Bitcoin Fundamentals Report #292

Massive short position in bitcoin futures explained, mergers and acquisition season, ETF inflow streak, FOMC and CPI this week, plus mining industry news

June 10, 2024 | Block 847,383

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Squeeze with ATH |

| Media sentiment | Extremely Positive |

| Network traffic | Medium |

| Mining industry | M&A time |

| Price Section | |

| Weekly price* | $70,040 (+$813, +1.2%) |

| Market cap | $1.380 trillion |

| Satoshis/$1 USD | 1429 |

| 1 finney (1/10,000 btc) | $7.00 |

| Mining Sector | |

| Previous difficulty adjustment | -0.7879% |

| Next estimated adjustment | +3% in ~8 days |

| Mempool | 249MB |

| Fees for next block (sats/byte) | $5.39 (55 s/vb) |

| Low Priority fee | $4.12 |

| Lightning Network** | |

| Capacity | 4984.08 btc (+1.0%, +51) |

| Channels | 52,002 (+0.0%, +4) |

In Case You Missed It...

Bitcoin Magazine Pro

- The Central Bank Tipping Point and the Rise of Bitcoin

- Market Tracker breakdown: By The Numbers: Key Bitcoin Metrics, Cycles, and Macro Positioning

- Mining Tracker breakdown: By The Numbers: Miners, Metrics and Market Movements

Member

- The Central Bank Tipping Point and the Rise of Bitcoin

- Full Bitcoin Update, Charts and Emerging Fundamentals - Premium

- 💢 June price forecast competition

Community streams and Podcast

Blog

- Demographic Collapse: Effects of Urbanization

- Discussing Reserves: Sources, Utility and Why QE Doesn't Work

- A Response from Team Transitory

Headlines

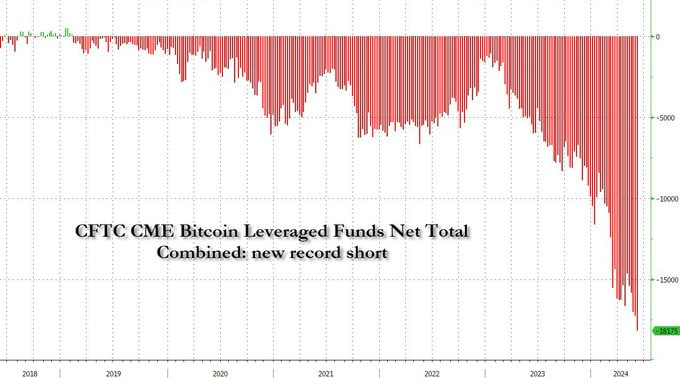

- Record high shorts in Bitcoin

I've seen this chart all over the place this week. It shows the number of shorts building up on the CME. I can't cite the original source because it was re-shared so many times.

The normie take is that these are shorts that will be squeezed and fuel a moon shot once we break ATH resistance. That's not exactly what is happening.

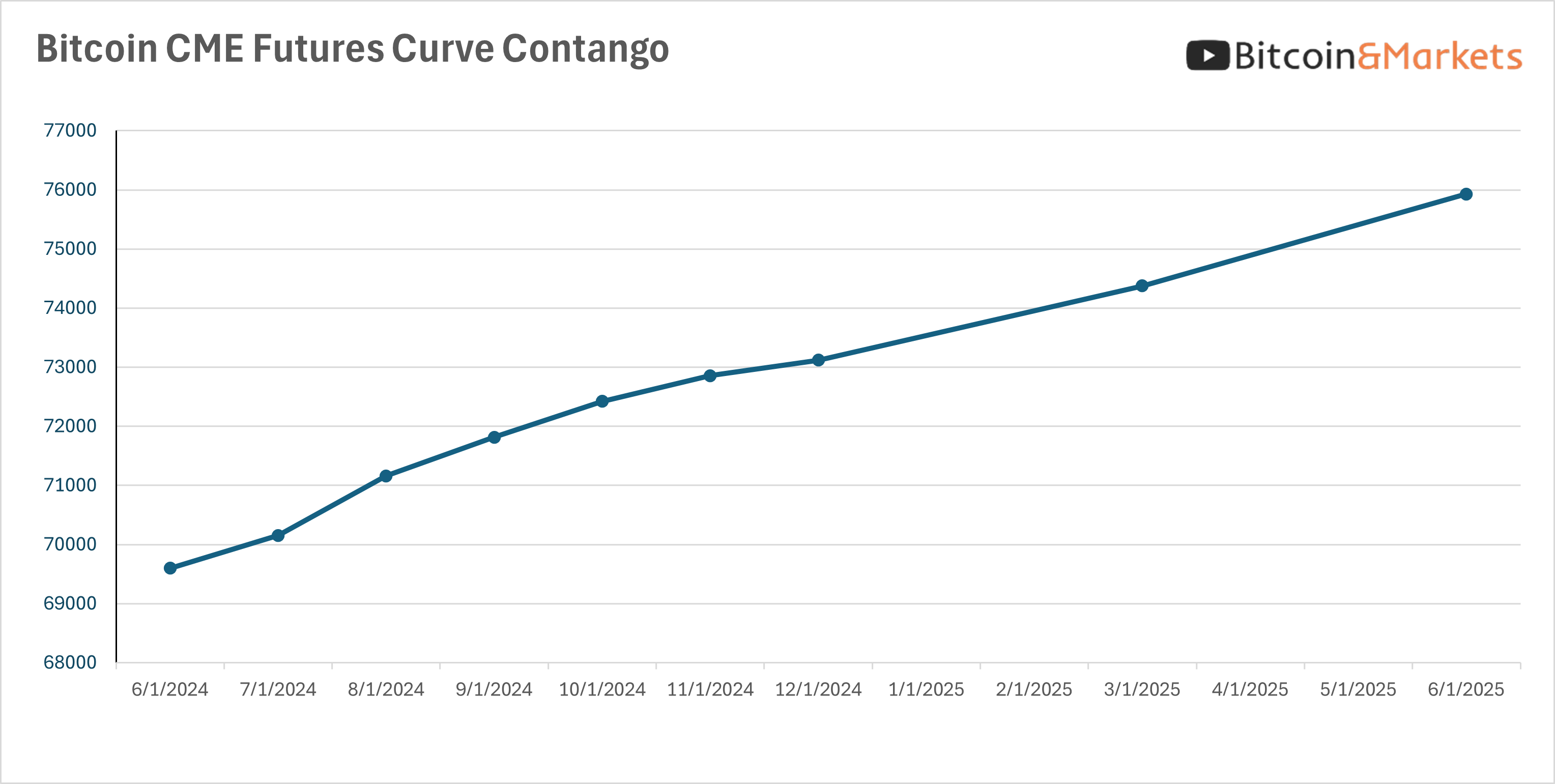

I'm not surprised at all by this. I've been talking about the carry trade for weeks. Specifically, on Bitcoin Magazine Pro where we go over the derivatives market in detail. Bitcoin has been deep in contango for months. This enables hedge funds to short futures and buy spot.

