Bitcoin Fundamentals Report #291

Roughly 17% of Americans own bitcoin, bitcoin floods out of exchanges, Andreas reappears, OPEC keeps cuts, Trump, price analysis, and mining news.

June 3, 2024 | Block 846,369

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Nearing ATH |

| Media sentiment | Extremely Positive |

| Network traffic | Medium |

| Mining industry | Recovering |

| Price Section | |

| Weekly price* | $69,227 (-$937, -1.3%) |

| Market cap | $1.360 trillion |

| Satoshis/$1 USD | 1446 |

| 1 finney (1/10,000 btc) | $6.92 |

| Mining Sector | |

| Previous difficulty adjustment | +1.4830% |

| Next estimated adjustment | +1.1% in ~2 days |

| Mempool | 212MB |

| Fees for next block (sats/byte) | $3.00 (31 s/vb) |

| Low Priority fee | $2.33 |

| Lightning Network** | |

| Capacity | 4932.67 btc (+0.0%, +4) |

| Channels | 51,998 (+0.1%, +55) |

In Case You Missed It...

Bitcoin Magazine Pro

- Unstoppable Bullish Fundamentals: Bitcoin Will Soon Follow

- Market Tracker breakdown: By The Numbers: Key Bitcoin Metrics, Cycles, and Macro Positioning

- Mining Tracker breakdown: By The Numbers: Miners, Metrics and Market Movements

Member

Community streams and Podcast

Blog

- Discussing Reserves: Sources, Utility and Why QE Doesn't Work

- A Response from Team Transitory

- Response to AIER's Salter on Inflation and Interest Rates

Headlines

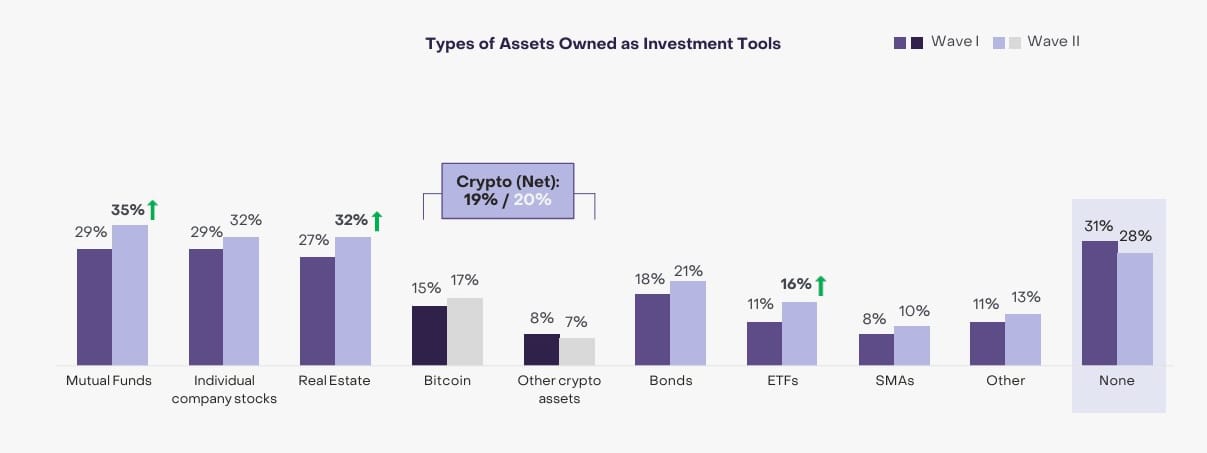

Grayscale's poll also found that the largest concern of the American public is by far inflation. Bitcoin is a great inflation hedge. Nearly 25% of respondents said bitcoin was a good long-term investment.

These numbers, in addition to the ETF and Wall Street blessing, are behind the recent political realignment, where bitcoin is suddenly supported by both parties. Instead of fighting it, they are promoting bitcoin.

