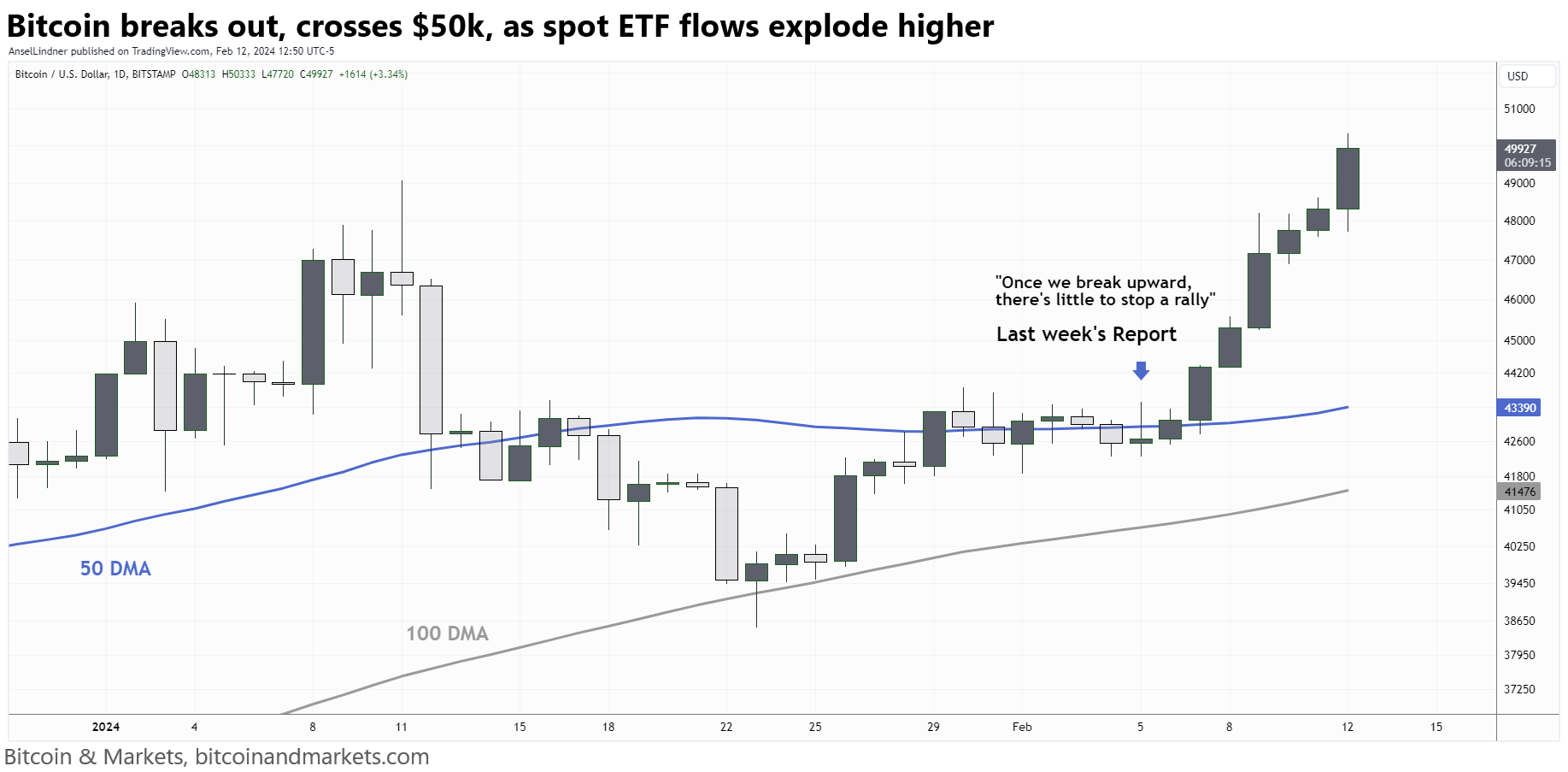

We are so back!

Last week price was playing with the 50-day MA. This week 🚀

There is no sign of a slowing of demand at this point. Everything I'm seeing is extremely bullish and pointing in one direction, which makes me a little worried.

Always be prepared for the unexpected, i.e. an exchange hack, regulatory announcement, or something. Don't be over-invested. I might be the only bitcoin focused analyst to say that, but you can be over-invested in bitcoin if the prospect of a 25%-50% dip causes you major stress. Never get 100% of bitcoin though. I'm just talking about being 100% in bitcoin and betting your house or your kids lunch money. Be mentally and strategically prepared for a dip.

