Bitcoin Fundamentals Report #296

Germany dumps bitcoin, ETF flows turn positive, China in economic trouble, Price analysis and mining sector updates.

July 8, 2024 | Block 851,295

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Possible bottom |

| Media sentiment | Indifferent |

| Network traffic | Very low |

| Mining industry | Struggling and shifting |

| Price Section | |

| Weekly price* | $56,525 (-$7,257, -11.4%) |

| Market cap | $1.112 trillion |

| Satoshis/$1 USD | 1770 |

| 1 finney (1/10,000 btc) | $5.65 |

| Mining Sector | |

| Previous difficulty adjustment | -4.9956% |

| Next estimated adjustment | +1.5% in ~10 days |

| Mempool | 175MB |

| Fees for next block (sats/byte) | $0.47 (6 s/vb) |

| Low Priority fee | $0.47 |

| Lightning Network** | |

| Capacity | 5162.68 btc (+0.9%, +45) |

| Channels | 51,050 (-0.6%, -310) |

In Case You Missed It...

Bitcoin Magazine Pro

- Analyzing Bitcoin’s Current Correction and Future Forecasts

- Mining Tracker breakdown: Bitcoin Miners Weather Market Disturbances

Member

- BMPRO content a few days delayed

- Short, Medium and Long Term Forecast Update - Premium

- 💢 July price forecast competition

Community streams and Podcast

Blog

- Demographic Collapse: Effects of Urbanization

- Discussing Reserves: Sources, Utility and Why QE Doesn't Work

- A Response from Team Transitory

Headlines

Something is rotten in Deutschland.

The German Government sent another 5200 BTC ($297.3M) to Kraken, Bitstamp, Coinbase and 139Po right after we posted this tweet. That makes this the biggest day for them so far - over 16,000 BTC in total.

— Arkham (@ArkhamIntel) July 8, 2024

They currently hold 23,787.7 BTC ($1.35B). Less than half of the BTC… pic.twitter.com/tO7r0J0w08

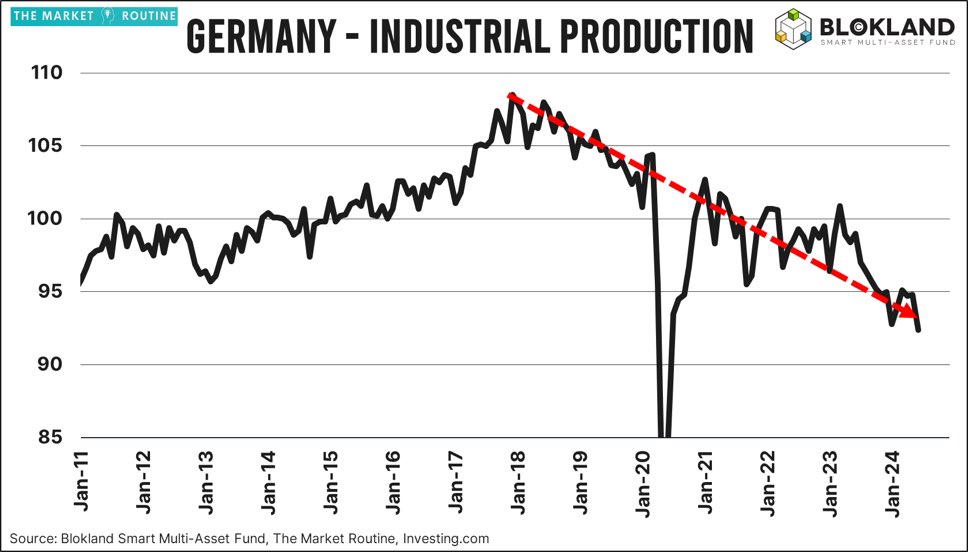

I still do not see this as the result of an anti-bitcoin stance, I see it as Germany needing money badly. Their industrial base continues to collapse, they're in a rapidly worsening demographic collapse, and they suppressing the democratic process there. The German people, especially young people are waking up.

