Bitcoin Fundamentals Report #286

Bitcoin halving debrief, HK ETFs, looming dollar crisis, bitcoin price analysis for after the halving, miners raked it in, Runes update.

April 22, 2024 | Block 840,386

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Inscriptions or Layer 2Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Halving excitement |

| Media sentiment | Neutral |

| Network traffic | Coming down |

| Mining industry | Stable |

| Days until Halving | 1433 |

| Price Section | |

| Weekly price* | $66,599 (+$2,404, +3.7%) |

| Market cap | $1.312 trillion |

| Satoshis/$1 USD | 1501 |

| 1 finney (1/10,000 btc) | $6.66 |

| Mining Sector | |

| Previous difficulty adjustment | +3.9236% |

| Next estimated adjustment | +0.5% in ~2 days |

| Mempool | 263 MB |

| Fees for next block (sats/byte) | $13.43 (1144 s/vb) |

| Low Priority fee | $11.28 |

| Lightning Network** | |

| Capacity | 4651.92 btc (+1.7%, +80) |

| Channels | 52,448 (+0.4%, +223) |

In Case You Missed It...

Bitcoin Magazine Pro

- This Time is Different: Unprecedented Halving Forces

- Market Tracker breakdown: Bitcoin's Pre-Halving Inflection Point

- Mining Tracker breakdown: Bitcoin Mining Industry’s Pre-Halving Dynamics

Member

- Gold and Yields Tell Us Everything About the Upcoming Recession

- What to expect heading into the halving?

- 💢 April Price Forecast Competition

Community streams and Podcast

Blog

Headlines

- Happy Halving 🍾🍻🥳

The Fourth Bitcoin Halving occurred at 8:09 pm ET, April 19th. That is 12:09 am UTC, April 20th. We got our 4/20 halving! LOL Congrats if this was your first halving!

I live stream immediately following on Telegram with the community. The video is now up on my YouTube and Rumble channels.

Not many big takeaways. We were prepared here for what what coming. We expected consolidation into the halving and price went sideways for 6 weeks prior. Some expected a "sell the news" event, but we did not. Some MSM commentators said miners would be crushed, but we debunked that. Perhaps the largest surprise was fees which I cover below. The transition to 3.125 btc/block was smoothed by the astronomical fees from Runes (more on that below as well).

All-in-all, it was a very successful halving, something that will cause more people to ask questions and understand how bitcoin works. Specifically, large asset allocators might be more at ease that the halving has once again occurred with zero complications.

We are still waiting on the eventual launch date for the Hong Kong ETFs but they have been approved. The latest is the fee structure, reported by WuBlockchain.

Fees for in-kind creation/redemption: 0.5-1%

Cash redemption: 0.1-0.15%

Secondary market trading fees: 0.25% telephone, 0.15% online

Exclusive: Victory Securities internally released the Hong Kong Bitcoin Ethereum spot ETF subscription guide and disclosed its charging standards. Hong Kong securities firms are selling to potential clients.

— Wu Blockchain (@WuBlockchain) April 20, 2024

The original text of the picture is in Chinese, using Google Translate… pic.twitter.com/oCqlU6EoSm

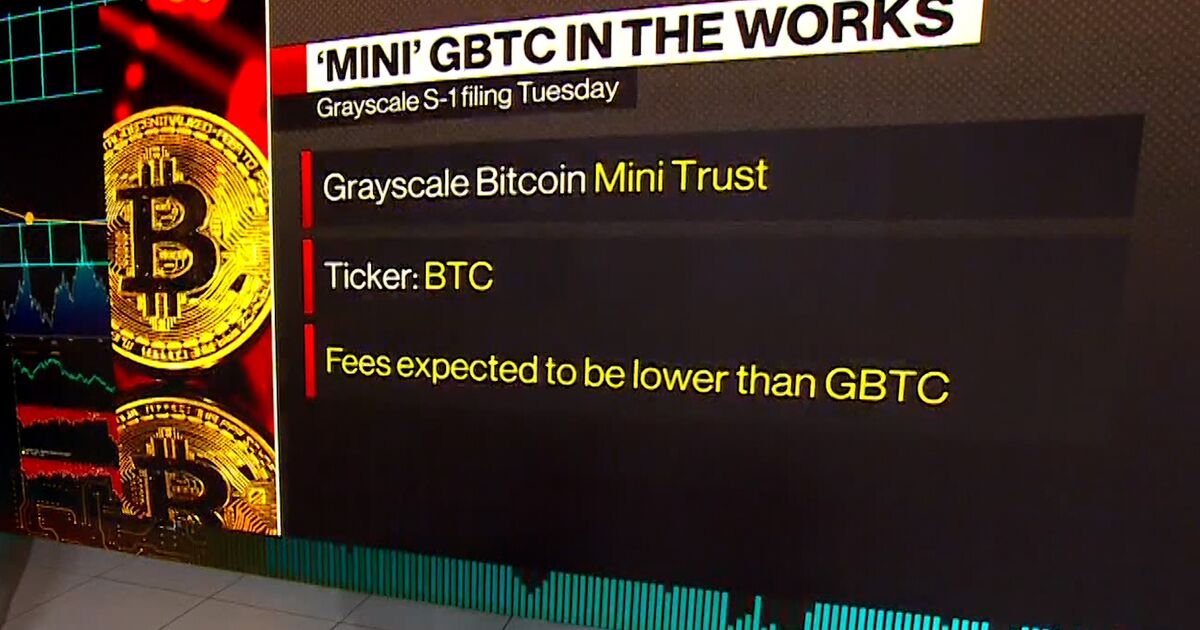

Grayscale said it will contribute 10% of Grayscale Bitcoin Trust (GBTC) assets to the Bitcoin Mini Trust.

Grayscale, which currently offers the highest-cost spot bitcoin ETF, revealed that a planned spinoff version of the fund will have a 0.15% fee, which would be the lowest of them all, according to pro forma financials in its latest filing.

The existing Grayscale Bitcoin Trust (GBTC) has a 1.5% fee. When Grayscale's Bitcoin Mini Trust (BTC) is introduced, the filing says the company will contribute 10% of the assets in GBTC to the BTC Trust. Shares of the BTC trust are to be issued and distributed automatically to holders of GBTC shares. (The pro forma financial statements are projections of future expenses and revenues, based on a company's past experience and future plans.)