That being said, I don't expect a dip here. I think the ETFs were not nearly priced in, so we have a long way to go for that. Prior to the launch, I estimated that high $50k's were fair for the launch, but the flows cannot be priced in.

Net flows as of Friday were $2.6 billion, which should correspond to $260 billion gain in market cap at a 100x multiplier. That would bring us to $1.175 trillion market cap or $59.8k per coin with current circulating supply. If we rapidly make up that difference, it would fit with my warning over the last several weeks, expect "brief steep appreciation followed by periods of calm".

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

I think this is very interesting. I'm hard of Africa because they have horrible geography for economic development. However, bitcoin mining can leverage the internet and bitcoin's unique ability to equalize transportation costs.

Ethiopia has seen an increased inflow of miners recently as companies in the segment search for low-cost energy and ideal climate, Bloomberg has reported. It has become home to Chinese companies, for example, who were forced out of operating in their home country following a crypto mining ban in 2021.

Certain African countries have stranded or underutilized power, Schumacher told Blockworks.

“If we can attach bitcoin miners to these power sources, then we can increase the profitability of those power sources and ensure they stay online for the people who need them,” he said.

“Across the continent, there is also a need for more power,” Schumacher added. “Bitcoin miners can incentivize the buildout of more power across the continent by serving as the first customer for new power projects.”

I don't believe this is a sure thing for the whole continent or anything. Most of Africa will suffer in coming years, but places like Ethiopia (if they can maintain peace with Egypt) and Nigeria (if they can manage their tribal disputes) can do quite well.

Houston said a crypto-mining operation in her rural district had subjected long-time residents to noise that she heard firsthand and called “absolutely atrocious.” At a committee meeting held Thursday, she also pointed out more than once that China had recently banned Bitcoin trading and mining.

“I’ve always come to the conclusion that if it wasn’t good enough for China, it’s not good enough for Cook County,” Houston said.

“I’m still confused about what we’re mining,” said Rep. Dale Washburn, a Macon Republican. “I have rock quarries in my district, and they find the granite under the ground, and they get permitted and we can all ride by and watch what they’re doing.”

The division has done over 20 investigations on staking and crypto mine investment programs. Staking is when someone agrees to commit crypto assets for a period of time with the expectation of earning more cryptocurrency.

That work identified more than 16,000 Georgia investors with more than $160 million in digital assets who have been harmed. Some of them lost all their savings, Zaharis said.

TLDR: Ordinals will help miners not go broke through increased fees and the ETF flows promise to boost the price.

I thought this was a comprehensive write up, so wanted to share. I disagree that ordinals will be a major player in the future. But this is right up Grayscale's shitcoiner alley.

