Bitcoin Fundamentals Report #290

The pro-Bitcoin realignment continues. Trump endorses bitcoin and disavows CBDCs. Something strange is happening in China. Price analysis, mining sector news, and more.

May 27, 2024 | Block 845,401

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Nearing ATH |

| Media sentiment | Extremely Positive |

| Network traffic | Low |

| Mining industry | Recovering |

| Price Section | |

| Weekly price* | $70,164 (+$1363, +2.0%) |

| Market cap | $1.381 trillion |

| Satoshis/$1 USD | 1426 |

| 1 finney (1/10,000 btc) | $7.01 |

| Mining Sector | |

| Previous difficulty adjustment | +1.4830% |

| Next estimated adjustment | +6% in ~8 days |

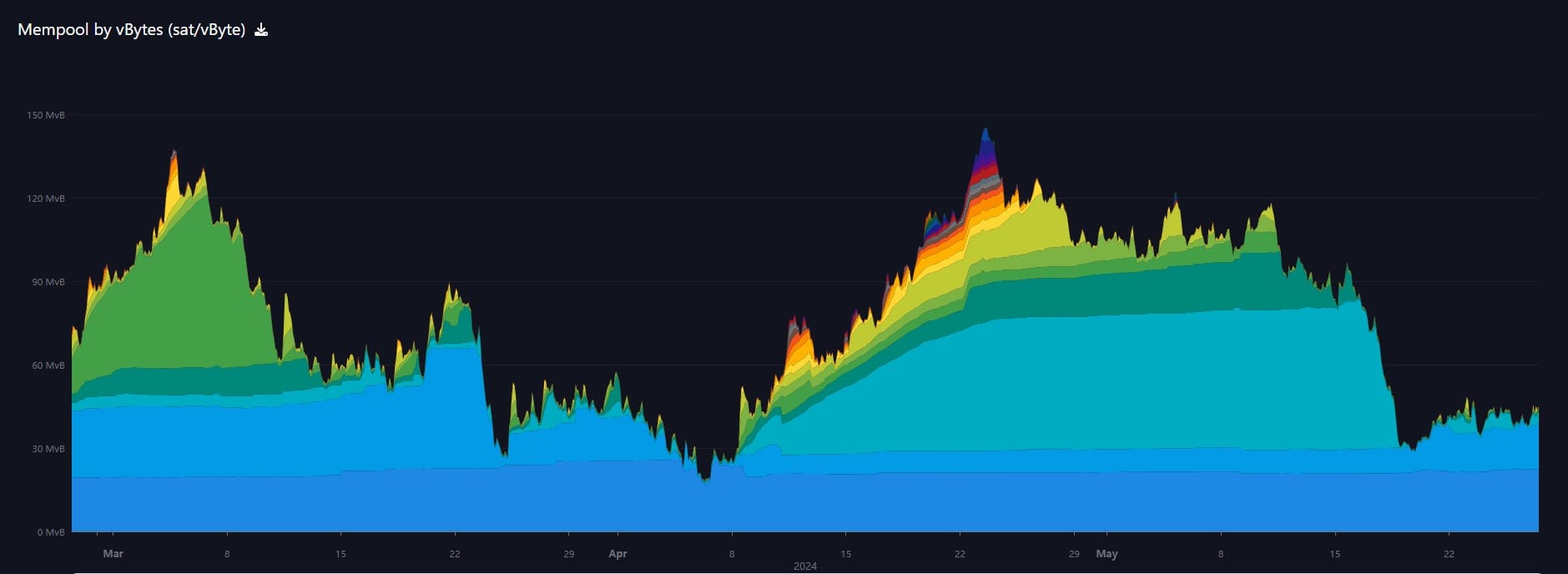

| Mempool | 187 MB |

| Fees for next block (sats/byte) | $1.47 (15 s/vb) |

| Low Priority fee | $1.08 |

| Lightning Network** | |

| Capacity | 4928.69 btc (+1.7%, +83) |

| Channels | 51,943 (+0.3%, +133) |

In Case You Missed It...

Bitcoin Magazine Pro

- Recession Risks Rise: How Will Bitcoin Handle It?