This will have the effect of pushing supply into hoards today, to be released in the future, resulting in price increasing. This carry trade has a very utilitarian reason behind it. Traders want to go long, and someone has to take the other side of the trade. Hedge funds will gladly oblige and reap the premium in the process. They'll take the short side, and buy spot. Large hedge funds with a position in the ETF now, like Millennium's $2 billion position, will hedge with some shorts.

There will not be a technical squeeze in this case, but there will be some closing of shorts if we crack the ATH and shoot higher. There's less need for a downside hedge if we are heading to the moon. For instance, if a hedge fund has a quarterly short on at $70k and the price goes to $78k, they could roll that short to a higher spot, wherever the market is pricing it above spot, say to $80k. They aren't squeezed, they are reestablishing at a higher price and are hedged on both sides.

BREAKING: ROBINHOOD BUYS #BITCOIN AND CRYPTO EXCHANGE BITSTAMP FOR $200 MILLION. pic.twitter.com/Q9LfBDw3Di

— Bitcoin Magazine (@BitcoinMagazine) June 6, 2024

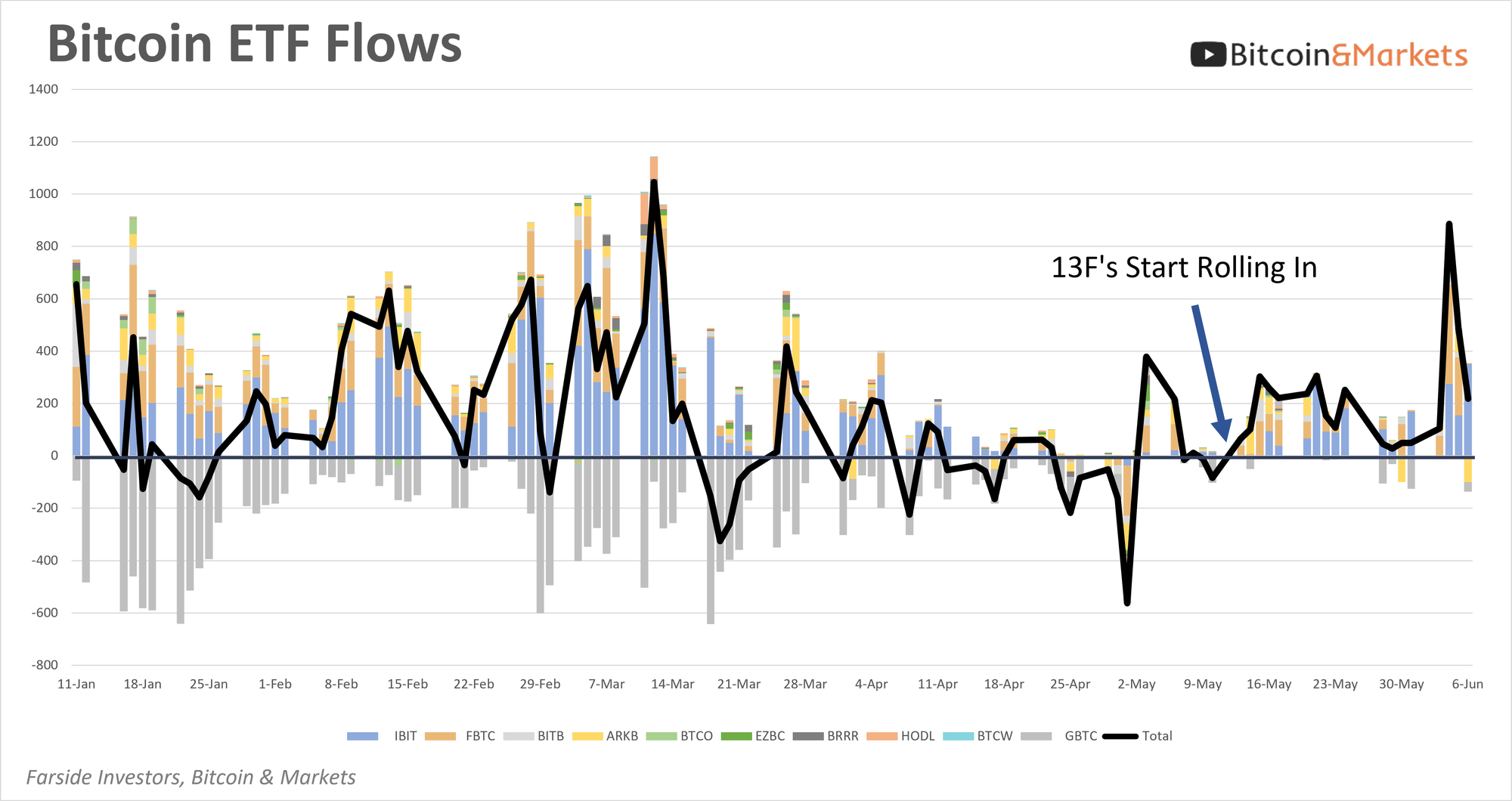

I said the 13F filings would cause more inflows, and I've been right. Last week alone there were $1.8 billion in inflows, averaging $366M/day. During this record streak a total of $4 billion has flowed into the ETFs. Remember, before the ETF launch, rosy projections were for $10 billion in 2024. It is now at $15 billion with 6 months to go. Each 13F will cause more people to allocate. This is just getting started.

Macro

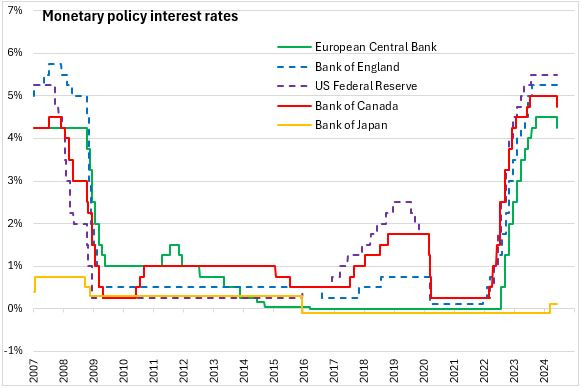

The Bank of Canada (BoC) became the first G7 nation to cut interest rates this week, reducing its key policy rate from 5% to 4.75%. This was followed the next day by the European Central Bank (ECB) cutting its key interest rate from 4% to 3.75%, despite ongoing inflationary pressures in the euro zone. These cuts are a huge signal of a coordinated shift in monetary policy. To switch to fighting a slowdown from fighting inflation is a serious juggling act.

