Bitcoin Fundamentals Report #279

Bitcoin eats gold, ECB FUD, Peak Cheap Oil collapses, Bitcoin price analysis, miner sue US Gov.

February 26, 2024 | Block 832,174

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Was consolidation |

| Media sentiment | Neutral |

| Network traffic | Moderate |

| Mining industry | Consolidation |

| Days until Halving | 50 |

| Price Section | |

| Weekly price* | $54,668 (+$2,810, +5.4%) |

| Market cap | $1.072 trillion |

| Satoshis/$1 USD | 1831 |

| 1 finney (1/10,000 btc) | $5.46 |

| Mining Sector | |

| Previous difficulty adjustment | +8.2324% |

| Next estimated adjustment | -2.3% in ~3 days |

| Mempool | 192 MB |

| Fees for next block (sats/byte) | $4.36 (57 s/vb) |

| Low Priority fee | $3.21 |

| Lightning Network** | |

| Capacity | 4589.06 btc (-1.2%, -57) |

| Channels | 55,493 (-0.9%, -509) |

In Case You Missed It...

Bitcoin Magazine Pro

- Analyzing the Correlation Between MicroStrategy's MSTR Stock and Bitcoin

- Market and Mining Dashboards

Member

Community streams and Podcast

Blog

Headlines

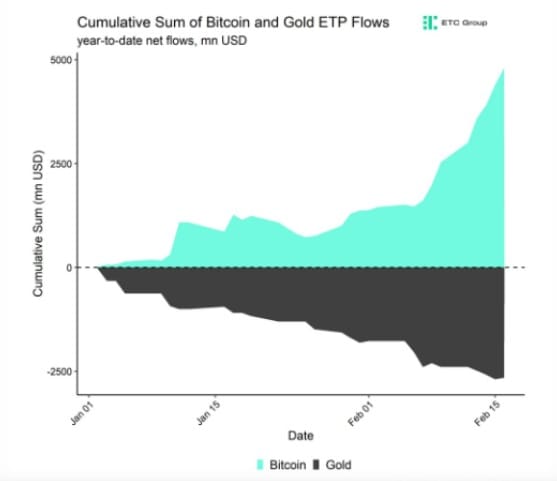

According to ETC Group Head of Research André Dragosch, there is an increasing divergence between global fund flows into bitcoin and equivalent flows into gold. "This might be an early sign for bitcoin stealing gold’s crown as the primary store-of-value," Dragosch told The Block.

That was last week, this morning on the Bloomberg terminal, the ETF team published a post about gold vs bitcoin product flows as well.

