Bitcoin Fundamentals Report #289

Price up, 13Fs stimulate more demand, CME to get spot trading, Tether in China, CPI heading down, heads of State under attack, price analysis and mining news.

May 20, 2024 | Block 84x,xxx

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | We are so back |

| Media sentiment | Positive |

| Network traffic | Low |

| Mining industry | Adjusting |

| Price Section | |

| Weekly price* | $68,801 (+$6,018, +9.6%) |

| Market cap | $1.355 trillion |

| Satoshis/$1 USD | 1453 |

| 1 finney (1/10,000 btc) | $6.88 |

| Mining Sector | |

| Previous difficulty adjustment | -5.6250% |

| Next estimated adjustment | +1% in ~2 days |

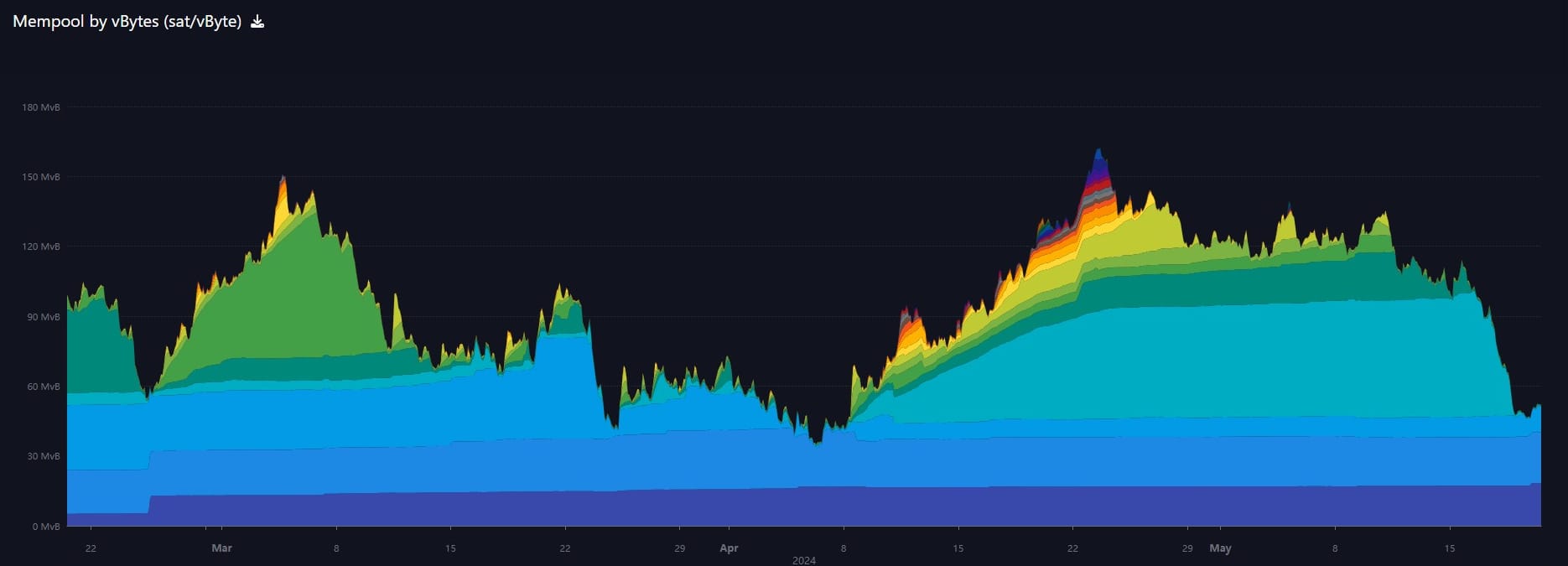

| Mempool | 174 MB |

| Fees for next block (sats/byte) | $1.06 (11 s/vb) |

| Low Priority fee | $0.87 |

| Lightning Network** | |

| Capacity | 4846.19 btc (-0.3%, -13) |

| Channels | 51,810 (-0.1%, -73) |

In Case You Missed It...