Grayscale’s Bitcoin Mini Trust was conceived to offer GBTC investors a lower fee option that’s more competitively in line with other bitcoin ETFs approved back in January. Currently, the Franklin Bitcoin ETF (EZBC) at 0.19% is the lowest-cost spot bitcoin ETF.

The Grayscale spinoff is also considered a non-taxable event for GBTC’s existing shareholders, so those investors will not be expected to pay capital-gains tax to automatically transfer into the new fund.

Macro

- A Looming Dollar Crisis

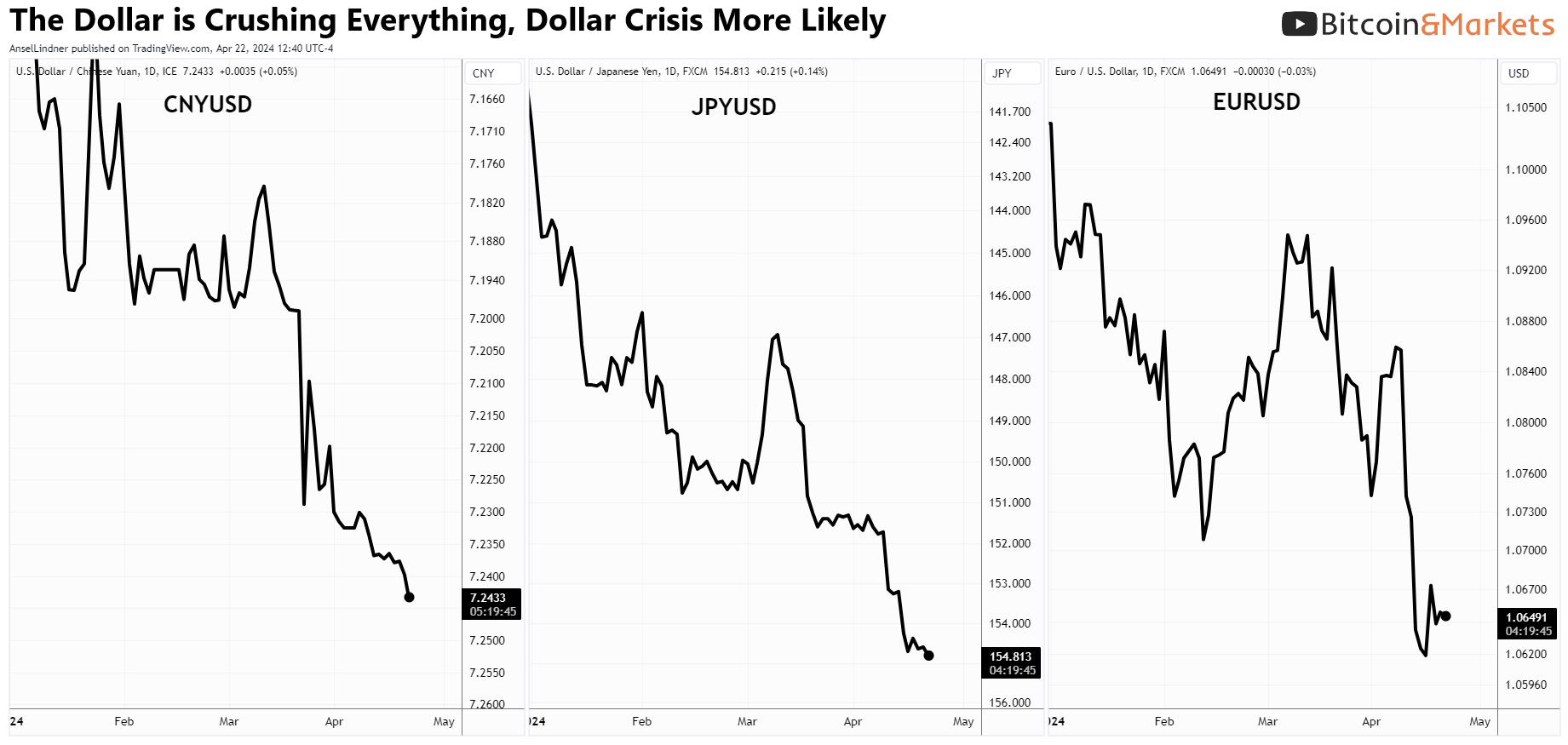

Despite the ever-present call for a dollar collapse, currently, it is the yuan, yen and euro that are having major problems.

A currency-led crisis could be starting now. As economic activity in a country drops, the domestic demand for their currency also drops. However, they have fixed costs, typically denominated in USD because globalization is based on it as the global reserve currency.

These forex moves indicate that the economies of these countries are in sharp decline relative to the US. Dollar debts are becoming harder to service, as they struggle to access the dollars needed.