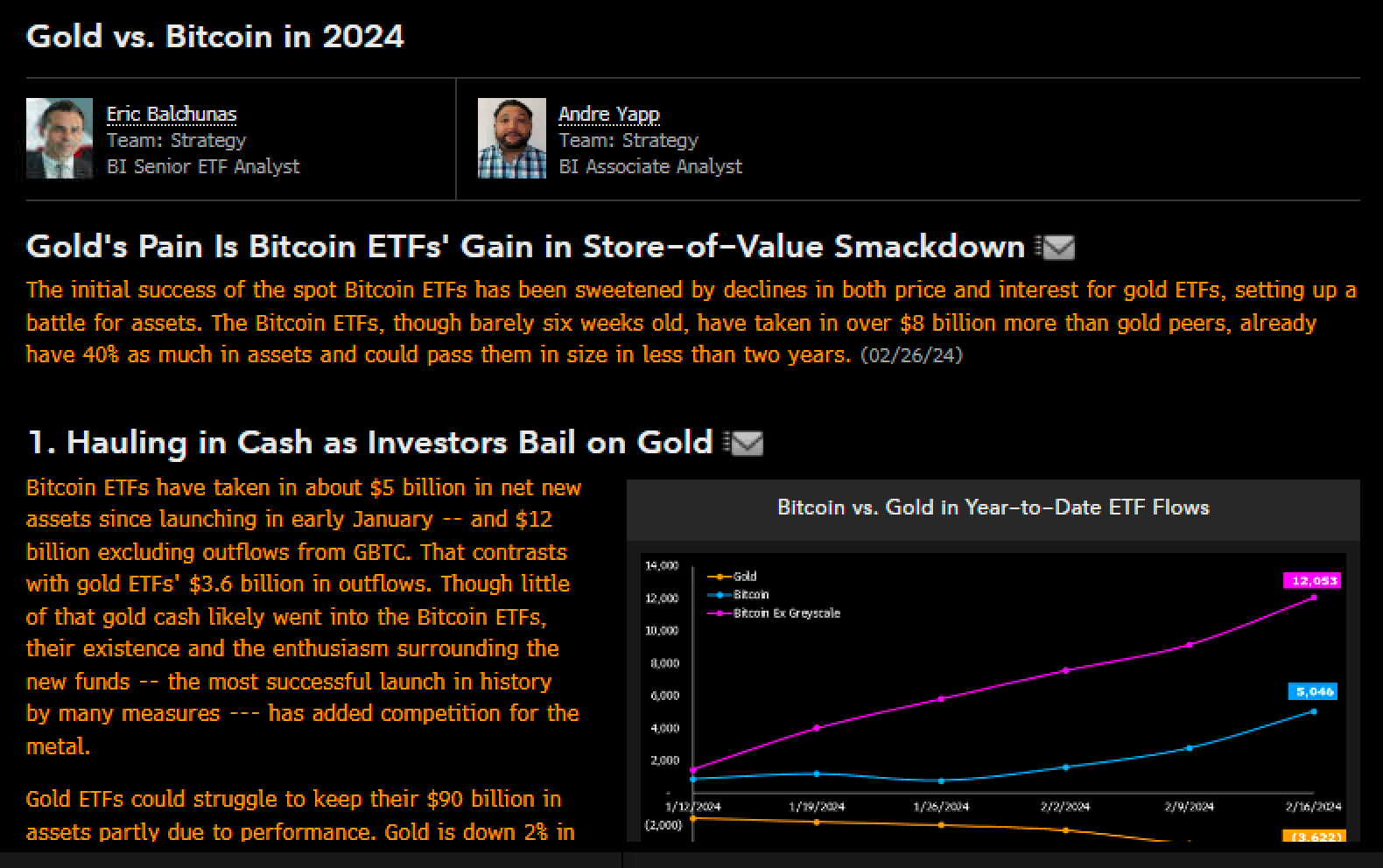

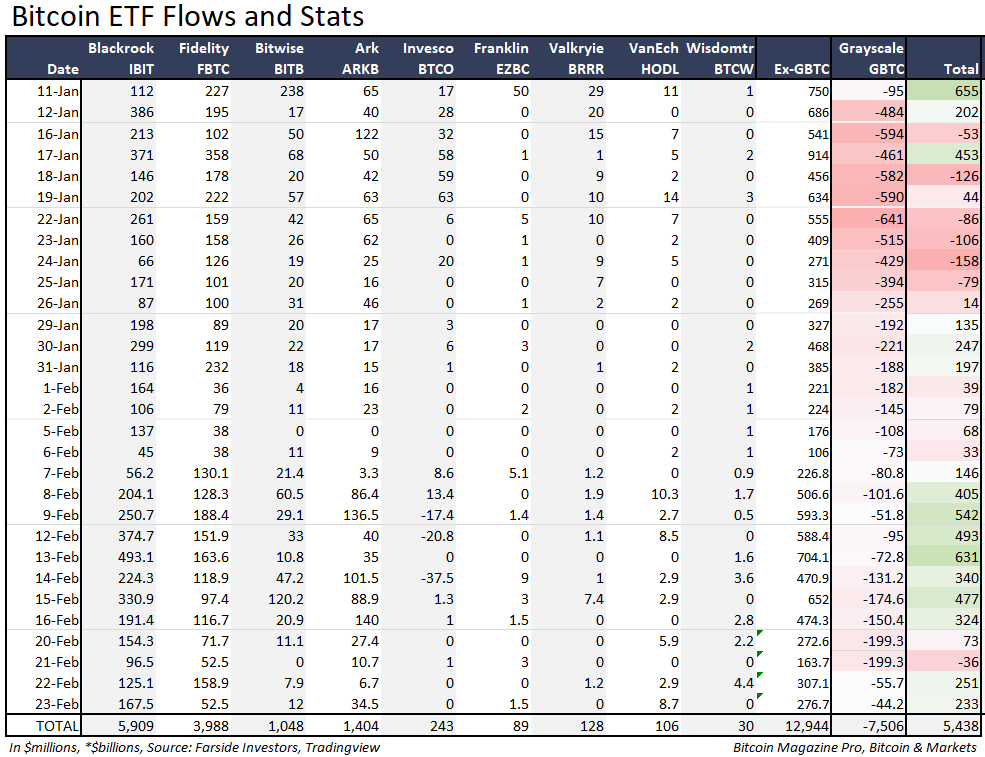

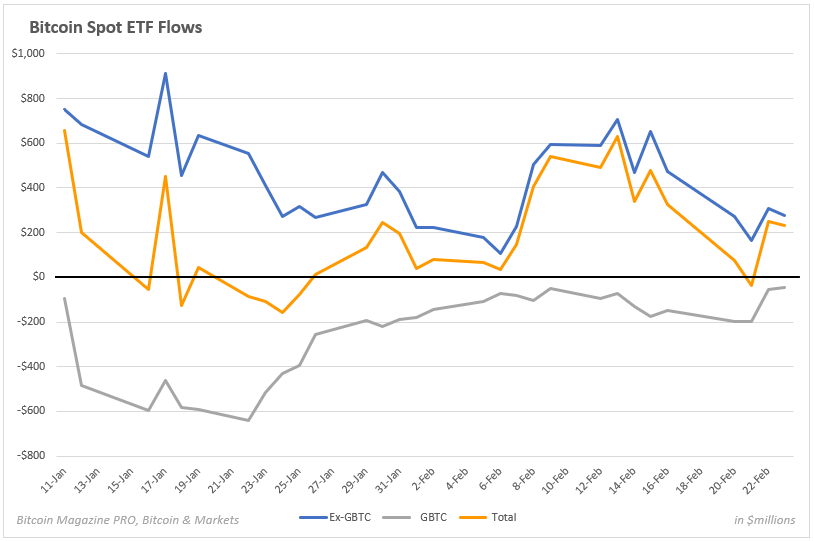

Bitcoin ETFs have taken in about $5 billion in net new assets since launching in early January [...]. That contrasts with gold ETFs' $3.6 billion in outflows.

- ETF inflows finished last week strong

After a couple smaller days in flow volume on Tuesday and Wednesday, last week finished out with respectable $200 million plus days. I'll remind the reader that pre-launch inflow estimates were for approximately $10B in 2024, or an average of $40M per trading day. We are already over halfway there and averaging $169M per trading day!

- ECB tries to FUD Bitcoin: ETF approval for bitcoin – the naked emperor’s new clothes

They're scared...

For disciples, the formal [ETF] approval confirms that Bitcoin investments are safe and the preceding rally is proof of an unstoppable triumph. We disagree with both claims and reiterate that the fair value of Bitcoin is still zero. For society, a renewed boom-bust cycle of Bitcoin is a dire perspective. And the collateral damage will be massive, including the environmental damage and the ultimate redistribution of wealth at the expense of the less sophisticated.

I don't think in "proof". If you approach monetary economics with a scientific lens, nothing is ever proved 100% true. The rally is definitely EVIDENCE that bitcoin economists are correct, and at the same time, it is evidence contrary to the claims of the ECB Fudsters.

A "renewed" boom-bust cycle is presumptuous. It never went anywhere. It has been working in the background the whole time. They want you to believe that bitcoin was dead and then the ETF breathed life back into it. LOL Nothing could be further from the truth. Bitcoin's persistence is what made the SEC give way. Bitcoin defeated the anti-bitcoin interests. It was a victory based on incentives and self-interest. The ECB and globalists lost hard and now they are coping.

There will be no "environmental damage" from bitcoin. Instead, it will usher in an era of low cost and efficient energy usage, and a greening of the planet. It will get rid of the loopholes in the current monetary order that allow for overbuilding and corrupt programs that strip the environment (see China and EPA failures in the US).

It will redistribute wealth, at least initially. But one thing Marxists always lie about is that redistribution is an ongoing process. If you did it once, it would only take 10-20 years for the most able amongst us to re-earn their fortunes. For lasting redistribution, you must have a boot on someone's neck and violate their property rights over and over again. Bitcoin has no ability to do that. What it can do is a one time redistribution away from kleptocrats and those who can't earn it back. The Marxists are terrified of that.

Macro

- Chinese stock market CSI 300 posts big bounce

I've been waiting for this bounce in Chinese stocks. We finally got one due to massive government intervention. We'll have to see if this lasts, but a relief rally might be in order. Bitcoin typically does well along with Chinese stocks.