- Bitcoin is racing off exchanges

The amount of bitcoin on exchanges plunged this week. On the chart below, you can see that exchange reserves fell from 2.57 million BTC on May 26th, to 2.51 million BTC today. That is approximately $4 billion in liquidity getting removed from exchanges. Based on this data, there is likely some volatility in the near future. - me on BitcoinMagazinePro.com

The Bitcoin Realignment I've been talking about for several weeks led to this bill that if signed would allow banks to custody bitcoin. It was momentous because it got bipartisan support, including the Democrat leader in the Senate. The banks obviously want it and were able to push it through the Congress. However, this puts the globalist v banker fight in perfect view. Biden is controled by the globalists and they do not want bitcoin getting more deeply entrenched.

Earlier this month, the full House and Senate voted in favor of the measure to repeal the SEC's staff accounting bulletin, also called SAB 121. The House previously voted 228-182 to pass the measure, with mostly Republicans, though 21 Democrats did sign on. A week later, the Senate voted 60 to 38, with several Democrats, including Senate Majority Senate Majority Leader Chuck Schumer, D-N.Y., voting in favor of the measure.

"My Administration will not support measures that jeopardize the well-being of consumers and investors, [...] Appropriate guardrails that protect consumers and investors are necessary to harness the potential benefits and opportunities of crypto-asset innovation." said President Biden in a letter addressed to the U.S. House of Representatives posted on the White House website.

- Andreas reappears, confused over big blocks

If you can't see video, here is the podcast. This part is from the 21:00 mark.

"I would say, in 2017 we had a partial agreement to scaling with Segwit that in practice would increase the block size to 4 MB. It has now been 7 years, could we afford, from a bandwidth and storage perspective, another increase in the block size? Now, that is heresy to say in some circles. And for me, it's simply a pragmatic question. Have computers and bandwidths increased to a point where we could increase the block size without damaging decentralization? I think the answer to that is, yes."

I think Andreas did great things for bitcoin early on. He was a massively powerful voice for bitcoin. But he's wrong here. He is considering the loss of decentralization from a cost to run a node perspective. This might also explain his irrational belief in Ethereum as well. The centralization comes from the process of hard forking itself.

Hard forks have a commitment problem. It's a problem with the game theory that will always lead to centralization if successful. There was never a block size debate, it was a bunch of confused people who wanted to centralize bitcoin. The original network always wins, because it is the current Nash equilibrium. Everyone continues on the original chain unless there is a *centralized* outside force that changes the payoffs. You have to centralize the network to shift to new rules, which destroys the value prop. This makes the new network's coins less valuable and hence will be dumped for more bitcoin. This has nothing to do with bandwidth costs, and not seeing this makes Andreas think Ethereum is legit.

Macro

OPEC+ has agreed to extend its production cuts until 2025 because the outlook for demand remains uncertain. Members of the oil production group see that copper prices have soared 72% in the past five years, rising 22% in the last year alone, and may fear that the push for electric vehicles is shifting demand elsewhere. Oil prices have performed adequately in the past five years, but they are nowhere close to the levels that producers would consider adequate to balance their budget. If copper can tell us anything, it is that Chinese demand and the development of electric vehicles are much stronger forces than fossil fuel demand. However, this may be an incorrect way of looking at things.

I disagree with the repeated emphasis on EVs. They are marginal at best, but prices are set at the margin.

OPEC should worry about the United States and non-OPEC supply. The doom predictions of a collapse in oil production from unconventional oil have failed. The Energy Information Administration (EIA) shows that average daily production in 2024 is 13.12 million barrels per day, a 7.1% production increase over 2023 figures and 1.4% above its previous all-time high. The United States production has become stronger and more efficient, breaking even at $40 a barrel. Additionally, government measures to place regulatory burdens on energy production have failed. The United States production level is robust, sustainable and, more importantly, adaptable to regulatory risks.

