Bitcoin Fundamentals Report #297

Bottom is in, Trump Tragedy and its affect on Bitcoin, China woes, Price Update and Mining sector news

July 15, 2024 | Block 852,344

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Rally into resistance |

| Media sentiment | Positive |

| Network traffic | Very low |

| Mining industry | Recovering |

| Price Section | |

| Weekly price* | $63,510 (+$6985, +12.4%) |

| Market cap | $1.253 trillion |

| Satoshis/$1 USD | 1574 |

| 1 finney (1/10,000 btc) | $6.35 |

| Mining Sector | |

| Previous difficulty adjustment | -4.9956% |

| Next estimated adjustment | +4% in ~2 days |

| Mempool | 134MB |

| Fees for next block (sats/byte) | $0.89 (10 s/vb) |

| Low Priority fee | $0.62 |

| Lightning Network** | |

| Capacity | 5237.85 btc (+1.5%, +75) |

| Channels | 50,959 (-0.2%, -91) |

In Case You Missed It...

Bitcoin Magazine Pro

- Soft CPI Sparks Rate Cut Speculation, And Its Effect on Bitcoin

- Market Tracker breakdown: Bitcoin's Path to Recovery Amidst Market Volatility

- Mining Tracker breakdown: Bitcoin’s Bull Market Evolution

Member

- BMPRO content a few days delayed

- Analyzing Bitcoin’s Current Correction and Future Forecasts

- 💢 July price forecast competition

Community streams and Podcast

Blog

- Demographic Collapse: Effects of Urbanization

- Discussing Reserves: Sources, Utility and Why QE Doesn't Work

- A Response from Team Transitory

Headlines

In an interview this morning, Larry Fink came out once again and praised bitcoin. If you cannot see video below, here is a tweet version.

Points he made:

1) Bitcoin has uncorrelated returns

2) An investment instrument when you are scared

3) For when your country is debasing its currency

4) It's outside your governments control

5) It's digital gold

6) An asset class all its own, like other asset classes

7) There's a real need for it

8) It is a way to hedge for hope and optimism

9) Bitcoin has industrial uses (likely talking about mining benefits)

With the likelihood of a Trump Presidential win increases, China is taking a fresh look at Bitcoin. They definitely do not want to cede ground to the US with a major pivot coming in the US.

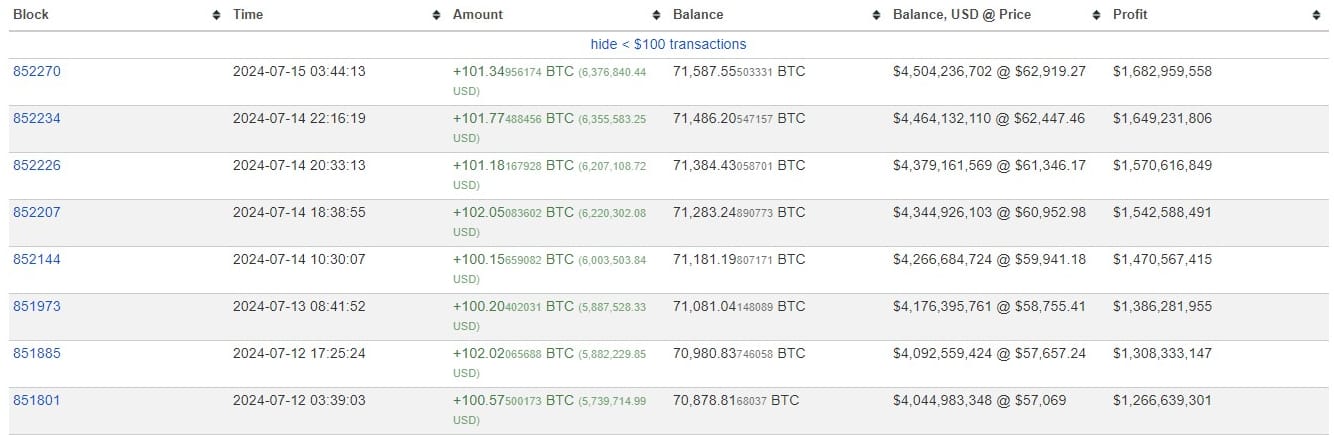

- Mr 100 is back!

I'm aware of the claim that Mr 100 is simply an Upbit cold wallet address, but this is not the behavior of other exchanges and their cold wallet addresses. Why don't we have 10 Mr 100s, one from each major exchange?

Who is Mr. 100?

— Arkham (@ArkhamIntel) March 16, 2024

Mr. 100 is a BTC address that receives 100 BTC at a time.

Many have speculated that Mr. 100 is buying BTC - as a large fund, Middle Eastern nation, or even a Bitcoin ETF.

We believe these assertions are incorrect - ‘Mr. 100’ is in fact an Upbit Cold Wallet. pic.twitter.com/92KMljoZ6e

No, it is more likely that this is a large customer with a segregated cold wallet account with Upbit. He has bought 1,500 bitcoins in the last week and 3,200 since the bottom on July 5.

