Bitcoin Fundamentals Report #278

Bitcoin spot ETF inflows surge, bitcoin adoption route, China and other macro, bitcoin price analysis for the week, mining sector update.

February 19, 2024 | Block 831,167

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Bullish |

| Media sentiment | Neutral |

| Network traffic | Moderate |

| Mining industry | Consolidation |

| Days until Halving | 57 |

| Price Section | |

| Weekly price* | $51,858 (+$1,954, +3.9%) |

| Market cap | $1.018 trillion |

| Satoshis/$1 USD | 1928 |

| 1 finney (1/10,000 btc) | $5.18 |

| Mining Sector | |

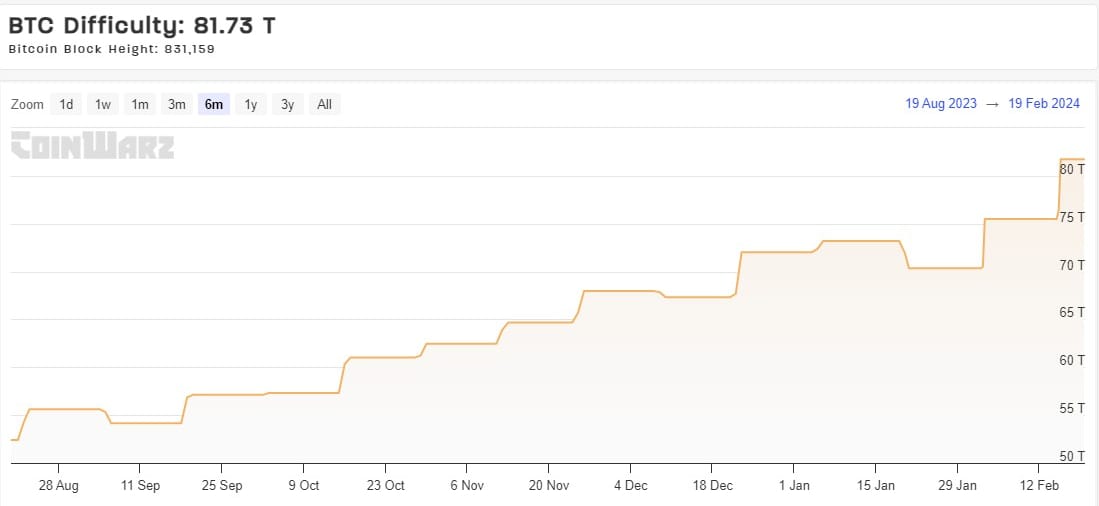

| Previous difficulty adjustment | +8.2324% |