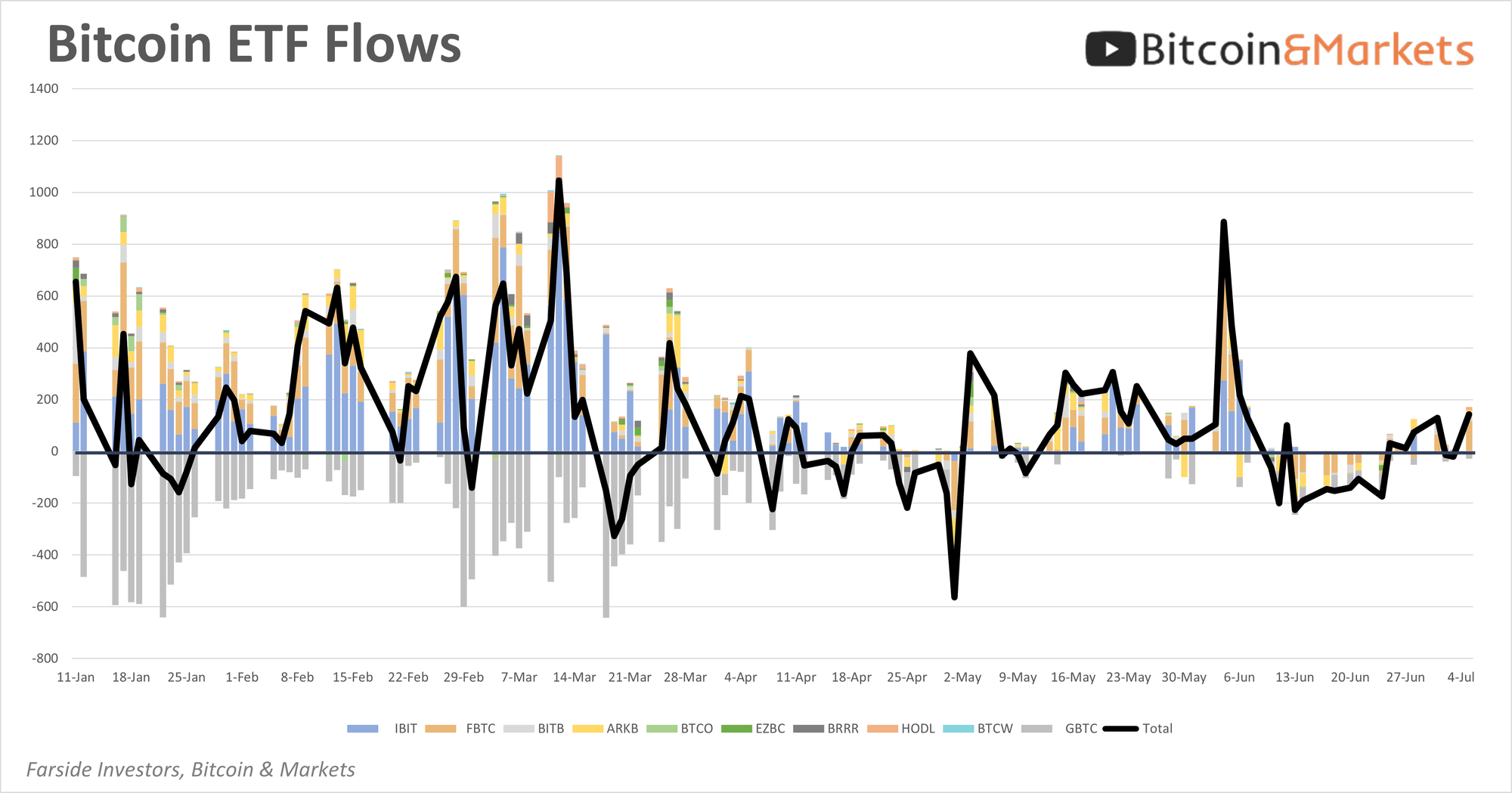

- ETF flows turn positive last week

Following the record setting 19-day streak of inflows ending on 12 June, the Bitcoin ETFs experienced a string of outflows. Those outflows seem to have stopped with the shortened last week seeing a total of $238 million of inflows. To put that into perspective, this is roughly the same amount of dumping going on by Germany. YTD the average inflow to the ETFs is still at $118 million/day.