- Market Tracker breakdown: Bitcoin Breaks Out: Analyzing the Market's Renewed Bullish Momentum

- Mining Tracker breakdown: What’s Working for Bitcoin Miners: Industry Summary

Member

Community streams and Podcast

Blog

- Discussing Reserves: Sources, Utility and Why QE Doesn't Work

- A Response from Team Transitory

- Response to AIER's Salter on Inflation and Interest Rates

Headlines

- Trump Goes Hard, Publicly Endorses Bitcoin and Promises to Free Ross

It has to be said up front, that politicians lie. This could be simple pandering to get elected. However, Trump does have a love for sound money and gold, a move to bitcoin is within the realm of possibility. He won't support a complete hands off approach IMO, he knows the dangers of blatant Ponzi schemes, fraud and leverage.

Bitcoin doesn't need Trump, Trump needs bitcoin. Remember that. Bitcoin will always be free, it will always confirm your transactions, this action only makes their job easier. They will not have to spend massive amounts of money on trying to enforce an unenforceable ban or launching and maintaining a CBDC. This will be a win for them no matter what, all they have to do is give up.

Whoever is writing his talking points is doing a pretty good job:

"The future of bitcoin will be Made-In-USA"

"I will support your right to self-custody."

"I will keep Elizabeth Warren and her goons away from your bitcoin."

"I will never allow the creation of a CBDC"

Being a long-time bitcoiner, this is hard to believe. It's going to take a while for all the winning to sink in. Instead of fighting us, they are actively courting us. This reads like a wish list from Bitcoiners. The only thing I can think of that's not included is treating it like a currency for tax purposes, no capital gains taxes.

Trump has also promised to commute Ross Ulbricht's sentence. More amazing news and Ross responded on twitter:

- Ethereum ETFs are unfortunately approved

The reason this destroys the SEC reason to exist is because they are supposed to be the bulwark against scams and fraud. Ethereum is obviously fraudulent. What logical reason is there now to stop Solana, Ripple or Dogecoin from launching an ETF? Nothing. The only thing is there will likely not be enough demand from the big issuers, like Blackrock and Fidelity, to launch those ETFs. But someone else will and the SEC will sign off on the P&D scheme.

My main issue with this is the legitimization of "crypto" and all the scams. Remember, Bitcoin is not crypto, crypto is a hot bed of fraud and deception pretending to be like bitcoin. I do not want to see people get scammed and rekt. I even feel bad for the Ether folks. They were all mad in my comments, LOL, saying things like "cry harder" (originally a bitcoin line, they stole that, too), and "cope". The joke is on them, they don't understand that this is likely crash the ethereum price.

It's worse than I originally thought. Imagine holding ETHE (the existing Grayscale Ethereum Trust being converted into an ETF) with a 10% annual penalty. The ETFs will not stake and the average yield from staking so far is high single digits (6-9%). Now, add in management fees of 1.5-2.5% (like the Grayscale Bitcoin ETF). Outflows are going to huge.

The Bitcoin ETF launch saw a similar event, GBTC has seen a massive outflow of $17 billion so far. However, the inflows have outweighed this outflow by $13 billion. Bitcoin doesn't have the staking problem which will hamper any whale demand for the ETH ETFs. Ethereum is supposed to be like oil, used as gas in smart contracts. ETH in the ETF can't be used to stake or as gas, and have to pay a fee on top of it. I think this is going to be very bad for the price of Ethereum.

Last Wednesday, the House passed the Financial Innovation and Technology for the 21st Century Act (FIT21) with a vote of 279 to 136 and bipartisan support. This bill, viewed as a significant milestone for the industry by many, aims to establish a regulatory framework for bitcoin, defining what activities should be regulated by what agency. Although the bill is largely seen as expanding the Commodity Futures Trading Commission’s (CFTC) oversight of the spot market, the Securities and Exchange Commission (SEC) would still retain a significant regulatory role.

"Crypto" lawyers don't like it. Gabriel Shapiro criticizes the bill for not reducing the SEC's power and for creating a dual regulatory regime shared between the SEC and CFTC. He highlights that it gives the CFTC unprecedented regulatory authority over the spot commodities market, which could lead to overreach. Shapiro views the bill as a government sanction of activities already happening without permission, fearing potential interference in free markets.

Stephen Palley also disapproves of the bill, arguing it unnecessarily expands CFTC jurisdiction and creates a protected environment for incumbents. He blames the industry for demanding new laws that could lead to adverse outcomes.