| Next estimated adjustment | -3.5% in ~10 days |

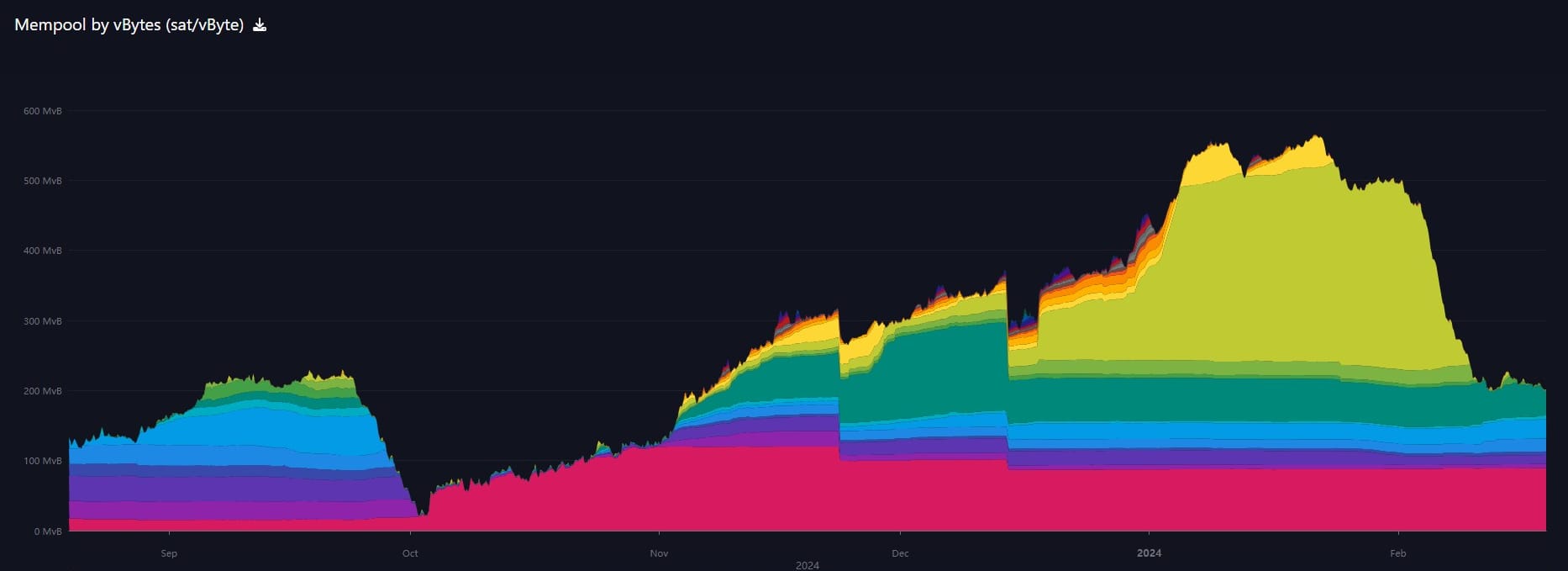

| Mempool | 201 MB |

| Fees for next block (sats/byte) | $1.74 (24 s/vb) |

| Low Priority fee | $0.58 |

| Lightning Network** | |

| Capacity | 4646.48 btc (-2.0%, -96) |

| Channels | 56,002 (-1.7%, -959) |

In Case You Missed It...

Member

Community streams and Podcast

Blog

Bitcoin Magazine Pro

Headlines

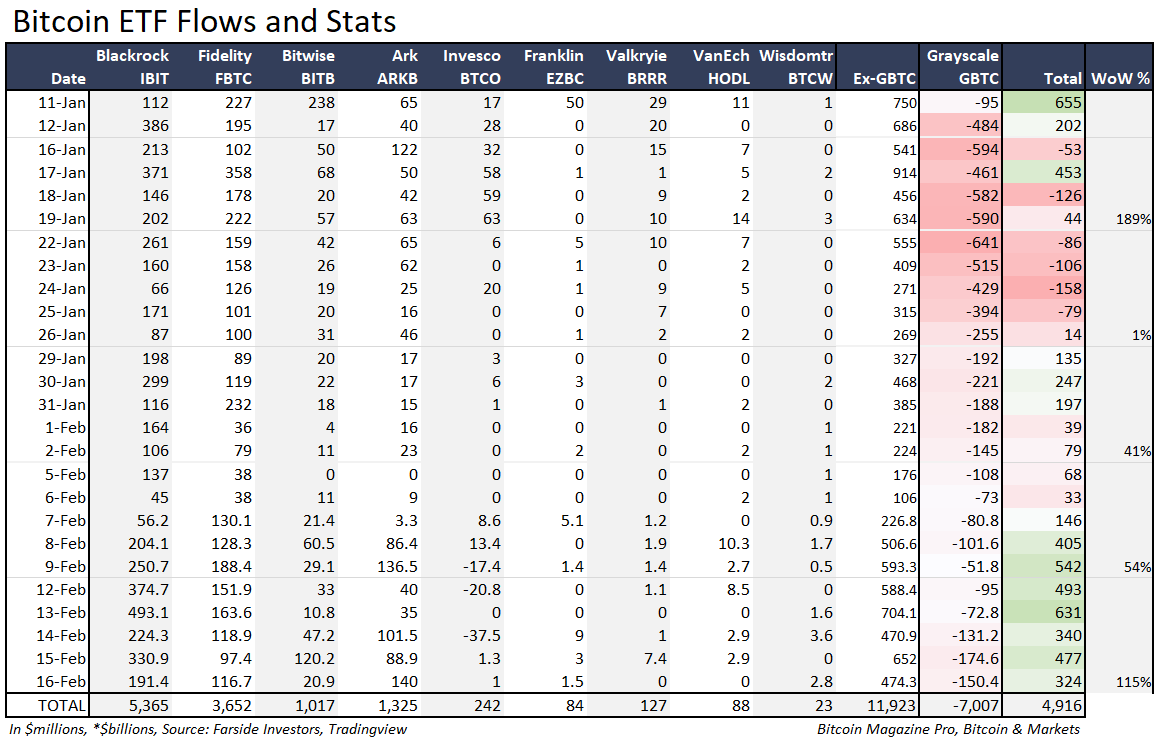

- ETF inflows explode higher

Last week was the largest week for net inflows into the Bitcoin ETFs, up 115% week-over-week, for a total of $4.9 BILLION. Blackrock's IBIT alone had $1.6 billion inflows last week.