Excellent points. Peak oil doomers were so wrong. OPEC definitely has to worry about US production, especially when Trump gets reelected. He is going to "drill baby drill." I can easily see US production climbing to 15+ mmbpd in a Trump second term, in the face of FALLING global demand. With a breakeven of $40, which could easily fall with better regulations, I can see the price of oil dropping to $40-50 in the next couple of years.

This verdict has galvanized many people behind Trump, just the opposite of what the Dems thought would happen. A new poll shows 75% of the American population thinks this White House is "out of control." Large players from Silicon Valley are also switching Shaun Maguire of Sequoia Capital announced he donated $300k to Trump.

I just donated $300k to President Trump

— Shaun Maguire (@shaunmmaguire) May 30, 2024

The timing isn't a coincidence https://t.co/LDU4nJ8FBx

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Price has been stuck at resistance for two weeks. On May 20th's report I said:

ATH resistance is the next level to watch for.

Last week, I said we were still waiting to break the ATH, nothing has changed since then:

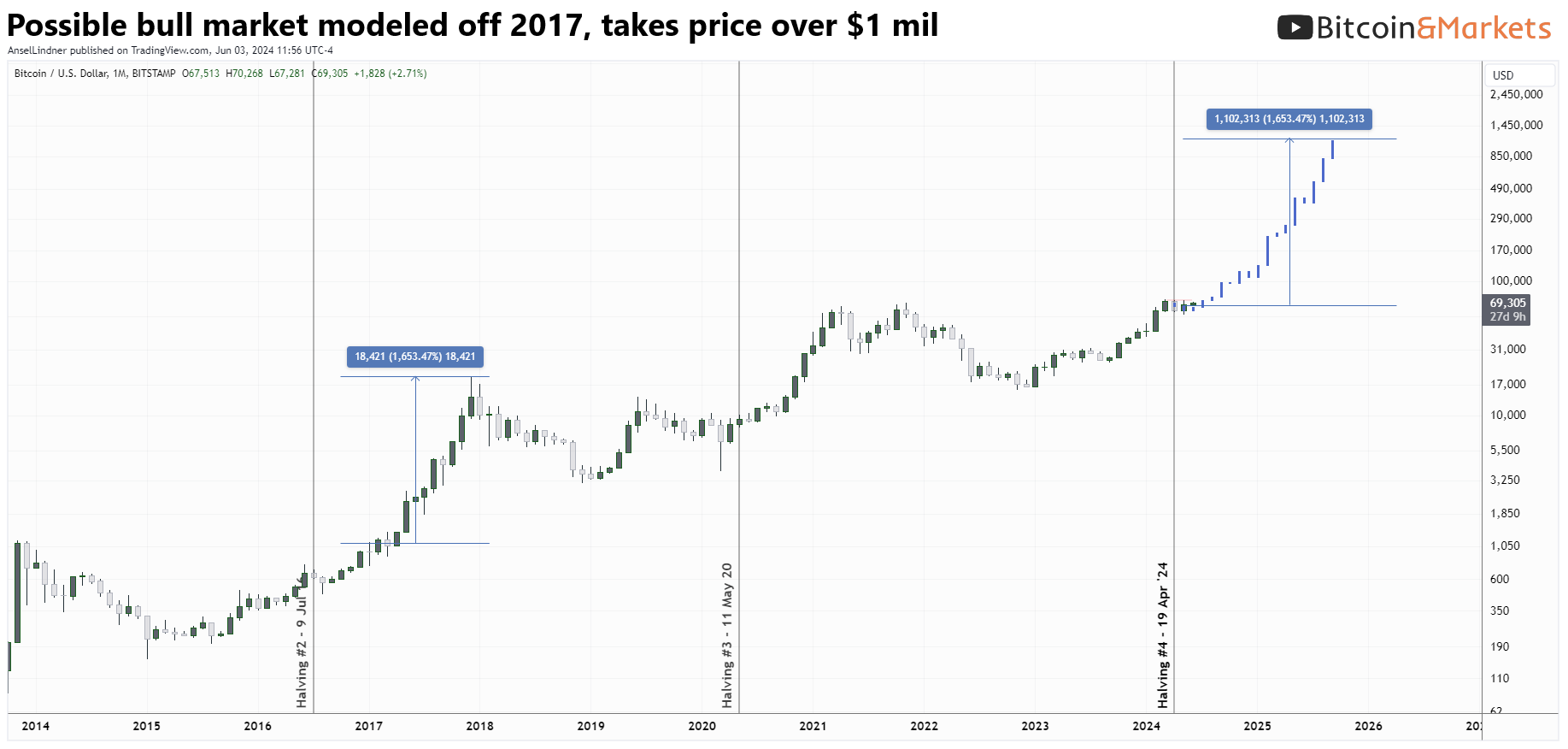

Fundamentals are so positive for bitcoin right now, when it breaks the ATH, you can expect a significant move higher.

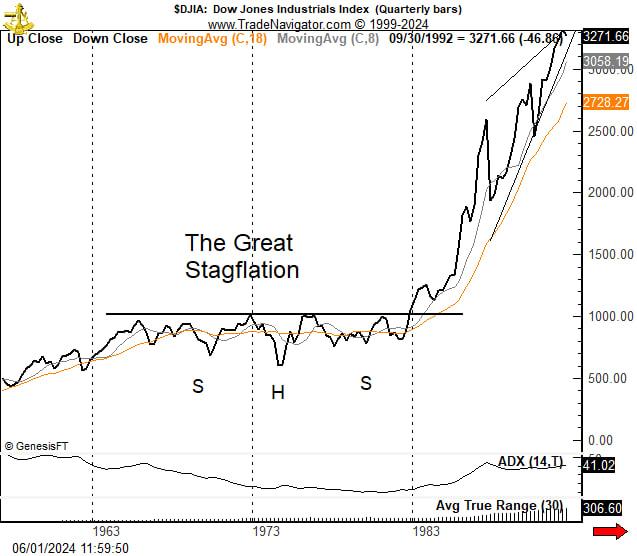

Influential trader Peter Brandt has some interesting charts this week on twitter. The first one shows the Dow Jones Industrial Average (DJIA) during the Great Stagflation of the 1970s, and the second one is Bitcoin divided by M1 money supply to show a similar pattern, not necessarily a connection.

Brandt got the idea for measuring bitcoin against M1 from Techdev who offered these charts.

You're looking at the first breakout of Bitcoin against M1 money supply since March 2017 when it went historically parabolic for 9 months.