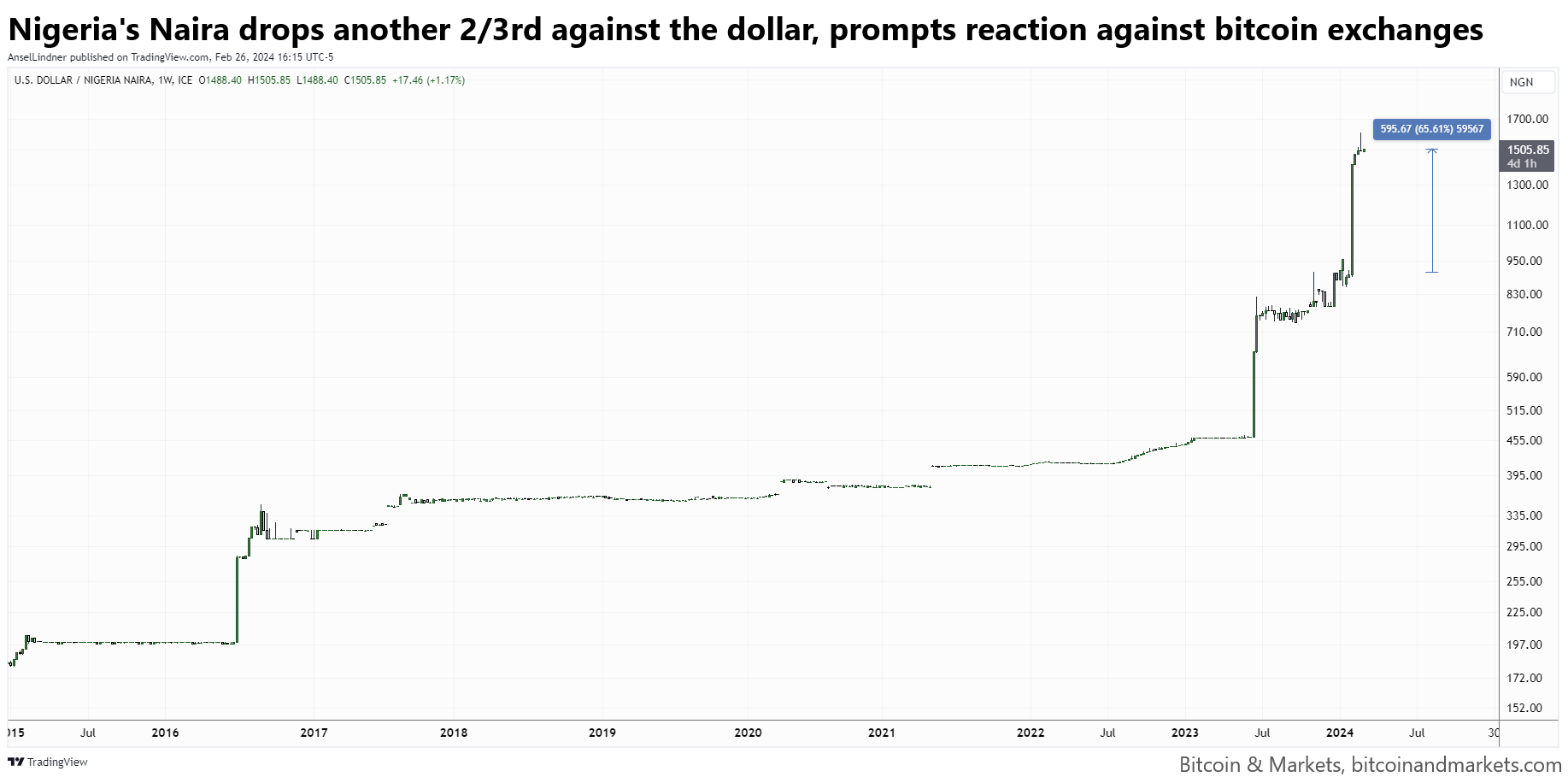

The love-hate relationship between Nigerian financial authorities and the country's crypto exchange platforms is not going away anytime soon. Under a new move to control a currency crash, the government is reportedly scapegoating digital currency exchanges, with plans to shut them out, yet again.

“Binance, facing regulatory showdown in many countries, and causing disruptions in the currency market, should not be allowed to dictate the value of the naira, not on its crypto exchange platform. Other crypto platforms such as Kucoin and Bybit should be banned from operating in our cyberspace. FX platform Aboki should be re-banned", Onanuga said.