I don't think this bill is necessary, but it is still a positive step, not in the regulation but in what it stands for. This bill exposes the alignment of lawmakers in a positive direction for Bitcoin. It puts to bed the often used normie critique that "they will just ban bitcoin whenever they want." A new bill can fix things later after most people in the US own bitcoin.

Macro

- Something big is happening in China

Hundreds of Chinese are make the very dangerous journey to flee China and sneak into the US. Tweet thread here, and if you can see the video below YT link.

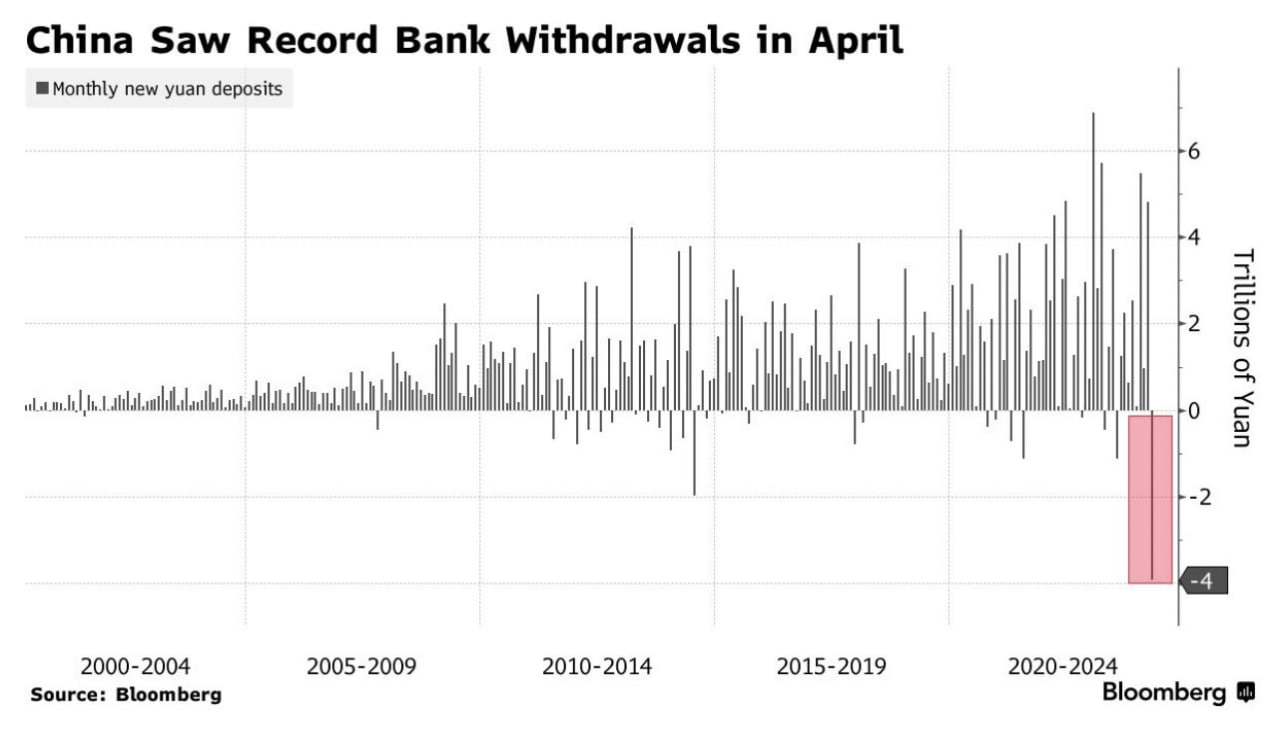

April saw a huge flush of withdrawals from Chinese banks, the most ever.

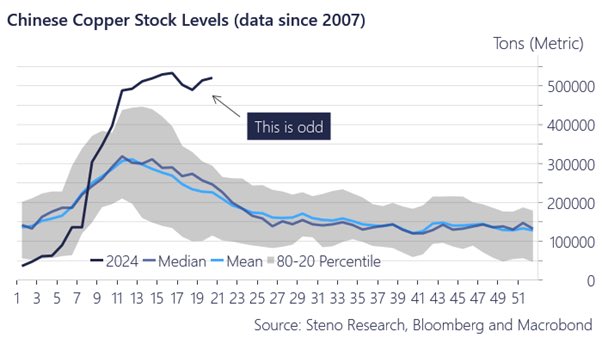

China's is stockpiling resources. This could be explained by a slow economy not using them as fast or a specific plan to stockpile commodities in anticipation of war. There have been reports of China stockpiling corn, wheat, soy, oil, copper, and even steel.