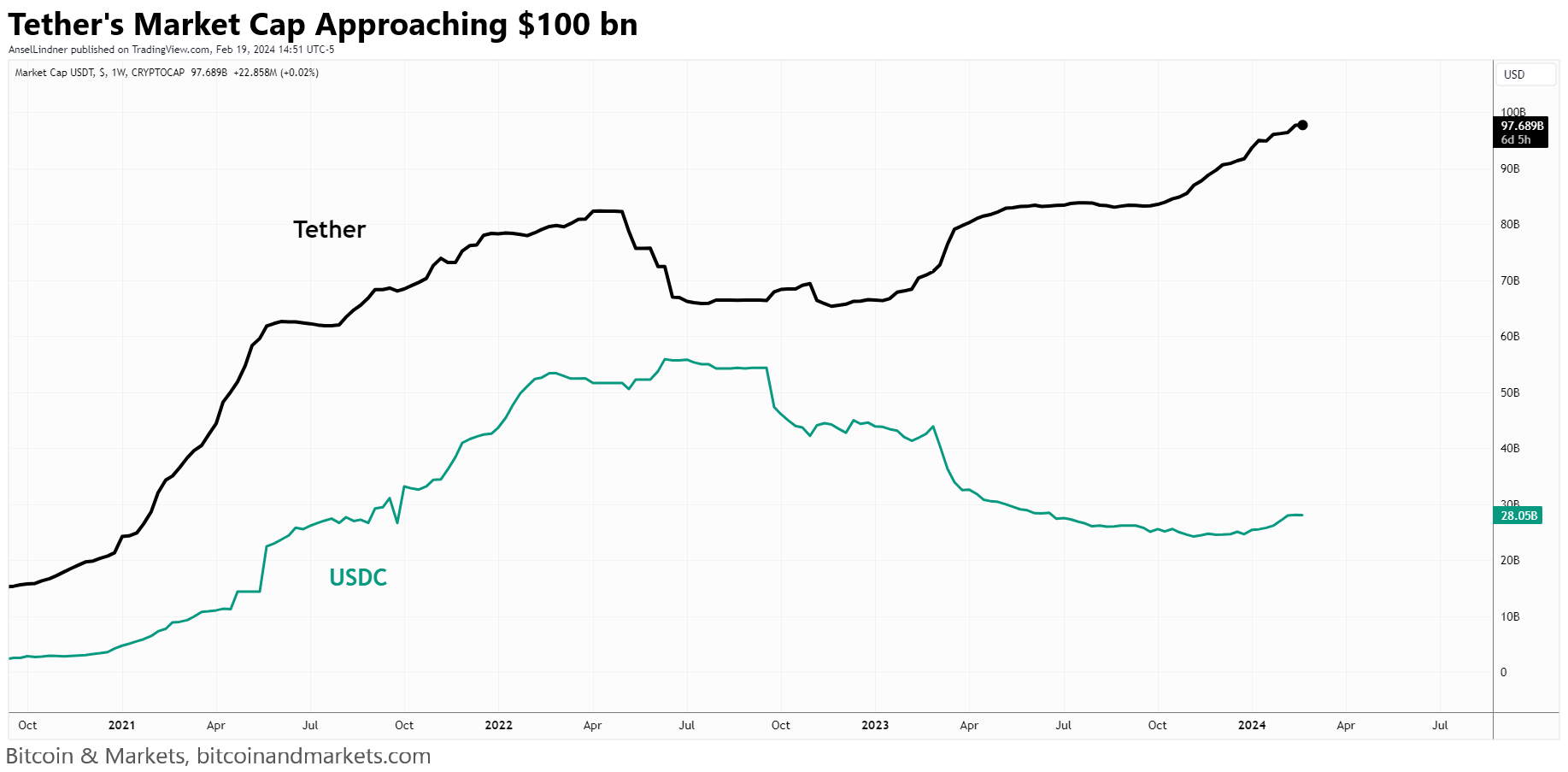

- Tether's market cap continues to rise

Representatives from Coinbase and their scheme partner Circle, who issues USDC, went in front of a Congressional committee last week and suggested Tether get taken down a peg with regulation and outright pressuring their banking partners to drop them. It is my strong suspicion that Circle is behind most of the Tether FUD of the last few years.

Wow, @Circle's Caroline Hill is really begging to congress for the treasury department to go after @Tether_to and their banking partner, Cantor Fitzgerald https://t.co/SmnAqeuEyB pic.twitter.com/oia8YxLvAI

— Pledditor (@Pledditor) February 15, 2024

Despite this development, Tether's supply continues to rise undaunted. Tether also holds bitcoin to back their tokens, which could act as a powerful example for how bitcoin can be used going forward to back dollars specifically.

As Tether marches toward dollar dominance, we can look at their Euro product as well. I can't chart EURT with USDT because you wouldn't be able to see it. There's only 36 million EURT. No one wants it. USDT threatens the very foundations of the Euro as an international currency. People would rather use and invoice in USD via Tether than Euros. That is why the ECB is so worriedly moving forward with a digital Euro CBDC.

I've said for a long time that bitcoin will not be adopted by the global south, or the world's poor first. Bitcoin as a store-of-value function will be adopted where there is savings. If you don't have any savings, you won't even consider bitcoin.

Okung says Africans would rather hold USDT than bitcoin.

During my time in Africa, while advocating for the Lightning Network, I faced a cold, hard realization.

— OKUNG 🥋 (@RussellOkung) February 18, 2024

Despite my efforts, I found that more people were interested in dealing with USDT rather than Bitcoin.

They desired USD, even if they were synthetic versions.

Macro

This week shocked European leaders from Helsinki to Brussels and back via Berlin to Warsaw without skipping any of the other European NATO member capitals in Europe. What happened? During one of Trump’s campaign rallies Trump said that he would sort of encourage Russia to do whatever it wanted with NATO members that have not been meeting their defense spending fair share of 2% of GDP.

I've been saying for years that NATO is about to collapse. The Europeans don't do anything but rope the US into massive military spending and all the conflicts on their borders. Their borders, not the US' borders. They don't pay, and the US provides the money and men to fight their never-ending wars.