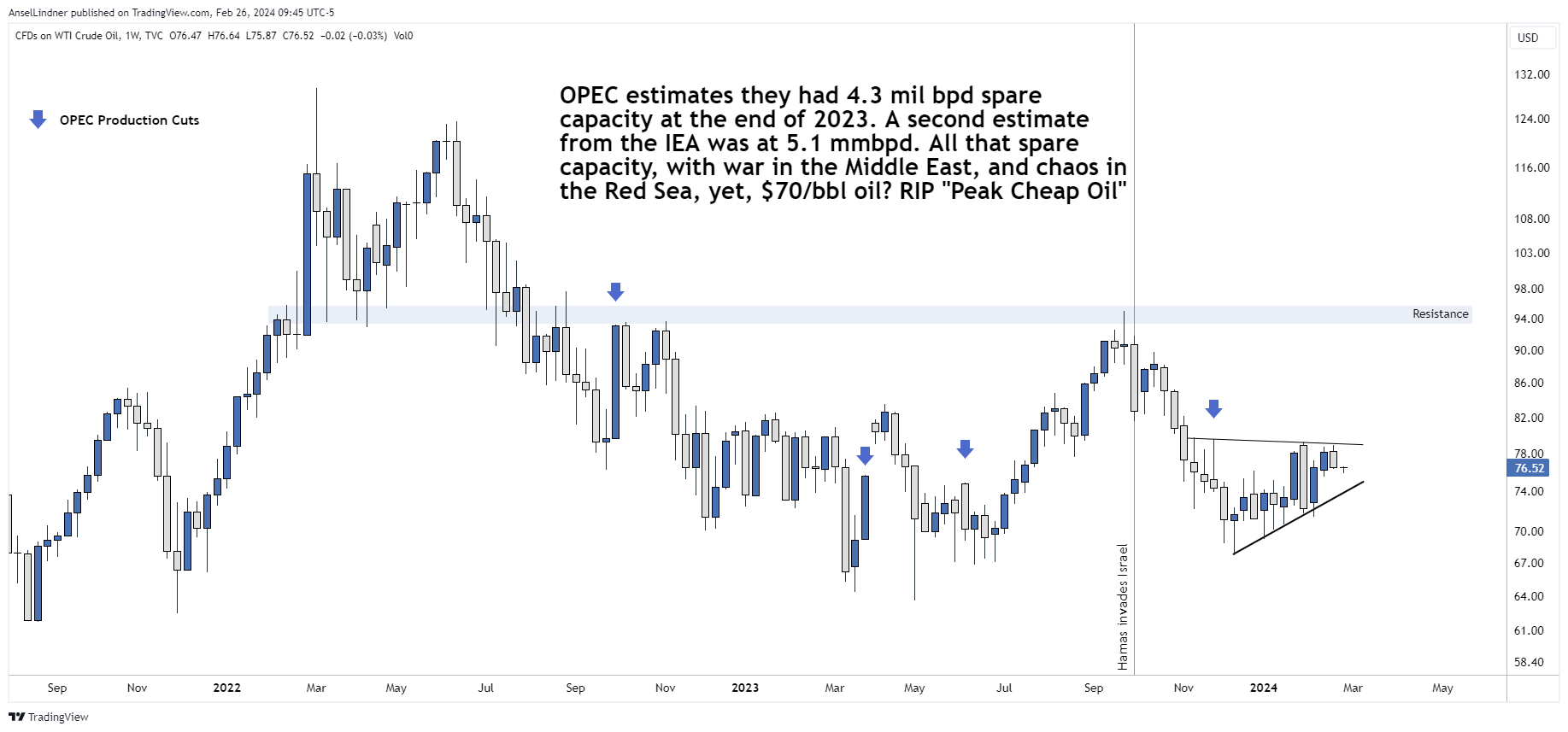

- Peak Cheap Oil is falling apart

I had another run with Luke Gromen this morning. He is the proprietor of the Peak Cheap Oil theory, that says all the cheap oil for extracting is gone and the future level for oil is higher in price. IMO it is riddled with linear extrapolation and doomer-ism. He's also made fun of my objectively more correct Peak Oil Demand theory.

Anyway, he posted this morning "RIP Peak Oil Demand".

RIP “Peak Oil Demand” 👇 https://t.co/L0L5Q1ZMeE

— Luke Gromen (@LukeGromen) February 25, 2024

I responded with a chart. ME:

Luke:

Saudi Aramco CEO says 100m global oil production declining at ~7% annual rate.

Diamondback says their base decline rate in 816,000 b/d of Permian production is 31%.

The treadmill just keeps speeding up. Higher price has to be the release valve over time.

Me: The chart doesn't show that though. Without effects it's just stories. Aramco CEO is taking you for a ride to talk up the oil price, supplementing their production cuts, they are very aware that OPEC has 5 mmbpd spare capacity. So is the market.

Luke:

Yes; mkt is also very aware if you take oil much <$60, US shale that has been ~80-90% of global production growth for the past 10 yrs will begin to go offline & won't return to prior peak for 3+ yrs (see 2015, 2019), ceding the mkt to Saudi & Russia in the meantime:

2/ My base case is oil is range bound b/t $65-85 this yr, & the release valve is gold prices.

IE, gold/oil ratio keeps moving up over time (up nearly 4x over past decade)

Me: Are you saying that without the OPEC intervention, oil would be much cheaper (<$60). How does that square with peak cheap oil?

You well know, there are restraints on both sides, marginally higher prices incent more production and loses market share for OPEC. If they let prices fall, they can take out US shale. So, your call for a range would be a good one, if you don't consider a recession, and the end of a giant debt glut that is going to preclude much if any economic growth until it is handled, a decade or more.

That's where it ended. Maybe, he is starting to come off his Peak Cheap Oil theory if he's calling for a range and that price could be much lower if OPEC just pumped. I'll also add that Trump is +8 in nation wide polling now and ahead in all key swing States. He's vowed, on day one, to drill baby drill. Oil is going lower in recession, and lower structurally with competition.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last week:

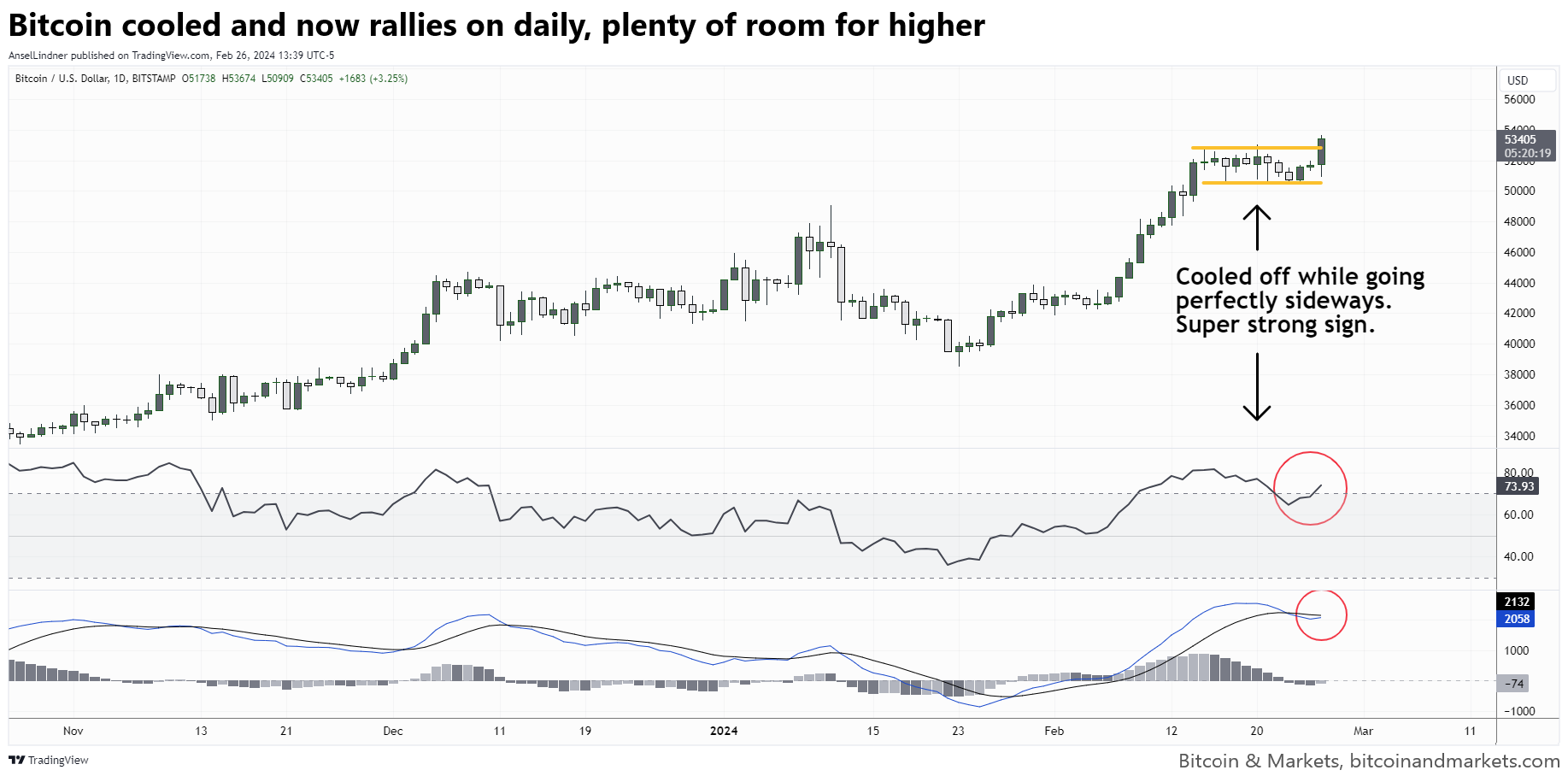

Bitcoin is above all volume-by-price resistance, horizontal structural resistance, and all moving averages. The path of least resistance has been cleared of all obstacles up to $57k.