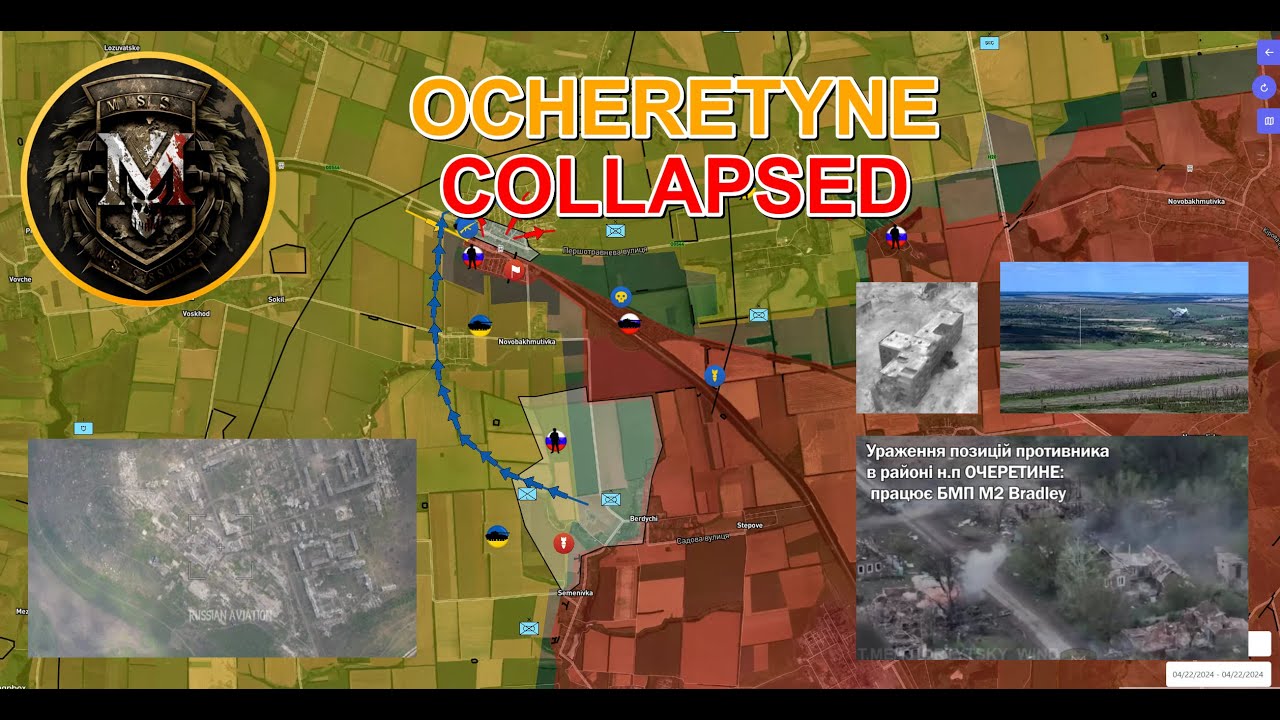

With an insane $61 billion of aid for Ukraine passing the Republican held House, and likely to pass the Senate, it looks like the Ukraine conflict will continue into next year.

At the current time, Russia is making consistent gains. Without this money, it would likely have led to major Russian breakthroughs in the coming months, right before the US elections.

The spending bill also includes money for Israel and Taiwan, seemingly created on purpose to maintain the highest possible geopolitical threat level possible, without actually solving or trying to "win" any of them.

Relating this back to bitcoin, this means geopolitical tensions will remain elevated adding incentive to own safe haven assets. It also destabilizes the globalization and global credit markets.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