- Metaplanet and Bitcoin Magazine plot thickens

I was unaware of this move but it makes sense. Bitcoin Magazine started UTXO Management, where Dylan LeClair and Sam Rule ended up after leaving Bitcoin Magazine PRO. Sam is still at UTXO, but Dylan has moved on to Metaplanet.

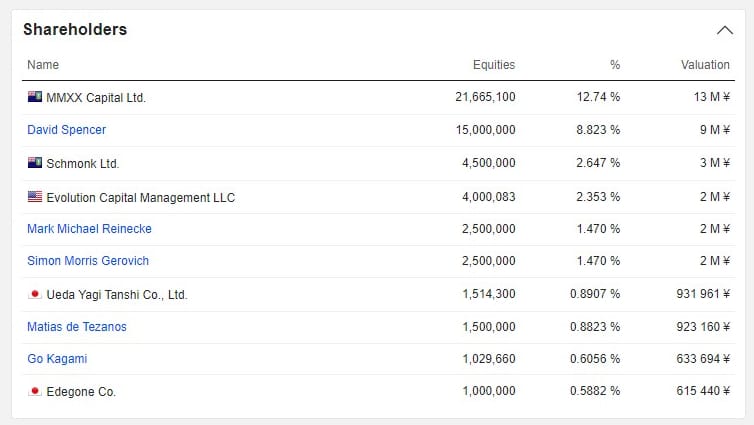

Metaplanet's largest shareholder is MMXX Capital, which is a "cryptocurrency" accelerator. It's hard to find any information on the company itself, especially due to its website being private. Note, they own 21 million shares.