Even if it is not Trump this year, the US will exit NATO soon regardless.

Readers should know my bearishness on China going back almost 5 years now. Here is video from Blockworks with guest Brian McCarthy who is a China expert. His main point is that the currency is very overvalued but the regime can't let it collapse to fair value because it will destroy the countries massive population of poor. The whole problem over there is due to their economic model being over, exactly as I have been saying now for years.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

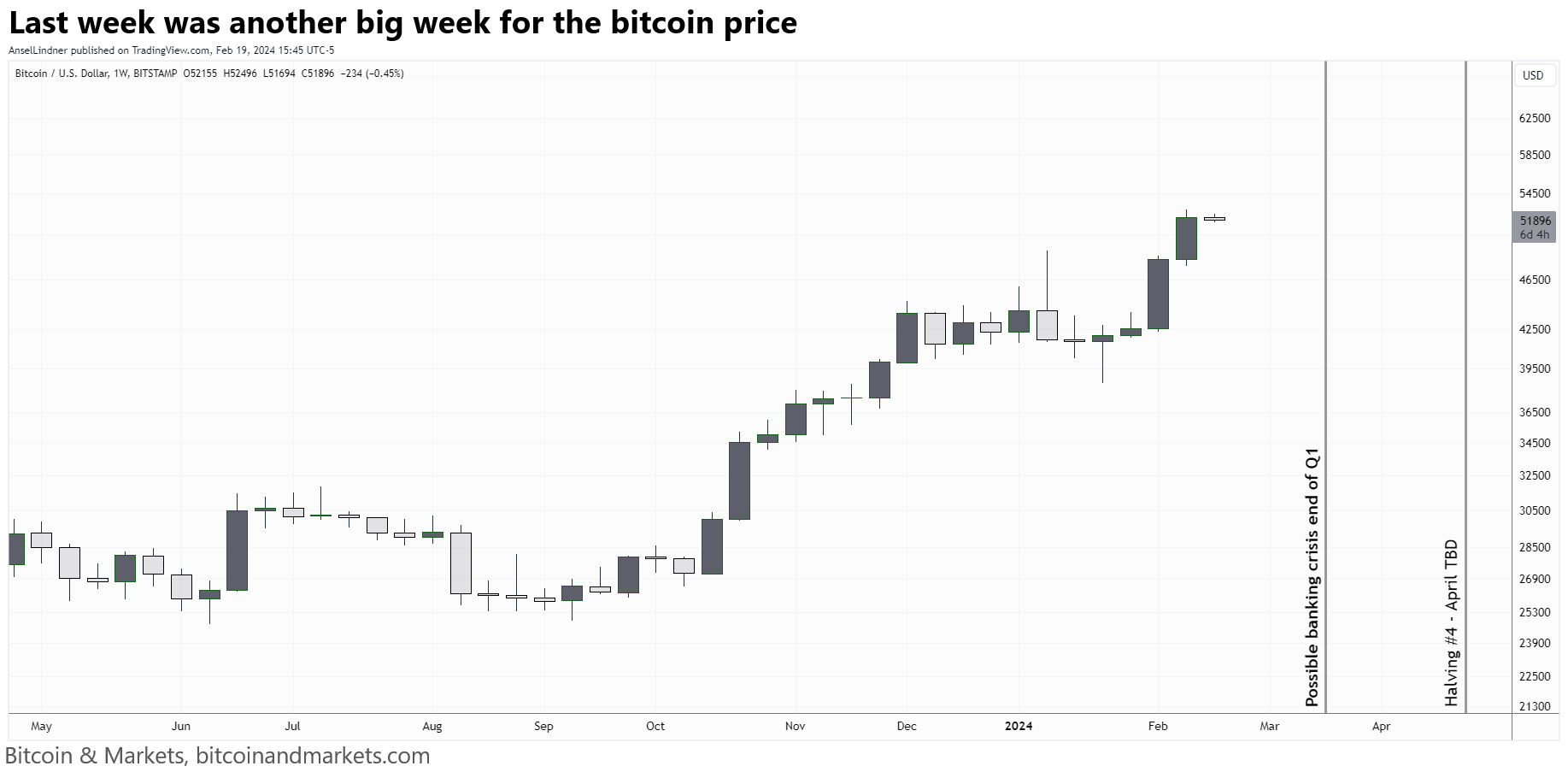

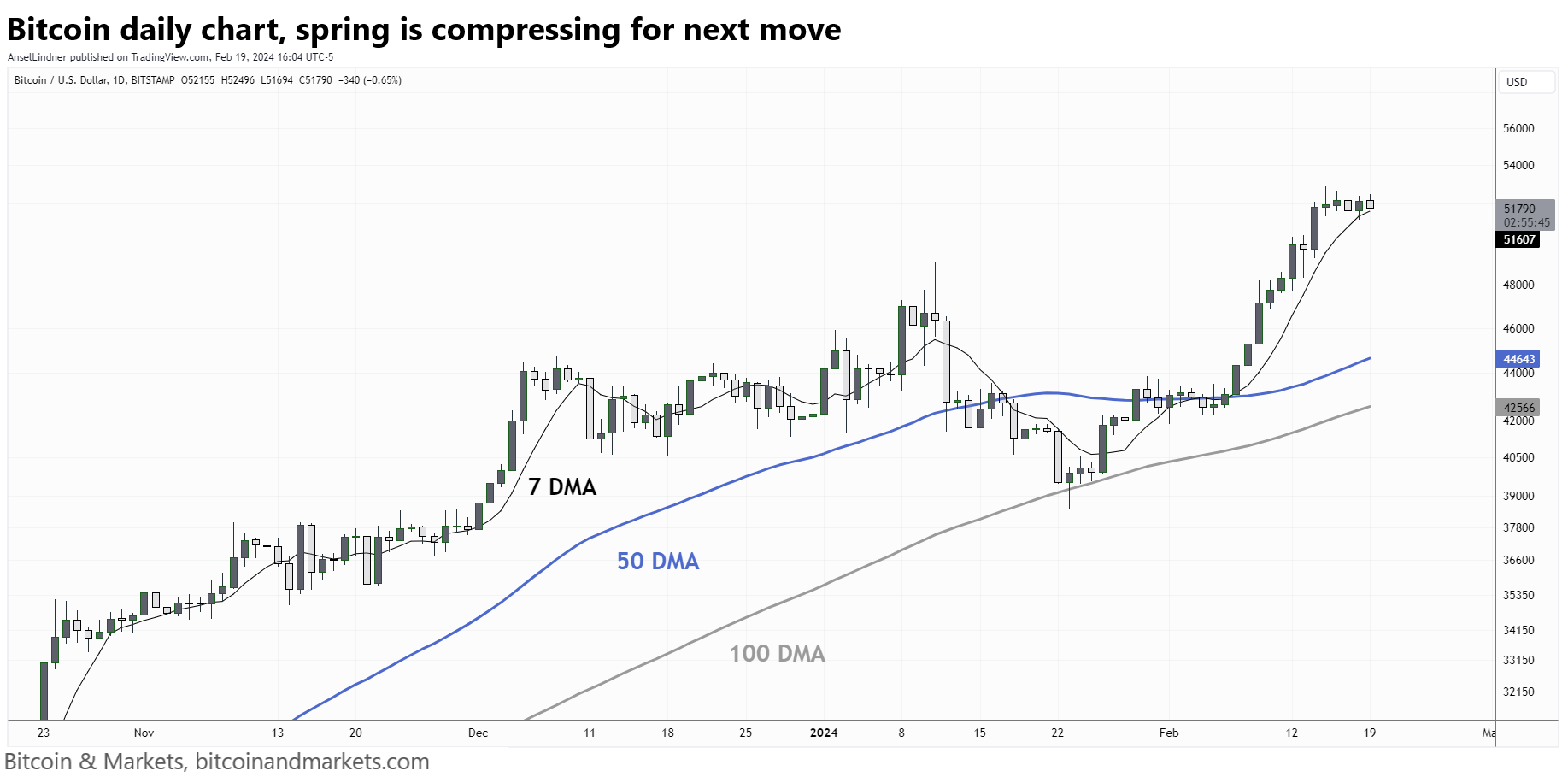

Bitcoin Charts

Last week, I expected it to be a big week for price based on several indicators approaching max territory. Price ended almost 8% higher, but I expected it to beat the prior week of a 13% gain.

We are in a similar position to last week when it comes to indicators. There is still room to move higher to the high $50k's before a drawn out consolidation. I think this cycle will be characterized more by sideways consolidations instead of rapid 20% crashes of previous cycles.

Bitcoin is above all volume-by-price resistance, horizontal structural resistance, and all moving averages. The path of least resistance has been cleared of all obstacles up to $57k.