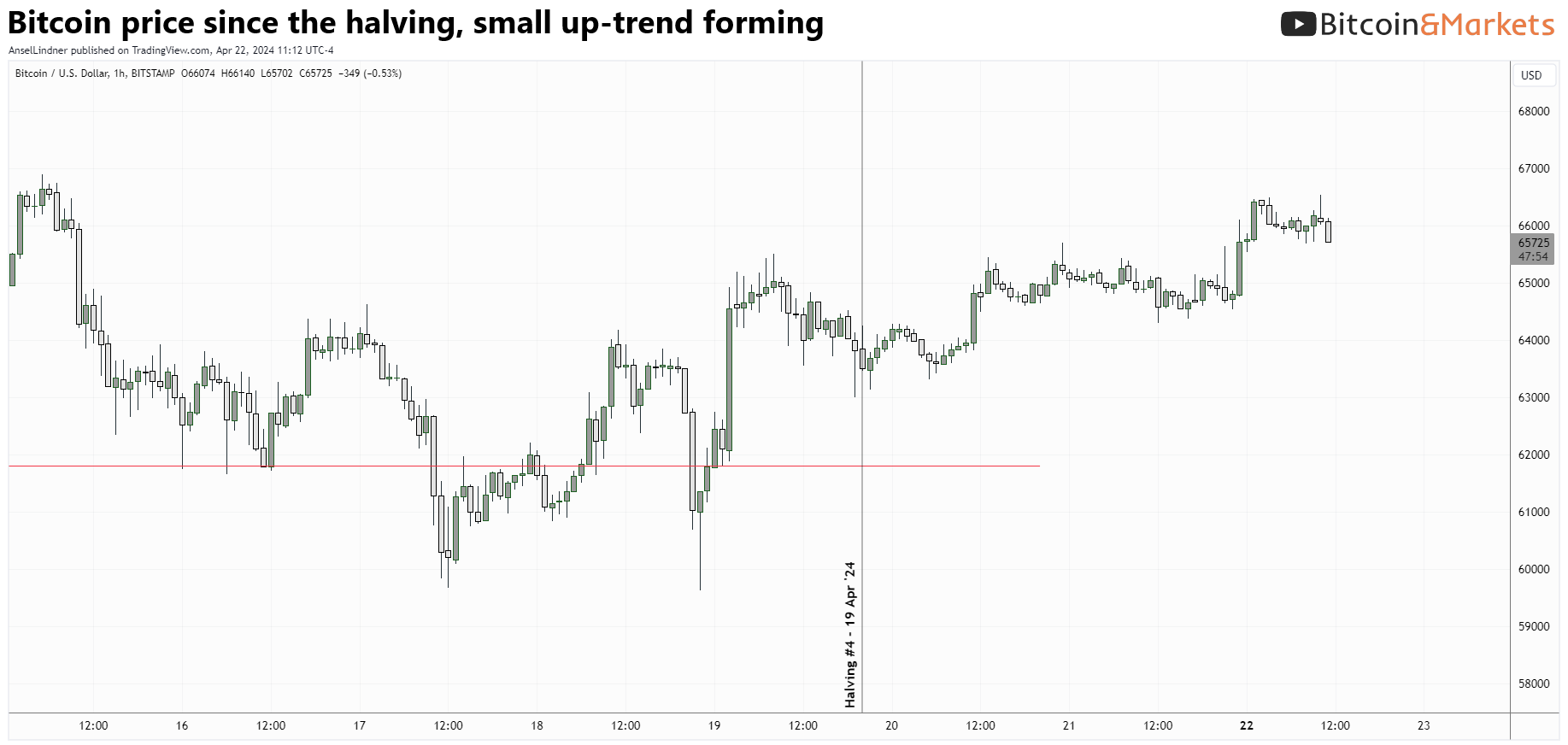

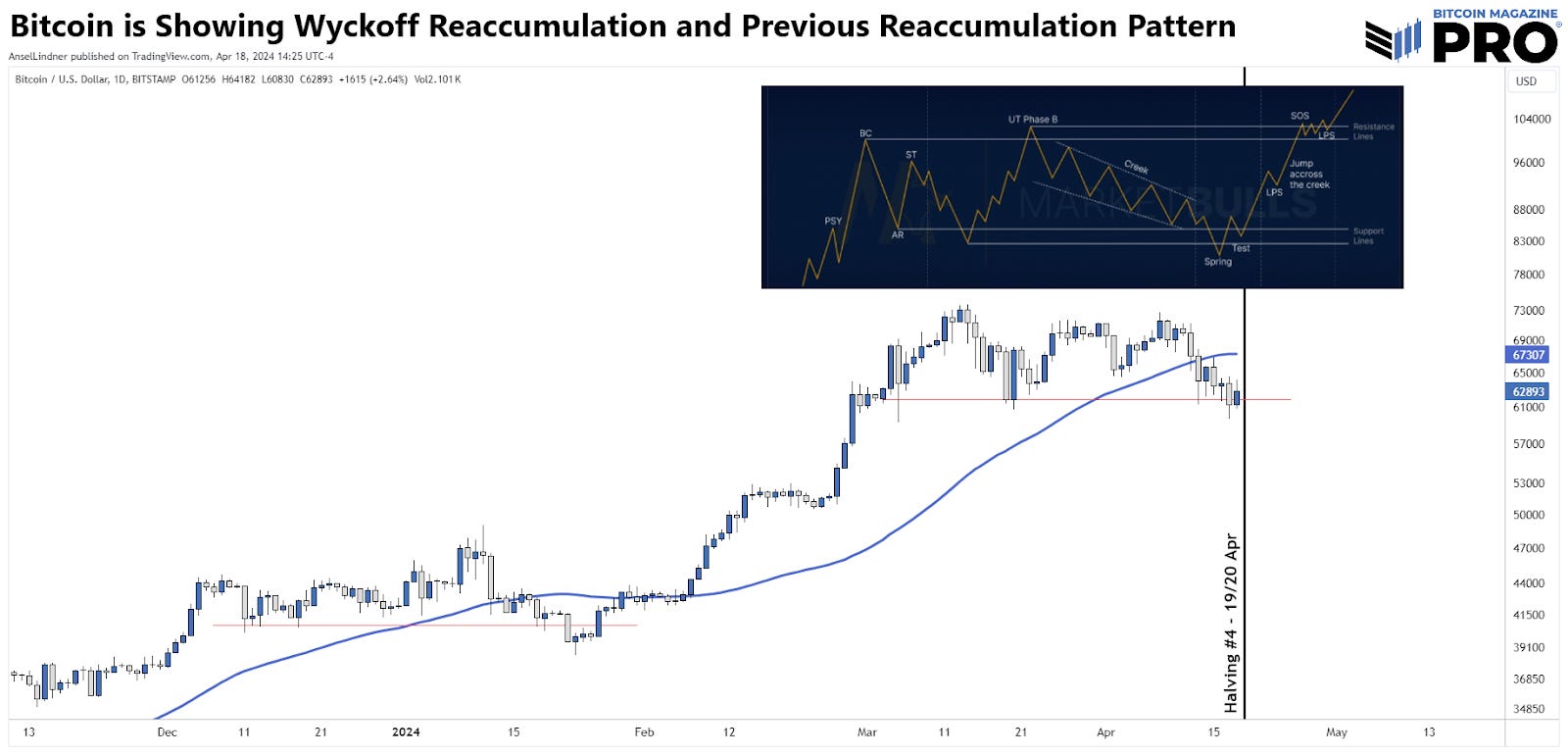

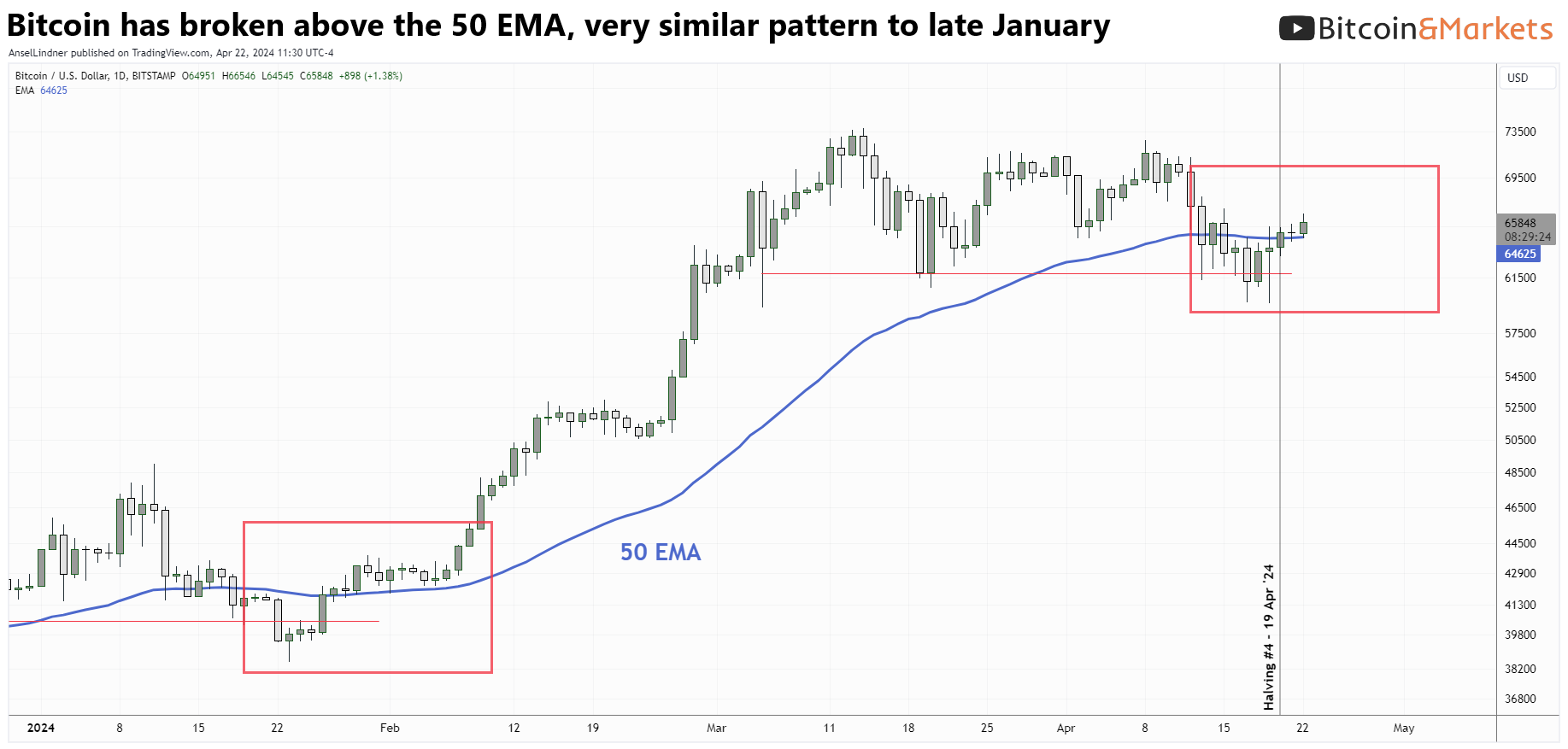

The halving has come and gone. The uncertainty has waned, however, the spamming from inscriptions has kept a certain level of uncertainty in the market, more than I had anticipated.

We have moved up slightly since the halving. I expected, as stated last report, for the halving to occur with the price between $65-70k. I was just shy of that mark at $63,700 at the time of the halving.

I included this chart on last Thursday's BMPRO post.

Weekly RSI has recovered nicely. It is okay that it did not fully get into normal territory yet, but it would be an easier call if it had. MACD is also narrowing, but like in January, it could simply reaccelerate.

Overall, the price is still relatively weak. We haven't seen a huge relief rally post-halving, but it is only Monday. $70k looks like a level to watch. If we can break above there, we might be off to the races again. Failure to break $70k this week, we likely have another couple weeks of consolidation ahead of us.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

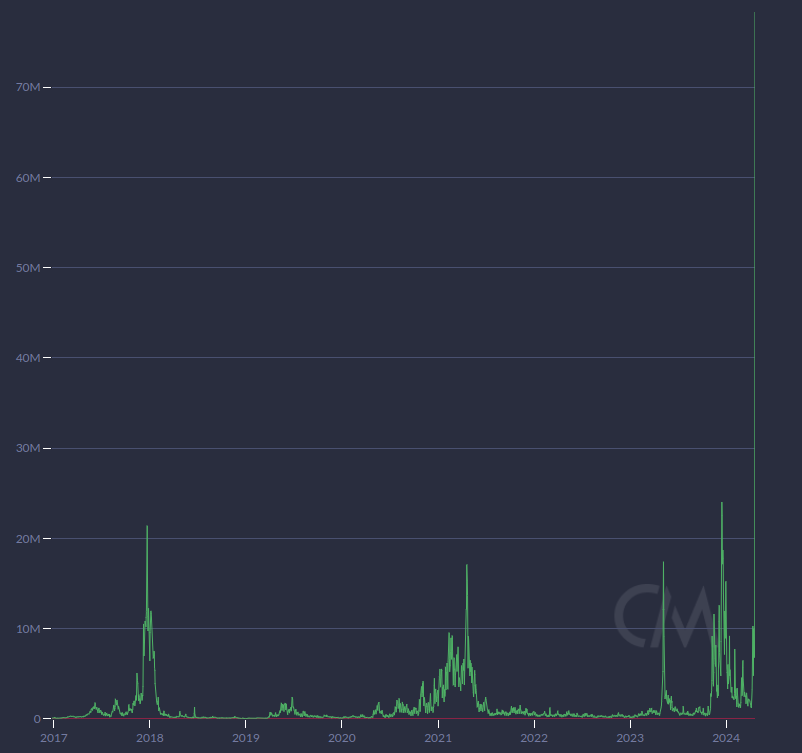

The halving transition for bitcoin miners from 6.25 btc every block to 3.125 was eased by the massive onslaught of Runes traffic. Jameson Lopp reported on Twitter that, not only did miners triple their ATH revenue record after the halving, but we also had, "a new record streak of 104 blocks in which fees exceeded newly created BTC!"

That is important if you think long-term about bitcoin's viability. With block reward getting cut in half every 210,000 blocks, eventually the block subsidy itself won't be enough to incentivize miners to mine. At that point, transaction fees have to be high enough to do it all by themselves.

This dynamic causes a lot of confusion in bitcoin, but it is one I am convinced will easily work itself out over the next 10-20 years, long before the subsidy gets to critically low levels. For example, the base-layer will be more used for very large transactions and settlement between large players. If the bitcoin network's base layer can transact $1 trillion per day in value, 1% fee level of $10B is plenty to sustain mining.

As comparison, in 2004, SWIFT recorded 5 million messages per day at an average size of $500k. That comes out $2.5 trillion. Last year, SWIFT handled 48 million messages per day. Even if the average transaction size is much smaller, SWIFT alone transacts >$5 trillion/day today.

Bitcoin currently handles approximately 640,000 transactions per day. For it to have $1T/day in volume, transactions would need to average $1.6 million. But that is just for the base-layer. Bitcoin layer 2's will be used by the common man, while the base layer will be bank-to-bank transactions.