There is more evidence building that this bull market will be like 2016-2017, not 2020. This would mean price could hit $1M this cycle. Seems crazy, but remember the Bitcoin Realignment is happening!

What about this week? The risk of a major sell off is very low. Price will continue to threaten to break to new highs. Chances of breaking the ATH are higher each week, and once we break it, there is going to be a rapid move higher for price. Time to pay attention!

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

Stablecoin issuer Tether Holdings Ltd. has acquired a $100 million stake in Bitdeer Technologies Group, the US-listed Bitcoin miner owned by Chinese billionaire Jihan Wu, with an option to purchase an additional $50 million in shares within a year.

The deal will fund an expansion of Bitdeer’s data center operations, development of ASIC-based crypto mining equipment and other general corporate purposes, Bitdeer said. The companies didn’t disclose what percentage of Bitdeer is now held by Tether under the agreement. Tether didn’t immediately respond to a request for comment.

The agreement marks a major step forward for Tether in its plan to become a major Bitcoin miner, having begun construction of its own mining facilities in Uruguay, Paraguay and El Salvador last year.

I just bought 3 Bitcoin miners that started hashing today in Iraan, TX.

— Ted Cruz (@tedcruz) May 31, 2024

I’m proud to join the ranks of Texas #BITCOIN miners! pic.twitter.com/kALhVGy13l

The Oklahoma state Senate has approved House Bill 1600, which grants tax exemptions to Bitcoin (BTC) and crypto mining operations. The bill, which now awaits the governor’s signature, was passed by the Senate on May 30 with a vote of 29 to 15, following a successful passage in the House by a 68 to 20 vote.