Gold trading activity has exploded higher, with some analysts thinking a devaluation is imminent.

Maybe the gold trading volume has something to do with concern about the consequences of their latest stimulus. Just last week, "China is trying to end its ‘epic’ property crisis. The hard work is just beginning."

Beijing has launched its most ambitious plan yet to rescue its property market, a development that investors have eagerly anticipated for months. But it’s far from certain that the measures will work.

The package is centered around Beijing’s adoption of a policy that has already been tested in a major city — asking local governments to buy unsold homes from developers and convert them into social affordable housing. It also features a reduction in mortgage interest rates and down payment ratios, and more importantly, 300 billion yuan ($41.5 billion) in cheap central bank cash to fund state purchases of unsold properties.

Sounds like are printing money like mad over there, which is certainly putting pressure on their exchange rate.

Lastly, the recent Chinese military drills that completely surrounded Taiwan. This isn't the first time they have done this, but the timing is significant. It is well-known that they want Taiwan to come back into the fold, and with its failing economy, an attack on Taiwan would distract the people from rising up. My opinion is that they fear the people rising up, so are preparing to use this as a distraction if any protests arise.

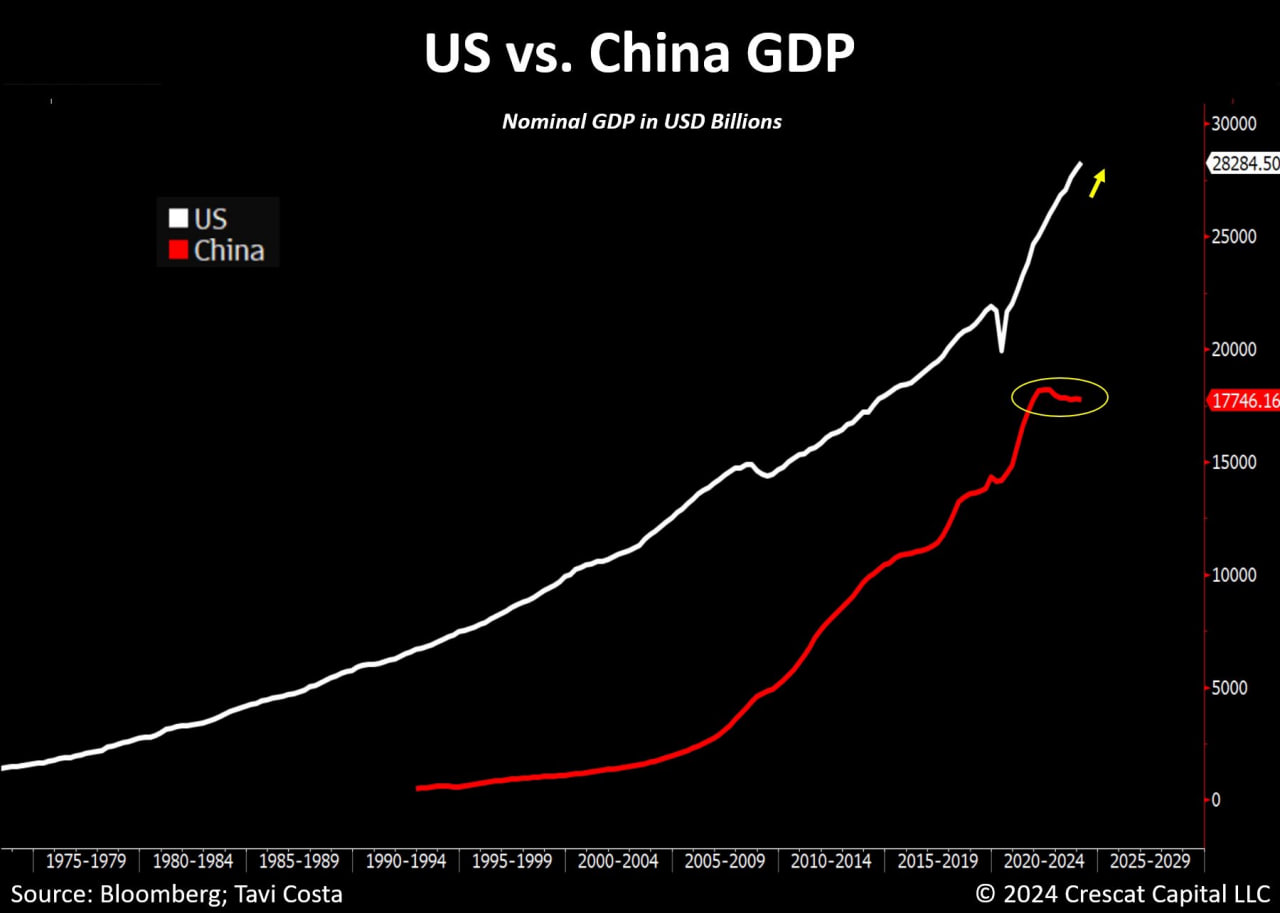

The following chart summarizes what I've been saying for years now. China's economic model is over, they are going to resemble Japan's lost decades or crackdown and become like North Korea.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last issue:

ATH resistance is the next level to watch for.