Bitcoin Magazine Pro

- We Aren't Bullish Enough: Monumental Shift in Bitcoin’s Fundamentals

- Market Tracker breakdown: Signs of Renewed Trader Activity and Price Growth in Bitcoin

- Mining Tracker breakdown: Deflationary Effects of Halving are Starting

Member

Community streams and Podcast

Blog

- Discussing Reserves: Sources, Utility and Why QE Doesn't Work

- A Response from Team Transitory

- Response to AIER's Salter on Inflation and Interest Rates

Headlines

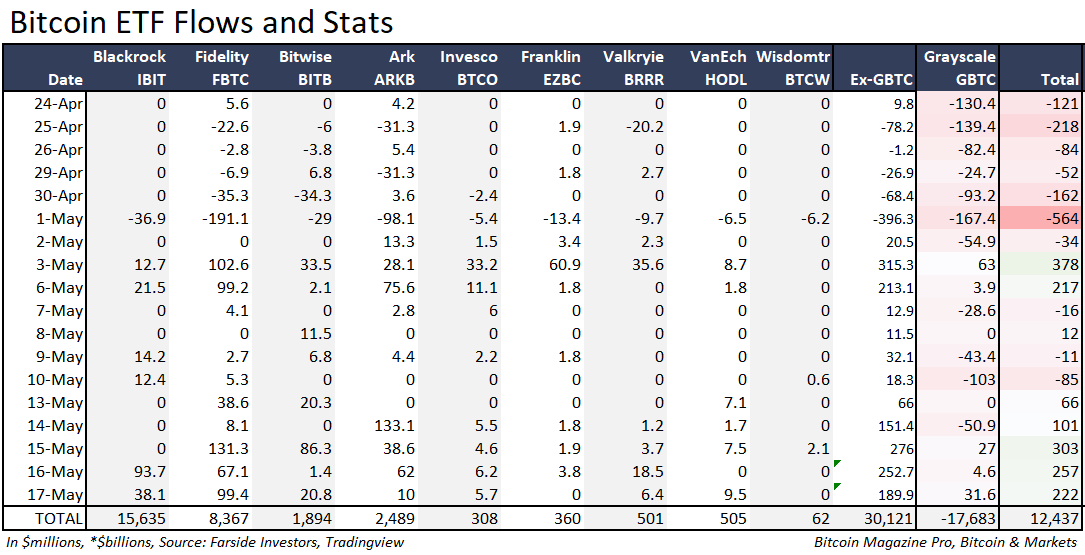

- ETF Flows Rise Drastically After 13F Filings

After a couple of weeks of net negative flows, last week was big for inflows. Just as I predicted, the wave of 13F filings have stimulated further demand.

The Chicago Mercantile Exchange (CME), the world's largest futures exchange, is planning to offer spot bitcoin trading on its platform, according to a Financial Times report. This move would provide major hedge funds and institutional traders with a regulated venue to trade Bitcoin.

CME is already the global leader in Bitcoin futures trading. By adding spot bitcoin, it can offer clients an integrated platform that includes both spot and derivatives markets.

This enables complex trading strategies like arbitrage and basis trading that leverage price differences between the two.

Currently, most spot bitcoin trading occurs on offshore exchanges like Binance. CME, providing a regulated alternative, targets institutional investors who require strict due diligence and compliance standards.

The exchange has reportedly held talks with traders expressing strong interest in trading bitcoin in a regulated environment.

Chinese police have unearthed a $1.9 billion underground banking racket involving the popular stablecoin Tether.

The underground banking operations operated in the Chinese city of Chengdu, where the Tether stablecoin was used to exchange foreign currencies. The city police issued a media report highlighting the details of the underground operations and said they had arrested 193 suspects across 26 provinces.

The police report noted that the underground USDT banking operations began in January 2021 and were primarily used to smuggle medicine, cosmetics and investment assets overseas.

The authorities destroyed two underground operations in Fujian and Hunan, and the police also froze 149 million yuan worth $20 million linked to the USDT banking operations.

Despite a comprehensive prohibition on crypto-related activities in China, Chinese traders persist in circumventing the national ban and utilizing crypto assets in alternative ways.

A report published by Kyros Ventures indicates that Chinese traders are among the largest stablecoin holders worldwide. The report shows that 33.3% of Chinese investors hold several stablecoins, ranking them second only to Vietnam’s 58.6%.