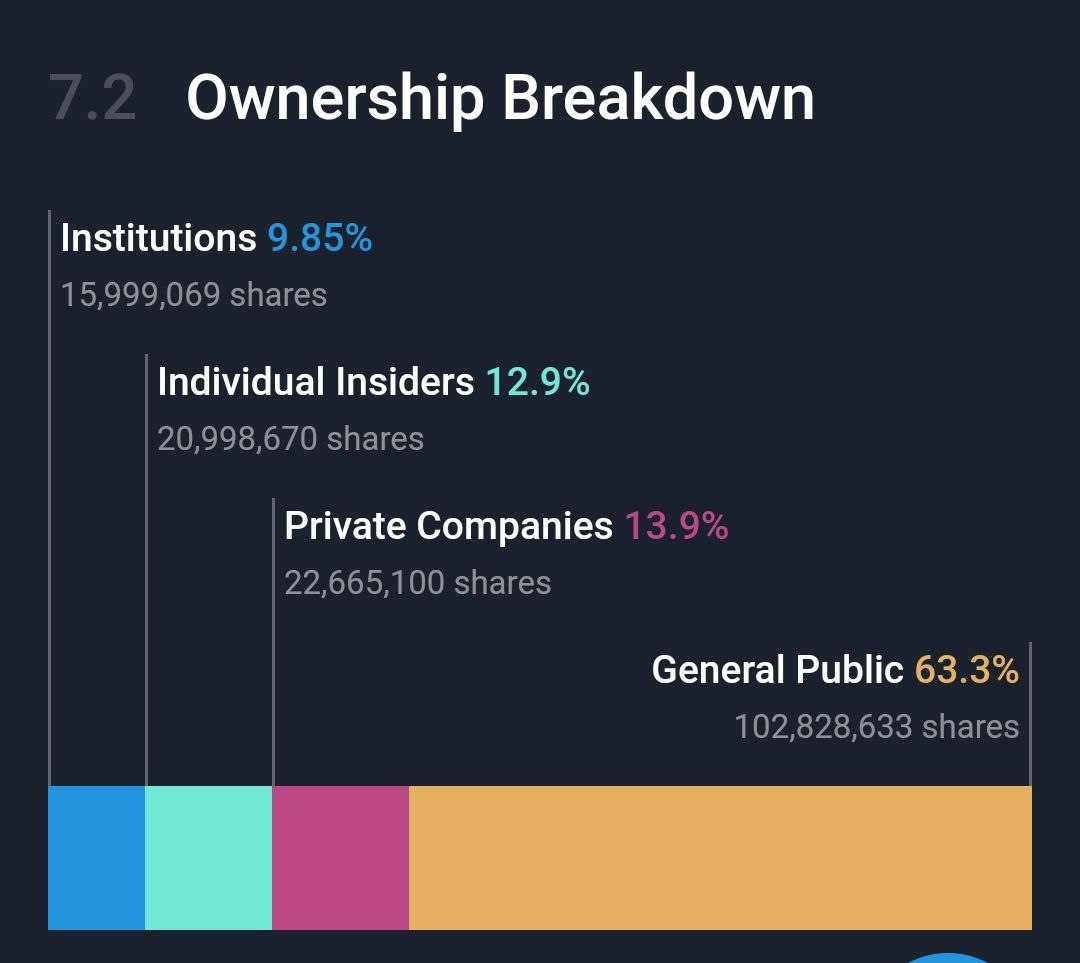

However, they don't hold a controlling number of shares, with 63% owned by the "general public."

Therefore, IDK exactly what Bailey is talking about here, the board has not changed recently. Unless Bailey is associated with MMXX (major shitcoin investor shop), who is now the largest shareholder, and convinced them to pivot to this strategy, and installing Dylan as director of Bitcoin strategy.