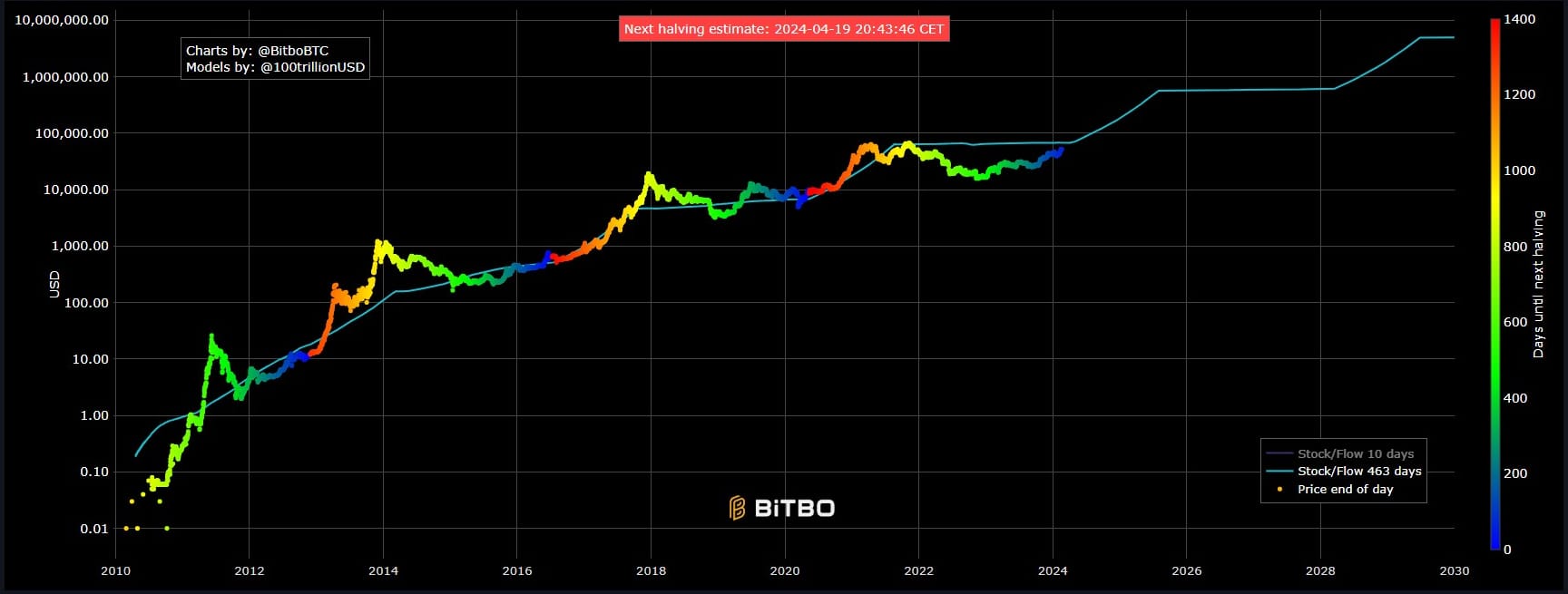

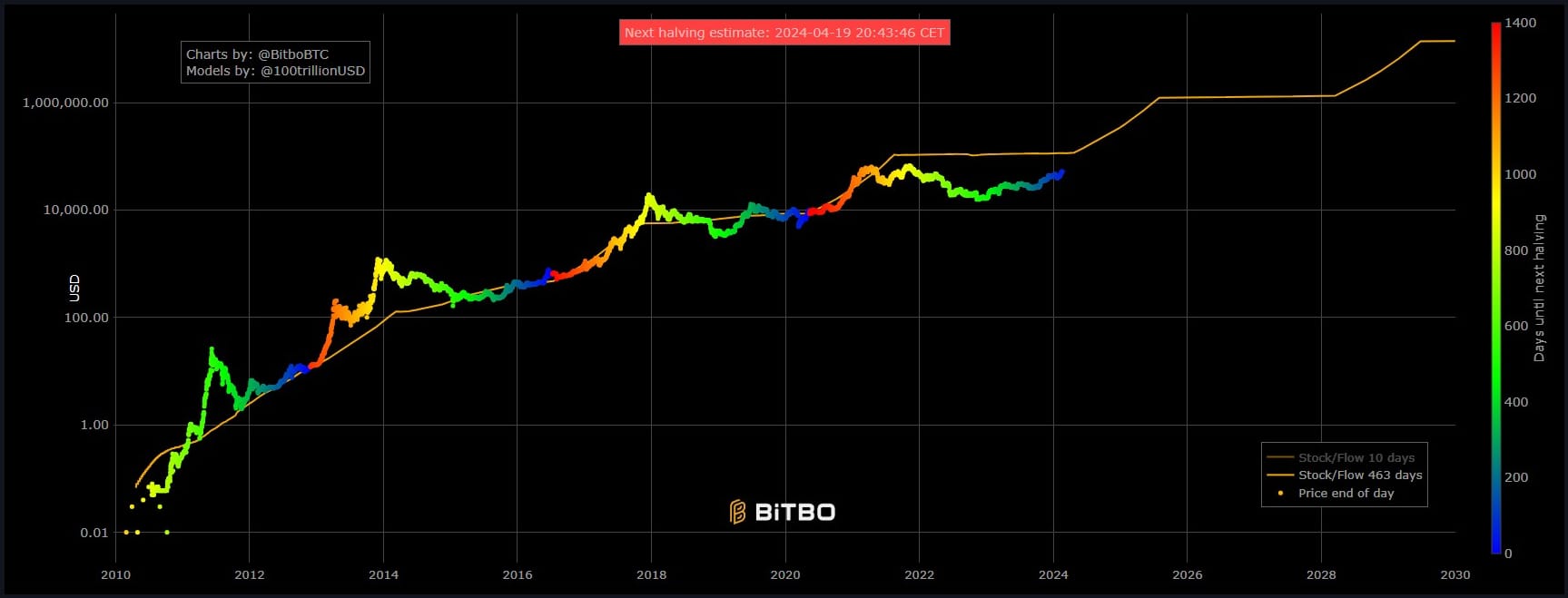

S2F Update

Nothing bring out as much disagreement in bitcoin as the Stock-to-flow (S2F) model. IDK why that is the case, but it is. Some people are viciously against it, probably because it points out that you aren't as rational as you think you are. There is a glitch in the matrix. You are a Borg in the collective.