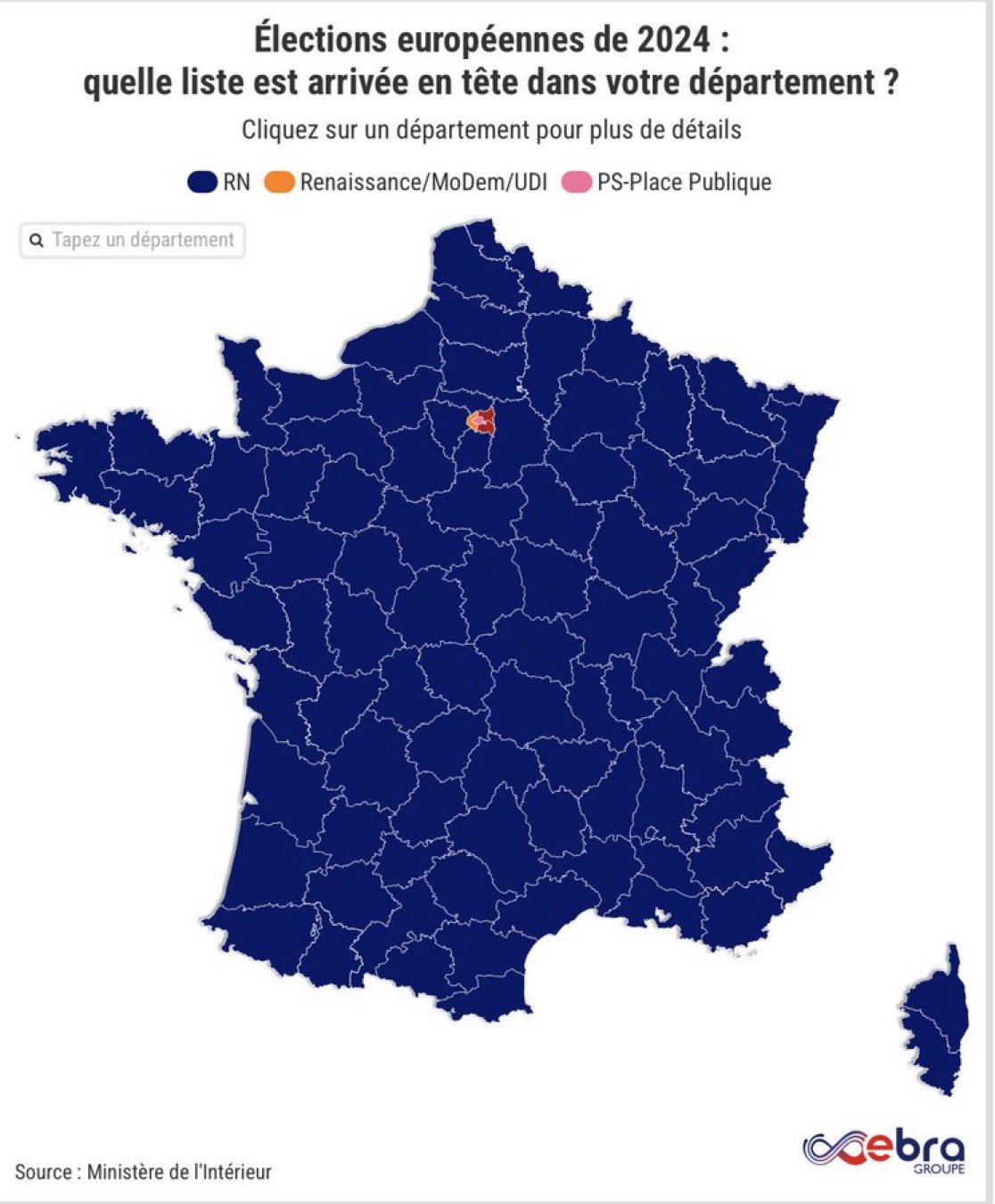

I've been saying it for years, the pendulum will swing back. The globalists are losing on all fronts. The EU elections notably swung hard against them. Macron in France was crushed, 15% to Le Pen's 30%. This is what French politics looks like.

Macron was so crushed, he instantly dissolved parliament and called for new elections. Some sources are saying that Macron is calling the populists' bluff and making them vote in national, instead of EU elections. That is going to turn out badly.