Macro

- Trump triumphant after attempted assassination

I have only one thing to add to the wall-to-wall coverage you probably are already seeing, that being how bullish this is for bitcoin. Trump has come out and said he'd back the USD with bitcoin, protect self-custody, and promotes mining. This tragic event has raised Trumps chances in the election even higher than before. Everything the globalists try backfires and makes him even more popular.

We also will get a VP pick from Trump at 430 ET. Top pick on betting markets by a wide margin is JD Vance, MAGA Senator from Ohio. This would leave an open seat in the Senate that would be filled by a MAGA-friendly Governor until the election. Vance is probably the best possible pick for Bitcoin. Bullish.

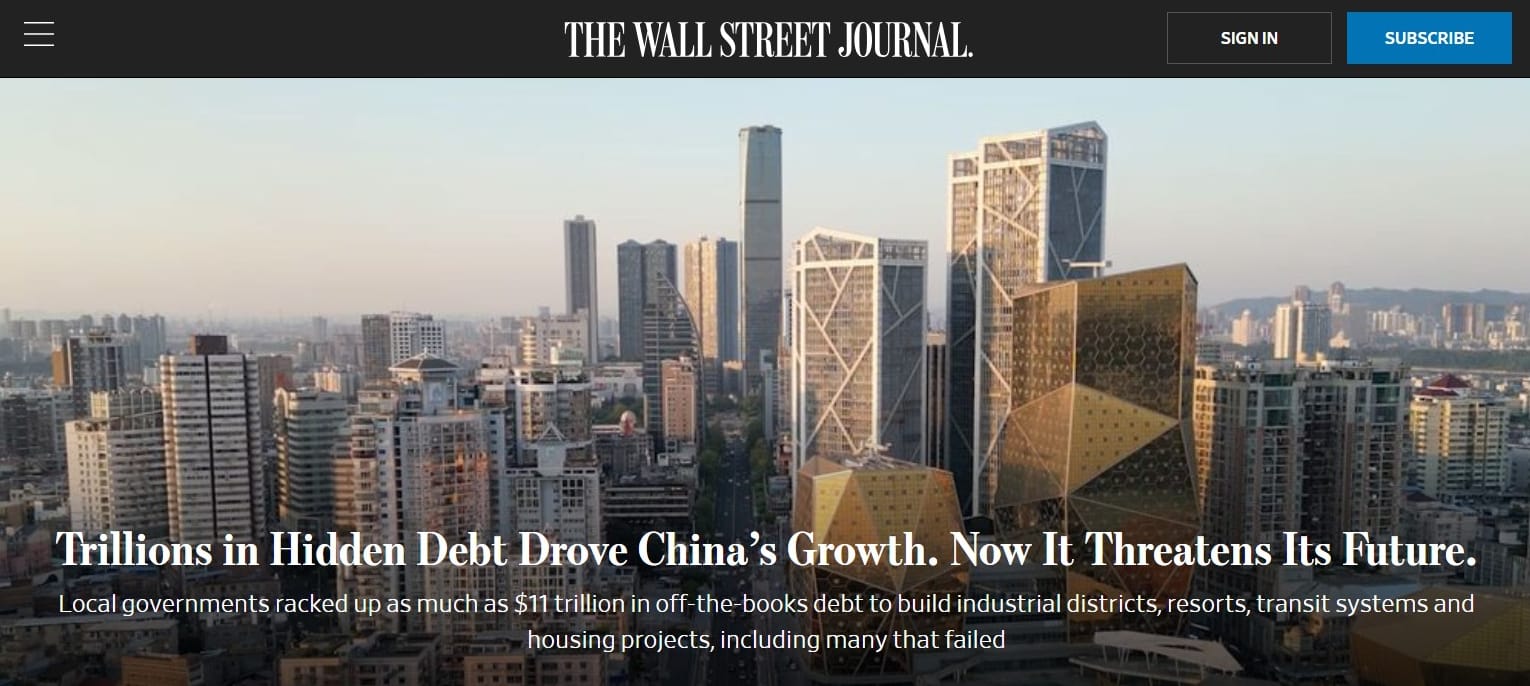

A story out of the Wall Street Journal is detailing exactly what I have been warning about for years. The Chinese economy is on the brink of collapse.

For years, Liuzhou and scores of other Chinese cities together amassed trillions of dollars in off-the-books debt for economic development projects. The opaque financing was the yeast that helped China rise to the envy of the world.

Liuzhou, a city in the southern region of Guangxi, raised billions of dollars to build the infrastructure for a new industrial district, where a state-owned financing group acquired land and opened hotels and an amusement park. Other tracts of acquired land sit vacant, and many area streets look practically deserted. Birds flit through the rows of abandoned buildings at an unfinished apartment complex.

“The government is broke,” said one local resident.