Hash rate and Difficulty

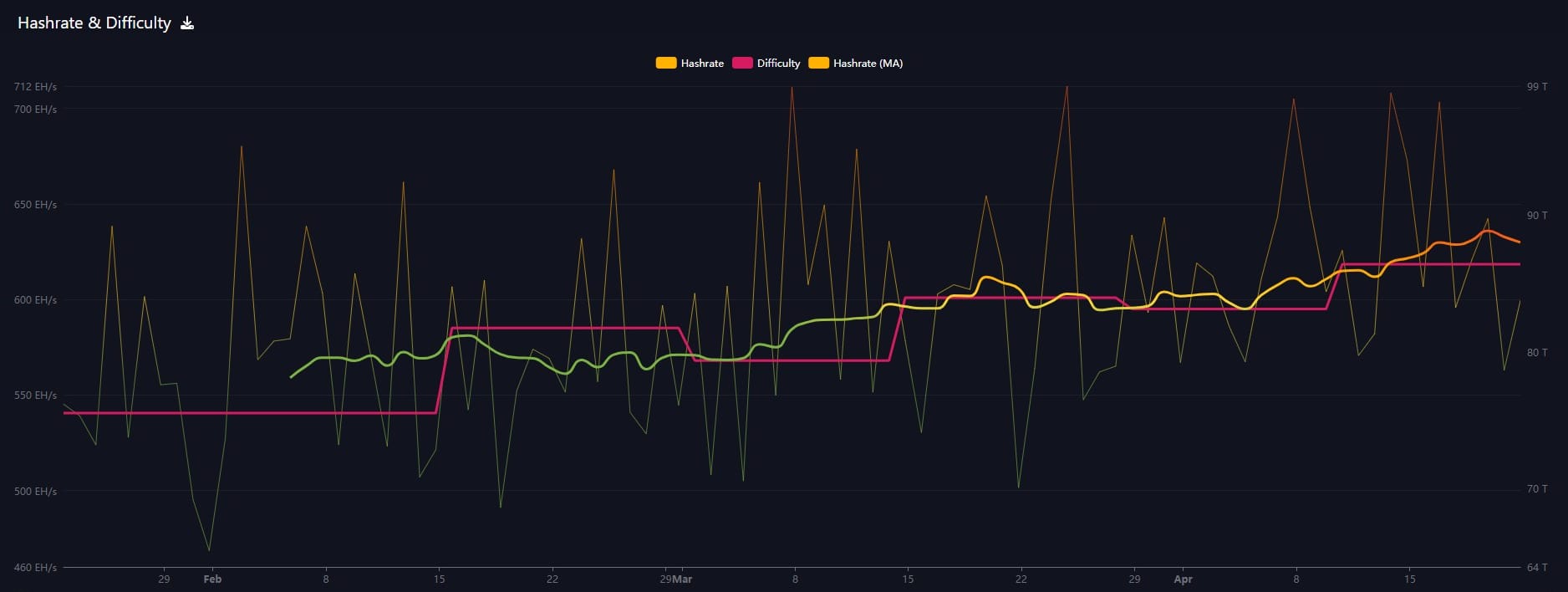

Hash rate continues near ATHs, with difficulty set to adjust upward <1% this week.

Last week:

It will be interesting to watch the hash rate after Friday's halving, but I expect less fireworks than seems to be the consensus out there.

So far, there has been very little miner drama after the halving, it has all been around the transaction fees. If you look at the right side of the chart below, you can see a little hash rate drop off since the halving, but it is within normal ranges.

Mempool

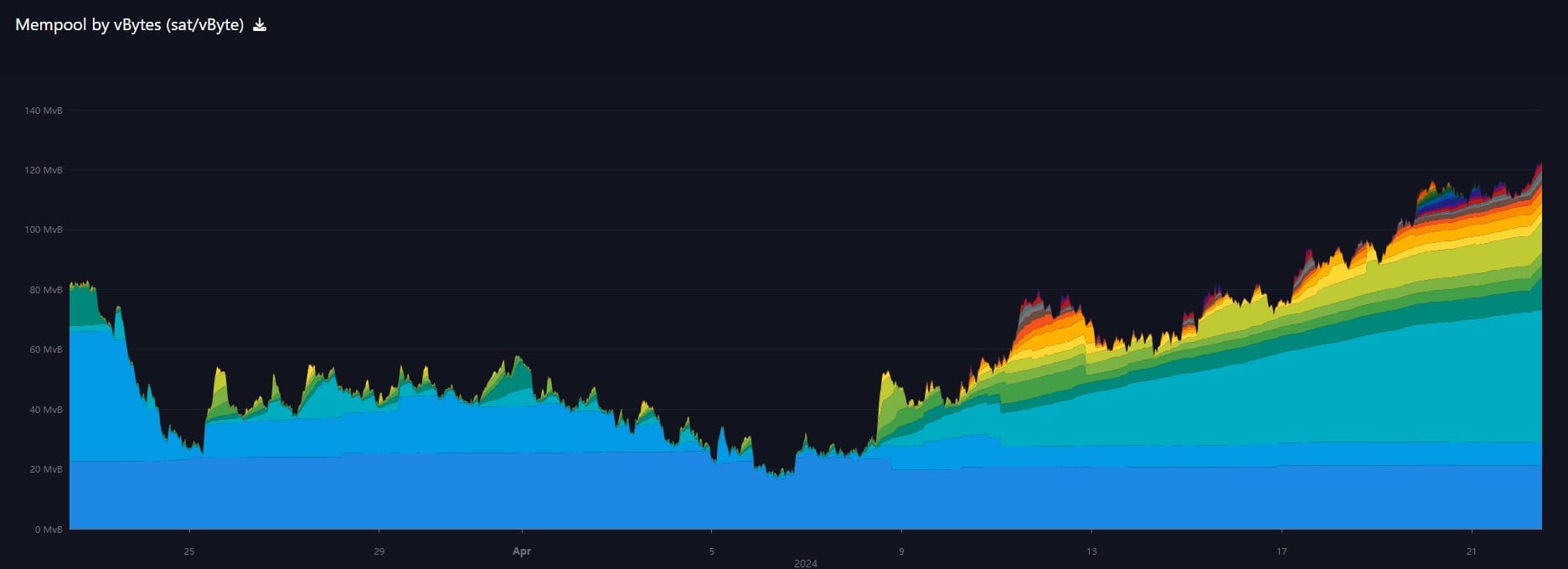

This is where all the drama was on the halving. Apparently, all the degens were trying to get tokens minted on bitcoin in the first block or so after the halving causing a massive bidding war (see the tight rainbow of fees levels on Friday evening).

What else is interesting is most of the gains in mempool size have come from the 8-12 sats/vb range (teal and very recently green in the chart). These transactions were previously getting approved throughout March, but starting on 8 April, transactions paying more have taken up confirmation space and these mid-tier fee levels have built up.