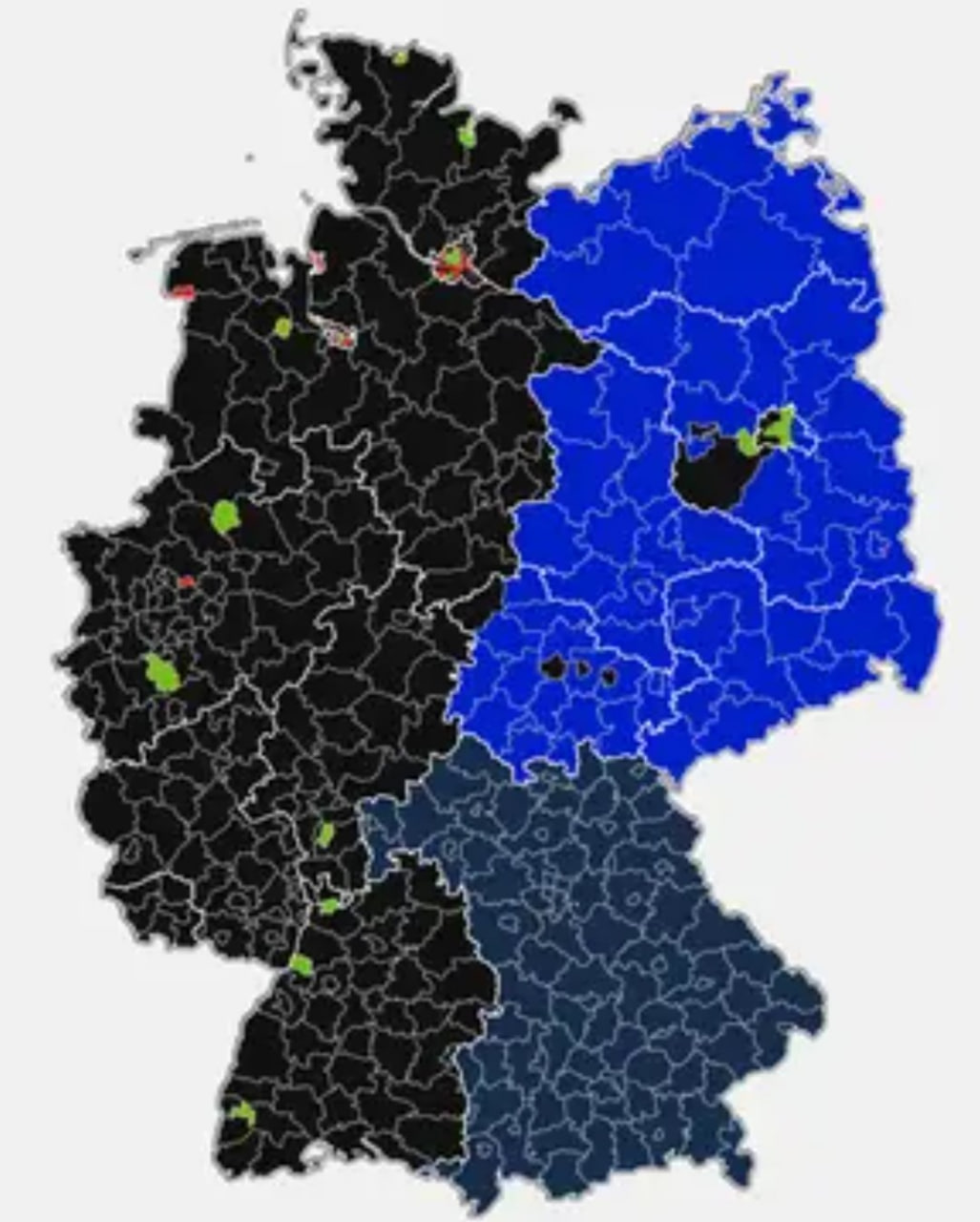

German Chancellor Olaf Scholz's party slipped to third, behind the center-right alliance and the surging populist AfD party. In the Netherlands, the conservatives surged but were held at bay by a coalition globalist party. Still a good showing. In Austria, the populist anti-immigrant Freedom Party notched a victory with 25% of the vote, winning it 3 more seats in the EU parliament. Spain's populists also won this weekend, with the combined "right" getting 50% of the vote. Flemish nationalist parties dominated general elections in Belgium.

Overall, there was a hard shift toward populist nationalism, which is likely to be mirrored in the US this November, as well. This is a pro-people movement, that cobbles together the anti-war and anti-immigration issues. The globalists position, which cedes sovereignty to a bureaucratic Marxist elite, lost big.

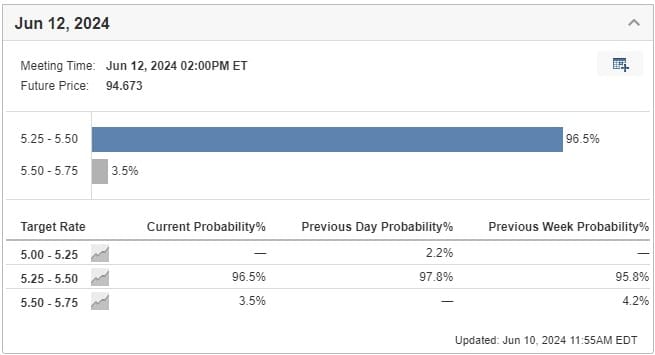

- FOMC and CPI this week

FOMC will publish their next policy decision on Wednesday. Remember, last meeting they said they were going to start tapering QT, so we'll have to see what they say about that. Other central banks are cutting, and I'm sure Powell wants to cut. He likely sees the risks as asymmetric, meaning it is worse to be late than to cut a little early when going into recession.

As for market positioning, it does not expect a cut, with even a 3% possibility of a hike!? I think the probability of a cut is higher than people think.

CPI is also coming out Wednesday, with forecasts of 0.08% MoM. The base effect from May 2024 is 0.1%. That means even with a low MoM, it is unlikely to affect the YoY number much. That is unless we get a 0.0% or lower in May. That is unlikely but possible. Shelter is just too big of a force right now.

If CPI misses to the upside above 0.1%, there will likely be a negative reaction by the market and risk of bitcoin moving lower is elevated. However, on forecast or under will be bullish.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