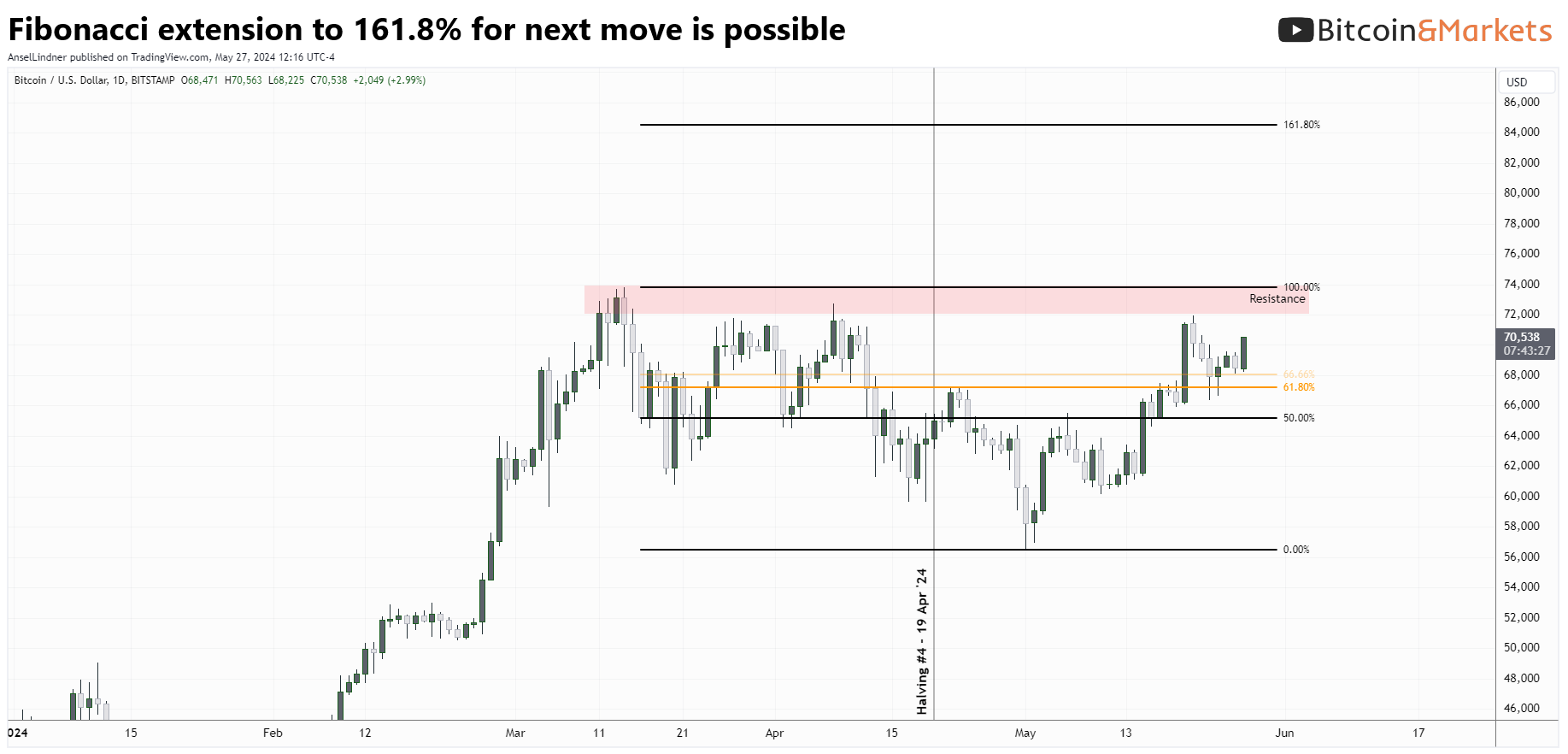

Price action fell short of the ATH last week, but is already starting to make another push this week. Fundamentals are so positive for bitcoin right now, when it breaks the ATH, you can expect a significant move higher.

There really isn't any price structure to go off of, like horizontal resistance, so round numbers like $80k will become important resistance levels and Fibonacci extensions. Price has done two 90% moves this year, if we repeat that again it would take us