House Bill 1600 explicitly targets the commercial mining of digital assets, proposing tax-exempt status for selling essential mining machinery and equipment. This includes servers, computers, software, electricity, cabling, and transformers. The bill defines commercial mining as using blockchain technology to mine digital assets at a colocation facility. This legislative effort is part of a broader move to foster a crypto-friendly environment in the state, attracting more digital asset operations.

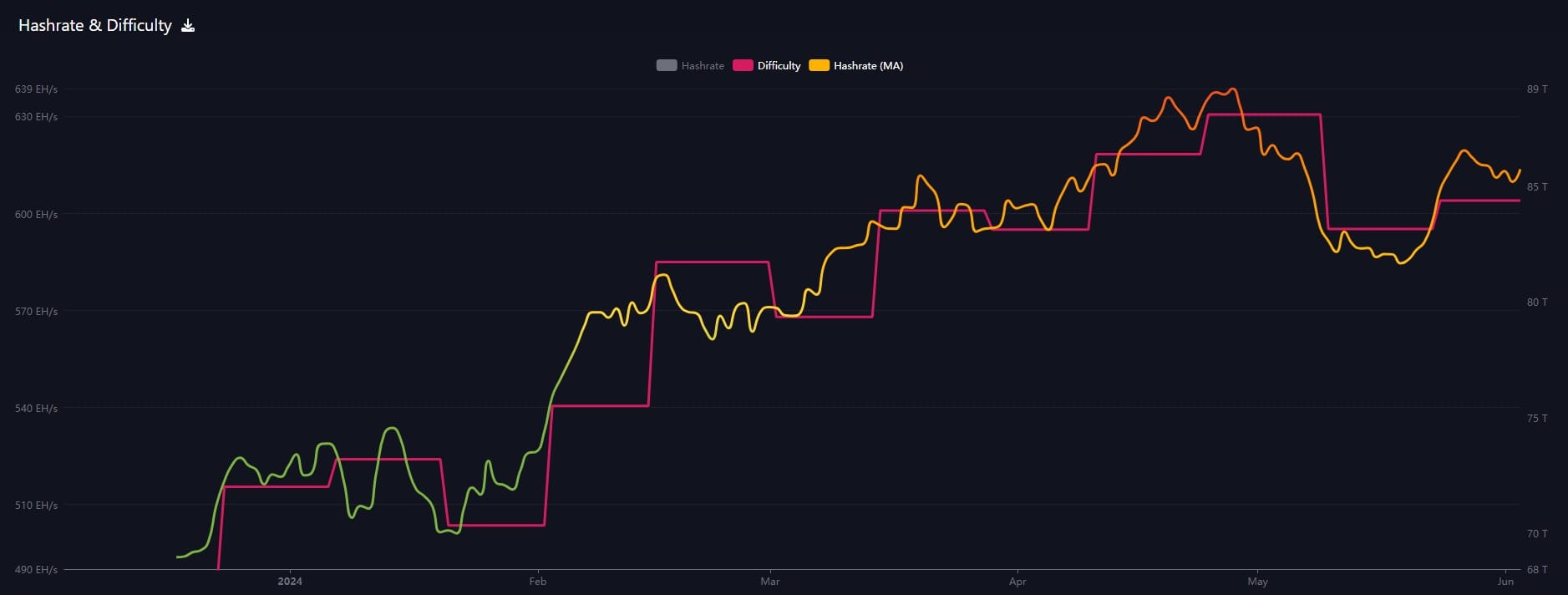

Hash rate and Difficulty

Hash rate has maintained its gains from last week. The next difficulty adjustment will be in 2 days and is estimated to be +1.5%.