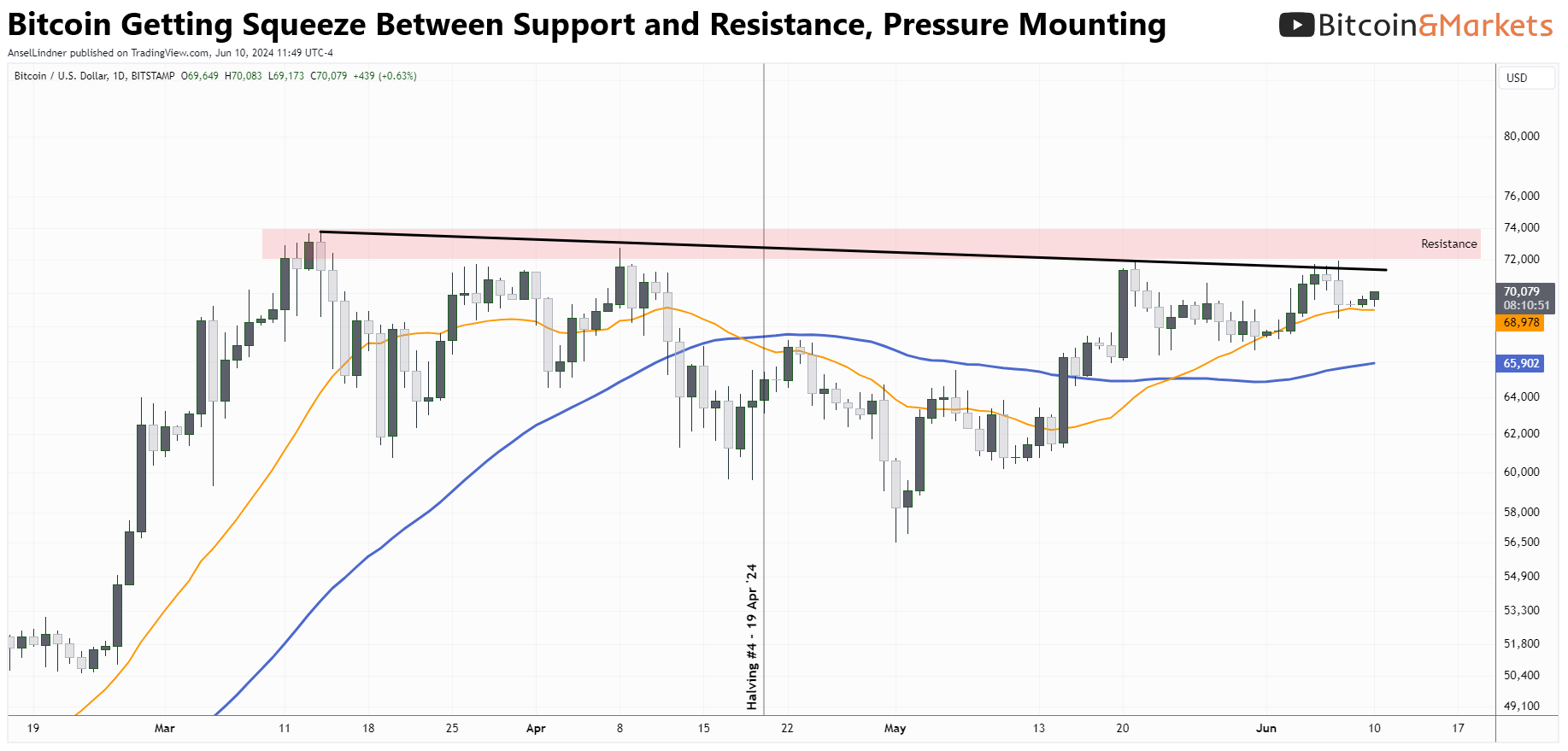

Here on the Bitcoin Fundamentals Report I've been talking about the resistance at the ATH zone for the last 3 weeks. Last week:

The risk of a major sell off is very low. Price will continue to threaten to break to new highs. Chances of breaking the ATH are higher each week, and once we break it, there is going to be a rapid move higher for price.

We haven't moved much at all, still pinned between strong support and resistance. The 20-day that we were watching 2 weeks ago, held again. It is getting closer and closer to forcing a decision, up or down. Are you ready for some fireworks.

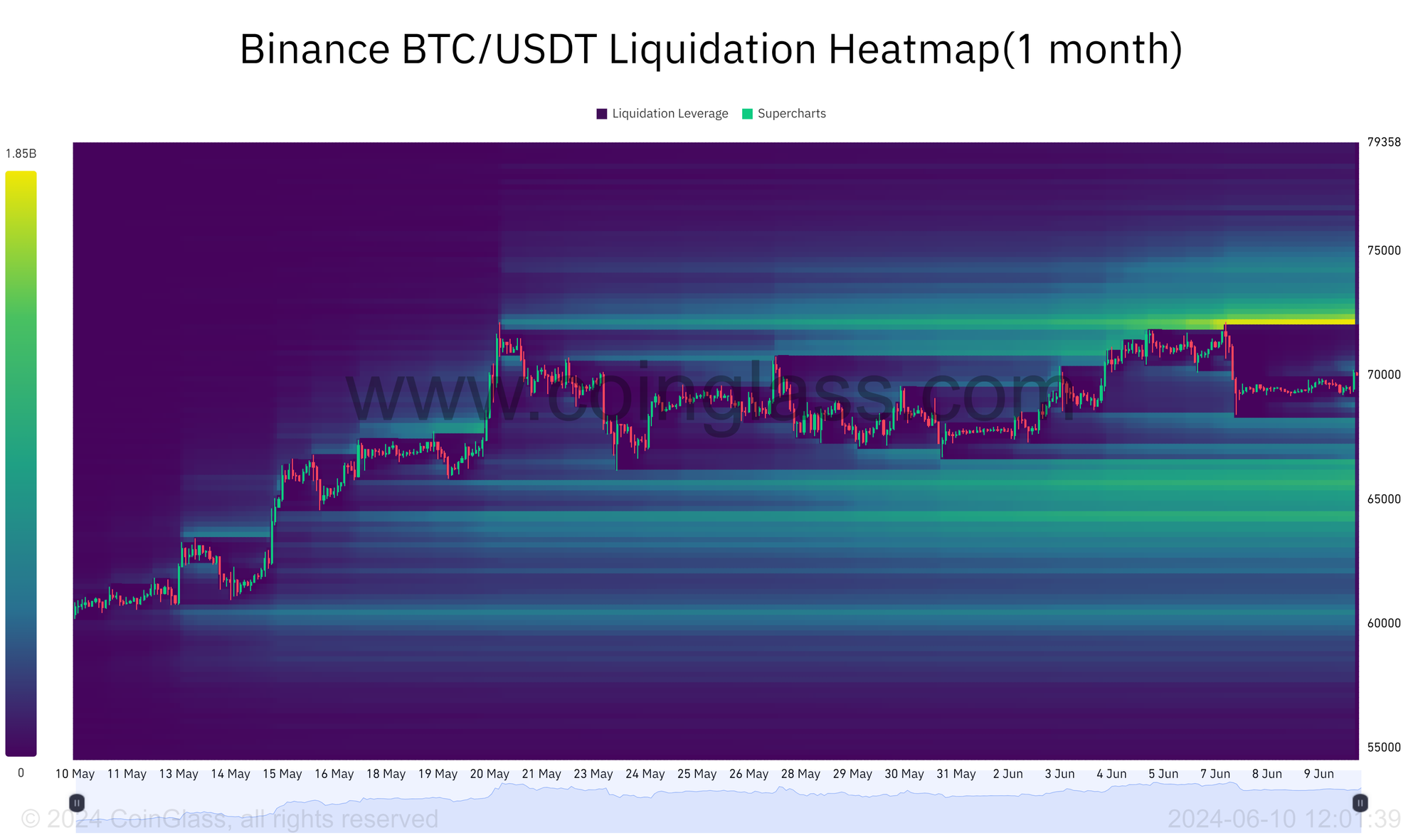

A move up is much more likely. The liquidation heat map is stellar. That yellow line is approximately $1.8 billion in liquidations at $72.3k on Binance alone. All that liquidity is like a magnet for price.