Macro

- CPI below forecast, May Looks Like It Will Be Near Zero

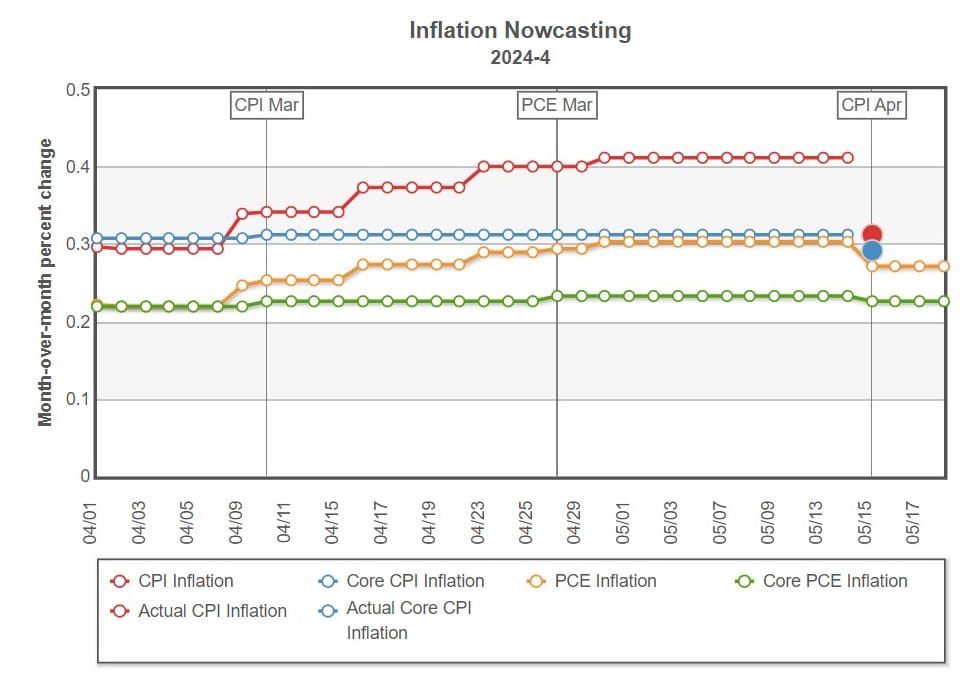

Headline CPI for April came in at 0.3% MoM, under the 0.4% consensus forecast. Next month is expected to be much lower, with current estimates at 0.1%. However, if the Atlanta Fed's Inflation Nowcast is off by as much as it was for April, May's CPI could reach 0.0% MoM. Slowing of prices rises is a sign that we are getting closer to recession.

- Heads of State Under Attack

Last Wednesday, May 15th, Slovakian PM Robert Fico was shot several times and remains in critical condition. Doctors now say he is likely to recover, and is awake after emergency surgery. Slovakia has been against the war in Ukraine and very recently rejected the new World Health Organization treaty that would cede sovereignty to the WHO in a pandemic.

Iranian President dies in a helicopter crash. First reported as a hard landing, it appears the helicopter crashed and fully burned killing everyone on board. The President and his delegation was returning from a trip to the Azerbaijan border. Travel is not without risk, but any time a political leader dies in a plane crash or helicopter crash, it is very suspicious.

Another world leader has an important day. Today is the last day of Zelenskyy's legal term in office. He suspended elections to protect democracy.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last issue:

Once we break the 50 DMA price should rapidly hit $68k. That will be the true resistance IMO. If price can make it to $70k, price movements could be explosive. $78k by end of next week is not out of the question, if we can break $68k this week.

Price did not break $69k last week, but we are breaking it at the time of writing. ATH resistance is the next level to watch for, but it is possible for price to slash right through it heading up to the next round number resistance of $80k.

If this move is 90% like the last two rallies have been, that would take price to $110k.