over $100k within a few weeks. Whatever happens, the moves should happen quickly and then consolidate. We are nowhere near the end of this bull market.

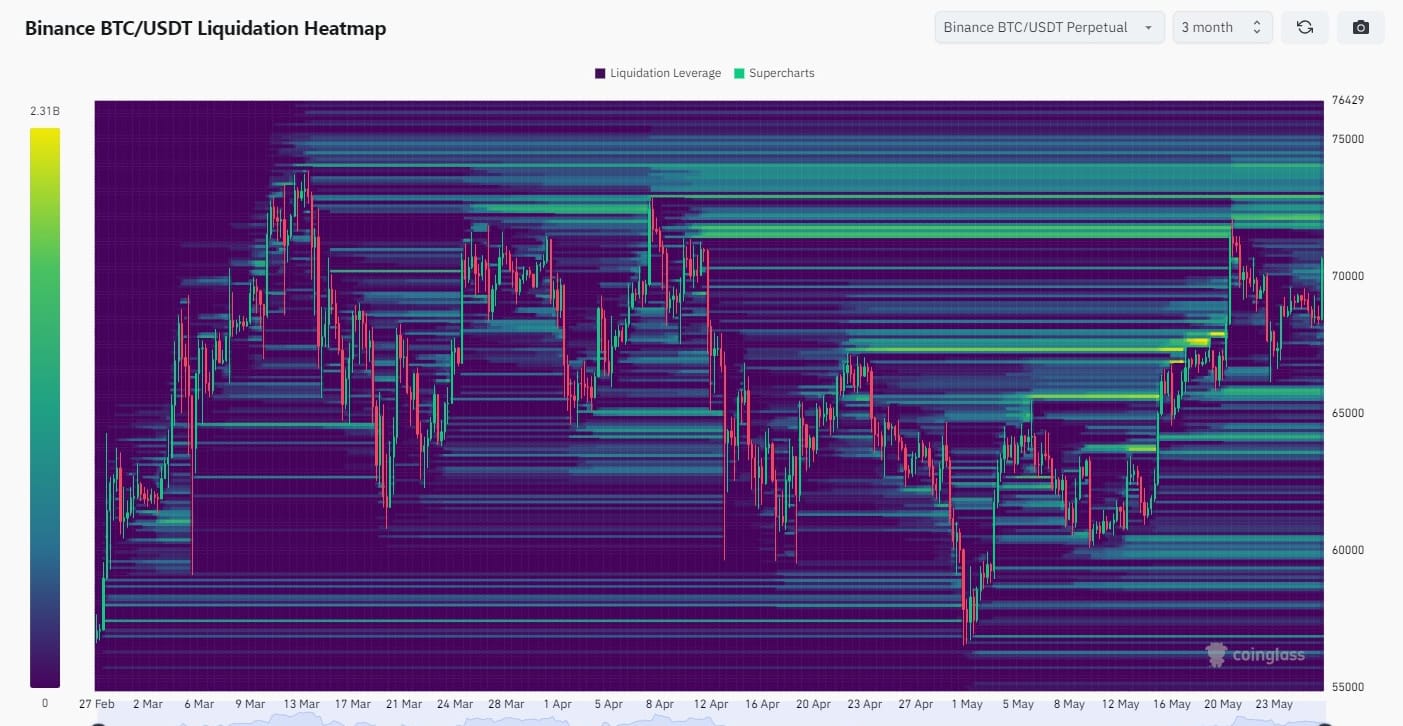

The heat map this week is showing a significant amount of liquidations still above the price. The liquidity of liquidations acts like a magnet for trading activity. But once price gets above the ATH, there is very little price structure for trades to congregate around.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