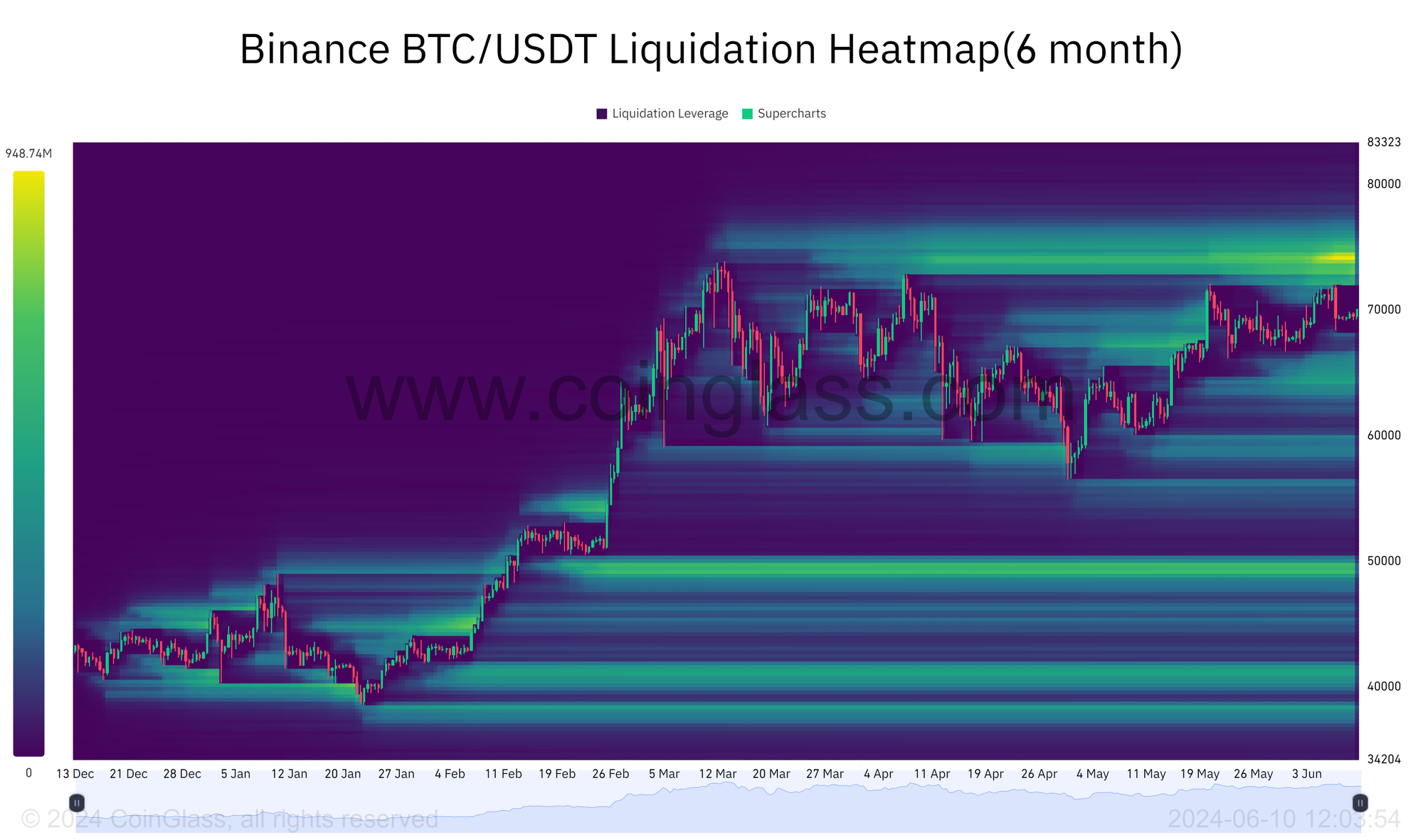

Zooming out to the 6 month view below, the absolutely massive short liquidation level at ATH stands out. I'm estimating that at roughly $5 billion on Binance alone. These liquidations are different than the short positions of hedge funds discussed above. Those are typically done on CME and don't have a liquidation level per se. This is leveraged traders on bitcoin exchanges that are going to have to buy the bitcoin as they get liquidated. That is enough to rocket bitcoin to $80k in a day or two.

That could quickly lead to a FOMO feedback loop. Institutions dragging their feet will jump in rapidly. This thing might have the power to rally 25-30% in two weeks. I'm not necessarily saying that will happen this week, but I'm confident that the ATH break will be explosive.

As for this week, not much has changed since last. Each week continues to increase the likelihood of a breakout. Heat maps and ETF flows point to an imminent breakout and hunt for liquidity, leading to a major move higher.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

Bitcoin miner Core Scientific rejected an all-cash buyout offer of more than $1 billion from cloud computing company CoreWeave, saying in a news release that the offer significantly undervalued it.

This unsolicited proposal immediately followed Core Scientific and CoreWeave entering into a separate series of 12-year contracts for Core Scientific to provide about 200 MW of infrastructure to host CoreWeave’s high-performance computing services.

Shares of miners such as Stronghold (SDIG), Core Scientific and TeraWulf (WULF) surged more than 15%. Gains in Iris Energy (IREN), Mawson (MIGI), Cathedra (CBIT) and Argo Blockchain exceeded 10%.

Most recently, one of the largest miners, Riot Platforms (RIOT), started a hostile takeover attempt of peer Bitfarms (BITF), while artificial intelligence firm CoreWeave proposed buying another mega-cap miner, CoreScientific (CORZ).

Although Bitfarms and CoreScientific both rejected the offers, the takeover attempts have reminded investors that the industry may be primed for mergers.

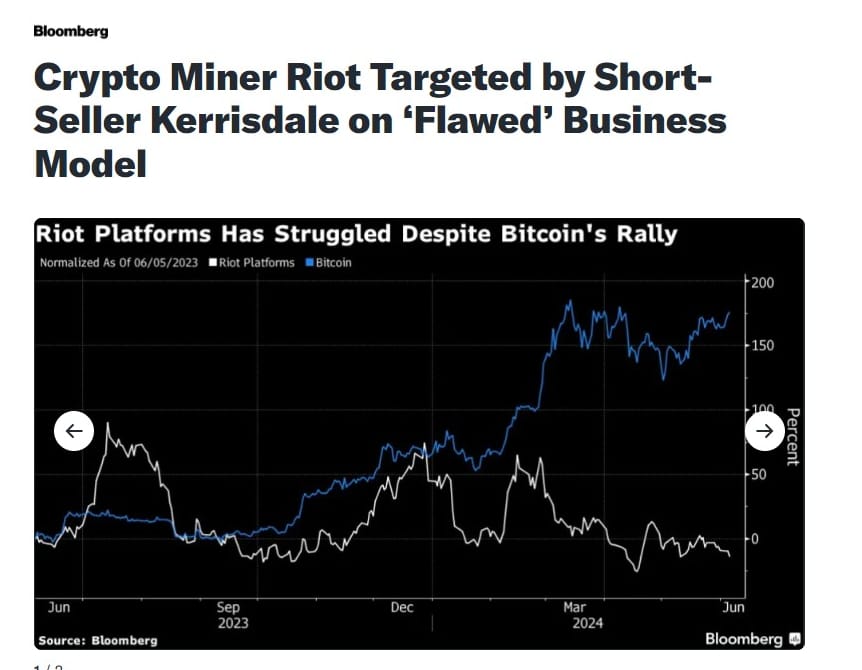

The strategy is part of bets the short-seller has been making across the industry with its latest short position targeting Riot Platforms Inc. The thesis is that investing in a business built to corral unpredictable revenue in a tremendously competitive environment is flawed when crypto believers can instead buy Bitcoin outright.