Macro

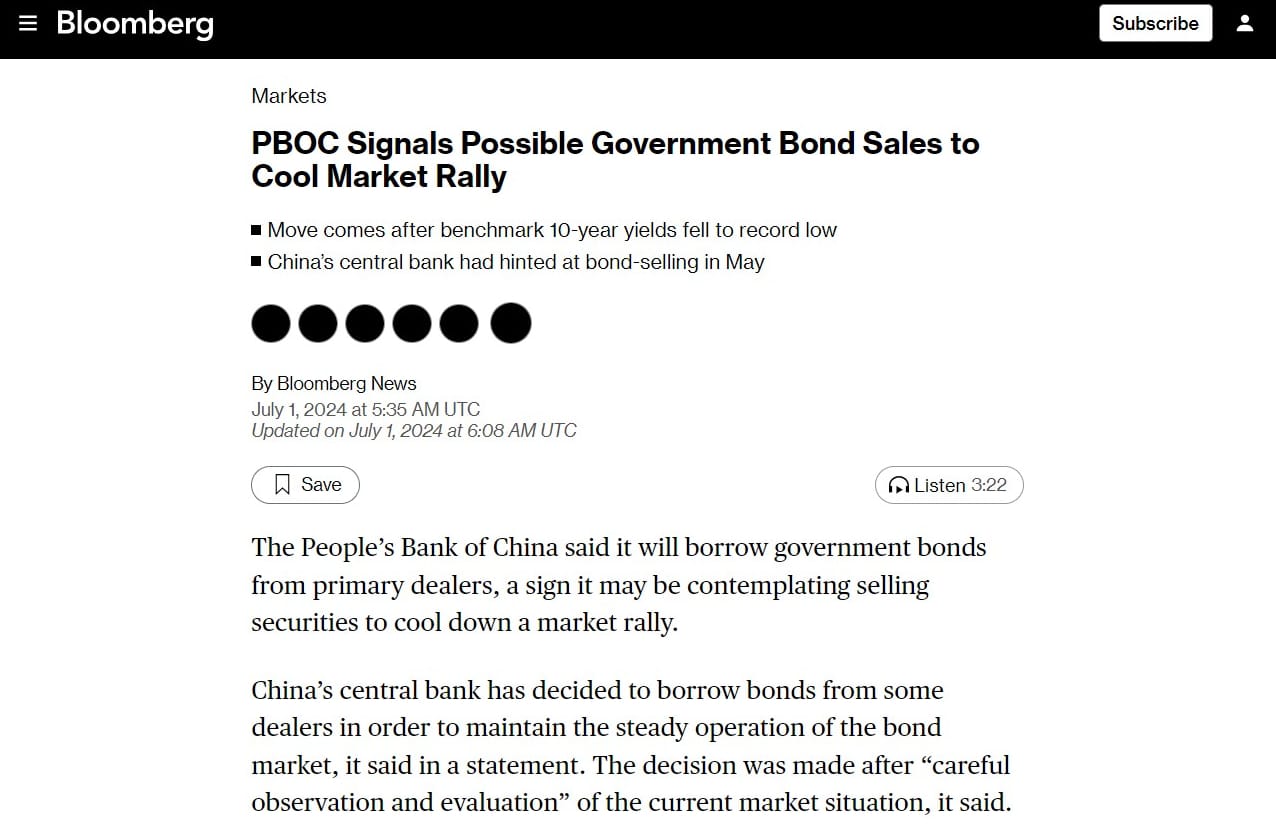

This is an interesting story if you think of the mechanics of it. Chinese gov bond yields are crashing to record lows due to horrible economic conditions there. What does the Fed typically do when the US enters recession? They BUY bonds. Yields will start falling naturally, the the Fed starts buying bonds, the exact opposite of what China is likely to start doing. We are told that QE (buying bonds) is stimulus AND that QT (selling bonds) is stimulus. Which is it macro pundits?

Bottom line for this story about China is that their economy is in a slow motion communist collapse. We can't say "free fall" because there are so many communist regulations to keep the economy become marked to market.

Also, notice in the article, the PBOC has to borrow bonds to sell them which does not match other central bank playbooks. Why does the CCP not institute massive deficit spending to increase the supply of government bonds like the US? Because the yuan is already under massive forex pressure.

- French Elections

The National Rally won the popular vote by a large margin, but were the aim of collusion by other parties to keep their seats to a minimum. The other parties strategically dropped candidates for seats to get this outcome. France is going to get hotter because of this. The NFP are already demanding Macron step down. This will likely lead to new elections soon anyway.

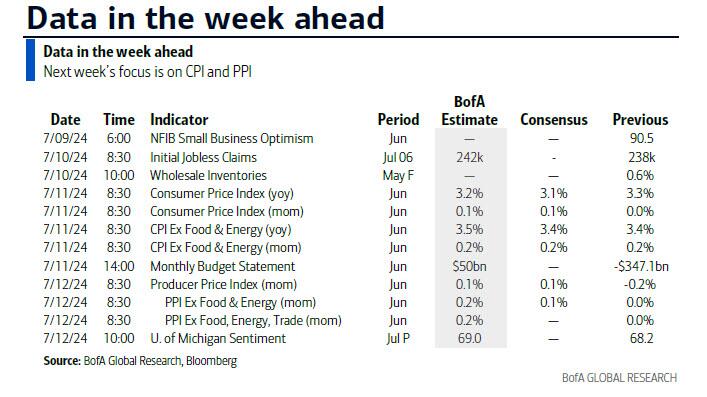

- Main Events in the Coming Week

June CPI will be released Thursday this week with a concensus forecast of 0.1% MoM and the YoY number falling once again. The number being replaced in the base effect from June '23 is 0.21% MoM. This base effect will get very interesting in August, with the August '23 number at 0.51% MoM. Therefore, within 3 months, we might see the YoY CPI number drop to 2.5% or below.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last week:

My important levels to watch are the top of the flag at $61,800. If we close below that number, we will likely see a lower low close and bullish divergence. To the upside, the level to watch is the 50-day MA at $66,500.

Last week I warned of possible downside, though I'm still overall bullish. We did break below the $61,800 level I warned about and did close at a bullish divergence, in oversold territory.

From a mood perspective, we are very bearish, but the context is extremely important. We aren't bearish in a neutral stance or even at a near ATH correction. We are bearish in a very oversold position, with a bull div.

The weekly chart is in a rare place, with price threatening to close under the lower Bband for only the third time in a bull market. That is if we consider the COVID crash a bull market. Also note, that was before the halving, we are currently in a bull market after the halving. This would be unprecedented.

Bitcoin on exchanges has also changed dramatically since the big sell off on 4-5 July, despite Germany dumping coins. There are many hodlers of last resort who are buying the dip.

In fact, spot demand is the substantial share of buying, approximately 4x as much as the ETF demand! You can clearly see on the below chart that the fundamental flows do not match price action over the last couple of weeks, telling me that this is FUD driven pricing and will snap back the other way once it starts moving.

It is impossible to call an exact bottom, but I can draw attention to certain indicators are are telling us this drawdown is close to over. IMO price is has bottomed or will bottom with one more flush being less likely. With ETH flows turning positive again, the FUD around MtGox disbursements waning, and Germany unable to maintain dumping for much longer, as well as the price being oversold on the daily for the first time since August '23, all these things are pointing to limited downside risk.