Economists estimate the size of such off-the-books debt is somewhere between $7 trillion and $11 trillion, about twice the size of China’s central government debt. The total amount isn’t known—likely not even to Beijing, say bankers and economists—because of the opaqueness surrounding the financial arrangements that allowed the debt to balloon.

As much as $800 billion of that debt is at a high risk of default, economists say.

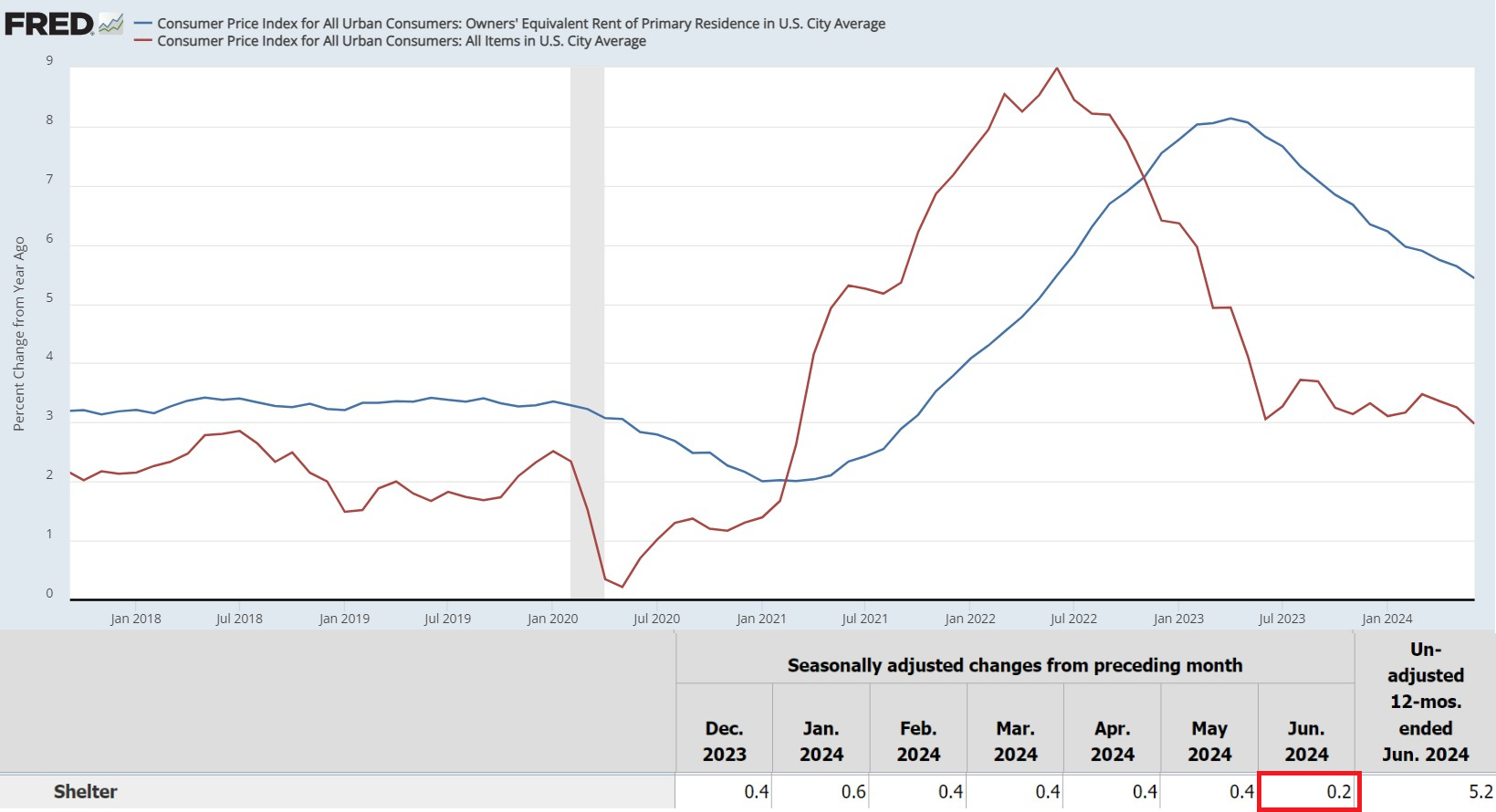

- CPI comes in negative for June, Recession odds rise

Last week's CPI release seems like a distant memory now. However, it is extremely important. CPI is cooling rapidly, matching exactly what we'd expect going into a recession. If you missed my live stream reaction, you can see it here. Huge decrease in the Shelter component MoM. If it continues this weak, headline will drop rapidly YoY and likely be negative in a couple more months this year.

Unemployment rate is ticking up and triggering the Sahm Rule.