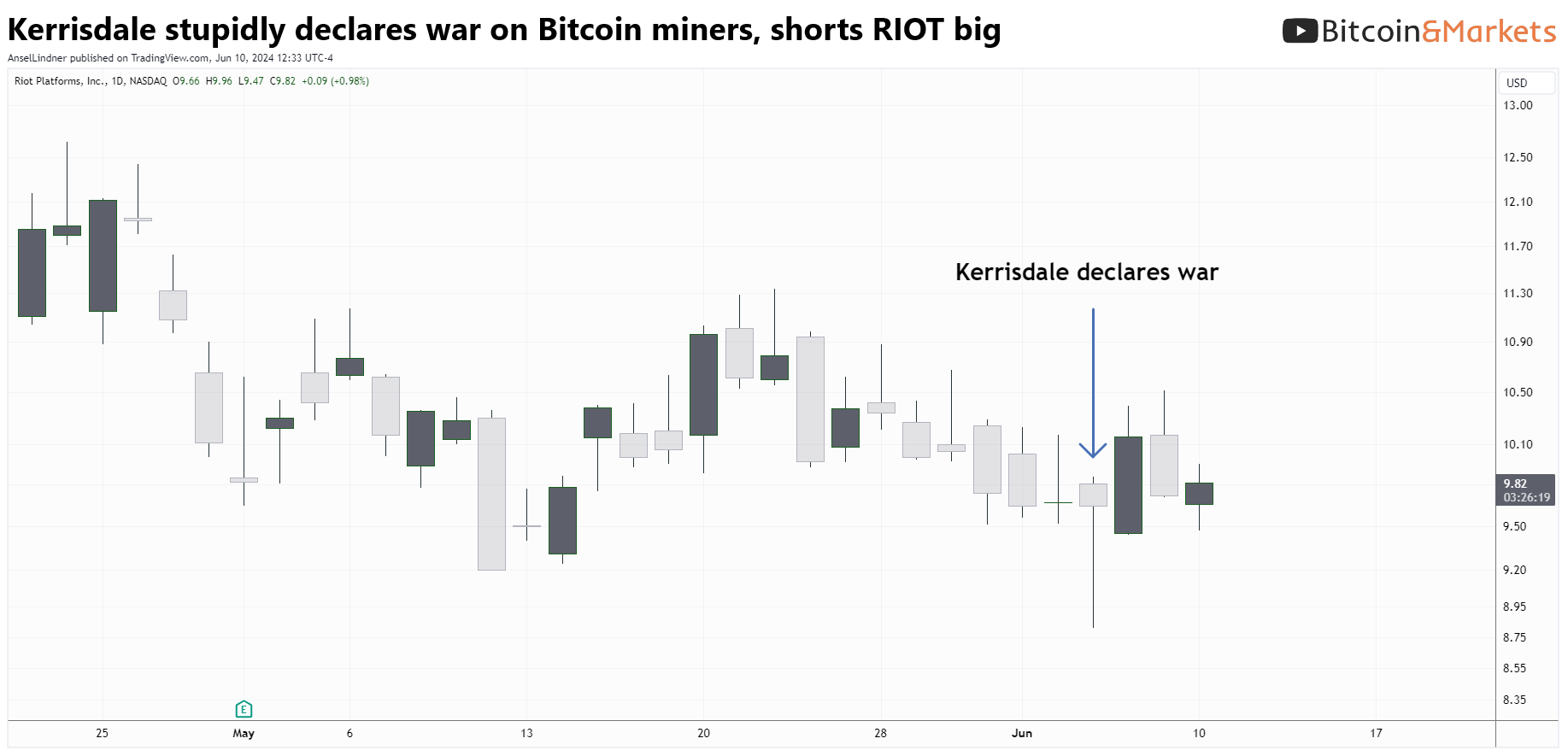

June 5th, they tweeted their declaration of "war" against bitcoin miners and RIOT. Let's see if they can call the bottom. So far, the price is almost exactly where it opened June 5th, while other miners are up huge. If right catches up, it's going to be painful for Kerrisdale.

Hash rate and Difficulty

Hash rate had a terrible week last week. It dropped so much, it was able to pull the difficulty adjustment, which was estimated to be 1.5% just 2 days prior, to come out to be negative 0.78%.