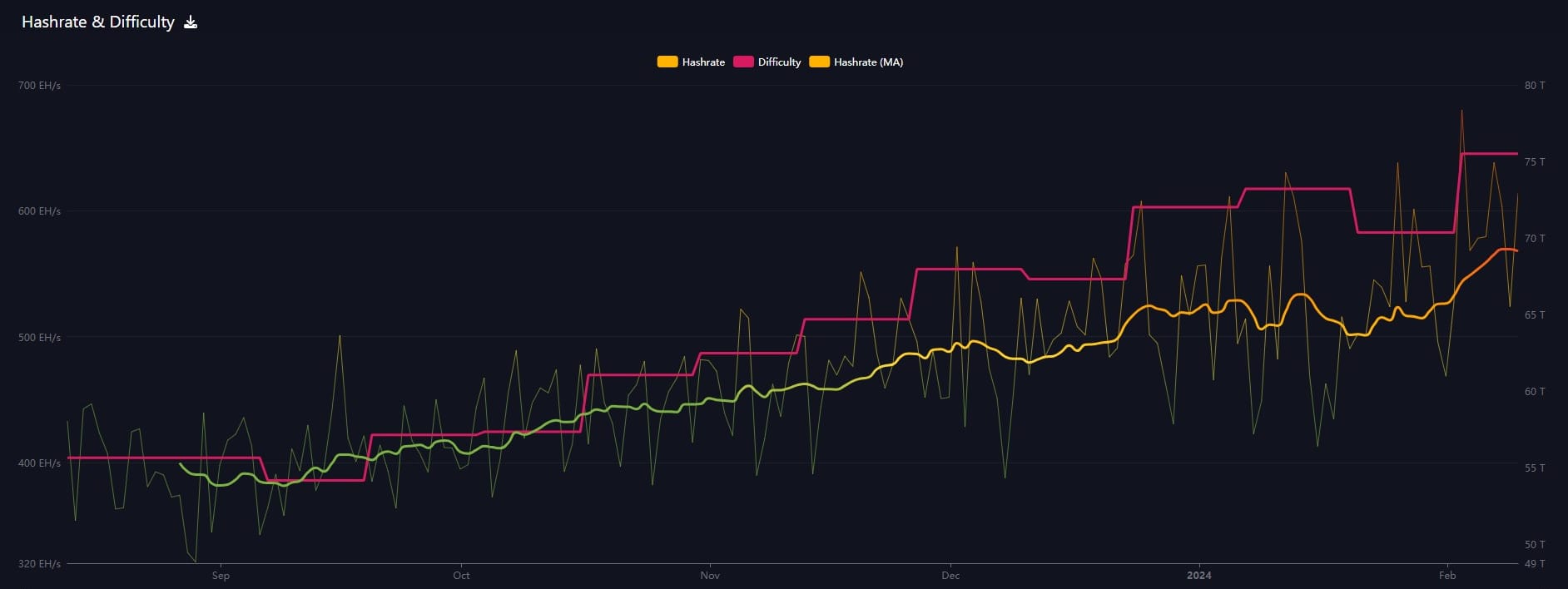

Difficulty and Hash Rate

Hash rate continues to scream higher. Difficulty adjusted +7% two weeks ago, and is estimated to adjust up again by 9%+ in 2 days.

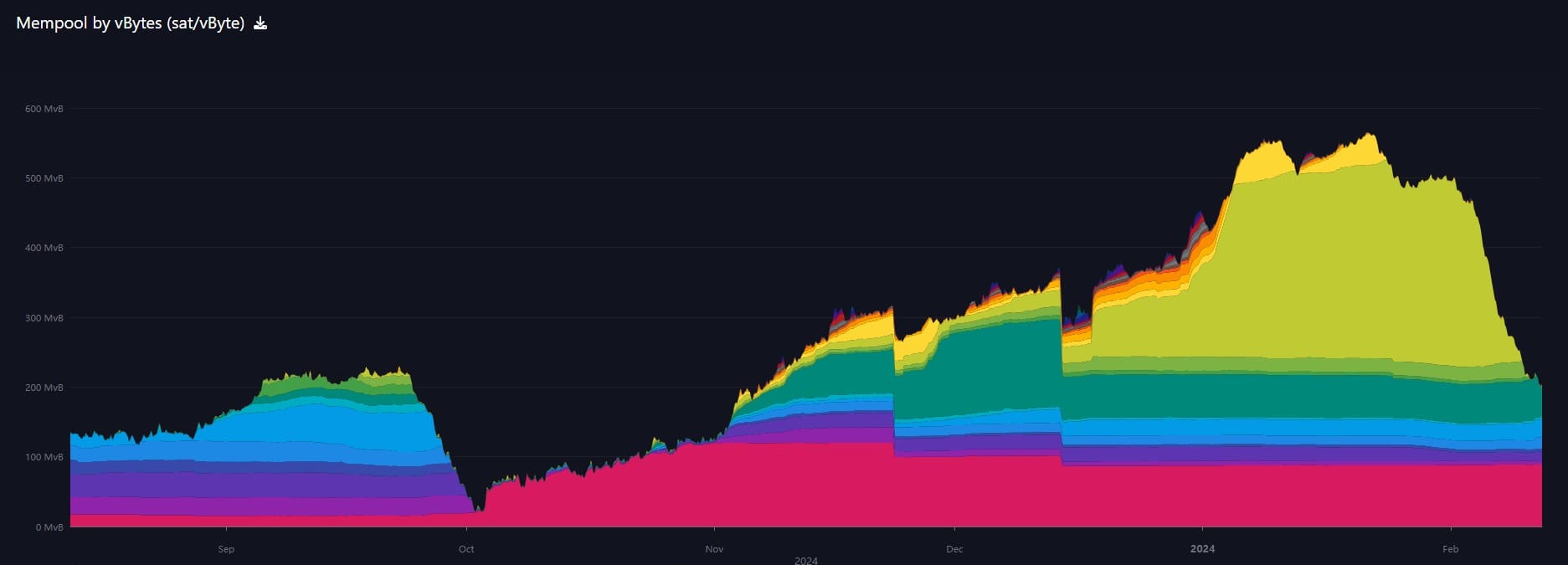

Mempool

Mempool has come down dramatically over the last week, currently only 206MB, the lowest since 7 November 23.