The preponderance of risk is in an upward move. This can happen rapidly and gain fuel from liquidations.

Important levels to the downside is a new intraday low below $54,300. If that breaks price might give us a gift of being able to buy at $50,000. To the upside, we have to be eyeing the 50-day MA ($65,400) and the 20-week ($65,200).

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

Bitcoin (BTC) mining was more profitable in June than May as the price of the cryptocurrency rose 2% and the network hashrate dropped by 5%, and as the market adjusted to the effects of the halving, investment bank Jefferies said in a research report on Monday.

“June was a month of modest recovery from the immediate impacts of the halving that were most pronounced in May,” analyst Jonathan Petersen wrote.

The bank noted that a number of bitcoin miners have pivoted towards to high-performance computing (HPC) and artificial intelligence (AI) hosting to diversify their revenue and capitalize on surging demand for AI and cloud computing infrastructure.

“This strategic shift has been driven by the declining profitability of bitcoin mining, particularly after the recent halving events,” Petersen wrote.

U.S.-listed mining companies produced a greater share of new bitcoin in June than May, the bank said, increasing to 20.8% of the total network versus 19.1% the month before as they brought on new capacity and the network hashrate dropped.

Hash rate and Difficulty

Difficulty adjusted down by 5% which should give miners a little more breathing room, and since then, miners are slightly ahead of pace for the next adjustment in 10 days. This has been a major period of consolidation in the space, where diversified miners who took the opportunity to also host AI compute, have done very well. However, once price starts to moon, those miners with high bitcoin reserves will be rewarded.