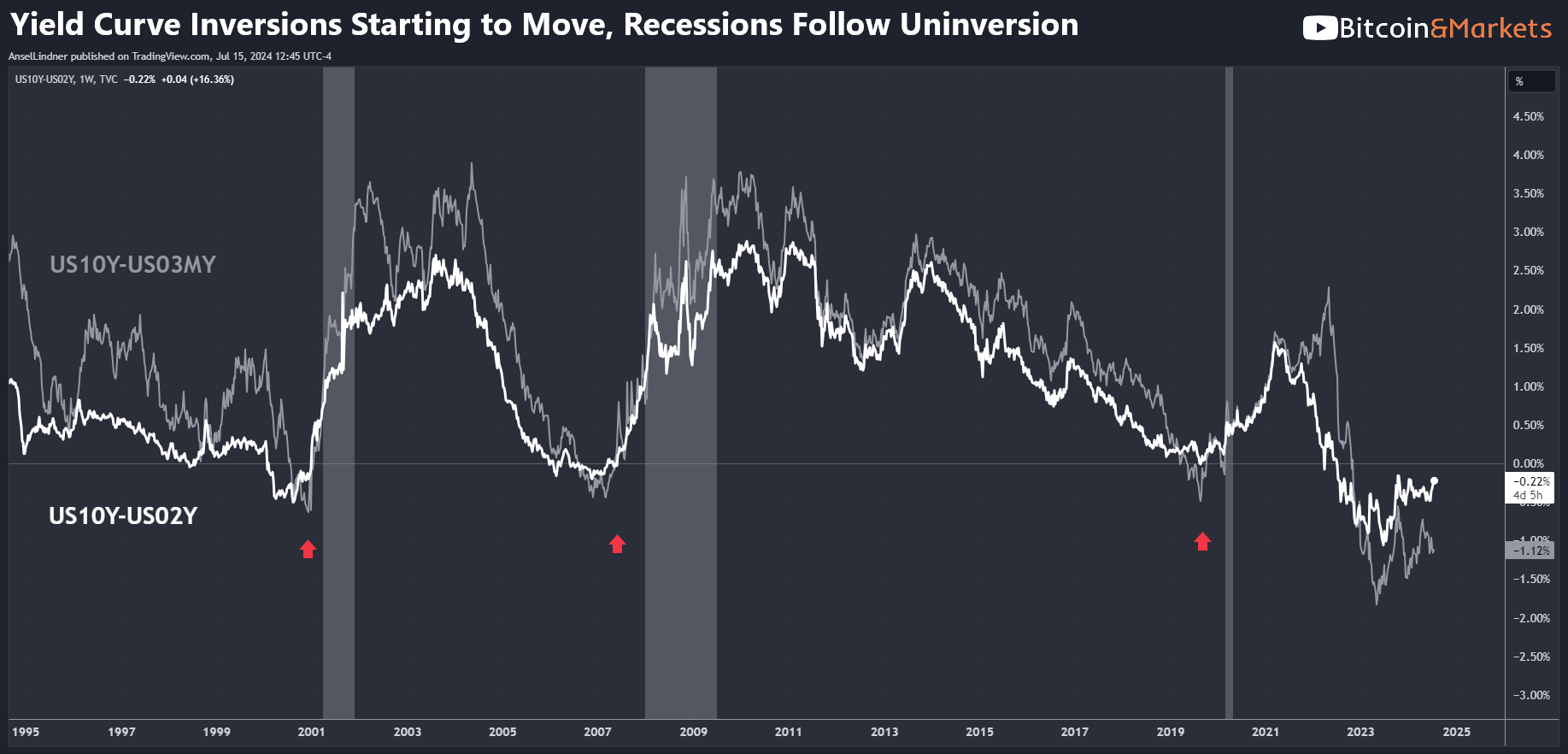

The 10Y-2Y inversion is also on the move. This is a massively powerful indicator and it is now clearly moving to uninvert. Recessions typically follow this. Go back up to Larry Fink's reasons for liking bitcoin. #2) When you are scared. IOW a safe haven asset for a recession.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last week:

IMO price is has bottomed or will bottom with one more flush being less likely.

The preponderance of risk is in an upward move. This can happen rapidly and gain fuel from liquidations.

The bullish divergence was the perfect call! At the time of writing price is up 18% from the low on July 5. We've broken cleanly through the 200/20-day cross (that might not even happen now), and are approaching the major resistance zone at $65,000.

It was most bearish before the turn around. Now, we are looking at the real possibility of a break out with good news coming out of our ears.

1) Germany is done selling their 50,000 BTC

2) MtGox effect of distributions likely highly overestimated for strong holders

3) Tether has yet to make their Q2 purchase, or are in the process of it. They've been buying 8,888.88 the last two quarters.

4) ETFs bought $1.047B last week, and likely to keep buying.

5) Halving effect will kick in.