Last week:

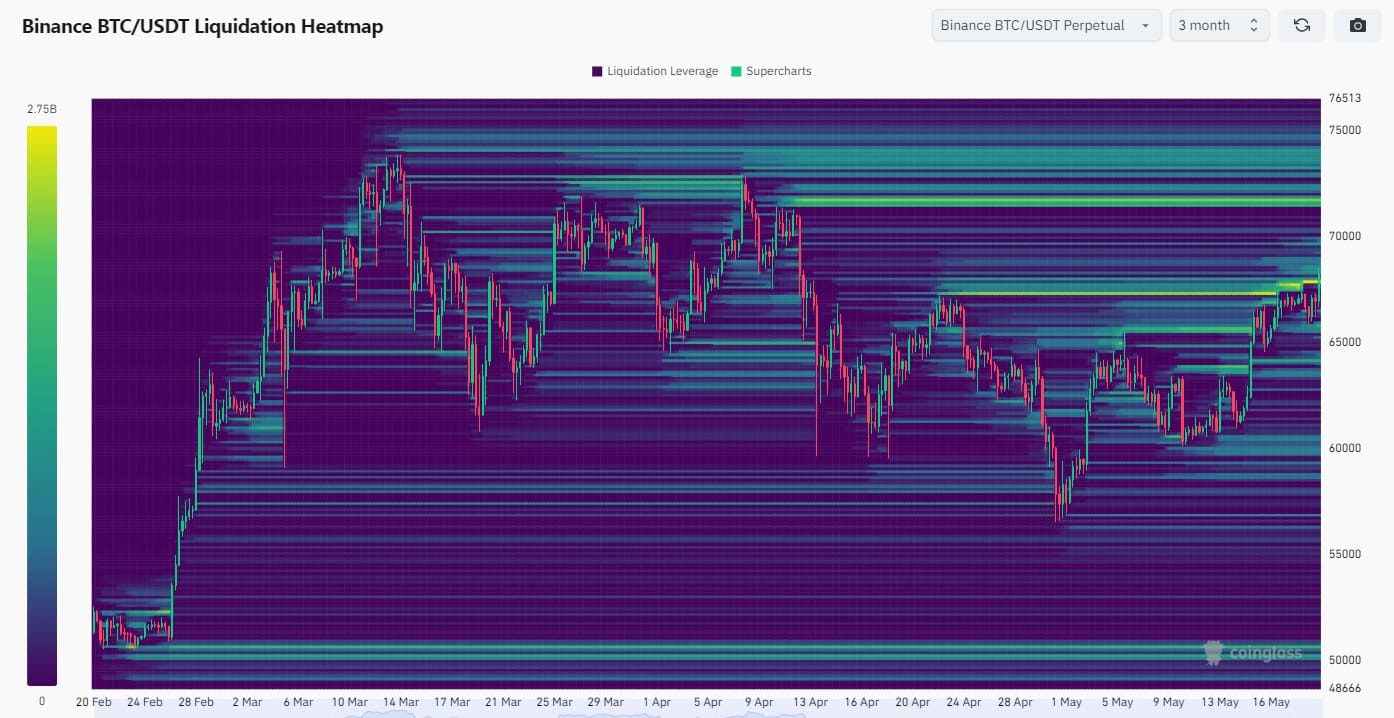

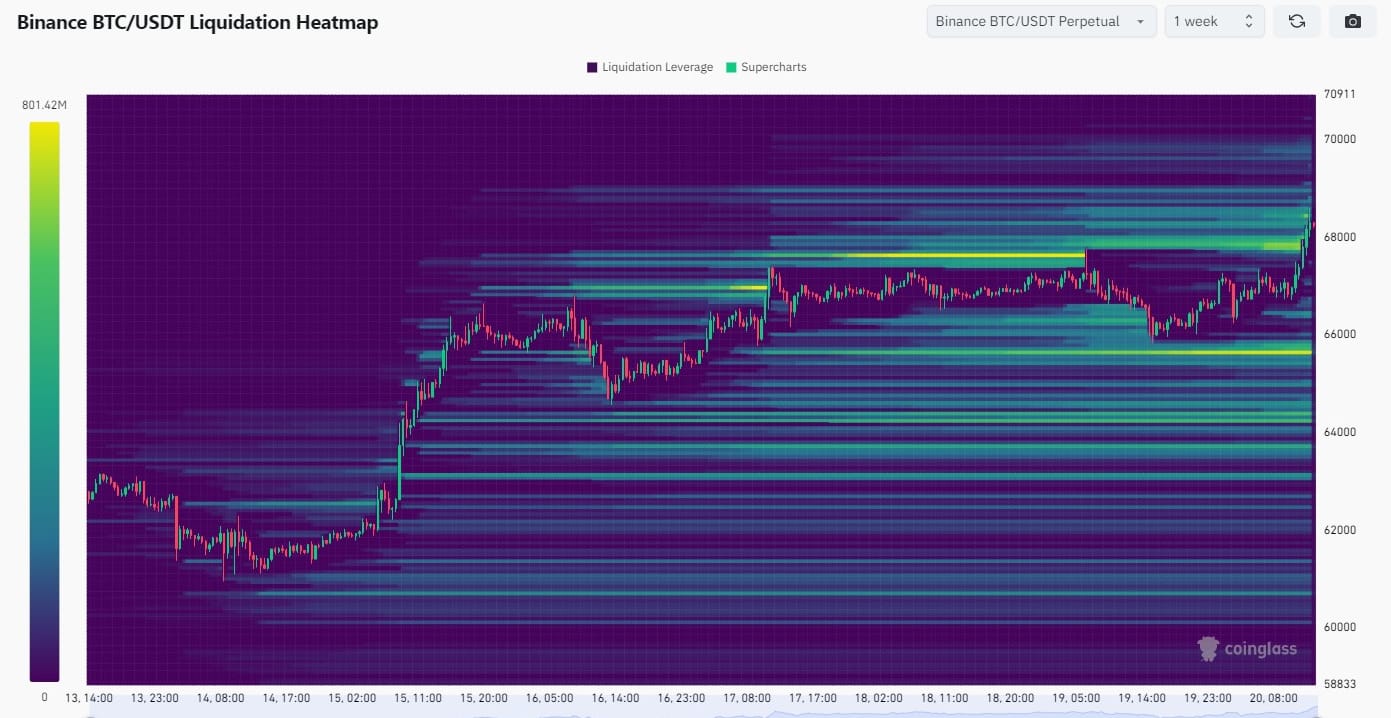

The heatmap is still favoring a cascade UP to $68k.

We got our cascade up to $68k, with shorts just getting taken to the cleaners each time. This is very visible on the 1-week chart two below. That might have exhausted the shorters for the time being.

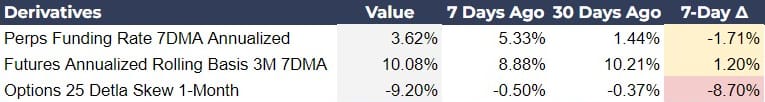

Derivatives markets have surprisingly shifted bearish, with perps funding rates coming down, meaning there is a better balance of short and long interest. Also, the Options 25 Delta Skew is decided negative, meaning that options traders are pessimistic and hedging downside moves. Perhaps this could be because they are taking long spot positions, but it is a big change.

Overall, price has broken out of its 10-week consolidation period and we are eyeing ATHs again, which I think could come this week. I say it often that the gains in this market will happen relatively quickly and catch fencing sitters off guard.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

Not particularly surprising or important news for the hash rate, but it is interesting because of the totally mixed signals. They are banning mining while increasing their use bitcoin and/or Tether for oil trade.

Venezuela’s government has announced it will ban bitcoin mining and seized 11,000 application-specific integrated circuits used to mine the cryptocurrency.

The statement also said the government had disconnected a number of Bitcoin mines as it sought to “disconnect all cryptocurrency mining farms in the country from the electrical system, avoiding the high impact on demand,” Bitcoin.com reported.

Venezuela, despite its oil wealth, has trouble with reliable electricity supply amid years of U.S. sanctions and mismanagement. Blackouts in Venezuela are a frequent occurrence, which has made Bitcoin even more problematic for it than for other countries where the practice is popular.

Yet at the same time, the country’s government is very much in favor of cryptocurrencies: state-owned PDVSA uses them for its international oil trade to avoid sanction action by Washington. Last year, the use of cryptocurrencies was at the center of a corruption investigation at PDVSA involving some $21 billion in unaccounted receivables, Reuters noted in a recent report on plans by the Venezuelan government to step up its use of digital currencies.

The current hashrate and power consumption on the Bitcoin (BTC) network implies an estimated mining cost of about $45,000, down from above $50,000, JPMorgan (JPM) said in a research report on Thursday.