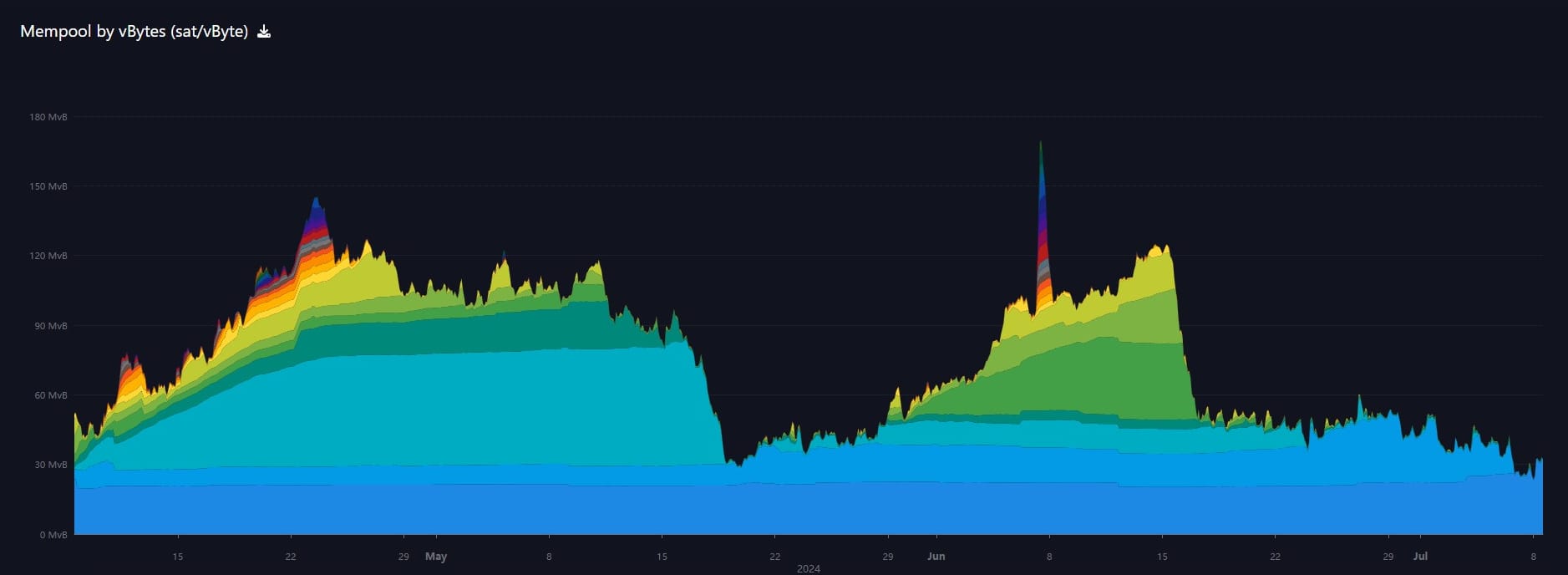

Mempool

The mempool continues to decline. This is typically not the behavior of the mempool if there is downside risk. In those periods, the mempool tends to rise as people are fee insensitive to get their bitcoin to exchanges. This matches the chart above in the price section that shows bitcoin on exchanges falling rapidly. More bitcoin is going to self-custody or into large custodians.

Layer-2 and Tokens

Rootstock, the first and most enduring sidechain of Bitcoin, experienced a quarter of unprecedented growth, consolidating itself as the leading blockchain thanks to a record number of transactions and a series of new integrations.

According to data from the block explorer, Rootstock has surpassed 13 million total transactions, with a monthly average of 45,000 transactions over the past three months. This significant increase highlights the growing adoption of the sidechain, which offers a secure and reliable environment for building on Bitcoin. With over 60% of Bitcoin’s hash rate ensuring the network’s security and 100% uptime since its launch in January 2018, Rootstock stands out as a premier destination for development on Bitcoin.

Runes and Inscriptions

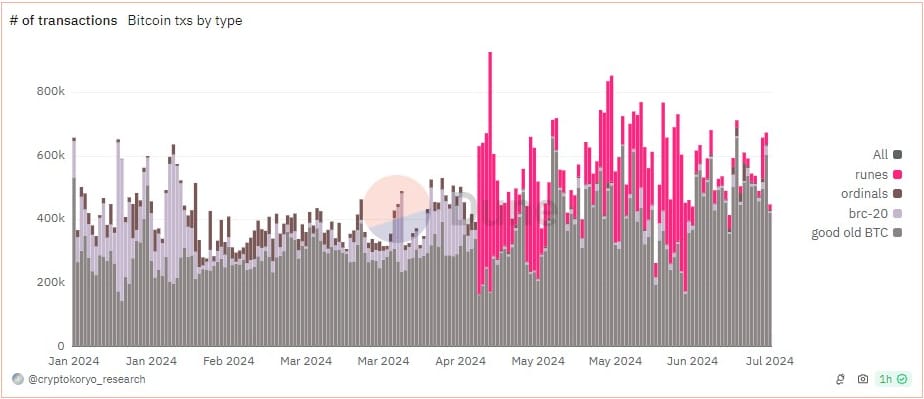

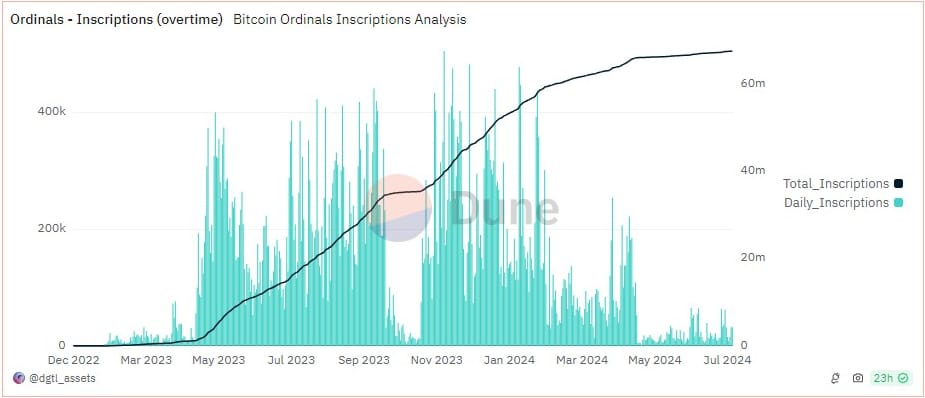

The use of layer 2 token protocols on Bitcoin has collapsed. Runes is a ghost town, signaling the massive lack of speculative interest in the space. This also matches with the struggles of altcoins to find any market what so ever right now.

Inscriptions are hanging on to a very low, much diminished volume, despite very low transaction fees at the current time.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com