We aren't quite there yet, but we have broken out of this level near the ETF launch that has had a psychological hold on the price.

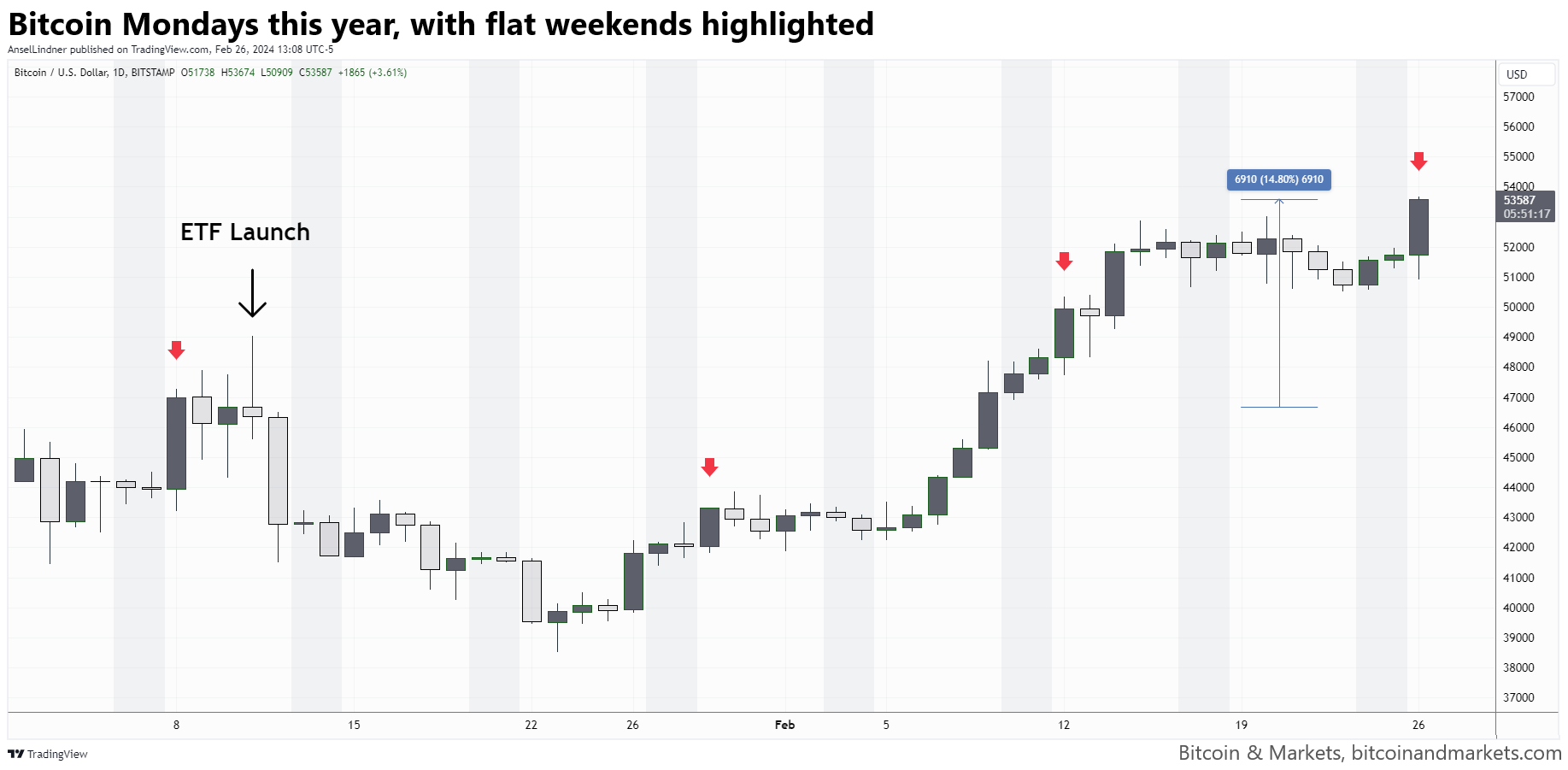

The first chart below is showing the Mondays this year that have been big green days. I also highlighted the weekends (it is an indicator called "weekend Saturday Sunday" on Tradingview). Notice the weekend are almost always flat, the one real exception might be Feb 11-12.

Importantly, I also highlight when the ETFs launched and that we were only up ~15% since then, with $5 billion+ of inflows. Totally insane it has only been 15%.

The fact that bitcoin was able to go sideways while its indicators cooled off, is a very bullish sign. RSI is back back above 70 after dipping into normal territory. MACD is crossing back bullish. Indicators on the weekly are still bullish as well, everything has room to rally significantly from here. I see little downside risk other than a crisis event or external market shock. Bitcoin is being sucked into strong hands of Microstrategy and the ETFs, shorters were liquidated, starving them of more capital to short again or sell outright.