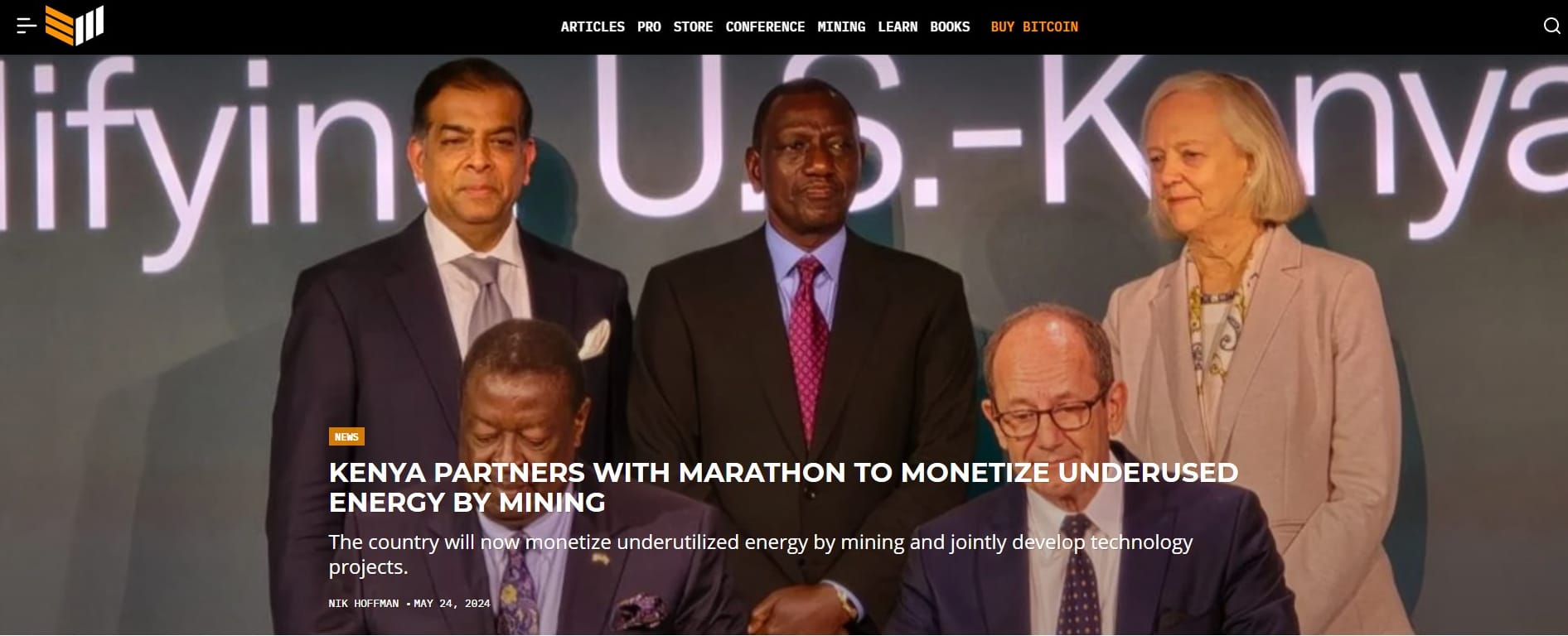

Kenya's geothermal energy capacity is substantial, with the country being one of the leading producers of geothermal power in Africa. Despite this, a significant portion of the generated energy remains untapped. By partnering with Marathon Digital Holdings, Kenya seeks to turn this surplus into a valuable resource, generating additional revenue and promoting energy efficiency.

The deal involves not only the use of untapped energy for mining but also the joint development of technology projects that could benefit the country's infrastructure and technological landscape.

Northern Data’s Peak Mining revealed the acquisition of a new Texas location featuring a 300-megawatt (MW) ERCOT-approved interconnect. Peak announced on Friday that construction is in progress and the site is expected to be operational by early 2025.