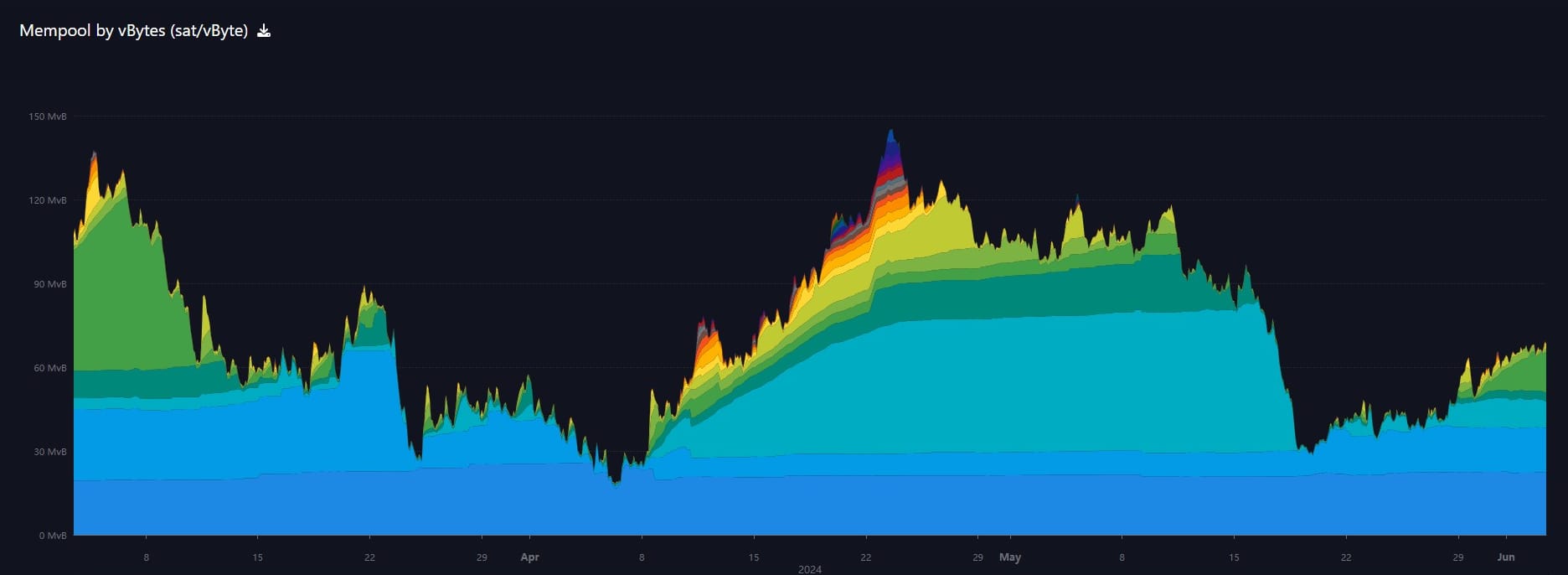

Mempool

Fees have risen slightly over the last week. On the far right, you can see that fees on May 31 did start to rise. I tweeted about it at the time, because that is a period of heightened risk for price and we were watching if the 20 DMA would hold at that time. Fees have since come back down, currently around $2.50.