Short Liquidations

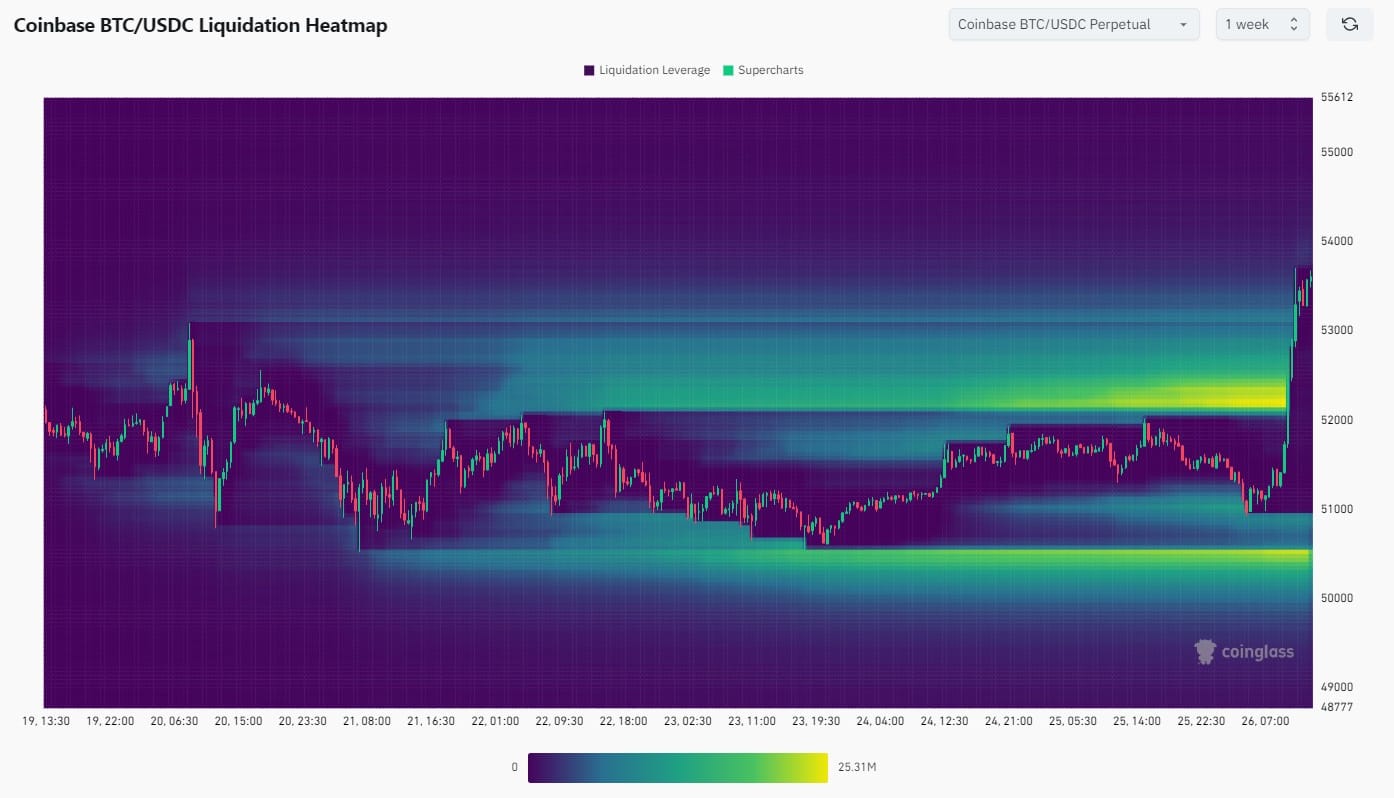

There has been some talk about a $53k liquidation level. Here is what that looked like. Quite a few shorts were liquidated between $52-53k.

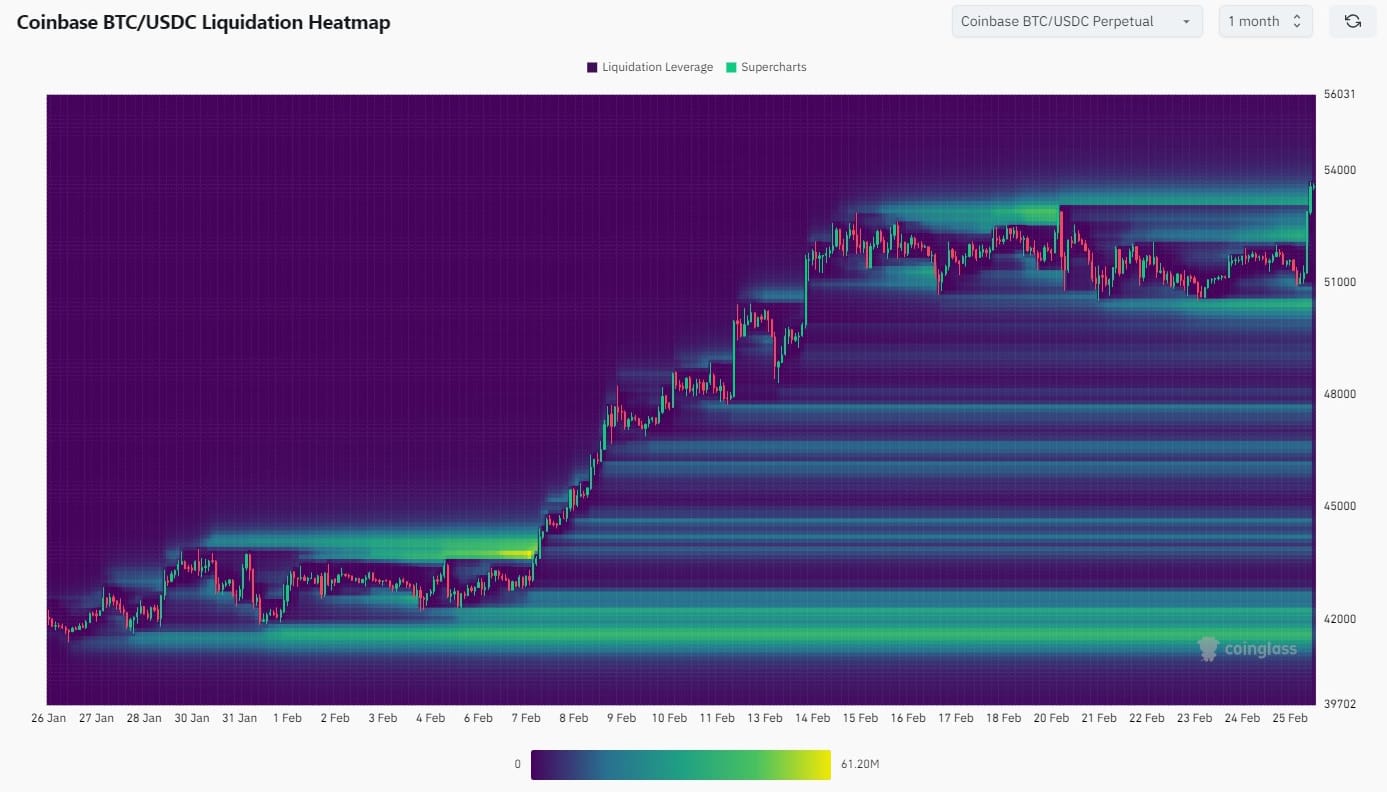

If we zoom out to the 1 month time frame, this is what we get. Notice the fuel we passed through back in the first week of Febrary. Short liquidations not only force them to buy to close their position, it also wrecks their ability to sell to protect their position. There is little reason to fight the price anymore.