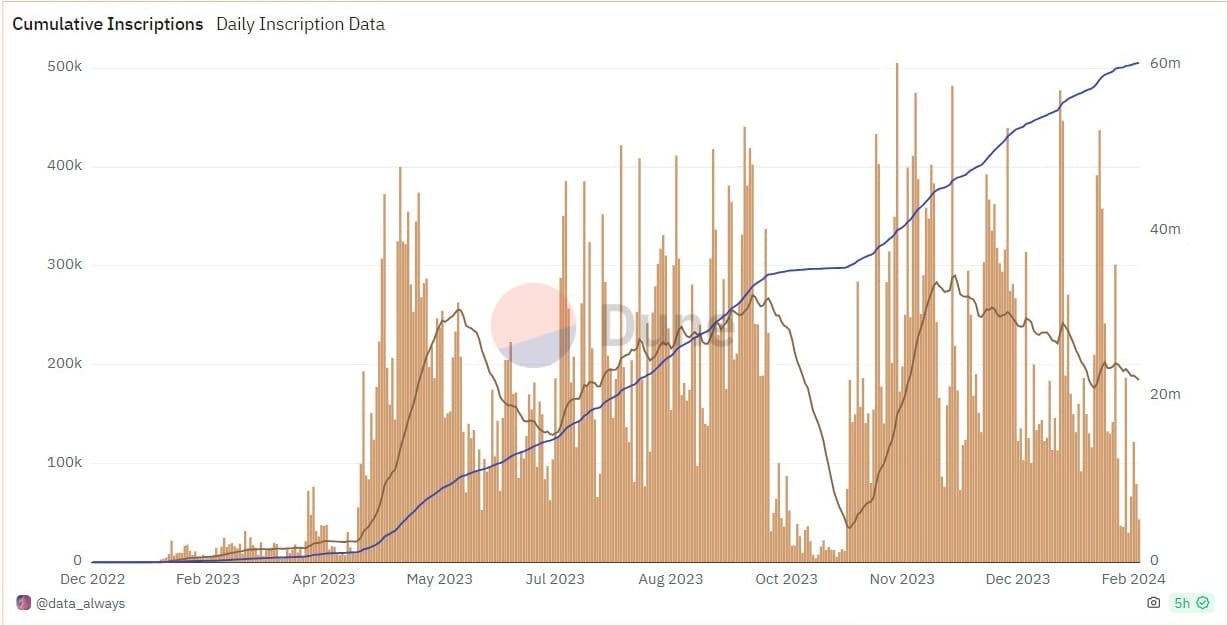

Inscriptions

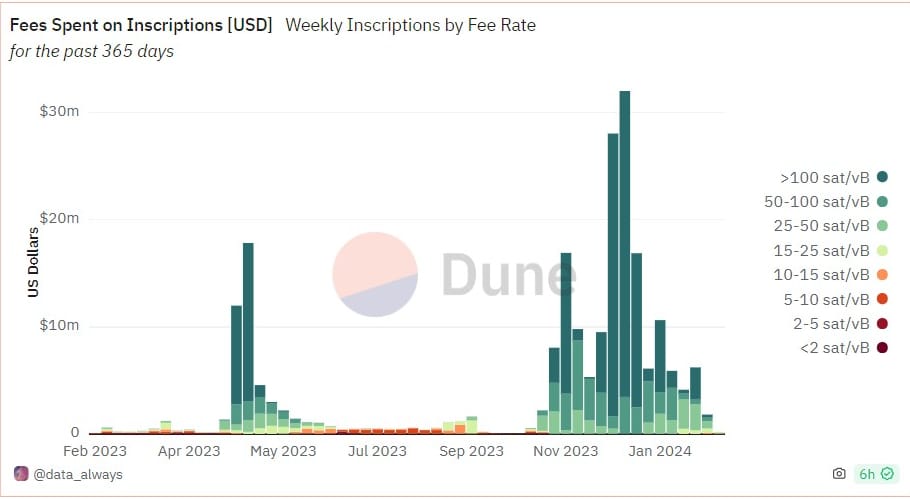

The shrinking mempool matches with the decline in inscription volume. The dark brown line (moving average on this chart) continues to decline. The last week has been very low. Yesterday saw only 79,000 inscriptions.

Fees paid by inscriptions has also logically fallen. To-date there is still no organic market for ordinals or other inscriptions.

Layer 2

Shitcoiners are coming to bitcoin L2's. It is very true that bitcoin needs a scaling solution, but there are several to choose from. The demand has to come first. Right now, the demand is for SoV. These altcoin pumpers are just trying to run scams on bitcoin. Let them do it, pay the miners.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com