Inscriptions

If you are anything like me, you don't follow much of the inscription debate. It is not central to Bitcoin's success, I view it as an unexplored niche that some people are trying to exploit. The altcoin niche (not bitcoin but the same) has been tried and failed, although some projects are still holding on to a shred of their former credibility.

For that reason I haven't been follow Runes very closely at all, but I wasn't surprised that the halving would attract the whole batch of promoters.

From Casey Rodarmor:

Runes were built for degens and memecoins, but the protocol is simple, efficient, and secure. It is a legitimate competitor to Taproot Assets and RGB.

The protocol is self contained and has no dependencies on ordinals or inscriptions, making it extremely simple.

Balances are stored in UTXOs, which can be locked in HTLCs, so runes can be lifted on the lightning network.

Rune names are optional, and if an etching does not specify a name, a reserved name is allocated. Etchings of reserved names are unconditionally valid, and, if they don't have a supply-capped mint, are very light client friendly.

The ordinals library provides everything needed to encode and decode runestones, so integration should be straight forward.

I'm highly skeptical of "serious" tokens, but runes is without a doubt a "serious" token protocol.

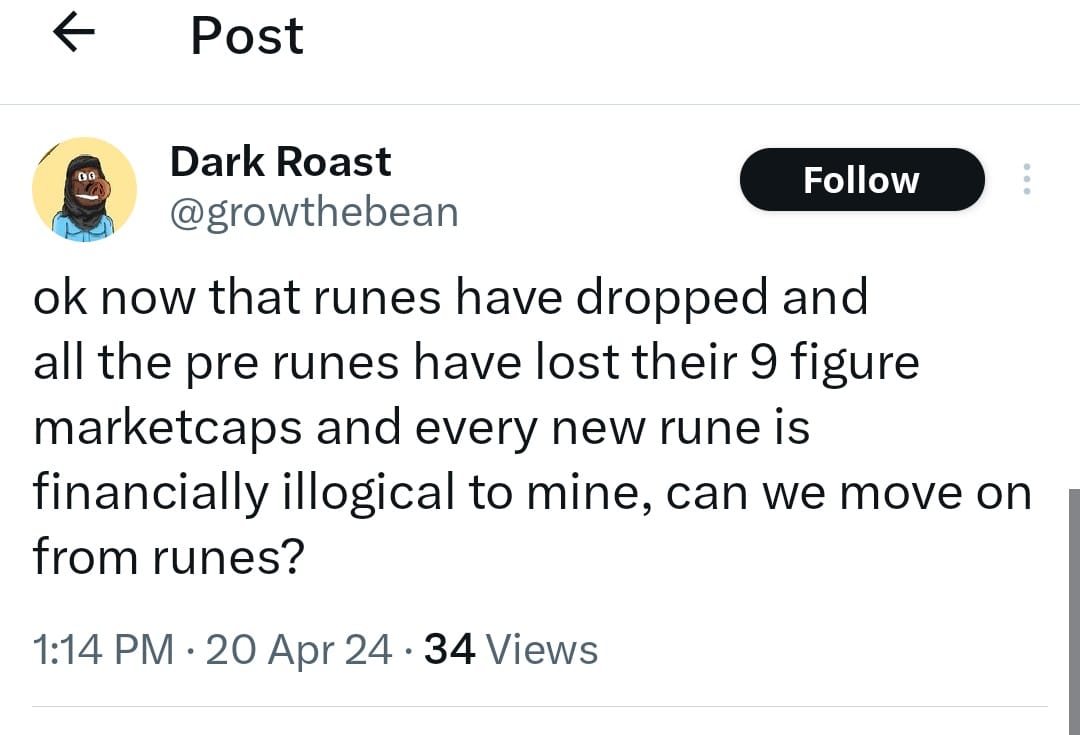

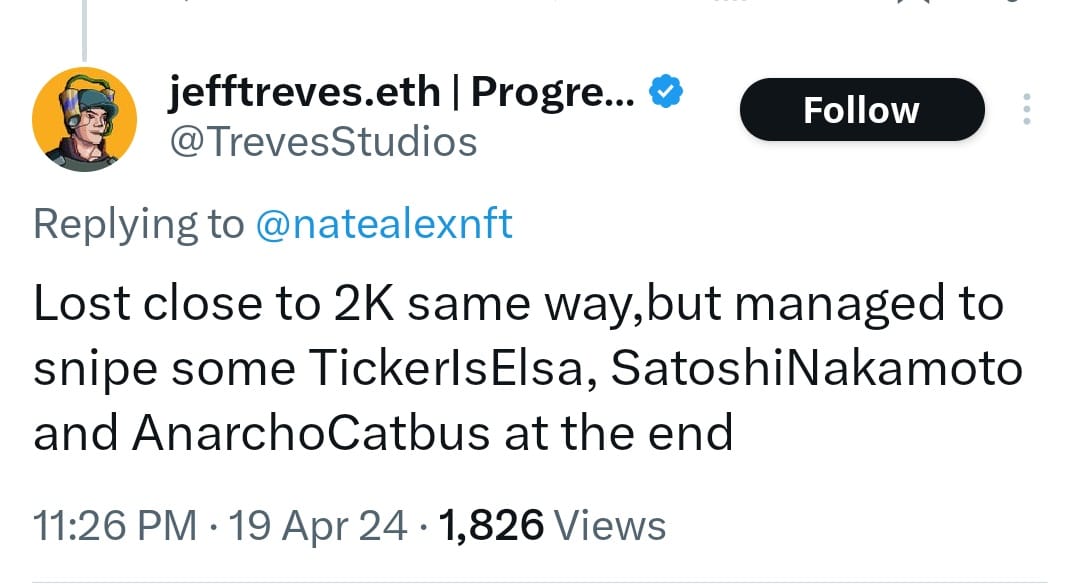

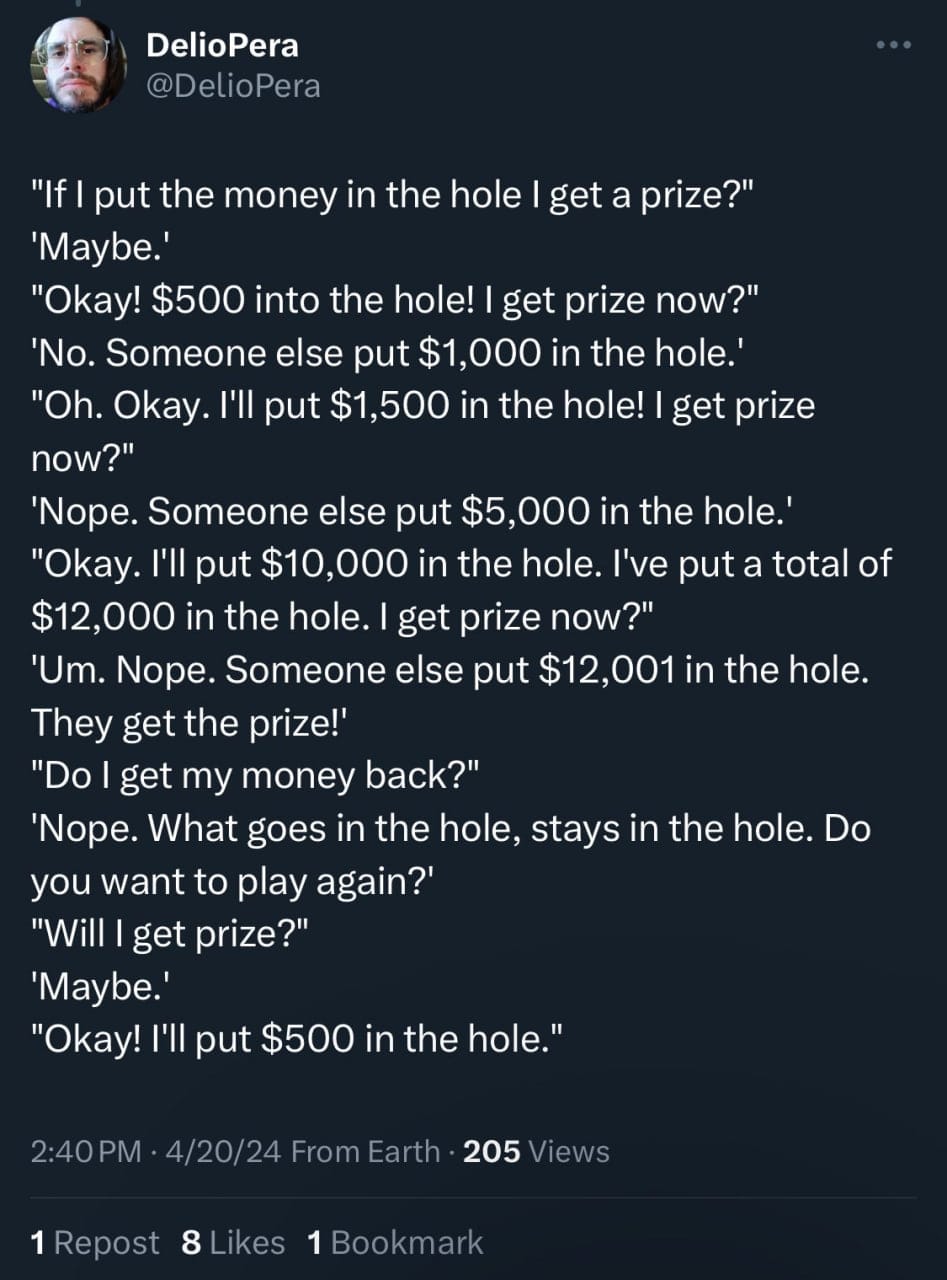