Mempool

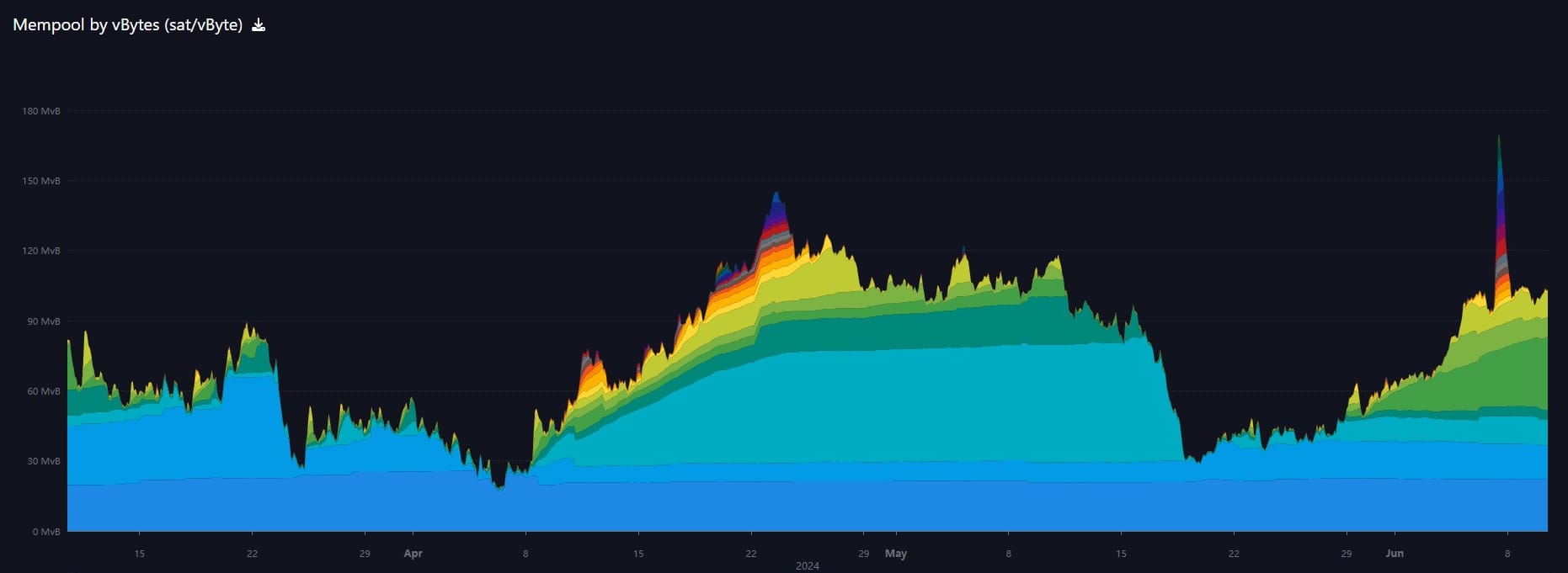

What a wild ride for the mempool and fees this week. That massive spike on June 7 was due to a mess up from OKX wallet consolidation. They clogged the network for a couple hours causing fees to spike. Everything shortly returned to normal.

Layer 2 including Token Protocols

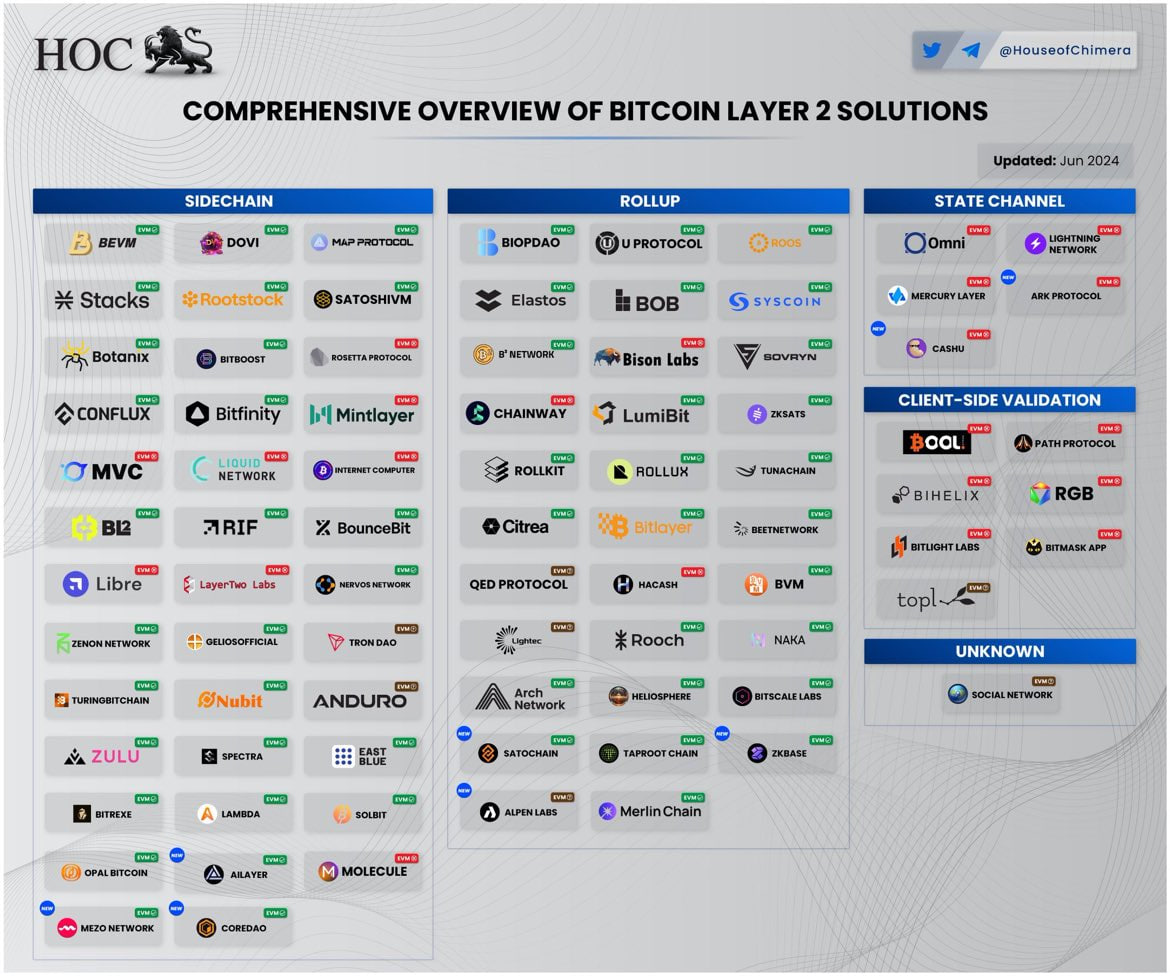

Love it or hate it, bitcoin layer 2 is where the innovative energy is. Nothing that will stick has come out of these groups yet that I'm aware of, but I like that fact that the sidechain section is the biggest.

Runes

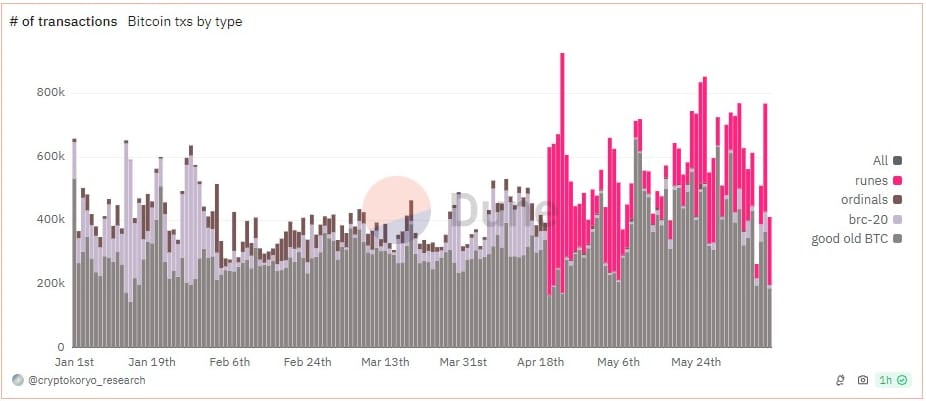

Runes volume has remained relatively high with 339,000 transactions yesterday, suggesting that speculative interest in bitcoin is healthy.

Lightning

Quick update on Lightning Network, capacity has increased slightly over the last couple of months as the number of channels continues to decline. Lightning is serving a specific sort of power user, but has failed to get mainstream product market fit. Recent use of Lighting + Liquid is personally the most exciting Layer 2 development recently.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com