The announcement highlights the deployment of indoor, custom-designed, fully-integrated, and liquid-cooled HPC data center systems to significantly enhance deployment speed and reduce infrastructure costs. This purchase follows a 300 MW site acquisition finalized last December, with both sites situated next to each other.

Hash rate and Difficulty

Hash rate has staged a remarkably fast come back after the halving. Estimates for the next difficulty adjustment in 8 days is around 5%.

Mempool

Fees are embarrassingly cheap right now. Average priority fees is running around $1-2. No volatility signal in fees at this time. If there were a risk of a significant sell-off, fees tend to start rising in the days prior.

Layer 2 including Token Protocols

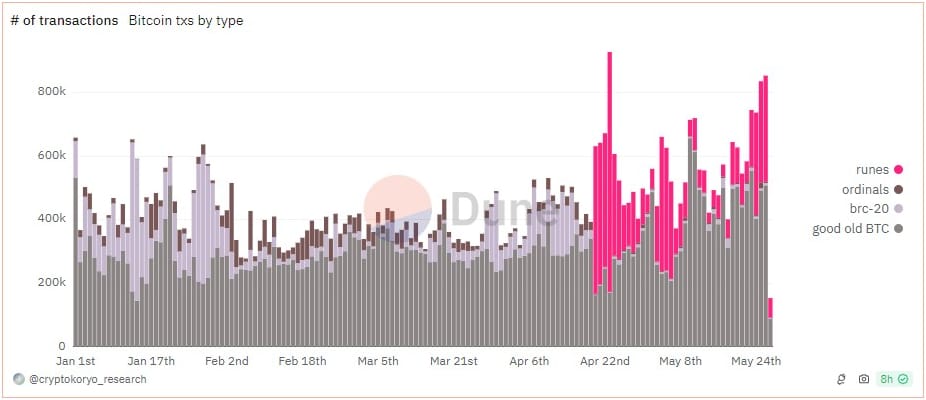

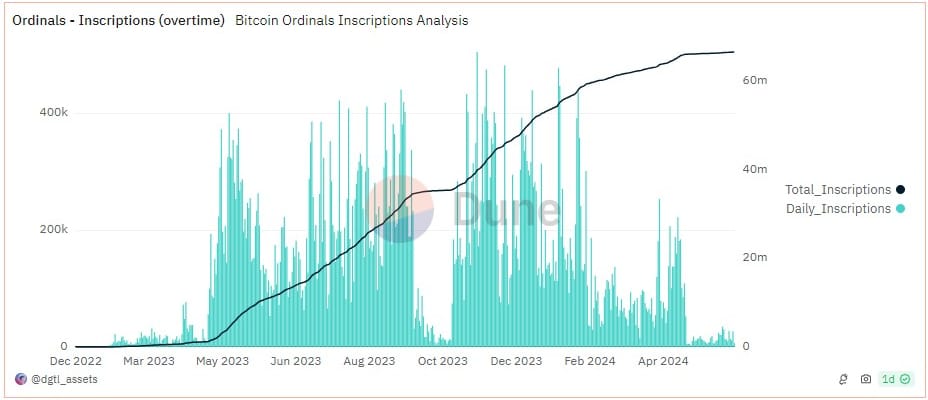

- Will Runes and Inscriptions bounce back with the price break out?

These layer 2 tokens on bitcoin are a proxy for speculative demand. I expect that their volume will pick up as the price breaks to a new ATH. Inscriptions on the other hand are much more expensive and resource intensive, so their volume might not pick back up. The rise in volume for Runes might be the reason behind why the mempool is having a hard time clearing. Every time the fees are low and the network can start eating through the backlog, Runes take advantage and up their volume.

Taproot Consensus is a Layer 2 protocol of connected signatures to enable Ethereum-like functionality. I'm not endorsing it, I'm just offering it as an example of the explosion happening in bitcoin layer 2's.

On May 20, 2024, the Bitcoin Layer2 development team BEVM released the technical yellow paper titled "Taproot Consensus: A Decentralized BTC Layer2 Solution." This paper details the implementation of Taproot Consensus, leveraging native Bitcoin technologies such as Schnorr signatures, MAST, and Bitcoin SPV nodes to build a fully decentralized BTC Layer2 solution. Taproot Consensus represents a significant leap in native Bitcoin scalability, combining existing Bitcoin technologies innovatively without modifying Bitcoin's core code.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com