These two charts don't match very well for the 20 Feb spike. Above, it looks minimal, but below it appears to be significant. Sometimes we do see price dipping or spiking into these areas of liquidity before reversing, but the current move has completely the entire transit above the resistance, similar to back on 7 Feb.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

Huge news from the US survey of bitcoin miners. For the record, I don't necessarily like this effort by the US government because it does increase the attack surface of what should be considered a monetary player, but I am not as black-pilled about it. I tend to believe government employees will just be orange-pilled by their research. Anyway, back to the article...

The U.S. Department of Energy (DOE) on Friday agreed to temporarily suspend its emergency survey of energy use by cryptocurrency miners following a lawsuit by bitcoin miner Riot Platforms (RIOT.O), opens new tab and an industry group.

The DOE's statistical arm, the U.S. Energy Information Administration (EIA), will halt its mandatory survey for a month and sequester the data it had already received after it began collecting information from bitcoin miners on Feb. 5, the agency said in a Friday notice to a Texas federal court.

Riot Platforms and the Texas Blockchain Council had sued the Biden administration in that court on Thursday seeking to block the survey, which they said could harm businesses by forcing them to divulge confidential and sensitive information.

They said the emergency demand from EIA was based on “speculation and conjecture” that bitcoin mining is likely to present a threat to the power grid, and failed to follow proper public notice and comment requirements under federal paperwork reduction and administrative laws. They asked the court for a permanent injunction prohibiting EIA from requesting the data without first complying with the law.

“This is a case about sloppy government process, contrived and self-inflicted urgency and invasive government data collection,” the plaintiffs said.

and

Bitcoin mining in Ethiopia is starting to get a few headlines. Bitcoin mining might leave the US on net, but the apples to apples comparison of electricity price is not the whole picture. Jaran Mellerud of Hashlabs, has been the one in my feed promoting a move from the US to Ethiopia, saying post-halving, $0.07/kWh in the US will be unprofitable.

So much hashrate will move from the US to Africa as hosting above $0.07/kWh becomes unprofitable 🇪🇹🌍https://t.co/WVSu7rC1Be

— Jaran Mellerud 🟧⛏️🇳🇴 (@JMellerud) February 24, 2024

While, I'm fine if that is the case, what they do not consider is security cost and tail-risk in their calculations. Ethiopia just experienced a civil war from 2020-2022, exposing deep tribal and governmental tensions, and a fundamental precariousness of legality and security in the country.

Egypt and Ethiopia are still in stalled talks about Ethiopia's new Grand Ethiopian Renaissance Dam (GERD) on the Blue Nile. The disagreements involve the speed of filling the reservoir and down stream effect in Sudan and Egypt. As well as security concerns for Egypt if much of their fresh water supply is under the control of country that is less than best friends.

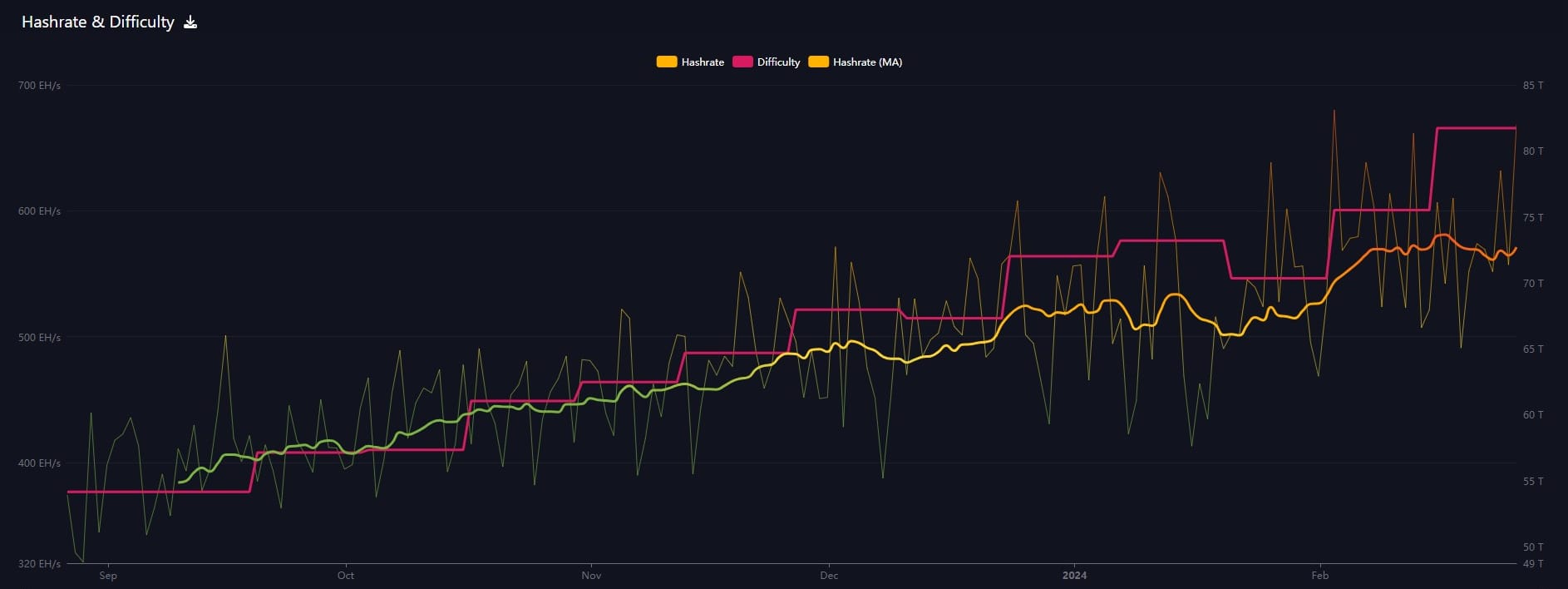

Hash rate and Difficulty

Mempool.space's charts are back up this week, so I'll be bouncing to them. I like their format.

As you can see on the far right, hash rate has come off since the last difficulty adjustment of +8% (thick yellow line). However, in recent days hash rate has again recovered to near recent highs. Estimates for the difficulty adjustment in 3 days is a -3.2% decline.