6) MSTR is going to do a 10:1 split to allow smaller allocations

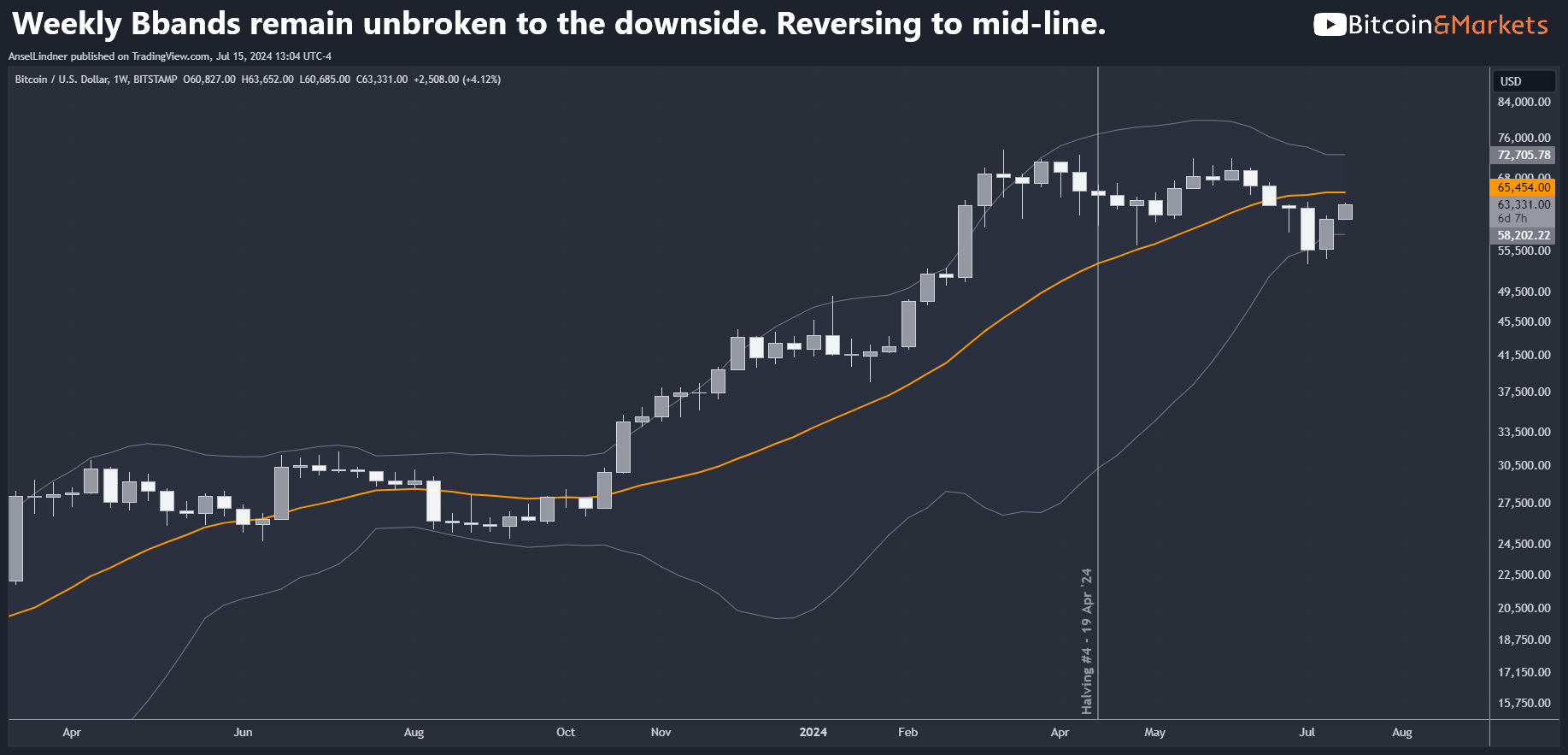

The weekly Bbands held and price is now threatening the mid-line (20-week MA).