I like S2F. It's elegant and simple. Below are two versions. The top is the first version of the S2F including Satoshi's estimated 1 million BTC hoard and the bottom is the second version considering Satoshi's coins lost. Version 1 has a current model price of roughly $68,000. Version 2, $115,000.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

On Feb. 16, the Denton Record Chronicle reported that a number of unnamed mining operations are pursuing partnerships with Denton Municipal Electric (DME). Although the identities of these firms remain undisclosed, DME confirmed that discussions about leases have been ongoing for a year. The Chronicle’s Christian McPhate also reported on a potential five-year lease option, noting that DME’s spokesperson, Stuart Birdseye, was not able to provide the names of the interested miners.

These potential newcomers would follow in the footsteps of Core Scientific, which has already secured a deal with DME to set up a mining facility in Denton, Texas. Operating since 1905, DME is a non-profit utility supplying power to 64,000 customers using entirely renewable sources.

My reaction to this clip:

All talk. Not going anywhere. They couldn't do anything when bitcoin was a fraction of the size and importance it is now. They're still years behind. No majority will to get this stuff passed, and will be less in the future.

She also says that miners "validate" transactions, which they do not. They order transactions, nodes validate. Billionaires who now have interest in US-based bitcoin mining operations, privately and through Blackrock, will fight little nuances like that in court.

You didn’t believe me did you Anon? #Bitcoin https://t.co/WW8DGGaX3v pic.twitter.com/BqTHRcuGaN

— Magoo PhD (@HodlMagoo) February 15, 2024

Difficulty

Difficulty adjusted +8% last week, and is now in a consolidation period after a crazy month of expansion. Current estimate for difficulty adjustment is -3.5% or so, in 10 days.

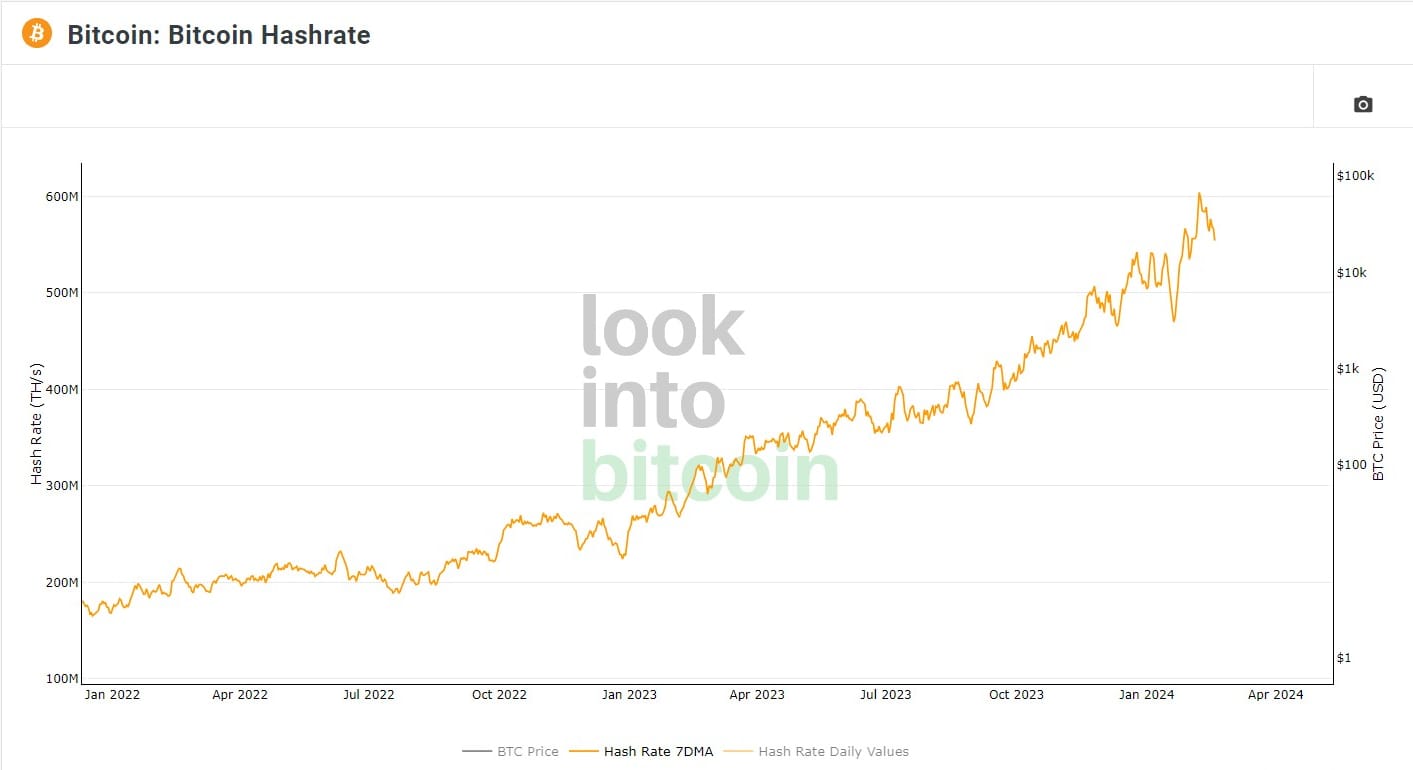

Hash Rate

The hash rate chart just looks like business as usual. We are now between the coldest part of winter and hottest part of summer, so miners will likely not have to turn off due to curtailment for the grid for another 4 or so months. A lot of their attention is now on the halving. Only 57 days away.