Layer 2 including Token Protocols

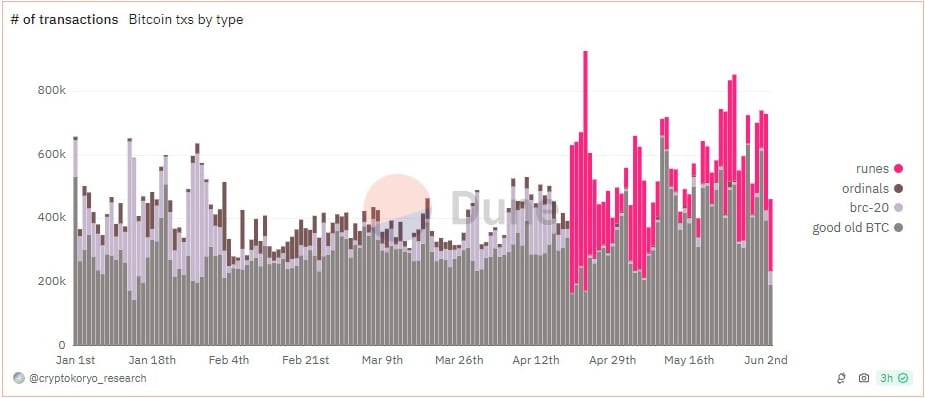

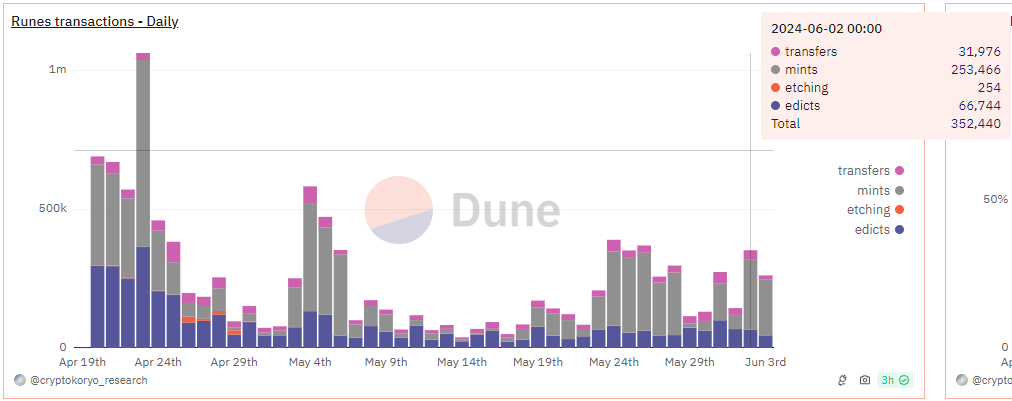

Runes

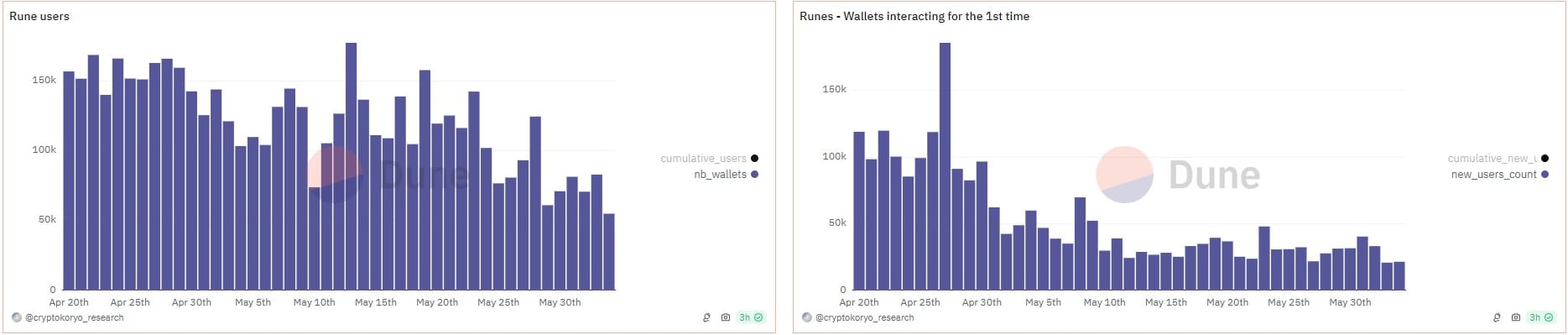

Runes volume has remained relatively high, and I wanted to take a closer look this week at the behavior we are seeing.

Here we can see that most transactions involving Runes are mints.

Their data are unclear about users. It appears that user totals are growing every day, but at a slower and slower rate. However, this does not account for new wallets by existing users. It is highly unlikely that there are 25,000 new users per day. I'd take the below charts as simply showing that activity is slowing for both existing and new users.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com