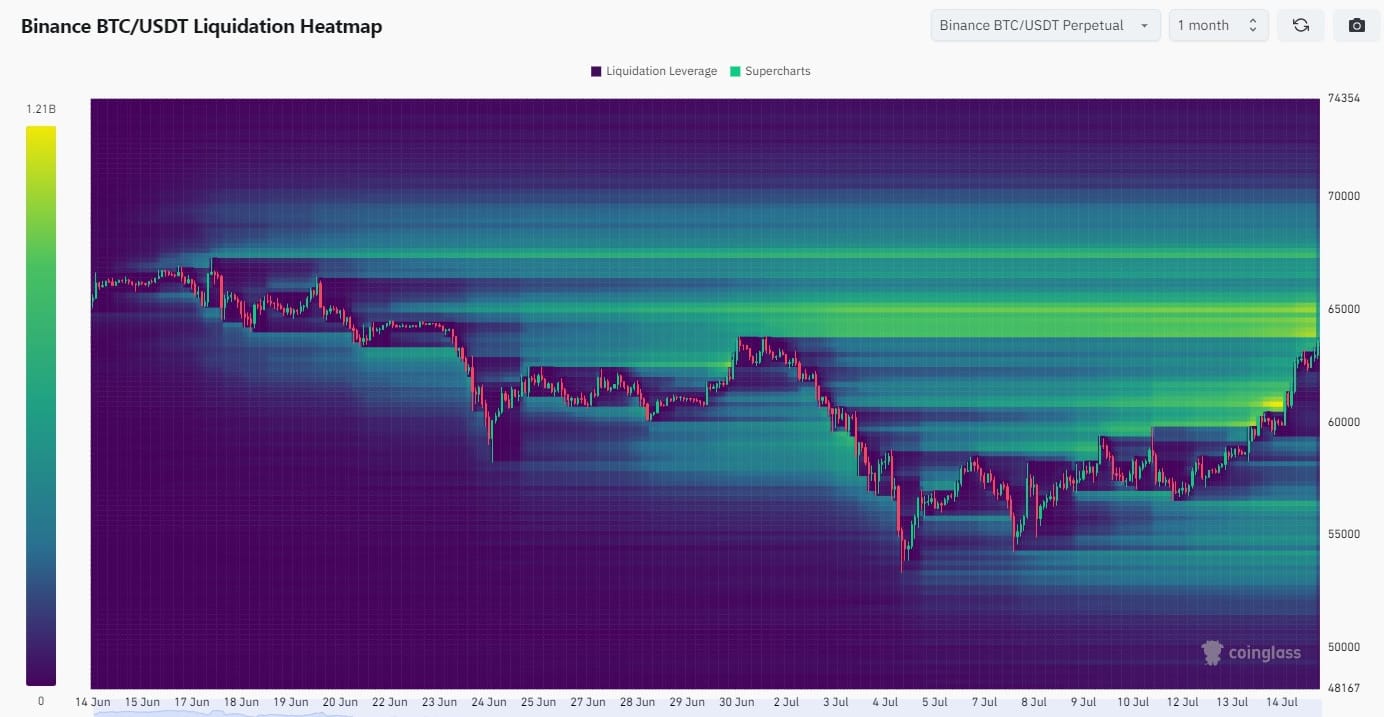

The one month heat map shows a strong liquidity pull higher into our $65,000 resistance area.

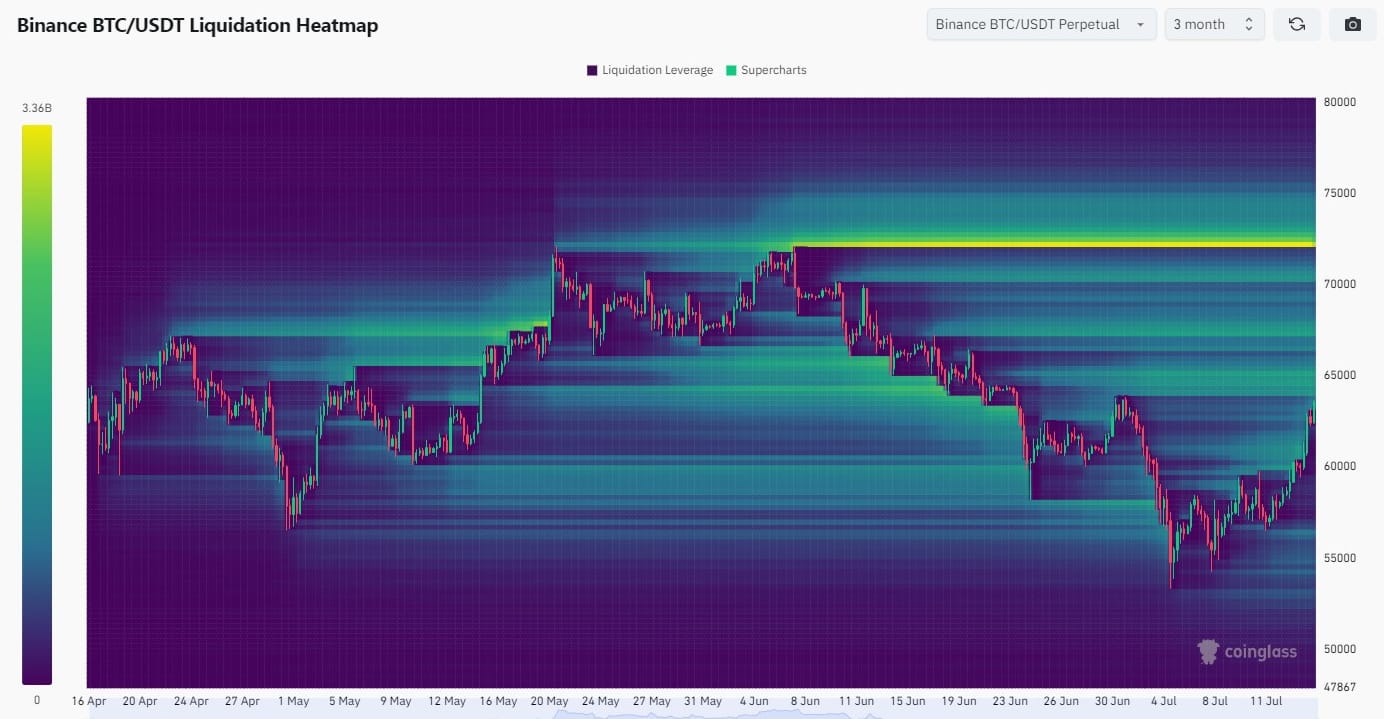

3-month heat map shows the mother of all liquidity pulls up to ATH to $73,000.