Mempool

Mempool cleared a little this week, from 206 MB to 201 MB, but overall there was not much action here. Fees are very low, under $2 for the next block.

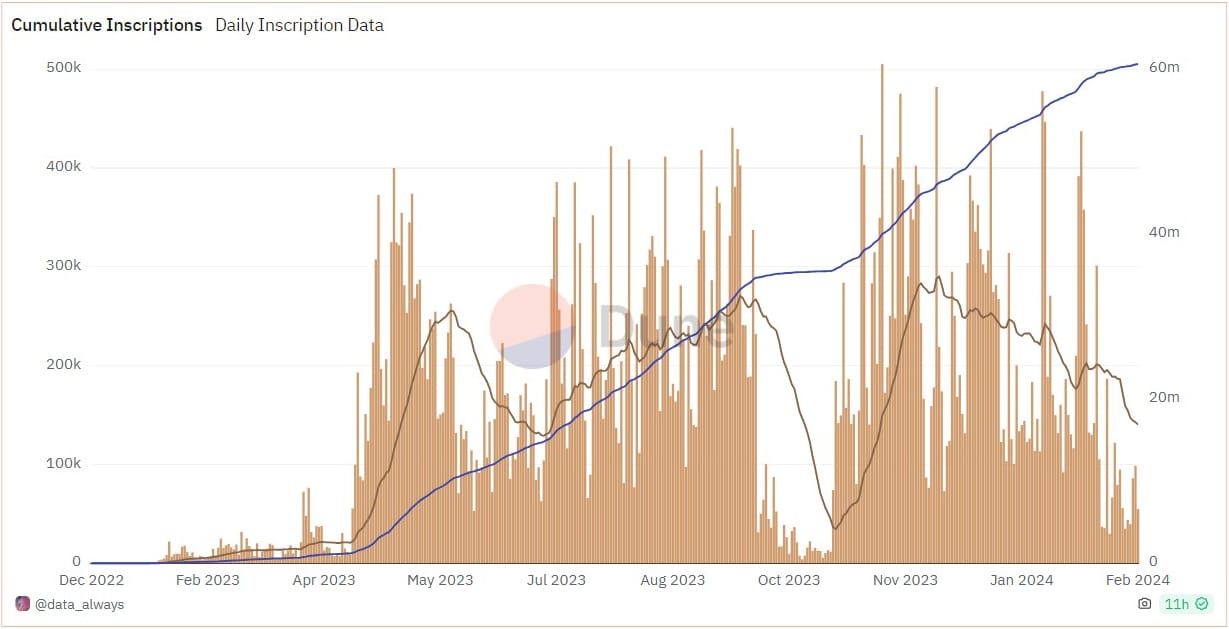

Inscriptions

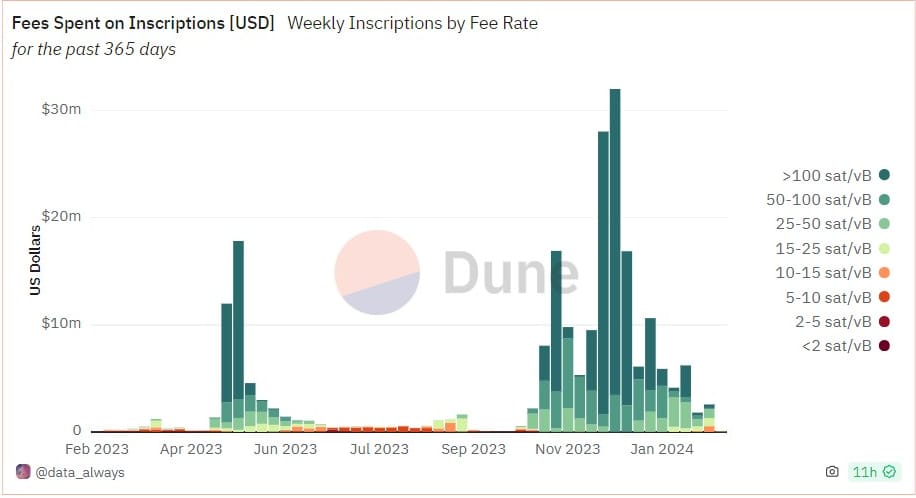

The number of daily inscriptions continues to fall. The last week caused the monthly moving average in this chart to drop significantly. There will likely be another period of higher volume for inscriptions, but as of now, there is no real market for these things, so they are a waste of money.

Fees paid by inscriptions remains very low, under $5 million/week.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com