Mempool

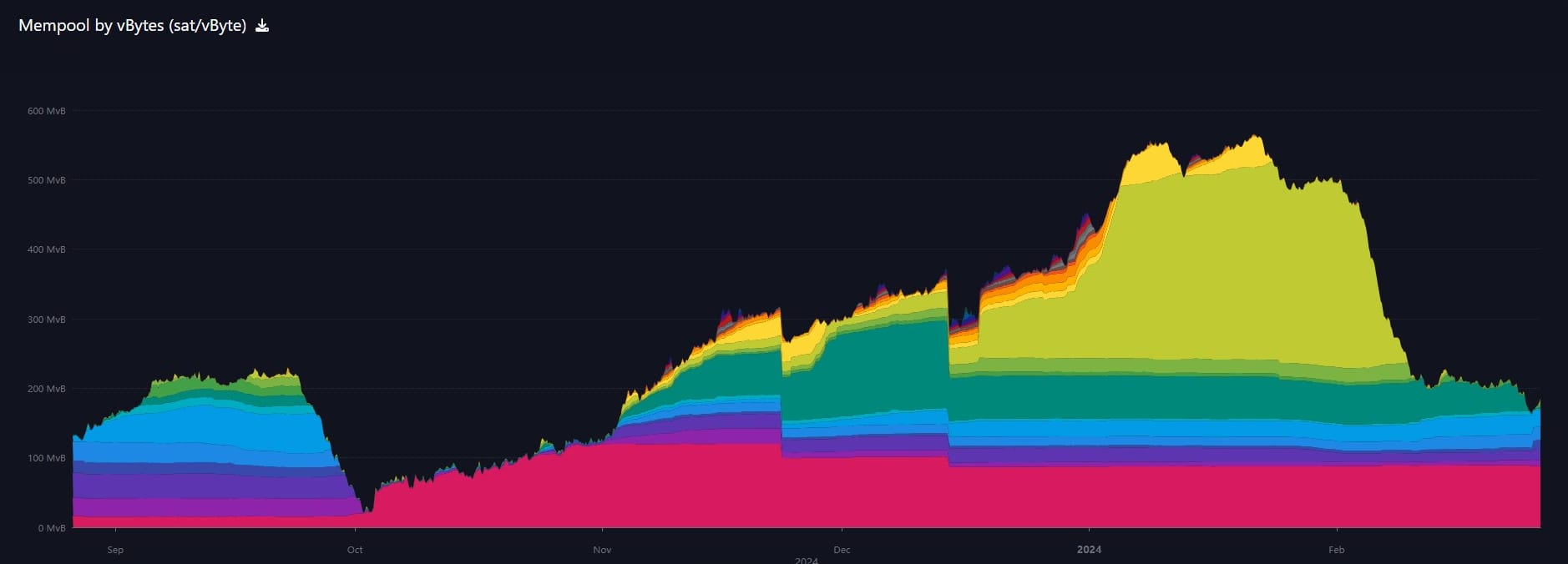

The mempool dipped into the next lower fee band this last week, meaning fees are coming down gently and manageably.

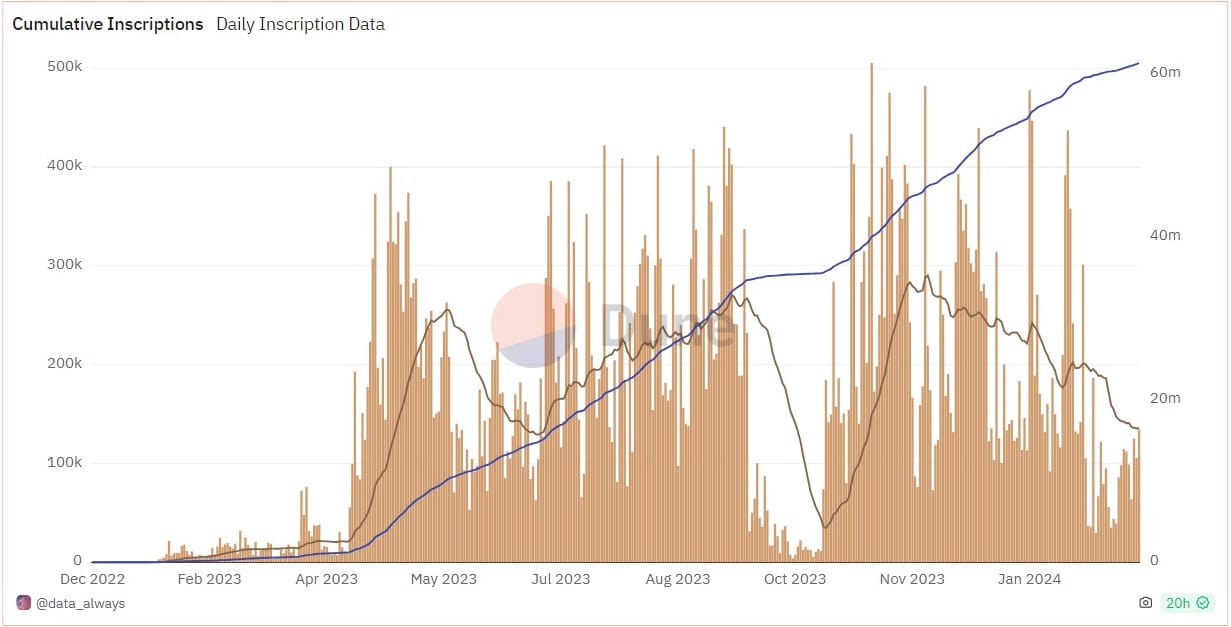

Inscriptions

The number of daily inscriptions continues to fall. The last week caused the monthly moving average in this chart to drop significantly. There will likely be another period of higher volume for inscriptions, but as of now, there is no real market for these things. They are a waste of money.

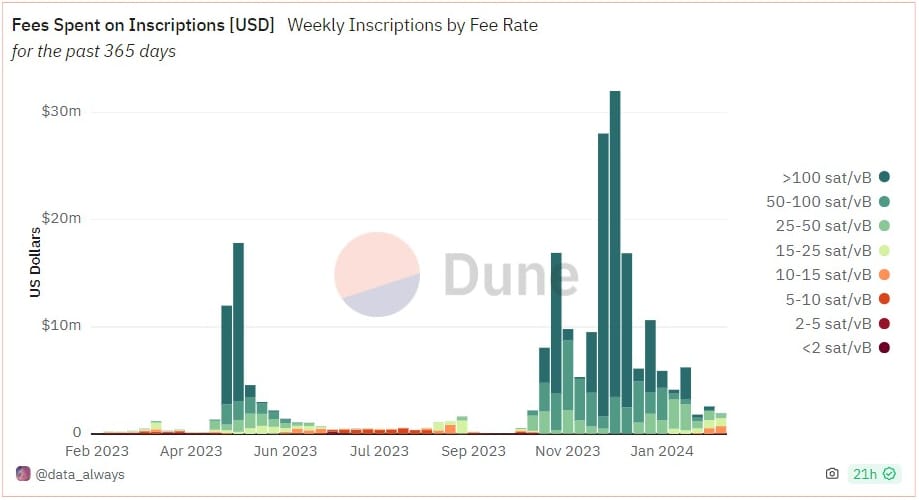

Fees paid by inscriptions remains very low, under $5 million/week.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com