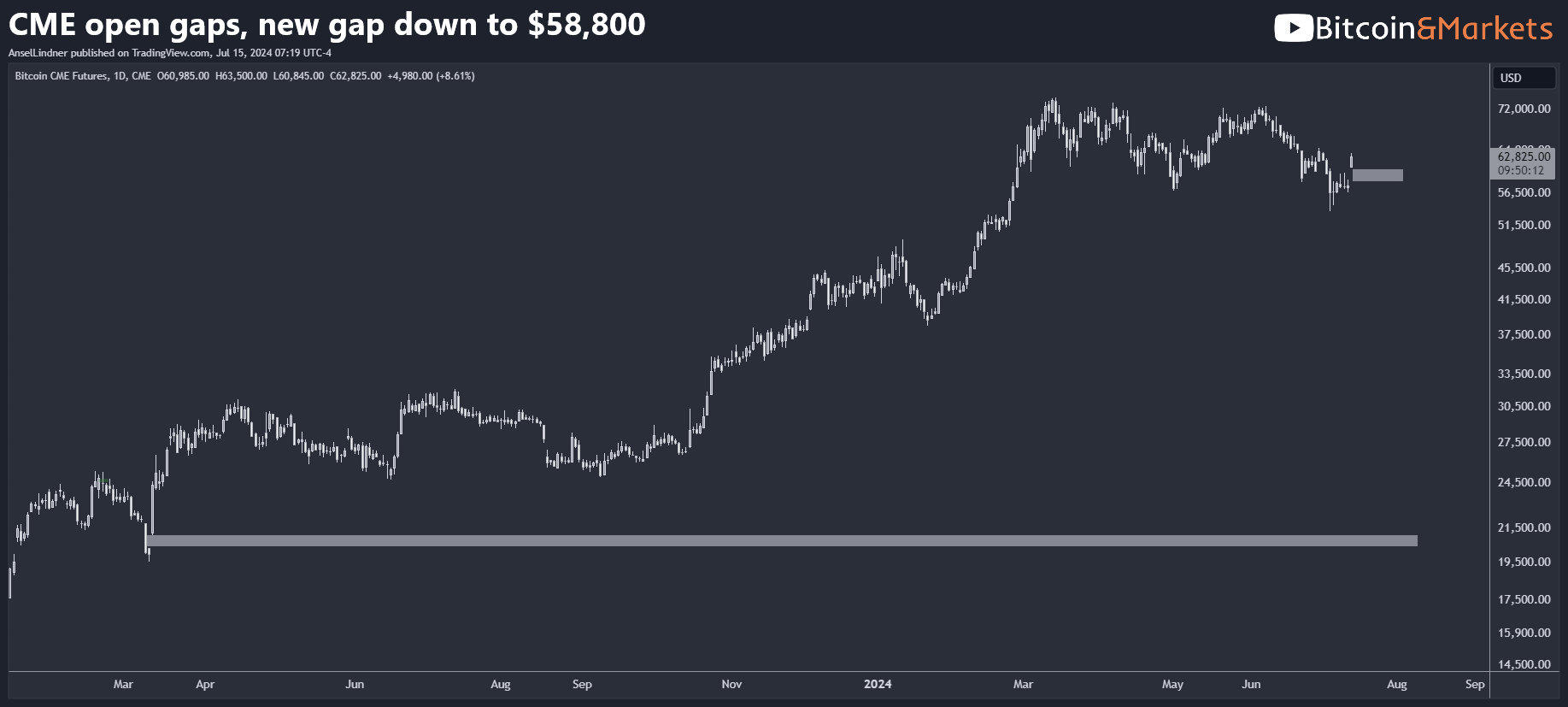

A CME gap has opened up down to $58,800. These gaps are formed because the traditional markets are closed overnight for a couple hours and on weekends and holidays. They act as Schelling points that attract attention and are almost always filled. There are a couple instances in the history of Bitcoin being traded on the CME, where gaps didn't fill. Known in the trade as breakaway gaps, they tend to happen at the beginning of large rallies on high volume. We'll have to wait until the end of the day to see how volume turns out.

Important level to the downside is now the gap at $58,800. To the upside, breaking the 50-day MA ($64,000) will be huge. The 20-week ($65,400) is another important level. If this strong bounce can close above there, we should see a couple days of consolidation, full of ETF inflows and Tether buys, and then resumption to that juicy liquidity at the ATH.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

A new report from Bernstein Research suggests that a highly favorable "Goldilocks scenario" is developing for the Bitcoin mining industry, driven by several critical factors, including increased chances of pro-Bitcoin political changes in the United States.