Runes have kind of blown up in people's faces through. They anticipate the return of the ultra-spec bubble of altcoins and NFTs last time. But people know better this time.

OG bitcoiner Francis Pouliot has a good thread on the incoming results of these tokens. It's not looking good. There are too many but here are several from his thread. I recommend checking it out.

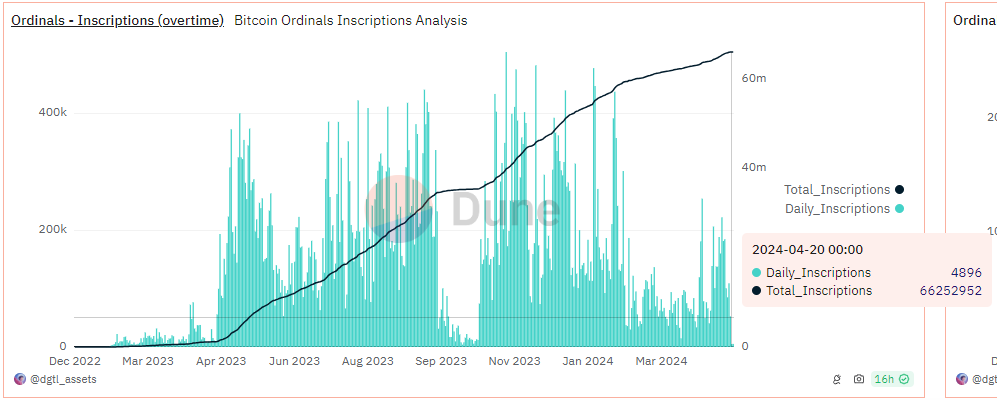

The total number of inscriptions has plummeted since the halving. 4/20 say only 4800 and 4/21 only 5000.

Note to Beginners

These types of tokens have existed on Bitcoin for a very long time. Little do people know that NFTs started on Bitcoin with the Counterparty protocol back in 2015-16. It was the advent of other altcoins, cheap trading and complex Defi that NFTs took off in 2020 or so. This was because these centralized altcoins allowed for near cost-less trading. The scams and Ponzi-like greater fool dynamics did not have an upfront cost. Bitcoin's fees are a Ponzi token shield that requires any of the schemes to actually produce significant economic value to support the higher fees.

For example, if I make a typical economic transaction for $10,000 in BTC, and I pay a 1% fee of $100, that's sustainable, because the value I derive from the product or service I buy I value highly enough to support that fee (typical credit card or payment provider fees can be 2-3%). However, considering an NFT, the fee presents a risk. If I cannot find a greater fool for these tokens, it will have cost me thousands of dollars in fees to create them and I'm stuck.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com