Hash rate and Difficulty

Hash rate hits a new ATH briefly before falling, resulting in the largest difficulty decrease since 2022 (-5.625%). So far in the current difficulty epoch blocks are slightly ahead of schedule and estimated for a difficulty increase in 9 days of 1-2%.

Mempool

Fees have come way down, with the miners chewing through the mempool. The last of a growing fees signals that the chance of a sell off at this point is muted.

Layer 2 including Token Protocols

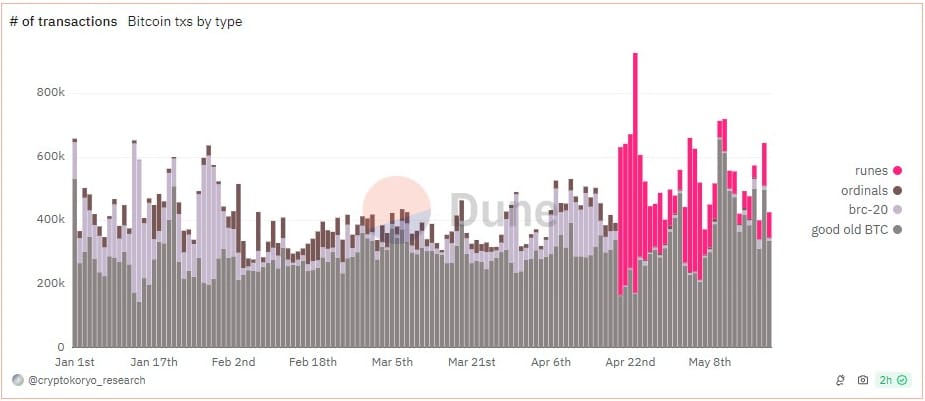

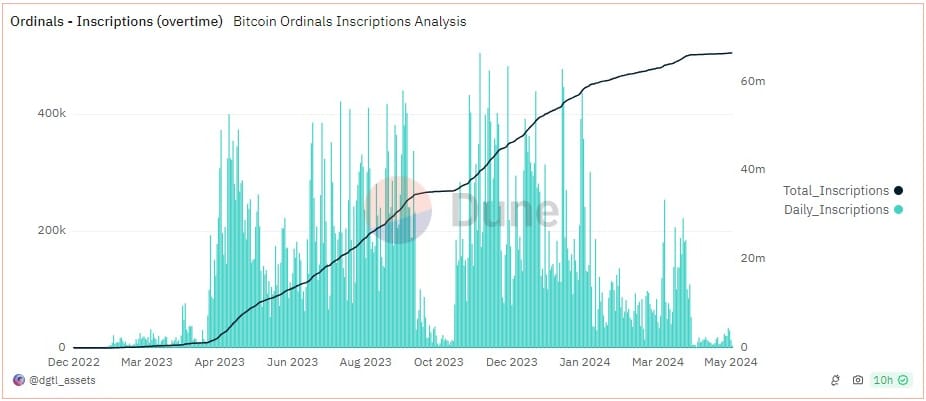

- Will Runes and Inscriptions bounce back with the price break out?

“Bitcoin L2s” are the hottest thing on the street. People are using a bunch of jargon to distract users from trust assumptions and shill Bitcoin Season 2.

Why all the sudden energy? See, about a year ago, some teams figured out how to use Bitcoin as a data availability layer for rollups. Others have been working on improving trust assumptions related to bridges (aka two-way peg). The research has been making great progress, and a lot of projects think we’ll have rollup-like blockchains in production by 2025.

All the new Bitcoin L2s are just modular sidechains. And when I say “modular sidechain”, I mean they run an alternative blockchain off of their parent blockchain for performance purposes. They also make security tradeoffs by using an alternative DA layer for improved performance.

You might read this post and think the entire situation has gone to hell and is not worth exploring. Some days it might feel like that, but there’s a lot of cool R&D work happening around improved sidechain designs.

Teams like Citrea and Alpen Labs are looking to develop rollups on top of Bitcoin. A lot of great work is being driven from the BitVM community and the ZeroSync team on improving two-way peg designs and developing a SNARK verifier that works today. This work is also inspiring a number of bridging proposals from various rollup and sidechain projects.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com