Analysts believe that Bitcoin prices will remain sensitive to election updates and positively correlate with the probability of a Trump presidency.

Bernstein notes that the balance of power in mining chip production is shifting from China to the United States.

Block's recent announcement of a production-ready 3nm Bitcoin mining chip, with Core Scientific as the first anchor client, represents a significant change in the industry landscape.

Over the last three years, Texans have experienced power outages because of deep freezes and hurricanes. Residents have been furious over the capabilities of the state's power grid, and the last week hasn't been rosy for utility providers in southeast Texas.

About 40 miles southwest of Fort Worth, a new threat to compound the state's power problems may be emerging. Texas is currently the center of the Bitcoin mining world with 10 large facilities, and residents near one mine in Hood County are feeling in the effects in two ways. They're worried that the cryptocurrency mining will lead to another statewide energy failure. Others? They're just getting sick.

According to a July 8 report by Time, a Bitcoin mining site in Granbury and recently acquired by Marathon Digital Holdings is causing residents to experience everything from heart palpitations to migraines 🤣. The Granbury residents say it's becoming impossible to live there because of the noises created by the site. - emphasis added LOL

I've been talking about this for months now. As the price of bitcoin rises, those underperforming miner that haven't diversified/locked some capacity into AI will likely be rewarded nicely with stock price gains.

Hash rate and Difficulty

Difficulty is on schedule for a 4% rise in 2 days. Hash rate is rising rapidly on the bitcoin price bounce as expected.

Mempool

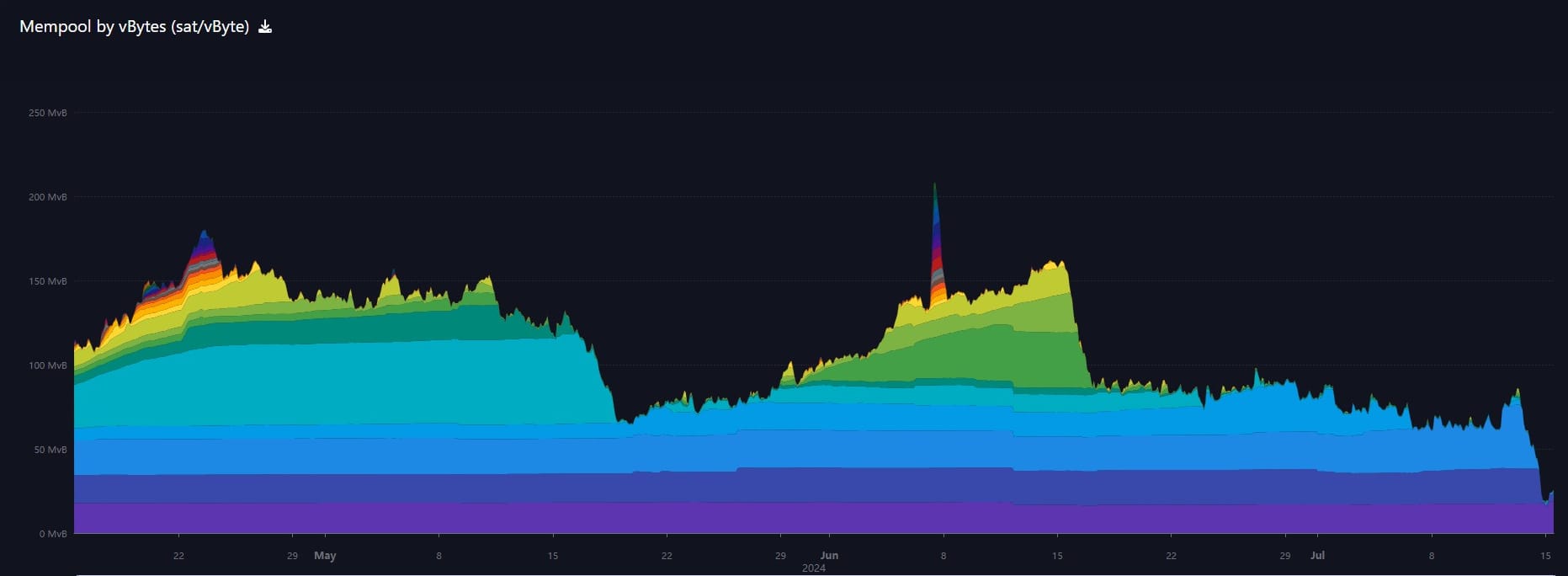

Mempool crashes to only 134 MB, it's lowest level since November 2023! This speaks directly to two developments in bitcoin right now.

1) Hodling behavior is very very strong entering this price bounce.

2) The risk of crash is low, since the rises in the mempool tends to proceed sell-offs.

Layer-2 and Tokens

NSTR

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com